1. Nasdaq Closes Below 50 Day First Time Since November.

Nasdaq Comp closes below blue 50 day line

©1999-2021 StockCharts.com All Rights Reserved

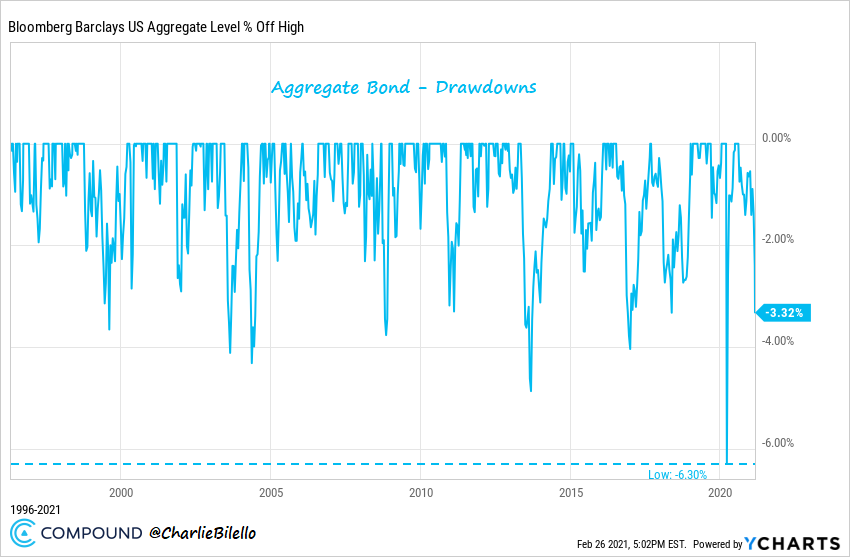

2. The Price of Admission in Bonds

BY CHARLIE BILELLO

Aggregate Bonds

The last category I want to cover is Aggregate Bonds, which are to bonds what the S&P 500 is to stocks.4 This broad category includes a number of different bond sectors with the highest weightings in Treasuries (38.6%), Agency Mortgages (26.8%), and Investment Grade corporate bonds (23.8%).

The result is an instrument that behaves somewhere in between Treasuries and corporate bonds, but much closer to the Treasury end of the spectrum. That makes interest rate risk the primary concern (with a duration of around 6 years), with a lesser impact from credit spreads.

During a brief period in March 2020, we saw both of these factors play out at the same time: a spike in risk-free interest rates combined with widening credit spreads. This led to the largest drawdown in Aggregate Bonds that we’ve seen in recent history (-6.3%).

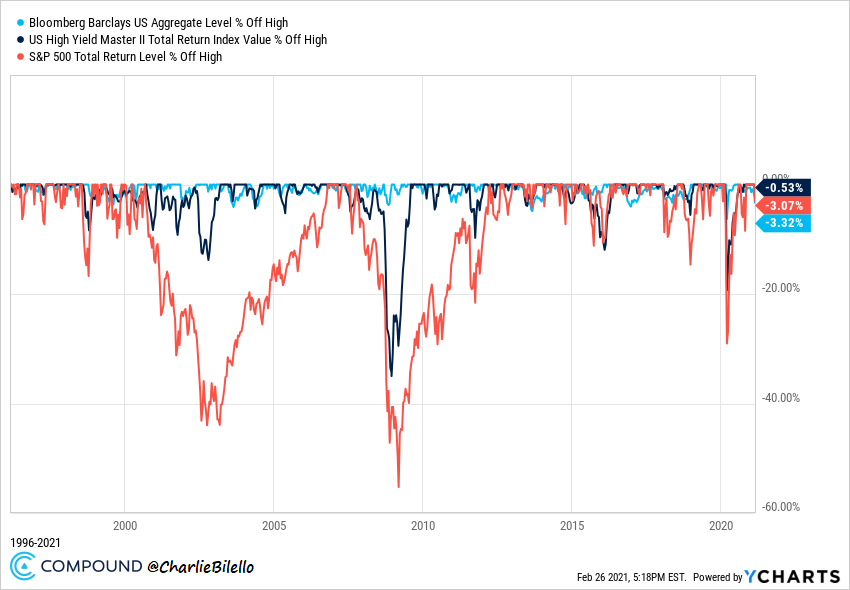

But when compared to High Yield bonds and the S&P 500, the 2020 drawdown in Aggregate Bonds is barely noticeable.

