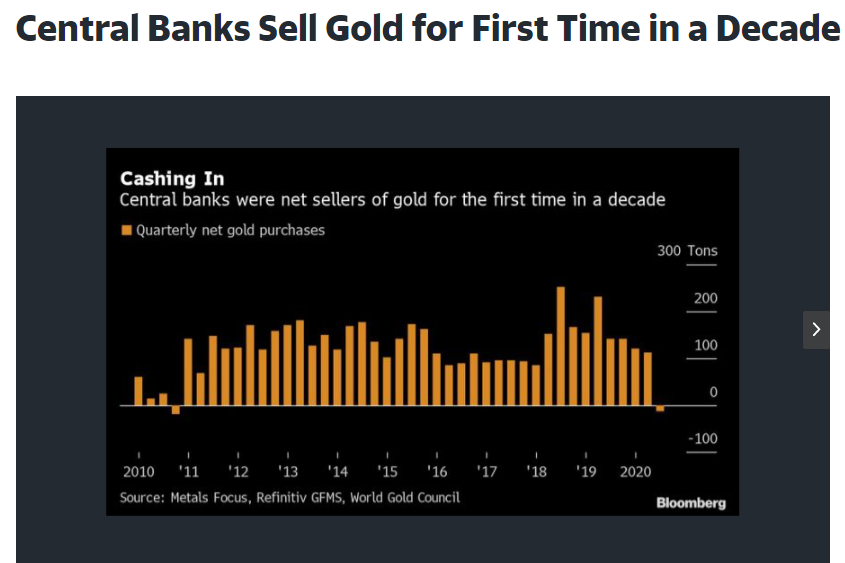

1. Central Banks Sell Gold for the First Time in a Decade

Eddie Spence

Thu, October 29, 2020, 6:34 AM EDT

(Bloomberg) — Central banks became gold sellers for the first time since 2010 as some producing nations exploited near-record prices to soften the blow from the coronavirus pandemic.

Net sales totaled 12.1 tons of bullion in the third quarter, compared with purchases of 141.9 tons a year earlier, according to a report by the World Gold Council. Selling was driven by Uzbekistan and Turkey, while Russia’s central bank posted its first quarterly sale in 13 years, the WGC said.

While inflows into exchange-traded funds have driven gold’s advance in 2020, buying by central banks has helped underpin bullion in recent years. Citigroup Inc. last month predicted that central bank demand would rebound in 2021, after slowing this year from near-record purchases in both 2018 and 2019.

“It’s not surprising that in the circumstances banks might look to their gold reserves,” said Louise Street, lead analyst at the WGC. “Virtually all of the selling is from banks who buy from domestic sources taking advantage of the high gold price at a time when they are fiscally stretched.”

The central banks of Turkey and Uzbekistan sold 22.3 tons and 34.9 tons of gold, respectively, in the third quarter, the WGC said. Uzbekistan has been diversifying international reserves away from gold as the central Asian nation unwinds decades of isolation.

Gold rallied to a record above $2,075 an ounce in August, before declining to trade around $1,900 in recent weeks. Overall bullion demand fell 19% year-on-year to the lowest since 2009 in the latest quarter, the WGC said, largely thanks to continued weakness in jewelry buying. Indian jewelry demand fell by half, while Chinese jewelry consumption was also down.

The fall off in jewelry was partially offset by 21% jump in demand from investors, according to the WGC, which draws data from both the International Monetary Fund and Metals Focus. Gold bars and coins made up most of the increase, as flows into exchange-traded funds slowed from preceding quarters.

Total supply of gold declined 3% year-on-year as mine production remained depressed, even after Covid-19 restrictions were lifted in producers like South Africa. A quarterly uptick in recycling softened the decline, with consumers cashing in on high prices.

