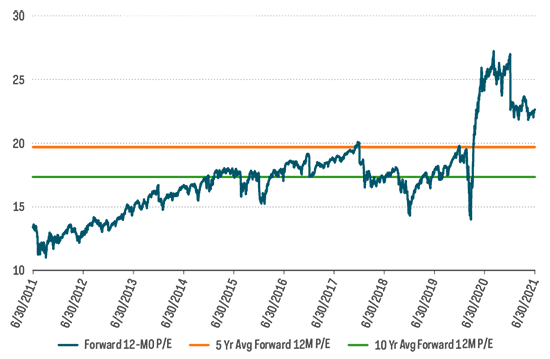

1. P/E Ratios vs. 5-10 Year Averages.

Today’s P/E Ratio Appears Elevated Compared With Historical Valuations

(S&P 500 Forward 12-Month P/E Ratios)

Source: Bloomberg. Data from 6/30/2011‒6/30/2021. The P/E ratio shows how much investors are paying for a dollar of a company’s earnings. Price-to-sales ratio shows how much investors are paying for a dollar of a company’s sales. Price-to-book ratio measures market value of a fund or index relative to the collective book values of its component stocks. Price-to-cash-flows ratio measures the value of a stock’s price relative to its operating cash flow per share.

(For a larger view, click on the image above)

https://www.etf.com/sections/

2. Inflation Surprise and Economic Surprises vs. Historical Returns.

Liz Ann Sonders Schwab

Surprise!

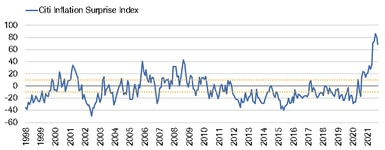

Commodities remain the lone major asset class continuing to extend an already-extreme bullish run. Since the low in March 2020, the Bloomberg Commodity Index is up 70%. This is in keeping with inflation, which continues to run hot; and has been a volatility-driver for the equity market. As shown below, although a bit off the boil, Citi’s Inflation Surprise Index (measuring how inflation data is coming in relative to expectations) remains in the stratosphere. As detailed in the accompanying table, historical returns for the stock market tend to be lower when inflation surprises are higher. Also shown though is the historical tendency for small cap stocks to perform significantly better in those high inflation surprise zones.

Inflation Surprises Easing?

Source: Charles Schwab, Bloomberg, 1/31/1998-9/30/2021. The Citi Inflation Surprise Indices measure price surprises relative to market expectations. A positive reading means that inflation has been higher than expected and a negative reading that inflation has been lower than expected. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

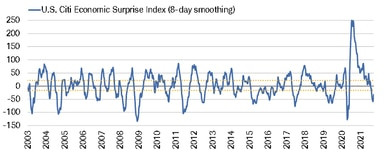

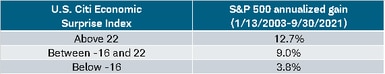

In contrast to inflation having been surprising on the upside, economic data has been surprising on the downside; albeit with a slight uptick recently as shown below. As with the Inflation Surprise Index above, Citi’s Economic Surprise Index is not a measure of the level of economic data readings; but a measure of how the data is coming in relative to expectations. Courtesy of some recent and notable economic data “misses,” including consumer confidence/sentiment and payroll growth, the index remains in negative territory. As detailed in the accompanying table, historical returns for the stock market tended to be lower when economic surprises are lower.

Economic Surprises Bottoming?

Source: Charles Schwab, Bloomberg, ©Copyright 2021 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/, as of 9/30/2021. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

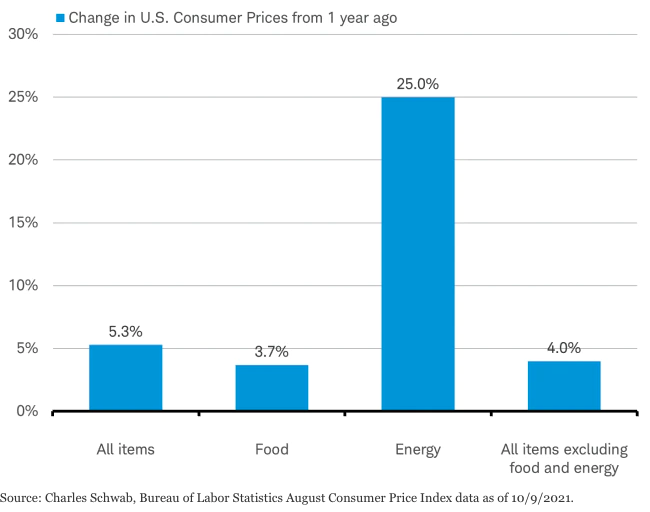

3. Change in Consumer Prices One Year…Energy Up 25%

Inflation: Persistently Transitoryby Jeffrey Kleintop of Charles Schwab

https://www.advisorperspectives.com/commentaries/2021/10/12/inflation-persistently-transitory

