1. Tech vs. Energy Sector Weighting Spread in S&P.

Momentum ETFs are re-balancing in coming weeks…watch for changes in sectors.

2. As of March….Companies with High Free Cash Flow Outperforming Companies with High Growth.

Schwab Market Perspective: Will the Economy Overheat?by Liz Ann Sonders, Jeffrey Kleintop, Kathy Jones of Charles Schwab, 5/17/21

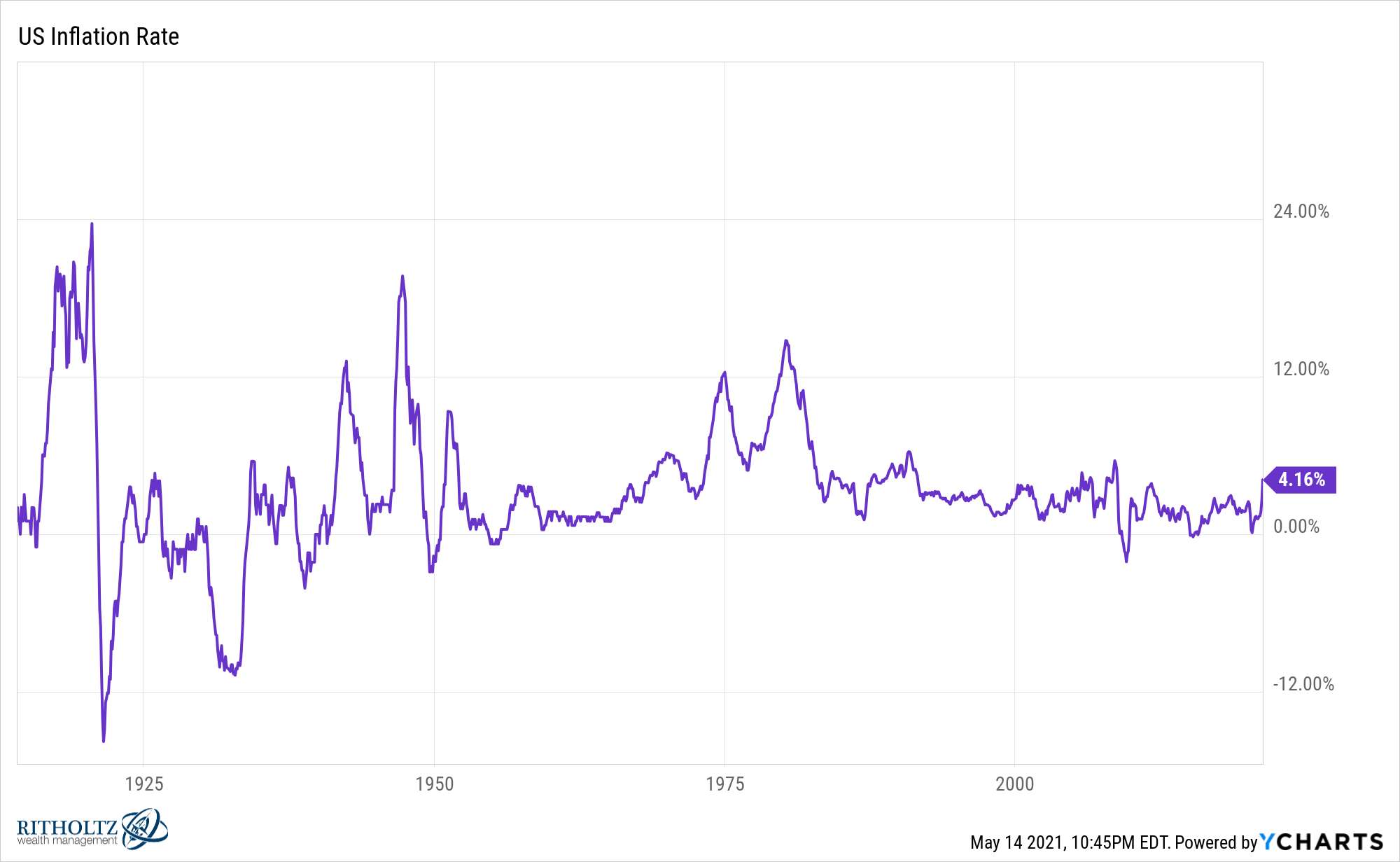

3. Will we finally see meaningfully higher inflation?

One of those obvious scenarios that would potentially cause higher interest rates would be a sustained rise in inflation.

Could all of the government spending lead to much higher inflation than we’ve experienced the past couple of decades?

It certainly feels like a higher probability than we’ve had in many years.

While rising in recent months, inflation has remained relatively low for the entirety of this century:

12 of My Biggest Post-Pandemic QuestionsPosted May 16, 2021 by Ben Carlsonhttps://awealthofcommonsense.com/2021/05/12-of-my-biggest-post-pandemic-questions/

4. Monthly CPI Gains were Related to Economic Re-Opening Plays…Cars, Airfares, Hotels.

Guggenheim

Core CPI jumped to 3.0 percent year-over-year in April, the fastest pace since 1996. While the base effect from low readings in April 2020 was widely expected by markets, the monthly pace of inflation also rose notably. Core CPI increased 0.92 percent from March to April, the largest monthly gain since 1981. The market seems to think this may be the start of an enduring trend of higher inflation, given record fiscal stimulus, ultra-easy Federal Reserve (Fed) accommodation, and ongoing supply bottlenecks. But a closer look at the data suggests that this spike in prices is a one-time adjustment as the economy reopens. Spooked bond investors pulled forward Fed rate hike expectations after the CPI release, despite the Fed repeatedly emphasizing that they view this reopening-induced rise in prices as transitory. Investors should believe the Fed when they say they will look through this temporary inflation noise and fade the bond selloff. The month-to-month gains in the core CPI were largely driven by a few small categories related to economic reopening and temporary pandemic-induced shortages. 