1. Market Cap of FANGMAN Doubled from March Low

Mkt cap of#FANGMAN(#Facebook,#Apple,#Netflix,#Google,#Microsoft,#Amazon,#Nvidia) dropped 0.7% this week on disappointing Netflix subscriber numbers and as investors rotating into select value stocks and away from the FANGMAN mega-cap Tech complex.

2. 76% of US CEOs Will Slash Office Space As Remote Work Dominates

by Tyler Durden

The virus pandemic has accelerated more flexible work options for employees, with many companies instructing employees to work remotely through 2021, or in some cases, permanently. As a result, according to a new survey, CEOs have said they will slash office space, a move that could ripple through commercial real estate markets, all the way down into local economies.

In collaboration with Deloitte, Fortune surveyed 171 CEOs between Sept. 23 to 30, found 76% of respondents are expected to reduce office space size in the near term. About 28% of them said they would need “a lot less” corporate space.

The survey is an eye-opener for all the empty office buildings in major metro areas as remote work continues to dominate. The prolonged economic downturn and persistent virus pandemic are whipping up a perfect storm where companies must reduce their corporate footprint.

https://www.zerohedge.com/markets/76-us-ceos-will-slash-office-space-remote-work-dominates

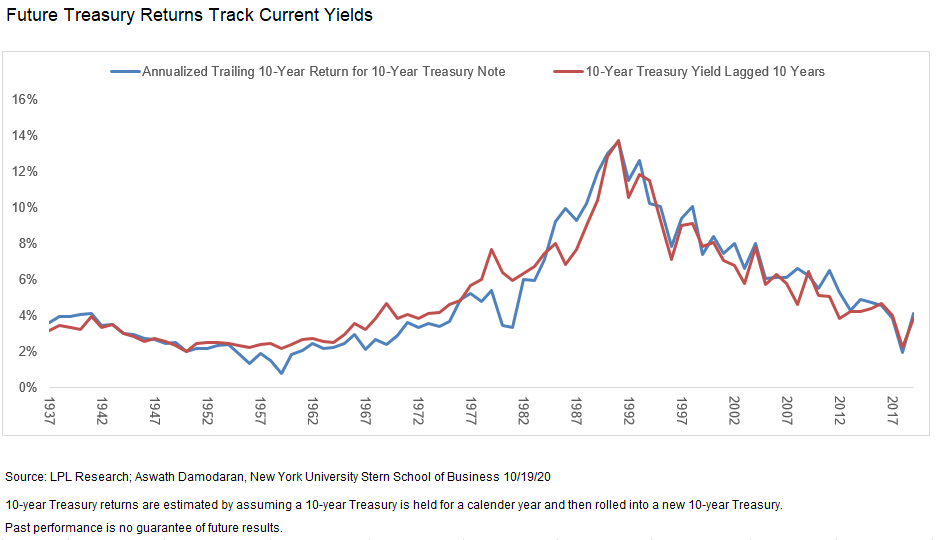

3. Future Treasury Returns Match Yields Almost Exactly Going Back to 1937

Treasury Return Expectations Historically Low

Posted by lplresearch

Market Blog

The 10-year US Treasury yield, at 0.77% as of October 19, is still near historical lows set earlier this year. Historically, 10-year Treasury performance for the next 10 years has tended to track the Treasury yield at the start of the period, as show in the LPL Chart of the Day. By that measure, the return outlook for the 10-year Treasury is just about as low as it’s ever been. As discussed in last week’s blog, Under-the-Radar Signal That Rates May Head Higher, right now the 10-year Treasury yield is not even enough to compensate for inflation, a very unusual relationship historically, but more common in recent years due to low interest rates.

“All else being equal, a 10-year Treasury yield of about 0.75% points to an expected annualized return of about 0.75% over the next 10 years, likely lower if rates rise,” said LPL Financial Chief Market Strategist Ryan Detrick. “But getting anything more than that from a bond allocation means taking on more risk, which may put more conservative investors in a tough position.”

