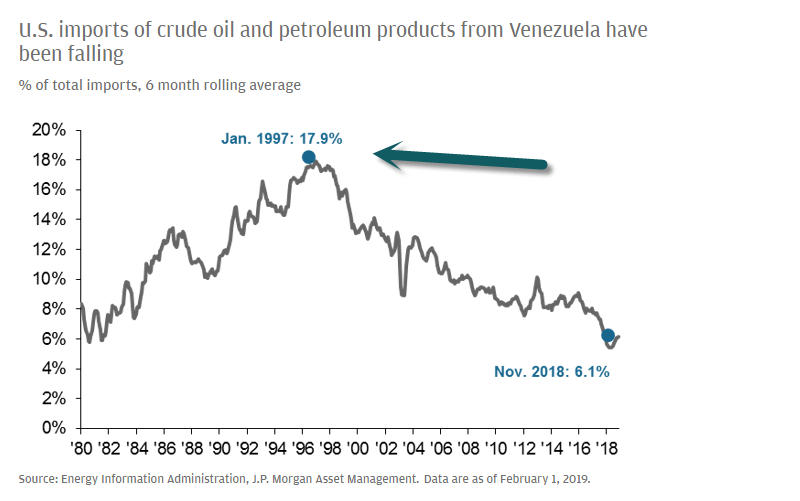

1.Amazing…The U.S. Got 18% of Crude Oil in Mid-90’s from Venezuela.

https://am.jpmorgan.com/us/en/asset-management/gim/adv/insights/investor-questions

2.WSJ-Earnings Don’t Matter as Much as You Think.

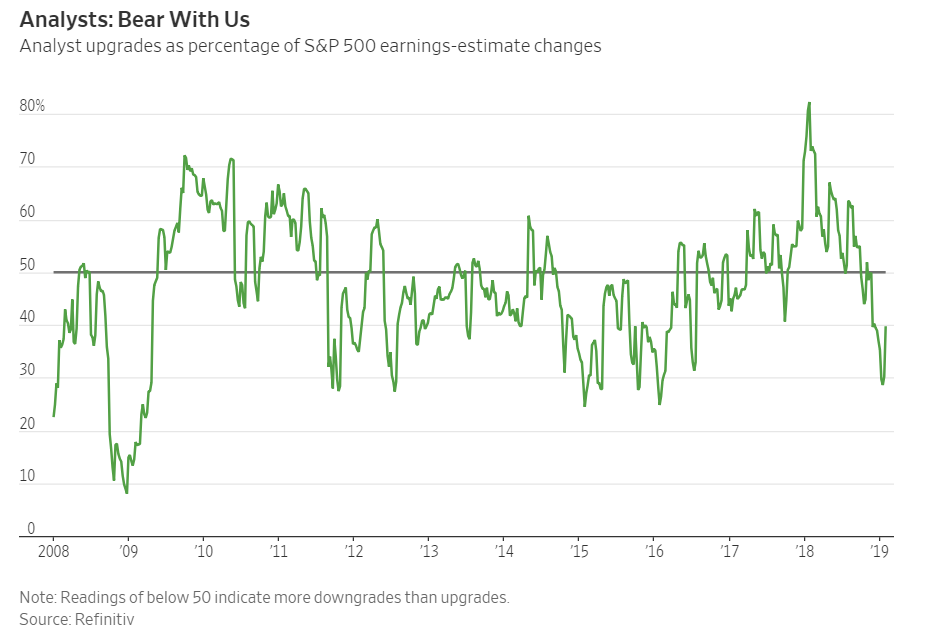

Earnings are overrated. As we reach the halfway point in the S&P 500’s fourth-quarter earnings season, investors are obsessing over financial reports and downgraded profit forecasts from Wall Street analysts. Here’s a heresy: This doesn’t matter nearly as much as people think.

Start with the reasons for concern. Estimates for U.S. earnings this year have come down sharply, and the first-quarter S&P 500 estimate is for just 0.5% year-over-year growth, the worst performance since early 2016, when profits fell, according to data from Refinitiv. Stock analysts have been downgrading profit forecasts for the year ahead far more than they’ve been upgrading them, both in the U.S. and world-wide. And U.S. companies have been lowering their guidance on future earnings, with 30 negative and only 12 positive so far this quarter.