Which is another way saying that the risk in equities is many orders of magnitude larger than the risk in aggregate bonds. Looking back at history, stocks have lost more in a bad day than bonds have lost in a bad year.

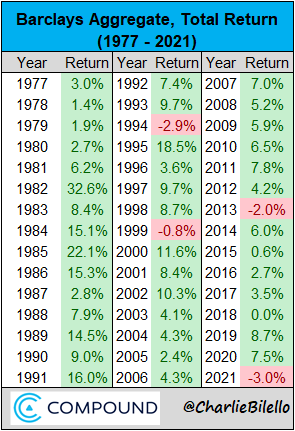

The Price of Admission

If the year ended today, it would be the worst ever for Aggregate Bonds, slightly edging out 1994. Interest rates are rising from historic lows and there is little cushion from the coupon to soften the blow.

For those that equate bonds with safety, this can be a tough pill to swallow. But bearing that risk is the price of admission for long-term bond investors, without which there would be no reward above cash.

https://compoundadvisors.com/2021/the-price-of-admission-in-bonds

Found at Abnormal Returns Blog www.abnormalreturns.com

3. Inflation Worries Going Up….Gold Going Down.

Here’s Peter Bernstein, from The Power of Gold:

The cost of living doubled from 1980 to 1999- an annual inflation rate of about 3.5 percent- but the price of gold fell by some 60 percent. In January 1980, one ounce of gold could buy a basket of goods and services worth $850. In 1999, the same basket would cost five ounces of gold.

