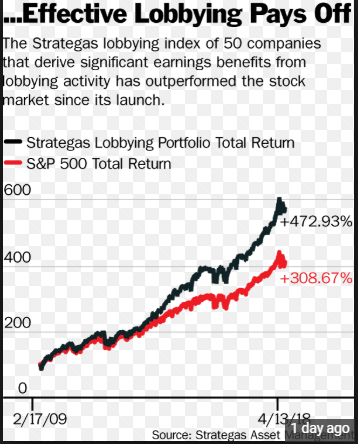

1.Corporate Lobbying is Big Business and It Shows Up in Returns.

About 10 years ago, Strategas devised a “lobbying” index of companies that get the most bang for their lobbying buck, including interactions with regulators. The index, it says, has outperformed the Standard & Poor’s 500 for nearly a decade by an average of almost five percentage points annually. The lobbying index returned an average 14.4% annually from its 2009 launch through April 13, versus 9.5% for the S&P 500. About $1 billion of assets are pegged to the performance of the Strategas index.

https://www.barrons.com/articles/lobbying-index-beats-the-market-1524863200

https://www.barrons.com/articles/lobbying-index-beats-the-market-1524863200

2.Rising Rates and Bank Stocks….KRE Bank Index +6% vs. S&P Negative YTD.

KRE VS. S&P Chart YTD

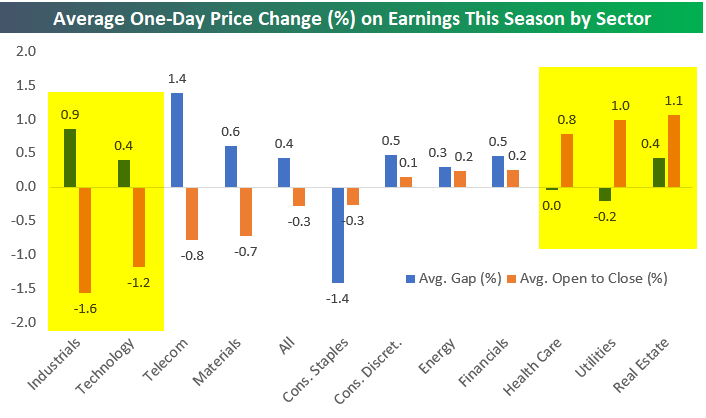

3.Earnings…Traders Unload Tech, Industrials…Buy Health Care, Utes, and REITs

Below we show how much the average stock that has reported earnings this season has gapped up or down at the open by sector. We also show how much the average stock that has reported has moved from the open to the close of trading.

For all stocks that have reported earnings this season, the average move has been a gap up of 0.40% at the open followed by decline of 0.30% from the open to the close. This means investors are initially bidding shares up on earnings before sellers come in during the trading day.

A few sectors stand out. First off, both Industrials and Technology have seen shares bid up at the open on earnings optimism, but they’ve sold off hard throughout the trading day. The average Industrial stock has gapped up 0.90% at the open following earnings only to sell off 1.60% from the open to the close. For Tech stocks that have reported, they have averaged a gap up of 0.40% and then an open to close decline of 1.20%. For these two sectors, positive earnings news appears to have already been priced in.

Other sectors have seen their stock prices do well this earnings season. Consumer Discretionary, Energy, and Financials have all seen initial gaps higher and continued buying throughout the trading day. Health Care, Utilities, and Real Estate (REITs) have seen a wave of buyers come in during regular trading hours. Utilities and Real Estate stocks that have reported have averaged gains of more than 1% from the open to the close. We don’t view shifts out of Tech and Industrials and into Utilities and Real Estate as a very bullish signal.

