1.This ETF is Telling America Where Wall Street Thinks Repatriation and Tax Cut Dollars Will Flow.

PKW-Stock Buyback ETF Spikes on Huge Volume…Will all the corporate tax cuts go to buybacks and dividends?

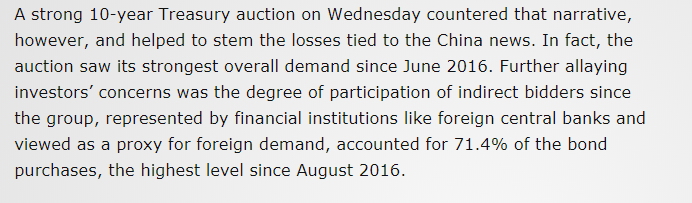

2.After a Brief Dip in Chinese Demand for Treasuries…Foreign Demand for Treasuries Hits Highest Level Since August 2016

Is Foreign Demand for Treasuries Fading?

Posted by lplresearch

https://lplresearch.com/2018/01/12/is-foreign-demand-for-treasuries-fading/

3.Euphoria is Kicking In…Money Pours into Equity ETFs to Start Year.

Weekly ETF Inflows Sizzle With Stock Market

January 12, 2018

A sizzling start to the year for the stock market went hand in hand with a sizzling start to the year for ETF inflows. The S&P 500 gained 4% in the first 10 trading sessions of 2018, its best start to a year since 2003, according to CNBC.

At the same time, U.S.-listed ETFs took in an impressive $18.7 billion during the week ending Thursday, Jan. 11, according to the latest data from FactSet. Year-to-date inflows now stand at $17.7 billion.

Unsurprisingly, most of this week’s inflows went into U.S. equity ETFs―$9.2 billion―amid growing euphoria about the state of the U.S. economy and corporate profits.

International equity ETFs weren’t far behind, with $7 billion worth of inflows of their own. U.S. fixed-income ETFs and international fixed-income ETFs followed suit, with inflows of $1 billion and $1.4 billion, respectively.

Bonds were hit this week, as the U.S. two-year Treasury yield topped the 2% mark for the first time since the financial crisis on the back of expectations that the Federal Reserve will have to hike rates more aggressively this year as inflation picks up. The 10-year Treasury yield briefly touched 2.6%, close to last year’s high.

Low-Cost Broad ETFs Still Favored

Just like last year, ETF investors continued to favor low-cost broad market ETFs. The SPDR S&P 500 ETF Trust (SPY) and the iShares Core S&P 500 ETF (IVV) took in a combined $5 billion this week.

The Industrial Select Sector SPDR Fund (XLI)was another favorite, garnering inflows of $1.2 billion.

In terms of international ETFs, the iShares Core MSCI Emerging Markets ETF (IEMG)and the iShares MSCI Emerging Markets ETF (EEM) had inflows of $1.1 billion and $837 million, respectively.

On the outflows side, the iShares Russell 1000 Value ETF (IWD), the Financial Select Sector SPDR Fund (XLF), the SPDR Gold Trust (GLD), the VanEck Vectors Gold Miners ETF (GDX) and the VelocityShares 3X Long Natural Gas ETN (UGAZ) were notable losers.

For a full list of this week’s top inflows and outflows, see the tables below:

Top 10 Creations (All ETFs)

| Ticker | Name | Net Flows ($,mm) | AUM ($, mm) | AUM % Change |

| SPY | SPDR S&P 500 ETF Trust | 2,720.61 | 279,066.33 | 0.98% |

| IVV | iShares Core S&P 500 ETF | 2,364.26 | 148,956.07 | 1.61% |

| XLI | Industrial Select Sector SPDR Fund | 1,223.04 | 15,076.06 | 8.83% |

| IEMG | iShares Core MSCI Emerging Markets ETF | 1,125.63 | 45,512.84 | 2.54% |

| QQQ | PowerShares QQQ Trust | 989.15 | 60,546.65 | 1.66% |

| EEM | iShares MSCI Emerging Markets ETF | 836.79 | 41,597.46 | 2.05% |

| EMB | iShares JP Morgan USD Emerging Markets Bond ETF | 719.02 | 13,460.49 | 5.64% |

| IEFA | iShares Core MSCI EAFE ETF | 677.36 | 44,185.20 | 1.56% |

| VOO | Vanguard S&P 500 ETF | 635.47 | 86,955.45 | 0.74% |

| VEU | Vanguard FTSE All-World ex-US ETF | 487.89 | 24,313.00 | 2.05% |

http://www.etf.com/sections/weekly-etf-flows/weekly-etf-flows-2018-01-11-2018-01-05