GLD Chart 50 day thru 200 day to downside

©1999-2021 StockCharts.com All Rights Reserved

Good Read on Gold What Happened to Gold?–by Michael Batnick

https://theirrelevantinvestor.com/2021/02/26/what-happened-to-gold/

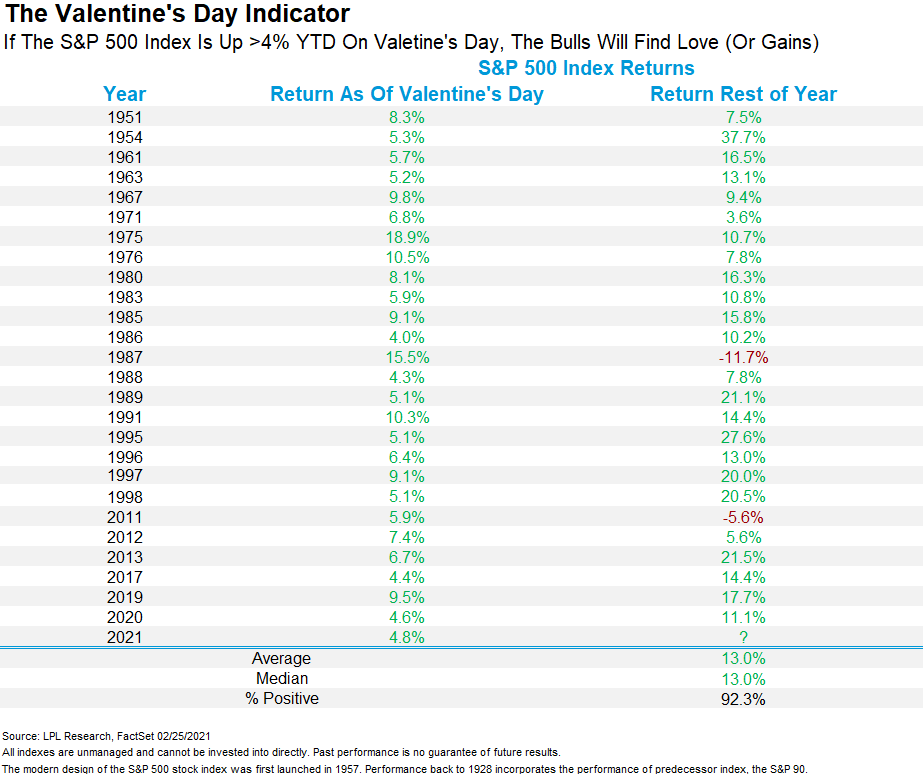

4. Historical Bullish Seasonality if S&P Positive Post Valentine’s

https://lplresearch.com/2021/02/26/three-charts-you-need-to-see/

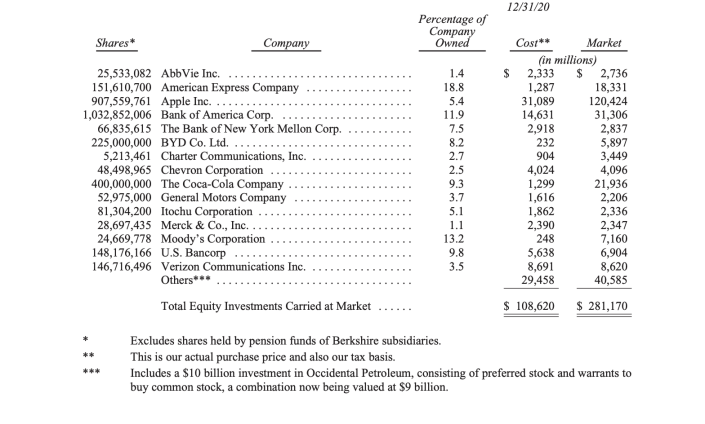

5. Buffett Top 15 Holdings

Berkshire owns large stakes in companies like AbbVie (ABBV), American Express (AXP), Apple (AAPL), Bank of America (BAC), Bank of New York Mellon (BK), BYD Co., Charter Communications (CHTR), Coca-Cola (KO), Chevron (CVX), General Motors (GM), Itochu, Merck (MRK), Moodys Corp (MCO), U.S. Bancorp (USB), and Verizon (VZ).

Berkshire Hathaway’s 15 largest stock positions.

6. Lumber Prices +170% in 10 Months.

WOOD lumber ETF

©1999-2021 StockCharts.com All Rights Reserved

7. What’s been happening with oil?

Bloomberg–Prices collapsed in 2020, even turning negative at one point, but have recovered as demand rebounded more strongly than many had expected. Early in 2021, the Organization of the Petroleum Exporting Countries and its allies were holding back crude equivalent to about 10% of current global supply. Market fundamentals have shifted, especially in the U.S. with the emergence of shale oil. Haunting traditional producers is the prospect that a prolonged period of high prices would trigger a new flood of supply beyond OPEC’s control. Even so, some oil bulls aren’t ruling out the eventual return of prices above $100 a barrel.

When Does a Commodities Boom Turn Into a Supercycle?

Mark Burton, Thomas Biesheuvel, and Alex Longley

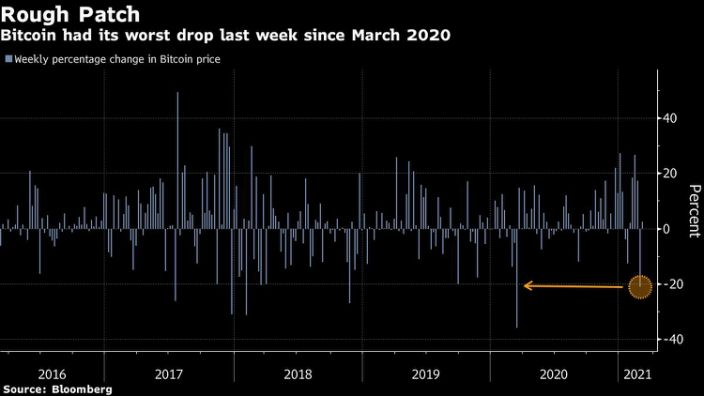

8. Bitcoin Drop Worse Since March 2020

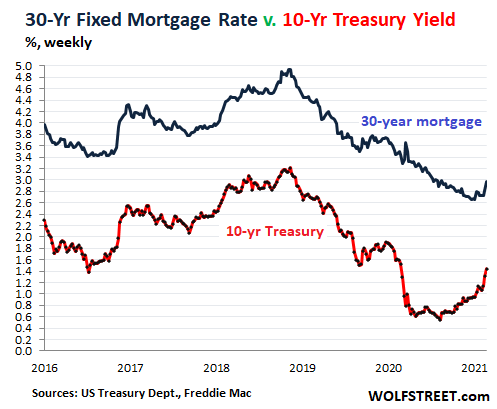

9. 10 Year Yield Vs. Mortgage Rates

And mortgage rates finally started to follow.