https://www.bespokepremium.com/think-big-blog/

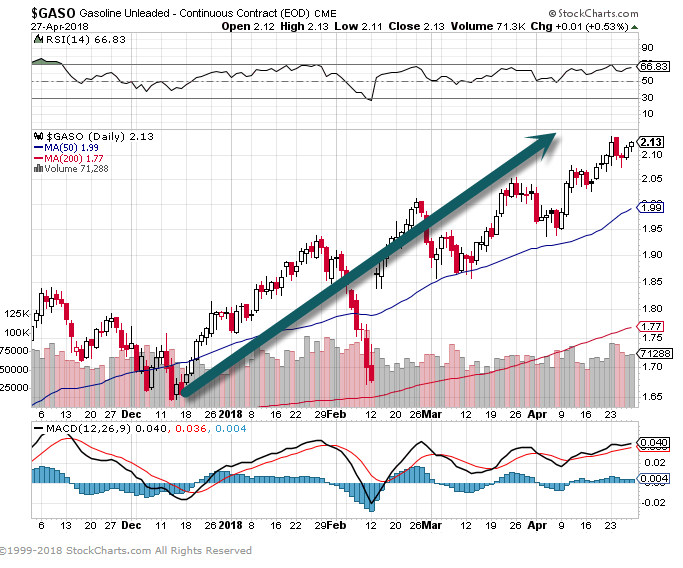

4.Hedge Fund Make Record Bet on Rising Gas Prices Heading into Summer Driving Season…

Unleaded Gas Chart

Hedge Funds Throw Record Bets on Rising Gasoline Prices

Jessica Summers

- Futures for the motor fuel are at their highest since August

- S. gasoline demand hit the highest level ever this month

Money managers are going all in on gasoline.

Hedge funds boosted bets on rising gasoline prices to the highest on record. That’s as futures for the motor fuel jumped to the highest since August amid robust demand and inventories hovering near their lowest since January.

“We are heading into the driving season and the market has tightened rather nicely,” said Michael Lynch, president of Strategic Energy & Economic Research in Winchester, Massachusetts. “People are gambling that the strong economy will yield a very strong driving season and that may stress out the refining sector.”

Global demand proves solid, with Goldman Sachs Group Inc. saying oil’s rally to three-year highs will spur fuel demand as reserves of Middle East petrodollars are reinvested overseas and stimulate the global economy. Gasoline products supplied, a measure of demand, hit a record-high earlier this month, according to U.S. government data.

Money managers increased their net-long position on benchmark U.S. gasoline by 14 percent to 111,397 futures and options, during the week ended April 24, according to the U.S. Commodity Futures Trading Commission. That’s the highest on record in data going back to 2006. Longs climbed 14 percent, while shorts jumped 30 percent.

U.S. crude exports jumped above 2 million barrels a day to a record high last week and gasoline exports also climbed, according to Energy Information Administration data.

Demand Narrative“There is a compelling demand narrative,” said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund. The jump in crude exports to above 2 million barrels a day “is notable.”

As for crude prices, West Texas Intermediate oil is sitting just above $68 a barrel as geopolitical tensions swirl, with focus on whether U.S. President Donald Trump will impose sanctions on Iran come May 12, which could limit the producer’s output and boost crude prices.

Hedge funds reduced their WTI net-long position — the difference between bets on a price increase and wagers on a drop — by 2.1 percent to 433,118 futures and options. Longs fell 1.5 percent and shorts increased 7.2 percent.“The fact that you would see some consolidation in the long positions makes sense,” said Tamar Essner, an analyst at Nasdaq Inc. in New York. “But the fact that you didn’t see too much also makes sense, as no one wants to be short going into the May 12 deadline on Iran.”

