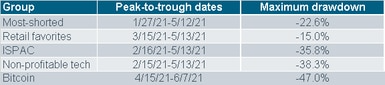

1. Hot Areas of the Market Already Corrected 20-50%

Market’s “Hot Pockets” Take Some Hits

Source: Charles Schwab, Bloomberg, as of 6/11/2021. Data indexed to 100 (base value = 12/31/2020). Goldman Sachs (GS) most-shorted basket contains the 50 highest short interest names in the Russell 3000; names have a market cap greater than $1 billion. GS retail favorites basket consists of U.S. listed equities that are popularly traded on retail brokerage platforms. GS non-profitable tech basket consists of non-profitable U.S.-listed companies in innovative industries. Technology is defined quite broadly to include new economy companies across GICS industry groupings. ISPAC Index is a passive rules-based index that tracks the performance of the newly listed Special Purpose Acquisitions Corporations (“SPACs”) ex- warrant and initial public offerings derived from SPACs since August 1, 2017. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance does not guarantee future results.

Liz Ann Sonders Schwab https://www.schwab.com/resource-center/insights/content/turn-turn-turn-rotations-persist

2. Dollar Rallied After FED Meeting ….Silver and Gold Sell Off.

SLV—Silver ETF –One Year Sideways Channel.

GLD-Gold ETF…One Year Sideways channel.

3. Bank Stocks Rally into Leadership Over Tech Under Pressure.

Banks vs. Tech Trade Huge Reversal –One Month…Tech +6.2% vs. Banks -10%

4.See Sector Rotation in Number of Stocks Trading Above 50 Day Moving Average.

Bespoke Investment Group Blog –Big Drops In The Percent of Stocks Above Their 50-DMAs In yesterday’s Sector Snapshot, we highlighted how the internals of several sectors have weakened dramatically in recent days. One such measure in which there are drastic differences versus a couple of weeks ago is the reading on the percentage of stocks above their 50-DMAs. In the charts below, we show the changes in this reading across sectors and for the broader S&P 500.

As shown, the two sectors which have seen the largest share of their stocks fall below the support of their 50-DMAs are Financials and Materials. Two weeks ago, both of these sectors boasted some of the strongest readings of all sectors, but through yesterday, those readings have fallen over 60 percentage points. Meanwhile, Energy and Real Estate have seen almost all of their stocks trade above their 50-DMAs over the past two weeks without much change. While the declines were not as dramatic as Materials and Financials, Industrials and Consumer Staples have also seen a significant share of their members fall below their 50-DMAs. While most sectors have seen a decline in this reading, Tech and Health Care have been notable standouts with both sectors having more stocks above their 50-DMAs now than two weeks ago. This is indicative of the rotation that has been going on underneath the surface throughout the entire bull market that began when the S&P made its 2020 low after the COVID Crash last March. Click here to view Bespoke’s premium membership options.

