Friends,

I apologize for almost a month of missed blog posts but I have launched a new firm Lansing Street Advisors. The blog suffered in the short-term transition but we are planning a comeback that is stronger than ever. Please enjoy today’s post and the daily should be back in your inbox starting Monday but most important there is much more to come around Lansing Street Advisors. Thanks for reading and hope your families are healthy.

Matt

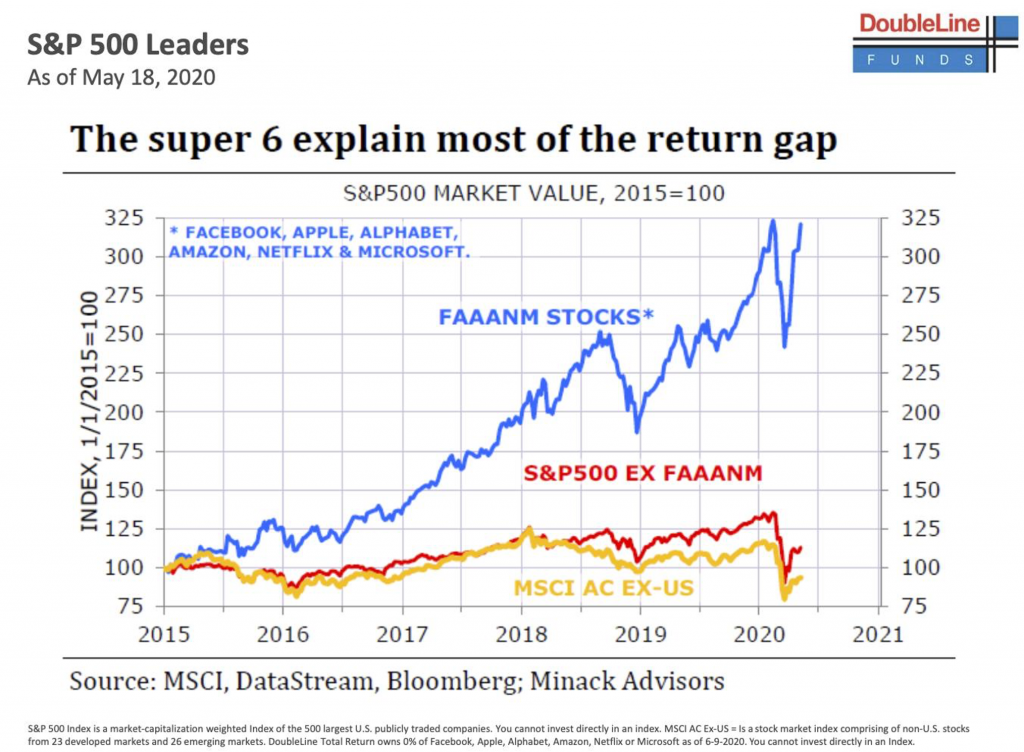

1. The Monopolies of Our Time…The Super 6 Stocks

Jeff Gudlach DoubleLine.

Take these six stocks out of the market and the USA has returns similar to the rest of the world over the last five years! That’s the story of the stock market in a nutshell.

#doubleline #gundlach #investing #wealthmanagement #fang #faang #covid19 #covid #stocks

David DeWitt, CFP DeWitt Capital Management, Author & Expert in MLPs Dtdewitt@dewittcm.com 610.975.4435

2. Josh Brown Ten reasons the “second wave” hasn’t spooked the markets (yet)

Posted June 11, 2020 by Joshua M Brown

In the state of Texas, hospitalizations for the virus are up 42% since Memorial Day. The state of Arizona just issued a warning that they’re getting close to full capacity in their hospitals. Many states that have reopened are experiencing surges of cases and deaths, along similar trajectories of the spikes seen in the early days for New York, New Jersey, California, Michigan, etc.

And while this uptick in cases hits dozens of states, the S&P 500 grinds ever higher, led by the now-expected large cap growth rally. This is also being accompanied by a surge in corporate credit enthusiasm along with a three-ring circus of speculative feats, penny stock freak shows and momentum magic acts.

Why isn’t the market spooked by what some are describing as the virus’s “second wave”?

I have a few reasons I’ve listed. I may not know much about virology, epidemiology or public health, but I know a lot about people and investor attitudes, so here is my best attempt to understand it:

1. We did this already. It’s easy to scare investors. It’s harder to keep them scared. There’s a lot of regret from investors who sold toward the bottom as stocks recovered right in their faces just weeks later. There is an unwillingness to have the same thing happen again, to the same people, so the hesitance to swing back to cash on virus headlines is high. The White House has stopped talking about this subject. Let’s assume half of the investor class takes its cues from the President because of party affiliation and decides to ignore it too. Maybe more than half.