54 of the 92 basis point increase came from used cars, rental cars, airfares, and hotels, despite these categories having a weight of just 5 percent in the core CPI basket. The contribution was so large because the monthly price increases were so huge (e.g. 10 percent gain in used car prices). These increases are unlikely to be sustained beyond the next few months, especially once prices in depressed categories recover back to the pre-COVID trend. Small, Temporary Factors Boosted April CPIContribution to Monthly Percent Change in Core CPI Source: Guggenheim Investments, Haver Analytics. Data as of 4.30.2021. To the Fed, what matters is the trend in the larger, more durable inflation categories that influence the longer-term inflation outlook. In those categories, sequential inflation was much more muted: rents (including owners’ equivalent rent) and healthcare services contributed just 8 basis points to the monthly gain, despite making up 49 percent of the core CPI index. The Fed is more focused on the chart below than the chart above—and the bond market should be too. Larger, More Durable Inflation Categories Remain TameContribution to Monthly Percent Change in Core CPI Source: Guggenheim Investments, Haver Analytics. Data as of 4.30.2021. To the Fed, what matters is the trend in the larger, more durable inflation categories that influence the longer-term inflation outlook. In those categories, sequential inflation was much more muted: rents (including owners’ equivalent rent) and healthcare services contributed just 8 basis points to the monthly gain, despite making up 49 percent of the core CPI index. The Fed is more focused on the chart below than the chart above—and the bond market should be too. Larger, More Durable Inflation Categories Remain TameContribution to Monthly Percent Change in Core CPI Source: Guggenheim Investments, Haver Analytics. Data as of 4.30.2021. OER is owner’s equivalent rent. By the Macroeconomic and Investment Research GroupBrian Smedley, Chief Economist and Head of Macroeconomic and Investment ResearchMatt Bush, CFA, CBE, U.S. Economist, Macroeconomic and Investment Research Source: Guggenheim Investments, Haver Analytics. Data as of 4.30.2021. OER is owner’s equivalent rent. By the Macroeconomic and Investment Research GroupBrian Smedley, Chief Economist and Head of Macroeconomic and Investment ResearchMatt Bush, CFA, CBE, U.S. Economist, Macroeconomic and Investment Research |

