First the important stuff…Who the Hell is Dead and Who is Alive in Thrones?

1.Earnings Update…Key to Maintaining the Bull.

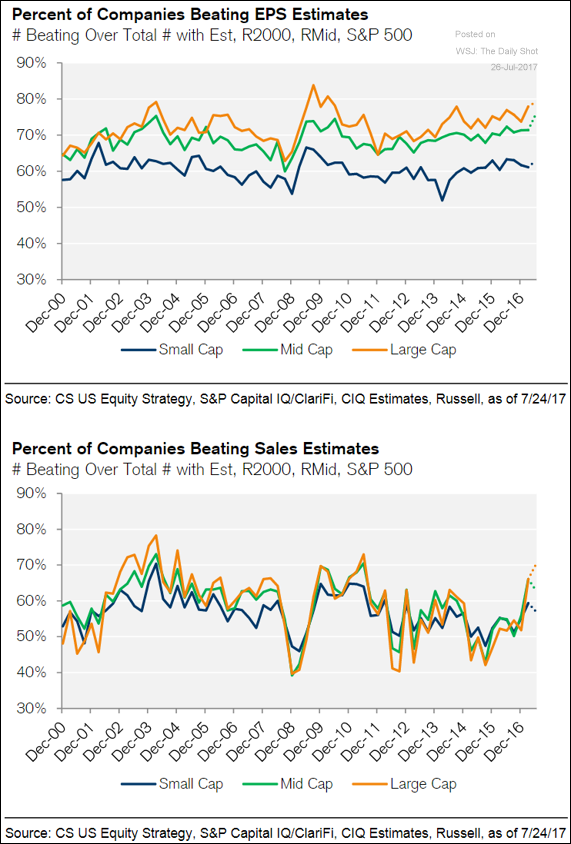

Equity Markets: The charts below show the percentage of companies beating earnings and sales estimates, broken out by company size.

Source: Credit Suisse

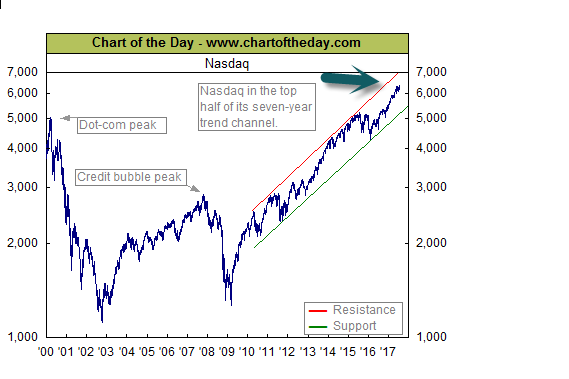

2.Nasdaq Bubble?? Not Near Resistance Yet.

Today, the Nasdaq closed at another all-time record high. For some perspective on the tech-laden Nasdaq Composite, today’s chart presents the overall trend of the Nasdaq since 2000. As today’s chart illustrates, the Nasdaq’s seven-year post-financial crisis rally is still very much intact. In fact, even with today’s record high, the Nasdaq is not trading near resistance.