2. The Fed is literally telling us, in word and in deed, that they believe the best way to satisfy their dual mandate of price stability and full employment is to continue to purchase tens of billions worth of securities every month, from corporate bonds to Treasurys. They are not going away. They are saying they are not going away. The message has gotten through. And as they buy low risk assets from the holders, those holders turn around and put that cash into higher risk assets. The Fed takes your place in the money markets while you run off and join Ringling Brothers.

3. We are better equipped to handle new cases. Think about how much medical professionals, EMTs, nurses, doctors and hospitals have learned since February. There’s no way we’ll be as overwhelmed on a patient by patient basis as we were in New York this winter. Right?

4. Nursing homes. Everyone I talk to points out the statistic of how many of the deaths occurred in nursing homes versus outside of them. The last person to relay a stat to me said 30%. The person before that said 25%. Who knows what data they’re quoting, from what date and from what place? It’s just what they believe – that infections among the most vulnerable populations made the virus look much more deadly than it is. I know this is very controversial, and I’m not saying it’s true – I think this is just what people feel now. So they are less afraid for their lives, and acting that way with their investment portfolios.

5. Gains embolden us. This is a fact. We are less afraid, as an investor class, when it seems like money is growing on trees. That’s what 50% rebounds in large, well-known stocks will do. That’s what “the best 50-day period for US stocks ever” will do. Money attracts money.

6. It’s global. Stock markets around the world are rallying as central banks around the world do some version of what the Federal Reserve has done. European stimulus and even policy change have gone further than ever. Italy is selling a new class of sovereign bonds to its citizens that include a coupon linked to the future GDP growth of the country’s economy (they’re called Futura, nice). Chinese stocks are on fire, German stocks are up 20% in a month, etc.

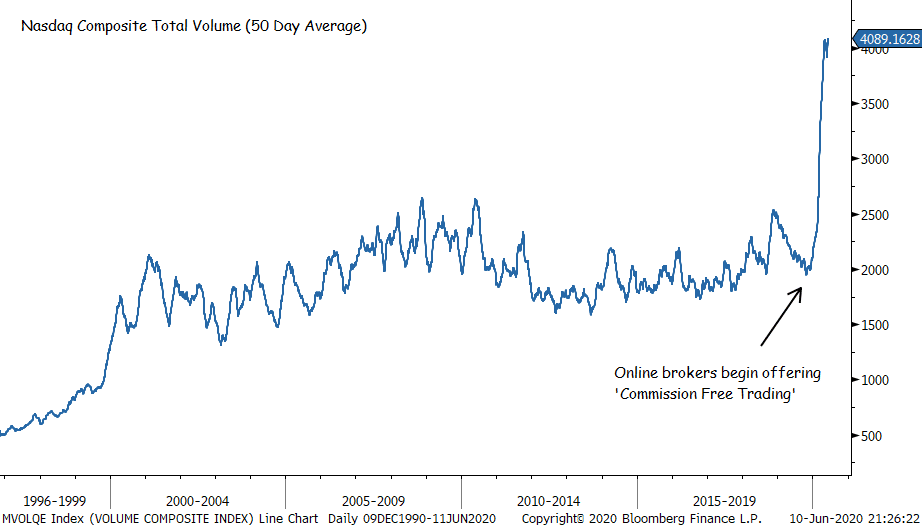

7. Casino! Popular sports commentators (and their legions of followers) have pivoted to playing the stock market in the absence of games to bet on. We haven’t seen this much excitement from retail investors in 20 years. I was there last time, there are a lot of similarities but valuations are more reasonable and there are way less IPOs dumping new shares on us now. New brokerage account openings are skyrocketing. Fidelity is running ads on active trader subreddits. Barstool’s Dave Portnoy has introduced perhaps hundreds of thousands of young men to the game they never knew they could love. This may not be moving the $1.5 trillion market cap for Apple, but it is definitely influencing the prices of smaller stocks and more speculative ETFs. We’ll see if this phenomenon persists as the NBA gets started in July and the NFL season approaches.

UPDATED!!! Including this chart from my pal Jon Krinsky – Nasdaq trading volumes have exploded!

8. Treatments and vaccines. Stock market participants tend to be optimists. I can’t know for sure, but I would guess two thirds of them believe that, between J&J, Moderna, Astra Zeneca and the hundreds of other trials taking place, something big is coming in the vaccine space. Enthusiasm for improved treatments is probably running on a parallel course.

