1. The Yield Curve is Flattening Quickly

Barrons-Ben Levisohn Follow

The yield curve is flattening quickly. On Friday, the two-year Treasury yield closed at 1.17%, while the 10-year closed at 1.779%, putting the gap between them at 0.61 of a percentage point. On Dec. 31, that gap was 1.069 points. Since 1955, the yield curve has flattened about 0.8 of a point a year during the first year of a tightening cycle, which would mean the curve would invert sometime in the first half of 2023, says Jim Reid, global head of credit strategy at Deutsche Bank.

Recessions usually follow in eight to 19 months, which would put the next one in the middle of 2024. If the current market follows the historical path, the current upheaval, though painful, should simply mark a tantrum in risk markets that will pass. “The playbook is consistent with history,” he says.

https://www.barrons.com/articles/when-is-the-next-recession-coming-heres-how-to-time-it-51643417919?mod=past_editions

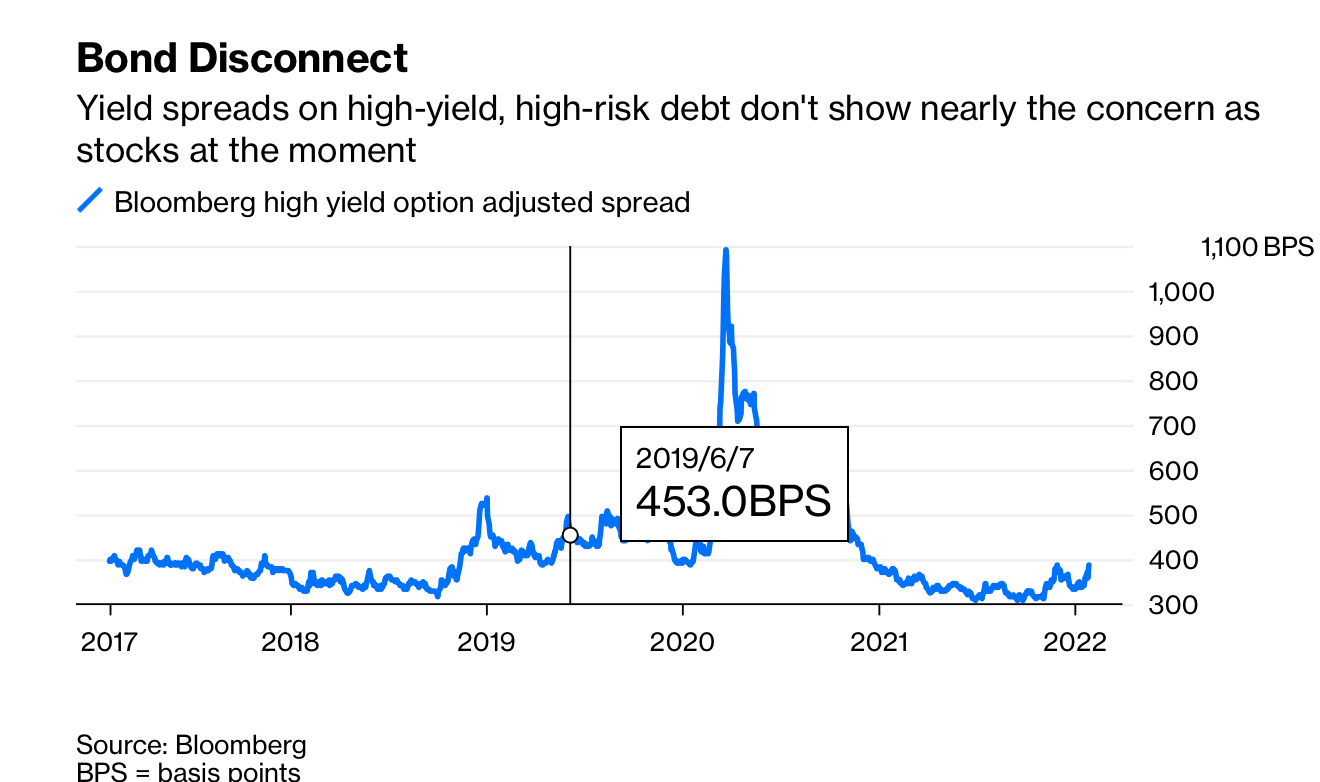

2. High Yield Bonds Calm During Stock Sell-Off

Bloomberg-Credit market’s reputation as a leading indicator has diminished at a time when even the Federal Reserve is having trouble anticipating where a highly volatile economy is heading. So if the economy experiences a significant slowdown, don’t look to corporate credit to send a signal, even if that part of of the debt market gets caught up in the fallout.

This month has been a good example of this changing dynamic. The U.S. stock market has suffered the worst start to a year since 2009 after waking up to the possibility that the Fed might tighten monetary policy much more than investors thought just a few months ago. And after the Fed’s monetary policy meeting on Wednesday and Chair Jerome Powell’s press conference afterward, money market traders were pricing in almost five rate increases in 2022, with Bank of America Corp. economists led by Ethan Harris seeing the possibility for seven. The S&P 500 Index is down 7% this year and the Nasdaq Composite Index has plunged 12%.

