1. Two Most Valuable Companies Ever to Choose SPAC IPO—Nikola and DraftKings.

WSJ-Twenty companies have used SPAC transactions to go public so far this year. Two of them, Nikola and DraftKings, are the most valuable companies ever to choose the SPAC route over a traditional IPO, according to Kristi Marvin, founder of SPACInsider.com, a website that tracks the sector. By Alexander Osipovich

Blank-Check Boom Gets Boost From Coronavirus-Volatility prompts companies to go public through SPAC deals rather than traditional IPOs

SPAC FORUM on REDDIT

https://www.reddit.com/r/SPACs/

2. P/E and P/B of Banks vs. Total Market

Banks Trading at Historical Low Discount to Markets

TopDown CHarts

https://www.linkedin.com/company/topdown-charts/

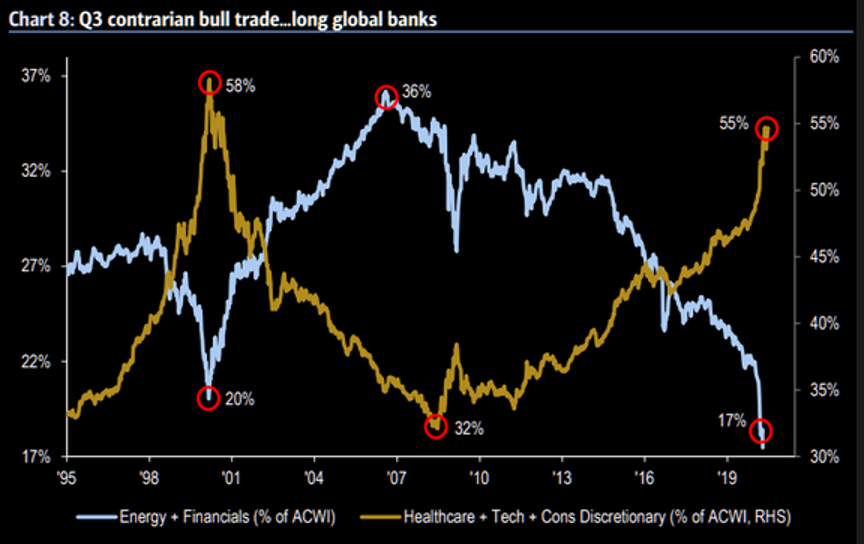

3. Energy and Financials Versus Healthcare, Tech and Consumer

From Dave Lutz at Jones Trading

BofA notes The contrarian trade for Q3 – long global banks?

4. S&P and Nasdaq 2 Std.Deviations Above 200 Week Moving Average.

Again. Reducing Risk As Tech Goes 1999Lance Roberts

Unique, unbiased and contrarian real investment advice

Twice In One Year

It is a bit hard to comprehend that twice, in the same year, I would be writing primarily the same article.

In early January, I penned the following:

“When you sit down with your portfolio management team, and the first comment made is ‘this is nuts,’ it’s probably time to think about your overall portfolio risk. On Friday, that was how the investment committee both started and ended – ‘this is nuts.'”

At that time, I tweeted the following chart, which compared the Nasdaq to the S&P 500 index. The bands on both charts are 2-standard deviations of the 200-WEEK moving average. There are a couple of things which should jump out immediately:

- The near-vertical price acceleration in the markets has been a historical hallmark of late-stage cycle advances, also known as a “melt-up” phase.

- When markets get more than 2-standard deviations above their long-term moving average, reversions to the mean have tended to follow shortly after that.

That was so 6 months ago.

Here is where we are today.