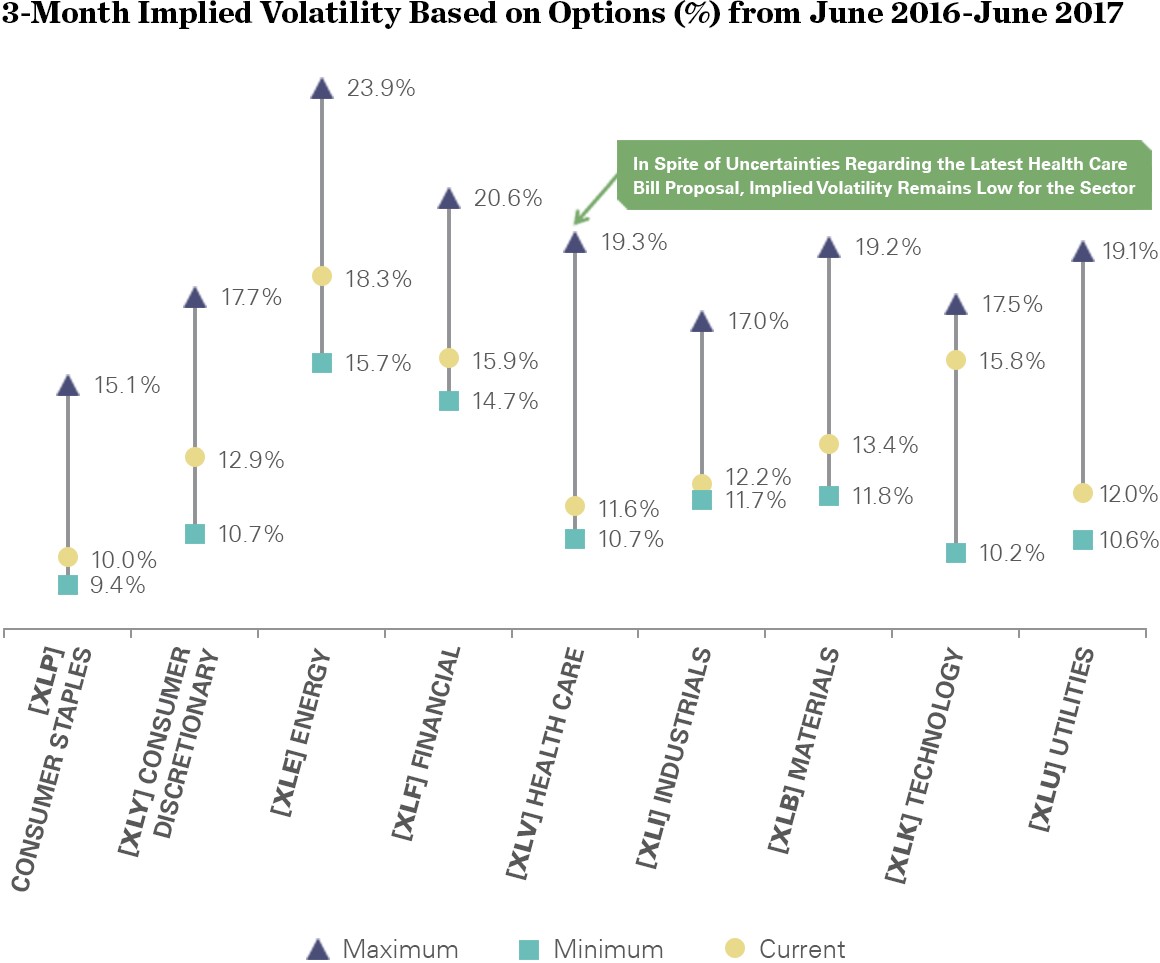

3.Sector Implied Volatility

Sector implied volatility shows health care is cooler than a polar bear

As markets become more susceptible to impending risks, expectations of volatility implied in options on ETFs can help investors zero in on the catalysts most likely to impact their portfolios. In the chart below, we have plotted the range of 3-month implied volatility over the last twelve months for sectors.

Source: State Street Global Advisors, Bloomberg Finance L.P., as of 6/30/2017

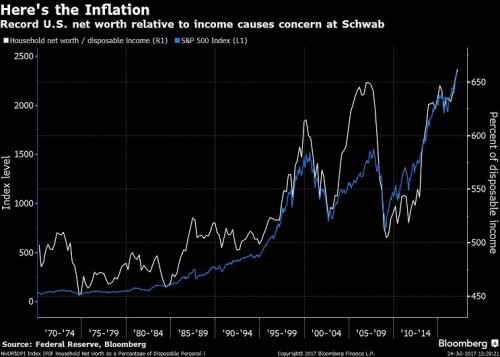

4.This is a New Chart for Me…Interesting but I will do more work on it.

