1. Producer Prices PPI +6% in May…Breaks Out of 10 Year Sideways Pattern.

Producer prices climb 6.6% in May on annual basis, largest 12-month increase on record

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

Producer prices rose at their fastest annual clip in nearly 11 years in May as inflation continued to build in the U.S. economy, the Labor Department reported Tuesday.

The 6.6% surge was the biggest 12-month rise in the final demand index since the Bureau of Labor Statistics began tracking the data point in November 2010.

On a monthly basis, the producer price index for final demand rose 0.8%, ahead of the Dow Jones estimate of 0.5%.

Those higher price pressures came amid a pronounced dip in retail sales, which fell 1.3% in May, worse than the 0.6% estimate, according to the Census Bureau.

Goods inflation continued to be the dominant inflation force, rising 1.5% as opposed to a 0.6% increase in services. In the pandemic economy, goods have run well ahead of services as economic lockdowns constrained consumer demand for services-related purchases.

Excluding food and energy, the 12-month final demand PPI rose 5.3%, which also was the biggest increase since that the BLS started tracking that number in August 2014.

Substantial price increases at the producer end came from nonferrous metals, which jumped 6.9% for the month. Prices of grains also surged, rising 25.7%, while oilseeds increased 19.5% and beef and veal rose 10.5%. Fresh fruits and melons fell 1.9%, while basic organic chemicals and asphalt also declined.

Though services continued to be a lower contributor to overall producer price pressures, the index rose for the fifth straight month.

The higher numbers likely will add to an ongoing debate over whether the inflation pressures over the past several months will last.

Federal Reserve officials believe the current increase will prove to be transitory as supply and demand issues balance out and low readings during the pandemic lockdown wash out of the system.

However, several notable Wall Street names, including Bank of America CEO Brian Moynihan and hedge fund billionaire Paul Tudor Jones, told CNBC on Monday that it’s time for the Fed to pull back on the easy-money policy it instituted during the pandemic.

The Fed begins a two-day meeting Tuesday, during which it is not expected to announce any major policy changes.

While the inflation readings have been gathering the Street’s attention, consumers have been pulling back on their purchases as the effects from government stimulus checks have worn off.

Excluding autos, retail sales were down 0.7% in May, well off the estimate for a 0.5% increase. Excluding gas stations, sales fell 1.5%.

Building material and garden supply sales tumbled 5.9% for the month, while miscellaneous store sales were off 5% and general merchandise sales fell 3.3%. Clothing and accessory stores rose 2%, while bars and restaurants were up 1.8%.

Sales remain dramatically higher now than they were a year ago, as the country wrestled with a pandemic that saw 22 million people sent to the unemployment line.

Clothing and accessory sales are up 200.3% from May 2020, while food service and drinking places surged 70.6% and electronic and appliance stores gained 91.3%.

https://www.cnbc.com/2021/06/15/retail-sales-producer-price-index-may-2021.html

2. Components of PPI—Healthcare Biggest Weight.

3. PCE Personal Consumption Expenditure is Fed’s Benchmark for Inflation.

Excludes food and energy….+3.1%…Highest Since 1990

Schwab–To understand why, we look beneath the surface. The inflation reading that the Fed uses as its benchmark—the personal consumption expenditure (PCE) price index excluding food and energy, or “core PCE” —rose 3.1% year-over-year in April, the highest level since the 1990s. This is notable because core PCE spent most of the past 20 years below the Fed’s 2% target. Much of the year-over-year gain in inflation is attributable to base effects—the comparison to collapsing prices a year ago. In addition, short-term supply constraints for some goods and services have driven up prices and should subside over time.

Core PCE is the preferred inflation measure of the Fed

Source: Bloomberg. U.S. Personal Consumption Expenditure Core Price Index (PCE CYOY Index).

Monthly data as of 4/30/20Schwab Market Perspective: Beneath the Surfaceby Liz Ann Sonders, Jeffrey Kleintop, Kathy Jones of Charles Schwab, 6/14/21

