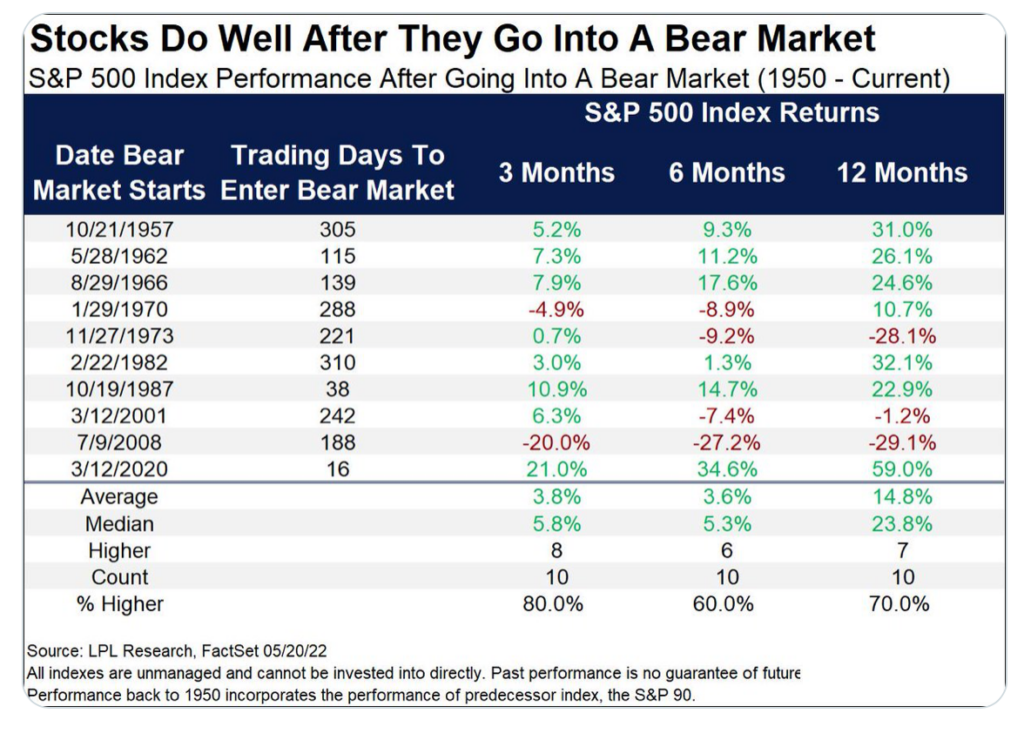

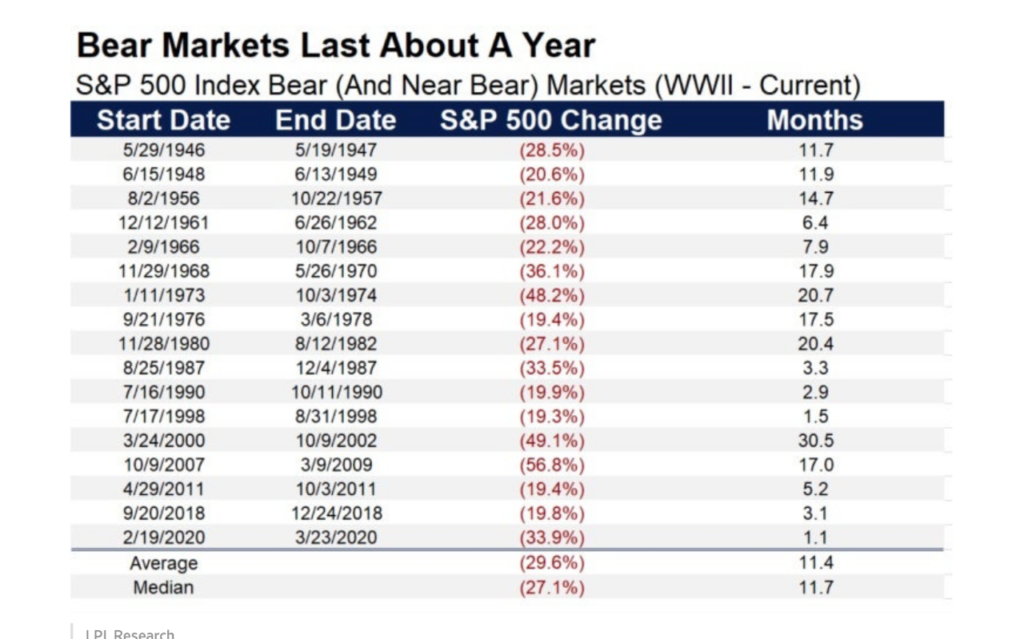

1. The Big Question….Bear Market without Recession or Bear Market with Recession? Here are the historical stats.

Ryan Detrick LPL Blog

https://twitter.com/RyanDetrick/status/1536343523640807427/photo/1

2. Pure Value Vs. Pure Growth…10 year returns…Beginning of 2022 Growth 200% Over Value for Decade

Reversion to Mean 50% Spread Last and Closing

www.yahoofinance.com

3. Small Cap Closes Below 200 Week Moving Average.

IWM Russell 2000 new low for 2022…hard close below 200 week…-30% from highs

4. 5 Year Chart…S&P +54% vs. IWM (small cap) +21%…2000-2022 Small Cap 100% Over S&P

5. SPLV Low Volatility Fund….Outperforming S&P YTD by 10%

6. Monday was Third Day Ever that 10 Year Treasury Yields Rose More than 20 Basis Points in One Day

Jim Reid Deutsche Bank-What a 48 business hours we’ve seen since Friday’s US CPI. Indeed yesterday was only the third day since daily Treasury data starts in 1962 that 10yr yields rose more than +20bps and the S&P 500 fell more than -3.5%. The other two times occurred in 1982 and 1986. That’s what happens when you see a regime change after decades under the old one.

If you’re looking for encouragement, at least the market is finally waking up to the extent of Fed hikes likely needed to tame inflation. Back in January, when we first used today’s CoTD, futures were only pricing in around 130bps worth of hikes over the first year of the hiking cycle. Even by the Fed’s meeting in March when they had begun to hike, futures were only pricing in 200bps. But, given inflation was already running at 7.0% last December and above 8% at the first hike, that would have been an unusually slow pace by historical standards, with the trend line of previous hiking cycles instead pointing to well over 300bps worth of hikes.

However, over the last 3 months markets have caught up to that trend line as inflation has proved stickier than the consensus was expecting. Futures now expect more than 300bps worth of further hikes by the February 2023 meeting (on top of the 75bps we’ve already had in March and May), meaning this is set to be the most aggressive pace of hikes in decades.

The terminal rate priced into the market is now at around 4%. This is starting to approach the 5% plus level we suggested was likely needed in our “Why the next recession will be worse than expected” (link here) note back in April.