9. Masks. They cost nothing and they work. In metropolitan areas around the country, people are wearing them. Takeout from restaurants, counters retrofitted with plexiglass and clear acrylic shields, delivery – we may not have the “old economy” but the new post-virus economy features businesses scratching and clawing their way back, which I love to see. Investors have decided that life will go on in the towns they live in, so why wouldn’t they invest accordingly?

10. Statistics. You can make a statistic say whatever you want, depending on when you start counting from. A lot of the data we’re seeing – in both corporate earnings reports and the overall economy – is coming off the bottom. Some of the percentage gains, for things like housing and airport traffic, are almost cartoonishly outsized. A Harvard economics professor remarked recently that Trump will have some of the best economic growth data in history to run on this summer because we are rebounding off of such low levels from the spring. You can fool a lot of people this way, and investors can always be relied upon to fool themselves.

Anyway, that’s what I think is going on. What do you think? Tell me here.

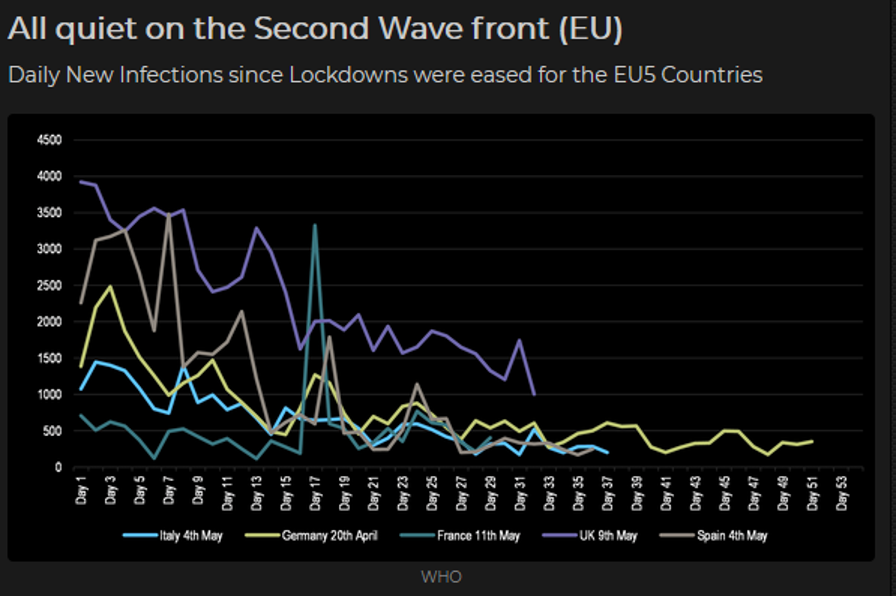

3. European Countries Not Showing “Second Wave”

DAVE LUTZ at Jones Trading

“It’s not a second wave, they never really got rid of the first wave,” says Dr. Scott Gottlieb on outbreaks in Arizona, Texas, South Carolina and North Carolina. There has been little evidence of a “Second Wave” in European countries that unlocked before the USA.

4. Tesla Valuation Close to Toyota….Tesla Produced 103,000 Vehicles vs. Toyota 2.4 Million….Nikola Electronic Truck Maker Skyrockets.

Electric truck maker Nikola looks like Tesla 2.0 — except even riskier…Formed thru a Reverse Merger ….Zero Trucks Sold.

- By Russ Mitchell Los Angeles Times (TNS)

A week before Nikola, the electric truck start-up, debuted its shares on the public market, it was time to spin up the hype machine. For some reason its founder and chief executive, Trevor Milton, wanted to talk about how much he loves Tesla.

You’d think he’d count Tesla as a rival, if not an enemy. Each aims to capture the market for long-haul diesel trucks. Each seeks to claim the mantle of brilliant inventor Nikola Tesla, who helped bring electricity to the masses by championing alternating current technology. Whenever the subject comes up, Tesla Chief Executive Elon Musk dumps on Nikola’s core technology, electric fuel cells, deemed by Musk as irredeemably inferior to Tesla’s own lithium ion battery power systems. “Fool cells,” he calls them.

But here was Milton, blowing kisses. “There are probably no bigger fans around the world than Nikola employees. Look at our parking lot. Teslas all over the place,” he said.

“We’re huge fans and the reason is this: Tesla paved the way for EVs” while traditional car companies “talked trash on them all day, every day. But they got it done.”

It’s easy to see why Milton, 38, might want to bill his company as the second coming of Tesla. Nikola’s position is similar to Tesla’s when the electric-car maker started out in the early 2000s: a renegade start-up promoting untried technology to push internal combustion incumbents out of the driver’s seat.

Like Tesla, Nikola also must raise loads of money to fund operations and capital expenses from investors willing to bear year after year of losses.