As I warned then, not only has the price of the Nasdaq gone parabolic, this time it is pushing 3-standard deviations of the 200-dma.

https://seekingalpha.com/article/4357982-this-is-nuts-again-reducing-risk-tech-goes-1999

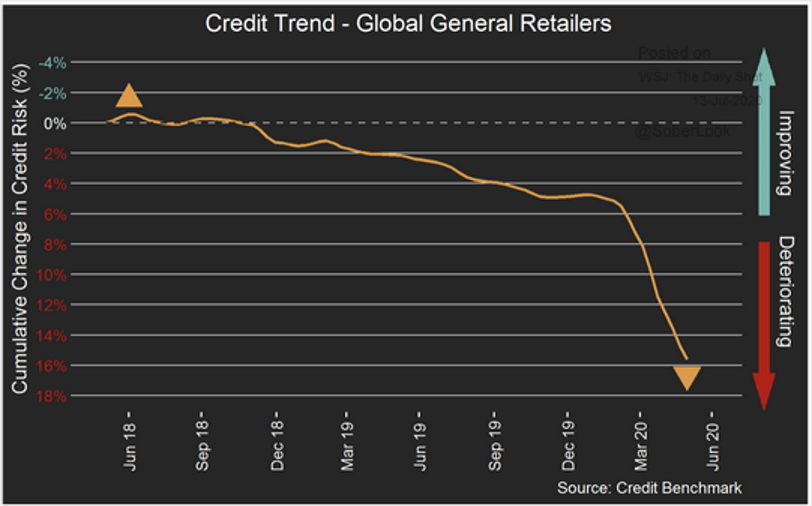

5. Credit quality for global retailers has deteriorated further in 2020.

Source: Credit Benchmark

6. Volatility Nasdaq….VXN-Nasdaq VIX

Sideways for 5 Year along bottom then Spike Corona….Very low volatility in tech.

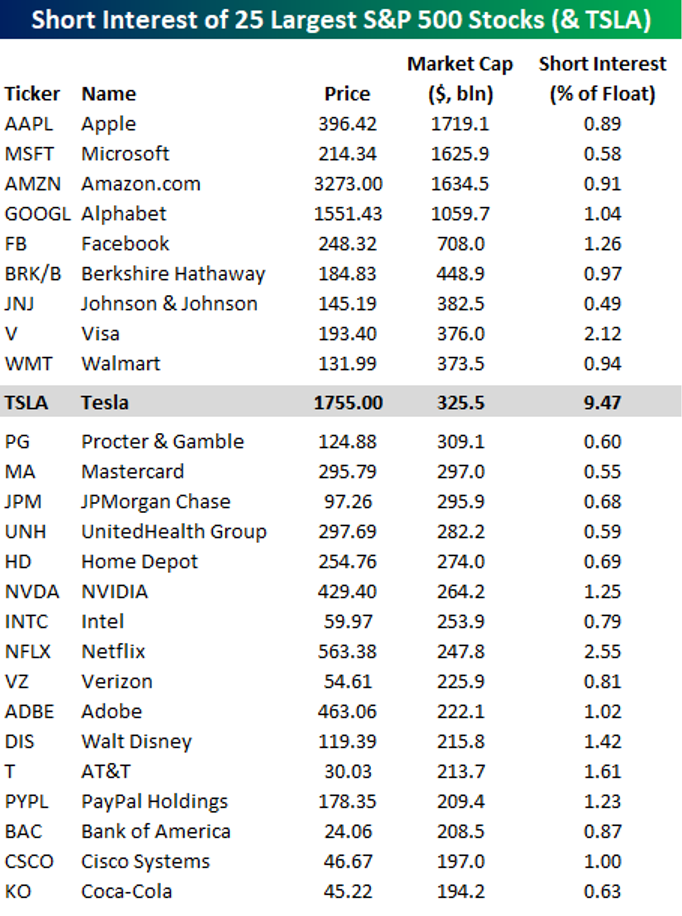

7. Tesla Would Rank as 10th Largest Company in S&P by Market Cap.

Tesla Would Top a Number of S&P 500 Lists If It Was Added to the Index We’ve tweeted a number of times in the last several days noting where Tesla (TSLA) would rank in terms of market capitalization if it were added to the S&P 500. As of Monday morning with the stock up over 10%, TSLA’s $325 billion market cap would rank it as the 10th largest company in the S&P 500. Besides market cap, though, there are also a number of other lists that TSLA would find itself near the top of. For starters, on lists of YTD performance and P/E ratios, you would find TSLA either at or near the top of the list. Another list TSLA would be near the top of is short interest.

