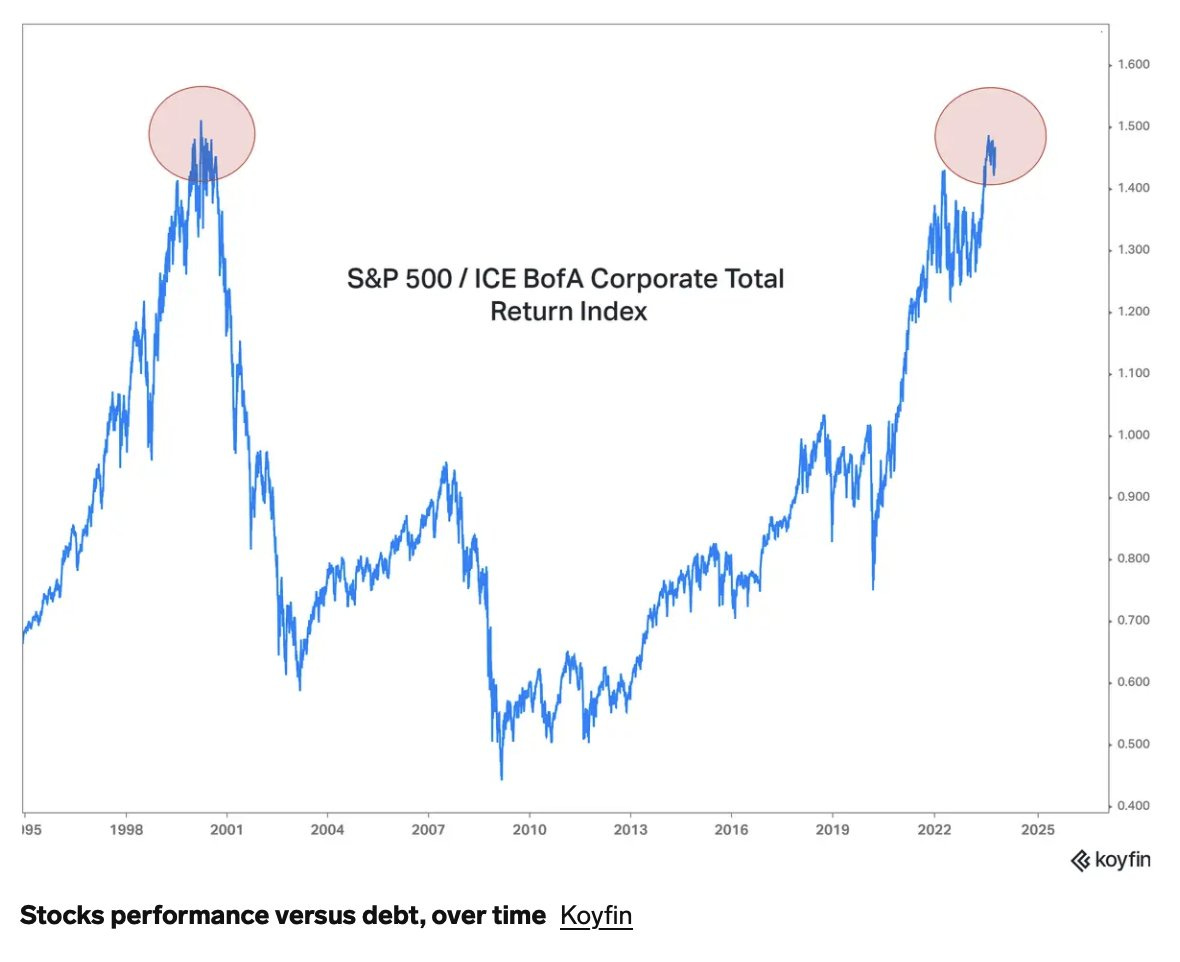

1. Stock vs. Bond Ratio

Callum Thomas Stocks vs Bonds: Stocks have had an amazing run vs corporate bonds since the 2009 market bottom. You might say though that they only just got back to the dot-com high, and effectively had a lost 2-decades. As they say: entry point and path matter! Interesting also though to see it peaking out after a sharp run up — overbought at resistance?