https://www.guggenheiminvestments.com/perspectives

5. XLE Energy ETF Rallies to 2019 Level and Pauses

6. Showed Bitcoin Chart with Sideways Channel Last Week…Follow Up.

Bitcoin broke downwards out of the channel ……..Next Support Arrow on Chart.

7. Stocks in Physical World Outperforming Digital World

The Real World-by Michael Batnick

“What’s going on in the stock market?”

This usually isn’t an easy question to answer. But we live in unusual times and right now the stock market is very easy to explain.

Look through a few dozen charts and you’ll find a very clean narrative. Today’s winners were last year’s losers and today’s losers were last year’s winners. Said differently, stocks in the physical world are outperforming stocks that live in the digital world.

Look at this chart which compares the two groups. In the physical world, we have Macy’s, Marriott, MGM, Royal Caribbean, Delta, Simon Property, Freeport-McMoran, and Exon. In the digital world, we have Docusign, Shopify, Peloton, Teladoc, Zoom, Spotify, Netflix, and Unity.

Homebuilders, materials, industrials, transports. These names are rocking. SAAS names, which have been all the rage the last few years, look like death.*

Right now investors are focusing on crypto, the digital asset of the 21st century. But inside the stock market, it’s all about the physical world.

*I’m only describing what’s happening today. I have no idea what tomorrow brings.

https://theirrelevantinvestor.com/2021/05/05/the-real-world/

8. Inter-Agency Sprint Team Being Put Together to Regulate Crypto.

Washington is rushing to regulate crypto. It’s a mess.

The SEC, CFTC, IRS, FinCEN and Congress all want a piece of crypto oversight. The confusion has some in the industry calling for clearer regulations.

The SEC is just one of the agencies considering new cryptocurrency regulations. | Photo: Saul Loeb/AFP/Getty Images

The wild swings in crypto prices this year have enthralled and disheartened investors, alarmed Wall Street and focused the attention of regulators and lawmakers who already had cryptocurrency in their sights.

With shares of Coinbase, a prize of Silicon Valley investors who placed early bets on cryptocurrency markets, swinging along with the price of Bitcoin, tech is worried too.

The soundness and stability of cryptocurrencies has gone from a fascination of early, enthusiastic adopters to a mainstream concern. One particular worry is the ability of vague tweets from a single person — Tesla CEO Elon Musk, who has mixed his personal ardor for cryptocurrencies with the electric-vehicle company’s business — to send crypto prices gyrating.

Subscribe to Protocol | Fintech for even more on crypto — and the latest news, analysis and research on fintech.

Washington once seemed befuddled by cryptocurrency, handing out confusingrulings. But the SEC is now chaired by Gary Gensler, who taught a course on blockchain at MIT. He made it clear at a recent House committee hearing that the crypto industry could come under greater regulation. “If one trades bitcoin in America today, there’s not an investor protection regime,” he said.

The early crypto scene was dominated by libertarian types seeking to evade or defeat regulation. But now, a substantial number of players in the crypto industry have been seeking more regulatory clarity. There are a number of areas where the industry interacts with regulators, from banking to securities to taxes.

That’s part of the problem: Tokens that act like securities could fall under the Securities and Exchange Commission. The Commodity Futures Trading Commission is eager to keep its oversight of currency markets. And the Internal Revenue Service wants to make sure transactions that result in gains are properly taxed.

Read more: Crypto regulation is coming. Even regulators aren’t sure how.