The average 30-year fixed mortgage rate rose to 2.97% during the week ended Wednesday, as reported by Freddie Mac on Thursday. This does not yet include the moves on Thursday and Friday.

The 30-year mortgage rate normally tracks the 10-year yield fairly closely. But in 2020, they disconnected. When the 10-year yield started rising in August, the mortgage market just ignored it, and mortgage rates continued dropping from record low to record low until early January, whipping the housing market into super froth.

But then in early January, mortgage rates started climbing and have now risen by 32 basis points in less than two months — though they remain historically low.

Note the disconnect in 2020 between the weekly Treasury 10-year yield (red) and Freddy Mac’s weekly measure of the average 30-year fixed mortgage rate (blue):

In this incredibly frothy and overpriced bubble housing market, higher mortgage rates are eventually going to cause some second thoughts.

And that too appears to be smiled upon approvingly by the Fed. They’re not blind. They see what is going on in the housing market – what risks are piling up with this type of house price inflation. They just cannot say it out loud. But they can let long-term yields rise.

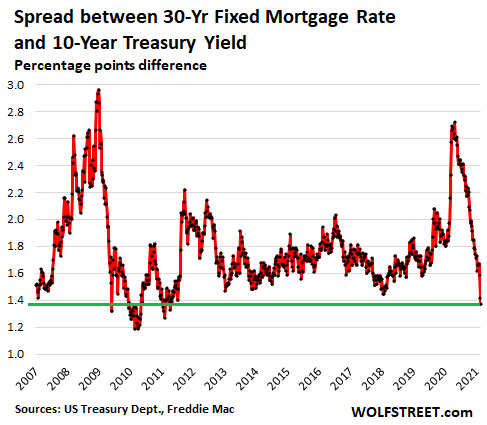

Mortgage rates have some catching up to do. The spread between the average 30-year fixed mortgage rate and the 10-year yield has been narrowing steadily since the March craziness, and at 1.37 percentage points, is the narrowest since April 2011.

Treasury Market Had a Cow, Mortgage Rates Jumped

10. How Great Coaches Ask, Listen, and Empathize

by Ed Batista

Historically, leaders achieved their position by virtue of experience on the job and in-depth knowledge. They were expected to have answers and to readily provide them when employees were unsure about what to do or how to do it. The leader was the person who knew the most, and that was the basis of their authority.

Leaders today still have to understand their business thoroughly, but it’s unrealistic and ill-advised to expect them to have all the answers. Organizations are simply too complex for leaders to govern on that basis. One way for leaders to adjust to this shift is to adopt a new role: that of coach. By using coaching methods and techniques in the right situations, leaders can still be effective without knowing all the answers and without telling employees what to do.

Coaching is about connecting with people, inspiring them to do their best, and helping them to grow. It’s also about challenging people to come up with the answers they require on their own. Coaching is far from an exact science, and all leaders have to develop their own style, but we can break down the process into practices that any manager will need to explore and understand. Here are the three most important:

Ask

Coaching begins by creating space to be filled by the employee, and typically you start this process by asking an open-ended question. After some initial small talk with my clients and students, I usually signal the beginning of our coaching conversation by asking, “So, where would you like to start?” The key is to establish receptivity to whatever the other person needs to discuss, and to avoid presumptions that unnecessarily limit the conversation. As a manager you may well want to set some limits to the conversation (“I’m not prepared to talk about the budget today.”) or at least ensure that the agenda reflects your needs (“I’d like to discuss last week’s meeting, in addition to what’s on your list.”), but it’s important to do only as much of this as necessary and to leave room for your employee to raise concerns and issues that are important to them. It’s all too easy for leaders to inadvertantly send signals that prevent employees from raising issues, so make it clear that their agenda matters.

In his book Helping, former MIT professor Edgar Schein identifies different modes of inquiry that we employ when we’re offering help, and they map particularly well to coaching conversations. The initial process of information gathering I described above is what Schein calls “pure inquiry.” The next step is “diagnostic inquiry,” which consists of focusing the other person’s attention on specific aspects of their story, such as feelings and reactions, underlying causes or motives, or actions taken or contemplated. (“You seem frustrated with Chris. How’s that relationship going?” or “It sounds like there’s been some tension on your team. What do you think is happening?” or “That’s an ambitious goal for that project. How are you planning to get there?”)

