1. GROWTH INVESTING HAS DOMINATED SINCE GREAT FINANCIAL CRISIS

SMART BETA OR FACTOR RETURNS SINCE 2008—GROWTH 100% OVER NEXT CLOSEST FACTOR

NASDAQ DORSEY WRIGHT WWW.DORSEYWRIGHT.COM

2. Another Look at the Big 4….Market Cap $322 Billion to $5.77 Trillion in 10 Years

Big tech returns in 2008 recession… $MSFT: -44% $AAPL: -57% $GOOGL: -56% $AMZN: -45% $QQQ: -42%

Big tech returns YTD in 2020 recession… $MSFT: +34% $AAPL: +28% $GOOGL: +12% $AMZN: +65% $QQQ: +22% Data via

3. Citigroup Economic Surprise Index Massive Spike

The Daily Shot

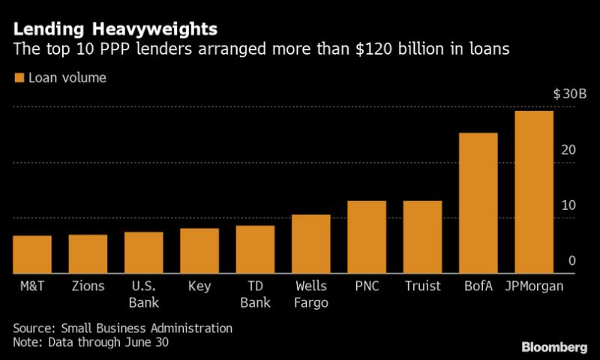

4. Banks Poised to Get Fee Windfall From Small-Business Stimulus

Hannah Levitt-Bloomberg•July 7, 2020

Banks Poised to Get Fee Windfall From Small-Business Stimulus

(Bloomberg) — Earlier this year, thousands of lenders rushed to arrange loans under the U.S. government’s Paycheck Protection Program. Now, some of them will be rewarded handsomely.

More than 30 banks across the country, including dozens of community banks and some lenders with more than $1 billion in assets, could generate fees that surpass their 2019 net revenue before set-asides for loan losses, according to a study distributed Tuesday by S&P Global Market Intelligence. The firms that will reap the biggest gains are the ones that punched above their weight in arranging loans for the rescue program.

The Small Business Administration’s $669 billion Paycheck Protection Program was launched in April as part of the $2 trillion CARES Act passed by Congress to help the U.S. economy through the coronavirus pandemic. The program was initially marred by confusion and technological glitches as banks large and small raced to secure loan funding for their clients.

As of June 30, lenders arranged almost 4.9 million loans supporting more than 51 million jobs, according to the SBA. Fees range from 1% to 5% for each loan, depending on its size.

Cross River Bank, a Fort Lee, New Jersey-based firm with $2.5 billion in assets at the end of the first quarter, arranged more than $5 billion in PPP loans, making it the 13th-most-active lender, according to the SBA. S&P estimates that Cross River will pull in $163 million in related fees, more than double its pre-provision net revenue last year.

JPMorgan Chase & Co., Bank of America Corp., Truist Financial Corp., PNC Financial Services Group Inc. and Wells Fargo & Co. were the top five PPP lenders by volume, arranging a combined $91 billion as of June 30, SBA figures show. JPMorgan could make $864 million in related fees, according to S&P, but that will “represent a modest boost to the top line.” And JPMorgan is among the lenders, also including Bank of America and Wells Fargo, that plan to donate the fees.

For more articles like this, please visit us at bloomberg.com

https://finance.yahoo.com/news/banks-poised-fee-windfall-small-175710346.html

5. End of an era? Series of U.S. setbacks bodes ill for big oil, gas pipeline projects

Valerie Volcovici, Stephanie Kelly

WASHINGTON/NEW YORK (Reuters) – A rapid-fire succession of setbacks for big energy pipelines in the United States this week has revealed an uncomfortable truth for the oil and gas industry: environmental activists and landowners opposed to projects have become good at blocking them in court.