While it’s unclear if or when Congress might pass legislation on the crypto industry, these agencies could have a major impact on how the industry operates. Yet key agencies still lack permanent heads, and future appointments could shift regulatory strategies considerably.

Here’s a rundown of where regulatory efforts stand.

Crypto exchanges

One big question is who is responsible for regulating crypto exchanges. The SEC’s Gensler in his recent remarks said he was concerned about manipulation and is reviewing how to regulate crypto exchanges.

Currently, crypto exchanges have no overarching regulation, as equity markets do. Coinbase, for example, is registered in most states with a money transmitter license, but not as an exchange. The Office of the Comptroller of Currency has granted national trust charters to a handful of exchanges, but the agency’s new chief has called for a review of crypto rules.

Read more: Bitcoin is crashing. Coinbase is looking beyond trading.

Those patchwork frameworks are designed to keep customers’ money secured and guard against money laundering, but they’re not meant to prevent price manipulation in the way regulations of securities exchanges and commodities futures do.

The House of Representatives passed a bill in April to create a digital asset working group with the SEC and CFTC. The group, which would include industry companies, would produce a report within a year on regulatory framework for digital assets. The fate of that bill in the Senate is unclear.

Also, the SEC and CFTC already have a cross-agency working group on crypto. “It’s not clear to me what a committee like that is going to do,” said Jerry Brito, executive director of the Coin Center, a D.C. industry policy group, referring to the new proposal.

Last year, then-Rep. Mike Conaway proposed the Digital Commodity Exchange Act, which would create new regulation of “digital commodity exchanges” under which crypto exchanges could opt in to regulation by the CFTC. The CFTC currently oversees foreign currency exchange markets and commodities futures markets. But rules for swapping heads of cattle don’t translate well to dogecoin and NFTs, and the commission currently has limited oversight of crypto trading exchanges.

That bill also would allow token sales to proceed as regulated securities under the SEC’s purview and then, if they pass a certain test, become commodities overseen by the CFTC. That could resolve lingering questions about the exact point in time that a project that raises capital for a future planned token as a security offering — a SAFT — later becomes a commodity that can be freely traded, Brito said.

However, the bill did not pass and Conaway has retired; the bill would need to be reintroduced in this Congress.

The SEC has an ongoing case against Ripple, the issuer of the XRP token and creator of the Ripple network, and two of its executives. The question of whether XRP is a security has been hotly debated in the industry for years. The legal action could prove to be a landmark for the industry.

Some in the industry believe the SEC should more clearly state what is a security — which requires a slew of regulations and investor protections — and what isn’t. But the SEC seems to be fine with what it has laid out so far and what enforcement actions it has taken, Brito said.

The CFTC doesn’t have a permanent head yet, but Chris Brummer has reportedly been a lead candidate. He has a deep background in crypto and is well-liked in the industry.

Cross-border questions

The Financial Action Task Force, a group of 200 countries and jurisdictions that sets international standards related to money laundering and terrorist financing released a draft of new guidance on regulating digital assets in March.

Some in the crypto industry aren’t happy. Coin Center argued that the guidelines are overly broad in requiring companies that aren’t acting as custodians of cryptocurrencies to register and conduct anti-money laundering activities. Currently FinCEN requires only those controlling the assets be regulated as money transmitters. The draft guidelines also seem to suggest prohibiting peer-to-peer cryptocurrencies and privacy coins, Coin Center said.

The guidelines would also add counter-party identification, similar to what FinCEN recently proposed in a rule that was hotly contested by Coinbase and others. FinCEN hasn’t made a decision on that proposed rule yet.

Then there’s China. What happens in that country often has an outsized effect on the crypto market, due to China’s role as a hotspot for crypto mining and a highly-activecommunity of crypto traders on social apps like Weibo.

China’s regulators this week effectively banned financial institutions and payment companies from most uses of cryptocurrencies. Chinese citizens can still trade crypto, but often need to do it through offshore exchanges. Yet the country remains interested in digital currencies, including the creation of a digital yuan.