It’s worked for Tesla: Look at its jaw-dropping stock price. The company has never earned an annual profit, its growth rate is slowing and a viral plague has pushed the world economy into deep recession. Yet Tesla investors remain so optimistic they’ve pushed the stock to almost $900, giving the company a market capitalization of about $162 billion. If you were Milton, wouldn’t you want in on that kind of action?

Both Milton and Musk have become billionaires thanks to new investment dollars flowing into their companies, not on company profits. Nikola’s revenue is negligible, a few hundred thousand dollars a year from engineering contracts. Since its founding in 2015, it has lost a cumulative $188.5 million. Whereas Tesla had debuted a car before its IPO in 2010, the low-production Roadster, Nikola has yet to sell a single truck.

Glory days may lie ahead, but the only trucks either company has to show are prototypes. Both have announced ambitious timelines while raising money and then let the schedules slip. Nikola claims $10 billion worth of “orders” for 14,000 semi trucks, but government filings make clear that those are more like expressions of interest, cancelable, with no deposit money required. Musk says there’s strong demand for the Tesla Semi, but he hasn’t released any order or reservation numbers at all. He also has claimed advances in battery technology that will allow its big-rig haulers to travel 500 miles between charges, but hasn’t yet demonstrated such performance in real life.

Another parallel: Milton and Musk have both been criticized for the way they’ve advanced their own interests during the COVID-19 crisis. Musk restarted production at its Fremont assembly plant May 11, defying orders from the Alameda County public health department.

Milton, meanwhile, was taken to task on CNBC for initially declining requests to return $4 million in federal Paycheck Protection Program forgivable loans meant to help small businesses. This, despite $85 million cash in Nikola’s bank account as of the end of 2019, and with a go-public deal in the works to provide Nikola with $735 million in new capital.

About that deal, consummated Thursday: It was financed by a complicated financial arrangement that avoided a traditional initial public offering, or IPO. Basically, a shell company was created and listed on Nasdaq. That company bought Nikola and folded it into the shell in what’s known as a reverse merger, raising the company’s valuation to $12 billion, up from $3 billion just last fall.