James Mackintosh

https://www.wsj.com/articles/dont-obsess-over-the-earnings-season-11549375380?mod=itp_wsj&ru=yahoo

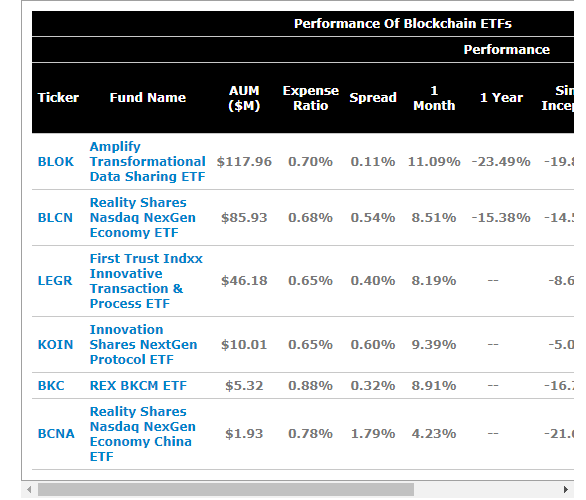

3.Remember Blockchain?

Blockchain ETFs Stumble Out Of The Gate

Last January, four blockchain ETFs launched within days of each other. Then, interest in blockchain ETFs all but evaporated (read: “Comparing 4 Blockchain ETFs“).

By the end of the month, the funds had attracted hundreds of millions in investor assets from speculators and true believers, many of whom saw blockchain as the next best thing to a cryptocurrency ETF. (After all, bitcoin and other cryptocurrencies are based on blockchain tech.)

Hype, thy name is blockchain

Though the six blockchain ETFs have taken in a combined $287 million over their lifetime, since February of last year, the funds have actually lost a combined $21 million in net investment assets:

https://www.etf.com/sections/features-and-news/blockchain-etfs-stumble-out-gate

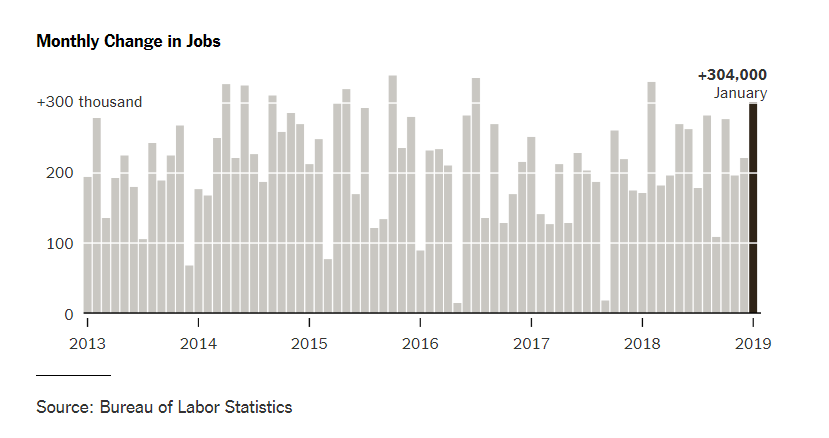

4.100th Consecutive Months of Job Gains…Shutdowns, Trade Wars, Natural Disasters.

Over the past eight years, the American economy has endured trade tensions, debt-limit standoffs, foreign-policy crises and all manner of natural disasters. Through it all, companies kept on hiring.

The resilience continued in January as employers shrugged off both the monthlong shutdown and fears of an economic slowdown to add 304,000 jobs, far more than forecasters had anticipated. The report from the Labor Department marked the 100th consecutive month of job gains, more than double the previous record.

https://www.nytimes.com/2019/02/01/business/economy/jobs-report.html

5.Nuts…400m Chinese will Travel During Holiday.