The table below lists the 30 stocks in the S&P 500 with the highest levels of short interest as a percentage of float. At TSLA’s current level, it would rank as the 31st highest short interest as a percent of float. Looking through the list, there are a number of troubled companies or those whose businesses have been severely impacted by COVID. For starters, there are a number of cruise lines operators, including Carnival (CCL), Norwegian (NCLH), and Royal Caribbean (RCL). Concert promoter Live Nation (LYV) has also seen its short interest levels soar since COVID with just over 10% of its float sold short. While not quite as high as LYV, with 9.47% of its float sold short, TSLA would find itself just outside the list of S&P 500 stocks with the highest short interest as a percentage of float if it was in the index.

What makes TSLA’s high short interest as a percentage of float notable is that it is accompanied by such a large market cap. Normally stocks with such large market caps don’t have high levels of short interest. There are two reasons for this. First, high levels of short interest are typically due to a problem with the company in question, and therefore the market wouldn’t allow a troubled company’s market cap to get so high in the first place. Second, the amount of capital dedicated to short selling is relatively small, and therefore it’s hard to build up multi-billion dollar short positions in a single stock. Looking at the list above, though, TSLA has been a major exception as its market cap is more than 21 times the market cap of the largest stock listed above (Campbell Soup – CPB) and 38 times the average market cap of the 30 stocks listed.

Looking at this another way, the table below lists the 25 largest stocks in the S&P 500 along with where TSLA would rank if it was in the index. Of the 25 stocks listed, the average short interest as a percentage of float is 1.02% and the highest short interest is Netflix (NFLX) at 2.55%. TSLA’s short interest is nine times greater than the average of the largest 25 stocks and more than 3.7 times the level of Netflix! It’s not often that you see a situation where a company reaches the point where it has one of the largest market capitalizations of any company in the world and gets there with such high levels of skepticism. A lot of investors have made a ton of money on the back of TSLA in the last several weeks, but a lot have been taken to the cleaners too. Like what you see?Click here to view Bespoke’s premium membership options for our best research available.

8. Corona Virus and California Shutdown….Cali is 5th Largest Economy in the World.

California would be the fifth largest economy in the world

If California were its own nation, it would be the fifth largest economy in the world. With a GDP of $2.9 trillion, California would slot between Germany and the United Kingdom in the world’s top economies.

The Golden State makes up 14% of the US economy

Source: Forbes

The two major university systems contribute more than $60 billion to the state’s economy

The University of California system, including UCLA and the University of California, contribute more than $46 billion yearly to the state’s economy. With 1.7 million living alumni, the University of California system has produced 61 noble laureates.

Meanwhile, the California State University system produces $17 billion a year in economic activity and one in every 10 California workers is a graduate, as more than half of alumni stay in the state.

Sources: Cal State University and University of California

16 mind-blowing facts about California’s economy–Pat Evans

9. Amazon is rolling out grocery carts that let shoppers skip checkout lines, bag their groceries and walk out

PUBLISHED TUE, JUL 14 20203:01 AM EDT

KEY POINTS

- -Amazon is launching smart shopping carts at its Woodland Hills, California, grocery store in 2020.

- -Dash Carts are embedded with cameras, sensors and a smart display that automatically track a shopper’s order.

- -Similar to Amazon’s cashierless Go stores, Dash Carts allow shoppers to avoid checkout lines as they exit the store.

-Each cart is equipped with cameras that use computer vision to identify items as they’re placed in bags inside the cart, and a built-in scale to weigh them if necessary. For items like fresh produce, shoppers type in the item’s four-digit code and quantity on the display, which registers the weight and price. The cart is also equipped with a coupon scanner that applies any rebates to the shopper’s order. The carts are designed for small- to mid-sized grocery trips, where shoppers might leave the store with one or two bags of items.

As shoppers add and remove items, a display on the front of the cart adjusts the total price.

When they’re ready to leave, shoppers exit via the store’s Dash Cart lane. The company charges the credit card linked to their Amazon account and emails a copy of the receipt

https://www.cnbc.com/2020/07/14/amazon-rolls-out-shopping-carts-that-eliminate-checkout-lines.html

10. How To Make Meetings Work, Part 1

Early to Rise Blog

How To Make Meetings Work, Part 1

By Mark Morgan Ford | 05/2/2001 | 0 Comments

“I am a great believer, if you have a meeting, in knowing where you want to come out before you start Excuse me if that doesn’t sound very democratic.” – Nelson Rockefeller

There’s an interesting article in the Harvard Business Review (HBR) this month. This one on a problem you have probably encountered time and again in the workplace. It goes something like this.

