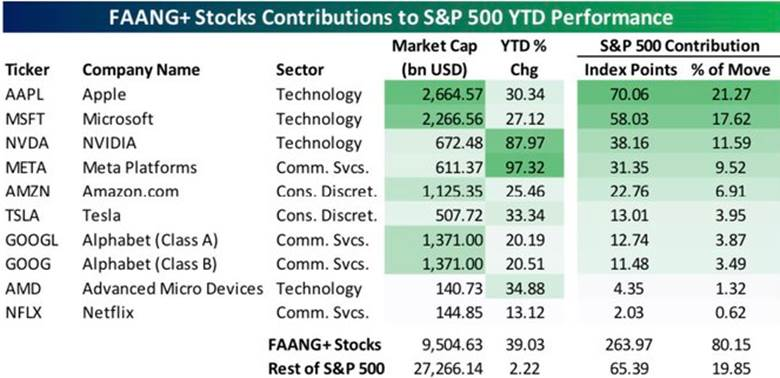

1. FAANG+ All of S&P Returns 2023

Dave Lutz Jones Trading EARNINGS ROLLS– Results from the big tech companies have sparked investors’ hopes that the worst of the postpandemic hangover is fading, but they also show how much growth has slowed – Companies as varied as AMZN, GOOGL, META, INTC signaled to investors in recent days that the brutal slowdown in sales growth that began as people emerged from the pandemic and re-engaged with daily routines was coming to an end. Digital ad spending is stabilizing, for instance, and laptop buying is showing modest signs of life. The big tech companies that reported results this past week added a combined $320 billion in market valuation after posting their figures, according to WSJ

For many individual investors, the stakes ramp up Thursday when Apple is on deck to report its earnings. The company makes up about 19% of the average individual investor’s portfolio, according to WSJ. Bespoke notes Apple and Microsoft account for 39% of the S&P’s gain so far in 2023. Add in NVIDIA and Meta and it’s 60%!