Source: @Barchart

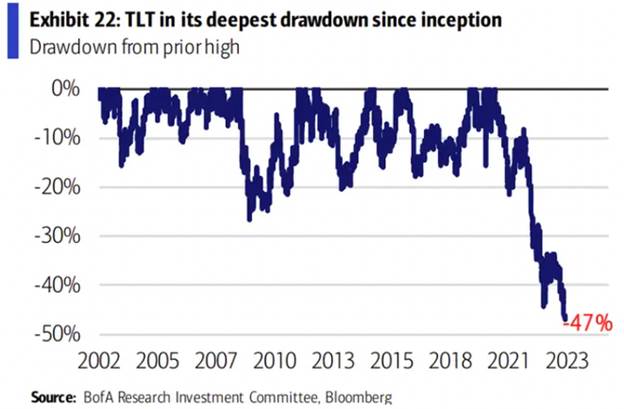

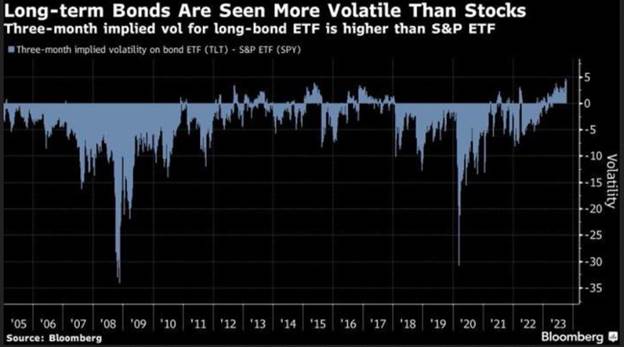

2. Long-Term Bonds More Volatile than Stocks.

From Dave Lutz at Jones Trading

BofA Notes that TLT is in its largest drawdown since inception – We had 3 Bad Auctions last week. Liquidity starting to get shaky in Treasuries?

Long-Term Bonds are now more volatile than stocks by the largest margin ever recorded, Bloombergs note.

3. Two-Year Yield Hits 2007 Levels.

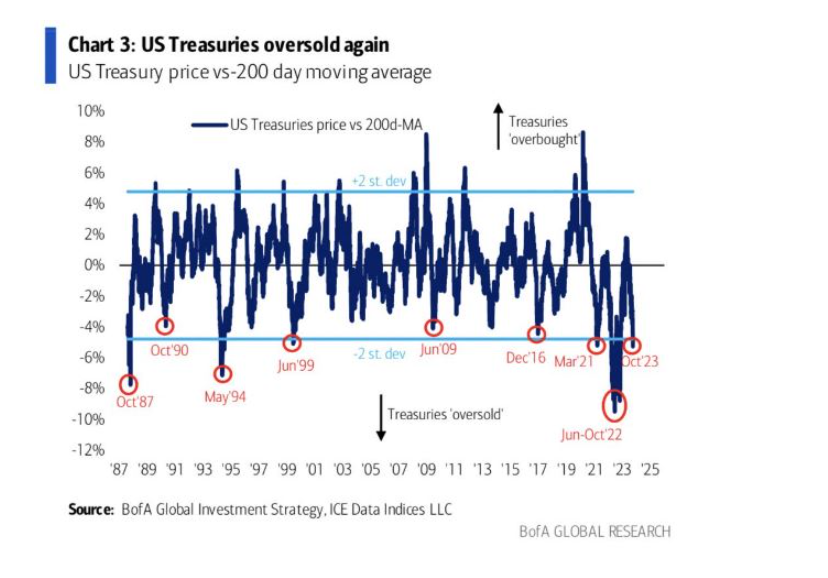

4. Short-Term…US Treasuries Oversold Again.

Found at Irrelevant Investor Blog https://theirrelevantinvestor.com/2023/10/15/these-are-the-goods-333/

