1. Mega-Cap Tech/FAANG+…Widening Underperformance.

The group that investors thought would lead forever rolling over at rapid rate

Equities: US mega-caps continue to widen their underperformance.

Source: The Daily Shot

https://dailyshotbrief.com/

2. Nasdaq Stocks Trading Above 200 Day Moving Average…50day about to go thru 200day to downside

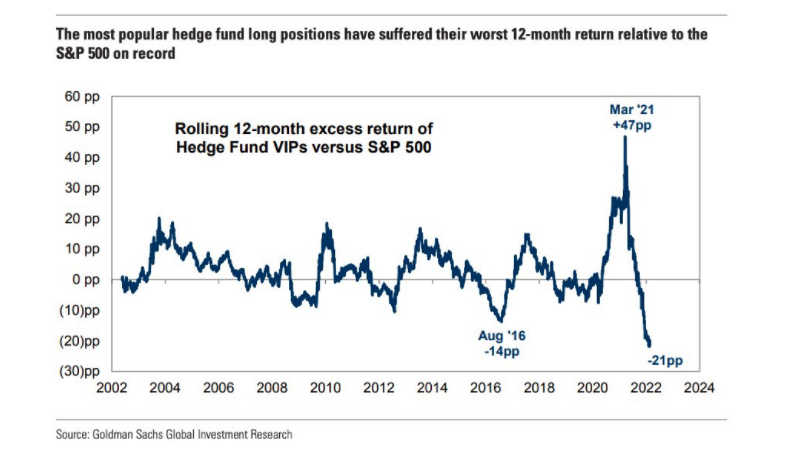

3. Most Popular Hedge Fund Positions Getting Smashed

https://theirrelevantinvestor.com/2020/03/05/animal-spirits-the-financial-rails-of-the-future/

4. Biggest One Week Move Ever in Thomson Reuters Commodity Index

Jim Reid

The week has started with a major increase in oil on the back of weekend comments from US Secretary of State Blinken raising the prospect of banning Russian crude imports. This follows the biggest week on record for our Commodity index (+13.4%) as our CoTD shows, eclipsing anything seen in the 1970s.

This is only the 7th day of March but at the time of writing (9am London time) here are the moves so far this month for a selection of commodities. UK Nat Gas +218%, Wheat +46%, Palladium +36%, WTI +30%, Brent +26%, Nickel +20%, Iron Ore +14%, Aluminium +14%, Copper 13%. By the time you read this, prices will probably change and gas in particular continues to trade in phenomenal intra-day ranges.

Before today’s move the rolling 3-month move in this overall commodity index was at +35.9%, just below the highest ever which was the +41.9% seen in the three months to August 11th 1973. We could easily beat this if markets continue to trade as they are.

So it’s going to be increasingly hard to ignore the comparisons to the 1970s as the commodity price action is increasingly resembling this. While oil hasn’t spiked by as much as in the 1970s (it more than tripled during the first oil shock from late1973), gas has increased by a much greater amount than at any point in history (see last week’s CoTD here) and the broader pace of the commodity rally is in many cases now beyond that seen in the 1970s.

For a recap a reminder that we published “Comparing the 2020s with the 1970s” (link here) and a “Back to the 1970s?” (link here) chart book back in October.

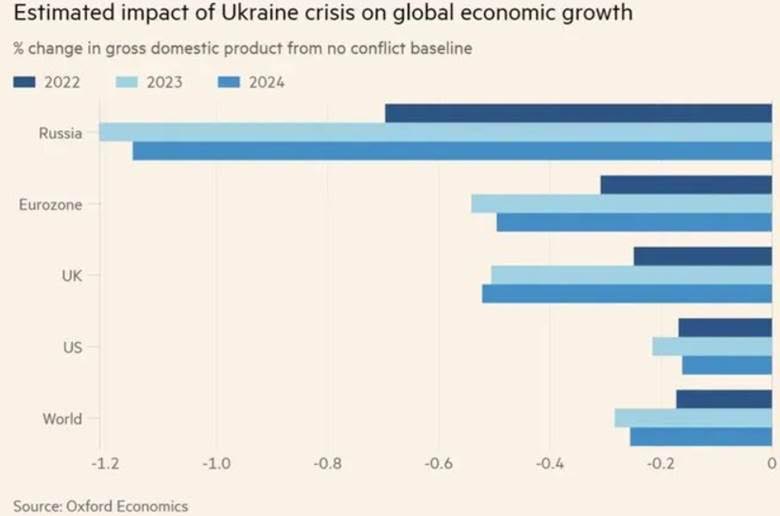

5. Ukraine War….GDP Hits to Eurozone and UK 2022-2024

Spike up in commodities has GDP forecasts globally dropping fast.