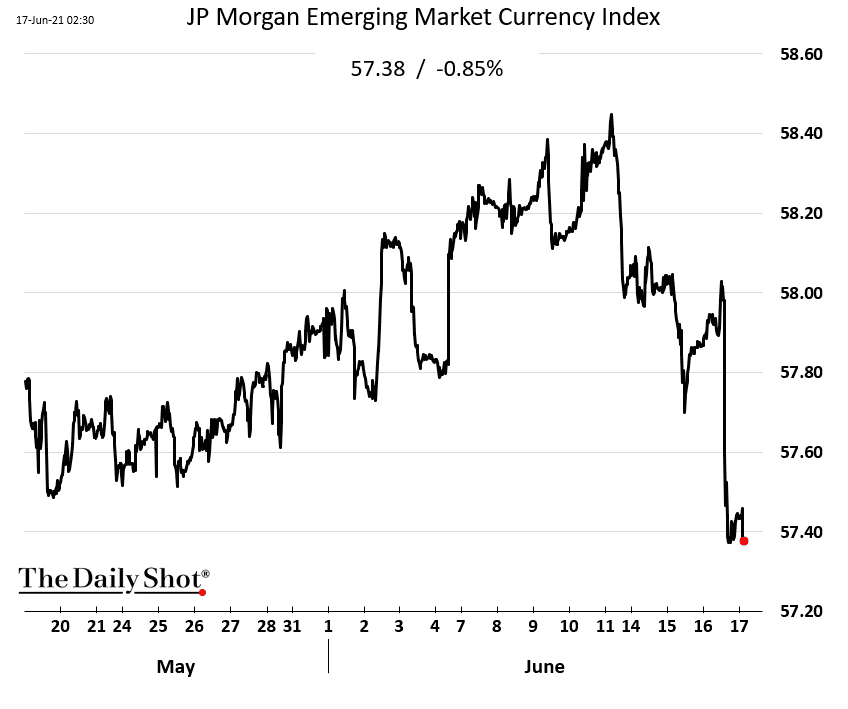

5. Emerging Markets: EM currencies took a hit in response to the FOMC’s hawkish shift.

Source: Daily Shot https://dailyshotbrief.com/the-daily-shot-brief-june-17th-2021/

Source: Daily Shot https://dailyshotbrief.com/the-daily-shot-brief-june-17th-2021/

6. Software is Eating the Car

Software Is Eating the Car

Hundreds of millions of new lines of code for self-driving and electric vehicles I was in the midst of a deep dive into the…

https://ritholtz.com/2021/06/software-is-eating-the-car/

7. Getting away with murder-In America, killers are nearly as likely to go free as to be caught-

TONI STEVENSON had just arrived at her home in St Louis when two masked men with assault rifles ran up, shot her and fled. Just 15 years old, she died at the scene. Four years have gone by, and her murderers have not yet been apprehended.

Daily chart

Daily chart

https://www.economist.com/graphic-detail/2021/06/11/getting-away-with-murder

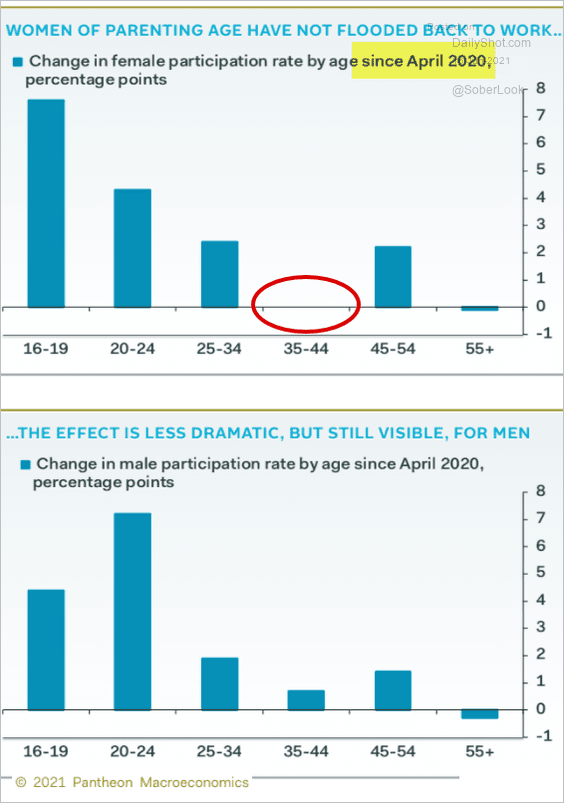

8. Women of Parenting Age Not Flooding Back to Work.

Food for Thought: Changes in US labor force participation by age:

Source: Pantheon Macroeconomics

9. The mRNA vaccine revolution is just beginning

Wired–mRNA brought us a Covid-19 vaccine in record speed. Next it could tackle flu, malaria or HIV

Katalin Karikó, a Hungarian biochemist, started working with mRNA as early as 1989PLATON

NO ONE EXPECTED the first Covid-19 vaccine to be as good as it was. “We were hoping for around 70 per cent, that’s a success,” says Dr Ann Falsey, a professor of medicine at the University of Rochester, New York, who ran a 150-person trial site for the Pfizer-BioNTech vaccine in 2020.

Even Uğur Şahin, the co-founder and CEO of BioNTech, who had shepherded the drug from its earliest stages, had some doubts. All the preliminary laboratory tests looked good; since he saw them in June, he would routinely tell people that “immunologically, this is a near-perfect vaccine.” But that doesn’t always mean it will work against “the beast, the thing out there” in the real world. It wasn’t until November 9, 2020, three months into the final clinical trial, that he finally got the good news. “More than 90 per cent effective,” he says. “I knew this was a game changer. We have a vaccine.”

“We were overjoyed,” Falsey says. “It seemed too good to be true. No respiratory vaccine has ever had that kind of efficacy.”