2. AAPL…Two Previous 2022 Runs at New Highs

3. Gold GLD ETF Needs $196 Print to Break-Out

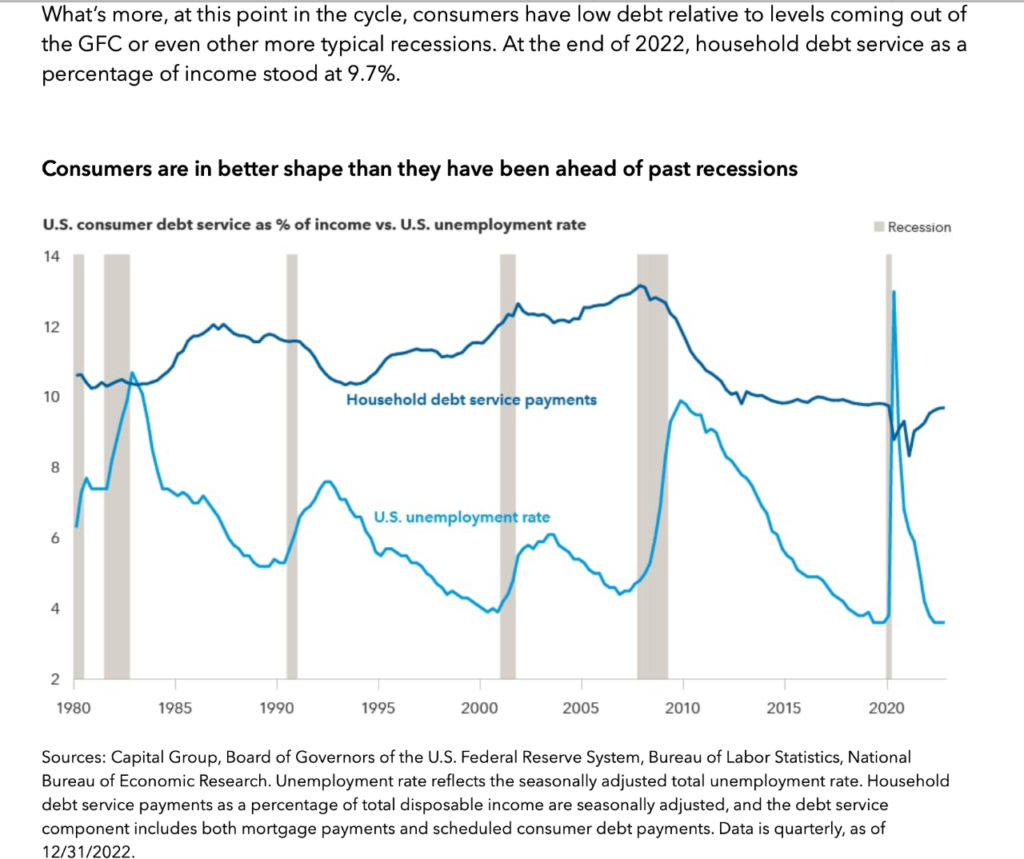

4. Household Debt Service at Lows of 9.7%

https://www.capitalgroup.com/advisor/insights.html

5. Personal Savings Rate Bottomed and Showing Recovery

The United States: Personal saving as a share of disposable income is recovering.

Source: The Daily Shot https://dailyshotbrief.com

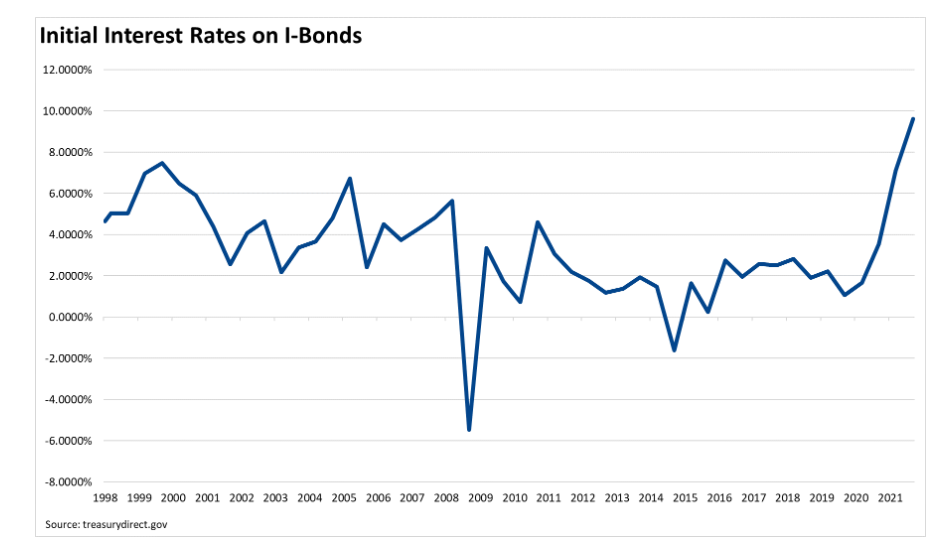

6. Interest Rates on I-Bonds Reset to 4.3%

I-Bonds Hit a High Over 9% But They Re-Set Every 6 Months.

New I-bonds are now officially earning 4.3% as inflation wanes, but have an attractive 0.9% fixed rate

Beth Pinsker From May 1 through the end of October, any new purchases get a 0.9% fixed rate for up to 30 years, making it pretty good deal for long-term savers.

With inflation numbers coming down, the Series I Bonds interest rate took a tumble for its semiannual adjustment, officially announced Monday.

New I-bonds, issued May 1 through the end of October, will have a composite rate of 4.3%, which is down from 6.89% over the previous six months and a peak of 9.62%. That includes a fixed rate of 0.9%, which is up from the last rate of 0.4% in the last six months, and 0% for several years before that.

The U.S. Treasury usually waits until May 1 and Nov. 1 to reveal the new rate on the investments, but this time posted the update with no warning on Friday on its TreauryDirect.gov, which is the only place to buy I-bonds, once sales were locked out for the previous rate on April 27. I-bonds have grown in popularity over the past two years as rates have climbed, and that the news spread quickly.

I-bond rates have two components: an adjustable rate based on inflation data that resets every six months and a fixed rate that is set at purchase and sticks with the bond until redemption (up to 30 years).

Some rules apply, most important: You can only buy up to $10,000 a year per individual. Also, you must hold I-bonds at least one year, and if you cash out before five years, you lose the last three months of interest.

