1. Sector Breakdown on Breadth….Above 50 day and 200 day.

https://finance.yahoo.com/news/stocks-set-steady-start-earnings-232622899.html

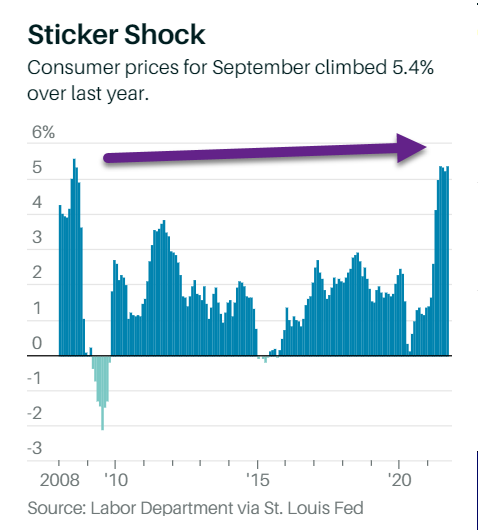

2. Consumer Prices Return to 2008 Levels.

Barrons https://www.barrons.com/

3. Nobody Wants Cash Flow…Consumer Staples Sink to 6% of S&P

Posted October 12, 2021 by Michael Batnick

Nobody wants cash flow when money costs nothing.

This is playing out right now in consumer staples stocks, which, according to Sentimentrader, have shrunk below 6% of the S&P 500 for only the 2nd time in 30 years. I’ll give you one guess as to when that other time was. Yep, you nailed it.

There are 26 detergent and toilet paper stocks with a market cap north of $10 billion that have a higher yield than the 10-year treasury.

What would you rather own for the next ten years? A security that promises to pay your principal back with interest payments that are currently running behind inflation, or Walmart, a company that has raised its dividend for 48 straight years?

What would you rather own for the next ten years? A security that promises to pay your principal back with interest payments that are currently running behind inflation, or Walmart, a company that has raised its dividend for 48 straight years?

I know there are more than two things to invest in, but, and call me crazy, I do think that ultra-low interest rates impact the way people allocate their capital. Right now, money is free and cash flows are worthless.

Nobody Wants Cash Flow – The Irrelevant Investor

4. 70-80% of Chinese Household Assets Tied to Real Estate

Business Insider.–How much debt does an average borrower in China get exposed to in order to buy a home?

Household exposure to debt is lower in China than in many other developed countries, but it still forms a significant part of their portfolio.

“The debt level is lower in China than what you would see in other countries, for example, Thailand or Malaysia,” Bernard Aw, an economist overseeing Asia Pacific for Coface, told Insider. “Chinese citizens have high savings rates — about 40% of their money goes into savings.”

They also tend to employ personal lending networks in order to purchase homes. At least 40% of China’s millennial homeowners received money from their families to help pay for their houses, a 2017 HSBC survey on millennials found.

That said, the majority of debt in Chinese households is property-based, Aw said, and household debt has been on the rise since the financial crisis. In 2020, household debt rose to 128% of income, according to a report from China-focused researcher Rhodium Group. At the end of 2018, housing-related debt accounted for nearly two-thirds of the average household’s total debt, according to a 2019 report from the International Monetary Fund.

Individual wealth in China is also heavily tied to real estate.

According to Moody’s estimates, 70-80% of Chinese household assets are tied to real estate, CNBC reported in August.

That’s more individual wealth tied to real estate than in just about any other developed country, Sun said: “In the west, people diversify their investments and the majority goes to capital markets.” But in China, where the capital markets are less developed and highly volatile, people keep much more of their money invested in real estate.

Household spending on real estate is also high, Aw said: “Some 30-40% of household spending is going into the real estate sector, be that rental payment or mortgages, for example.” This percentage is similar to how much Americans spend on housing.

5. Competition in online sports betting is fierce — and not profitable-Axios

The growth potential in the nascent market for American sports betting is huge. But for now, operators are still losing money — a lot of it.

The big picture: Sports betting is taking a page from the playbook of tech giants like Netflix, Amazon and Twitter, sacrificing profitability in the early days in the hope of engraining themselves in customers’ lives.

Even if you’re not a sports fan, you’ve probably seen or heard the deluge of ads from online sports betting companies offering major financial incentives to use their apps.

What we’re watching: This NFL season will go a long way in determining which companies live to fight another day in the ultra-competitive sports betting arena.

- “This football season is crucial, as more states legalized sports betting going into this season, and football is really the culmination of the U.S. market,” Barry Jonas, equity research analyst at Truist, tells Axios.

