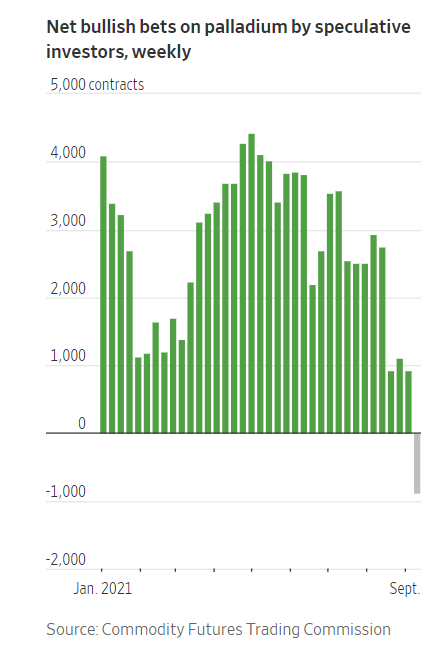

1. Hedge Funds Take Off Bullish Bets on Palladium.

WSJ By Hardika Singh “If you can’t get chips to build the car, you don’t need as much palladium for the time being,” said Bob Haberkorn, senior market strategist at RJO Futures.

Price declines in the relatively small, volatile markets for palladium and platinum are being driven by an acute shortage of semiconductor chips, commonly used in cars for everything from engines to touch-screen displays. The shortage has dented global vehicle demand and production. Global auto makers in recent weeks have warned the chip shortage will extend production slowdowns.

https://www.wsj.com/articles/palladium-prices-hit-by-car-production-slowdown-11632348053?mod=itp_wsj&ru=yahoo

