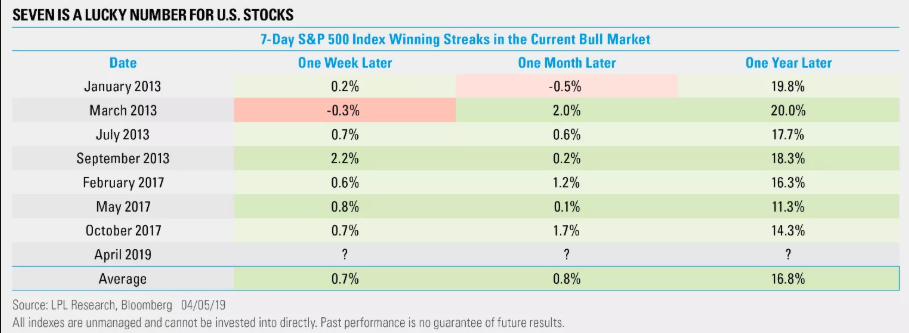

1.Seven Day Winning Streaks Historically Bullish One Year Out.

Seven has been a lucky number for U.S. stocks. The S&P 500 Index just notched its first seven-day winning streak since October 2017. As shown in the LPL Chart of the Day, this feat has occurred just seven other times in the current bull market.For the most part, each winning streak preceded both short-term and long-term gains.

https://lplresearch.com/2019/04/08/lucky-number-seven/#more-12513

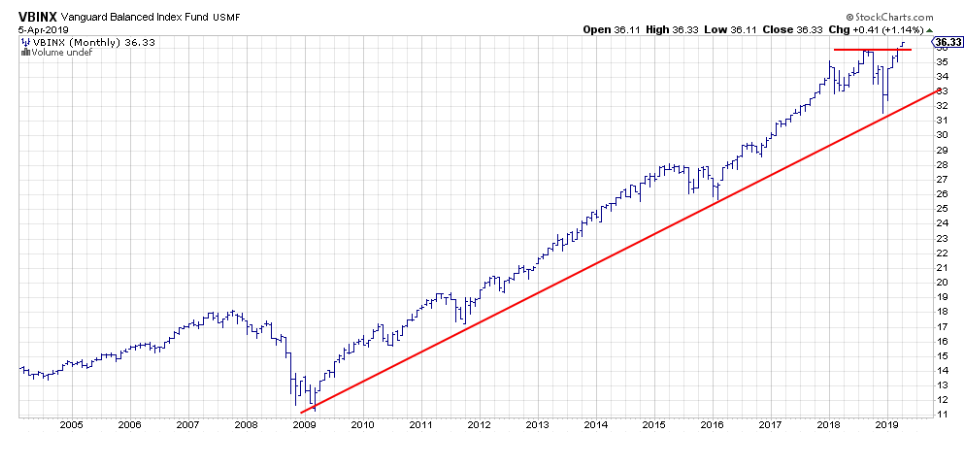

2.60/40 Portfolio Breaks to New Highs.

3.81% of Emerging Market Countries 50 day thru 200 day to Upside.

Global Equities – Gold Cross Breadth: This chart is one of my favorites, it shows the breadth of golden crosses (50-day moving average tracking above the 200-day) across countries. Of the 70 countries we monitor, 64% (or 45) have seen a golden cross. Out of interest, 81% of EM countries have seen a golden cross (vs 72% for DM) – on this indicator EM was the first to collapse, and importantly – the first to recover. (source)