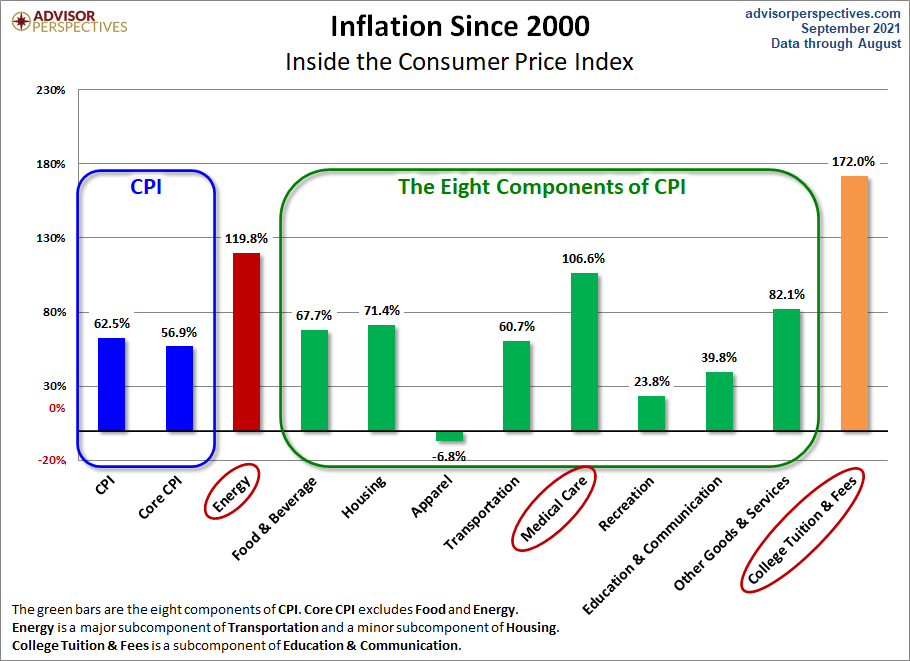

4. Inflation Since 2000

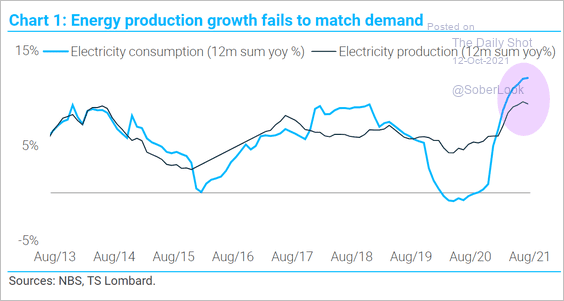

5. Energy Production Fails to Match Demand

Source: TS Lombard

https://dailyshotbrief.com/

6. Renewed Inflationary Concerns Pushing Global Yields Higher

Posted by lplresearch–Market Blog

Tuesday, October 12, 2021

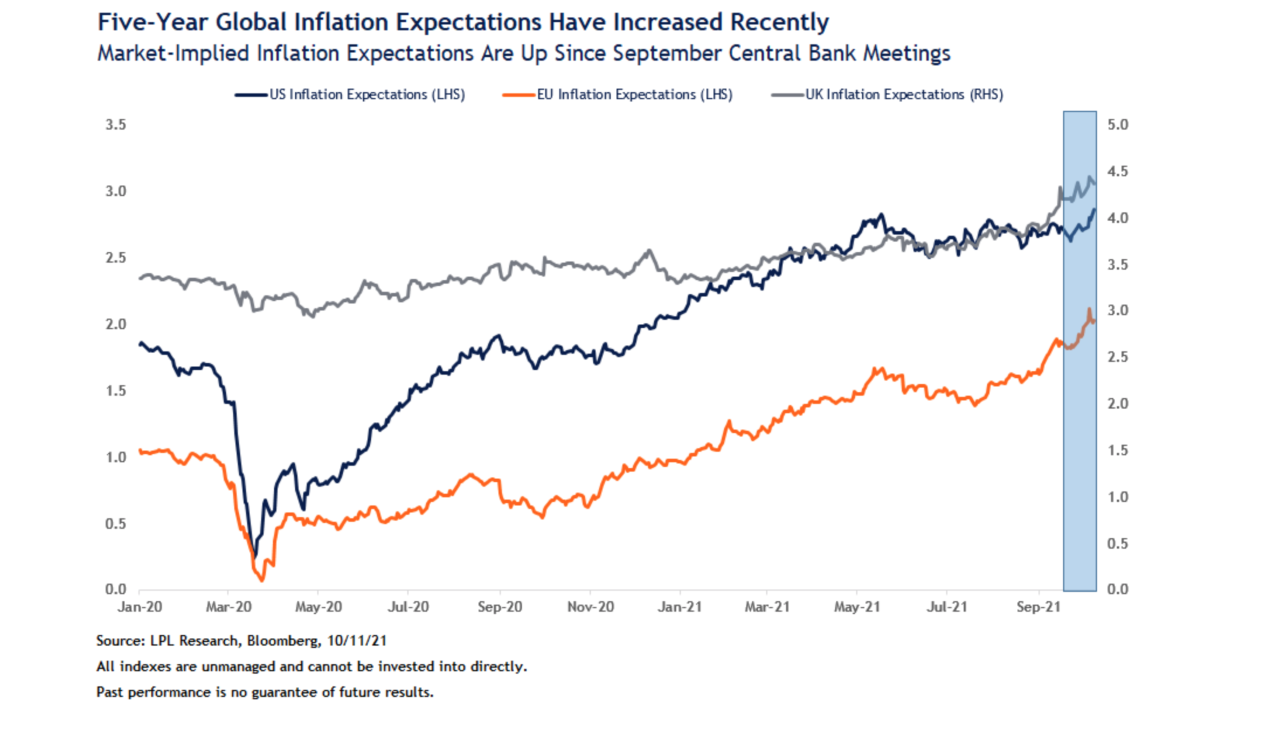

The week of September 20 was notable for monetary policy as there were eleven central bank meetings, including the U.S., E.U., U.K., Turkey, and Norway, to name a few. While many of these countries are in different phases of an economic recovery and some of these central banks are providing different levels of monetary accommodation, a central theme was present throughout: inflation. Inflationary pressures would likely be higher than originally thought and would likely take longer than had been expected to abate. Since those meetings, we’ve seen a general repricing of market-implied inflation expectations and that has pushed global bond yields higher.

“Inflation is the nemesis of bond investors,” noted LPL Financial Fixed Income Strategist Lawrence Gillum. “That we’re seeing signs of stickier inflation in the near term is causing bond prices to fall. We think these inflationary pressures will decline over time though.”

As seen in the LPL Research Chart of the Day, inflation expectations, globally, have increased since central bank week (shaded part). Now, 5-year market-implied inflation expectations are the highest they’ve been in years for some regions. Market participants in the U.S., for now think consumer prices will increase 2.9% each year