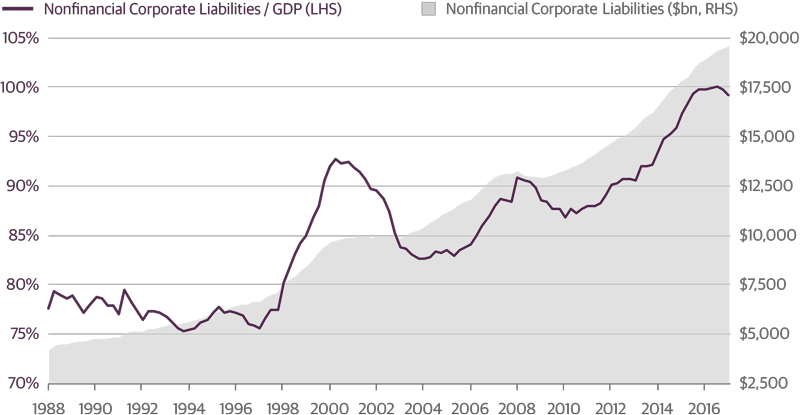

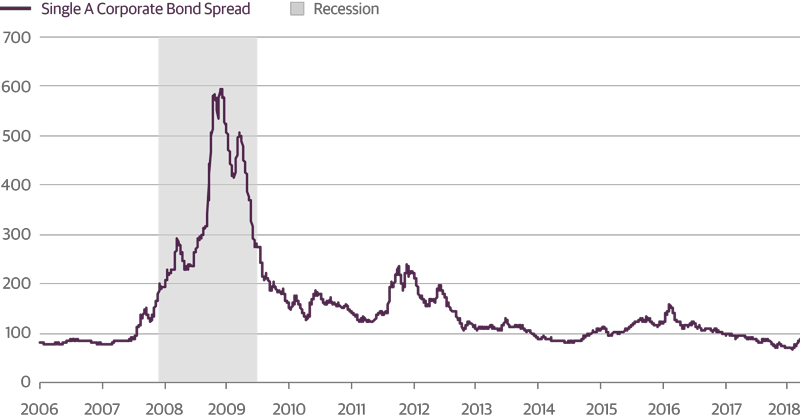

5.Corporate Bonds Will Be Ground Zero of Next Recession.

Guggenheim.We will enter the next recession with the highest debt load on record for corporate balance sheets. In the last recession, consumption by households collapsed because their balance sheets were overburdened by debt, and it was the household sector that led us into the recession. This time around, the household sector is in good shape. The next recession is going to emanate from the corporate sector. There is likely to be a sharp decline in employment and a sharp decline in profitability, followed by widening credit spreads as the market discounts the expectation of higher corporate defaults.

Record Debt Levels Will Make Corporate Bonds Ground Zero in the Next Recession

U.S. Nonfinancial Corporate Liabilities in $ bn and as % of GDP

Source: Haver Analytics, Guggenheim Investments. Data as of 12.31.2017

Little Potential for Corporate Spreads to Tighten from Here

Single A-rated corporate bonds vs Treasurys (bps)

Source: Bloomberg Barclays, Guggenheim. Data as of 3.16.2018.

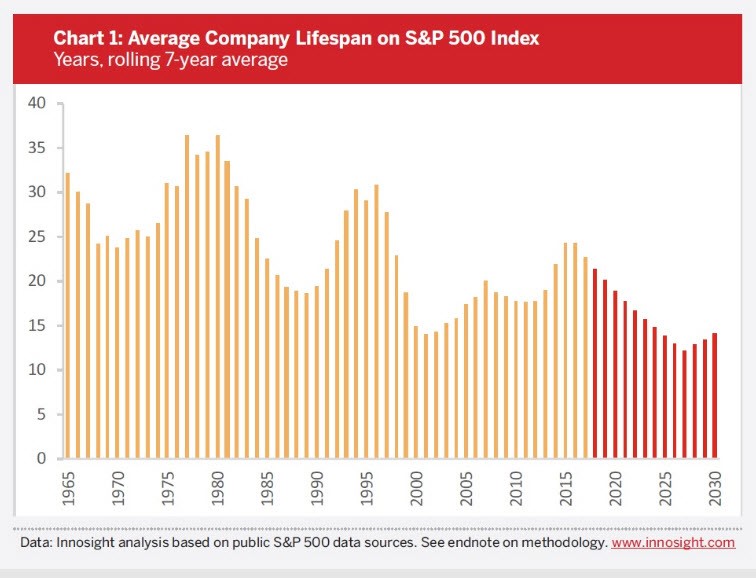

6.Over 50% of Today’s S&P Could Be Replaced Over the Next Decade.

Portfolio Management Perspective: The Pace of Creative Destruction is Accelerating

Does it seem like the pace of change seems to be accelerating as time goes on? Well, indeed it is when it comes to the average company lifespan in the S&P 500 Index (Source Innosight).

Imagine a world in which the average company lasted just 12 years on the S&P 500. That’s the reality we could be living in by 2027, according to Innosight’s biennial corporate longevity forecast.

There are a variety of reasons why companies drop off the list. They can be overtaken by a faster growing company and fall below the market cap size threshold (currently that cutoff is about $6 billion). Or they can enter into a merger, acquisition or buyout deal. At the current and forecasted turnover rate, the Innosight study shows that nearly 50% of the current S&P 500 will be replaced over the next ten years. This projection is consistent with our previous analysis from 2012 and 2016, which Innosight originally conducted with Creative Destruction author Richard Foster.