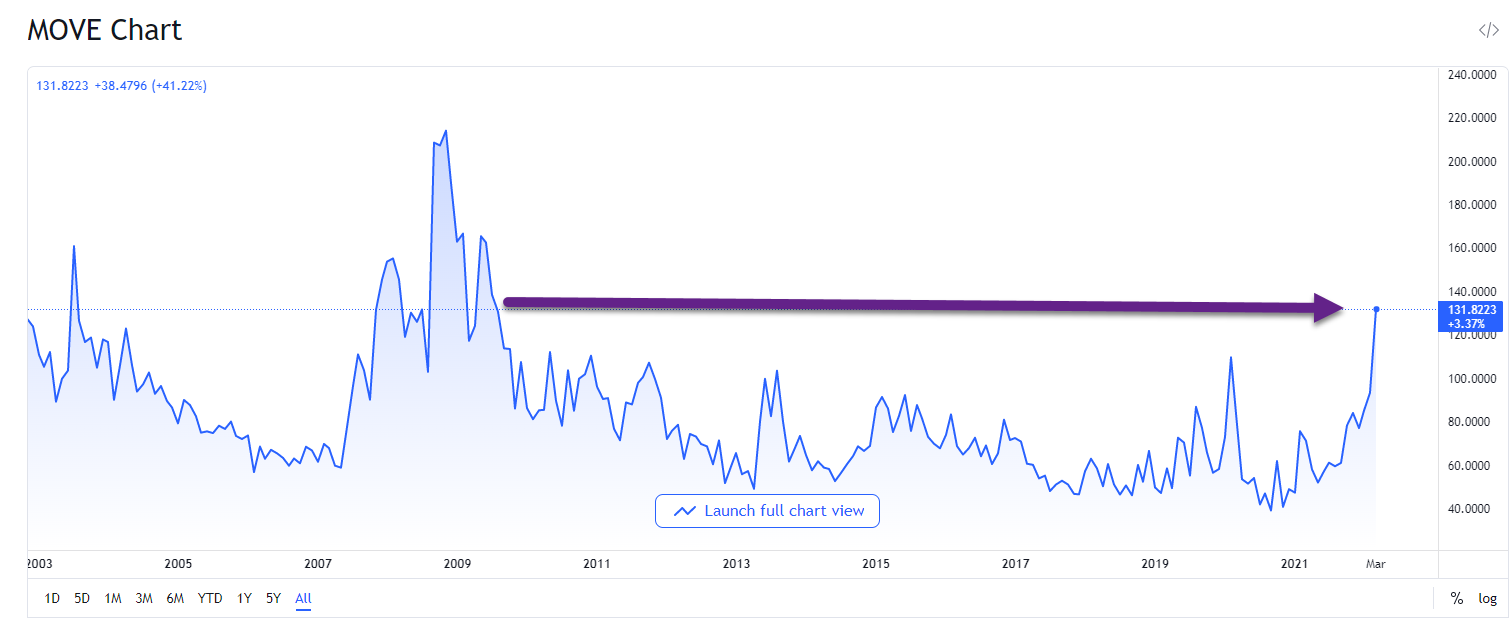

6. The Bond Volatility Index MOVE Hits 10 Year Highs

The MOVE Index is a well-recognized measure of U.S. interest rate volatility that tracks the movement in U.S. Treasury yield volatility implied by current prices of one-month over-the-counter options on 2-year, 5-year, 10-year and 30-year Treasuries.

https://www.tradingview.com/symbols/TVC-MOVE/

7. Airlines Now Face Gas Prices…-38% from Recent Highs.

Business Insider The surge in oil prices on the back of war in Ukraine is pointing to potential 22% downside for airline stocks, Barclays says

- Airline stocks could drop another 22% with oil prices soaring, Barclays said in a note Monday.

