1. Record Stock Sales From Money-Losing Firms Ring the Alarm Bells

By Lu Wangand Vildana Hajric

-AMC, GameStop lead troubled companies in flooding the market

-Glut of shares provides latest evidence of elevated enthusiasm

If you think a rush by companies to sell their shares is a bad omen for the market, imagine a scenario where most of the sales come from firms that don’t make money.

It’s happening now. Since the end of March, almost 100 unprofitable companies, including GameStop Corp. and AMC Entertainment Holdings Inc., have raised money through secondary offerings, twice as many as coming from profitable firms, according to data compiled by Bloomberg.

Granted, troubled companies are tapping into buoyant demand during a 16-month rally to beef up their balance sheets. And it’s further evidence that the capital market functions as smoothly as it’s supposed to. Yet some warn th at the flood of shares coming from money losers is becoming extreme.

2. 72% of Bitcoin are Held by Those with More Than 100 Coins….Plus a Look at Previous Bitcoin Pullbacks.

Bitcoin: A Solution to Excess Wealth?

Barrons-Crypto was born during a period of great concentrations of wealth, and it cannot help but reflect that origin. Despite the talk of decentralized finance, ownership of crypto, let alone trading, appears highly concentrated. One recent study found that more than 72% of Bitcoins (now about $33,000 each) are owned by those with 100 or more Bitcoins, along with miners and brokers. Nearly 32% are owned by those with 1,000 or more Bitcoins. A recent survey by Gemini, a crypto exchange, found that the “average” crypto trader was a 38-year-old male whose household made about $111,000, roughly 60% more than the median family income in the US.

By Marc Chandler

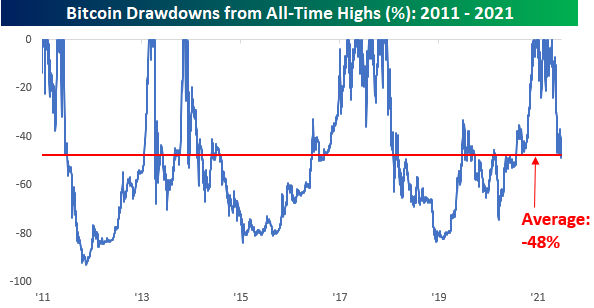

BESPOKE–Even after today’s bounce in bitcoin, its price is still over 48% below its all-time high reached just over two months ago in mid-April. While 48% sounds pretty steep, it looks like a walk in the park compared to prior drawdowns. Following peaks back in early 2011, early 2013, late 2013, and late 2017, bitcoin’s price fell anywhere from 70% to 93% each time. Even more surprising is the fact that since the start of 2011, bitcoin’s average percentage spread between its closing price on a given day and the all-time high as of that date was 48% – which is right where it is now.

https://www.bespokepremium.com/interactive/posts/think-big-blog/bitcoin-hangs-on-to-30k

3. Homes are Biggest Global Asset

by Barry Ritholtz-The Big Picture Blog

4. Housing Boom 2.0….Highest One Year Gain Ever in Home Prices.

Charlie Bilello

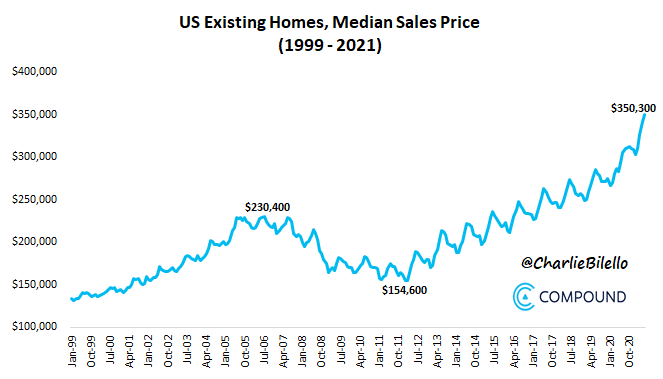

US existing home prices rose 24% in the last year, the highest rate of increase ever.

Over the last 10 years, prices have more than doubled, from $169,000 to $350,000.

New home prices also hit another record high in May, up 18% over the last year

Meanwhile, the Fed continues to purchase mortgage-backed securities in an effort to hold rates down and stimulate the housing market, with assets now totaling over $2.35 trillion.