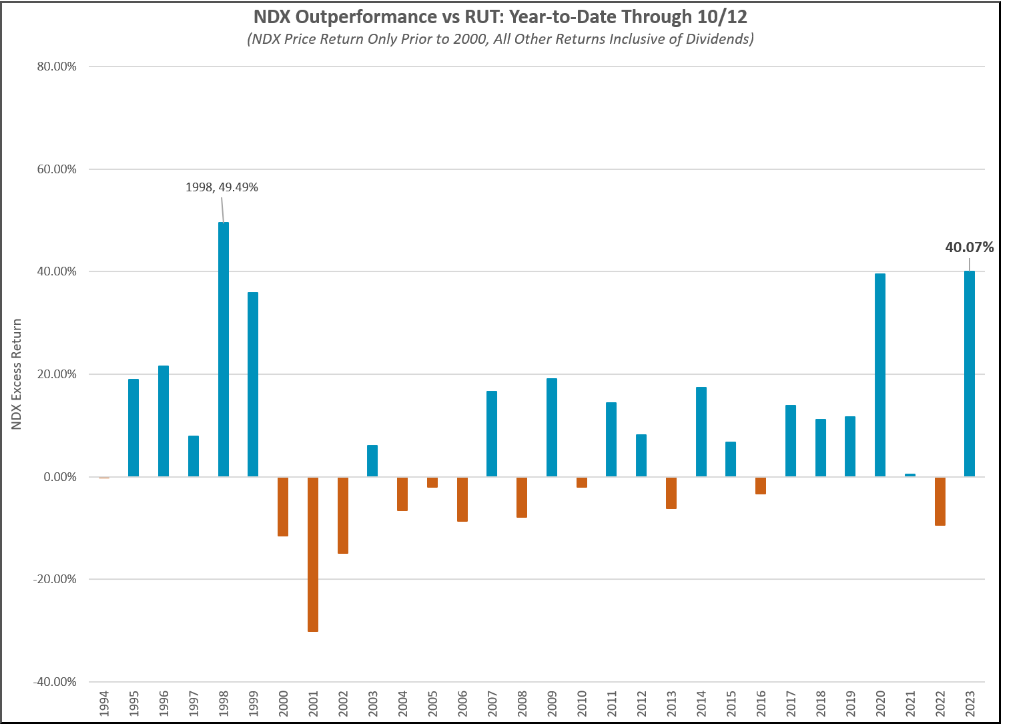

5. Nasdaq 100 vs. Russell Small Cap Close to Record Spreads in Performance.

6. NVDA -5% Tuesday …..

NVDA did not get to previous highs…..next support $400-404

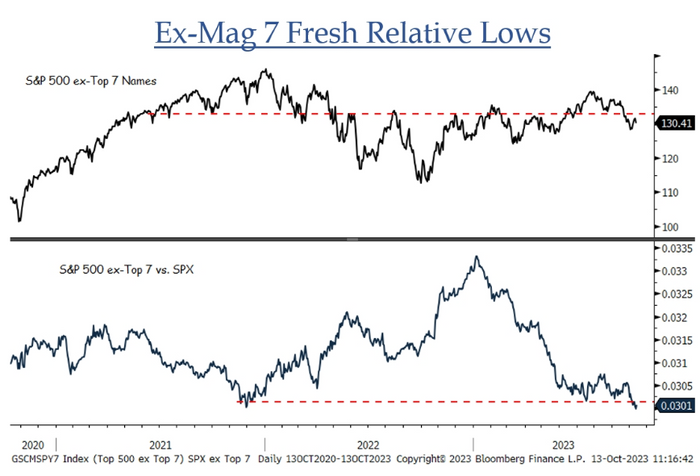

7. Ex-Magnificant Seven….S&P Just Hit Lowest Level of 2023

Marketwatch Jonathan Krinsky, chief market technician at BTIG, highlighted the fact that the S&P 500 excluding the “Magnificent Seven” megacap technology names recently touched its lowest level of the year, while the ratio of the S&P 500 excluding the Mag Seven vs. the entire index has fallen to its lowest level since late 2021. By Joseph Adinolfi

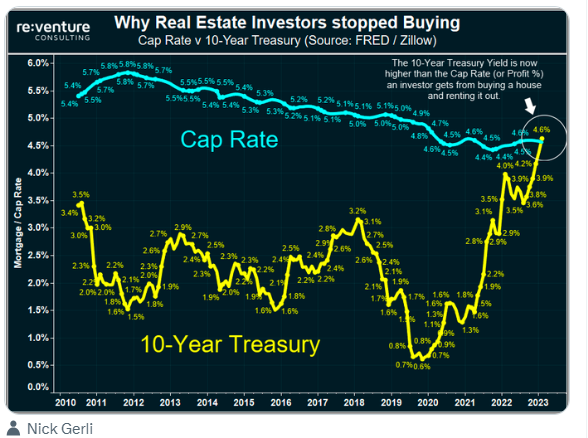

8. The Cap Rate for Real Estate Now Equals 10 Year Treasury Yield….

The 10-year government bond now yields a higher return than the Cap Rate, or profit from operating a rental property.