The latest setbacks have increased the difficulty for developers of billions of dollars worth of pipeline projects in getting needed permits and community support. The oil industry says the pipelines are needed to expand oil and gas production and deliver it to fuel-hungry markets, but a rising chorus of critics argue they pose an unacceptable future risk to climate, air and water.

“Any company that is going to look to invest that kind of money into our infrastructure is really going to have to take a hard look,” said Craig Stevens, spokesman for Grow America’s Infrastructure Now, a coalition comprised mainly of chambers of commerce and energy associations.

The Trump administration has sought to accelerate permits and cut red tape for big-ticket energy projects such as the Dakota Access and Keystone XL pipelines. That effort has failed so far, and may even have made legal challenges easier, because rushed permitting paperwork has caught the eyes of judges.

A federal judge on Monday ordered the Dakota Access pipeline, the biggest duct moving oil out of the huge Bakken basin, to shut down and empty because the Army Corps of Engineers had failed to do an adequate environmental impact study. The same day, the U.S. Supreme Court blocked construction on the proposed Keystone XL line from Canada pending a deeper environmental review.

For years, both those pipelines have been targets of protests and lawsuits by climate, environment and indigenous rights activists.

On Sunday, Dominion Energy Inc (D.N) and Duke Energy Corp (DUK.N) decided to abandon the $8 billion Atlantic Coast Pipeline, meant to move West Virginia natural gas to East Coast markets, after a long delay to clear legal roadblocks almost doubled its estimated cost.

“What we have been seeing in the last couple of weeks is a shift in the importance of communities and landowners — and their voices in this process,” said Greg Buppert, a lawyer for the Southern Environmental Law Center, which represented opponents of the Atlantic Coast Pipeline.

“Building energy infrastructure today is certainly more challenging than it was five, 10 or 15 years ago,” said Joan Dresken, chief counsel to the Interstate Natural Gas Association of America.

OIH—OIL SERVICES ETF $1400 to $119 Since 2007

BAR CHART

https://www.barchart.com/etfs-funds/quotes/OIH/interactive-chart

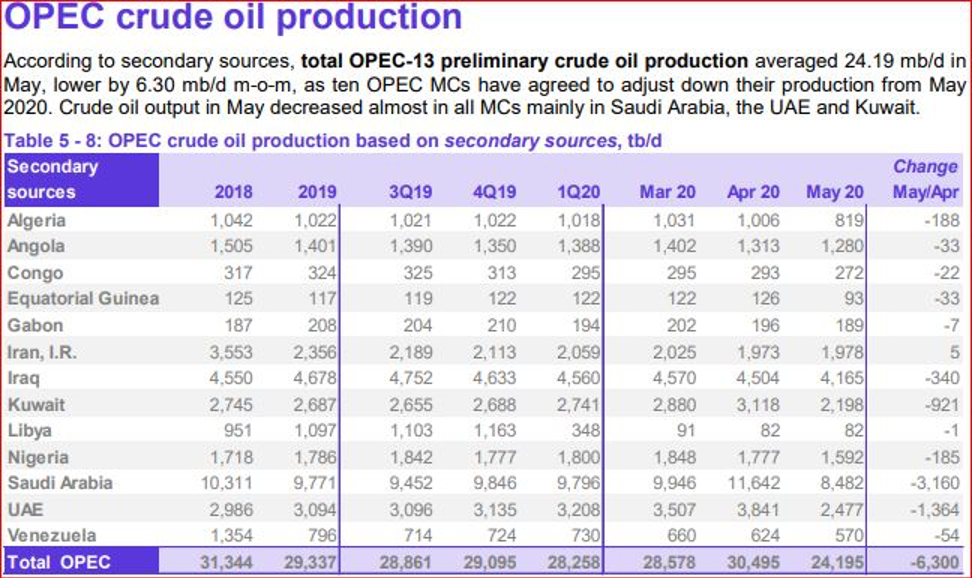

6. OPEC Cutbacks in Oil Production 2020

by RON PATTERSON posted on 06/18/2020 http://peakoilbarrel.com/

7. Will Bankruptcies Take Out the 2008 Highs?

U.S. Bankruptcies Based on Quarterly Filings

What to Watch in U.S. Corporate Credit Markets This Week

https://finance.yahoo.com/news/watch-u-corporate-credit-markets-140000494.html

8. China Projected to Have the Smallest GDP Hit from Corona Virus in 2020

9. Inside the Minds of the Ultra-Wealthy-

By Nicholas Vardy Investment U

Originally posted July 7, 2020 on Liberty Through Wealth

- The Forbes 400, a list of the richest people in America, has been our country’s wealth scorecard for decades.