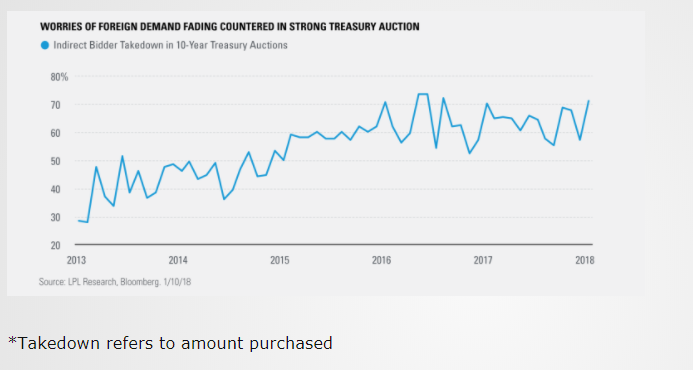

4.Top Companies with Biggest Piles of Cash

http://marketrealist.com/2017/10/tax-reforms-affect-amazon

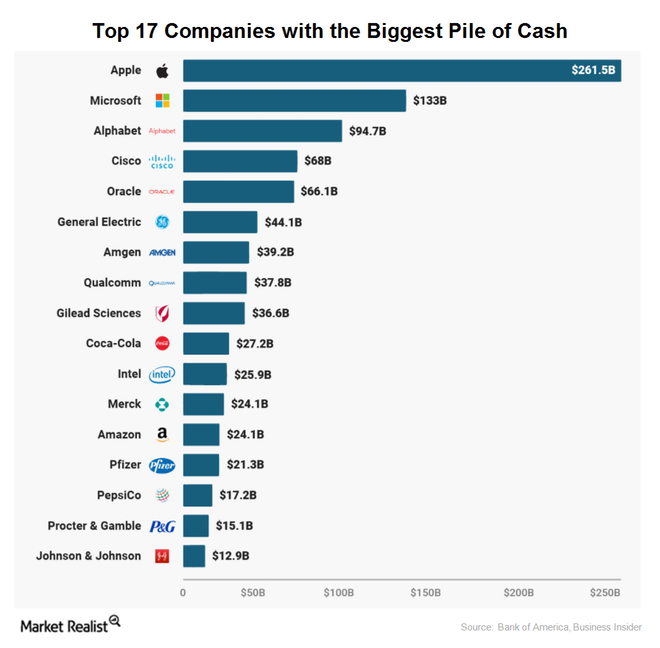

5.Two-day shipping has helped double warehouse land prices

E-commerce companies need to locate their distribution warehouses as close to their customers as possible.

By Rani Molla@ranimolla Jan 3, 2018, 3:39pm EST

Our increasing demand to buy gadgets, groceries and other goods online is actually driving up the price of land on which to store those items.

That’s because in order to ship goods to customers within a day or two — a time frame popularized by the likes of Amazon that has now become expected — e-commerce companies need to locate their distribution warehouses as close to their customers as possible.

Industrially zoned land, especially near cities, is already hard to come by. And new construction has consistently been unable to meet demand, though it’s starting to catch up.

All of this has led the average cost of land for large warehouses to double last year to over $100,000 an acre, from about $50,000 in 2016, according to data from real estate firm CBRE. The cost of land for smaller warehouses in or near cities — what’s used for last-mile or same-day delivery — rose to more than $250,000 an acre, up 25 percent from 2016 to 2017.

Rental prices for industrial buildings have followed suit.

6.From April of Last Year, Cryptocurrency Markets Attracted More Internet Traffic Than Stock Exchanges…It’s a Non-Investment Bank, Retail Driven Phenomenon…How will the Unregulated Exchanges Handle a Run on Bank?

From April last year, cryptocurrency markets attracted more traffic than stock exchanges, and grew 229% in December alone. Nearly 30% of searches came from the US and nearly 10% came from Russia.