At a rate of 4.3%, I-bonds will no longer be top of the savings heap when CDs, savings accounts and other Treasury products are yielding as much or more. But because of the way the inflation protection works, I-bonds are still attractive for long-term savers. That’s because the new issue I-bonds have such a robust fixed rate. Those who bought I-bonds in the last two years when the fixed rate was 0% might want to think about cashing those out and buying new ones, but this strategy involves waiting at least 15 months rather than just one year.

“I would recommend cashing out old bonds at 0% to switch to new bonds at 0.9%, but you have to be careful not to lose the 6.48% variable rate,” says Harry Sit, founder of the blog The Finance Buff.

The inflation conundrum

You might be wondering: If eggs are still so expensive, why did the I-bond interest rate drop so much?

“Inflation is never an ‘is’–it’s only a ‘was,’” explains Jeremy Keil, a financial adviser based in Milwaukee.

I-bonds are based on the last six months of inflation data from the Consumer-Price Index, which does not have the peak numbers from a year ago that are still included in headline inflation data. “Inflation is percentage of growth and it depends on when you start counting,” Keil says.

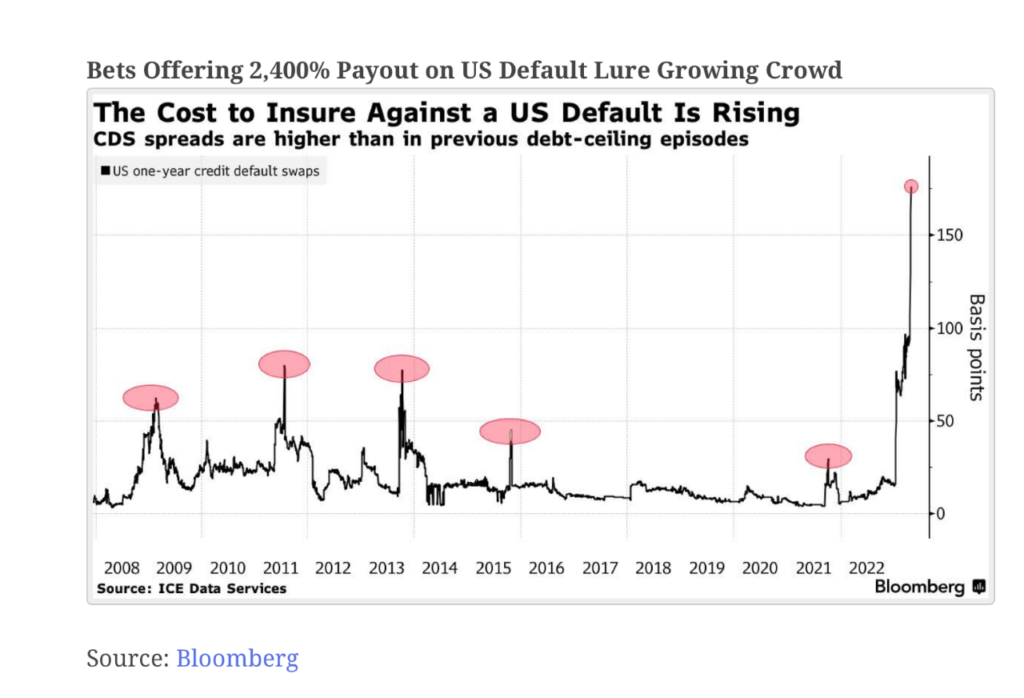

7. The Cost to Insure Against a U.S. Default is Rising

From Barry Ritholtz Blog https://ritholtz.com/2023/05/10-monday-am-reads-389/

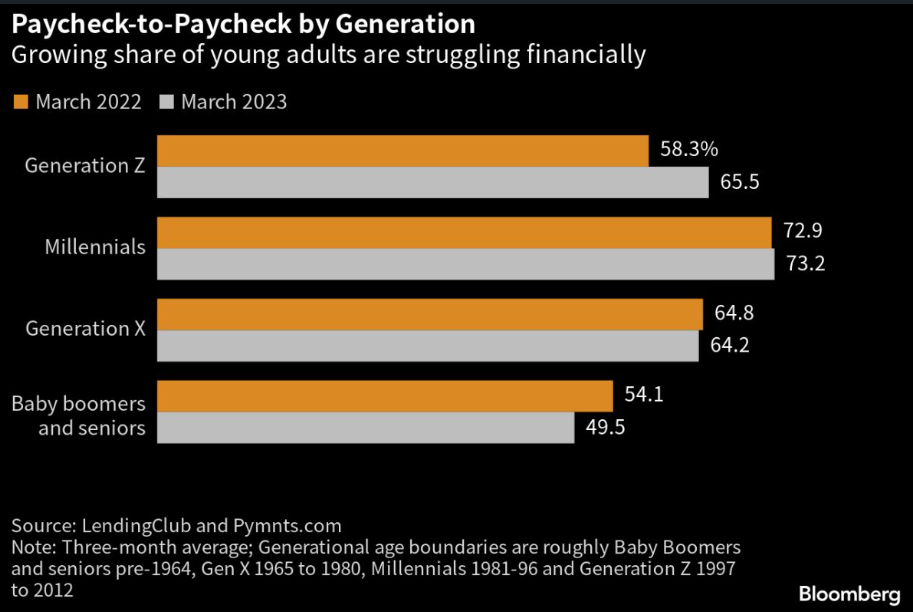

8. Paycheck to Paycheck by Generation

Liz Ann Sonders Schwab Survey from LendingClub shows that 65.5% of Gen Z were living paycheck-to-paycheck as of March, up from 58.3% a year earlier … share is greater for Millennials (73.2%), but increase from prior year (+0.3%) wasn’t as dramatic

https://www.linkedin.com/in/lizannsonders/

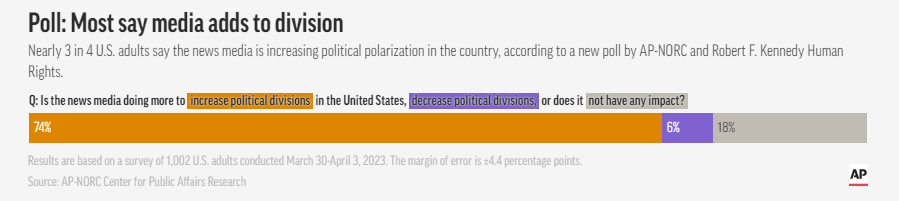

9. Nearly three-quarters of Americans blame media for dividing nation, poll says

By DAVID KLEPPERtoday WASHINGTON (AP) — When it comes to the news media and the impact it’s having on democracy and political polarization in the United States, Americans are likelier to say it’s doing more harm than good.