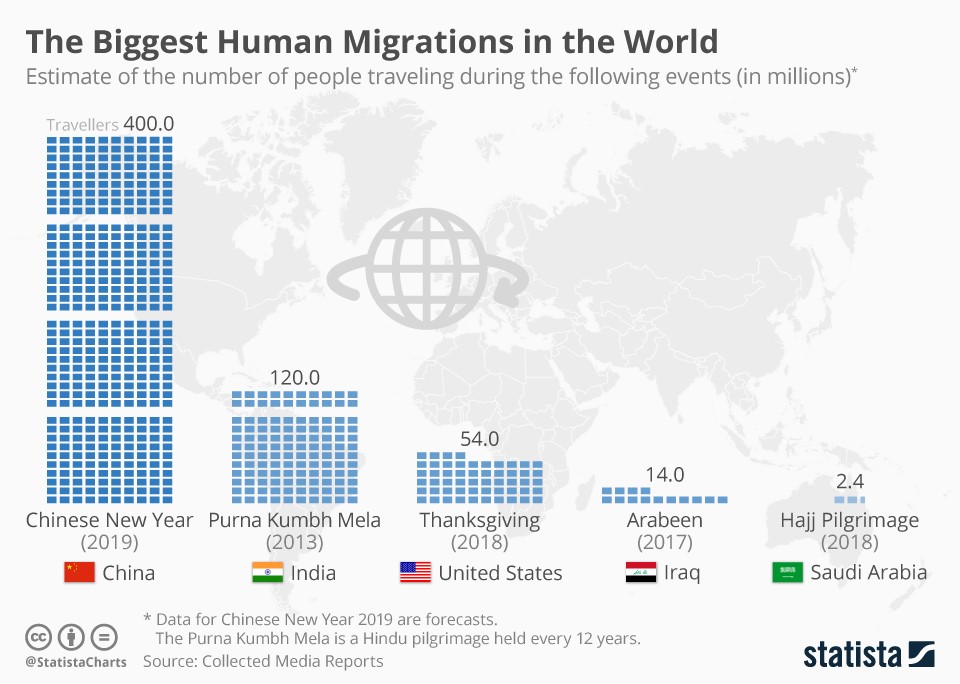

The Biggest Human Migrations in the World

by

Sarah Feldman,

Feb 5, 2019

The Chinese New Year begins today, and the year of the dog will cede its place to the pig, a zodiac sign that is supposed to attract luck and success.

Chinese New Year is one of the largest holidays for travel. During the New Year, hundreds of millions of people take planes, trains, and automobiles to celebrate the event with their friends and families. This year, more than 400 million people celebrating Chinese New Year are expected to travel, including nearly 7 million abroad mainly in Thailand, Japan and Indonesia, according to Ctrip estimates.

The second largest celebratory migration is for Purna Kumbh Mela, where in 2013 over 120 million Hindu people travelled to Allahabad for the two-month long holy festival. By comparison, only about 54 million people traveled for Thanksgiving in 2018.

https://www.statista.com/chart/16906/holiday-travel-events/

6.Good Read on Alternative Investments.