for the next five years. Moreover, markets are expecting consumer prices in the U.K. to increase by 4.5% annually over the next five years. Even in the European Union, where inflation goals have been tough to meet, inflation expectations continue to rise.

https://lplresearch.com/2021/10/12/renewed-inflationary-concerns-pushing-global-yields-higher

7. Binance to halt Chinese yuan-crypto trading and restrict mainland China customers to withdrawals only

Zhao, CEO of Binance.

REUTERS/Darrin Zammit Lupi

- Binance will discontinue Chinese yuan trading on December 31, it said on Wednesday.

- The crypto exchange said it would run checks to ensure users in mainland China can only make withdrawals.

- Binance says it has been blocked in China since 2017, and doesn’t engage in local exchange business.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Binance will end the use of the Chinese yuan on its peer-to-peer platform, in the crypto exchange’s latest move to cooperate with regulators in China.

The company, which is one of the world’s largest exchanges, is set to discontinue support for the Chinese currency on December 31 this year, it said in a statementWednesday.

Binance added that people in mainland China will be allowed to only make withdrawals, redeem, or close positions.

“At the same time, Binance will conduct an inventory of platform users,” the crypto exchange said. “If the platform finds users in mainland China, their corresponding accounts will be switched to the ‘withdrawal only’ mode.”

Relevant users will be notified of the restriction to withdrawals via email seven days before the transition.