The risk to our view is that something falls off the wheel as the Fed hikes aggressively over the coming months and they decide to pause or slow down the pace of hikes. This is clearly a risk but it’s not obvious that such a strategy would be enough to tame inflation.

7. Utilities -15% Off Highs…Pulls Back to Just Above 2022 Lows.

Yield on Utes ETFS below 3% vs. 10 year Treasury 3.5% Last

BITO -65% from highs

8. Floating Rate Bonds Beating AGG by 10% 2022

FLOT -1.3% vs. AGG -12.7%

9. 30 Year Treasury Yield Chart…50day thru 200day to Upside.

A couple weeks ago I showed this chart ….Surprised 50day was still below 200day….Upside breakout this week…Short-term overbought RSI long term bullish yield.

10. Wisdom is an Endless Pursuit-The Daily Stoic

It’s sort of strange—if you think back to when you were a kid, what appeared to you to be the best part about being an adult? No more school. Because that’s the example adults by and large set: that education stops. That adulthood is like one long summer break. That graduation is the final destination of learning and studying and investing in your education.

This is a relatively recent phenomenon. Not that long ago, adults prioritized their own education as much as their kids. There’s the story of Epictetus teaching one day when a student’s arrival caused a commotion in the back of the room. Who was it? Hadrian, the emperor. Hadrian’s example clearly had an impact on his successor and adopted grandson, Marcus Aurelius. Late in his reign, a friend spotted Marcus heading out, carrying a stack of books. Where are you going? he asked. Marcus was on his way to a lecture on Stoicism, he said, for “learning is a good thing, even for one who is growing old. I am now on my way to Sextus the philosopher to learn what I do not yet know.” In adulthood, Cato had the Stoic philosopher Athenodorus Cordylion come live with him so he could continue his studies. Thrasea, one of the Stoics who challenged Nero, continued his studies up until his last breath. In fact, he was discoursing and studying with Demetrius the Cynic when his death sentence from Nero arrived.

This is what it means to be a Stoic. To be a Stoic is to be a lifelong student. It’s to follow in the footsteps of Hadrian and Marcus and Cato and Thrasea. It’s to know that wisdom is an endless pursuit, to believe one never graduates, one never arrives at some final destination of education.