$10 to $93

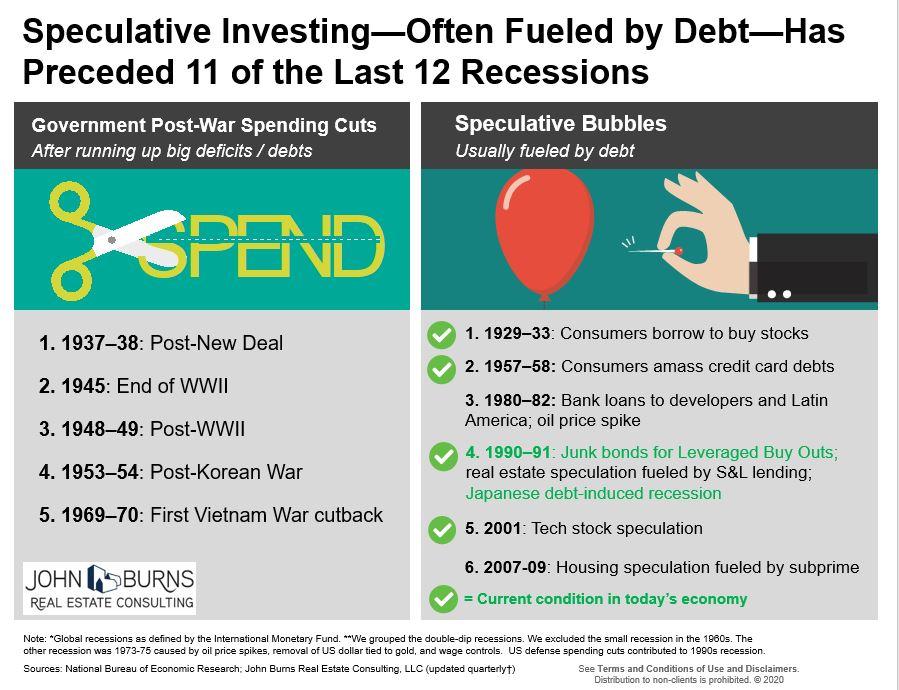

5. Easy Money Fuels Debt That Fuels Speculation.

John Burns Real Estate https://www.linkedin.com/in/johnburns7/

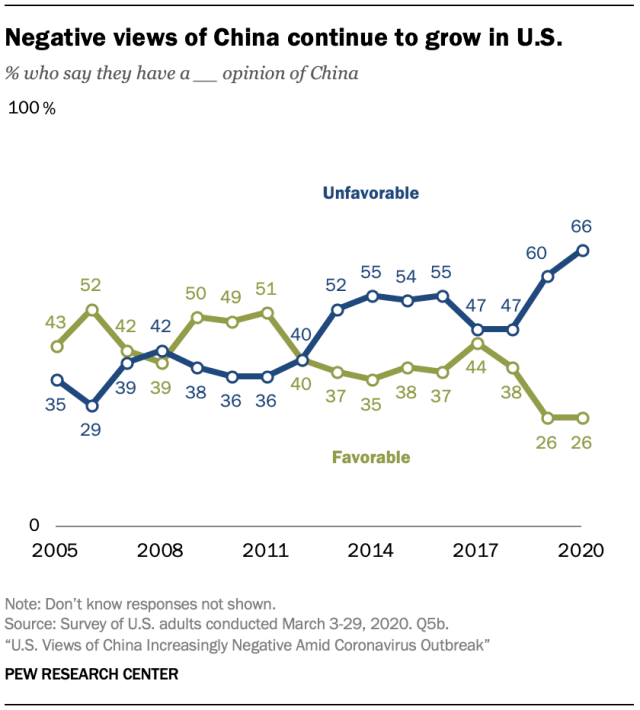

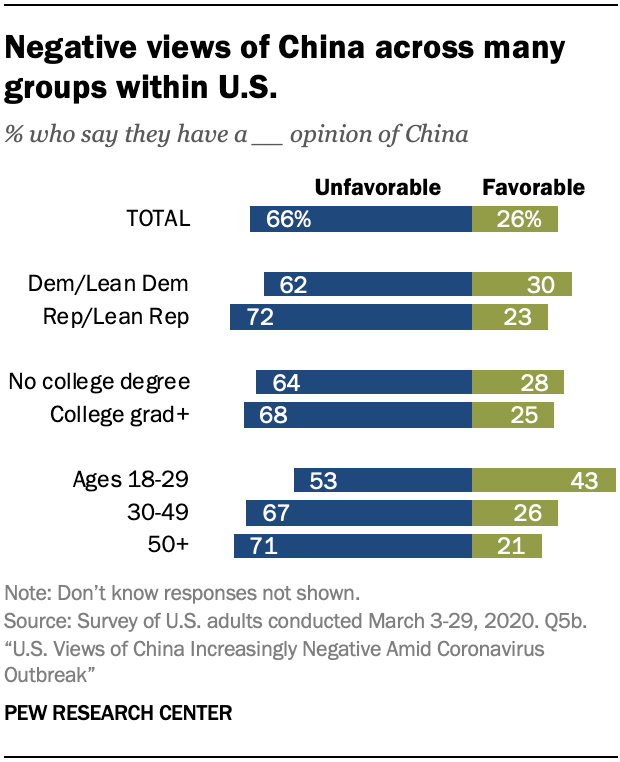

6. U.S. Citizens Negative Views on China Are Widespread Across Demographic Groups and Parties.

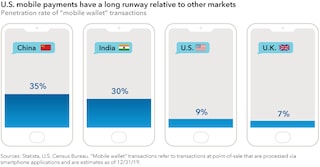

7. Digitization of daily life is here to stay…U.S. Mobile Payments Well Behind China and India.

From Capital Group American Funds –Digitization of daily life is here to stay

Some of the recent demand activity reflects an amplification of already established trends. Cloud demand, for example, was sky-high before the COVID-19 outbreak. But the events of 2020 have kicked that theme into overdrive. In the stay-at-home era, e-commerce, mobile payments and video streaming services have soared in popularity, occasionally pushing the limits of technology. While the levels of online activity are likely to moderate, the pandemic could be a catalyst for even stronger e-commerce growth in the years ahead.

“The response to the COVID-19 crisis — keeping everyone at home — has accelerated this powerful trend of digitizing the world,” explains Capital Group portfolio manager Mark Casey, Co-President of Fundamental Investors®.

“Services that were already useful have in some cases become almost essential. Many people felt compelled to try grocery delivery for the first time, for example, and subscriptions to Netflix skyrocketed.”

There’s also room to advance, Casey adds. While e-commerce has grown in popularity, it still represents only about 11% of U.S. retail sales last year, and mobile payments stood at similarly low levels. “Given where we are now in the consumer-technology space, the growth potential is truly exciting.”

U.S. Midyear Outlook: From recession to recovery

https://www.capitalgroup.com/advisor/insights/articles/us-midyear-outlook-2020.html

8. The Shutdowns Reveal Big Possibilities for Small-Format Bottles

By Roger Morris

Among the many ways the novel coronavirus outbreak has affected the wine and hospitality industries is the rejuvenation of the 375-milliliter bottle of wine. Easily shippable for virtual tastings and a sensible substitute for by-the-glass service, the small-format bottle is especially suited to pandemic life.