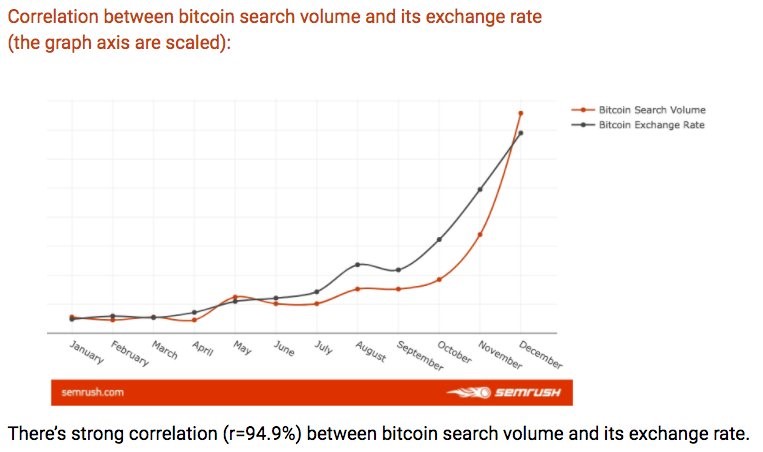

- The value of bitcoin moved almost perfectly in line with internet searches for the term in 2017, new analysis by SEMrush found.

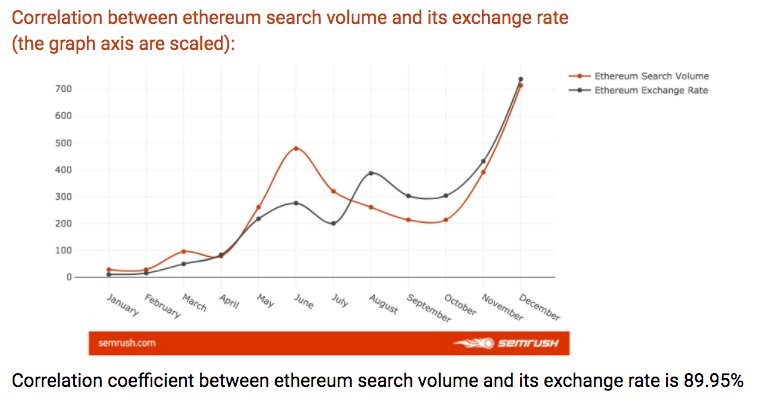

- Online searches for ethereum also moved the price of the cryptocurrency.

- Bitcoin began to lose ground towards the end of the year as cryptocurrencies such as litecoin and ripple gained in popularity.

LONDON — The price of bitcoin in 2017 correlated almost perfectly with how often the term was searched for online, according to new analysis by intelligence firm SEMrush.

Over the year, online searches for “bitcoin” increased by 1,258%, and in December the term was searched for 17 times more often than the dollar and 101 times more often than the euro. The price of bitcoin moved alongside search volumes almost exactly, the analysis found — the so-called “correlation coefficient” was 95%.

Here’s the chart:

SEMrush

As bitcoin soared in value, rising over 1,000% against the dollar over 2017, investors and financial executives expressed increasing interest and concerns in cryptocurrencies. In response to concerns that cryptocurrencies may be used to facilitate financial crimes and launder money, European and UK authorities are planning to crack down on bitcoin.

The relationship between ethereum’s price and the volume of internet search traffic for the term was similarly close to that of bitcoin, with a correlation coefficient of 90%.

http://www.businessinsider.com/value-of-bitcoin-correleated-almost-perfectly-searches-2018-1

7.Everyone Can Read the Headlines About Crypto Currencies Dropping this A.M. But the Important Part is How Exchanges Handle A Real Run on Bank.

One of the Biggest Crypto Exchanges Goes Dark and Users Are Getting Nervous

By

Camila Russo

One of the biggest cryptocurrency exchanges has been down for hours and its clients are starting to freak out.

Kraken went offline at 9 p.m. Pacific Time on Wednesday for maintenance that was initially scheduled to last two hours, plus an additional two to three hours for withdrawals, according to an announcement on the San Francisco-based company’s website.

“We are still working to resolve the issues that we have identified and our team is working around the clock to ensure a smooth upgrade,” according to a status update on Kraken’s website posted seven hours ago. “This means it may still take several hours before we can relaunch the site.”

In previous updates, Kraken mentioned it’s working on “unexpected and delicate issues” and assured clients their funds were secure, adding that “Yes, this is our new record for downtime since we launched in 2013. No, we’re not proud of it.”

The short history of cryptocurrencies has been rife with hackers and stolen bitcoin, so issues with exchanges are quick to unnerve investors. In the most famous case, Mt. Gox filed for bankruptcy in 2014 after losing hundreds of thousands of its clients bitcoins. Less dramatically, popular websites such as Coinbase have frequently crashed or slowed down in the past few months as they’ve been unable to handle the increased traffic coming from the growing number of investors trying to cash in on the crypto boom.