- The S&P 500 Airlines Index had lost more than 15% after Russia’s invasion of Ukraine and fell further on Monday.

- Brent crude futures briefly climbed near $140 a barrel on Monday.

Airline stocks are at risk to fall further as oil prices spike following Russia’s invasion of Ukraine, with Barclays seeing the potential for a key industry index to drop by more than 20%.

Oil in recent days has kicked up to prices not seen since the 2008 global financial crisis, a move that in turn has pressured stocks in the airline sector. The S&P 500 Airline Index fell 11% during Monday’s session after having lost 15% through Friday from February 25, the day after Moscow attacked Ukraine. Russia is the world’s second-largest oil producer.

Airline stocks had been “relatively insensitive” to rising oil prices until the invasion began nearly two weeks ago, said Barclays Monday. Brent crude, the international benchmark, on Monday briefly approaching $140 a barrel, and West Texas Intermediate crude reached past $130 a barrel. Prices for fossil fuels have gained roughly 60% so far this year.

Economists at Barclays estimate that surging energy prices will not stop the strength of the ongoing economic recovery in the US. But “our airlines analysts warn against the difficulty of airline companies matching higher fuel costs with higher fares,” wrote Maneesh S. Deshpande, head of US equity derivatives strategy at Barclays, in a research note.

“If the 1990 oil price shock is any guide, airlines could fall an additional 20% from current levels,” he wrote, referring to the shock that stemmed from Iraq’s invasion of its neighbor Kuwait in August 1990.

From peak to bottom on June 6 through August 23, 1990, airline stocks as measured by the S&P 500 Airlines Index fell 37.6%, compared with the S&P 500’s 15.9% decline.

“In comparison, airlines are currently 21% below their Feb-22 peak (vs the S&P -6.5%), implying a potential additional drop of 22% based on the above analysis,” said Deshpande in the note.

Russia accounts for around 8% of global oil supply. The US and its Western allies were discussing potential bans on Russian oil imports, reports said Monday, though some European leaders played down a potential embargo. Meanwhile, many traders have shunned Russian oil in the wake of the invasion.

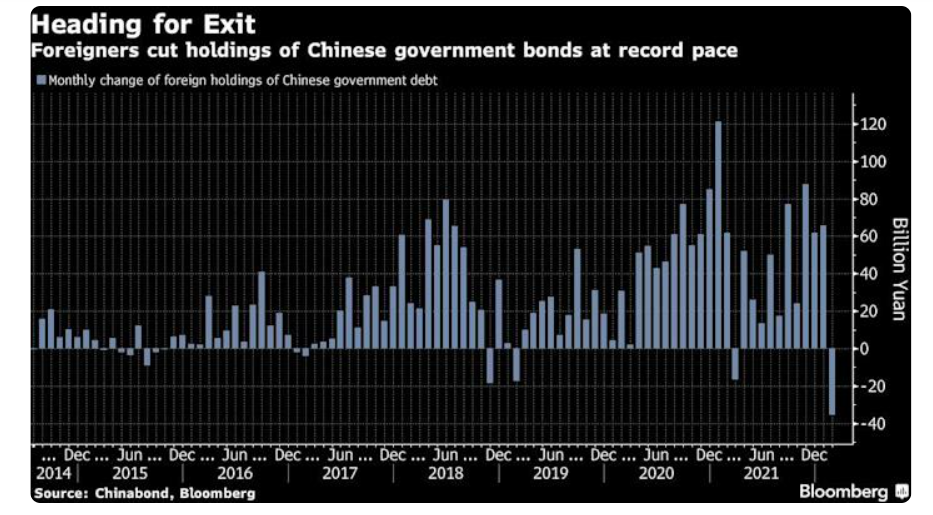

8. China Bonds and Stocks Seeing Major Outflows.

China Sees Record Bond-Market Retreat by Foreign Investors

Ye Xie https://finance.yahoo.com/

Large Cap Chinese Stocks Break to New Lows Breaking Covid 2020 Levels

9. Follow Up to Yesterday’s Comments on Euro Banks

UBS Has $200 Million Exposure to Russian Assets in Loans to Rich ByMarion Halftermeyer

Want the lowdown on European markets? In your inbox before the open, every day. Sign up here.