5. Investors Wildly Bullish on Expected Stock Market Returns.

Investors, Prepare to be Disappointed

Posted June 26, 2021 by Michael Batnick

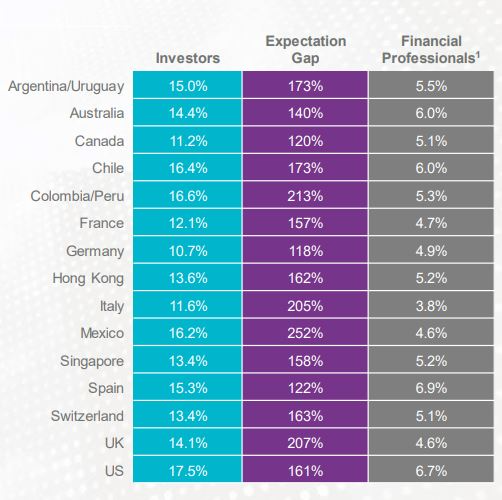

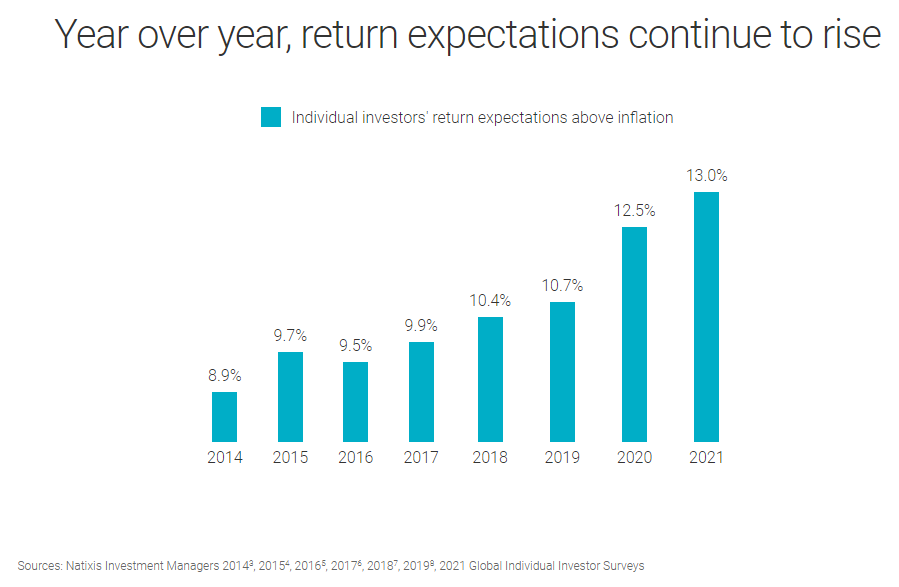

Investor expectations are way out of whack with reality, according to the global survey of individuals. U.S. investors* expect 17.5% real returns over the long term. If these survey numbers are to be believed, investors are about to be very disappointed.

The S&P 500 has returned 10.4% over the long term. The idea that we’re going to get 17% real, after getting 17% nominal over the last 5 years, is nothing short of absurd.

I spoke about this nonsense on The Compound and Friends this week with Amelia Garland, Jeremy Schwartz, and Josh Brown.

https://theirrelevantinvestor.com/2021/06/26/investors-prepare-to-be-disappointed/

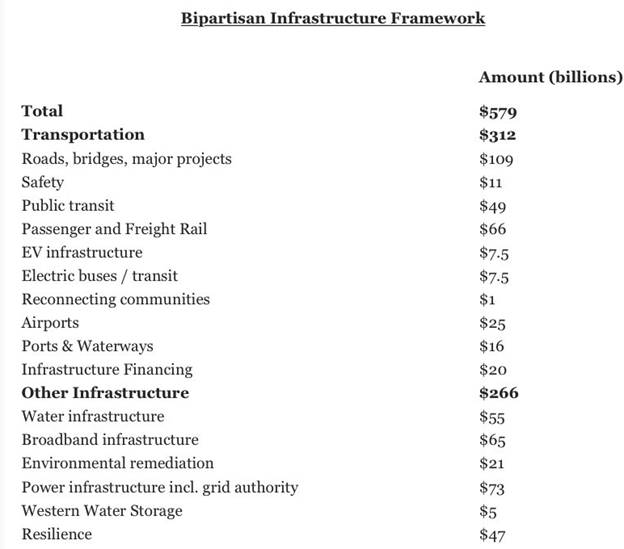

6. Infrastructure Bill Breakdown

From Dave LUTZ JONES TRADING INFRASTRUCTURE– What started as a $2 trillion infrastructure plan pitched by the White House is now a $1 trillion plan backed by the president and 10 senators from both parties. But parts of President Joe Biden’s original American Jobs Plan are notably missing from the framework announced on Thursday.

Biden first unveiled his $2 trillion infrastructure pitch in March, which included funding not only for physical infrastructure, like roads and bridges, but also for affordable housing and climate initiatives. While the $1 trillion plan Biden agreed to with the bipartisan group largely funds physical infrastructure, there are gaps where care-economy measures once were.