“Alternative” Assets Aren’t Exactly Alternative Any More

19 hours ago at 11:20 am by Michelle Jones

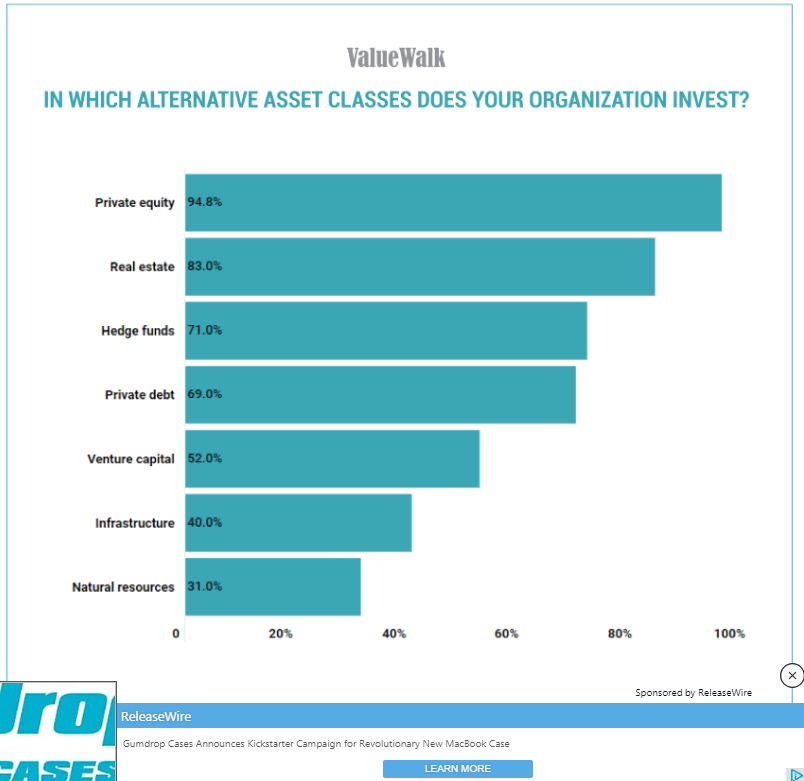

Alternative investments have grown so much in popularity that the “niche” is essentially no longer a niche. Data from Preqin indicates that 80% of institutional investors are now allocating to at least one asset which falls into the “alternative” category, even though such allocations cause problems in the way of management and transparency.

Now a new study of alternative asset allocations among institutional investors indicates that not only has demand for alternatives grown dramatically, but changes are reshaping the industry—and more changes are sure to come.

SEI teamed up with Preqin to survey limited partners about their views on alternative assets. The firms found that the growing demand for alternatives by institutional investors “has been accompanied by increasingly diverse and complicated portfolio holdings.” The result has been “increasingly diverse and complicated portfolio holdings” for many of them.

“And yet, the story of alternatives is still about growth—where investors are receiving record distributions and planning increased allocations to both funds and direct investments even as they seek to rebalance across asset classes,” SEI explained.

Growing interest in alternatives

SEI describes the growth of alternatives among institutional investors as “a growing stream of capital” which has “flooded the sector.” Because of the dramatic growth the firm h as observed, it said alternative assets can hardly be considered a “niche activity” any more. Instead, SEI sees alternatives as “a phenomenon that is so widespread that the ‘alternatives’ moniker hardly seems appropriate.”

According to the survey, private equity is by far the most popular alternative asset among institutional investors with 95% of those surveyed saying PE is in their portfolios. Real estate is in second place, while hedge funds are in third.

Interestingly, SEI found that private debt is now almost as popular as hedge funds in institutional portfolios.

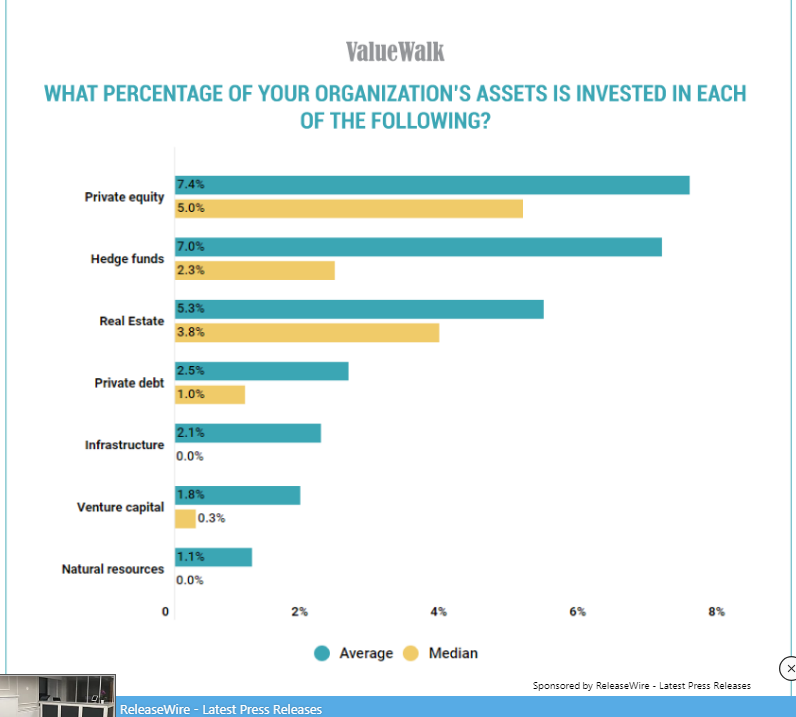

As far as allocations, private equity represents the greatest average percentage, followed by hedge funds. Interestingly, PE’s median allocation is more than twice as high as that of hedge funds, which demonstrates just how much more prevalent PE is in institutional portfolios.