- Today, Nicholas Vardy dives into the demographics and mindset of these ultra-rich Americans. And what he uncovers could offer lessons on what it means to live a rich life… far beyond the money.

F. Scott Fitzgerald: “The very rich are different from you and me.”

Ernest Hemingway: “Yes, they have more money.”

Americans are endlessly fascinated with the ultra-wealthy.

Fitzgerald’s novel The Great Gatsby – the iconic American story about the Roaring ’20s – remains required reading in many American high schools.

Reality TV shows feature the lifestyles of the rich and famous – the lavish “cribs,” cars and lives of the super-wealthy.

The Forbes 400 – compiled and published annually by Forbes magazine since 1982 – has been America’s wealth scorecard for decades.

Many in the Forbes top 10 are household names.

As one joke in the 1990s had it, ambitious American kids aspired to become the next “Bill.”

But their idol wasn’t then-President Bill Clinton. It was Microsoft founder Bill Gates.

But there’s more to the story of the Forbes 400 than just money…

By understanding the mindset and characteristics of the ultra-wealthy, we can get an idea of what it really means to live a rich life.

Sources of Wealth

So how did members of the Forbes 400 generate their wealth?

On the 2018 list, 241 of the 400 made their fortunes from scratch. And 36 made a large portion of their money that way even though they also inherited wealth.

That means that most of America’s ultra-wealthy were self-made. They attributed their wealth to ambition, initiative, drive, grit, ingenuity, hard work and entrepreneurship.

They weren’t just born into the lucky sperm club.

Education

It’s become fashionable to dismiss college as a waste of time and money. Really? How would you feel about flying in a plane designed by a team of aeronautical engineers who attended the “University of Life”?

Forbes 400 member and billionaire Peter Thiel (a bookish two-time Stanford graduate) even pays smart kids $100,000 to drop out of top colleges and start businesses.

The results of Thiel’s experiment have been mixed, at best.

In contrast, the verdict from the 2018 Forbes 400 list is clear.

Of the Forbes 400, 41 attended Harvard, 27 attended Stanford, 10 attended Yale and 3 attended Princeton – a total of 81 from the top-rated, most prestigious U.S. universities. That’s about 1 in 5.

Thirty-five members of the Forbes 400 have law degrees. Twenty-nine have master’s degrees. Twenty-one have earned PhD.s. Only five are M.D.s.

Yet, an even higher percentage of the ultra-wealthy attended run-of-the-mill universities or did not attend college at all. Sixty-three of the Forbes 400 have only high school diplomas.

And according to one statistic from 2015, those on the Forbes 400 list with college degrees were worth less on average than those without – $3.1 billion vs. $5.9 billion, to be exact.

Still, it’s worth remembering, Forbes 400 members aren’t your average college dropouts.

Gates started Microsoft after dropping out of Harvard. Mark Zuckerberg did the same after launching Facebook. Larry Page and Sergey Brin both dropped out of Stanford.

Six out of the top 10 members of the 2019 Forbes 400 attended or dropped out of Harvard or Stanford.

Jeff Bezos attended Princeton, and Warren Buffett graduated from Columbia.

The lesson?

Yes, college dropouts become billionaires. But they are also smart enough to drop out of a fancy college.

Marriage

The ultra-rich are a marrying bunch. Only 14 of the Forbes 400 list have never been married. Thirty-one have divorced at least once. But 281 have stayed married to their first spouses. That’s a far higher percentage than it is for the general population.

Cynics attribute that to the high price of divorce.

Johnny Carson once asked Burt Reynolds why Arnold Schwarzenegger was rich and Reynolds was not.

Reynold’s answer? “Number of wives.”

(Jeff Bezos’ recent divorce will likely topple him from the top position in this year’s Forbes 400.)