The next step in the process is what Schein somewhat confusingly calls “confrontational inquiry”. He doesn’t mean that we literally confront the person, but, rather, that we challenge aspects of their story by introducing new ideas and hypotheses, substituting our understanding of the situation for the other person’s. (“You’ve been talking about Chris’s shortcomings. How might you be contributing to the problem?” or “I understand that your team’s been under a lot of stress. How has turnover affected their ability to collaborate?” or “That’s an exciting plan, but it has a lot of moving parts. What happens if you’re behind schedule?”)

YOU AND YOUR TEAM

· Coaching

Get better at helping your employees stretch and grow.

In coaching conversations it’s crucial to spend as much time as needed in the initial stages and resist the urge to jump ahead, where the process shifts from asking open-ended questions to using your authority as a leader to spotlight certain issues. The more time you can spend in pure inquiry, the more likely the conversation will challenge your employee to come up with their own creative solutions, surfacing the unique knowledge that they’ve gained from their proximity to the problem.

Listen

It’s important to understand the difference between hearing and listening. Hearing is a cognitive process that happens internally — we absorb sound, interpret it, and understand it. But listening is a whole-body process that happens between two people that makes the other person truly feel heard.

Listening in a coaching context requires significant eye contact, not to the point of awkwardness, but more than you typically devote in a casual conversation. This ensures that you capture as much data about the other person as possible — facial expressions, gestures, tics — and conveys a strong sense of interest and engagement.

Effective listening also requires our focused attention. Coaching is fundamentally incompatible with multitasking, because while you may be able to hear what another person is saying while working on something else, it’s impossible to listen in a way that makes the other person feel heard. It’s critical to eliminate distractions. Turn off your phone, close your laptop, and find a dedicated space where you won’t be interrupted.

Coaching conversations can take place over the phone, of course, and in that medium it’s even more important to refrain from multitasking so that in the absence of visual data, you can pick up on subtle cues in someone’s speech.

In my experience taking brief, sporadic notes in a coaching conversation helps me to stay focused and lessens the burden of maintaining information in my working memory (which holds just five to seven items for most people.) But note-taking itself can become a distraction, causing you to worry more about accurately capturing the other person’s comments than about truly listening. Coaching conversations aren’t depositions, so don’t play stenographer. If you feel the need to take notes, try writing one word or phrase at a time, just enough to jog your memory later.

Empathize

Empathy is the ability not only to comprehend another person’s point of view, but also to vicariously experience their emotions. Without empathy other people remain alien and opaque to us. When present it establishes the interpersonal connection that makes coaching possible.

A key to the importance of empathy can be found in the work of Brené Brown, a research professor at the University of Houston whose work focuses on the topics of vulnerability, courage, worthiness and shame. Brown defines shame as “the intensely painful feeling or experience of believing that we are flawed and therefore unworthy of love and belonging.” Empathy, Brown notes, is “the antidote to shame.” When employees need your help they are likely experiencing some form of shame, even if it’s just mild embarrassment — and the more serious the problem, the deeper the shame. Feeling and expressing empathy is critical to helping the other person defuse their embarrassment and begin thinking creatively about solutions.

But note that our habitual expressions of empathy can sometimes be counterproductive. Michael Sahota, a coach in Toronto who works with groups of software developers and product managers, explains some of the traps we fall into when trying to express empathy: We compare our issues to theirs (“My problem’s bigger.”), try to be overly positive (“Look on the bright side.”), or leap to problem-solving while ignoring what they’re feeling in the moment.

Finally, be aware that expressing empathy need not prevent you from holding people to high standards. You may fear that empathizing is equivalent to excusing poor performance but this is a false dichotomy. Empathizing with the difficulties your employees face is an important step in the process of helping them build resilience and learn from setbacks. After you’ve acknowledged an employee’s struggles and feelings, they’re more likely to respond to your efforts to motivate improved performance.

When you coach as a leader you don’t need to be the expert. You don’t need to be the smartest or most experienced person in the room. And you don’t need to have all the solutions. But you do need to be able to connect with people, to inspire them to do their best, and to help them search inside and discover their own answers.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.