https://www.valuewalk.com/2019/02/alternatives-diverse-and-complicated-portfolio/

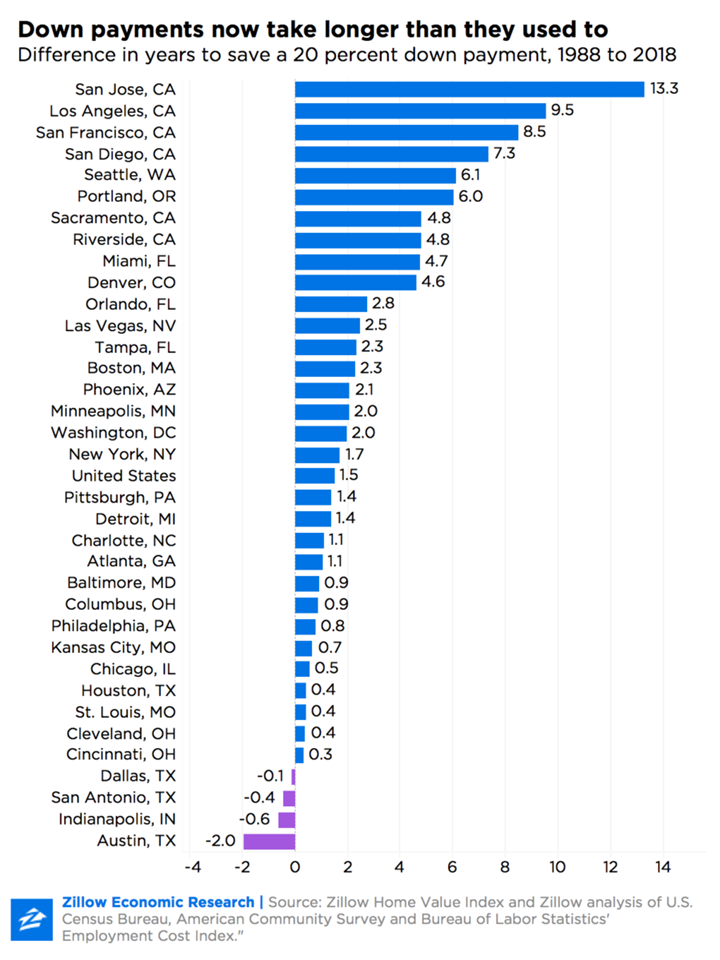

7.Home Buyers Need 7.2 Years to Save Down Payments – 1.5 Years More Than in 1988

February 6, 2019 6:00am by Barry Ritholtz

Source: Zillow

8.Americans Shifting Views on Weed.