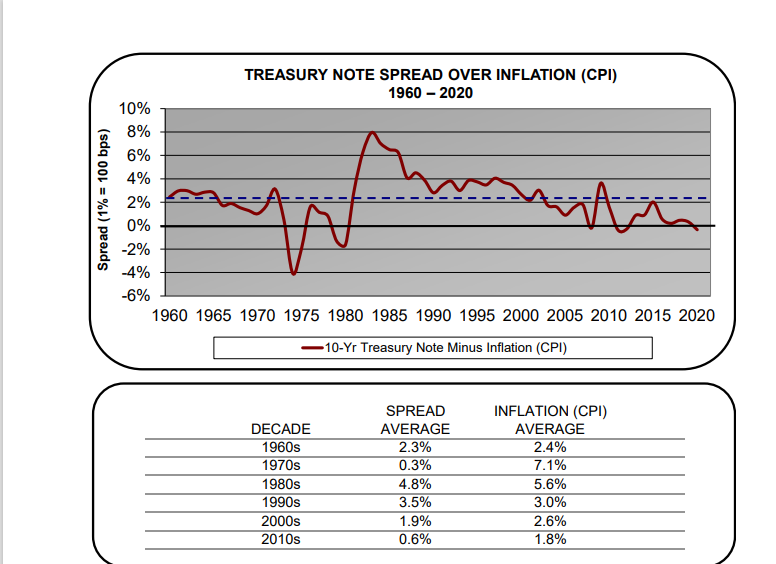

4. Treasury Note Spread Over Inflation….Historically 10 Year Spread Over Inflation 2-5%

Cresmont Research www.cresmontresearch.com

https://contrarianedge.com/about/

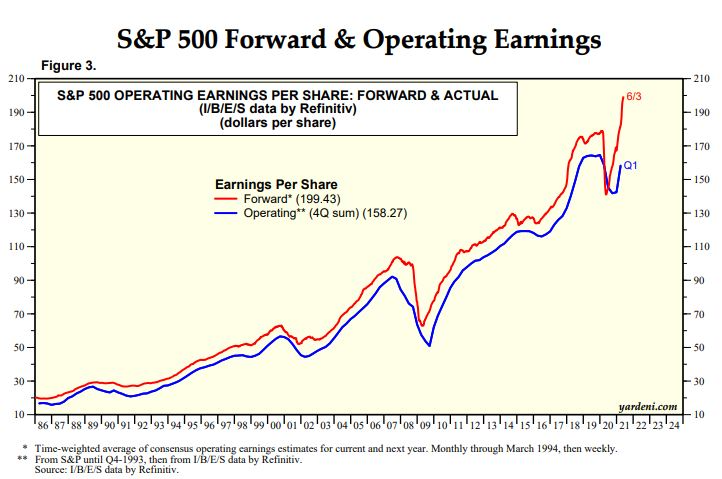

5. Stocks Delivering the Highest Operating Earnings in History.

Irrelevant Investor

Stocks have been rising over the last decade because businesses have been making more money for their shareholders. That sounds overly simplistic, but that’s just about all you need to know.

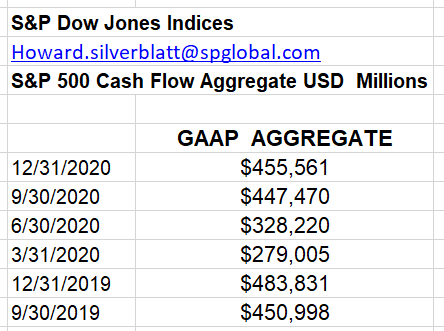

Last week Howard Silverblatt tweeted that for the first time, S&P 500 quarterly cash-flow will exceed $500 billion.

A Bubble in FundamentalsPosted June 12, 2021 by Michael Batnick https://theirrelevantinvestor.com/2021/06/12/a-bubble-in-fundamentals/

6. Value-oriented sectors play a larger role in non-U.S. markets

Capital Group Blog

Sources: MSCI, RIMES. As of 5/31/2021.

https://www.capitalgroup.com/advisor/insights/articles/2021-midyear-international-outlook.html

7. Lumber-Housing Permits and New Residential Construction Project +60% 2021

Why is lumber so expensive right now?An illustrated explainer of the factors driving up the market.By: Zachary Crockett | @zzcrockett

Why is lumber so ridiculously expensive right now? (thehustle.co)

8. Amazon Raised Capex by 75% Year Over Year.

The top fifteen spending companies in 2020 were:

· Amazon- $34 billion

· Verizon Communications- $16 billion

· AT&T- $15.5 billion

· Alphabet (Google)- $14 billion

· Intel- $12.5 billion

· Facebook- $11.7 billion

· Exxon Mobil- $11 billion

· Microsoft- $11 billion

· Duke Energy- $10 billion

· Comcast- $9.5 billion

· Exelon- $8 billion

· Walmart- $8 billion

· Charter Communications- $7.5 billion

· Chevron- $6 billion

· Apple- $6 billion

Progressive Policy Institute finds that over the last 12 months, Amazon invested more in the U.S. than any other American company. In 2020 alone, Amazon invested $34 billion in American infrastructure and created more than 400,000 jobs.

The Progressive Policy Institute (PPI) ranked Amazon as the No. 1 U.S. company investing in America. For the second year in a row, Amazon placed first on PPI’s Investment Heroes list, which identifies the Top 25 American companies investing in the U.S. PPI estimates that Amazon invested $34 billion in American infrastructure in 2020, which led to the creation of more than 400,000 jobs. The research PPI released highlights how investments by American companies are key to sustaining the economy during the COVID-19 pandemic and are helping to drive economic expansion, wage growth, and job creation across the country.