(Updates with gold price in sixth paragraph)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

https://finance.yahoo.com/news/central-banks-sell-gold-first-050000544.html

2. Nasdaq Comp -10% from Sept 2ndHighs

3. VIX Volatility Index Heading to June Levels

VIX Chart

Longer-Term VIX Chart with Covid Highs….Still Half of Highs

4. Emerging Markets ETF Got Above 2019 Highs and 2 Points from All-Time Highs.

5. Third Quarter Earnings Great But High Expectation for 2021 Causing Volatility

Lockdown worry is messing with the earnings narrative

Third quarter numbers have been great, but Wall Street has been betting that the following three quarters (Q4, Q1, and Q2) will also see sequential improvement as the reopening story proceeds:

S&P 500 Earnings: high expectations (estimates, YOY)

2020

- Q2 down 30%

- Q3 down 16%

- Q4 down 12%

2021

- Q1 up 14%

- Q2 up 44%

Source: Refinitiv

The “lockdown light” story kills a lot of this.

“The improvement in earnings is underway. Any prolonged shutdowns will put an end to that improvement,” Nick Raich from Earnings Scout told me.

Halfway through earnings season, the coronavirus resurgence is overshadowing great results–Bob Pisani

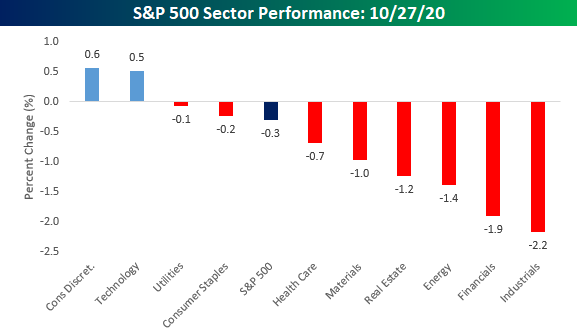

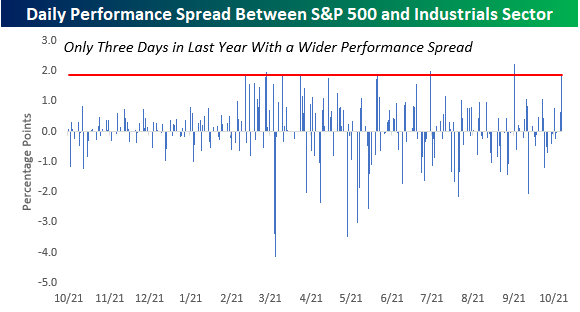

6. Market Sector Rotation into Industrials Thrown Off After MMM and CAT Earnings

Industrials Malfunction-Bespoke Investment Group

With poorly received earnings reports from 3M (MMM) and Caterpillar (CAT) and general weakness overall, Tuesday was just a bad day for the Industrials sector. Just five stocks in the sector were up on the day and the sector overall was down 2.2% compared to the S&P 500 which was down just 0.3%.

The chart below shows the daily performance spread between the S&P 500 and the Industrials sector over the last year. Positive readings indicate the S&P 500 outperforming the Industrials sector and negative readings indicate that the Industrials sector outperformed the S&P 500. With the S&P 500 outperforming the Industrials sector by 1.88 percentage points on Tuesday, it was the widest performance gap (in the S&P 500’s favor) since 9/21. Even more notable, though, was the fact that there have only been three other days in the last year where the Industrials sector underperformed the S&P 500 by a wider margin.

https://www.bespokepremium.com/interactive/posts/think-big-blog/industrials-malfuntion