UBS Group AG has about $200 million exposure to Russian assets that were used as collateral in loans to clients at its wealth unit.

The Swiss bank also identified “a small number” of wealth management clients who have been sanctioned in response to Russia’s invasion of Ukraine, it said in its annual report, published Monday. Those clients had less than $10 million in total loans outstanding as of March 3.

“We are working to implement sanctions imposed by Switzerland, the U.S., the EU, the UK and others,” Chief Executive Officer Ralph Hamers and Chairman Axel Weber said in the report.

UBS -30% from highs

10. 3 Psychological Nutrients Workers Need

Keys to improving worker engagement, commitment, performance, and mental health.

KEY POINTS

- Psychologists have identified the three human psychological needs necessary for optimal human functioning.

- The universal and innate psychological nutrients are competency, autonomy, and relatedness.

- When all three psychological nutrients are satisfied, workers experience improved passion, engagement, and commitment.

When faced with a nutrient deficiency, people seek to replenish those nutrients. When we are physically malnourished, we find sustenance. The same holds true mentally.

Psychologists Edward Deci and Richard Ryan have identified the three human psychological needs necessary for optimal human functioning. The universal and innate psychological nutrients are competency, autonomy, and relatedness. Satisfaction of these basic needs promotes mental health and intrinsic motivation, which drives engagement and higher performance at work.

A deficiency in any of these three psychological nutrients can cause workers to look elsewhere to get nourishment. When all three psychological nutrients are satisfied, workers experience the highest-quality motivation that fuels passion, engagement, and commitment. Might these psychological nutrients hold the key for reversing the Great Resignation?

Psychological Nutrient #1: Autonomy

Autonomy is the agency to do things on your terms. It’s the freedom from external constraints on behavior. Autonomy does not mean to be independent of others but, rather, constitutes a feeling of overall psychological liberty and freedom of internal will. When a person is autonomously motivated, their performance, wellness, and engagement are heightened rather than if a person is told what to do.

Autonomy is the opposite of micromanagement. Workers feel empowered when they have choices and when they are trusted to make the right decisions. Increasing someone’s options and choices has been proven to increase their intrinsic motivation.

Workers who have clear direction and the freedom to act on their own accord with the ability to take direct action satisfy their need for the psychological nutrient of autonomy.

What will workers say if they quit due to an autonomy deficiency?

- Their manager was too hands-on or micromanaged them.

- They want more independence.

- They want a better work–life balance.

- They want more career paths.

- They are conflicted about workplace policy.

How much autonomy does your team have to think and act on their own terms?

Psychological Nutrient #2: Competence

Competence is the need to feel capable. Competence occurs when someone is able to effectively meet the demands of their environment. Competency evokes feelings that someone is good at something.

When workers feel competent, they feel what they do is effective and masterful and can contribute to accomplishing worthwhile goals. Relevant feedback and expressing strong beliefs in the capabilities of others is key for satisfying the need for the psychological nutrient of competence.

article continues after advertisement

What will workers say if they quit due to a competence deficiency?

- They need more of a challenge.

- They feel uninspired.

- They want to feel valued.

- They feel that they have a lack of job growth or career advancement.

- They need more feedback.

- They want more recognition.

- They have vague goals or no direction.

- They want a clearer company vision.

Does your team feel competent in that they have the right skills and tools to contribute?

Psychological Nutrient #3: Relatedness

Relatedness is the need to feel involved with others. Relatedness is shorthand for being connected to colleagues, friends, family, and community. Humans have an innate need to belong. It is important to both make a contribution to the group and to feel cared for by the group.

Workers who are personally and emotionally connected to their colleagues and manager satisfy their need for the psychological nutrient of relatedness.

Relatedness is perhaps the most crucial psychological nutrient because high-quality relationships are able to provide individuals with a bond to another person while simultaneously reinforcing their needs for autonomy and competence.

What will workers say if they quit due to a relatedness deficiency?

- They are seeking a better management

relationship. - They have poor relationships with coworkers.

- They are looking to live somewhere else.

- Their company culture isn’t a good fit.

How connected does your team feel to one another?

Looking for a way to measure how disconnected your team is and gain custom solutions for improving your team’s connections? Check out the Team Connection Assessment here. It’s empirically validated to measure the strength and quality of connections teams have with their teammates, manager, and the work itself.