There are only 39 women on the Forbes 400 list. The highest-ranking one is Alice Walton at No. 11. Generally speaking, ultra-rich women still tend to amass their wealth through marriage, divorce and inheritance.

Age

The ranks of the ultra-rich skew mature.

The oldest 2019 Forbes 400 member is media mogul Sumner Redstone at 97. The youngest is (yet another) Stanford dropout and Snapchat founder Evan Spiegel at 30. The average age is 69.

Geography

The wealthy pay taxes. But they are reluctant to pay more than their fair share.

Out of 2018’s Forbes 400, 28 members had their primary residence in California and 24 resided in New York state.

California’s and New York’s numbers are down from 88 and 43 just five years ago – drops of 68% and 44%, respectively.

As cities and states like New York and California tax-target the wealthy, many of them are pulling up stakes and leaving. Sixteen members of the Forbes 400 now call low-tax states like Texas and Florida home. And their numbers are snowballing.

Rush Limbaugh famously exited New York for Florida and Glenn Beck for Texas. Both are low-tax states. Hollywood stars have fled Los Angeles in favor of places like Wyoming.

Mindset

The Forbes 400 deeply resent the idea that they got wealthy through inheritance or luck.

Nine out of the top 10 of the 2019 Forbes 400 built their fortunes from scratch. Many of the Forbes 400 members share the experience of starting a small business, expanding that business and leveraging their wealth into diversified investments.

As the marketer Dan Kennedy has pointed out, this shared experience gives the wealthy a particular mindset.

First, the ultra-wealthy are very methodical. They view everything through the prism of process. They relish the success stories of other self-made billionaires. They also modestly recognize the role of luck in their success.

Second, their public pronouncements to the contrary, the ultra-wealthy also don’t like taxes. The flood of Forbes 400 members abandoning California and New York for Texas and Florida confirms this.

Third, many ultra-wealthy don’t like inherited wealth. Warren Buffett and Bill Gates have both severely restricted the size of their children’s inheritances. Five of the Forbes 400 top 10 have committed to giving away a majority of their wealth in the tradition of Andrew Carnegie through the “Giving Pledge.”

So, yes, Fitzgerald was right. The rich are different from you and me.

But today’s rich also offer lessons on living a wealthy life that go far beyond just making money.

Good investing,

Nicholas

About Nicholas Vardy

An accomplished investment advisor and widely recognized expert on quantitative investing, global investing and exchange-traded funds, Nicholas has been a regular commentator on CNN International and Fox Business Network. He has also been cited in The Wall Street Journal, Financial Times, Newsweek, Fox Business News, CBS, MarketWatch, Yahoo Finance and MSN Money Central. Nicholas holds a bachelor’s and a master’s from Stanford University and a J.D. from Harvard Law School. It’s no wonder his groundbreaking content is published regularly in the free daily e-letter Liberty Through Wealth.

https://investmentu.com/inside-the-minds-of-the-ultra-wealthy/

10. 7 Ways to Own Your Personal Power

By Tami Bonnell | July 7, 2020 | 0

Sponsored by EXIT Realty

During this time of business as unusual, I can’t think of a better opportunity to work on yourself. Author and motivational speaker Jim Rohn famously advised, “Work harder on yourself than you do on your job.” Owning your personal power is a way to affect positive change in your own life and broaden your circle of influence.

1. Be authentic.

People value transparency and authenticity as a doorway to connection, but you can’t be authentic unless you first know who you are. I believe this so strongly that I have a tattoo that reads, “Be true to yourself and you will be able to lead others.” People want to connect with and learn from like-minded individuals, so your best way to influence them is by being your true, authentic self.

We were all born with specific gifts, and by making the most of these gifts, we can positively impact our own life as well as the lives of those we touch. But we tend to get in our own way. The words, habits and attitudes from our upbringing can continue to impact how we think about ourselves and what we focus on even today.

One of the best exercises to help you get out of your own way is to write a list of your pros and cons. What are things that you really love about yourself and your life? Few people find it easy to say they love themselves or to find positive attributes to list, but the greater your capacity to love yourself and what you represent, the easier it is to love others. What work, activities or hobbies are you doing when you’re in the zone? On the con side, write down the things about yourself that, if you could wave a magic wand, you’d change.