Taxing matters

The IRS has been less vocal on cryptocurrency, though on Thursday, the Treasury said the tax agency would require disclosure of cryptocurrency transfers worth more than $10,000.

Beyond beefing up reporting requirements, there are two categories of issues. First, what constitutes income and basis, a matter that gets complicated as the tax authorities have to figure out what to make of technical aspects of cryptocurrencies like hard forks and airdrops.

Bitcoin had a hard fork in 2017, which resulted in holders of bitcoin receiving bitcoin cash tokens. Some reported the bitcoin cash they received as income; some reported only the sale of bitcoin cash as income; and others treated it like a stock split. “There’s never been a clear ruling,” Brito said.

Rep. Tom Emmer reintroduced a bill this week to require the IRS to create a safe harbor until it clarifies that issue.

The second issue is whether cryptocurrency should qualify for a de minimisexemption. Some in the crypto industry believe there should be an exemption for crypto similar to a law for foreign currency. (The scenario envisioned is a U.S. tourist who bought euros for a trip to pay for meals and incidentals, and finds herself with a paper gain as the currency swings.) A bill has been proposed that would make gains from cryptocurrency equal or less than $200 not taxable.

This could apply not just to buying coffee with crypto that’s appreciated in value, but also for other uses of crypto that are not for buying goods, such as identity verification. For example, Microsoft has launched a decentralized identity authentication technology that uses Bitcoin. However, such technologies could require tiny transactions that currently could be taxable events, Brito said.

Bitcoin ETFs

Exchange-traded funds exist for gold and foreign currencies, giving investors the ability to bet on or hedge risk related to those commodity prices. But the SEC has yet to approve a bitcoin ETF, after years of efforts.

The SEC seems to believe that the real problem is that the underlying markets where they’re trading are not safe, said Brito.

“Whenever the SEC has rejected a bitcoin ETF, the reason is consistently about: They’re not confident in the integrity of the underlying markets,” Brito said.

The DCEA bill would resolve that concern because the ETFs could trade on a CFTC-supervised market, Brito said. Or the industry itself could decide to self-regulate and gain the SEC’s confidence that way. But unless either of those things happen, Brito doesn’t expect bitcoin ETFs to be approved anytime soon.

Stablecoins

You won’t hear about stablecoins on “Saturday Night Live” because they lack the potential for price appreciation (or big crashes) that define cryptocurrency in the popular imagination. But stablecoins have become a large part of the crypto trading market precisely because they address volatility in crypto prices. They also hold potential for other uses such as payments.

There hasn’t been much change to how stablecoins are regulated. But a recent move by Facebook-backed Diem to move back to the U.S. from Switzerland could cause Congress to act.

The OCC released an order last July clarifying that federally-chartered banks can custody cryptocurrency, which was seen as a positive step in mainstreaming the industry.

The OCC, however, still doesn’t have a permanent leader. Michael Barr, a former Treasury department official and former Ripple adviser, was slated to be nominated but was reportedly dropped due to opposition from liberal Democrats.

In the meantime, Michael Hsu, who has been acting comptroller since May 10, said Wednesday that the OCC, the Federal Reserve and FDIC are in talks for an “interagency sprint team” on crypto regulatory issues.

This story was updated Thursday at 10:28 a.m. Pacific to include the Treasury’s new rules for reporting cryptocurrency transactions.

https://www.protocol.com/fintech/bitcoin-cryptocurrency-regulations

9.Ford Just Started EV Price War

Ford’s F-150 Lightning Electric Pickup Truck Undercuts Rivals With $40,000 Starting Price

Production of new battery-powered version of its top-selling vehicle is expected to start next spring in Michigan

0:03

Ford Debuts Electric F-150

Ford unveiled the battery-powered version of its F-150 pickup, joining other auto makers in the nascent electric-truck segment. The F-150 Lightning undercuts several rivals with a starting price around $40,000. Photo: Dominick Sokotoff/Zuma Press

By Mike Colias

Ford Motor Co. F 3.14% plans to undercut several rival producers of electric pickup trucks when its battery-powered F-150 goes on sale next year.