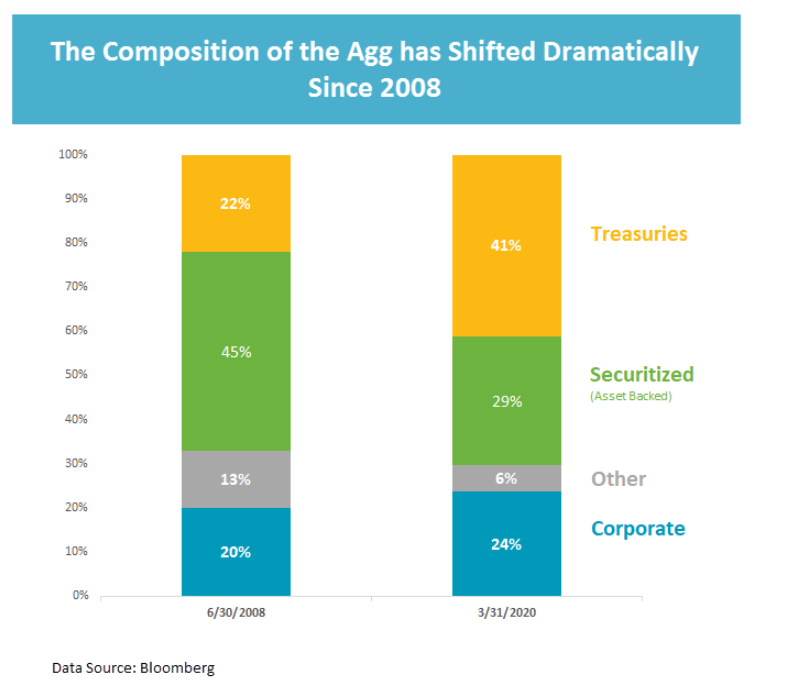

7. Composition of AGG (BONDS Index) 2008 vs. 2020

www.dorseywright.com Nasdaq Dorsey Wright

8. Consolidation Is Coming for theAsset Management Industry

The market recovery this year has masked underlying industry challenges, Morgan Stanley says.Alicia McElhaney

Alex Kraus/Bloomberg

Fee pressures, growing costs, and a desire for scale are signs that the fragmented asset management industry is ripe for more mergers and acquisitions, according to Morgan Stanley.

The top 10 asset management companies hold just a 35 percent share of the $90 trillion market, Morgan Stanley said in a research report dated October 25. The only industry more fragmented, the bank said, is the capital goods sector.

Although strong financial markets have helped assets under management swell, this growth has masked problems like outflows, fee pressures, and lower revenue growth, the report said. The market downturn and investor exodus in March revealed some of these problems, but after the market bounced back, they stabilized.

Still, Morgan Stanley expects that the market crisis will accelerate these existing trends, motivating some asset managers to make M&A decisions more quickly.

The report suggested that firms like T. Rowe Price, JPMorgan Chase & Co., Goldman Sachs Group, and Schroders are among those with enough excess capital and balance sheet capacity to be buyers in the current market. Attractive targets could include the Man Group, BrightSphere Investment Group, and WisdomTree Investments, all of which have niche product offerings, according to Morgan Stanley.

The bank noted in the report that these are all hypothetical targets and acquirers given their characteristics and what some of them have signaled to the market.

For certain managers, Morgan Stanley expects operating margins to decline one percent on average during the next four years. But a scale-driven deal could help to cut costs, improving these margins.

[II Deep Dive: A Deal Between Invesco and Janus Henderson Could Shake Up Asset Management]

While there are certainly opportunities for traditional deals, an asset management firm doesn’t have to swallow another whole.

A manager could, for instance, structure itself as a multi-boutique firm, avoiding cultural challenges by preserving autonomy among the purchased companies, according to the report. But Morgan Stanley points out that this could backfire. Natixis uses this model and has recently dealt with “challenges linked to risk oversight” at one of its boutiques, Morgan Stanley said.

Minority stakes are another deal option — one that offers the investing manager access to technology or distribution. BlackRock, for instance, has taken advantage of these deals by purchasing minority stakes in alternatives fintech provider iCapital Network and advice platform Envestnet.

9. Checklist: Getting Ready to Retire

With retirement coming into view, it’s time to get your financial planning into high gear. Check your progress and catch up if you need to. Plan ahead for things like Social Security, health care costs and how to go from saving to spending.

Planning to retire in 10 years or less? In addition to talking with your financial advisor, use this checklist to help you get started.

1. Sharpen your focus on retirement

The closer you get to retirement, the more important it is to be realistic about your goals and savings. By taking a close look at where you stand now, you can make changes to stay on track — or catch up if you need to.

· Work with your financial advisor to identify a specific goal for the amount of savings you want to have at retirement — and develop a strategy to reach it. Try out different scenarios by using our retirement calculator.

· If you still have a few years to retire, ramp up your retirement plan contributions and savings. Limits on contributions to IRAs and many employer plans, such as 401(k) 403(b) plans, are higher for people 50 and over.

· Work to pay off all your debits, including mortgage, car loans, credit cards and home equity loans.

