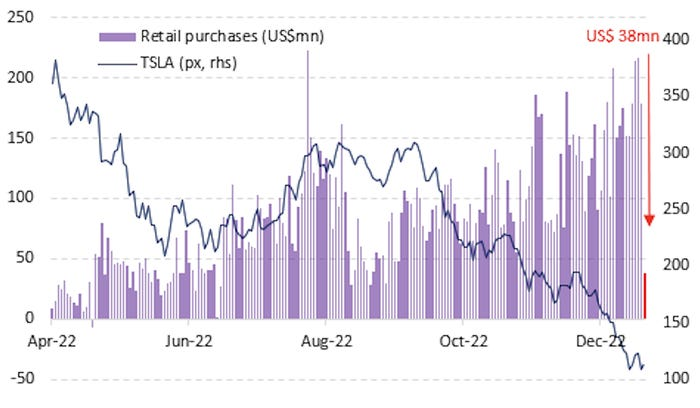

1. Retail Traders Giving Up on Tesla

Business Insider Carla Mozée -While Tesla’s stock price was under pressure last year, retail investors loaded up on the shares. Vanda’s research showed cumulative net retail purchases soared by more than 420% to $15.41 billion, edging out Apple as the most-purchased single stock by individual investors in 2022. Retail flows on Wednesday ended at $37.8 million but were “significantly weak” even as the EV maker’s stock found a respite from recent losses and surged by 5.1%.

2. Classic Run on Bank at Crypto Lender Silvergate

Silvergate Crypto Bank-Classic Run on Bank Wolf Street Losses and write-downs to wipe out much of its equity capital.

Silvergate reported a loss of $718 million on the sale of securities in Q4, a huge loss for a tiny bank like this.

It said it will incur more losses on the sale of securities. And it may have to mark to market the securities it doesn’t sell, for a loss possibly as high as another $300 million. It will book an impairment charge in Q4 to reflect some or all of this.

It took a $196 million loss in Q4 to write off the crypto technology it had bought from Facebook back when Facebook skuttled its own efforts to build the Diem stablecoin.

And it disclosed other write-offs and charges today that we’ll get to in a moment.

So, let’s see… Silvergate started out Q4 with $1.33 billion in equity capital:

- Minus $718 million due to the loss on the sale of securities;

- Minus a portion or all of $300 million on the loss from securities that it will sell, or that it may have to mark to market;

- Minus $196 million on the write-off of the crypto technology it bought from Facebook;

- Minus the other losses and write-downs we’ll get to in a moment.

Combined, this could wipe out much of Silvergate’s $1.33 billion in equity capital.

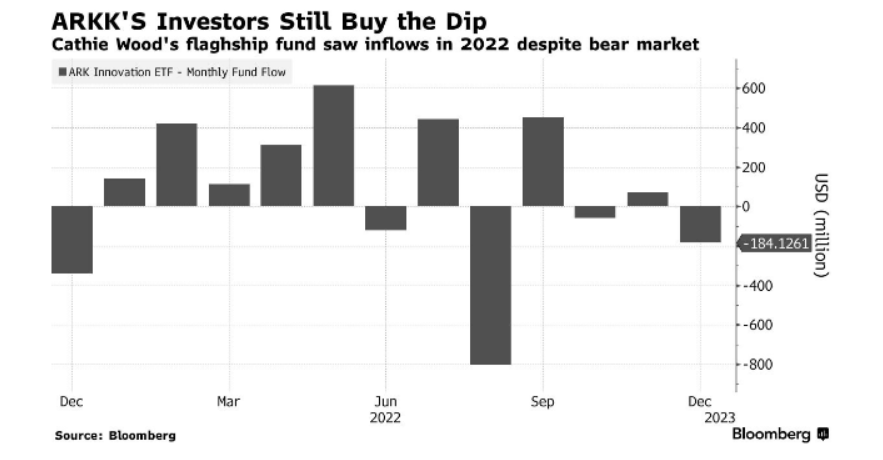

3. Cathie Wood ARKK Net Fund Inflows 2022

Found at Irrelevant Investor Blog

https://theirrelevantinvestor.com/2023/01/04/animal-spirits-10-predictions-for-2023/

