1.Oil Off to Its Worst Start Since in 20 Years.

So far this year, oil has lost 20 percent in value, its weakest performance for the first six months of the year since 1997.

Compliance with an agreement by the Organization of the Petroleum Exporting Countries and other producers to cut output by 1.8 million barrels per day from January reached its highest in May since the curbs were agreed last year.

Yet global inventories of both crude and refined products remain well above their long-term averages.

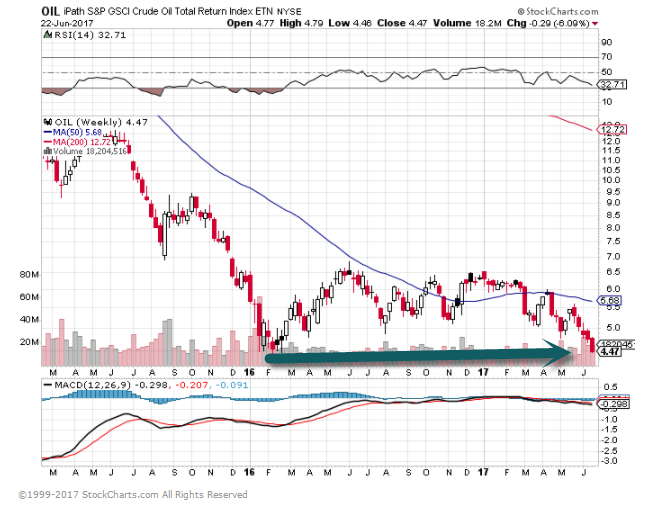

Oil ETF Right on 2016 Lows.

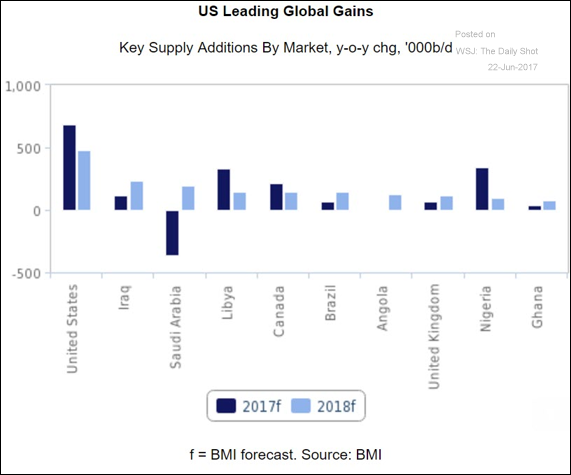

2.The U.S. as Energy Supplier is Making OPEC Compliance a Non-Factor.

|

|

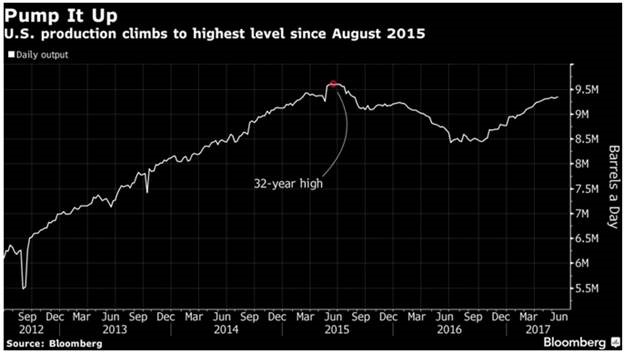

3.We are Closing in on 32 Year High for U.S. Oil Production.

Current stats

Oil has only been lower than this for 6% (188 days) of the time since the start of 2005, DB reports, while Daily Sentiment Surveys (DSIs) on Crude Light at 9% bulls – the lowest since 10% on 8/2/16, the DSI low for that move Thanks to Dave Lutz at Jones for data.