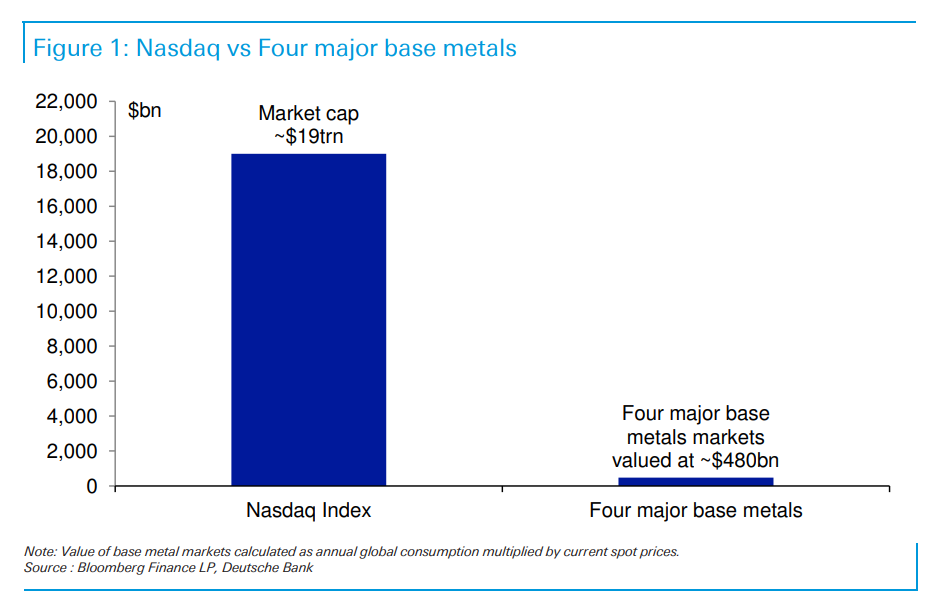

7. Nasdaq vs. Four Major Base Metals Market Cap Comparison.

Jim Ried-DB Bank

Commodities have surged over the past 12 months driven by very tight bottom-up fundamentals (recovering demand, supply disruptions) and a supportive macro backdrop (QE, weaker USD, rising inflation expectations). However, the recent hawkish turn by the Fed, together with slowing growth signals in China, has led to growing caution from investors over the sustainability of the rally.

For those who (still) believe that inflation will be more than just transitory: commodities have tended to perform strongly relative to other asset classes during periods of high inflation. Today’s CoTD shows that the size of major metal markets is only a tiny fraction of other asset classes such as equities and bonds; the combined market cap of the Nasdaq index alone is >30x larger than the combined size of the four largest base metal markets (copper, aluminium, zinc and nickel) based on annual volumes. Commodities as an asset class have been out of vogue for over 10 years, but, as the chart illustrates, just a small rotation back in favour could have a large impact on prices.

The Metals & Mining team remain constructive on the outlook. While cyclical growth rates are peaking in Q2, demand trends should remain elevated over the next 12 months, and structural drivers remain supportive for some commodities including copper and aluminium (underinvestment, decarbonisation). I am joining DB’s Liam Fitzpatrick and members of the China macro and property teams in a client webinar next Tuesday (29 June at 1200 UK) to discuss the outlook for commodities, China and inflation. The call flyer including registration details is here (direct registration link is here).

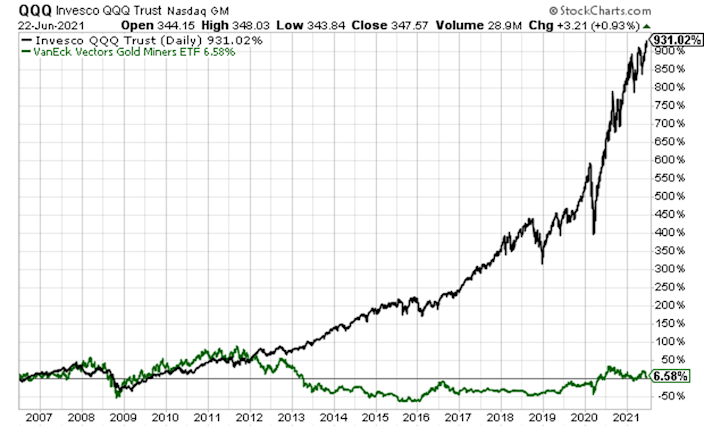

8-9. Technology Stocks 15 Year Dominance vs. Traditional Economy Names.

Yahoo Finance.

Tech vs. traditional banking, past 15 years

Tech vs. oil and gas, past 15 years

Tech vs. transportation (airlines, shipping, rails)

Tech vs. Gold Mining, past 15 years

Tech vs. manufacturing, 15 years

Tech vs. insurance, past 15 years

Tech vs. Warren Buffett, past 15 years

Why the Market is Surging-Jeff Remsburg. https://finance.yahoo.com/news/why-market-surging-161902812.html

10. Harvard career advisor: ‘Make others look good,’ and 3 more ways to stand out at work

Staying attuned to what your supervisors need can help you get ahead.