In late September, Chinese authorities declared all crypto-related transactions illegal and banned foreign exchanges from providing services to the country’s residents. Almost immediately, Binance said it would no longer accept registrations linked to Chinese mobile phone numbers.

Chinese crypto exchange Huobi said too it would stop new user registrations by mainland customers, and retire existing accounts by the end of this year. Two other Asia-focused crypto exchanges, Matrixport and Mexc, are also following by cutting off existing users.

Beijing’s recent hostile stance against towards crypto didn’t come as a surprise, after authorities imposed their first related “ban” in 2013.

Since then, China has been attempting to choke off the digital asset sector via various restrictions that target a range of market segments. In 2017, local crypto exchanges were ordered to end operations.

A Binance spokesperson told Insider that the crypto exchange has been blocked in China since 2017 and local users haven’t been able to access its website.

“Binance does not currently hold exchange operations in China,” the spokesperson said, and added that the company takes its compliance obligations “very seriously.”

News of crypto-related bans from China has not impacted the adoption rate of cryptocurrencies, according to Freddie Williams, a sales trader at UK-based digital asset broker GlobalBlock.

“It has not prevented adoption of bitcoin and digital assets from continuing their upward trend,” Williams said.

8. U.S. officially the top destination for bitcoin miners, beating out China for the first time

PUBLISHED WED, OCT 13 20213:10 AM EDT

MacKenzie Sigalos@KENZIESIGALOS

KEY POINTS

-The U.S. is now the top destination for bitcoin miners, eclipsing China for the first time ever.

-One-third of bitcoin’s hashrate is in the U.S., according to the Cambridge Centre for Alternative Finance, a 428% increase from September 2020.

The U.S. is now the number one destination for bitcoin miners, eclipsing China for the first time ever. While it was already trending in that direction, new data from Cambridge University released early Wednesday makes it official.

As of July, 35.4% of bitcoin’s hashrate – an industry term used to describe the collective computing power of miners – is in the United States, according to the Cambridge Centre for Alternative Finance. That’s a 428% increase from September 2020.

America partly has China to thank for its newfound dominance in the mining industry.

Twelve months ago, China was the market leader in terms of hashrate – by a long shot. But Beijing’s crypto crackdown in the spring took half the world’s bitcoin miners offline practically overnight.

Miners started fleeing China en masse, heading to the cheapest energy sources on the planet in what was dubbed “the great mining migration.” A whole lot of them ended up in America.

The newly-released Cambridge data zeroes out China’s average monthly share of the global hashrate in July – a major reversal from September 2020, when China captured about 67% of the market.

“The whole narrative of China controls bitcoin is now completely destroyed,” said Boaz Sobrado, a London-based fintech data analyst.

Heading to America

The U.S. ticks a lot of boxes for migrant bitcoin miners searching for a new home.

For one, states like Texas boast some of the world’s lowest energy prices, which is a major incentive to miners who compete in a low-margin industry, where their only variable cost is typically energy.

The U.S. is also flush with renewable power sources.

Washington state is a mecca for hydropowered mining farms. New York produces more hydroelectric power than any other state east of the Rocky Mountains, and it counts its nuclear power plants toward its 100% carbon-free electricity goal. Meanwhile, Texas’ share of renewables is growing over time, with 20% of its power coming from wind as of 2019. The Texas grid also continues to rapidly add more wind and solar power.

Miners across the country have also harnessed nuclear power. Some are latching their rigs to otherwise stranded energy, like natural gas going to waste in oil fields across Texas. This reduces greenhouse gas emissions and generates money for the gas providers and miners.

This shift toward zero-emission, clean energy sources has already begun to recast the narrative among skeptics that bitcoin is bad for the environment.

“Mining is price sensitive, so as to seek out the lowest-cost power and the lowest-cost power tends to be renewable because if you’re burning fossil fuels … it has extraction, refinement and transport costs,” Blockstream CEO Adam Back said.

Besides lower electricity costs, some U.S. states like Texas also have crypto-friendly policymakers and an adequate supply of hosting infrastructure.

The state has a deregulated power grid with real-time spot pricing that lets customers choose between power providers, and crucially, its political leaders are pro-crypto. Those are dream conditions for miners who want a kind welcome and cheap energy sources.

“If you’re looking to relocate hundreds of millions of dollars of miners out of China, you want to make sure you have geographic, political, and jurisdictional stability. You also want to make sure there are private property rights protections for the assets that you are relocating,” said Darin Feinstein, co-founder of Core Scientific.