2. Determine your income and insurance needs

With retirement typically lasting 25 or 30 years and beyond, it’s important to create a retirement investment strategy that can convert your savings into retirement income

· Work with your financial advisor to estimate how much income you think you’ll need in retirement. Take into account how many years you may spend in retirement and how you’d like to spend your time — either working part-time or leaving the workforce altogether to spend time with family, volunteer, travel and so forth.

· If you don’t already own a permanent life insurance policy, you might want to consider purchasing one from Edward Jones. It allows you to build cash value that you can pass on to beneficiaries, tax-free.

· Consider annuities to supplement your retirement income.

· What other financial obligations do you have? Are you caring for parents or supporting children? Do you want to help children or grandchildren with their education or leave an inheritance? Do you wish to make donations to charity?

3. Plan now for the cost of health care

With greater longevity and rising health care costs, retirement is getting more expensive. And while Medicare will pay some of your health care costs (once you reach 65), it doesn’t cover everything

· If you’re leaving your job before age 65, determine how you’ll cover health care. Some options include:

o Enrolling in your spouse’s medical plan

o Obtaining insurance through the federal Health Insurance Marketplace

o Extending your employer’s coverage under COBRA

o Purchasing private insurance

· Consider funding a health savings account (HSA) on your own or at work, if your employer offers one. Qualified distributions will be federally and possibly state tax-free. Any unused balance carries over from one year to the next.

· Consider purchasing long-term care insurance.

4. Develop a Social Security and retirement date strategy

Although Social Security will make up just a portion of your retirement income, it’s an important part of your overall retirement strategy. Give careful consideration to when its most advantageous to take your benefit.

· Estimate your Social Security benefits and any pensions or other government benefits.

· Besides Social Security, you may be eligible for other benefits and programs to help pay for medications, health care, tax relief, and more. Visit this National Council on Aging website to find out.

5. Revisit your estate plan

Meet with an estate-planning attorney to ensure you have a strategy in place that will carry out your wishes. Review and, if necessary, update your:

· Will

· Living Will

· Durable health care power of attorney

· Trust

How we can help

You’ve been working for retirement your whole life. First, talk to your financial advisor to make sure you’re on track according to your goals ‒ and then start living the life you’ve been planning for.

Important Information:

Edward Jones is a licensed insurance producer in all states and Washington, D.C., through Edward D. Jones & Co., L.P., and in California, New Mexico and Massachusetts through Edward Jones Insurance Agency of California, L.L.C.; Edward Jones Insurance Agency of New Mexico, L.L.C.; and Edward Jones Insurance Agency of Massachusetts, L.L.C.

10. The 7 Types of Fear That Hold Us Back—and How to Overcome Them

By Shine | October 30, 2019 | 0

The other day, I listened to a podcast featuring Ruth Soukup, author of the book Do It Scared: Finding the Courage to Face Your Fears, Overcome Obstacles, and Create a Life You Love.

After surveying over 4,000 adults, Soukup and a team of researchers and psychologists found that the type of fear that holds us back in life manifests itself in seven different ways. It’s what she refers to as the “fear archetypes.”

According to Soukup’s study, the fear archetypes include: the Procrastinator, the Rule Follower, the People Pleaser, the Outcast, the Self-Doubter, the Excuse Maker and the Pessimist.

You can probably already see yourself in one (or many) of these categories—I know I could.

“While each of us possesses a few qualities of all seven archetypes, most of us have at least one dominant archetype that affects us more strongly than the others and plays out in our lives in more noticeable ways,” Soukup explains in an article for Mindbodygreen.

At first glance, I assumed my “dominant archetype” would be the People Pleaser, or maybe the Rule Follower. But after taking Soukup’s archetype assessment quiz, I was surprised to learn that I was actually a Procrastinator. She explained this archetype is often associated with those who consider themselves to be perfectionists.

I worried learning more about my “Procrastinator” tendencies would upset me—but after taking a deep dive into the Procrastinator archetype, I actually found the information empowering. It reminded me: By identifying what holds you back, you’re better able to make the changes necessary to overcome it. We all carry fear, and accepting the type of fear you carry is the first step in pushing past it.

By identifying what holds you back, you’re better able to make the changes necessary to overcome it.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.