“Most people don’t want to open three or four [standard] bottles of wine at home to do a traditional tasting, so the half bottles have been a very nice alternative,” says Laura Kirk Lee, vice president of sales and marketing for Knights Bridge Winery. “We find that our guests enjoy the opened bottles with dinner after the virtual tasting.”

Rachel Martin, vintner/owner of Oceano Wines, sent half-bottles of her Chardonnay along with recipes and videos as “care packages” to members of The Supper Club in Los Angeles, San Francisco and Austin. “In St Louis, I hosted an Oceano virtual tasting block party where we sent a couple of cases of half bottles to residents, and they distributed them to their friends and family,” she says.

Frank Pagliaro, owner of Frank’s Wine in Wilmington, Delaware, increased his selection of half bottles by 60% to accommodate virtual tastings. Suzie Kukaj-Curovic, director of public relations for Freixenet Mionetto USA, says smaller-format sales have increased, though modestly, at less than 10%.

Will this enthusiasm continue once customers regain greater access to winery tasting rooms and in-store retail tastings?

“We had started offering virtual tastings before Covid-19 because we wanted to stay connected,” says James Blanchard of Blanchard Family Wines. “We’ve been selling a lot of 375s, and I think our virtual tastings will continue for some time.”

Other wineries express similar sentiments about continuing online tastings even after tasting rooms reopen. At a recent webinar sponsored by Silicon Valley Bank, winery consultant Paul Leary emphasized the importance for producers to maintain contacts forged during the pandemic. “The worst thing we can do is to go back to our old ways,” he says. “You now have the opportunity to go directly into the customers’ dining rooms.”

Wines in cans, another 375-ml option, have also grown in popularity during the shutdown. It raises the issue of whether some wineries will see half bottles as a suitable alternative for consumers.

“The question is whether the consumer trend will trade down to value over premium wines, like the previous recession, and what will premium wines do [to] make up sales—reduce price or seek alternate packaging in 375 ml,” says Todd Nelson, director of marketing for Winesellers, Ltd. “I don’t know if this kind of trend to smaller formats will translate very much for the high-end premium.”

Rob McMillan, EVP for the Silicon Valley Bank Wine Division, points out that sales of half-bottles increased 20% in 2019 while standard 750-ml bottles declined slightly. This growth trend continued into the first quarter of 2020. In his annual report, McMillan gave another reason for increased interest in premium 375-ml bottles.

“As boomers retire, they will join millennials as frugal consumers and change their consumption and spending,” he says. “But as any wine lover will tell you, it’s hard to drink good wine and go backward to lesser-quality wine.”

It is still too early for most restaurants, many of which have pivoted to takeout and delivery sales, to reorder wines of any size. Nevertheless, wineries have begun to order additional half bottles for upcoming bottling runs. “We are getting more requests than normal for 375-ml bottles,” says TJ Hauser, president of Hauser Packaging. “It’s too early to tell if wineries are using them as a stopgap for virtual tastings or whether 375s will become a more permanent trend in the industry.”

Jason Haas, Tablas Creek Vineyard partner and general manager, has decided to give the format a second look.

“Before the pandemic, we saw a sustained decrease in the interest in half-bottles, to the point that we’ve been considering eliminating them,” he says. “But for virtual tastings, they’re really ideal. It’s definitely opened up new connection possibilities with our customers, but will people still want to do virtual tastings once they can visit wineries again? Right now, we’re in a holding pattern.”

Instead of eliminating the format, Haas says Tablas Creek will be reordering the same numbers of half-bottles for the next bottling period in case the resurrected interest becomes permanent.

9. A Single Session of Exercise Alters 9,815 Molecules in Our Blood

The types of molecules also ranged widely, with some involved in fueling and metabolism, others in immune response, tissue repair or appetite. And within those categories, molecular levels coursed and changed during the hour. Molecules likely to increase inflammation surged early, then dropped, for instance, replaced by others likely to help reduce inflammation.

“It was like a symphony,” says Michael Snyder, the chair of the genetics department at Stanford University and senior author of the study. “First you have the brass section coming in, then the strings, then all the sections joining in.”

Interestingly, though, different people’s blood followed different orchestrations. Those who showed signs of insulin resistance, a driver of diabetes, for instance, tended to show smaller increases in some of the molecules related to healthy blood sugar control and higher increases in molecules involved in inflammation, suggesting that they were somewhat resistant to the general, beneficial effects of exercise. The levels of other molecules ranged considerably in people, depending on their current aerobic fitness.