4. Tech Stock Insider Buying Falling Off a Cliff

Sentiment Trader

https://cressetcapital.com/post/recap-2022-outlook-2023/

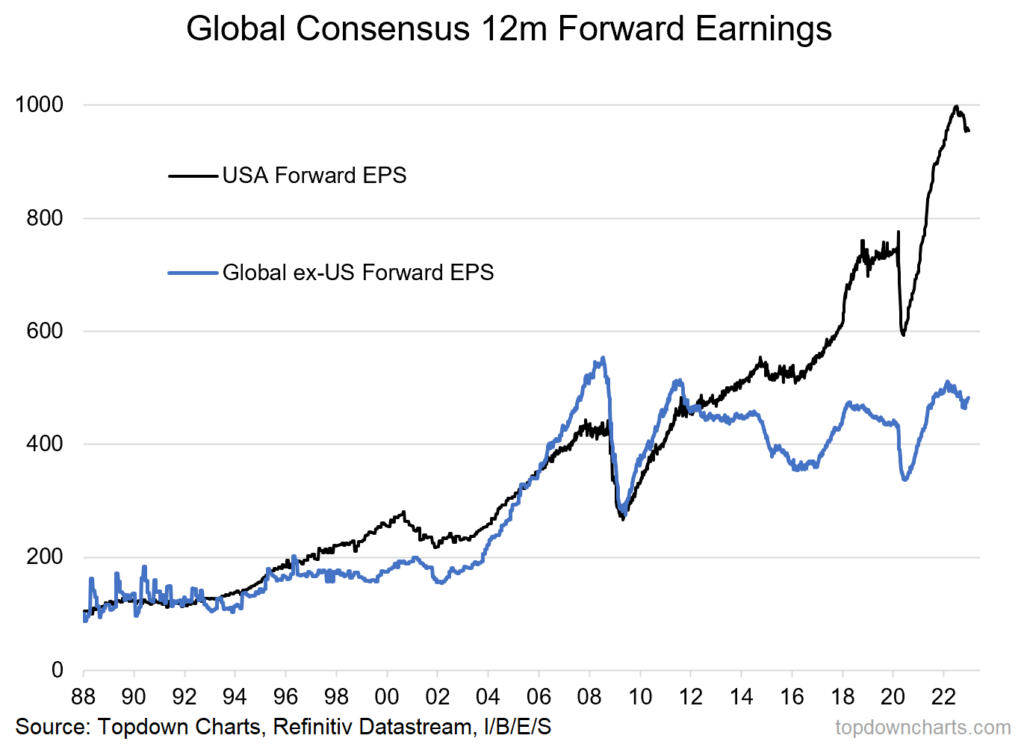

5-6. Two Charts from Callum Thomas on Earnings

Callum Thomas Chart Storm Peak Earnings: After a roaring rebound post-covid (thanks to reopening, massive fiscal + monetary stimulus, and an element of inflation pushing up earnings in nominal terms), the peak has now been seen. Compared to the experience of global equities ex-US the surge in US earnings does have an air of unsustainability to it — and perhaps between the two, US has the most to lose…