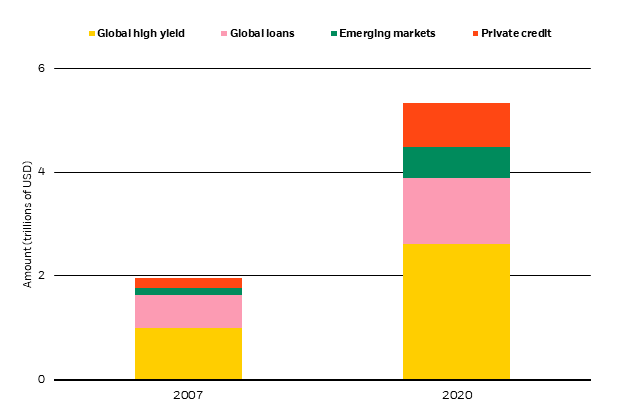

4. Sub-Investment Grade Debt Outstanding. 2007 vs. 2020

Chart of the week—Blackrock

Sub-investment grade debt outstanding, 2007 and 2020

Sources: BlackRock Investment Institute, October 2020. Notes: Indexes used are Bloomberg Barclays Global High Yield Index, S&P/LSTA Leveraged Loan Index + S&P European All Loans Index, and JP Morgan CEMBI Index. Private credit data are from Preqin. Index data are as of June 30, 2020, and the private credit data as of Dec. 31, 2019. Indexes are unmanaged and do not account for fees. It is not possible to invest directly in an index.

https://www.blackrock.com/us/financial-professionals/insights/weekly-commentary#latest-commentary

5. Utilities Still Well Below Previous Highs.

Barrons

“While the S&P 500 should see 25% growth, utilities will likely eke out only a 3.5% advance,” says Sam Stovall, chief investment strategist at CFRA. On the plus side, utilities trade at a 23% discount to their 20-year average, based on estimated profits over the next 12 months, he notes.

8 Utility Stocks That Offer Safe and Growing Yields-Lawrence C. Strauss

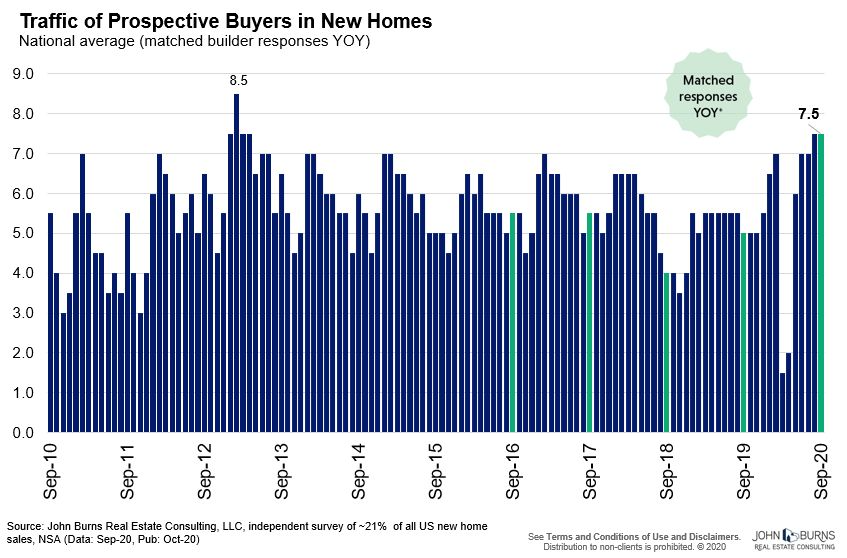

6. September was Second Highest Month of Buyer Traffic in 10 Years.

John Burns • FollowingCEO, John Burns Real Estate Consulting3d • 3 days ago

https://www.linkedin.com/in/johnburns7/

7. Cybercrime Damages $6 Trillion By 2021

Cybercriminal activity is one of the biggest challenges that humanity will face in the next two decades

New! 2019 Official Annual Cybercrime Report

The 2017 Official Annual Cybercrime Report is sponsored by Herjavec Group, a leading global information security advisory firm and Managed Security Services Provider (MSSP) with offices across the United States, Canada, and the United Kingdom. Download PDF

Menlo Park, Calif. – Oct. 16, 2017

Cybercrime is the greatest threat to every company in the world, and one of the biggest problems with mankind. The impact on society is reflected in the numbers.

Last year, Cybersecurity Ventures predicted that cybercrime will cost the world $6 trillion annually by 2021, up from $3 trillion in 2015. This represents the greatest transfer of economic wealth in history, risks the incentives for innovation and investment, and will be more profitable than the global trade of all major illegal drugs combined.

The cybercrime prediction stands, and over the past year it has been corroborated by hundreds of major media outlets, universities and colleges, senior government officials, associations, industry experts, the largest technology and cybersecurity companies, and cybercrime fighters globally.