“We have a long track record of investing in the U.S., and in 2020, we doubled-down on our investments to continue delivering for our customers and supporting the American economy,” said Holly Sullivan, vice president of Worldwide Economic Development at Amazon. “Building new infrastructure, from new fulfillment centers to wind and solar farms, allowed us to create more than 400,000 jobs in the last year in communities across the country. Every one of our jobs comes with a starting wage of $15 an hour—twice the federal minimum wage—and comprehensive benefits for our regular, full-time employees. This means more money in the pockets of our workers, healthcare coverage, and access to free skills training to reinvent their careers.”

“Amazon and the rest of the Investment Heroes are leading the way for what corporate investment in America should look like,” said Michael Mandel, chief economic strategist at the Progressive Policy Institute. “Our data shows that not only is this type of investment critical in driving the creation of high-productivity and well-paying jobs, but it also helps hold down inflation by creating more supply. Coming out of the pandemic, our government needs to be squarely focused on keeping inflation at bay, and the continued investment from companies like Amazon is exactly what will help do that.”

Amazon’s investments in the U.S. in 2020 included:

- Logistics infrastructure – Amazon opened more than 150 delivery stations, fulfillment centers, and sortation centers in dozens of communities to allow for faster, easier, and more sustainable delivery for our customers.

- Green infrastructure – In 2020 alone, Amazon invested in the development of more than 20 new solar and wind farms, creating the necessary infrastructure to meet our Climate Pledge commitment to be net-zero carbon by 2040.

- New physical retail options – Amazon opened more than 45 Amazon Fresh, Amazon Go, Amazon 4-star, Amazon Books, Pop Up and Whole Foods Market locations in 2020, providing customers more options to shop for fresh groceries and nutritious meals, books, games, toys, and more.

- Tech Hubs and HQs expansions – Amazon expanded its Tech Hub locations in cities like Boston, Massachusettes, Dallas, Texas, and Phoenix, Arizona and started construction of its second headquarters in Arlington, Virginia, where the company has already invested more than $450 million. In 2020, Amazon added more than 2 million square feet of office space for the company’s growing tech and corporate workforce.

- Testing for COVID-19 at Amazon labs and neighborhood health clinics – Amazon built its own labs to test for COVID-19, and the facilities have already processed more than 1 million tests for Amazon employees. The company also opened 17 neighborhood health centers in five cities across the U.S. to provide 115,000 employees and their families access to a primary care physician.

- Advanced manufacturing – Amazon built a Robotics Innovation Hub in Westborough, Massachusetts, to grow its engineering, manufacturing, and test capabilities for Amazon Robotics and continued to invest in prototype manufacturing facilities in Redmond, Washington, for Project Kuiper—an Amazon initiative that will launch a constellation of low Earth orbit satellites to offer high-speed broadband connectivity to unserved and underserved communities around the world.

Amazon ranked No. 1 investor in America (aboutamazon.com)

9. Bloomberg Economic Surprise Index Back to 1 Year Lows.

ZeroHedge-The dismal disappointment in retail sales today, combined with Empire Manufacturing’s miss, a worse than anticipated drop in homebuilder confidence, and a bigger than expected drop in business inventories, the US macro surprise index fell to its lowest since May 2020…

10. The Pursuit of a Greater Life

Having the Audacity to Live Life Big

The Thrive Global Community welcomes voices from many spheres on our open platform. We publish pieces as written by outside contributors with a wide range of opinions, which don’t necessarily reflect our own. Community stories are not commissioned by our editorial team and must meet our guidelines prior to being published.

By Jamelle Sanders, CEO, Jamelle Sanders International

As I write to you, I am coming off of an incredible week. I was able to hit some big goals and celebrate a major milestone in my business. This week my business turned eleven years old. While that may not mean that much to you, you have to understand my journey to really grasp why this is so important. As an entrepreneur that has been very transparent about his journey, my business almost collapsed three times, I was mocked and criticized, and I was told I was too ambitious. This journey has been anything but easy. However, it has produced an exceptional life and I make no apologies for that. Fast forward eleven years later and I have been featured on television, in the pages of numerous magazines and on some of the largest media outlets in the world. In addition, I have written nine books, won numerous awards and become a highly respected thought leader. What I am trying to get you to understand is that you are in control of your own destiny. You do not have to live as a prisoner to your circumstances or become a product of the conditions in your life. You are the master of your fate and you can manifest your prophetic future. I hope this piece will inspire you and ingite you to pursue a greater life!