PALL—3 Lower highs over on chart…..still above 200 day

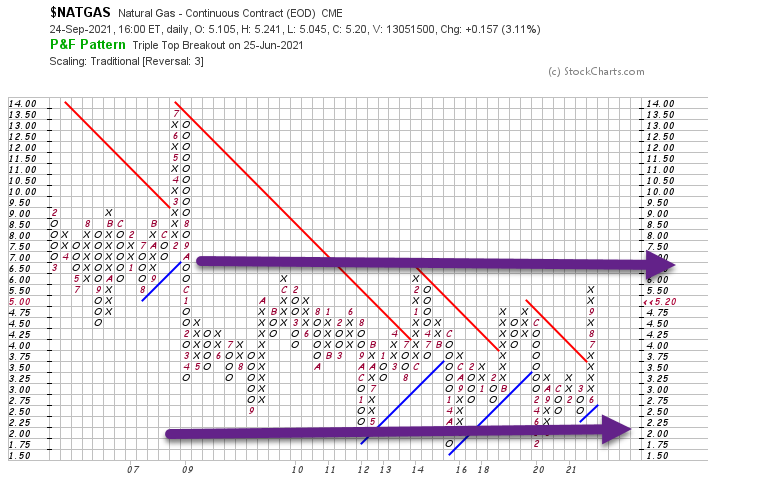

2. Lots of Talk About Hight Natural Gas Prices.

Natural Gas Sideways for 14 Years

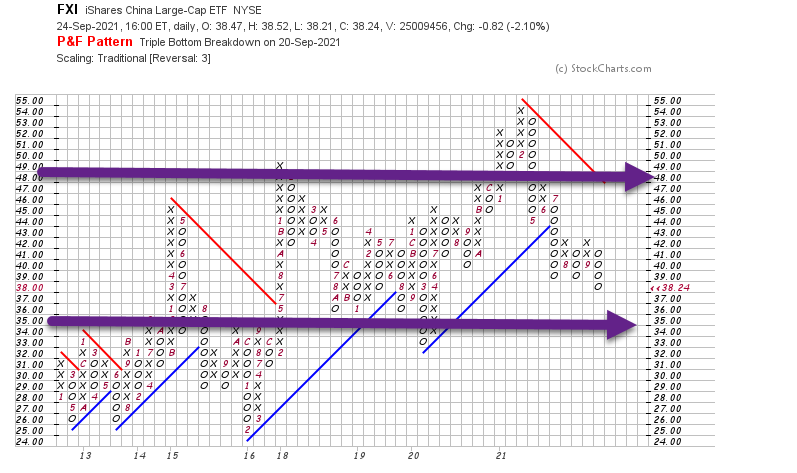

3. Large Cap China ETF FXI Sideways for a Decade

FXI China Large Cap ETF in a 10 year range bound chart

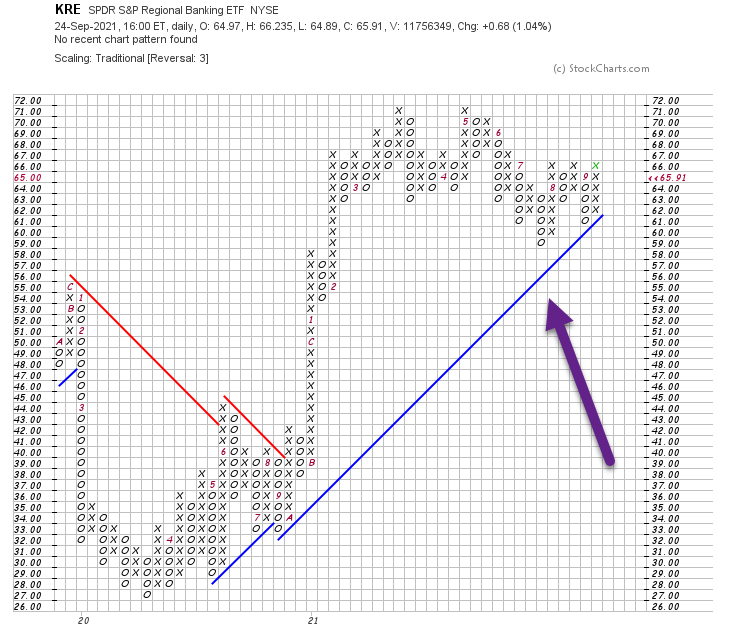

4. KRE Regional Bank Index Held Rising Support Line for Second Time This Year.

Blue rising support line on banks in play during recent pullback

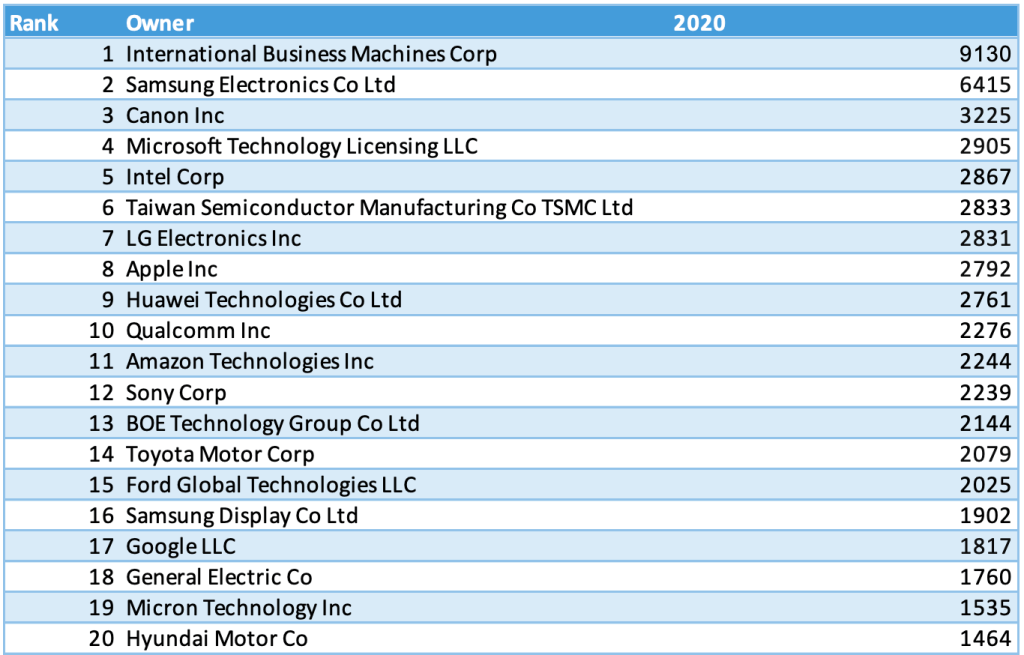

5. Top 20 Patent Recipients 2020

Here is a list of the top 20 patent recipients for 2020, including the number of patents they have received.