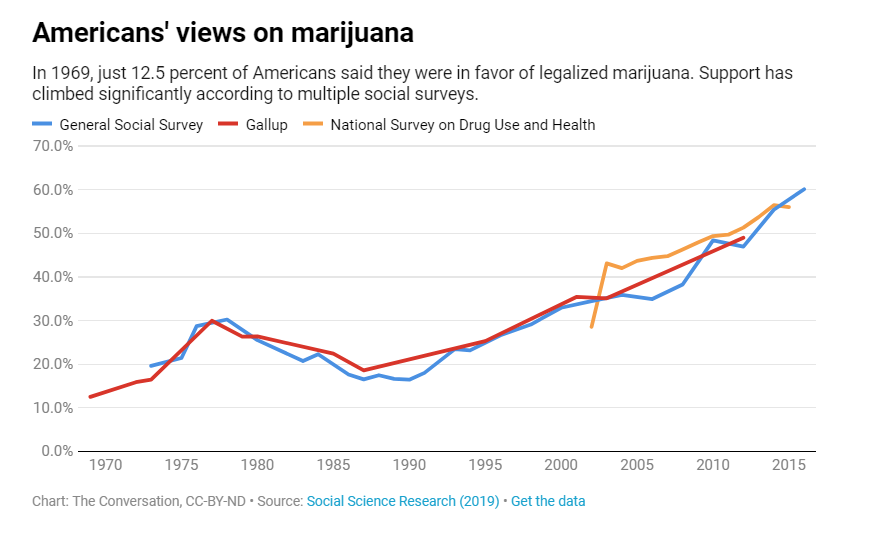

American views on marijuana have shifted incredibly rapidly. Thirty years ago, marijuana legalization seemed like a lost cause. In 1988, only 24% of Americans supported legalization.

But steadily, the nation began to liberalize. By 2018, 66% of U.S. residents offered their approval, transforming marijuana legalization from a libertarian fantasy into a mainstream cause. Many state laws have changed as well. Over the last quarter-century, 10 states have legalized recreational marijuana, while 22 states have legalized medical marijuana.

So why has public opinion changed dramatically in favor of legalization? In a study published this February, we examined a range of possible reasons, finding that the media likely had the greatest influence.

Opinion: This is the surprising reason why Americans have dramatically shifted their views on legalizing pot

ByAMYADAMCZYK CHRISTOPHERTHOMAS

9.Investing in Weed.

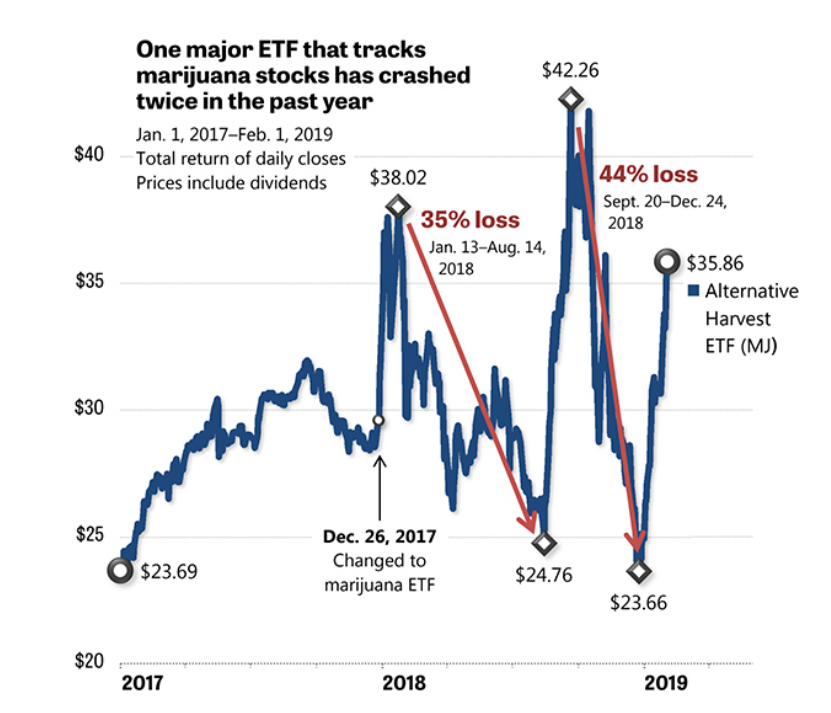

After excluding the highest and lowest outliers, the average company’s enterprise value was 103 times its revenues.

By comparison, Bank of America BAC, -0.35% has an enterprise value to revenue ratio of about 1.1. Apple’s AAPL, +0.16% is around 3.1.

The graph above shows that one index of tradable marijuana stocks crashed 35% or more—twice—just in 2018. The Alternative Harvest ETF MJ, -1.80% started its life as a little-known index of Latin American stocks. Then it changed its focus on Dec. 26, 2017, to a pure play on marijuana stocks. Its price soared and then cratered, an effect of legalization headlines that came and went. Similar index funds, such as the Horizons Marijuana Life Sciences ETF HMMJ, -1.68% similar crashes, although not on exactly the same dates.

Invest in marijuana? What are you smoking?