Inflation in U.S. Asset Values Causes Concern at Schwab

Inflation in the value of U.S. assets is at “concerning levels,” strategists at Charles Schwab Corp. wrote Friday in a blog posting. They cited data compiled by the Federal Reserve on households’ net worth relative to their disposable income, which rose to a record 662 percent in the first quarter. The chart displays the S&P 500 Index for comparison.

#CHART OF THE DAY #INFLATION #NET WORTH #ASSETS #FINANCIAL ASSETS #ASSET VALUES #STOCKS #S&P 500 #STRATEGY #INVESTING

Home , About the charts , Archive

http://theonedave.tumblr.com/post/163373337612/inflation-in-us-asset-values-causes-concern-at

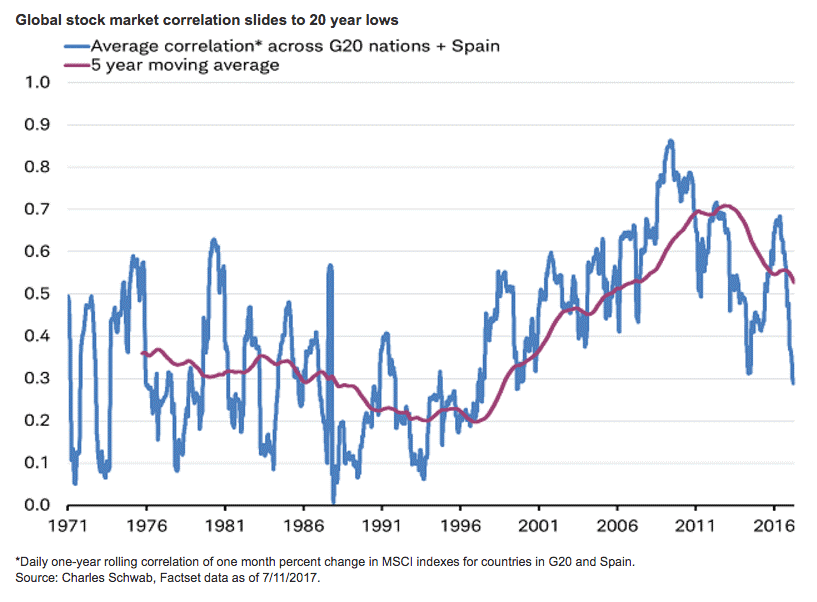

5.Global Stock Market Correlations Have Fallen to 20 Year Low.

Chart o’ the Day: Global Stock Correlations Plunge

Posted July 25, 2017 by Joshua M Brown

If you manage a globally diversified portfolio, you want stocks around the world to maintain some degree of non-correlation. Even if that means you’re seeing drawdowns in part of your portfolio.

This is, of course, counterintuitive, as on television it seems as though everyone is trying to maximize every dollar they have into only stocks that are trading higher every day. That’s obviously a fantasy.

The reality is that falling correlations are the whole point of diversification and without having some assets within a portfolio getting cheaper while others rise, there’s no benefit to rebalancing and the whole thing doesn’t work.

Jeff Kleintop at Schwab looks at falling correlations between country markets in the G20 and sees reasons for optimism in terms of this sort of approach.

Fortunately for investors, diversification has made a comeback. Measured statistically, the correlation between stock markets of the Group of 20 nations (plus Spain, which is a quasi-member), that together make up 80% of world GDP, peaked in 2011 and has subsequently fallen in recent years to levels not seen since 1997, a time before the tech bubble had fully inflated.

This decline in correlation has taken place despite broad economic growth in these economies and in the trade among them. On the chart below, it almost appears to be a return to “normal” for correlation as it moves back to the average level that prevailed for more than 25 years through the 1970s, 1980s, and for much of the 1990s prior to the bubbles in tech and housing.

And his chart:

Josh here – having cheap assets and highly appreciated assets to choose between is a gift. It’s how the game can be won. This is also a rebuke to the whole “CENTRAL BANKS ARE INFLATING EVERYTHING ALL AT ONCE” tribe. Here is yet another reason for them to be wrong and lose money.