https://fortune.com/2021/01/12/ibm-most-patents-2020-full-rankings/

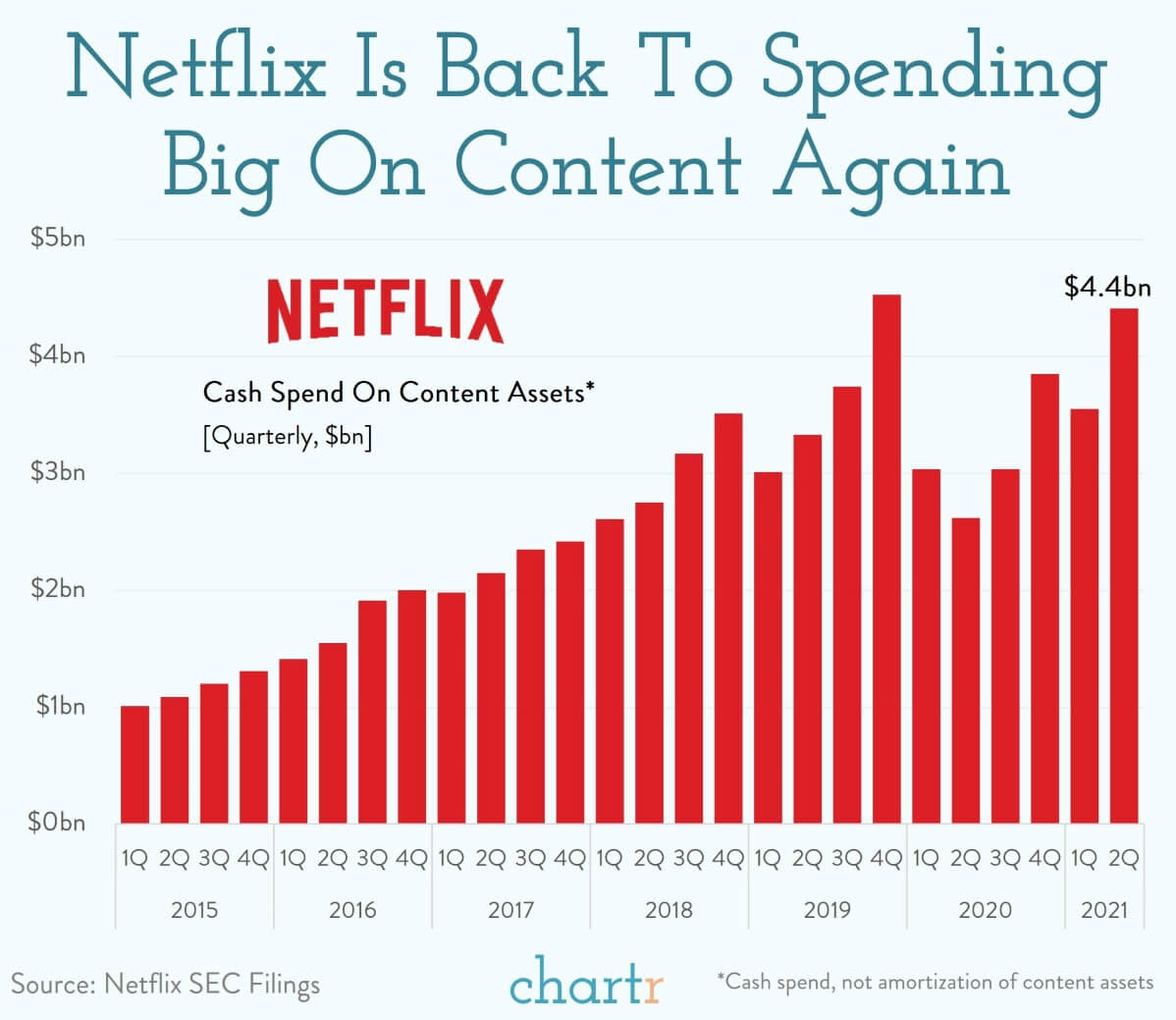

6. Netflix About to Break Previous Record for Content Spending.

Streaming wars, episode 317

This week’s episode of the streaming wars has been an eventful one. CNN announced a streaming service (?), Netflix paid almost $700m to acquire the works of Roald Dahl and Disney announced that its streaming subscriber growth was likely to slowdown this year.