The company revealed prices for its newest truck—the first fully electric version of its top-selling and most-profitable vehicle—during an event Wednesday evening at its Dearborn, Mich., headquarters.

The company said the F-150 Lightning will have a starting price of $39,974 when it arrives in showrooms next year, significantly below that of some other electric trucks slated to hit the market. That is before tax credits are factored in.

Production of the new electric pickup is expected to start next spring in Michigan, the company said.

Ford’s F 3.14% strategy diverges from that of most other companies entering the nascent electric-truck segment. While several traditional auto makers and startups are preparing to roll out sporty, adventure-theme pickups at higher prices, Ford wants to attract fleet buyers, who generally prefer no-frills trucks that are cheaper to operate.

“That is a lot of truck for that starting point,” said Darren Palmer, Ford’s general manager of battery electric vehicles, adding that it will accelerate faster than any F-150 that Ford has made. “People are just making their first moves into electric, and we want to tempt them.”

https://www.wsj.com/articles/ford-to-unveil-electric-f-150-lightning-pickup-truck-11621441759

Motor Trend

A few key F-150 Lightning specs:

- The 2022 Ford F-150 Lightning is a five-passenger SuperCrew cab with a 5.5-foot bed. These are the same dimensions as its conventional counterpart, meaning common accessories and equipment will work and fit just the same.

- Maximum payload of 2,000 pounds, of which 400 pounds can go in the frunk where the engine used to be.

- It can tow up to 10,000 pounds.

- With extended battery: 563 horsepower, 775 lb-ft of torque, and a driving range of about 300 miles on a single charge.

- With standard battery: 426 hp, 775 lb-ft, and a range of about 230 miles.

- Front and rear motors provide standard all-wheel drive, and skidplates protect the underbody while off-roading.

- It retains the full-size spare tire in the back.

https://www.motortrend.com/news/2022-ford-f-150-lightning-electric-first-look-review/

10. 25 Things You Need to Stop Wasting Time On

WRITTEN BY MARC CHERNOFF–Here are some things to consider that I’ve been examining in my own life:

1. Distractions that keep you from special moments with special people. – Pay attention to the little things, because when you really miss someone you miss the little things the most, like just laughing together. Go for long walks. Indulge in great conversations. Count your mutual blessings. Let go for a little while and just BE together.

2. Compulsive busyness. – Schedule time every day to not be busy. Have dedicated downtime – clear points in the day to reflect, rest, and recharge. Don’t fool yourself; you’re not so busy that you can’t afford a few minutes of sanity.

3. Negative thinking about your current situation. – Life is like a mirror; we get the best results when we smile. So talk about your blessings more than you talk about your problems. Just because you’re struggling doesn’t mean you’re failing. Every great success requires some type of worthy struggle to get there.

4. The needless drama around you. – Be wise enough to walk away from the nonsense around you. Focus on the positives, and soon the negatives will be harder to see.

5. The desire for everything you don’t have. – No, you won’t always get exactly what you want, but remember this: There are lots of people who will never have what you have right now. The things you take for granted, someone else is praying for. Happiness never comes to those who don’t appreciate what they already have.

6. Comparing yourself to everyone else. – Social comparison is the thief of happiness. You could spend a lifetime worrying about what others have, but it wouldn’t get you anything.

7. Thinking about who you were or what you had in the past. – You’re not the same person you were a year ago, a month ago, or a week ago. You’re always growing. Experiences don’t stop. That’s life.

8. Worrying about the mistakes you’ve made. – It’s OK if you mess up; that’s how you get wiser. Give yourself a break. Don’t give up. Great things take time, and you’re getting there. Let your mistakes be your motivation, not your excuses. Decide right now that negative experiences from your past won’t predict your future.

