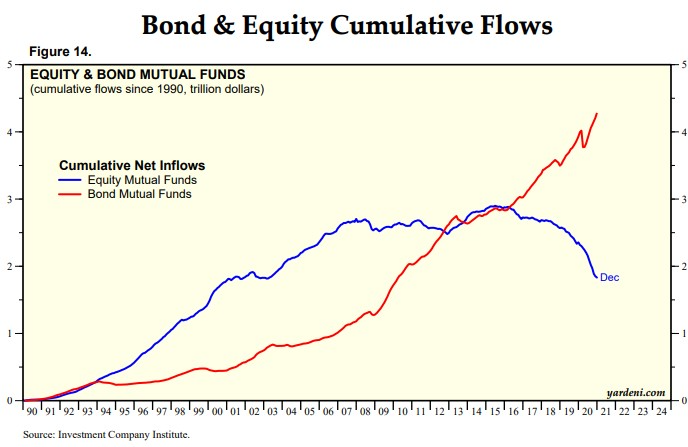

1. Visual of Bond Flows Cumulative Flows Massively Outpacing Equities.

https://awealthofcommonsense.com/2021/06/why-arent-interest-rates-higher/

2. Lumber Reversion to the Mean

Lumber is crashing more. HT: @2x4caster

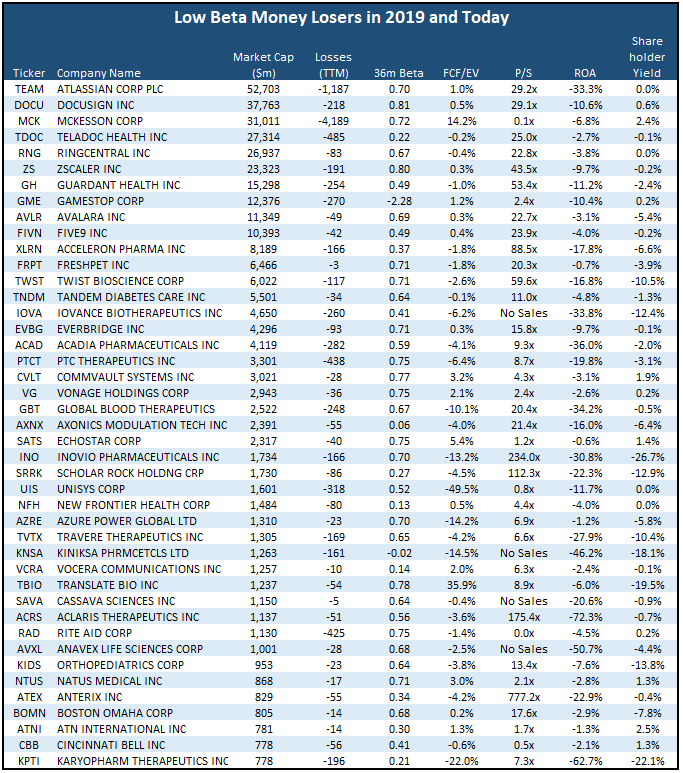

3. Money Losing Public Companies Going Up the Most

We believe quality & valuation are better measures of risk:

· Beta, or the amount a stock price goes up and down relative to the market, is a popular measure of “risk”

· Famous investors such as Seth Klarman have observed that this idea is “preposterous”1

· Below is the market cap of firms that that lose money but are very low risk2 based on beta

· In our CFTC here we documented that there is a record $6 trillion worth of stocks losing money

· We believe common sense indicates that expensive firms bleeding cash are dangerous

As documented in our research on volatility and beta we discussed the dangers of relying on these commonly used and accepted measures of “risk.”