Over the past five years alone, the companies that have been displaced from the S&P list include many iconic corporations (Table 1).

By tracking all the additions and deletions from the S&P 500 over the past half century, our study shows that lifespans of companies tend to fluctuate in cycles that often mirror the state of the economy and reflect disruption from technologies, ranging from biotech breakthroughs to social media to cloud computing. Over time, the larger trendline is for average longevity to continue to slope downward.

Nasdaq Dorsey Wright.

https://oxlive.dorseywright.com/help/contact?

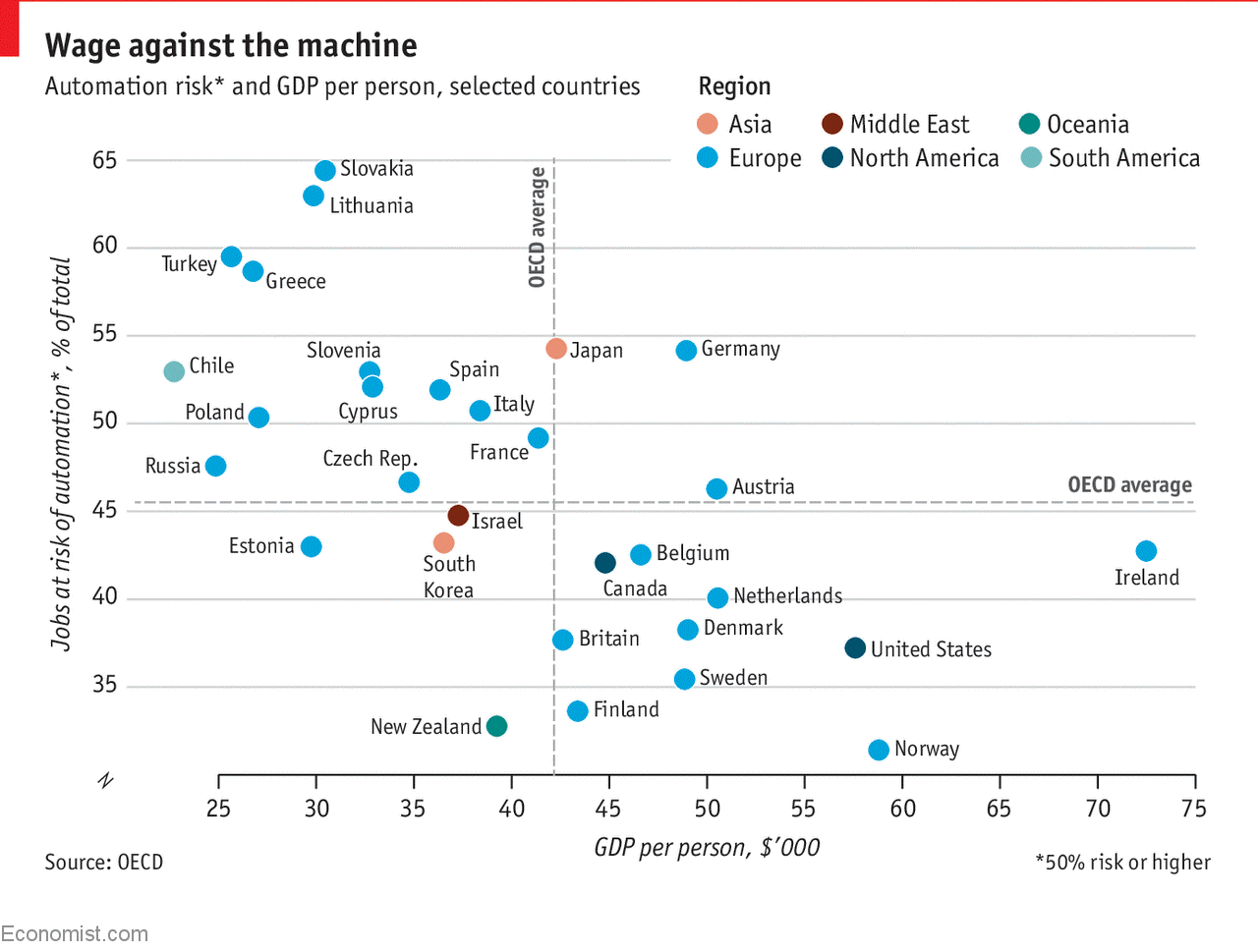

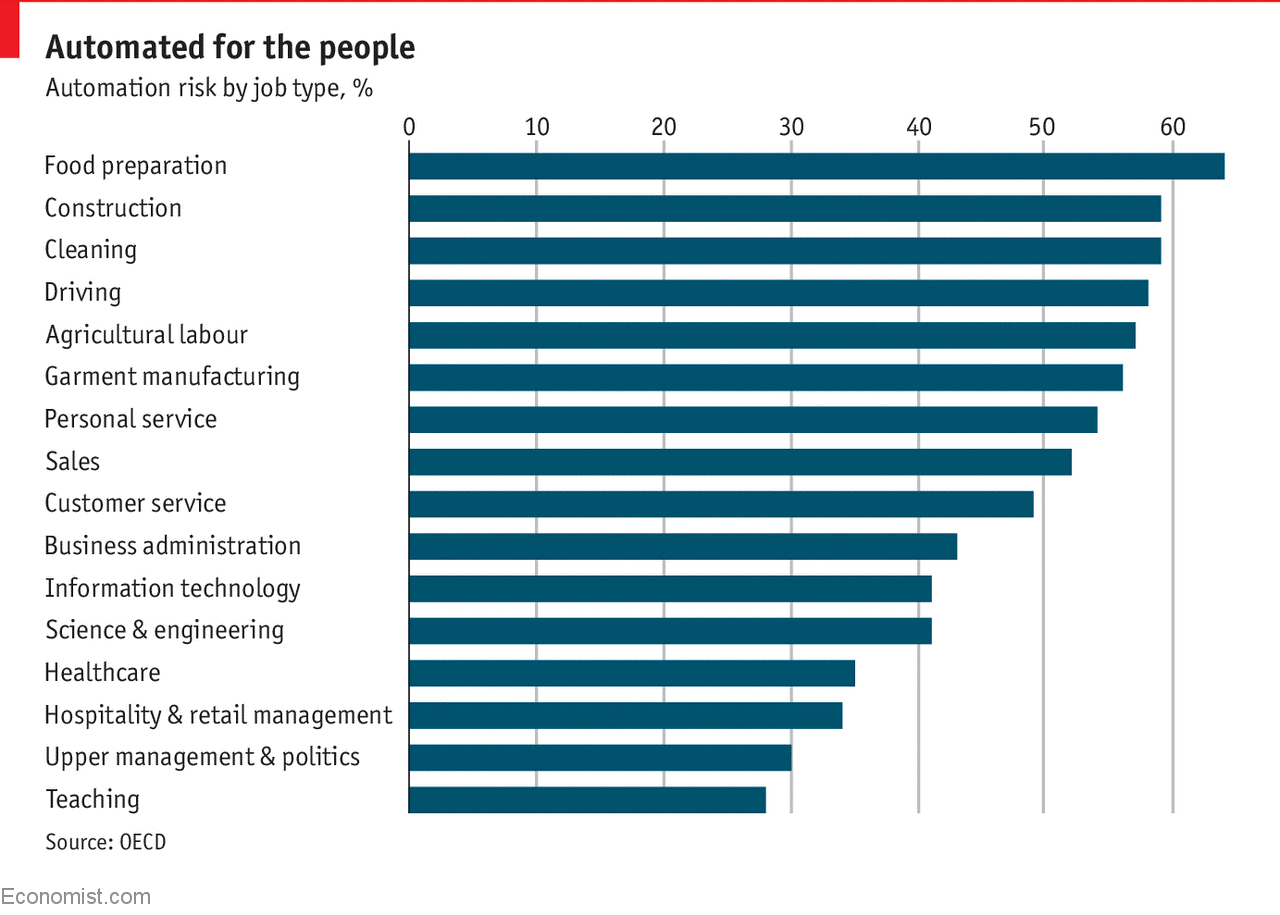

7.My Opinion-Technology has been Changing the American Workforce for 2 Centuries and Here We Sit at 4% Unemployment—We Will Survive.

A study finds nearly half of jobs are vulnerable to automation

That could free people to pursue more interesting careers

A WAVE of automation anxiety has hit the West. Just try typing “Will machines…” into Google. An algorithm offers to complete the sentence with differing degrees of disquiet: “…take my job?”; “…take all jobs?”; “…replace humans?”; “…take over the world?”