Where it stands: The Supreme Court only opened the door to widespread legal, online sports betting in 2018, and the sector is still in its infancy.

- So far, a total of 21 states, representing 40% of the population, allow online sports betting, according to a Wells Fargo research note. Another 8 states allow in-person betting.

State of play: The weekly fantasy sports operators — FanDuel and DraftKings — have taken the lead with market shares of 33% and 19% respectively, in the first half of 2021, the Wells report says.

- DraftKings, which went public in 2019, is currently valued at $19 billion.

- Legacy casino companies are also in the running, most notably MGM’s brand, BetMGM (13%), and Caesars Casino & Sportsbook (4%) which just formally launched in August.

Those companies are shoveling money into marketing and promotions, sometimes including hundreds of dollars of free bets.

- “DraftKings and FanDuel are really customer acquisition platforms, operating as sports books,” Jed Kelly, equity research analyst at Oppenheimer, tells Axios.

- “It’s going to be highly promotional right now … The beginning of football season is the peak in terms of customer acquisitions,” Daniel Politzer, senior equity analyst at Wells Fargo, tells Axios.

What’s next: The operators are chasing a market that has massive growth potential — Politzer estimates annual U.S. sports betting revenue could grow to $11.3 billion in 2025, compared to $3.8 billion estimated this year.

- “At some point you have to start to show profit. But we’re so early that investors are willing to pay a decent multiple for revenue growth over profit. That’s where we’re at,” Kelly says.

Yes, but: Analysts think consolidation is ultimately the most likely endgame, with 3 to 4 players all but dominating the field.

- Amy Howe, CEO of FanDuel, last week told the FT (perhaps self-servingly) that the level of marketing spending that’s happening right now is unsustainable, and that many companies won’t make it.

There’s a Catch-22 for sports books: Making too little money is obviously bad for business, but if they start making too much money — it may attract the attention of regulators.

- “Certainly, states don’t want to see too much problem gaming and social consequences,” Jonas says.

- And there are lots of regulators — a gaming commission in each state, as well as potentially the federal government.

The big question: Whether regulators become concerned about the gamification of the old in-person betting process — too easy, too fun, too instantaneous — similar to the scrutiny that Robinhood’s received for gamifying stock trading.

6. Price of Airline Fares Rolling Back Over

7. KKR Public Market Assets Explode to Half of Book.

This week two titans of the finance world, Henry Kravis and George Roberts, called time on their 45 year run at the top of high finance.

Kravis and Roberts were the second “K” and the “R” in KKR — the private equity giant that originally made its name, and their respective fortunes, in aggressive leveraged buyouts during the 80s and 90s.

Most famous of their deals is probably still the $25bn hostile acquisition of RJR Nabisco, a sprawling conglomerate that sold cigarettes and food, in 1989. That deal was immortalized by book Barbarians at the Gate, and was a rare mis-step in the history of KKR, which has otherwise delivered solid returns and has ballooned into a behemoth managing more than $400bn in assets.

Bread & butter

For years KKR’s bread and butter was in private equity. Take money from investors, borrow some more from lenders and buy a private company. Try and make it more efficient (read: profitable), pay back the debt you borrowed and sell it on in 5-10 years, for more than you paid. That is a formula that’s worked for 45 years, and will probably work for another 45.

But in recent decades KKR has expanded. Into public credit markets, real estate, other alternatives, hedge funds — and most recently insurance with the acquisition of Global Atlantic. The other formula that hasn’t changed? Managing more assets = more fees.

8. More than half of Bay Area residents plan to leave permanently: poll

BY JORDAN WILLIAMS – 10/13/21 09:19 AM EDT 870

More than half of the residents living in the San Francisco Bay Area say they are considering moving out of the area permanently, according to a poll from Joint Venture Silicon Valley released Monday.

The survey of voters in five Bay Area Counties found that 56 percent of respondents said they were likely to leave the region within “the next few years,” a higher percentage than in any of the think tank’s previous polling.

A separate 44 percent said they were unlikely to leave, with 14 percent of these people saying they want to move but could not.

Russell Hancock, president and CEO of Joint Venture Silicon Valley, told The San Francisco Chronicle that the issue comes down to the costs of housing.

“It’s housing, stupid,” Hancock told the newspaper. “That is driving almost all of the results we see in this poll.”

Among those who were likely to leave, 84 percent cited the cost of living as a major reason, 77 percent specifically cited high housing costs and 62 percent cited the quality of life.