See below for a list of stocks that lost money in 2019 (pre Covid) and are still losing money today but beta is telling you are “low risk”

https://kailashconcepts.com/is-beta-broken/?twclid=11409602961244708877

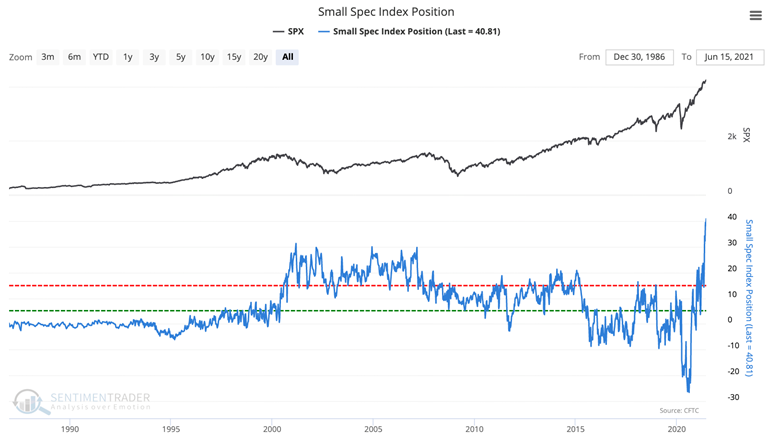

4. Small Speculators Held Record Amount of Equity Index Futures in June.

Sentiment Trader Blog

Small spec-big gains. Nonreportable traders, otherwise known as small speculators, held more than $40 billion in major equity index futures, the largest amount ever, as of mid-June. In the latest week, they drastically reduced those positions.

https://sentimentrader.com/blog/this-led-to-declines-every-time-in-the-past-93-years/

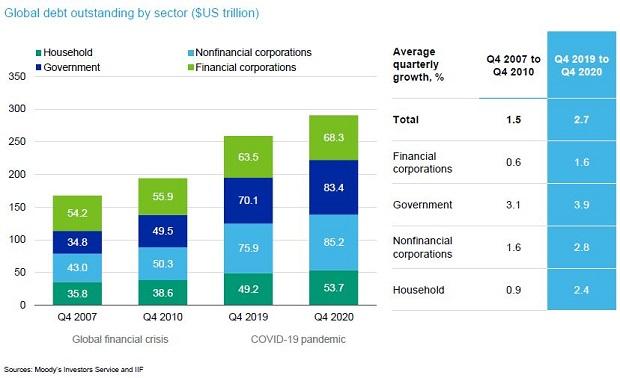

5. Global debt rises $32 trillion in 2020 amid Covid pandemic: Moody’s

Household debt, on the other hand, rose to 66 per cent of GDP from 61 per cent at the end of 2019, partly reflecting loan moratoriums and the resilience of residential real estate markets through the pandemic, the rating agency said.

“Non-financial corporate debt experienced the second-largest increase, rising to 102 per cent of GDP from 93 per cent at the end of 2019. EM’s ratio of corporate debt-to-GDP is higher than that of advanced economies. Financial corporate debt grew to 86 per cent of GDP from 80 per cent at the end of 2019,” Moody’s said.

Emerging versus developed markets

EMs, Moody’s believes, are facing rising debt-servicing costs and deteriorating external vulnerability. An added risk are the tightening financial conditions. In this backdrop, Central and Eastern Europe is better positioned than Latin America or Asia, while Africa and the Caribbean are most vulnerable, the rating agency said.

Developed markets have their own set of challenges to tackle. Though low interest rates will support debt affordability and have more fiscal space in the short term, Moody’s believes they will face medium-term debt sustainability challenges arising from low productivity growth and unfavorable demographic trends

Corporate debt rose by 27 percentage points (pp) of GDP between 2010 and 2020 in EMs (16 pp in advanced economies during this period), while government debt rose by 22 pp (36 pp in advanced economies).

“Advanced economies contributed 65 per cent of the build-up in government debt between 2010 and 2020. Greece, Spain, Slovakia, Cyprus, the UK, Portugal and Italy saw the sharpest increases. EM contributed 64 per cent of the rise in corporate debt following the global financial crisis, particularly China, Russia, Turkey and Chile, among others,” Moody’s said.