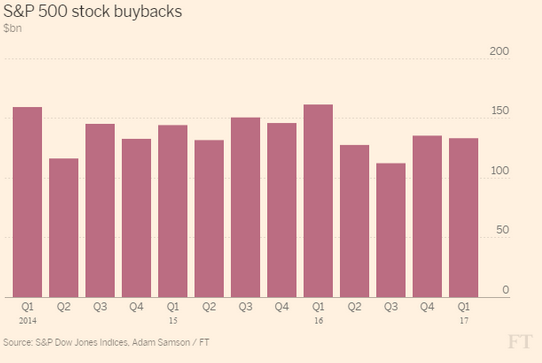

4.Buyback ETF Trailing S&P in 2017…Buybacks have been Huge Fuel for the Bull Market.

S&P +8.8% vs. PKW +6.6%

Large US companies reduced share buybacks in the first quarter, curbing the programs that have provided a boon to earnings-per-share growth.

Companies listed on the S&P 500 index bought back $133.2bn in shares in the first three months of this year, down 1.6 per cent from the final quarter of 2016 and off 17.5 per cent from the same period last year, according to data from S&P Dow Jones Indices.

5.Banks have Gone Sideways Since Trump Bump….Regulatory Changes Coming into Focus?

U.S. bank regulators have room to “eliminate” or “relax” aspects of the Volcker Rule, Fed Governor Jerome Powell declared in prepared remarks to the Senate Banking Committee. He is due to deliver testimony later today, along with several other regulators, at a hearing discussing how the Trump administration might reform banking rules.

Dividend-focused bank investors will be paying attention today to the first round of the Fed’s annual stress tests on 34 of the largest U.S. financial institutions. The quantitative part will show the impact of hypothetical scenarios on banks’ capital levels. The second round, which will take place on June 28, will say whether any firm failed because of either insufficient capital or on qualitative grounds.

KRE regional bank etf sideways

6.One Reason Banks Going Sideways….Rates Failing to Rise Once Again…..Interest Rate Bear ETF Straight Down.

TBT –Favorite Trader Bet on Rates Rising….50day thru 200day to downside.

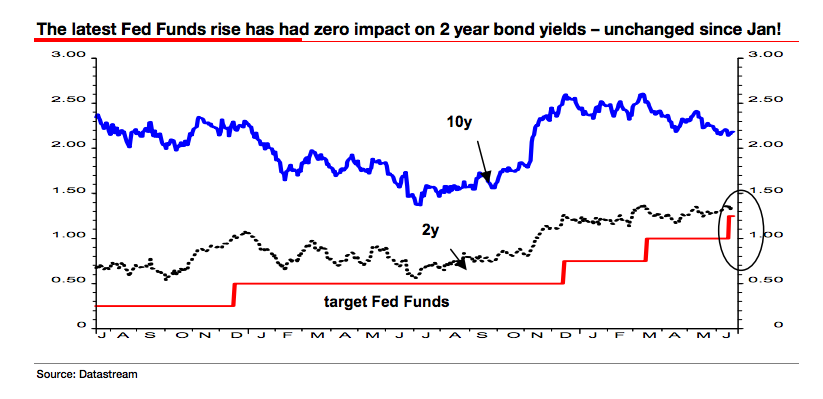

7.One striking chart shows traders don’t believe the Fed

The Federal Reserve keeps telling the bond market it wants interest rates to move higher, but traders aren’t listening.

That suggests investors don’t believe the Fed’s justification for interest rate increases, which are predicated not only on recent economic improvement but also on a continued bright outlook.

One startling chart from Societe Generale’s Albert Edwards illustrates the Fed’s dilemma. Two-year notes are historically the maturity that is most responsive to moves in the official federal funds rate.

Yet look at what’s happened to the two-year note’s yield this year as the Fed ratcheted up its monetary tightening campaign despite an inflation rate that continues to undershoot the central bank’s 2% target: Absolutely nothing.

http://www.businessinsider.com/fed-raises-rates-but-bond-market-does-not-2017-6

8.One Concern with Market Making New Highs….Dow Transports Failing to Confirm New Highs.

In a healthy bull, transportation stocks would be making new highs with other market indices.