Source: Topdown Charts @TopdownCharts

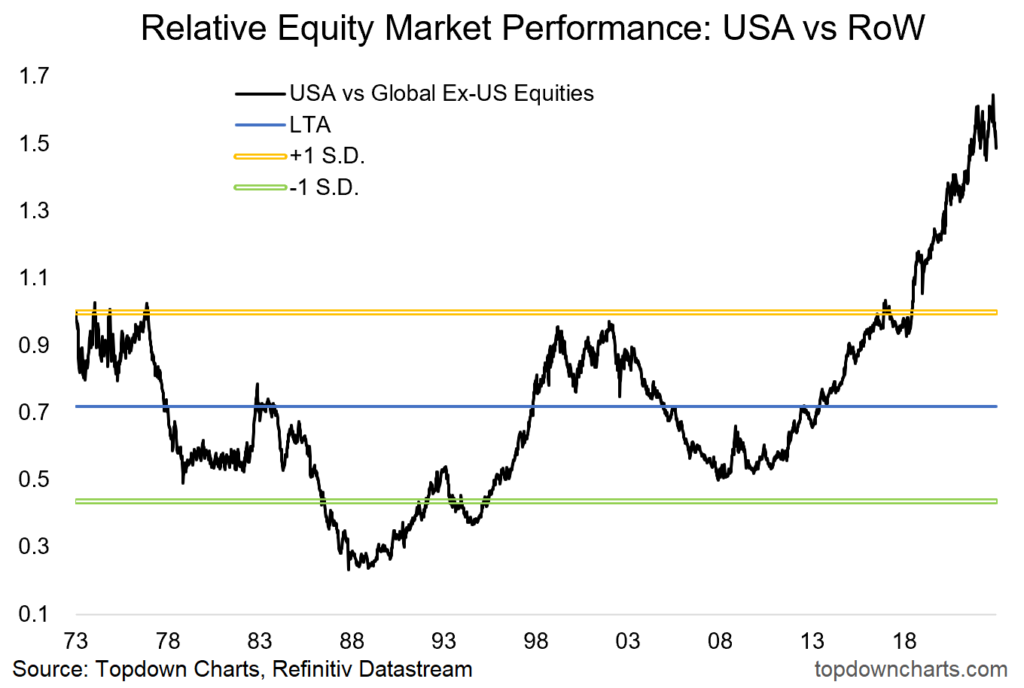

US vs Global Equities – Price: The big surge and breakaway of the USA vs rest of world ~earnings~ in that previous chart has been a key driver of the big surge in US vs global relative *price* performance (whodathunkit).

Interestingly though this trade ran into firm resistance this year…

Source: Topdown Charts@TopdownCharts

https://chartstorm.substack.com/p/weekly-s-and-p500-chartstorm-1-january

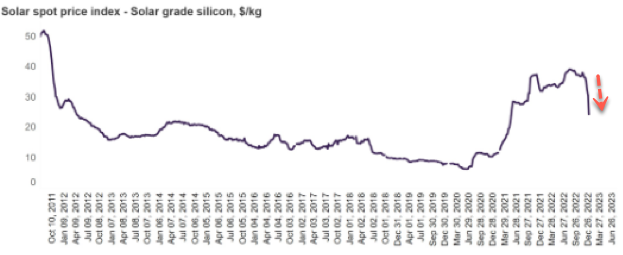

7. Solar Panel Material Price Plunges Amid Glut

BY TYLER DURDEN-ZEROHEDGE

The price of critical material for solar panels plunged this week as supply has caught up with demand, according to BloombergNEF.

The average cost of the highest grade of polysilicon slid another 20% this week due to oversupplied conditions. This also led to a 1% drop in solar panel prices to the lowest nominal value since May 2021.

According to the China Silicon Industry Association, polysilicon produced in China increased to 96,700 metric tons in December 2022, 7.5% more than in the previous month. New polysilicon manufacturing capacity in China boosted domestic production in 2022 by 66%.

BNEF analysis shows polysilicon prices are in freefall. Now at $24 per kilogram.

https://www.zerohedge.com/commodities/solar-panel-material-price-plunges-amid-glut

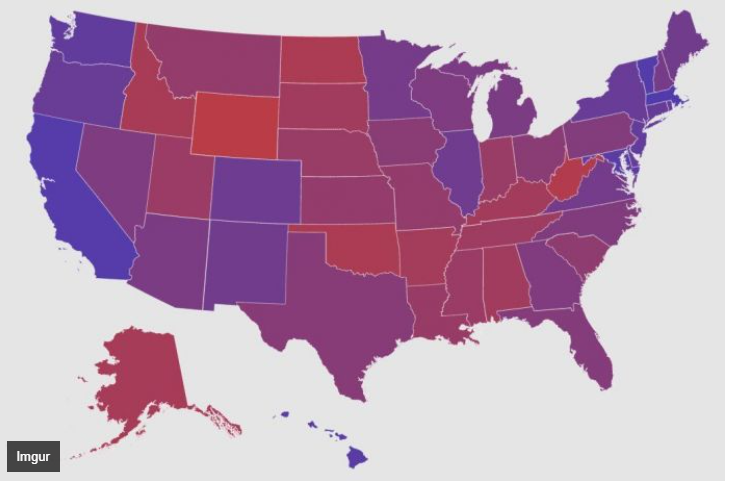

8. THERE ARE “BLUE STATES” AND “RED STATES” BUT MOST STATES ARE ACTUALLY A SHADE OF PURPLE

Daily Time Waste Blog Based on the way the majority votes, most stated get labeled as either “blue” or “red.” We usually think this way because there is only one winner, and there is usually a significant enough majority to recognize election patterns. However, if we could represent the states in shades of purple, this is what the map would look like.