A meeting is called to discuss a project/problem/opportunity. A presentation is made, and the room falls quiet. Everyone looks around waiting for someone else to open up the discussion. The CEO breaks the silence. He asks a few mildly skeptical questions to show he’s been thinking the subject over and then renders his opinion, either directly or subtly. The rest of the meeting is spent discussing how to implement the CEO’s ideas. It seems as if everyone agrees with him. A plan is established, yet, as the months go by, none or very little of it ever gets done.

Accordingto Ram Charan, a former business professor at Harvard, a consultant to “topexecutives,” and the author of “What the CEO Wants You to Know: How YourCompany Really Works,” the problem is the meeting itself. What looks like general agreement on a specific game plan is, in truth, “silent lies and a lackof closure,” leading to a culture of “indecision” and “false decisions.”

It all begins with dialogue, Charan says. Business leaders who want to make sure that good decisions get made and are then implemented must create a dialogue that has four characteristics:

1. Openness: The outcome should not be predetermined.

2. Candor: There should be a willingness to discuss the unpleasant things, to air the conflicts.

3. Informality: Formal, prepackaged presentations stifle candor.

4. Closure: At the end of the meeting, everyone should know exactly what he is expected to do.

This approach is fundamental to the way Jack Welch runs General Electric. Welch has instituted three “social operating mechanisms” that encourage useful dialogues:

1. The Corporate Executive Council (CEC): The company’s top leaders meet four times a year for 2 1/2 days to share their best business practices, assess the current market, and identify the company’s most promising opportunities.

2.The Session C Meeting: Once a year, Welch and GE’s senior VP meet with the head of each business unit as well as with his top personnel manager to talk about leadership and organizational issues and to identify the best talent.

3. The S-1 Meeting: This is a yearly meeting held about a month after the Session C Meeting. Welch, his chief financial officer, and members of the office of the CEO meet individually with each unit head and his or her team to discuss strategy for the next three years.

4. The S-2 Meeting: This is another once-a-year meeting similar to the S-1 Meeting, but it focuses on a shorter-term horizon (usually 12-24 months).

The whole process is unrelenting in terms of demanding that the divisional leaders involve their managers effectively in the decision-making process, that they create dialogues that are open, candid, and informal, and that they end up with specific action plans.

There is no question in my mind that the executive who runs his meetings this way will achieve more and suffer fewer setbacks than the employer who is all output and no input. That said, it must be acknowledged that quite often in business the senior leader is the senior leader precisely because he has a better understanding of how the business works and a more aggressive attachment to its primary goals.

So while it is easy to embrace the idea of open dialogue, it is much more difficult to make it happen. If you have tried it yourself, you know what I’m talking about. There is too much time wasted listening to comments that are simply uninformed, naïve, narrow-minded, or just plain silly.

Still, you should try. Here are some tips I try to follow:

* Let someone else — the next-most-senior person in the room — state the purpose and objectives of the meeting. This will give you a chance to find out if you are on the same basic track. It may also be a good chance to get a feeling for where everyone is, roughly speaking, on the issue at hand.

* In the beginning, ask only open-ended questions (questions that can’t be answered with a “yes” or “no”).

* When people ask you for your opinion, as they inevitably will if they’ve been trained to follow your lead, turn the question around toward them: “What do YOU think about it?”

* If the meeting has seven people or fewer (as it should), make a mental note of anyone who hasn’t said anything. After others have chimed in, ask his opinion.

* If you can’t engineer a sensible plan of action from the group, put one together yourself. But talk about it as if it had come from them. (In fact, much of it should have come from them.)

* Ask the next-most-senior person to create — on the spot — a written action plan with specific deadlines and identified responsible executives.

[Ed. Note. Mark Morgan Ford was the creator of Early To Rise. In 2011, Mark retired from ETR and now writes the Palm Beach Letter. His advice, in our opinion, continues to get better and better with every essay, particularly in the controversial ones we have shared today. We encourage you to read everything you can that has been written by Mark.]

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publically available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only