|

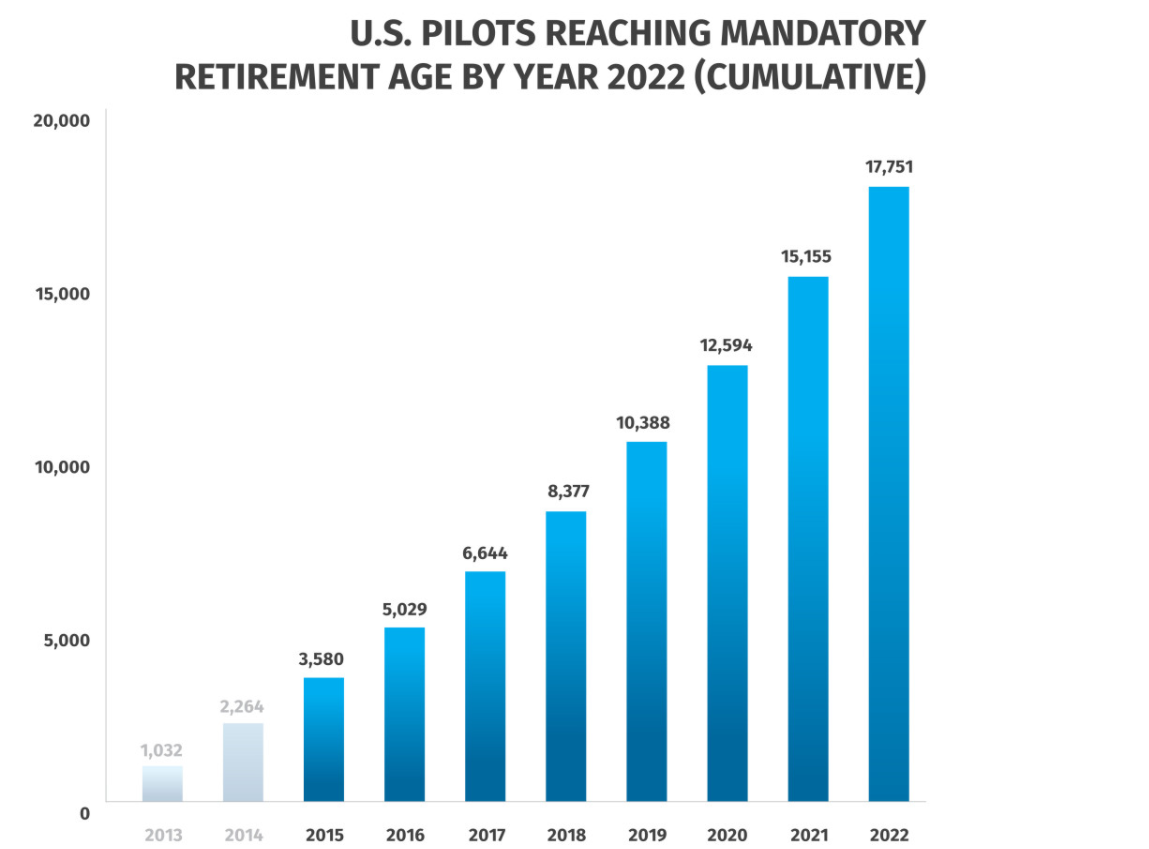

7. Big 4 Airlines Looking at Baby Boomer Pilot Retirement Boom

https://iflycoast.com/aviation-industry-demand/cft_graphs_02/

8. Household net worth rises above $141 trillion, but debt up sharply as well

Jeff Cox@JEFF.COX.7528@

KEY POINTS

- Household net worth at the end of the second quarter was $141.7 trillion, the Fed reported.

- Household debt rose 7.9% as well, while the federal government’s red ink also ballooned.

American households saw another significant jump in net worth as well as hefty increases in debt and credit, the Federal Reserve reported Thursday.

Thanks in good part to a big surge in stock market earnings, total household net worth rose to $141.7 trillion through the second quarter of 2021, the central bank’s Financial Accounts of the United States report showed.

That was good for a $5.85 trillion increase, or 4.3% from the first quarter. Looking back to a year ago, when the nation was in the early days of the Covid-19 pandemic, the net worth total represents a 19.6% increase.

A large chunk of the new wealth came from stocks, which accounted for $3.5 trillion of the gain, while real estate appreciation was responsible for $1.2 trillion.

However, along with that increase came a big surge in debt.

Consumers debt totaled $17.3 trillion as of June 30, a quarterly gain of 7.9%. Consumer credit grew at an annual pace of 8.6%, while mortgage debt was up 8%.

Household debt mirrored that of the federal government, which ended the quarter owing $28.5 trillion after a 9.6% increase. That was the largest percentage gain since the second quarter of 2020 as the government launched an aggressive stimulus program to pull the economy out of the pandemic. State and local government debt increased 3.1%, a slowdown from the 3.5% pace in the first quarter.

Nonfinancial business debt grew much more slowly, rising just 1.4% to $18 trillion.

Total nonfinancial debt outstanding across all sectors was $63.3 trillion, a quarterly increase of 6.4%, down from the 6.7% rise in the first quarter.

9. Top 10 Poorest States in U.S.

https://www.fcnl.org/updates/2020-10/top-10-poorest-states-us