Kraken is one of the exchanges that the CME Group Inc. is using to price the bitcoin futures it introduced last month.

Lack of communication from fledgling companies, delays in withdrawals and transfers, high fees, and the creeping fear of a malicious attack are some of the issues largely retail investors face, and discourage many more from jumping in.

With not even a phone number or e-mail listed on Kraken’s status page, the exchange’s clients vented on Twitter.

A Twitter user with the name of Victor M. said “im seriously considering suing kraken. anyone interested as well?” The Tweet got more than 300 likes. A user with the name North Canton Cab Com tweeted to Kraken saying “due to the length of down time can you at least assure us that our coins and accounts are safe and havent been hacked or stolen please, seems beyond any normal circumstance at this point when people are worried sick!”

Others are resorting to humor, with Twitter user @Subbedeius posting “Kraken is the best platform to avoid panic-selling. It just doesn’t work when sh*t hits the fan.”

For more on cryptocurrencies, check out the Decrypted podcast:

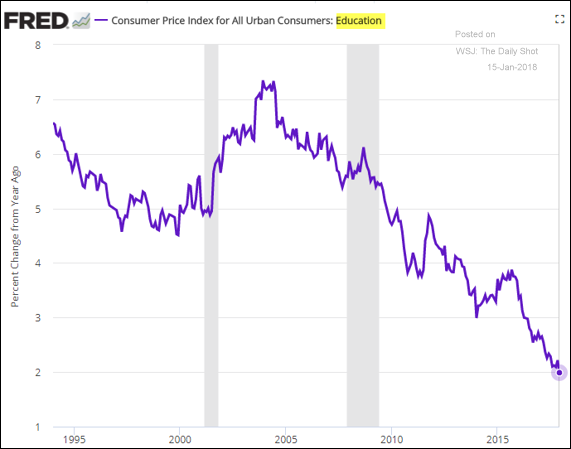

8.Has the Education/Tuition Bubble Finally Burst?

The Never Ending Run Up in College Tuition Might Be Ending….

9.The Rise of the Machines is Closer and Closer.

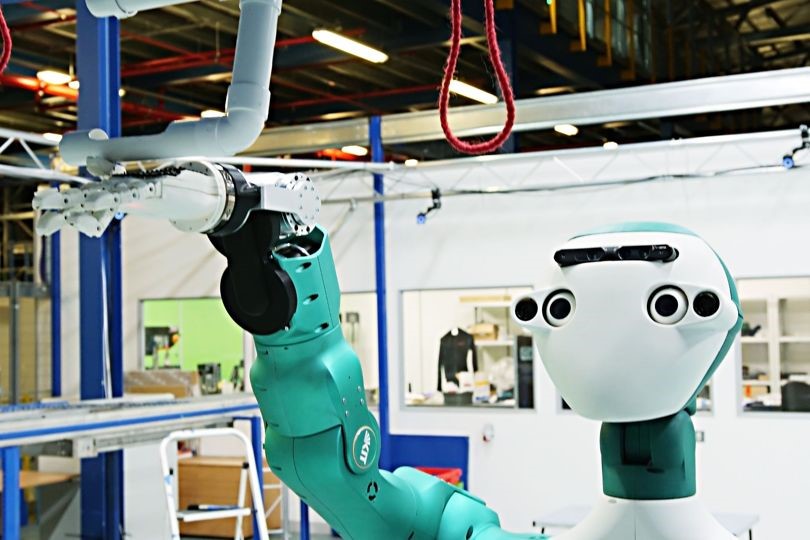

Ocado’s collaborative robot is getting closer to factory work

The ARMAR-6 prototype robot can help humans with basic maintenance tasks in prescribed scenarios. But it still needs to get smarter

By Matt Burgess

<img src=”https://wi-images.condecdn.net/image/x6NnzM46BNM/crop/405” class=”” />

Ocado

Retailer Ocado is getting closer to creating an autonomous humanoid robot that can help engineers fix mechanical faults in its factories. The firm’s latest robot, ARMAR-6, has a human-looking torso, arms with eight degrees of freedom, hands that can grip and a head with cameras inside. But it doesn’t have legs and is equipped with a large wheeled base that lets it move around.