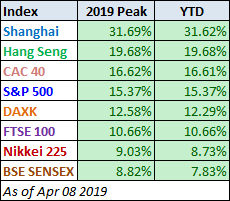

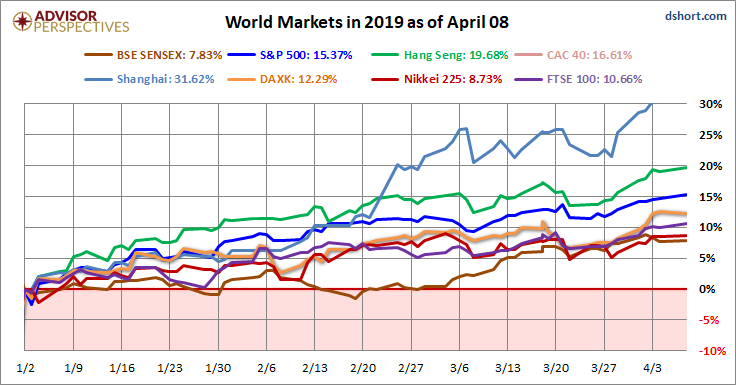

4.World Markets Update

by Jill Mislinski, 4/8/19

All eight indexes on our world watch list posted gains through April 8, 2019. The top performer is the Shanghai SSE with a 61.62% gain and in second is Hong Kong’s Hang Seng with a gain of 19.68%. In third is France’s CAC 40 with a gain of 16.61%. Coming in last is Tokyo’s Nikkei 225 with a gain of 7.83%.

Here are all eight world indexes in 2019 and the associated table sorted by YTD.

https://www.advisorperspectives.com/dshort/updates/2019/04/08/world-markets-update

5.Euro Currency Sinking and Stock Market Approaching 2015 Highs

Euro currency sinking ..helping exports?

Stoxx 600 Watch for Breakout.

Could This Be Third Time Lucky for European Bulls?: Taking Stock

By Michael Msika and Jan-Patrick Barnert

https://www.bloomberg.com/news/articles/2019-04-09/could-this-be-third-time-lucky-for-forever-bulls-taking-stock-ju9e8dko?srnd=premium

6.When Wages and Unemployment Converge?

Goldilocks?

Friday’s report was generally cheered as Goldilocks—not too hot, not too cold. But digging into the details yields some concerns worth noting. The number of jobs gained or lost each month comes from the payroll survey; while the unemployment rate comes from the household survey. Payroll gains averaged 180k per month in the first quarter, which is lower than last year’s average of 223k. Household employment actually fell by 197k in the first quarter, 48k of which was in the prime working age (25-54) category. That category has seen employment losses in four of the past five months. In addition, temporary employment, which is a leading indicator of job growth, fell by 5k.

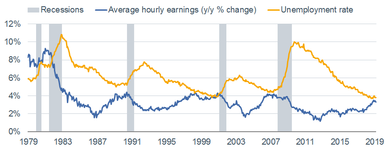

It’s too soon to judge whether the weaker month-over-month and year-over-year AHE gain is a sign of a top in wage growth, but the convergence between the unemployment rate and AHE is worth watching as a recession indicator. As you can see in the chart below, historically once wage growth rolled over and the unemployment rate began to elevate, a recession was either underway or imminent.

Wages & Unemployment Converging

Source: Charles Schwab, Department of Labor, FactSet, as of March 31, 2019. Average hourly earnings for production and nonsupervisory workers.

There had been high hopes for higher wage growth. The widely-watched monthly small business survey from the National Federation of Independent Business (NFIB) has as one of its survey questions whether member companies are planning to raise worker compensation. This percentage has historically led AHE changes by about two years, as you can see in the chart below (the NFIB line is advanced two years). Until the latest release, the surge in the percentage of small businesses planning to raise worker compensation in the next three months—from a recession low of 0% to the recent high of 25%—pointed to higher wage gains to come. The latest down move down to 18% will be troublesome if it persists; but a rebound would provide hope for higher wage gains to come.

Did the Jobs Report Give You a Peaceful Easy Feeling?

7.Estate planning: 6 steps to ensure your family is financially ready for when you die

Tamara E. Holmes, Special to USA TODAYPublished 5:00 a.m. ET April 1, 2019

On Monday, a Minnesota judge overseeing the legal proceedings in regards to Prince’s estate said there will be no fast decisions on who should be allowed to inherit from the late star. USA TODAY

When Vivian Young and her then-husband took their first vacation without the kids, the need for estate planning struck them like a jolt.

“I started thinking about worst-case scenarios,” says Young, now 64, of Los Angeles.

Worried about who would take care of the children if something were to happen to them, they found an attorney who quickly drew up a will.