Job-grabbing robots are no longer science fiction. In 2013 Carl Benedikt Frey and Michael Osborne of Oxford University used—what else?—a machine-learning algorithm to assess how easily 702 different kinds of job in America could be automated. They concluded that fully 47% could be done by machines “over the next decade or two”.

A new working paper by the OECD, a club of mostly rich countries, employs a similar approach, looking at other developed economies. Its technique differs from Mr Frey and Mr Osborne’s study by assessing the automatability of each task within a given job, based on a survey of skills in 2015. Overall, the study finds that 14% of jobs across 32 countries are highly vulnerable, defined as having at least a 70% chance of automation. A further 32% were slightly less imperilled, with a probability between 50% and 70%. At current employment rates, that puts 210m jobs at risk across the 32 countries in the study.

The pain will not be shared evenly. The study finds large variation across countries: jobs in Slovakia are twice as vulnerable as those in Norway. In general, workers in rich countries appear less at risk than those in middle-income ones. But wide gaps exist even between countries of similar wealth.

Differences in organisational structure and industry mix both play a role, but the former matters more. In South Korea, for example, 30% of jobs are in manufacturing, compared with 22% in Canada. Nonetheless, on average, Korean jobs are harder to automate than Canadian ones are. This may be because Korean employers have found better ways to combine, in the same job, and without reducing productivity, both routine tasks and social and creative ones, which computers or robots cannot do. A gloomier explanation would be “survivor bias”: the jobs that remain in Korea appear harder to automate only because Korean firms have already handed most of the easily automatable jobs to machines.

https://www.economist.com/blogs/graphicdetail/2018/04/daily-chart-15

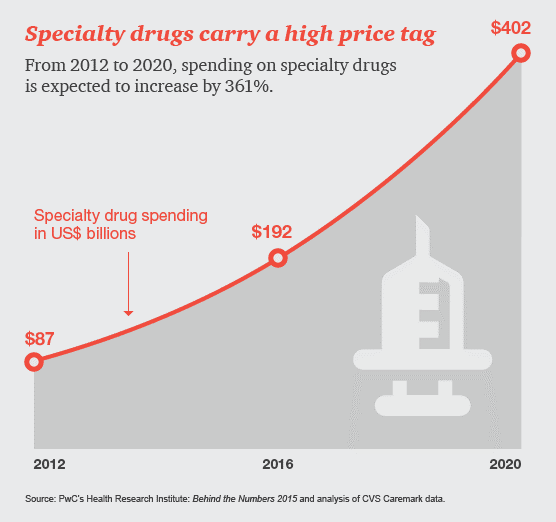

8.Specialty Drugs are 1% of Prescribed Drugs But Compromise 32% of Drug Spending.

Biologics are a large portion of spending.

What is a biologic drug (biologics)?

- A biologic drug (biologics) is a product that is produced from living organisms or contain components of living organisms.

- Biologic drugs include a wide variety of products derived from human, animal, or microorganisms by using biotechnology.

- Types of biologic drugs include vaccines, blood, blood components, cells, allergens, genes, tissues, and recombinant proteins.

- Biologic products may contain proteins that control the action of other proteins and cellular processes, genes that control production of vital proteins, modified human hormones, or cells that produce substances that suppress or activate components of the immune system.

- Biologic drugs are sometimes referred to as biologic response modifiers because they change the manner of operation of natural biologic intracellular and cellular actions.

9.Read of the Day..AI that detects cardiac arrests during emergency calls will be tested across Europe this summer

The software listens in to calls and helps emergency dispatchers make judgements

By James Vincent@jjvincent Apr 25, 2018, 10:06am EDT

ShareAI that detects cardiac arrests during emergency calls will be tested across Europe this summer

share tweet Linkedin Reddit Pocket Flipboard Email

Illustration by James Bareham / The Verge

A startup that uses artificial intelligence to help emergency dispatchers identify signs of cardiac arrest over the phone will begin testing its software across Europe this summer.

Danish firm Corti says its algorithms can recognize out-of-hospital cardiac arrests (those that occur in the home or public) more quickly and accurately than humans. The software has already been deployed in Copenhagen, but this year, it will start four new pilots in as-yet-unnamed European cities in partnership with the European Emergency Number Association (EENA).