The damage cost projections are based on historical cybercrime figures including recent year-over-year growth, a dramatic increase in hostile nation state sponsored and organized crime gang hacking activities, and a cyber attack surface which will be an order of magnitude greater in 2021 than it is today.

Cybercrime costs include damage and destruction of data, stolen money, lost productivity, theft of intellectual property, theft of personal and financial data, embezzlement, fraud, post-attack disruption to the normal course of business, forensic investigation, restoration and deletion of hacked data and systems, and reputational harm.

Cybersecurity Ventures predicts cybercrime damages will cost the world $6 trillion annually by 2021, up from $3 trillion in 2015.

Cyberattacks are the fastest growing crime in the U.S., and they are increasing in size, sophistication and cost.

The Yahoo hack was recently recalculated to have affected 3 billion user accounts, and the Equifax breachin 2017 — with 145.5 million customers affected — exceeds the largest publicly disclosed hacks ever reported. These major hacks alongside the WannaCry and NotPetya cyberattacks which occurred in 2017 are not only larger scale and more complex than previous attacks, but they are a sign of the times.

“We are edging closer and closer to seeing Cybersecurity Ventures’ $6 trillion in costs attributed to cybercrime damages globally” says Robert Herjavec, founder and CEO at Herjavec Group , a Managed Security Services Provider with offices and SOCs (Security Operations Centers) globally.

“DDoS attacks, ransomware, and an increase in zero day exploits are contributing to last year’s prediction becoming a reality,” adds Herjavec, a Shark on ABC’s Shark Tank. “It’s concerning that all of the hype around cybercrime – the headlines, the breach notices etc. – makes us complacent. The risk is very real and we can’t allow ourselves to be lulled into a sense of inevitability. We all have a role to play in how we protect our businesses from the accelerating threat of cybercrime.”

Cyber Attack Surface

The World Wide Web was invented in 1989. The first-ever website went live in 1991. Today there are more than 1.2 billion websites.

There are 3.8 billion Internet users in 2017 (51% of the world’s population of 7 billion), up from 2 billion in 2015.

Cybersecurity Ventures predicts that there will be 6 billion Internet users by 2022 (75% of the projected world population of 8 billion) — and more than 7.5 billion Internet users by 2030 (90% of the projected world population of 8.5 billion, 6 years of age and older).

Like street crime, which historically grew in relation to population growth, we are witnessing a similar evolution of cybercrime. It’s not just about more sophisticated weaponry, it’s as much about the growing number of human and digital targets.

Microsoft helps frame digital growth with its estimate that data volumes online will be 50 times greater in 2020 than they were in 2016.

‘The Big Data Bang’ is an IoT world that will explode from 2 billion objects (smart devices which communicate wirelessly) in 2006 to a projected 200 billion by 2020, according to Intel.

Gartner forecasts that more than half a billion wearable devices will be sold worldwide in 2021, up from roughly 310 million in 2017. Wearables includes smartwatches, head-mounted displays, body-worn cameras, Bluetooth headsets, and fitness monitors.

Cybersecurity Ventures predicts that there will be 6 billion Internet users by 2022, and 7.5 Billion Internet users by 2030.

Despite promises from biometrics developers of a future with no more passwords — which may in fact come to pass at one point in the far out future — a 2017 report finds that the world will need to cyber protect 300 billion passwords globally by 2020.

There are 111 billion lines of new software code being produced each year — which introduces a massive number of vulnerabilities that can be exploited.

The world’s digital content is expected to grow from 4 billion terabytes (4 zetabytes) last year to 96 zetabytes by 2020 (this is how big a zetabyte is).

The far corners of the Deep Web — known as the Dark Web — is intentionally hidden and used to conceal and promote heinous criminal activities. Some estimates put the size of the Deep Web (which is not indexed or accessible by search engines) at as much as 5,000 times larger than the surface web, and growing at a rate that defies quantification, according to one report.

ABI has forecasted that more than 20 million connected cars will ship with built-in software-based security technology by 2020 — and Spanish telecom provider Telefonica states by 2020, 90 percent of cars will be online, compared with just 2 percent in 2012.

Hundreds of thousands — and possibly millions — of people can be hacked now via their wirelessly connected and digitally monitored implantable medical devices (IMDs) — which include cardioverter defibrillators (ICD), pacemakers, deep brain neurostimulators, insulin pumps, ear tubes, and more.