The arrival of a vaccine before the close of the year was an unexpected turn of events. Early in the pandemic, the conventional wisdom was that, even with all the stops pulled, a vaccine would take at least a year and a half to develop. Talking heads often referenced that the previous fastest-ever vaccine developed, for mumps back in 1967, took four years. Modern vaccines often stretch out past a decade of development. BioNTech – and US-based Moderna, which announced similar results later the same week – shattered that conventional timeline.

Neither company was a household name before the pandemic. In fact, neither had ever had a single drug approved before. But both had long believed that their mRNA technology, which uses simple genetic instructions as a payload, could outpace traditional vaccines, which rely on the often-painstaking assembly of living viruses or their isolated parts. mRNA turned out to be a vanishingly rare thing in the world of science and medicine: a promising and potentially transformative technology that not only survived its first big test, but delivered beyond most people’s wildest expectations.

But its next step could be even bigger. The scope of mRNA vaccines always went beyond any one disease. Like moving from a vacuum tube to a microchip, the technology promises to perform the same task as traditional vaccines, but exponentially faster, and for a fraction of the cost. “You can have an idea in the morning, and a vaccine prototype by evening. The speed is amazing,” says Daniel Anderson, an mRNA therapy researcher at MIT. Before the pandemic, charities including the Bill & Melinda Gates Foundation and the Coalition for Epidemic Preparedness Innovations (CEPI) hoped to turn mRNA on deadly diseases that the pharmaceutical industry has largely ignored, such as dengue or Lassa fever, while industry saw a chance to speed up the quest for long-held scientific dreams: an improved flu shot, or the first effective HIV vaccine.

Amesh Adalja, an expert on emerging diseases at the Johns Hopkins Center for Health Security, in Maryland, says mRNA could “make all these applications we were hoping for, pushing for, become part of everyday life.”

“When they write the history of vaccines, this will probably be a turning point,” he adds.

While the world remains focused on the rollout of Covid-19 vaccines, the race for the next generation of mRNA vaccines – targeted at a variety of other diseases – is already exploding. Moderna and BioNTech each have nine candidates in development or early clinical trials. There are at least six mRNA vaccines against flu in the pipeline, and a similar number against HIV. Nipah, Zika, herpes, dengue, hepatitis and malaria have all been announced. The field sometimes resembles the early stage of a gold rush, as pharma giants snap up promising researchers for huge contracts – Sanofi recently paid $425 million (£307m) to partner with a small American mRNA biotech called Translate Bio, while GSK paid $294 million (£212m) to work with Germany’s CureVac.

https://www.wired.co.uk/article/mrna-vaccine-revolution-katalin-kariko

10. More Thought Provoking from Farnam Street

To control the game, one tries to control as much of the board as possible. At the outset, using your pieces to seize the middle of the playing field is a great strategy, because it gives you the widest possible vantage point from which to control the movement of the other pieces. Both Rockefeller and the studio system in Hollywood employed this strategy successfully, allowing them to anticipate change and maneuver effectively for decades.

“Sevens kill companies. When someone has a four, you just know they’re not doing the job, they’re not up for it, and let’s take them out of the system. But the problem with a seven is that you don’t get to that point, because that person will have glimmers of being able to do the job … They’ll have these things that are redeeming. But because they have those things, two things happen. One, there’s an opportunity cost of that seat. When someone that’s a seven is holding the seat, it means you don’t have a nine having that seat. Two is that, and I see this all the time, the execution of a team is often brought down by the weakest link. An entire team can be brought down by that seven.”

Explore Your Curiosity

★ “Permanently divorcing physical location from economic opportunity gives us a real shot at radically expanding the number of good jobs in the world while also dramatically improving quality of life for millions, or billions, of people. We may, at long last, shatter the geographic lottery, opening up opportunity to countless people who weren’t lucky enough to be born in the right place.”

★ “Are you in control of the relationships in your life, or are you ceding that control to others? That standing lunch date, or the conference you’ve attended for years because your pal is involved — when is the last time those interactions either provided value or allowed you to give value? Do you come away energized or drained? If you are not deciding the rules of engagement and making deliberate choices about who you are spending time with, then you need to take back that control.”

Timeless Insight

“Be less curious about people and more curious about ideas.”

— Marie Curie

Tiny Thought

One of the biggest keys to success at anything hard is believing that you can figure it out as you go along. A lot of people won’t start until they figure it out. And because most hard things can’t be figured out in advance, they never start.

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.