Published Sat, Jun 26 20219:00 AM EDT

Share Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Many Americans are rethinking their jobs since the pandemic. A full 25% say they are more likely to seek work in a new field, and 27% are more likely to find a new position, according to a January 2021 National Association of Personal Financial Advisors survey of 2,006 adults.

Whether you’re looking to stay where you are or boost your value for a future move, it’s smart to begin implementing strategies to help you stand out at work.

“There will be a day when the higher-ups will all be in a room discussing who to give that career-building opportunity or promotion to, and there will be someone in that room who will bang the table and say, ‘We absolutely need to give it to X. I trust them with my life,’” says Harvard career advisor Gorick Ng, author of “The Unspoken Rules.” “You want to be person X. How? By building a reputation as someone who consistently delivers — and overdelivers.”

You may feel tempted to point out your own accomplishments, but you can really shine by giving credit to someone else, Ng adds: “There’s this unspoken rule of ‘make others look good, make others feel good.’” Here’s his best advice for how to do that, and how to get ahead in general.

Boost others and ‘build allyship’

Let’s say you’d like to present on a topic or new procedure during a staff meeting, but your manager is generally the person who does this. “Could you actually get further faster by briefing your manager so that they look good in the meeting?” he says. “If they look good and feel good at the meeting, they’ll turn around and reward you for making them look and feel good.”

You can benefit from praising your co-workers publicly while handling any corrections privately, says Ng. So if you’re in a virtual meeting and a co-worker is struggling to answer a question, you can type it to them in a private chat window. “No one has to know the answer came from you, but this person that you want to build allyship with knows and hopefully will remember that,” he says.

Find the balance between learner and leader

When you’re new to a team or a project, you may best excel by listening, taking notes, and learning how things work. Over time, you graduate into more of a leadership position where you can speak up more.

Make sure to stay humble and not presume you’re a leader too early. “It’s important to ask yourself if you are at a point where you are in leader mode. Otherwise you could come across as overbearing, as too much of a whippersnapper, before you’ve even proven yourself.”

While the general idea is that you’re learning more when you start, and over time you lead more, you don’t want to ever stop learning. “It never quite becomes 100 to 0 where you’re only leading and never learning,” says Ng. “I feel like that’s where you get problematic leadership.”

There’s this unspoken rule of ‘make others look good, make others feel good.’

Gorick Ng

HARVARD CAREER ADVISOR AND AUTHOR OF ‘THE UNSPOKEN RULES’

Whether you’re in learner or leader mode will also depend on who you’re in the room with, and whether you’re expected to be the person who knows a certain amount about the topic or procedure. Ng gives the example of an executive he interviewed at a venture capital firm whose employee prepared a research report for a meeting but barely said anything during the discussion about it. “There was an unspoken expectation from the higher-ups that, ‘Hey, you’re closer to the details. Why aren’t you speaking up right now?’”

So it’s not just about your rank, but also how familiar you are with the subject matter and how appropriate it is to share in that context. “Often your subject-matter knowledge can transcend or supersede your ranking, especially within a small group, small setting, and you’re the owner of this work,” says Ng. “There’s going to be an expectation that you’ll not just be seen but you’ll also be heard.”

Notice if your feedback patterns are positive or negative

Pay attention to whether you’re hearing good things or not-so-good things from your supervisors. For example, whether you are being given the same reminders repeatedly or if your supervisors are offering you extra responsibilities. The latter shows “positive feedback patterns that are indications that people are trusting you more and are unlocking more opportunities for you,” says Ng.

While feedback in school is represented as a clear grade, it isn’t usually as obvious at work outside of annual reviews or pay raises, so you have to be attuned to what you’re hearing or not hearing. “Even if it doesn’t seem like your manager has much feedback for you, that’s not necessarily a sign that they don’t have opinions,” he says.

‘Carve out your own swim lane’ to show performance and potential

Demonstrating great performance is about meeting and exceeding expectations — and then doing more, says Ng. “It’s about doing a task and then saying, ‘I can do this as well, would that be helpful?’” This way, you’re building trust and unlocking more opportunities and the potential for greater responsibilities.

One way to make your special skills stand out is to “carve out your own swim lane,” which Ng describes as “looking around and observing problems that have yet to be solved.”

Often, this means observing the priorities of the people above you. “The more that you are in tune with what matters to those who matter, the more you’ll be able to identify problems that matter and projects that matter,” he says. “And the more you’ll be able to align yourself with work that matters, and in turn, the more you will matter.”

https://grow.acorns.com/harvard-career-advisor-how-to-stand-out-at-work/

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.