Dr. Janusz Bryzek, Vice President, MEMS and Sensing Solutions at Fairchild Semiconductor predicts that there will be 45 trillion networked sensors in twenty years from now. This will be driven by smart systems including IoT, mobile and wearable market growth, digital health, context computing, global environmental monitoring, and IBM Research’s “5 in 5” — artificial intelligence (AI), hyperimaging, macroscopes, medical “labs on a chip”, and silicon photonics.

Our entire society, the Planet Earth, is connecting up to the Internet – people, places, and Things. The rate of Internet connection is outpacing our ability to properly secure it.

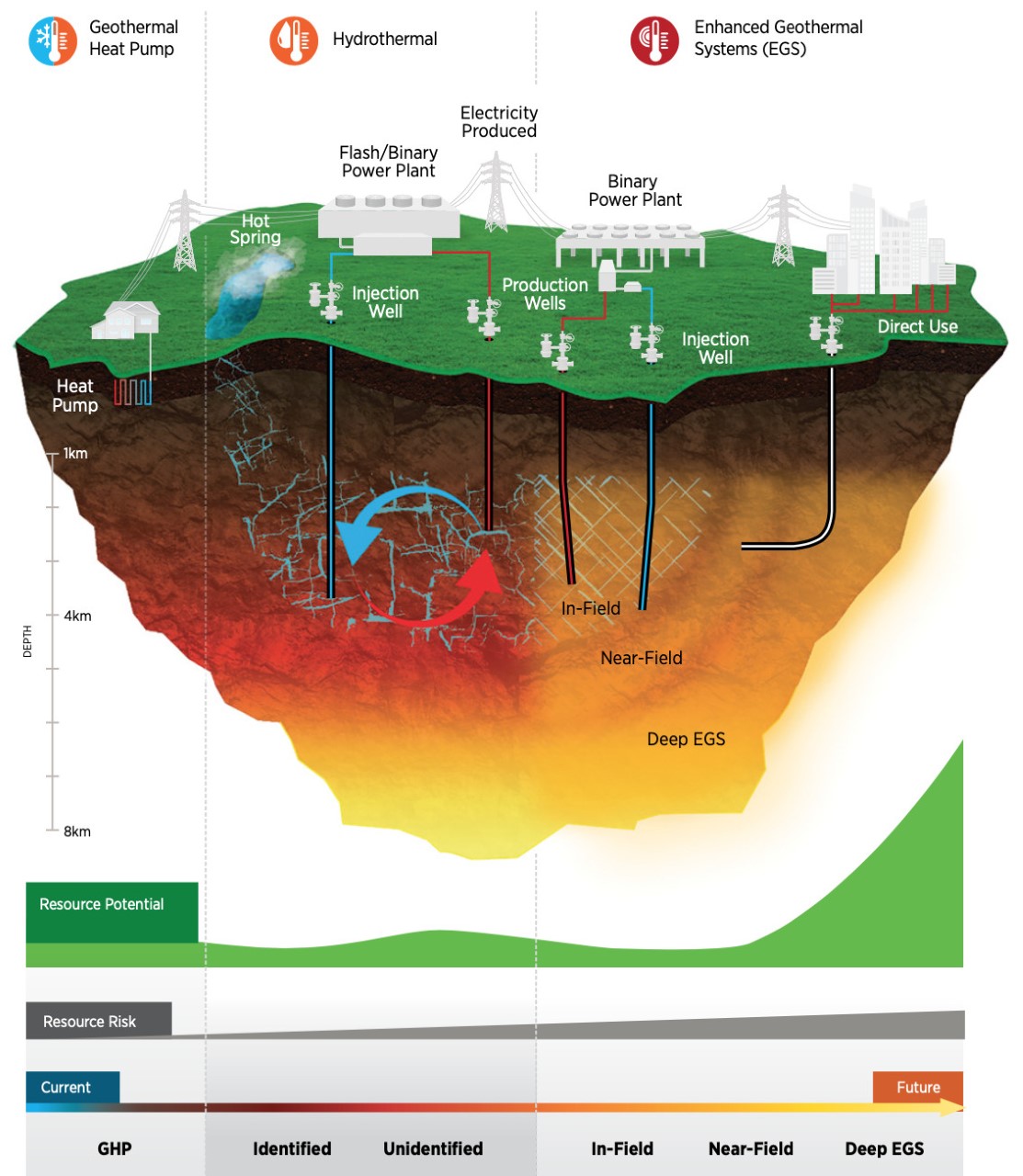

8. Geothermal energy is poised for a big breakout

“An engineering problem that, when solved, solves energy.”

By David Roberts@drvoxdavid@vox.com Oct 21, 2020, 8:30am EDT

What is geothermal energy?