Nearly three-quarters of U.S. adults say the news media is increasing political polarization in this country, and just under half say they have little to no trust in the media’s ability to report the news fairly and accurately, according to a new survey from The Associated Press-NORC Center for Public Affairs Research and Robert F. Kennedy Human Rights.

The poll, released before World Press Freedom Day on Wednesday, shows Americans have significant concerns about misinformation — and the role played by the media itself along with politicians and social media companies in spreading it — but that many are also concerned about growing threats to journalists’ safety.

“The news riles people up,” said 53-year-old Barbara Jordan, a Democrat from Hutchinson, Kansas. Jordan said she now does her own online research instead of going by what she sees on the TV news. “You’re better off Googling something and learning about it. I trust the internet more than I do the TV.”

That breakdown in trust may prompt many Americans to reject the mainstream news media, often in favor of social media and unreliable websites that spread misleading claims and that can become partisan echo chambers, leading to further polarization.

Overall, about 6 in 10 said the news media bears blame for the spread of misinformation, and a similar percentage also said it has a large amount of responsibility for addressing it. Majorities also think others, including social media companies and politicians, share in the responsibility both for the spread of misinformation and for stopping it from spreading.

“So many people get their information from social media, and people believe whatever they want to believe,” said Araceli Cervantes, a 39-year-old Chicago woman and mother of four who said she is a Republican.

When it comes to protecting the freedom of the press in the U.S., 44% of respondents say the U.S. government is doing a good job, more than the 24% who say it’s doing a bad job. Most Americans are at least somewhat concerned, however, when it comes to the safety of journalists, with roughly a third saying they’re very concerned or extremely concerned about attacks on the press.

