1. Crypto Shaves $850B Off Market Cap….Still a Blip on Chart

Crypto markets have shaved more than $850 billion from their combined market value, according to CoinMarketCap.com.

COINMARKETCAP.COM

By Mark DeCambre-Marketwatch

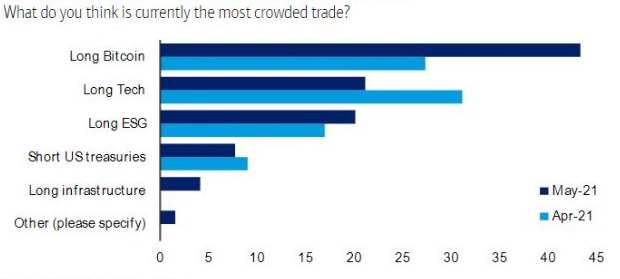

2. Long Bitcoin is “Most Crowded Trade”

From Dave Lutz at Jones Trading

Bank of America Most Crowded Trade Poll

One Huge Pain Trade – BofA notes Bitcoin is the most “Crowded Trade” on the street

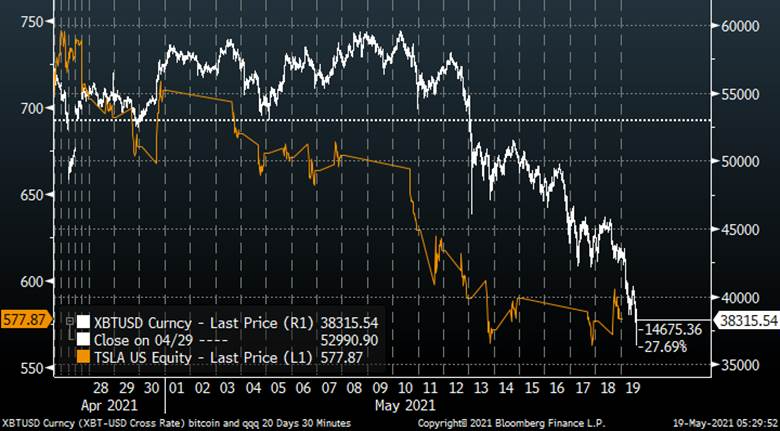

3. Bitcoin and TSLA Trade Now Married.

And note how Bitcoin de-levering is the same trade as in TSLA….

4. Large Cap Tech Stocks Down Even After Massive Earnings Beats

Jim Reid-DB Bank

Technology shares have been battling the cross currents of strong growth and higher yields all year. Throw in heroic valuation levels in many names and 2021 is proving to be much more of a struggle than 2020.

Today’s CoTD shows the performance of the largest NASDAQ constituents in these two years with the graph cut-off to reflect Tesla’s outsized +743% gain in 2020. So far in 2021 it’s the worst performer amongst these names (-18.1%).

Even peerless companies like Apple and Amazon, which have announced two very strong quarters of results so far this year, have slightly declined in 2021.

At the start of the year, my two biggest worries were notably higher yields and a bubble bursting in tech shares. As we get closer to midyear, yields are indeed a lot higher across the globe and tech is deflating from its February peaks. However, this has so far had minimal impact on many other risk assets.

Could you continue to get buoyant markets, higher yields and falling tech? Or will the latter two become greater risks as we move into and through H2?