Over all, the researchers were taken aback by the magnitude of the changes in people’s molecular profiles after exercise, Dr. Snyder says. “I had thought, it’s only about nine minutes of exercise, how much is going to change? A lot, as it turns out.”

This study was small, though, and looked at a single session of aerobic exercise, so cannot tell us anything about the longer-term molecular effects of continued training or of how, precisely, changes in molecular levels subsequently alter health. It also did not include young volunteers under 40.

Dr. Snyder and his colleagues are planning follow-up experiments with more volunteers and sustained exercise programs. They hope to establish whether certain molecular responses to exercise might distinguish people who would benefit from emphasizing resistance exercise over endurance training and whether specific molecular profiles indicate who has higher or lower aerobic endurance. This information could allow physicians and researchers to check fitness with a simple blood draw instead of a treadmill stress test.

10. Harvard researcher says the most emotionally intelligent people have these 12 traits. Which do you have?

Daniel Goleman, Contributor@DANIELGOLEMANEI

What makes someone great at their job? Having knowledge, smarts and vision, to be sure. But what really distinguishes the world’s most successful leaders is emotional intelligence — or the ability to identify and monitor emotions (of their own and of others).

Companies today are increasingly looking through the lens of emotional intelligence when hiring, promoting and developing their employees. Years of studies show that the more emotional intelligence someone has, the better their performance.

What most people fail to realize, though, is that mastering emotional intelligence doesn’t come naturally. Tom, for example, considers himself an emotionally intelligent person. He’s a well-liked manager who is kind, respectful, nice to be around and sensitive to the needs of others.

And yet, he often wonders, I have all the qualities of emotional intelligence, so why do I still feel stuck in my career?

This is a common trap: Tom is defining emotional intelligence too narrowly. By focusing on his sociability and likability, he loses sight of all other essential emotional intelligence traits he may be lacking — ones that can make him a stronger, more effective leader.

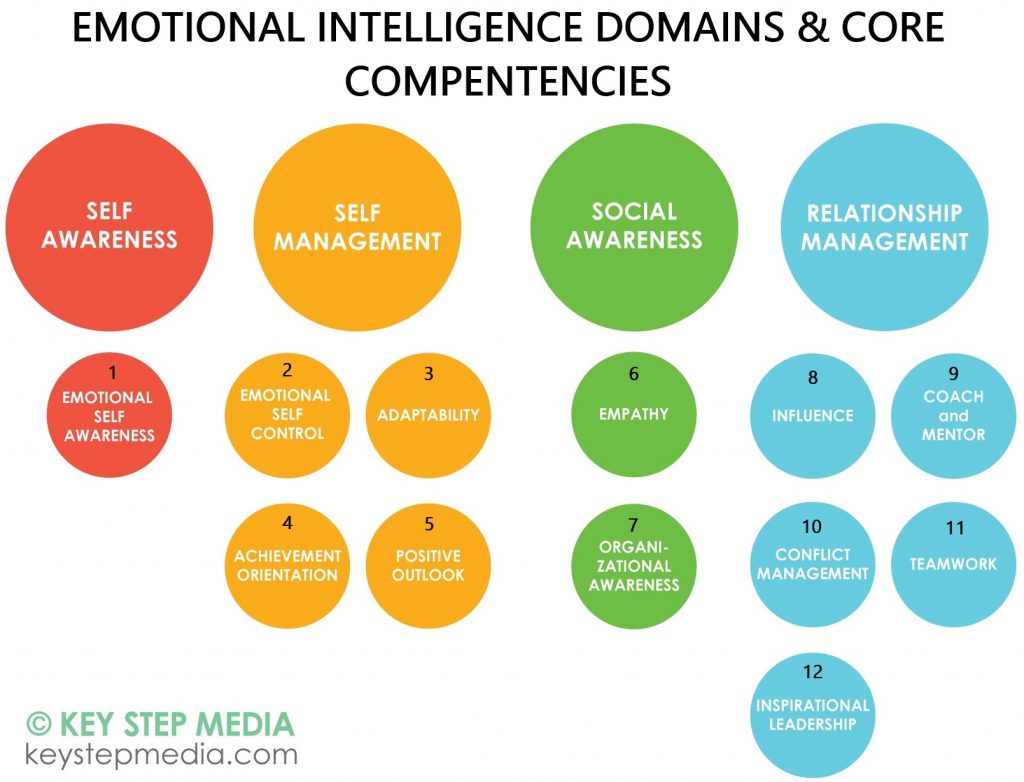

After spending 25 years writing books and fostering research on this topic, I’ve found that emotional intelligence is comprised of four domains. And nested within these domains are 12 core competencies.