“The ambition is that the robot will be able to decide what the technician’s intentions are and chip-in as appropriate at the right point in time,” says Graham Deacon, the robotics research team leader at Ocado Technology. The robot isn’t designed to replace human workers but work alongside them inside within the company’s automated warehouses.

To this end, ARMAR-6 uses a three camera systems inside its head to help it detect and recognise humans and objects; speech recognition helps it understand commands; and its hands are able to pick-up and grasp objects.

At present, the robot is still a prototype but getting to this point has taken two and a half years. Four European universities have been working to create each of the systems, under the EU’s Horizon2020 project.

Full article and videos

http://www.wired.co.uk/article/ocado-humanoid-armar-6-secondhands

10.3 Winning Habits You’ll Find in the Most Successful People This Year

Adam Grant, Dan Pink, and Reid Hoffman share some useful workplace hacks for 2018.

I’ve been following Wharton’s top-rated professor Adam Grant as well as Dan Pink, one of the 10 most-influential management thinkers in the world, for years now. Whenever they have some new scientific insight to impart about things related to productivity or positive psychology, I tune in.

For this piece, Reid Hoffman, LinkedIn co-founder and partner at the venture capital firm Greylock Partners, also caught my attention for his interesting take on networking.

Without further ado, here are three useful success strategies that I hope will not only brighten your day but also illuminate your business or work in 2018.

- Develop your “network intelligence.”

In his 2014 book, The Alliance: Managing Talent in the Networked Age, Hoffman, one of the most well-connected people in tech, emphasizes why networking is critical for success. No, we’re not talking about referral networks at your local chamber meetings. For starters, he says that managers should create a culture in which employees — whatever function, team, or business unit — connect with one another as well as with external contacts. Hoffman expands further:

Here’s what most people do when problem solving. They schedule a meeting with all the smart people at their company who might have ideas. That’s a good first step — talk to people. [But] the most valuable professional information is often in other people’s heads. Great information and insight from the people you know can be a significant competitive advantage. We call it … network intelligence. When it comes to knowledge in a highly networked era, who you know is often more valuable than what you’ve read.

And when faced with a truly difficult problem, Hoffman advises that you extend your network outwardly. He says:

There are more smart people in the world who do not work at your company than the total number of smart people who work at your company. So look beyond your office. If you do, your team becomes a whole lot bigger.

- Stop the fake schmoozing and create something of value to capture attention.

We’ve all heard that it’s “who you know” that will open up doors and take you far. Well, to a certain point. Adam Grant, author of the mega-bestseller Give and Take, wrote in The New York Times that something of greater value will yield greater returns and enlarge your network: accomplishing great things that capture people’s attention. Here’s Grant for a case in point:

Spanx took off when Oprah Winfrey chose it as one of her favorite things of the year — but not because she was stalked by the company’s founder, Sara Blakely. For two and a half years, Ms. Blakely sold fax machines by day so that she could build her prototype of footless pantyhose by night. She sent one from the first batch to Ms. Winfrey.

And the rest is history. In 2012, Blakely was named by Time magazine as one of the 100 most influential people in the world. As of 2014, she is listed as the 93rd most powerful woman in the world by Forbes.

- To be happier and more productive, take more breaks.

In Dan Pink’s forthcoming book, When: The Scientific Secrets of Perfect Timing,” to be released tomorrow, he casts a light on the benefits of the ever-increasing workplace habit of taking short, frequent breaks. Pink states in The Wall Street Journal:

A 2016 study published in the International Journal of Behavioral Nutrition and Physical Activity showed that hourly five-minute walking breaks boosted energy levels, sharpened focus, and “improved mood throughout the day and reduced feelings of fatigue in the late afternoon.” These “microbursts of activity,” as the researchers called them, were also more valuable than a single 30-minute walking break. And regular short walking breaks increase motivation and concentration and enhance creativity, according to researchers at Stanford University.

Pink says that for maximum effect, research advises spending break time with others, because “social breaks” have been found to “minimize physical strain, cut down on medical errors, and even reduce staff turnover.”

For the most replenishing effects, take a colleague with you on a nature break. Here’s Pink on the science:

A 2011 study found that people who took a short walk outdoors returned feeling happier and more rested than people who walked indoors. What’s more, while people predicted they’d be happier being outside, they underestimated how much happier.

And when taking your breaks, detach completely. That means no emails, texts, etc. When you lose the tech and stop multitasking on breaks, it eases your stress and boosts your mood in a way that multitasking breaks do not.

Like this column? Sign up to subscribe to email alerts and you’ll never miss a post.

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.