Dow Transports +3% vs. S&P +8.5%

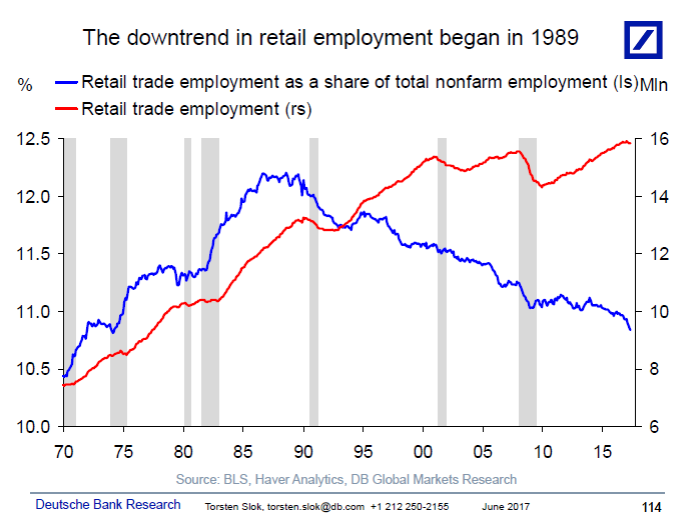

9.Retail Employment has been in a Downtrend Since 1989.

Employment in grocery stores, department stores, electronics stores, furniture stores etc. has been declining as a share of total employment since 1989, see chart below. Another way of saying this is that we have seen less growth in the retail sector relative to other sectors in the economy. Put differently; it is nothing new that the retail sector is underperforming, and looking at the absolute level of employment in retail it is currently close to the highest level in twenty years, and so far there are no signs of automation or robots having any macro impact on the level of employment. The bottom line is that the retail sector is facing structural headwinds, but those headwinds alone are not big enough to drag the economy into a recession.

10.5 Types of Decisions We Regret Most

The capacity to acknowledge what is regrettable in life emerges from maturity.

Posted Jan 04, 2017

Regret is a negative emotion that one feels when one realizes or believes that an outcome could have been better if one had chosen differently (Connolly & Zeelenberg, 2002). The judgment behind regret is “I should have done differently.” One is motivated to undo the harm and to do things differently in the future.

The following reasons are commonly found why we regret:

1. The near-miss effect

The nearer one comes to achieve a goal, the greater the regret one experiences. For example, missing a train by 5 minutes seems worse to most of us than missing it by half an hour. Bronze medalists, on average, tend to be happier when receiving their medals than silver medalists (Medvec et al., 1995).

2. Feelings of responsibility

The more control you felt you had over the outcome of an event, the greater the regret you experience if the outcome turned out badly. These are cases where one had responsibility for the choice and might have done something to avoid it (Lewis, 2016).

3.Lost opportunities

When people look back on their lives, their failures to act cause greater grief (e.g., should have stayed in school, should have asked her out). Opportunity breeds regret (Roese & Summerville, 2005). In a world of scarcity, choosing one thing means giving up something else. Once a commitment to a choice is made, available opportunities become psychologically unavailable and represent lost opportunities. For example, many students regret switching from a correct answer to an incorrect answer more than they regret staying with an incorrect answer.

4. Changeable decisions

Too many choices can confuse and make decisions worse. Shoppers are happier when they can’t get refunds (Gilbert & Ebert, 2002). Reversible decisions interfere with our ability to justify our choice, resulting in reduced satisfaction.

5. Social belonging

We feel greater regret for decisions that involve a threat to our senses of social belonging (e.g., romantic or family relationships) than those in less social domains (e.g., work, education) (Morrison et al., 2012).

Regret guides better decision-making

Although the emotion of regret is directed toward the past, psychologists have argued that this emotion has an important effect on our future lives.

Anticipated regret. In some choices people aim to minimize anticipated regret (practice safer sex, or avoid consuming too much alcohol). Anticipated regret is one of the most important determinants of choice (Koch, 2014). Many instances of prolonged hesitations, and of continued reluctance to take positive action, should probably be explained in the anticipation of regret.

Do it right the next time. Having experienced regret over a choice, we may choose differently when faced with a similar choice again. Psychologists suggest that the capacity to acknowledge what is regrettable in life emerges from maturity and contributes to maturation itself (King & Hicks, 2007). Regretting lost opportunities reminds people not to lose out on other current opportunities. Thus, regret motivates people to seize the day.