Source:

From Josh Brown’s Blog

http://thereformedbroker.com/2017/07/25/chart-o-the-day-global-stock-correlations-plunge/

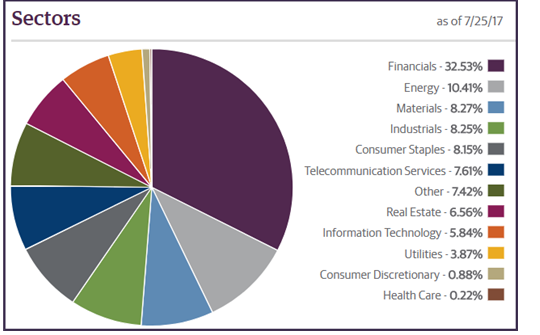

6.International Markets Outperforming Across Board 2017….Frontier Markets.

Frontier Market ETF +23% vs. S&P +10.69%

Frontier Markets Still Nowhere Near Previous Highs…Amazingly, they had run to 2007 highs in 2011 before another 50% correction

Heavy in Financials.

7.Dollar Approaching 2016 Lows.

Dollar at 2016 lows and on 200day moving average.

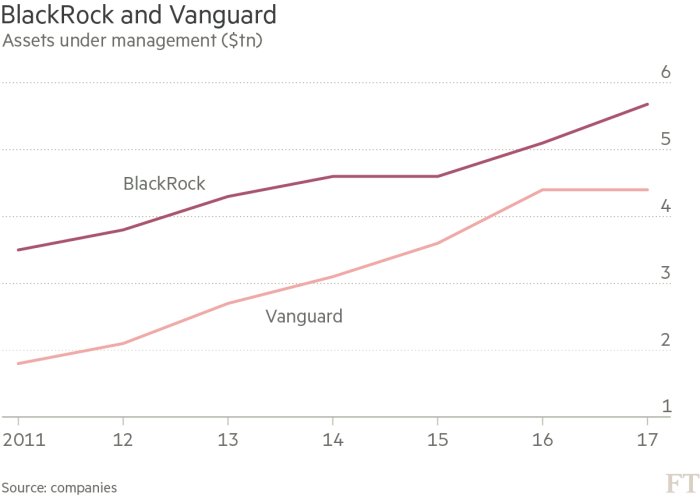

8.How Long can the Two Horse Race Last?

From Abnormal Returns Blog

https://abnormalreturns.com/2017/07/24/etf-links-the-horse-race/

9.Read of the Day….I Never Miss Howard Marks Qt. Letters, Always Learn Something New.

Today’s Investment Environment

Because I don’t intend this to be a “macro memo,” incorporating a thorough review of the economic and market environment, I’ll merely reference what I think are the four most noteworthy components of current conditions:

- The uncertainties are unusual in terms of number, scale and insolubilityin areas including secular economic growth; the impact of central banks; interest rates and inflation; political dysfunction; geopolitical trouble spots; and the long-term impact of technology.

- In the vast majority of asset classes, prospective returns are just about the lowest they’ve ever been.

- Asset prices are high across the board. Almost nothing can be bought below its intrinsic value, and there are few bargains. In general the best we can do is look for things that are less over-priced than others.

- Pro-risk behavior is commonplace, as the majority of investors embrace increased risk as the route to the returns they want or need.

The checklist for market sanity and safety is simple, and the answers will tell you what to do:

- Are prospective returns adequate?

- Are investors appropriately risk-averse?

- Are they applying skepticism and discipline?

- Are they demanding sufficient risk premiums?

- Are valuations reasonable relative to historic standards?

- Are deal structures fair to investors?

- Are investors declining any of the new deals?

- Are there limits on faith in the future?

The basic proposition is simple: Investors make the most and the safest money when they do things other people don’t want to do. But when investors are unworried and glad to make risky investments (or worried but investing anyway, because the low-risk alternatives are unappealing), asset prices will be high, risk premiums will be low, and markets will be risky. That’s what happens when there’s too much money and too little fear.