The Kobeissi Letter https://twitter.com/KobeissiLetter

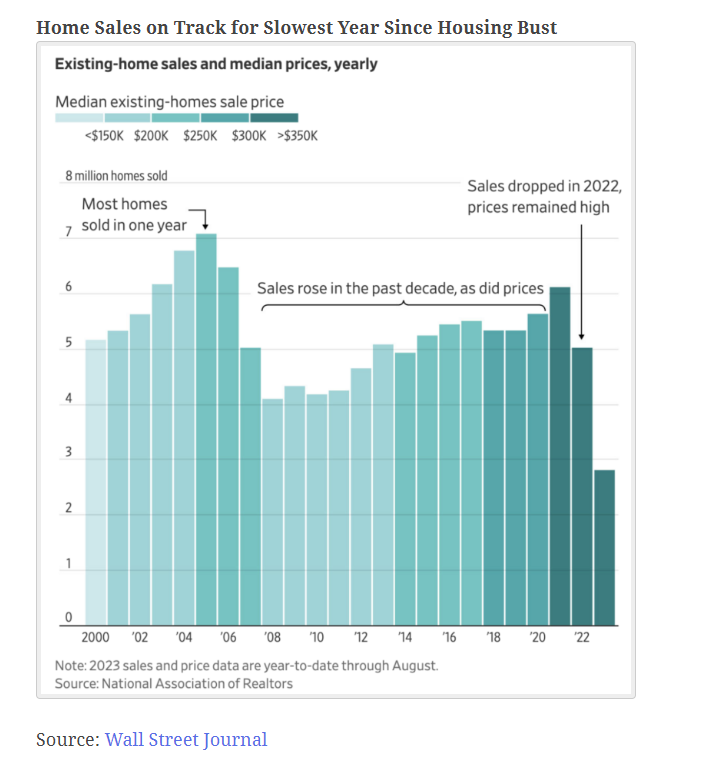

9. Home Sales Major Drop in Volume.

Found at The Big Picture Blog Barry Ritholtz https://ritholtz.com/2023/10/10-tuesday-am-reads-446/

10. How to Achieve Goals.How to Achieve the Goals You Set

One of the most widely read TraderFeed posts in the last few years dealt with the topic of FIGS: Focused, Intensive Goal Setting. Too often, the goals that we set are not much more than good intentions. New Year’s resolutions are a notorious example. How can we become better at actually achieving the goals we set?

As the previous post emphasized, when we focus our attention on fewer priorities and work consistently and intensively on those, we are much more likely to make progress than if we have a laundry list of changes to make and work on those as the need/desire arises. So, for instance, if we want to get in good physical shape, dedicated daily time with gym equipment and running is a great start. That time with lifting, stretching, and running has to challenge us, which means we always tackle more when a given level of effort becomes routine. If our pursuit of goals is not focused, frequent, and intensive, we’re unlikely to sustain a consistent growth path.

We are most likely to succeed if our goals become our commitments. When I worked at a well-known hedge fund, the founder once commented that, “If it’s not in your calendar, it’s not part of your process”. This most certainly applies to our trading processes: researching ideas, turning ideas into trades, monitoring markets, and managing risk/reward. It equally applies to any of our purposeful activities, including the personal goals we set.

When we commit to our goal-seeking in the daily calendar and create a dedicated time for making efforts at improvement, we experience our desired future every day. “Anyone who fights for the future lives in it today,” Ayn Rand once observed. Fighting for the future daily means that we experience a piece of our future consistently, making it an intrinsic part of ourselves. What starts as passion and desire is expressed through regular effort and evolves into positive habit.

Imagine that you have a single hour every day to pursue one goal that will dramatically benefit your trading, your health, your mindset, or your relationships. Imagine that this is the first item to go into your calendar; routine work and home tasks have to fit around your one key objective. Every day, without fail, you are going to use a slice of your day to be your own performance coach and bring your real self closer to your ideal self. That way, you will spend a fraction of every day living in your future.

That is most likely to occur if we have very concrete targets to hit in pursuit of our goals. If we want to lose weight, we want to define a challenging but doable objective. If we are looking to improve our trading, we need to keep stats so that we can truly see our progress: number of winning/losing trades, average sizes of winners/losers, overall profitability, etc. If we are making improvements in our relationships, we want to very intentionally do more of the things that bring closeness, happiness, and fulfillment to our partners and to us.

Mental illness is when we live in the past every day. Mundane life is when we simply live life each day at a time. Greatness is when we live a consistent portion of each day in the future we are designing and building.

What future do you want to build? How can you immerse yourself in that future today?

https://traderfeed.blogspot.com/2023/10/how-to-achieve-goals-you-set.html Found at Abnormal Returns Blog www.abnormalreturns.com