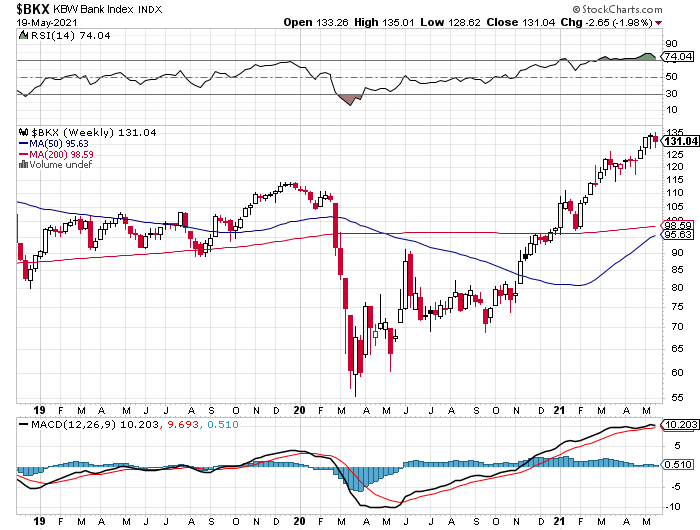

5. Leadership Rotation? YTD KBW Bank Index +37% vs. S&P 10%

©1999-2021 StockCharts.com All Rights Reserved

6. Short-Treasury ETF +13% YTD

TBF short U.S. treasury up big but still not even back to Jan 2020 levels

©1999-2021 StockCharts.com All Rights Reserved

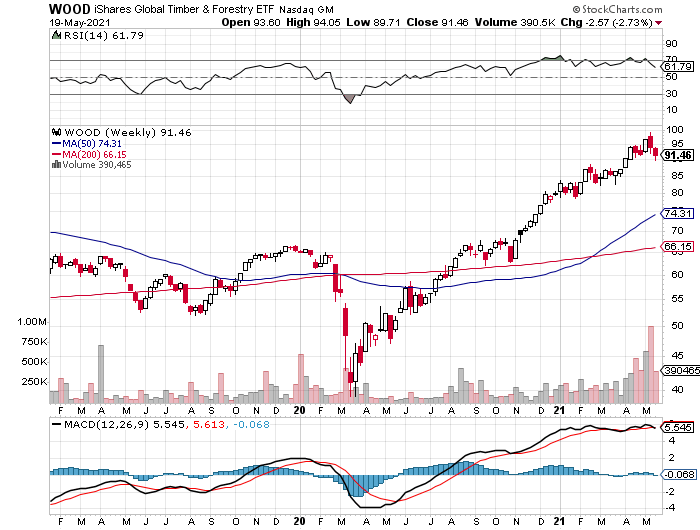

7. Lumber futures swing 10% in wild session as speculative frenzy ends

David Paul Morris | Bloomberg | Getty Images

Lumber futures gyrated in wild trading on Wednesday as traders struggled to determine if a recent pullback in wood prices had removed enough froth from the market.

Lumber futures for July delivery at first fell 5% to $1,201 per thousand board feet Wednesday morning, only to turn positive and rally 5% by the afternoon. Prices hit what’s known as limit down, and then limit up, the maximum percentage changes allowed by the Chicago Mercantile Exchange, where the futures trade.

Prices have fallen every day since lumber hit a record of $1,711 per thousand board feet on May 10. Despite the swoon, the price of lumber is still up about 37% in 2021.

“Price stifled demand. Period. There’s no other question about it,” Robin Cross, a commodities broker at StoneX, said of the recent pullback from highs. “It’s not like I have a whole bunch of guys calling and selling it. What’s really happening is guys bought high-priced inventory, and they’re afraid to add to it. … No one wants to get left holding the $1,700 bag.”

Tens of thousands of stuck-at-home homeowners, and new homebuilders, have for much of the last year snapped up processed pine by the ton. But more recently, with sawmills unable to keep up with demand as the calendar turned to spring, a speculative frenzy entered the market with traders bidding up prices aggressively since March.