The poll of 1,002 adults was conducted March 30-April 3 using a sample drawn from NORC’s probability-based AmeriSpeak Panel, which is designed to be representative of the U.S. population. The margin of sampling error for all respondents is plus or minus 4.4 percentage points.

Follow the AP’s coverage of misinformation at https://apnews.com/hub/misinformation.

10. A psychologist shares 6 toxic phrases ‘highly narcissistic’ people always use—and how to deal with them-CNBC

Ramani Durvasula, Contributor@DOCTORRAMANI

The world is full of difficult personalities, but the one that’s impossible to avoid is the narcissist. They are usually the most insecure people in the room, but have established a way of appearing ultra-confident.

As a psychologist who studies narcissism, I’ve found that, in most cases, highly narcissistic people are masters of gaslighting. Their primary goal in a relationship is to offset their insecurity by controlling and manipulating others.

Here are six phrases that they always use — and how to deal with them:

1. “I don’t want to make this about me, but…”

Statements like this show that narcissistic people know they shouldn’t dominate the conversation, yet they do it anyway. It’s like a pseudo-disclaimer that gives them permission to only focus on themselves.

Olivia de Recat for CNBC Make It

How to handle it: If you get into a conversation with a narcissist, be prepared for their story hour. If it’s interesting, listen. You can even treat it like an IRL podcast. But if you’re hoping for a two-way conversation, look elsewhere.

2. “I’m sorry you feel that way.”

Narcissists have a hard time admitting fault, and this is their classic attempt at an apology. But it’s actually more of a deflection.

With this phrase, they’re implying that your feelings are your issues alone, and that they’ll take no responsibility for their behavior.

How to handle it: Without genuine remorse, no matter what the transgression was, they’ll likely do it again. My advice is to simply disengage. To avoid getting hurt in the future, it is often best to see people for who they really are.

3. “Why are you doing this to me?”

Narcissists have a stunning capacity to shift from being the offender to being the victim.

You may be the one who has the flu or a tough week at work. But if whatever you’re struggling with inconveniences them, it will be framed as their problem.

How to handle it: You can get a degree of power back through self-awareness. Otherwise, you may find yourself constantly wondering if you’re actually at fault. Seek support — from a therapist or empathetic friend, for example — to remind yourself that you’re not the offender.

4. “I’m a busy person. I don’t have time for this.”

“This” can be anything — maybe you want to discuss a project you’re working on together or you’re inviting them to a work event.

The hallmarks of a narcissist are entitlement, a lack of empathy and the inability to maintain reciprocal relationships. Not only are they unable to understand another person’s needs, but they’re also dismissive of them.

How to handle it: Recognize their limitations. They likely won’t make time for you unless they need something. These relationships are often the equivalent of going to an empty well for water, so do what you can to foster support independent of the narcissist.

5. “I hope you know who you’re messing with.”

The evil twin to this is: “If you ever do wrong by me, I’ll make your life a living hell.”

This tactic of dangling menace and the possibility of vengeance is how they create an illusion of power and a sense of fear in you. Most people don’t want to face this perceived threat, so they comply.

How to handle it: This can be unsettling, especially if you’re dealing with someone who does have a track record of making other people miserable. Documentation is key. Save all emails and messages. If there’s a genuine safety issue, work with local authorities to devise a plan.

6. “It’s not fair.”

Narcissists believe there should be a set of rules for them, and separate set of rules for everyone else. When they have to comply, or a consequence is enforced, it’s a reminder that they are not special.

Whether their friend’s company is doing great and making lots of money, or they have to pay a penalty because they tried to game the system and got caught, you can expect a rant of “it’s not fair” statements.

How to handle it: You may be tempted to appease them, perhaps out of guilt or to avoid conflict. But doing so will set an impossible precedent. Don’t try to be a person who tries to make life “fair” for them by making unreasonable personal sacrifices.

Dr. Ramani Durvasula is a psychologist, professor of psychology at California State University, Los Angeles, and founder of LUNA Education. She is also the author of “Don’t You Know Who I Am: How to Stay Sane in the Era of Narcissism, Entitlement and Incivility″ and ”Should I Stay or Should I Go: Surviving a Relationship With a Narcissist.” Follow her on Twitter @DoctorRamani.