Quick recognition of cardiac arrests is vital, as every minute that passes without treatment reduces an individual’s chances of survival by 7 to 10 percent. Corti’s software works by listening in during emergency calls and looking out for a number of “verbal and non-verbal patterns of communication.” These include cues like a caller’s tone of voice and whether or not the subject is breathing.

Corti’s software acts like a personal assistant for the dispatcher during the call, prompting them to ask the caller certain questions and then making a recommendation as to whether or not it thinks the individual is suffering a cardiac arrest. The dispatcher can then summon an ambulance or give instructions for administering CPR. You can watch a demo of the system in action below.

(A quick aside: although the two terms are often used interchangeably, a heart attack is not the same as a cardiac arrest. A cardiac arrest is an electrical fault that causes the heart to stop beating, while a heart attack happens when a blocked artery limits the circulation of blood around the body.)

Corti’s software has performed impressively in the company’s own tests. In one study on a database of 161,650 historical emergency calls, the startup’s software identified 93.1 percent of out-of-hospital cardiac arrests (or OHCAs) compared to 72.9 percent recognized by the actual human dispatchers. It was also quicker, spotting signs of a cardiac arrest in 48 seconds on average, compared to 79 seconds for humans. Similar figures were reported during ongoing tests in Copenhagen.

Despite this success, there are still some unanswered questions about the software and its integration into emergency medical services. For example, Corti has yet to publish its study of the 161,650 calls in full, meaning that certain key figures (like the software’s false positive rate or the number of times it incorrectly identifies cardiac arrests) are still unknown. Speaking to The Verge, Corti’s CTO Lars Maaløe said these statistics were being processed, but that the rate was “comparable to that of humans.”

Corti seems to outperform humans, but some questions remain

It also might worry medical professionals that Corti’s software cannot explain how it makes its decisions. Like a lot of machine learning software, Corti’s algorithms learn by combing vast datasets, looking for the patterns that match certain outcomes (in this case, whether or not someone is having a cardiac arrest). But, explaining what patterns it spots and how it weights them is not part of the software’s design. Maaløe tells The Verge that Corti’s team knows that certain words “have a higher impact on the final output than others,” but he says this analysis is necessarily “imprecise.”

Corti is confident that its software makes the right decisions, and its tests seem to bear that judgment out. But it’s possible that the AI will miss certain nuances or make bad judgments when faced with unfamiliar situations. Maaløe gives the example of someone calling to a report that a loved one is suffering a cardiac arrest. He says that in these cases, the callers tend to be more confident that the person is breathing because they want it to be true. Can AI pick up on these sorts of human subtleties? It’s for that reason that Corti’s software doesn’t make the decision itself; it only offers guidance to a trained dispatcher.

These problems aren’t specific to Corti, though. They’re a challenge for the whole health care community. As diagnostic AI takes on a bigger role, medical practitioners and the general public will have to decide what they think is a reasonable level of transparency to demand from such algorithms. To what degree will we be willing to just trust a machine?

In the meantime, Corti is going to be listening in to more emergency calls around Europe this year. It’ll be learning — and hopefully saving lives, too.

https://www.theverge.com/2018/4/25/17278994/ai-cardiac-arrest-corti-emergency-call-response

10. Focus On One Thing At A Time: Here’s Why.

Tim Denning

The problem you have, above all, is you’re trying to do too much all at once.

I should no because I have a cluster bomb of goals I’m trying to achieve right now. What ends up happening is you achieve nothing. You go to narrow and so wide that nothing gets done. Nothing gets traction. Then you get pissed off and give up.

Giving up is not the answer. Focusing on one thing is.

I’d love to be the worlds best blogger, speaker, author and lover all at once. It’s not going to happen like that. That’s not how the game of life works.

Here’s why you should focus on one thing at a time:

Your memory sucks.

We now have so much information to store in our mind that we end up forgetting most things whether we want to admit that or not. Focusing on one thing frees up space in your mind to store all the knowledge associated with your one goal.

Get used to ignoring information that you don’t feel is needed. I do this all the time. When I check emails, most of them are deleted before they are even read. If an email is not aligned with my two-line purpose or my current goal, then it’s gone. Never to be seen again.

What you want to do instead is use the virtual memory in your mind to do the same habits associated with your goal over and over. This carves a deep path in your mind for the tasks and habits you need to be awesome at to hit your current goal.