1. You first have to perceive that more is available to you. It is very challenging to help a person that has settled for mediocrity. You can give them all the motivational words in the world and it still not incite them to change. One of the things I have discovered is what we live in a culture that romanticizes the idea of change but rarely ever realizes change. Why is that? You have to first have the perception to recognize that more is available for your life. Never be deceived into believing that the best of your life is behind you. Or that this is all that is going to be in your life. Perception is a powerful prophetic tool empowering you to break free from the limitations of today in order to embrace the possiblities of tomorrow. If you want to live a greater life, then you must first perceive that a greater life is possible. Anything that you cannot perceive cannot become a present reality in your life. You have to stop seeing yourself as small and insignificant. Start seeing yourself as significant and impactful. Perception is making the decision to marry your potential and not your problems, to embrace your capacity and not your circumstances and to affirm your power and not the pressures of life. Perception is not only your portal to deliverance but it is the prophetic catlayst into your destiny. Perception changes what you are concentrating on so you can change what you are creating in your life. Your perception is the prescription for all future possibilities and opportunities.

2. You must expand your paradigm for more. While it is good to perceive more for your life, you have to take it a step further and expand your paradigm. As someone that has written extensively about the mind, I always talk about how nothing changed in my life until I shifted my paradigm. Your paradigm is essentially your belief system and core principles. What we do not understand is that if our thinking is wrong then our cycles are crippled. Toxic thoughts create toxic cycles. More importantly, an undeveloped mind will always produce unfruitful moments. If you want to live your greatest life, you must understand that it begins with addressing the way that you think. If your thoughts have brought you to a place of frustration, failure and defeat, the good news is that your thoughts can also bring you to a place of success, prosperity and victory. I’ve discovered that if you will take the time to address your mind you can alter your moments. The health of your mind will determine the freedom and fulfillment of your life. A bankrupt paradigm will never produce a beautiful life. The reality is that expanding your paradigm takes work. You have to be willing to confront self-limiting beliefs and perceptions. Also, you must dare to address patterns and cycles that have robbed you of change and breakthrough. Most of all, you must be willing to replace toxic thoughts with intentional thoughts to create a life of success and prosperity. More cannot manifest in your life as long as you live with an unhealed mind. Healing the mind is how you honor the seed of your potentail and embrace the more that is available to you. The attention you give the mind will determine the advancement of your life.

3. You must be willing to pursue more for your life. While the mind is such an important piece, so many people stop there. I have worked with so many people over the years and I have had to tell them that simply addressing the mind does not mean that the work is done. Now you have to move into the next phase which is called pursuit. In my life, I have discovered that you will never possess what you are unwilling to pursue. Furthermore, all progress in your life is the product of pursuit. So I want to ask you a very important question and I want you to answer it honestly. What are you pursuing? Notice that I did not say what are you dreaming about. Nor did I say what are you hoping for. I want you think about what you are pursuing. Many people mistake desire for pursuit. Desire is having a strong passion for something. On the other hand, pursuit is always reflective in our priorities. Do not tell me that you are pursuing something and yet it is never a priority in your life. Your pursuits are revealed by your priorities, investments and where you direct your energy. In order to live your greatest life, you must be willing to pursue your greatest life. Pursuit is not timid or passive. Pursuit is radical and relentless. After all, you will never manifest anything in your life that you are not willing to move towards. Pursuit is the total engagement of your will in the direction of the thing that you want the most. You literally have to be willing to hunt your destiny. You must be willing to give your all to embracing your greatest life. You will always be willing to chase after what you cherish. Your heart is located by your pursuit. Possibilities diminish as pursuit dies.

4. Dare to model a big life. One of the greatest travesties in the world is to dishonor the seed of your potential. How do you dishonor the seed of your potential? You dishonor the seed of your potential by choosing the status quo and embracing medicority. As I often say, you do not serve the world by playing small. You were created to live big. However, you must first dare to play a bigger game. Stop scaling back your dreams to fit low expectations and appease the opinions of your critics. Scale up your dreams, raise your expectations and shut down the opinions of your critics. Your critics become irrelveant when you raise the bar on your potential. The seed of greatness that is within you is waiting for expression. That seed of greatness is waiting for you to stop playing it safe and start playing big. Your greatness is unlocked when you dare to push your limits, shatter barriers and defy the odds. When you dare to push beyond the status quo, you propel your way into limitless possibilities and opportunities. Your decision to live life big will empower others to break through limitations and barriers to live bigger lives. We never lose when we take leaps of faith and leverage our capacity for greatness. In fact, I have discovered in my life that what I thought was a ceiling was a simply a frontier that had never been conquered before. People look at my life today and they marvel. What they fail to understand is that they can have the same results. All you have to do is move beyond your self-imposed limitations. I stopped letting barriers intimidate me and started allowing them to birth me into infinite possibilities. Living a bigger life begins when you understand you are not limited by conditions. You are only limited by your lack of courage.

— Published on June 12, 2021

https://thriveglobal.com/stories/the-pursuit-of-a-greater-life/

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.