10. We unconsciously become what we are near

Farnam Street Brainfood.

“We have been fighting on this planet for ten thousand years; it would be idiotic and unethical to not take advantage of such accumulated experiences. If you haven’t read hundreds of books, you are functionally illiterate, and you will be incompetent, because your personal experiences alone aren’t broad enough to sustain you.”

— General Jim Mattis

Tiny Thought

“It is inevitable if you enter into relations with people on a regular basis…that you will grow to be like them. Place an extinguished piece of coal next to a live one, and either it will cause the other one to die out, or the live one will make the other reignite. … If you consort with someone covered in dirt you can hardly avoid getting a little grimy yourself.” — Epictetus

We unconsciously become what we are near. If you work for a jerk, sooner or later you will become one yourself. If your colleagues are selfish, sooner or later you become selfish. If you hang around someone who is unkind, you will slowly become unkind.

Few things are more important in life than avoiding the wrong people. It’s tempting to think that we’re strong enough to avoid adopting the worst of others. But that’s not how it typically works. The changes are too gradual to notice until they are too large to address.

Over a long enough timeline, bad people eventually destroy themselves. They ignore relevant data because it doesn’t agree with them, they take unwarranted risks, they end up alone, without any friends. They might achieve external success, but they lack inner calmness and clarity.

Just as you watch what you put into your body or your mind, closely look at who you spend your time with. Are they kind? Are they honest? Are they thoughtful? Are they helping you or pulling you down? Are they reliable? Are they clear thinking? In short, are they the things you want to become? If not, don’t tempt fate, cut bate.

Distance yourself from the people you don’t want to become. Cultivate people in your life that make you better. People whose default behavior is your desired behavior. If circumstances make this difficult, choose among the eminent dead.