6. S&P Dividends Per Share Have Grown 100% in 10 Years.

What’s Better Than Dividends? Growing Dividends

Michael O’Connor

Dividends are payments that companies typically make to shareholders at regular intervals, usually quarterly. They signal the financial health of a company and are a strong force in generating investor returns and income.

Dividends paid by the companies in the S&P 500 have grown by an annualized rate of 10% since 2010. Investors looking for a growing source of income should consider stocks. However, for companies to grow their dividend payouts to investors, they need to be profitable enough to generate cash flow.

S&P 500 dividend per share has grown by over 100% during the last 10 years

Source: Bloomberg Finance L.P., data as of 12/31/2020. Past performance does not guarantee future results.

https://finance.yahoo.com/news/whats-better-dividends-growing-dividends-114754658.html

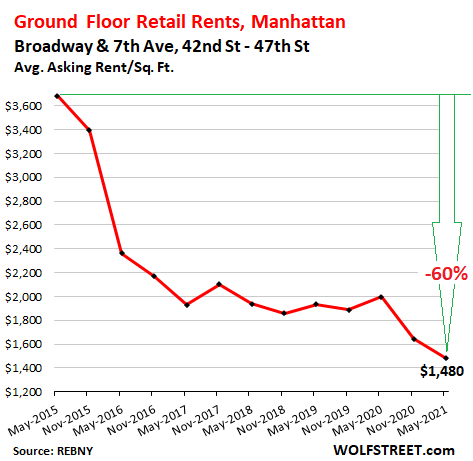

7. Ground Floor Retail Rents in Manhattan

Wolf Street–Year-over-year, the average asking rent plunged 26%, with eight ground-floor retail spaces available for rent in the corridor:

On Fifth Avenue, from 42nd Street to 49th Street, the average asking rent dropped by 11% year-over-year, and by 55% from the peak in 2016, to $615 per square foot per year, with 15 ground-floor retail spaces available:

The Breathtaking Collapse of Retail Rents in Manhattan, Year 7by Wolf Richter • Jun 23,

8. One of the largest owners of bitcoin, who reportedly held as much as $1 billion, is dead at 41: reports

Billionaire bitcoin owner Mircea Popescu has reportedly died, leaving behind a cache of virtual currency and a controversial crypto legacy.

The bitcoin BTCUSD, -0.25% pioneer, who was believed to own over $1 billion in the world’s No. 1 crypto, making him, at the time, one of the asset’s larger single-holders, died off the coast of Costa Rica, according to a Spanish-language publication, Teletica.com, which reported last week that a foreigner had drowned at Playa Hermosa de Garabito, Puntarenas in Costa Rica, describing him as a 41-year old of Polish origin.

Popescu was viewed as a pioneer in digital assets and one of the earliest adopters. An article in Bitcoin Magazine written by Pete Rizzo said that Popescu was known for starting MPEx, a Bitcoin securities exchange, around the same time as the Coinbase Global COIN, +9.86% launched.

At its mid-April peak this year, Popescu’s bitcoin holdings would have been worth nearly $2 billion.

At last check, bitcoin prices were changing hands at around $34,295, up 3.2% and Ether ETHUSD, -0.30% on Ethereum’s blockchain was trading at $2,079, up over 13%, even amid reports that the world’s largest crypto trading platform Binance was facing a regulatory crackdown in the U.K., and a separate report noting that the platform has been compelled to pull out of doing business in Canadian province Ontario.

Word of Popescu’s reported death was circulating in crypto circles, with some wondering where his holdings would go.

The latest news also comes as crypto continues to wrestle with China’s ban on bitcoin mining and crypto trading in the world’s second-largest economy and the biggest crypto miner.

9. Analysis: When do electric vehicles become cleaner than gasoline cars?

Paul Lienert

10. Deep Work Is Deep Reading

We need a more literate business world.– Tim Leberecht

KEY POINTS

- Business leaders must be deep readers, not just skimmers.

- Deep reading rewires our brain and fosters empathy.