Over the years, Young’s estate plan evolved when her life changed, such as when she divorced and when her children turned 18. Putting off planning can be tempting, she admits, “but there are consequences.”

More than half of Americans will learn those consequences first hand, as only 42 percent have a will or other estate planning documents, according to a 2017 Caring.com study. Among parents of children under 18, only 36 percent have created a will.

But if you die without a will, your state’s laws will determine what happens to your property or who should be legally responsible for minor children. That might be OK in some situations, but in others, a grandchild with special needs might not get the resources you want him to have, or an estranged family member might get possession of your house.

High at work: As nation struggles with opioid, workers bring addiction to the job

Lyft goes public: Here are 5 things to know about ride-hailing company’s IPO

“What people get wrong is thinking that if they don’t do anything, things will work out,” says John Terrill II, incoming president of the American College of Trust and Estate Counsel, an organization of estate planning attorneys.

Since we don’t know when we will die, it’s never too early to start coming up with a plan.

Here is what you should consider:

Start with a will

A will is a document that designates who should get your money and possessions, as well as who would become a guardian to your minor children if both parents die.

“Each state has its own unique estate planning laws, and those laws can change each year,” says Dave Hanley, CEO of Tomorrow, a Seattle-based company that developed the Tomorrow app, which lets consumers create wills for free. Websites such as LegalZoom and Rocket Lawyer also walk you through the process if you want to do it yourself. But make sure any will you create meets your state’s legal requirements.

Joy Loverde and David Schultz in Sedona, Arizona. (Photo: www.elderindustry.com)

Think beyond death

When Joy Loverde, 67, and David Schultz, 74, of Chicago married in 1999, they realized that they had like-minded philosophies about money. However, Loverde, who writes about elder issues in her book, “Who Will Take Care of Me When I’m Old,” found that people often overlooked planning for hardships that can occur while they were still alive.

“One of the things that I brought to the table early on is this idea about protecting each other in the event of incapacity more so than in the event of death,” she says.

A living will is a legal document that states what medical procedures you want or don’t want if you are incapacitated and can’t speak for yourself. This would be the go-to document if the question ever arises about whether to continue life-sustaining treatment. Durable powers of attorney are legal documents that let someone you appoint make legal, financial and health care decisions for you if you can’t do it.

Consider establishing a trust

Some may benefit from establishing a trust, a legal entity that holds any property that you want to leave to your beneficiaries. With a trust, your family won’t have to go through the legal process of probate, where the court ensures that your assets are distributed and your debts are paid. Trusts also allow you to set up rules for how and when property is distributed. If you do this, you’ll need to identify a trustee who will manage the trust.

Communicate your wishes

It’s important to let people know when you’ve designated them a trustee or a guardian, says S. Mark Alton, president of the National Association of Estate Planners & Councils. “We don’t often communicate with the trustees and/or the trust protectors, and say, ‘This is going to be your role. You’re going to be a surrogate for me.’”

Review your beneficiary choices

If you have investment accounts and retirement plans such as a 401(k), make sure the person you have listed as the beneficiary is the person you want to receive those funds. Even if your will says otherwise, the beneficiaries listed on the account will inherit the money. Your plan will likely change as your life evolves.

“You have marriages and divorces. You have births and deaths,” says Alton. “You have to change beneficiary designations at those times.”

Seek professional help

Estate planning can cost hundreds or even thousands of dollars depending upon how complex your affairs are, says Terrill. However, if your affairs are complicated, seek help.

When Shultz and Loverde married, he had two grown children and she had one. Like many blended families, their needs were complex.

“I was an attorney myself but didn’t handle that kind of legal situation, so knowing what you know and knowing what you don’t know is pretty important,” Schultz says.

Not only do estate planners help you ensure that your wishes are met, they can also help you figure out how to allocate your assets in a way that is most tax-advantageous, adds Terrill.

End-of-life planning isn’t something that we typically look forward to, but it’s a necessary action if you want to have full control over your life and your assets.

“We have to move toward more intentional and more purposeful planning,” Alton says.