9. Worrying about what everyone thinks and says about you. – Don’t take things too personally, even if it seems personal. Rarely do people do things because of you; they do things because of them. You honestly can’t change how people treat you or what they say about you. All you can do is change how you react and who you choose to be around.

10. Self-deception. – Your life will improve only when you take small chances. And the first and most difficult chance you can take is to be honest with yourself.

11. A life path that doesn’t feel right. – Life is to be enjoyed, not endured. When you truly believe in what you’re doing, it shows, and it pays. Success in life is for those who are excited about where they are going. It’s about walking comfortably in your own shoes, in the direction of YOUR dreams.

12. Everyone else’s definition of success and happiness. – You simply can’t base your idea of success and happiness on other people’s opinions and expectations.

13. Those who insist on using and manipulating you. – What you allow is what will continue. Give as much as you can, but don’t allow yourself to be used. Listen to others closely, but don’t lose your own voice in the process. (Angel and I discuss this in detail in the “Boundaries & Expectations” chapter of“1,000 Little Habits of Happy, Successful Relationships”.)

14. Trying to impress everyone. – One of the most freeing things we learn in life is that we don’t have to like everyone, everyone doesn’t have to like us, and that’s perfectly OK. No matter how you live, someone will be disappointed. So just live your truth and be sure YOU aren’t the one who is disappointed in the end.

15. All the fears holding you back. – Fear is a feeling, not a fact. The best way to gain strength and self-confidence is to do what you’re afraid to do. Dare to change and grow. In the end, there is only one thing that makes a dream completely impossible to achieve: Lack of action based on the fear of failure.

16. Doubting and second-guessing yourself. – When in doubt just take the next small step. Sometimes the smallest step in the right direction ends up being the biggest step of your life.

17. People who continuously dump on your dreams. – It’s better to be lonely than to allow negative people derail you from your sanity. Don’t let others crush your mood or dreams. Do just once what they say you can’t do, and you will never pay attention to their negativity again.

18. Thinking the perfect time will come. – You can’t always wait for the perfect moment. Sometimes you must dare to do it because life is too short to wonder what could have been.

19. Band-Aids and temporary fixes. – You can’t change what you refuse to confront. You can’t find peace by avoiding things. Deal with problems directly before they deal with your long-term happiness. Build sustainable habits that move your life forward. (Angel and I build small, life-changing daily habits with our students in the “Goals and Growth” module of theGetting Back to Happy course. And we’d be truly honored to work with YOU.)

20. Close-minded judgments. – Open your mind before you open your mouth. Don’t hate what you don’t know. The mind is like a parachute; it doesn’t work when it’s closed.

21. Other people’s mistakes and oversights. – Today, be tolerant of people’s mistakes and oversights. Sometimes good people make bad choices. It doesn’t mean they’re bad; it simply means they are human.

22. Resentment. – Kindness is not to be mistaken for weakness, nor forgiveness for acceptance. It’s about knowing that resentment is not on the path to happiness. Remember, you don’t forgive people because you’re weak. You forgive them because you’re strong enough to know that people make mistakes.

23. Any hateful thoughts at all. – Set an example. Treat everyone with kindness and respect, even those who are rude to you – not because they are nice, but because you are. Make kindness a daily habit; it’s what makes life happier and more fulfilling in the long run.

24. Regrets of any kind. – You don’t have to be defined by the things you once did or didn’t do. Don’t let yourself be controlled by regret. Maybe there’s something you could have done differently, or maybe not. Either way, it’s merely something that has already happened. Leave the unchangeable past behind you as you give yourself to the present moment.

25. Every point in time other than right now. – Don’t cry over the past, it’s gone. Don’t stress too much about the future, it hasn’t arrived. Do your best to live NOW and make this moment worth living.

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..