- More shooting fatalities, injuries already reported in Seattle area…

- Collectives seek to lower cost of renewable energy, offer choice at…

Forty-eight percent of respondents said the region was headed in the right direction, while 52 percent said it was on the wrong track. Seventy-one percent thought the quality of life is worse now than it was five years ago.

But despite the problems, 71 percent said the Bay Area was still a good place to pursue a career. Fifty-six percent rated the region as good or excellent to grow up, and 46 percent said it was a good or excellent place to raise a family.

The poll was conducted by Embold Research and surveyed 1,610 registered voters in Santa Clara, San Mateo, Alameda, San Francisco and Contra Costa counties from Sept. 21 to 26. It has a margin of error of plus or minus 2.8 percentage points.

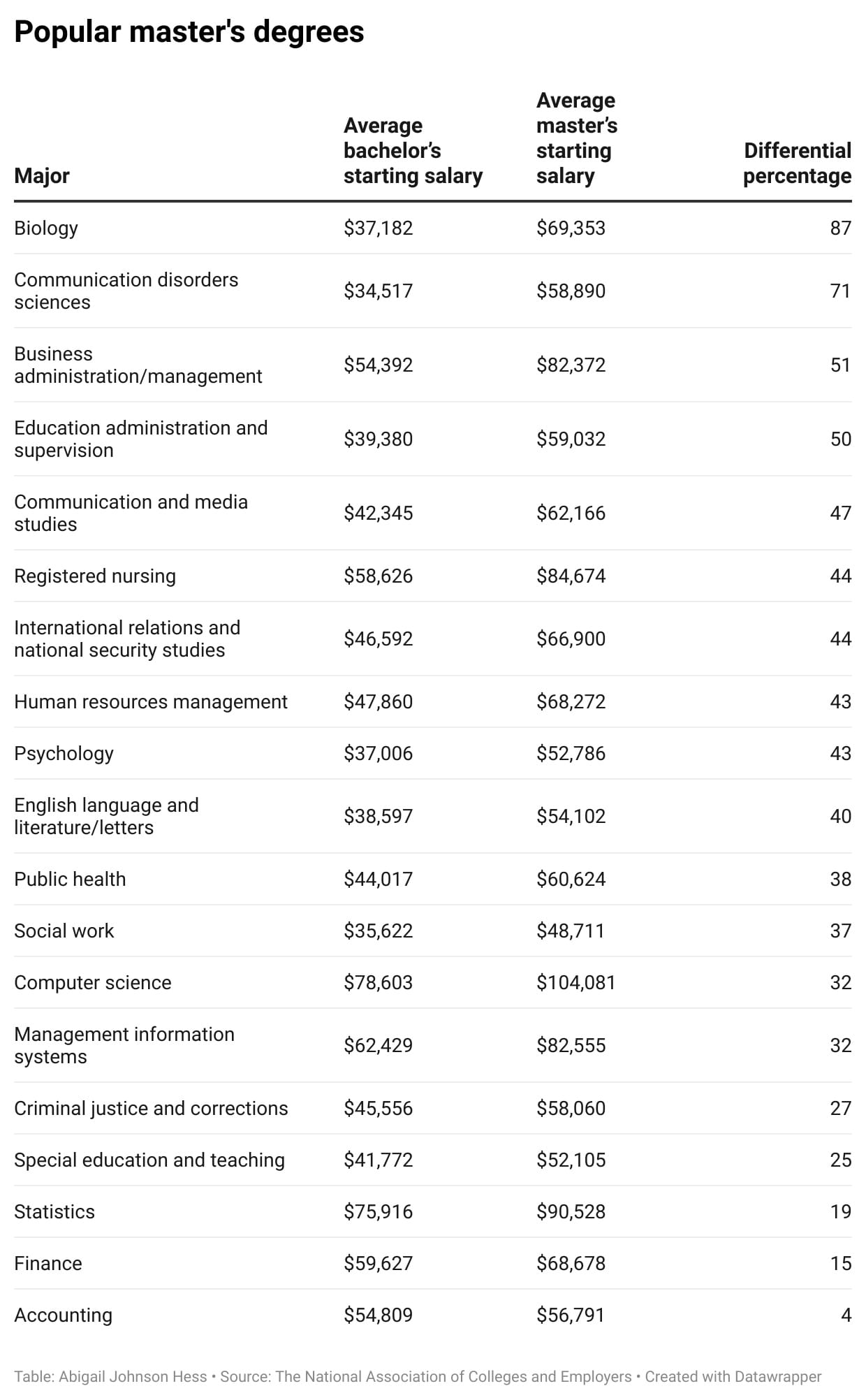

9. Master’s Degrees That Give You Greatest Pay Boost.

10. The Philosophy Of Stoicism: 4 Lessons From Antiquity On Self-Discipline

Stoic Exercises, Wisdom, and More

This is a guest post by Philip Ghezelbash.