9. Ten States with the Most and Least Net Domestic Migration

WSJ By The Editorial Board

10. How the World’s Best Leaders Use the ‘Ripcord Rule’ to Tackle Their Toughest Decisions

INC BY BILL MURPHY JR., WWW.BILLMURPHYJR.COM@BILLMURPHYJR

Fighter pilot Michael Allen pulls the safety pins out of an ejection seat as he pre-flights an F-15 at Aviano AFB, Italy. Photo: Getty Images

Here are three quick questions. Ready?

1. What are the 2 or 3 worst things that could happen at your business?

2. What would you do immediately, if any of them happened?

3. Finally, imagine that you had to shut down everything quickly. How would you do it in a manner that lets you relaunch smoothly when the danger has passed?

These are incredibly tough questions to answer in the abstract, and they’re even harder when you’re under pressure.

Yet, we’ve had a lot of examples recently in which leaders had to decide things quickly under tragic circumstances: for example, the NFL game where Damar Hamlin was left fighting for his life on the field, and the Utah ski resort in which a member of the ski patrol fell off a lift and was killed.

These are dire situations, and they made me think about the U.S. military, where training for the worst case scenario is part of the job.

It’s done by planning and building muscle memory to the point at which soldiers, sailors — and as we’ll see, aviators — can react quickly and recite the protocol for events that they hope will never happen.

I call this the Ripcord Rule, because the most compelling examples I can imagine are ones in which you’re literally falling through the sky and something goes wrong with no time to think: either an airborne operation in which there is a parachute malfunction, or else the detailed, memorized checklist of things to do when a fighter pilot has to eject out of a doomed airplane.

The second example is more on my mind, because not long ago, I happened to have watched an interview with retired Navy fighter pilot Capt. Sam “Slammer” Richardson, who described what happened when he was forced to eject during a training exercise over the Pacific Ocean.

You can watch the video of his interview below, but the short version is that he tells a compelling story, and describes out all the little intermediate steps involved.

For example, as Richardson describes his ejection from an F-14 Tomcat fighter plane back in the 1980s, the protocol starts months or even years before the emergency, when he worked to memorized everything involved–just in case the worst-case ever happened:

· First, as Richardson describes, you quickly separate the canopy from the fuselage, so that the escaping pilot and “back-seater” don’t eject directly into it. (Basically, the thing that went wrong and caused Goose’s death in Top Gun.)

· Next, there’s the fact that the back-seater’s seat ejects a fraction of a second before the front-seat pilot, because otherwise the explosion from the front-seater’s ejection could burn the back-seater.

It goes on: a parade of small decisions and engineering choices–what you’re supposed to be thinking about as you make sure the parachute opens correctly, what you’re supposed to do during the several minutes it might take to float down to the ground, etc.

It’s pretty intriguing stuff — exactly what to do in a worst-case scenario, and frankly how to weigh the risk of death or injury versus the certainty of destroying a $40 million aircraft in the first place.

(Even that initial decision is standardized and committed to memory: basically, you learn to think about ejecting when you’re (a) in an out-of-control airplane, and (b) you’ve fallen below 10,000 feet.)

Now, neither you nor I is likely ever to eject from an F-14 Tomcat. (This is especially true since the F-14 is now retired, but you get the point.)

But, if you run an organization, you do face the possibility of a worst-case scenarios happening before you even have time to process them. And having thought through what you’ll do ahead of time is invaluable.

· What do you do if, God forbid, a customer or an employee has a serious medical emergency? How do you get them help? What do you do for all your other other customers and employees who have likely just witnessed something traumatic?

· Imagine a less than life-and-death emergency, but still important: a massive database failure or security breach, or a crucial supplier that suddenly cuts out and makes it impossible for you to fulfill orders. Who do you contact? How do you prioritize? What systems do you shut down immediately?

· When do you “pull the ripcord,” so to speak? And if you do so, have you thought through ahead of time each and every little decision you’ll have to make under intense pressure and time constraints?

Nobody wants to think about these kinds of things. They’re not pleasant. But if you do the mental exercises ahead of time, and put together procedures for what you’ll do in the worst-case scenario — if you follow the Ripcord Rule, in other words — you’ll be much better prepared if the time ever comes.

And the people you’re leading will be grateful that you did.

(Here’s Captain Richardson’s story.)

How the World’s Best Leaders Use the ‘Ripcord Rule’ to Tackle Their Toughest Decisions | Inc.com