- Literacy is a human right.

- We must teach algorithms to read deeply so they can develop empathy.

Source: Photo by Victoria Heath on Unsplash

In the business world, the idea of “literacy” is often taken for granted. We like to think we know what we’re looking at, that we’re in touch with our customers, and up-to-date on trends. But we often judge a book by its cover, and that is often not good enough.

Business can be illiterate when it’s all-too-literal. It spawns an incredible number of ideas only to quash most of them in the grinds of a binary bureaucracy that has no tolerance for fiction, even though one could argue that companies (and markets) are essentially stories that come (or at least ring) true. “Real artists ship,” Steve Jobs famously remarked. As BCG’s Martin Reeves, aiming to deliver on Jobs’s demand, explores how to turn your company into an “imagination machine,”reading seems fundamental. Imaginative business leaders read.

Reading is not about learning but forgetting what we know.

In business, however, reading is often reduced to absorbing information. Services such as Blinkist and GetAbstract have fueled an optimized, hyper-efficient reading culture that is rewarded for reducing books to mere “key takeaways,” avoiding cognitive dissonance and more complex truths. When Elon Musk or Mark Zuckerberg boast how many books they can read in one week, they and other “professional readers” ignore the most important benefit of reading: it is not learning, but rather forgetting what we know.

Last week I had the great pleasure of interviewing MIT professor and bestselling author Sherry Turkle, and we spoke about the correlation between empathy and ethics, her recent memoir The Empathy Diaries, and the need to “reclaim conversation in a digital age,” to cite one of her previous books. Turkle bemoaned the loss we face when we rely increasingly on digital technology to replace our social interactions. She told me she was unimpressed by the “fake empathy” of chatbots like Woebot (an AI-based therapist) or other examples of social robotics and so-called Emotion AI. “True empathy requires vulnerability, and vulnerability is inherently human,” she insisted.

We don’t all need to read the same book, but it is critical we all read.

This is what books help us do. Reading rewires our brain, a product of a phenomenon called neuroplasticity that describes our brain as malleable and ever-evolving in response to our experiences. Neuroplasticity is the foundation for a change of perspective, for true empathy. It is what makes us human, one could argue. But it does require deep reading, not just skimming.

article continues after advertisement

The whole point of reading is thus reading, and howwe read. There is a direct line from deep reading to empathy to embracing views, values, and ideologies that are different from our own. To overcome polarization and heal divides, we don’t all need to read the same book, but it is critical we all read.

This is the argument that Maryanne Wolf, one of the world’s leading scholars on literacy and the director of the Center for Dyslexia, Diverse Learners, and Social Justice at UCLA, so passionately presents. In a conversation I had with her last week, she made the case for “literacy as a human right.”

How do we teach machines to develop empathy?

And while that is compelling and profound, literacy is now also a feature — and soon a right? — of AI. There is dispute over how well AI can actually read, but the fact of the matter is that automated or augmented reading by machines will increasingly replace human reading. And AI is not just the new reader, but also the new writer on the block. Microsoft’s Xiaoice chatbot, for example, has learned to write poetry and short stories, and for its more than 660 million users, these texts are often the literature most integral to their daily lives. And then there are the algorithms that infiltrate our lives through social media platforms like TikTok. They require a new form of literacy while also presenting a chance to become more literate on issues of identity, race, and gender.

“External technologies transform us. They transform us at a physiological level, at a psychological level, and at a social-emotional level,” Wolf observed. How can we teach algorithms to develop empathy? Should we? Maryanne Wolf said she is hopeful that “if we manage to “combine the imagination of the artist with the beautiful intelligence in our technologies, we will never lose what makes us uniquely human, whatever we create.”

Citing the moral philosopher Martha Nussbaum, she laid out the consequences of failure: “It would be catastrophic to become a nation of technically competent people who have lost the ability to think critically, to examine themselves, and to respect the humanity and diversity of others.”

Deep reading is beautiful business. Take time for it; the whole world depends on it.

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.