***

Stoicism is an ancient Greco-Roman philosophy. The ideal for the Stoic, as with the Buddhist, is to show complete equanimity in the face of adversity.

The four virtues of Stoicism are wisdom, justice, courage and temperance. Temperance is subdivided into self-control, discipline and modesty.

I think that with discipline everything else falls into place.

Discipline is the fundamental action, mindset and philosophy which keeps one in a routine and making progress towards whatever one is pursuing.

Stoicism cultivates iron will in anyone who adheres to its teachings. Here are 4 lessons I’ve taken away which have helped me develop discipline in regards to my health and overall quality of life.

1. FIND WISE PEOPLE TO EMULATE

Seneca wrote that,

“Without a ruler to do it against, you can’t make crooked straight.”

We need to recognise the importance of having wise people in our lives which we look up to for inspiration.

These figures serve as models for ourselves to emulate.

Pick carefully and choose someone who is living a good life. By good life I mean someone who morally sound.

Envision the person you wish to become and find someone who is one step ahead of you.

Watch what they do, listen to what they say, learn from them and more importantly, pay attention to what they don’t do.

Humble yourself and embrace ignorance. Follow the words of Socrates and admit wholeheartedly to yourself then you know that you know nothing.

What is motivating this person’s actions, their ambitions, why are the consequences they experience happening to them.

Changing your mindset will build confidence and trust in yourself to stay on track and become more self-disciplined.

Apply this knowledge actively in your life and you will be rewarded.

2. REVIEW YOUR DAY

It’s not enough to go to sleep without considering the implications, lessons and knowledge you gained throughout the day. It’s a shame to forget to do this.

Thinking about thinking late at night were referred to as ‘evening retrospections.’ Today one may call this journalling.

Ask yourself,

What did I do well today?

Where were my discipline and self-control tested, where did I do good?

What did I do bad, why did this occur? Furthermore, how can I improve?

One of the best ways to become more disciplined is to scrutinize yourself, find your weak spots. Be brutally honest and use this time to connect with your subconscious.

Practicing evening retrospections on a consistent basis will allow you to become more self-aware through every step of your day because you will be actively gathering information to formulate and articulate constructive answers to the latter questions.

The moment you find something which derailed you from your pursuits, recognise it, don’t ignore it. Never regret your actions or words and most importantly strive to never make the same mistake moving forward.

3. YOUR DISTRACTIONS ARE YOUR OWN DOING

Marcus Aurelius said,

“If you are distressed by anything external, the pain is not due to the thing itself, but to your estimate of it; and this you have the power to revoke at any moment.”

Being distressed, being bothered by small things instantly is terrible for discipline. You have a goal, you’re working and then thoughts and distress about something external [meaning it’s out of your control] de-rails you.

The best thing you can do in these circumstances is to apply Epictetus’ dichotomy of control.

Reinforce to yourself what is within your control and what is out of your control; if you embrace what is out of your control and accept it, you will experience tranquillity.

Refer to the following wording next time you’re distressed and distracted:

Do you have a problem in your life?

No? ► Then don’t worry.

Yes? ► Can you do something about it?…

Yes? ► Then don’t worry.

No? ► Then don’t worry.

4. EVERY DAY IS A NEW LIFE

Seneca said,

“Begin at once to live, and count each separate day as a separate life.”

A bad day doesn’t have to become a bad week, a bad week doesn’t have to become a bad year.

The moment you wake up, remember that the new day is a new life. The past shouldn’t be forgotten, but it most definitely should not be something which holds you back.

All previous actions from previous days are now out of your control and if pondered on too much, serve no good other than to drag you down like an anchor.

Release the anchor and move forward by opening your eyes and focusing on what’s in front of you, which is life itself.

If you binged on your diet yesterday, it does not mean you’ve failed and now there’s no point in continuing.

If you didn’t exercise when you know you should have, this doesn’t define your character. Your ability to keep going is what moulds you into a disciplined and strong person.

Get back on the horse as the expression goes.

***

Philip is a health nut, writer and trainer. His mission is to close the gap between health and philosophy. He is the upcoming author of the book The Stoic Body. What he is striving to do is combine the seemingly unrelated fields of nutrition and health in with the philosophical world and in particular, Stoicism.

The Philosophy Of Stoicism: 4 Lessons From Antiquity On Self-Discipline (dailystoic.com)