Go for one big goal.

Instead of having lots of small goals that are mostly meaningless, go for the big goals. Try knocking off one every few months or even one a year if you have to. My current goal is to pivot my career in a new direction. Then straight after that, I’m going to knock off some big speeches to up my public speaking game. Other than those two items, that’s about it.

Nice and easy to remember. This strategy puts large amounts of focus on only one or two goals meaning you get results faster. I find that as I gain momentum and see results quickly, my one big goal doesn’t require motivation. Your results should become your motivation and that requires all your energy and focus.

I had another big goal this year to sort out my love life. People laughed at how crazy and deep I went on this goal. Within five months and after more than fifty dates, I got my goal. There’s a lot that you can get from focusing on one big goal. Try it for yourself.

Keeps fear from destroying your action.

Fear is a constant battle – even for me. Having too many goals means that you’ll get a small slice of fear with each one. Once you add up all of that fear, you can easily become crippled by it. By focusing on one big goal, you only have one slice of fear to deal with.

For me, changing career and nailing public speaking at the same time is just too much fear. It’s way easier to tackle one at a time. You can’t just block fear out and pretend it doesn’t exist. You have to work through the fear that comes with your goals and this requires smaller doses.

Your conversations become simpler.

We all get asked to join 101 meetings and do lots of coffee catch ups. These two things already annoy me enough. What having one goal has done for me is make my conversations simpler. If someone wants to talk about something, if it doesn’t align with my current big goal, I decline.

I explain that I’m working towards one big goal and anything that’s not part of that goal is on hold for the moment. By saying it in this manner, you avoid sounding like a smart ass and your no is delivered in a respectful way.

To-Do lists become a thing of the past.

These problematic lists become near irrelevant because when you have one big goal, you don’t have as many tasks to manage. Right now, when I wake up, I work on my career goal and then get to work. I don’t need a to-do list because there’s only one goal to think about.

Deep thinking sessions deliver more value.

I tell everybody to spend a bit of time every day doing some deep thinking. When you have too many goals, these sessions are wasted. By having one big goal, I’ve been able to use my deep thinking time to really reflect on what it’s going to take to achieve my goal.

The progress I get from these deep thinking sessions has tripled. I’m no longer trying to fix all of the world’s problems every time I go into deep thinking. I’ve found that I’m becoming much better at solving my own problems because I can deeply think about what’s standing in my way.

Answers are much less challenging to find.

My mind has become a beacon for the information I need to achieve my one big goal. When you have lots of goals, all the information you consume get’s lost. Having one big goal makes your mind focused on what bits of knowledge you need.

“All the answers you seek have already been presented to you in one form or another. The problem is that you can’t hear the answers because there are too many goals which have created a lack of focus for your very busy mind”

For example, my public speaking goal is something I always thought would be near impossible to solve. As I practice my habit of listening to podcasts, I’ve found that all the good tips for crushing fear when it comes to public speaking have been there all along.

People like Tim Ferriss and Gary Vee have been sharing the wisdom needed for good public speaking for a long time. The problem was I had too many goals, so I didn’t hear their golden nuggets of advice. With more focus, I do not only hear their tips, I’m meditating and doing deep thinking on their ideas.

You can’t be known for everything.

Ever been to someone’s LinkedIn page and it says something like this:

“Kimbo is an entrepreneur, blogger, speaker, coach, finance professional, investor, advisor, avid reader, professional hockey player and lover of cars.”

I mean you can’t be known for all of that. When all of us see profiles of people like this, we end up switching off. Focus on being a world-class blogger, or an accomplished author.

“There’s no point trying to be A-grade at everything because you never will be, and your personal message will get lost”

Simple is always better.

Whether it’s your goals, fitness routine, business, etc, simpler is always better.Simpler equals focus. Focus equals power. Power equals energy and motivation towards your one big goal that will make you unstoppable.

Stop trying to do so much because you’re not fooling anyone, least of all yourself. Chunk things down, go for simple and be incredible at fewer goals.

You can be a standout person when you go for one big goal rather than a huge lists of goals that never get actioned.

What do you really want more than anything? That’s your big goal.

Now go execute on your goal.

https://addicted2success.com/motivation/focus-on-one-thing-at-a-time-heres-why/