Aretha Franklin is reportedly one of the latest celebrities to die without a will. But what happens to your money and assets without one? Buzz60’s Natasha Abellard has the story. Buzz60

Found at Barry Ritholtz Blog

https://ritholtz.com/2019/04/10-sunday-reads-145/

8.5 Simple Fixes for an Afternoon Slump at Work

What to do when your energy and focus take a nosedive after lunch.

You know the feeling: It’s 2 p.m. at the office, and you have a ton of work to finish up before heading home. But the only thing you really feel like doing is curling up in a quiet corner and falling asleep. This afternoon drop in energy and focus can lead to careless mistakes and lost productivity at work. If your energy level is falling off a cliff every afternoon, here’s how to pick it up again.

Work with your body’s natural rhythms

The urge to sleep naturally waxes and wanes at certain times of day. According to the National Sleep Foundation, it’s generally strongest between 2 and 4 a.m., which is convenient for most people, and between 1 and 3 p.m., which is decidedly not.

To the extent that you can, schedule your work activities around your natural highs and lows in alertness. People typically experience a peak in alertnessaround 8 to 9 a.m., so that’s often an excellent time to tackle the most cognitively demanding and detail-oriented tasks. If you save such tasks for the early afternoon, be aware that you may not be operating at 100% efficiency.

Eat a good lunch, including some healthy fat

Avoid loading up on refined carbs and sugar. They can cause a sudden spike in blood sugar that gives you a quick pick-me-up, followed shortly by a crash that leaves you tired and hungry. To stay energized and feeling full for longer, build your lunch around high-quality protein combined with fiber-rich whole grains, vegetables, and fruits. Include some healthy, unsaturated fat.

In one study, overweight adults were randomly assigned to eat lunches containing either almonds or extra refined carbs (such as white bread) for three months. The meals contained the same number of calories, but the almond-enriched lunches provided more fiber and “good” fat. In both groups, memory test scores dropped about a half hour after eating. But the decline was lessened in the almond group, likely thanks to the mix of lower carbs, higher fiber, and healthy fat.

Pay attention to your calorie intake as well. Research has confirmed what anyone who ever supersized a meal already knew: Drowsiness is a bigger problem after a heavy meal than a light one.

Grab a nap, if you can—but keep it short

If you’re struggling to keep your eyes open, taking a nap seems like the obvious solution. Indeed, research has shown that a short nap can reduce drowsiness and may help combat an afternoon slump in certain cognitiveabilities. For example, one study showed that nappers experienced less decline in cognitive flexibility—the ability to switch their thinking quickly from one thing to another—compared to those who didn’t nap.

The ideal length for a workplace nap is 20 minutes or less. Longer naps can cause sleep inertia—a sense of grogginess that may linger for several minutes after awakening. If your boss objects to snoozing on the clock, point out that a growing number of companies—such as Nike, Google, and Ben & Jerry’s—have already adopted nap-friendly policies.

Stand up and move around for a few minutes

Walk down the hall, up and down the stairs, or around the block. Do some jumping jacks or wall pushups. Use a jump rope or set of hand weights that you keep stashed in your desk. Run through a yoga or tai chi sequence. Doing something physically active is a great way to revive flagging energy and engagement.

If you can step outside and stroll among trees and flowers, your focus and mood may get an added lift. But even if you simply stroll among the cubicles, research shows that moving around may help you feel less bored and sluggish.

article continues after advertisement

Wake up your brain with bright light

Exposure to bright light gives your sleepy brain a wake-up call. In one study, participants wore special glasses, which emitted either bright blue light or dim orange light, for 30 minutes after lunch. The results showed that the early-afternoon dip in cognitive flexibility was diminished in the group wearing bright-light glasses.

Typical office lighting is around 500 lux (a unit of illumination). The bright-light glasses used in the study were four times brighter (2,000 lux), and many light therapy boxes are 20 times brighter (10,000 lux). If you’re thinking about trying a bright-light device, ask your health care provider for guidance on how to safely maximize the benefits.

Of course, you could also simply pop outside to enjoy the sunshine on your break. The change of scenery, especially if it offers a glimpse of nature, may give your brain the extra boost it needs to power through the rest of your day.