By BRIANLIVINGSTON

https://www.marketwatch.com/story/invest-in-marijuana-what-are-you-smoking-2019-02-06

10.Simon Sinek Says Understanding 1 Thing Will Speed Up Your Success as a Leader

It will build trust and improve relationships, whether you’re a startup of 10 or an established firm of 1000.

By Marcel SchwantesPrincipal and founder, Leadership From the Core@MarcelSchwantes

I’m a big fan of Simon Sinek and subscribe to receive his daily inspirational messages via email. In my inbox this morning was this little gem:

Transparency doesn’t mean sharing every detail. Transparency means always providing the context for our decisions.

To Sinek’s first point, one ongoing debate is around how much access to (privileged) information employees should be given in order to do their work.

The answer: they should get whatever they explicitly request so they can perform at a high level. This is good for business.

In command-and-control hierarchies fueled by hubris and fear, managers horde information, impose layers of bureaucracy, call for unnecessary meetings, and cause gridlock for knowledge workers trying to do their job effectively.

In open and inclusive cultures of collaboration, information travels at the speed of light right down to customer-facing workers, managers serve instead of dictate, and employees are given instant feedback and access to resources to do their jobs well.

How much transparency is too much transparency?

But still, to Sinek’s point that transparency doesn’t mean “sharing every detail,” where do you draw the line?

The Container Store has a strong culture of values and define its communication practices like this: “Simply put, we want every single employee in our company to know absolutely everything.”

Buffer, the social media management company, publishes pretty much everything publicly: financials, revenues, how your money is being spent, even salaries (Joel Gascoigne, Buffer’s CEO, currently makes $225,518). But they share this with everyone in the hopes of becoming a more authentic and trusted community.

Bridgewater Associates, the world’s largest hedge fund, records every meeting and makes it available to all employees. They do it as a communication vehicle and a learning tool to illustrate how decisions are made, and how the most senior people in the organization are learning and growing.

Too much? Maybe for some companies. But choosing not to disclose information may pose a greater risk: backlash by unhappy employees who air their complaints on Glassdoor and social media.

That brings us to Sinek’s second point in his wise quote, which is more apropos to the discussion.

Provide the context for your decisions.

Transparency is a management buzzword you didn’t hear 10 or 15 years ago. Back then, management decisions made in secrecy weren’t questioned. Today, it’s a mechanism embedded in the engines that drive trust cultures. Millennial employees expect it and even demand it in their leaders.

But to Sinek’s point, the real reason for transparency practiced as a business value is so that employees know and understand why and how things are happening and decisions are made.

Take Buffer’s CEO Joel Gascoigne. Three years ago, he made the tough decision of laying off 11 percent of his workforce. In a very transparent public announcement, Gascoigne laid out all the reasons, including the very mistakes he made, behind his decision. He wrote:

I had poor judgment and took the wrong actions in many different areas. Especially at this time, I want to try to live our value of transparency and share everything about the big mistakes we’ve made, the tough changes we’ve decided upon as a result, and where we go from here.

He continues:

In short, this was all caused by the fact that we grew the team too big, too fast. We thought we were being mindful about balancing the pace of our hiring with our revenue growth. We weren’t.

One of our advisors gave us an apt metaphor for what happened: We moved into a house that we couldn’t afford with our monthly paycheck.

He took the fall. Some will call Gascoigne’s public admission naive and corporate suicide. Skeptics will say that that level of transparency hindered Buffer’s ability to hire talent and raise funding to propel them forward.

Actually, what it did was strengthen their culture (since transparency is a cleary-defined core value of Buffer’s) and allowed them to make better decisions moving forward.

Carolyn Kopprasch, chief customer officer at Buffer, stated that operational transparency can be time consuming, particularly for a remote company like Buffer, but it’s well worth the effort. “As a team, we feel like you should be able to say, ‘I wonder what our leads are talking about, I wonder how product is doing on their goals.’ We’re a small enough company that every team’s successes influences every other team.”

In the end, leaders should choose to practice and model transparency to build trust and solve problems, not to create uncertainty and confusion, which will raise more questions and problems you don’t want to solve.