(Click here to enlarge chart)

Don’t shortchange your development by assuming that emotional intelligence is all about being sweet and chipper. By reviewing the competencies below and doing an honest assessment of your strengths and weaknesses, you can better identify where there’s room to grow.

1. Self-awareness

Self-awareness is the capacity to tune into your own emotions. It allows you to know what you are feeling and why, as well as how those feelings help or hurt what you’re trying to do.

Do you have the core competency of self-awareness?

- Emotional self-awareness: You understand your own strengths and limitations; you operate from competence and know when to rely on someone else on the team. You also have clarity on your values and sense of purpose, which allows you to be more decisive when setting a course of action.

Developing the skills:

Every moment is an opportunity to practice self-awareness. One of the biggest keys is to acknowledge your weaknesses. If you’re struggling with something at work, for example, be honest about the skills you need to work on in order to succeed.

Be conscious of the situations and events in your life, too. During times of frustration, pinpoint the root and cause of your frustration. Think about any signals that accompany how you feel in that moment.

2. Self-management

Self-management is the ability to keep disruptive emotions and impulses under control. This is a powerful skill for leaders, especially during a crisis — because will people look to them for reassurance, and if their leader is calm, they can be, too.

What core competencies of self-management do you have?

- Emotional self-control: You stay calm under pressure and recover quickly from upsets. You know how to balance your feelings for the good of yourself and others, or for the good of a given task, mission or vision.

- Adaptability: This shows up as agility in the face of change and uncertainty. You’re able to find new ways of dealing with fast-morphing challenges and can balance multiple demands at once.

- Achievement orientation: You strive to meet or exceed a standard of excellence. You genuinely appreciate feedback on your performance, and are constantly seeking ways to do things better.

- Positive outlook: You see the good in people, situations and events. This is an incredibly valuable competency, as it can build resilience and set the stage for innovation and opportunity.

Developing the skills:

During moments of distress, do not brood or panic. Take a deep breath and check in with your emotions. Instead of blowing up at people, let them know what’s wrong and offer some solutions.

Accept that there will always be sudden changes and challenges in life. Try to understand the context of the given situation and adjust your strategy or priorities based on what is most important at the time.

3. Social awareness

Social awareness indicates accuracy in reading and interpreting other people’s emotions, often through non-verbal cues. Socially aware leaders are able to relate to many different types of people, listen attentively and communicate effectively.

What core competencies of social awareness do you have?

- Empathy: You pay full attention to the other person and take time to understand what they are saying and how they are feeling. You always try to put yourself in other people’s shoes in a meaningful way.

- Organizational awareness: You can easily read the emotional currents and dynamics within a group or organization. You can sometimes even predict how someone on your team or leaders of a company you do business with might react to certain situations, allowing you to approach situations strategically.

Developing the skills:

First and foremost, social awareness requires good listening skills. Do not talk over someone else or try to hijack the agenda. Ask questions and invite others to do the same.

Challenging your prejudices and discovering commonalities is also key. Practice putting yourself in other people’s shoes. When we do this, we are often more sensitive to what that person is experiencing and are less likely to tease, judge or bully them.

4. Relationship management

Relationship management is an interpersonal skill set that allows one to act in ways that motivate, inspire and harmonize with others, while also maintaining important relationships.

Which core competencies of relationship management do you have?

- Influence: You’re a natural leader who can gather support from others with relative ease, creating a group that is engaged, mobilized and ready to execute the tasks at hand.

- Coach and mentor: You foster the long-term learning by giving feedback and support. You put your points into persuasive and clear ways so that people are motivated as well as clear about expectations.

- Conflict management: You’re comfortable dealing with disagreements between multiple sides and can bring simmering disputes into the open and find win-win solutions.

- Teamwork: You interact well as a group member and can work with others. You participate actively, share responsibility and rewards, and contribute to the capability of your team as a whole.

- Inspirational leadership: You inspire and guide others towards the overall vision. You always get the job done and bring out your team’s best qualities along the way.

Developing the skills:

If you’re a constantly negative person, you’ll have a very difficult time managing long-term relationships. Instead of focusing on “the worst that can happen,” try to see yourself as an agent of positive change.

Don’t be afraid to go against the grain of conventional norms or take risks, either. These kinds of people ultimately leave the people they work with feeling inspired, motivated and connected.

Daniel Goleman is a psychologist and best-selling author of “Emotional Intelligence” and “Social Intelligence.” His latest book is “What Makes a Leader: Why Emotional Intelligence Matters.” Daniel received his PhD in psychology and personality development from Harvard University. His work has appeared in The New York Times and Harvard Business Review. Follow him on Twitter @DanielGolemanEI.

Disclaimer

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publically available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only