Print long version for weekend read

http://www.valuewalk.com/2017/07/latest-memo-howard-marks-go/?all=1

10.Attracting and Retaining the Talent of Tomorrow

FollowingUnfollowWilliam Crager

President at Envestnet

As time marches on, new generations push the envelope and change the status quo. Gen X introduced their parents to grunge music, and millennials have shown how a single generation can revolutionize the way we share our daily lives (hello, Instagram and Snapchat). It only makes sense that the financial services industry would be ripe for change at the hands of this younger generation, too.

In 2015, nearly 60 percent of millennials thought big banks weren’t designed to serve their generation[1]. The financial services industry needs to continually adapt to meet the changing needs of each generation. Millennials are not only future clients, but also prospective employees. Our ability to attract young innovators to the workforce will be crucial to the continued success of the wealth management industry. As seasoned leaders in the field, it’s important for us to think strategically about whom we are hiring, what qualities we are looking for and how we enable these young minds to innovate in our industry.

I recently spoke with Wealth Management Today about what I look for in potential hires at Envestnet. I was an English major in college, and before starting the company; I had no academic background in finance. We’ve reached the point where we’re looking beyond resumes from folks with business and finance degrees. We’re looking for individuals who are willing to take risks, are creative and have the potential to ride the wave of disruption and change in the wealth management space.

When I’m speaking to college students, I often emphasize that their age and generation is all about potential. It’s not always about taking a job that’s the “right” or “safe” choice – rather, it’s about finding a company that’s doing innovative, meaningful work. Corporate culture is critical in attracting and retaining smart talent, and I believe that empowering employees to take risks and learn from their mistakes in a meaningful way can help drive companies forward.

Look no further than “Zenvestr” for a glimpse into how millennials will impact the future of the wealth management industry. As I told InvestmentNews last month,“Zenvestr” is a concept developed by a group of former Envestnet interns that aimed to make investors less stressed about their finances, tapping into the physiological impact and anxiety that finances can cause millennials. Through their creativity, the team designed an approach that catered well to the needs of a younger demographic.

There is a huge population of young people that are beginning to think about investing and it’s imperative that advisors are mindful of this next generation’s unique wants and needs. By attracting young people and creative minds to our industry, we’ll be able to better develop services to meet the needs of this generation.

By attracting young people and creative minds to our industry, we’ll be able to better develop services to meet the needs of this generation.

As you might expect, technology is playing, and will continue to play, a huge role in millennials’ investing experiences. In fact, according to a recent survey[2], two in five Americans make and manage their investments through an online or mobile service, and 13 percent of Americans and 22 percent of millennials are currently using a robo advisor or would consider using one in the next year.

The same survey found that many Americans expect investing to continue changing significantly over the next decade[3]. As leaders in financial technology, I believe it’s our duty to bring in the talent that will drive this change, and one of the core reasons we developed the Envestnet Institute on Campus program. It connects college students with mentors and training in the investment management industry to foster the future of our field. Through programs like this, we are able to cultivate our business’ culture to make room for young, creative minds to innovate and grow the industry to better serve the needs of generations to come.

Envestnet, Inc. (NYSE: ENV) is a leading provider of intelligent systems for wealth management and financial wellness. Envestnet’s unified technology enhances advisor productivity and strengthens the wealth management process. Envestnet empowers enterprises and advisors to more fully understand their clients and deliver better outcomes.

The opinions expressed herein reflect our judgment as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities, or investment advice or a recommended course of action in any given situation. Investment decisions should always be made based on the investor’s specific financial needs and objectives, goals, time horizon, and risk tolerance. Information obtained from third party resources are believed to be reliable but not guaranteed. This paper may contain ‘forward- looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader

[1] Infographic: Why Millennials Are Losing Interest in Banks, Marty Swant, AdWeek. October 20, 2015.

[2] Merrill Edge Report. Spring 2016.

[3] Merrill Edge Report. Spring 2016.