Fun fact: The molten core of the Earth, about 4,000 miles down, is roughly as hot as the surface of the sun, over 6,000°C, or 10,800°F. That’s why the geothermal energy industry is fond of calling it “the sun beneath our feet.” The heat is continuously replenished by the decay of naturally occurring radioactive elements, at a flow rate of roughly 30 terawatts, almost double all human energy consumption. That process is expected to continue for billions of years.

The ARPA-E project AltaRock Energy estimates that “just 0.1% of the heat content of Earth could supply humanity’s total energy needs for 2 million years.” There’s enough energy in the Earth’s crust, just a few miles down, to power all of human civilization for generations to come. All we have to do is tap into it.

Tapping into it, though, turns out to be pretty tricky.

The easiest way to do so is to make direct use of the heat where it breaks the surface, in hot springs, geysers, and fumaroles (steam vents near volcanic activity). The warm water can be used for bathing or washing, and the heat for cooking. Using geothermal energy this way has been around since the earliest humans, going back at least to the Middle Paleolithic.

Slightly more sophisticated is tapping into naturally occurring reservoirs of geothermal heat close to the surface to heat buildings. In the 1890s, the city of Boise, Idaho, tapped one to create the US’s first district heating system, whereby one central source of heat feeds into multiple commercial and residential buildings. (Boise’s downtown still uses it.)

After that came digging deeper and using the heat to generate electricity. The first commercial geothermal power plant in the US was opened in 1960 in the Geysers, California; there are more than 60 operating in the US today.

The technology for accessing deep geothermal is developing at a dizzying pace these days. Let’s take a look at its basic forms, from established to experimental.

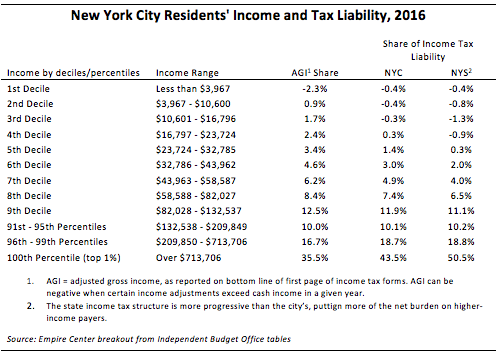

9. NYC High Income Tax Problem

Ed McMahon

The highest earning 1 percent of New York City residents generated 43 percent of city income taxes and 51 percent of the New York State income taxes collected from individuals living in the city as of 2016, according to newly released data from the Independent Budget Office (IBO).

The IBO’s latest tax liability estimates highlight once again New York’s heavy dependence on the top 1 percent, for which the income cut point as of 2016 was $713,706.

As shown below, the highest-earning 1 percent of New Yorkers paid more city and state income taxes than the lowest-earning 90 percent—combined.

https://www.blackrock.com/us/financial-professionals/insights/weekly-commentary#latest-commentary

10. 10 Best Marcus Aurelius Quotes from Meditations-The Daily Stoic Blog

“Waste no more time arguing what a good man should be. Be one.”

“If it is not right, do not do it, if it is not true, do not say it.”

“The mind adapts and converts to its own purposes the obstacle to our acting. The impediment to action advances action. What stands in the way becomes the way.”

“Concentrate every minute like a Roman—like a man—on

doing what’s in front of you with precise and genuine

seriousness, tenderly, willingly, with justice. And on freeing

yourself from all other distractions. Yes, you can—if you do

everything as if it were the last thing you were doing in your

life, and stop being aimless, stop letting your emotions

override what your mind tells you, stop being hypocritical,

self-centered, irritable. You see how few things you have to

do to live a satisfying and reverent life? If you can manage

this, that’s all even the gods can ask of you.”

“We all love ourselves more than other people, but care more about their opinion than our own.”

“Not to feel exasperated, or defeated, or despondent because your days aren’t packed with wise and moral actions. But to get back up when you fail, to celebrate behaving like a human—however imperfectly—and fully embrace the pursuit that you’ve embarked on.”

“How easy it is to repel and to wipe away every impression which is troublesome or unsuitable, and immediately to be in all tranquility.”

“You could leave life right now. Let that determine what you do and say and think.”

“Ambition means tying your well-being to what other people say or do…Sanity means tying it to your own actions.”

“Discard your misperceptions. Stop being jerked like a puppet. Limit yourself to the present.”

Meditations by Marcus Aurelius: Book Summary, Key Lessons and Best Quotes

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.