2. Ask effective questions.

With your list in hand, start asking yourself open-ended, effective questions:

- Why is this important to me?

- What price am I willing to pay to change this?

- Who could be my mentor?

- What skills could I learn?

- Which books could I read? Podcasts could I listen to?

- Who could I add to my circle?

- What behavior could I change to continue to grow?

Write down the questions and then let your subconscious mind get busy delivering the answers. Time is our most valuable resource, yet we spend 20% of it on the activities that produce 80% of our results. No one is good at everything, but we all have something—or things—that comprise our natural skill set. Concentrate on doing more of that. If you really want to own your personal power and grow as an individual, amplify the 20% and delegate everything else.

3. Establish specific a.m. and p.m. routines.

How you begin and end your day matters. Some of the world’s most successful and influential people rise early and spend time alone on specific activities to prime their day. One collection of activities—in fact, the one I practice—is described in Hal Elrod’s book The Miracle Morning as silence, affirmations, visualization, exercise, reading and scribing (writing). The acronym spells SAVERS. Spending even 10 minutes on each of these activities first thing in the morning puts you in control of your entire day.

Whether I start my day at home or in a hotel room, I close my eyes and visualize for 120 seconds how I want my day to unfold, how I want people to feel, and what I want the end result to be. More often than not, my day evolves the way I visualized because I already lived it in my mind.

At the end of the day, I close my eyes and ask myself what worked. It could have been the right tagline in an email, or perhaps I was there for someone at exactly the right time. Regardless of what it is, I write it down.

I keep a legal pad beside my bed, and before I go to sleep, I write down what I’m concerned about and a few effective questions. I likely can’t do anything about my concerns between midnight and 5 a.m. anyway, and by writing them down, my mind is freed up to sleep restfully. Effective questions might include, what did I learn today? Who did I help? How did I take my company further? What am I grateful for? This practice sets the stage for my productive tomorrow.

4. Income = value.

Regardless of your job, your income is directly related to the value you provide. So, what are you doing to add value to the person in front of you? Do your homework. Google them, friend them on Facebook, connect with them on LinkedIn. Discover what’s going on in their world so you can make an authentic and sincere connection. Don’t only worry about nailing the presentation or making the sale. The more you build a relationship that adds value, the more they will trust you. Without question, this is the experience economy, so personalizing your service is key.

5. Invest in people.

Every time you have an opportunity to invest in someone by teaching them, offering advice or catching them doing something good, you’ll see the benefit paid back to you—directly or indirectly—many times over.

I believe too often we complete a job for someone else because we think we’re being helpful, or it’s easier to do it ourselves than it is to teach the other person. But doing so won’t help them to grow. True leaders build other leaders. So, my best advice for empowering both yourself and others is to learn it, do it, teach it. If you learn it, you’re going to absorb it, but you may not retain it. Once you do it, you learn best practices through experience. But when you teach it, you cement the knowledge into your brain and you’re empowering someone else.

6. Measure your impact.

How will you know your efforts are paying off? What does your owning your personal power translate to in black and white? Measure your impact on everyone you’re touching. Is your yardstick increased sales? A greater audience? The measurable success of the people you’re influencing? Ask for constructive feedback on a regular basis so you can improve. Aim for unconscious competency.

7. Never stop growing.

If we want people to follow us, we must continue to grow as human beings. If we really want to attract more success and better experiences, then we must be someone who attracts the right people into our lives. That won’t happen unless we’re constantly growing as individuals.

Magic happens when you know you nailed your day, moment after moment. You were in the flow and all the right people did all the right things, including you. You owned it, start to finish. But you also have to own your day when you make a mistake. Those days present some of the best opportunities for personal growth. People respect and empathize with others who are truthful and forthright when something goes wrong. Own it instantly, correct it, make amends, and move on.

Owning your personal power is at the core of everything you want to accomplish in life: dreams fulfilled, goals achieved, successful relationships and influence on others. Put as much time and attention into working on yourself as you do your career, and your investment will pay off exponentially.

https://www.success.com/7-ways-to-own-your-personal-power/

Disclaimer

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publically available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only