Just a blip so far on Lumber ETF chart

©1999-2021 StockCharts.com All Rights Reserved

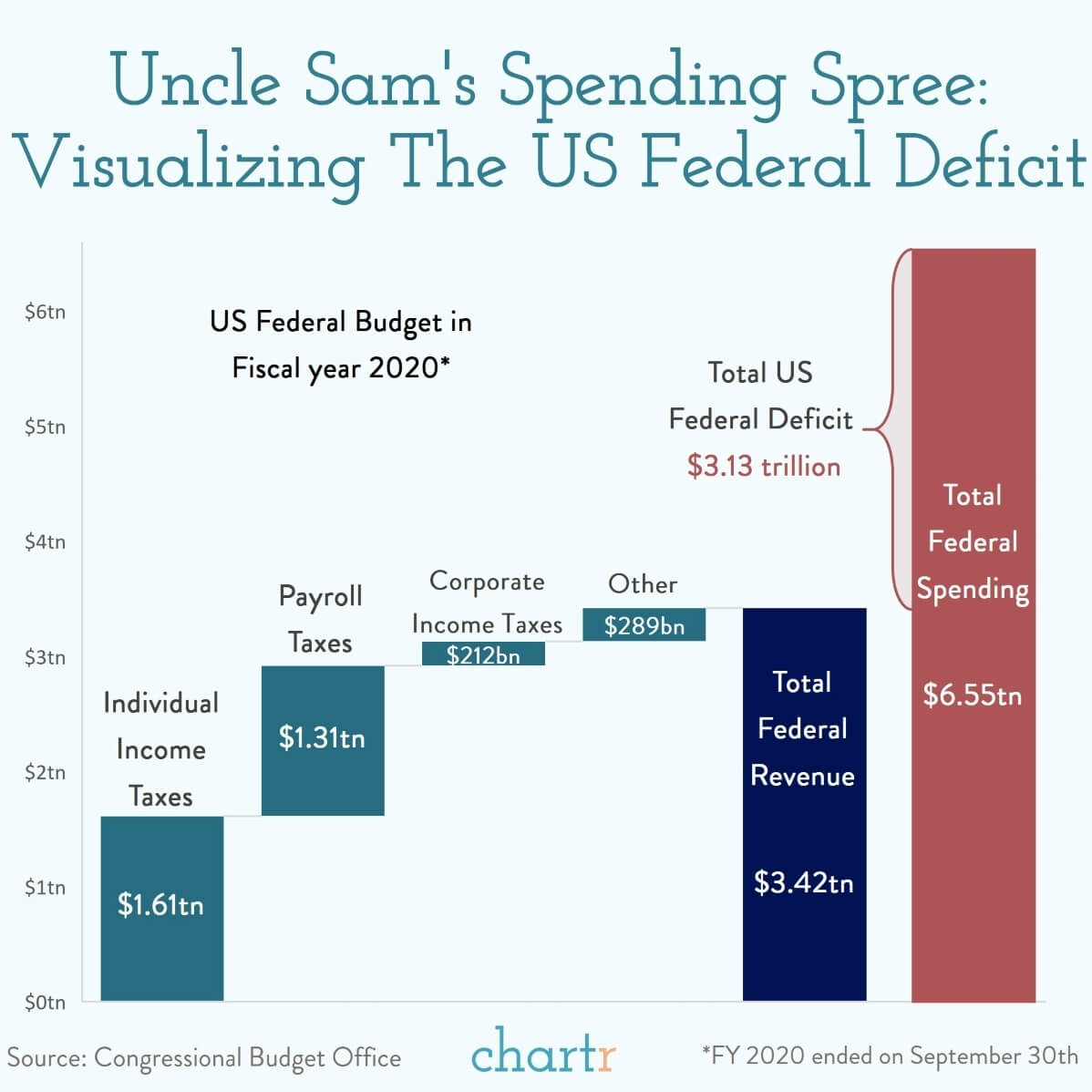

8. Visualizing the U.S. Federal Deficit

| Uncle Sam spent a lot of money last year. About $6.5 trillion in US federal spending to be exact. That figure is not far from double what the federal government collected in revenue from taxes — meaning that the US federal deficit broke through the $3 trillion mark for the first time in history. Much of that deficit can be attributed to COVID-19 relief efforts. Federal spending jumped ~45% compared to FY2019, mostly thanks to support for businesses, unemployment insurance, stimulus checks and other forms of COVID-related aid. Revenues decreased by 3%. I O U $27 trillion If you’re not that familiar with government finances you might be wondering where they got the cash after coming up a little short. The simple truth is that the government borrowed it, adding a few trillion to its already enormous tab (AKA the national debt) — which at the end of 2020 was about $27 trillion and change. That works out to about $82k for every single person in the United States (including children). As alarming as that number sounds, the US gets about as good a rate on its debt as any borrowing institution in the world, and it’s hard to make a case for frugality in the middle of a global pandemic. |

9. How to Keep Brain Healthy.

David Asprey Bulletproof Blog

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..