Luck meets preparation

America’s rise to the top is also a case of luck meeting preparation. The U.S. has been quietly boosting its hosting capacity for years.

Before bitcoin miners started coming to America, companies across the country made a gamble that eventually, if adequate infrastructure were in place, they would set up shop in the U.S.

That gamble is paying off.

When bitcoin crashed in late 2017 and the wider market entered a multi-year crypto winter, there wasn’t much demand for big bitcoin farms. U.S. mining operators saw their opening and jumped at the chance to deploy cheap money to build up the mining ecosystem in the States.

“The large, publicly-traded miners were able to raise capital to go make big purchases,” said Mike Colyer, CEO of digital currency company Foundry, which helped bring over $300 million of mining equipment into North America.

Feinstein says that in the last 18 months, there has been a serious growth of mining infrastructure in America. “We’ve noticed a massive uptick in mining operations looking to relocate to North America, mostly in the U.S.,” continued Feinstein.

Companies like North American crypto mining operator Core Scientific kept building out hosting space all through the crypto winter to ensure the capacity to plug in new gear, according to Colyer.

“A majority of the new equipment manufactured from May 2020 through December 2020 was shipped to the U.S. and Canada,” he said.

Alex Brammer of Luxor Mining, a cryptocurrency pool built for advanced miners, points out that maturing capital markets and financial instruments around the mining industry also played a big role in the industry’s quick ascent in the U.S. Brammer says many of these American operators were able to start rapidly expanding once they secured financing by leveraging a multi-year track record of profitability and existing capital as collateral.

Covid also played a role.

Though the global pandemic shut down large swaths of the economy, the ensuing stimulus payments proved a boon for U.S. mining companies.

“All the money printing during the pandemic meant that more capital needed to be deployed,” explained bitcoin mining engineer Brandon Arvanaghi.

“People were looking for places to park their cash. The appetite for large-scale investments had never been bigger. A lot of that likely found its way into bitcoin mining operations in places outside of China,” continued Arvanaghi.

https://www.cnbc.com/2021/10/

9. Tesla vs. All Automakers.

Updated Chart.

Might as well trot out this one today, because who doesn’t love this visual (whether $TSLA or $TSLAQ)? Oh, and the non-Tesla automakers also have about $200 billion in net industrial cash. Truly a sight to behold.

https://twitter.com/

10. How to be remarkable

From this week’s Guardian:

1.

Understand the urgency of the situation. Half-measures simply won’t do. The only way to grow is to abandon your strategy of doing what you did yesterday, but better. Commit.

2.

Remarkable doesn’t mean remarkable to you. It means remarkable to me. Am I going to make a remark about it? If not, then you’re average, and average is for losers.

3.

Being noticed is not the same as being remarkable. Running down the street naked will get you noticed, but it won’t accomplish much. It’s easy to pull off a stunt, but not useful.

4.

Extremism in the pursuit of remarkability is no sin. In fact, it’s practically a requirement. People in first place, those considered the best in the world, these are the folks that get what they want. Rock stars have groupies because they’re stars, not because they’re good looking.

5.

Remarkability lies in the edges. The biggest, fastest, slowest, richest, easiest, most difficult. It doesn’t always matter which edge, more that you’re at (or beyond) the edge.

6.

Not everyone appreciates your efforts to be remarkable. In fact, most people don’t. So what? Most people are ostriches, heads in the sand, unable to help you anyway. Your goal isn’t to please everyone. Your goal is to please those that actually speak up, spread the word, buy new things or hire the talented.

7.

If it’s in a manual, if it’s the accepted wisdom, if you can find it in a Dummies book, then guess what? It’s boring, not remarkable. Part of what it takes to do something remarkable is to do something first and best. Roger Bannister was remarkable. The next guy, the guy who broke Bannister’s record wasn’t. He was just faster … but it doesn’t matter.

8.

It’s not really as frightening as it seems. They keep the masses in line by threatening them (us) with all manner of horrible outcomes if we dare to step out of line. But who loses their jobs at the mass layoffs? Who has trouble finding a new gig? Not the remarkable minority, that’s for sure.

9.

If you put it on a T-shirt, would people wear it? No use being remarkable at something that people don’t care about. Not ALL people, mind you, just a few. A few people insanely focused on what you do is far far better than thousands of people who might be mildly interested, right?

10.

What’s fashionable soon becomes unfashionable. While you might be remarkable for a time, if you don’t reinvest and reinvent, you won’t be for long. Instead of resting on your laurels, you must commit to being remarkable again quite soon.