And yet, the corporate bond market has been relatively calm. Yes, yields have risen substantially along with U.S. Treasury securities, but what we’ve seen this month has not been a 2013-style “taper tantrum.” That is seen in the premium investors demand to compensate against the risk of default. That so-called spread on corporate bonds rated below investment-grade, or junk, have remained below levels reached late last year. Investment-grade rated companies have kicked off the year selling dollar-denominated bonds at a record pace, issuing 10% more such securities this month than a year earlier, according to data compiled by Bloomberg.

https://www.bloomberg.com/opinion/articles/2022-01-30/credit-traders-lack-edge-in-fed-s-new-regime?sref=GGda9y2L

3. Small Cap Value -6% vs. Small Cap Growth -19%

VBR Vanguard Small Cap Value vs. IWM Small Cap Growth YTD

4. Warren Buffett Overcomes ARRK…Very 1999 Like Event.

https://www.linkedin.com/in/

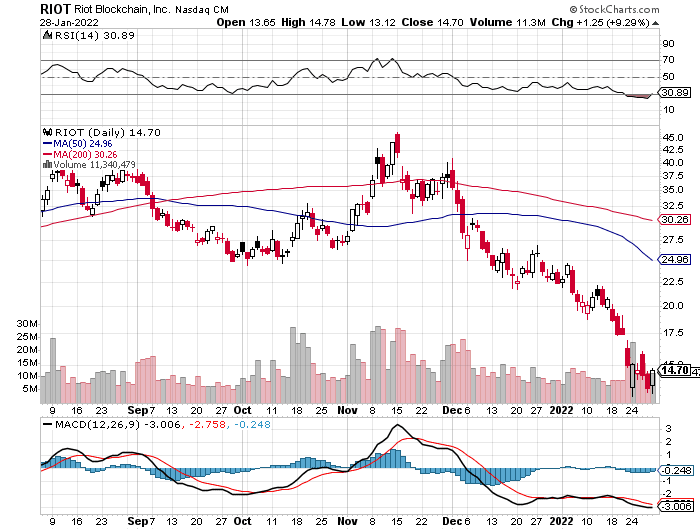

5. Break-Even for Crypto Miners 27,000

MARA $85 to $19.50

RIOT $46 to $13

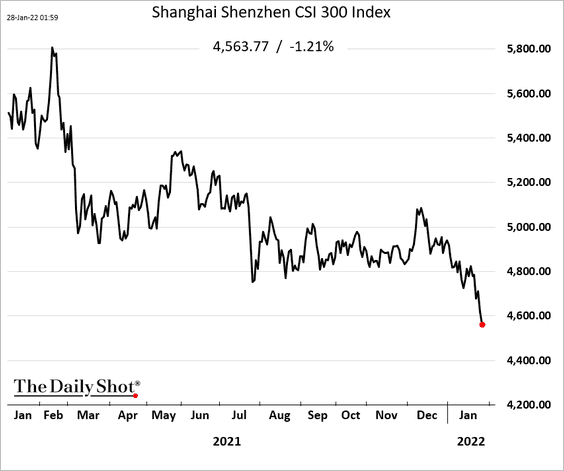

6. China No Bounce.

China: The stock market selloff continues, …

Source: Daily Shot

… as Hong Kong and international investors pulled capital out.

Source: Daily Shot

https://dailyshotbrief.com/

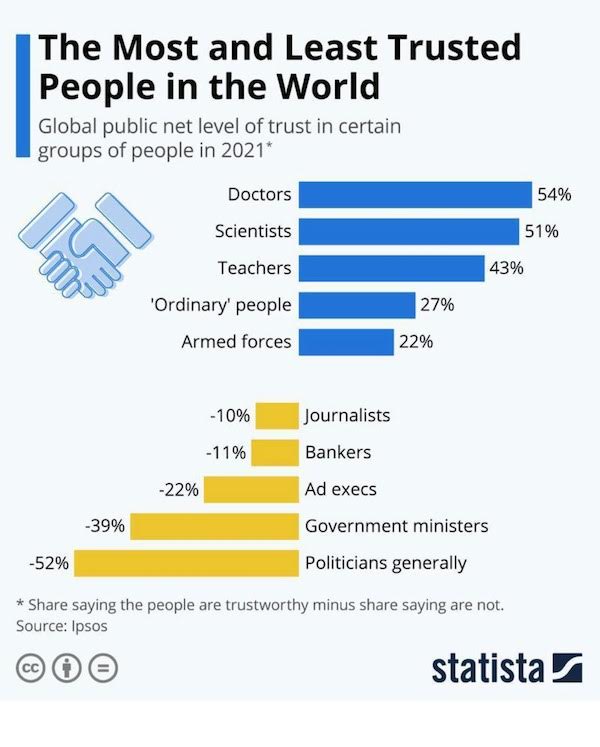

7. Doctors Most Trusted…Politicians Least Trusted

From Barry Ritholtz Blog

https://ritholtz.com/2022/01/eliminate-childhood-vaccinations/

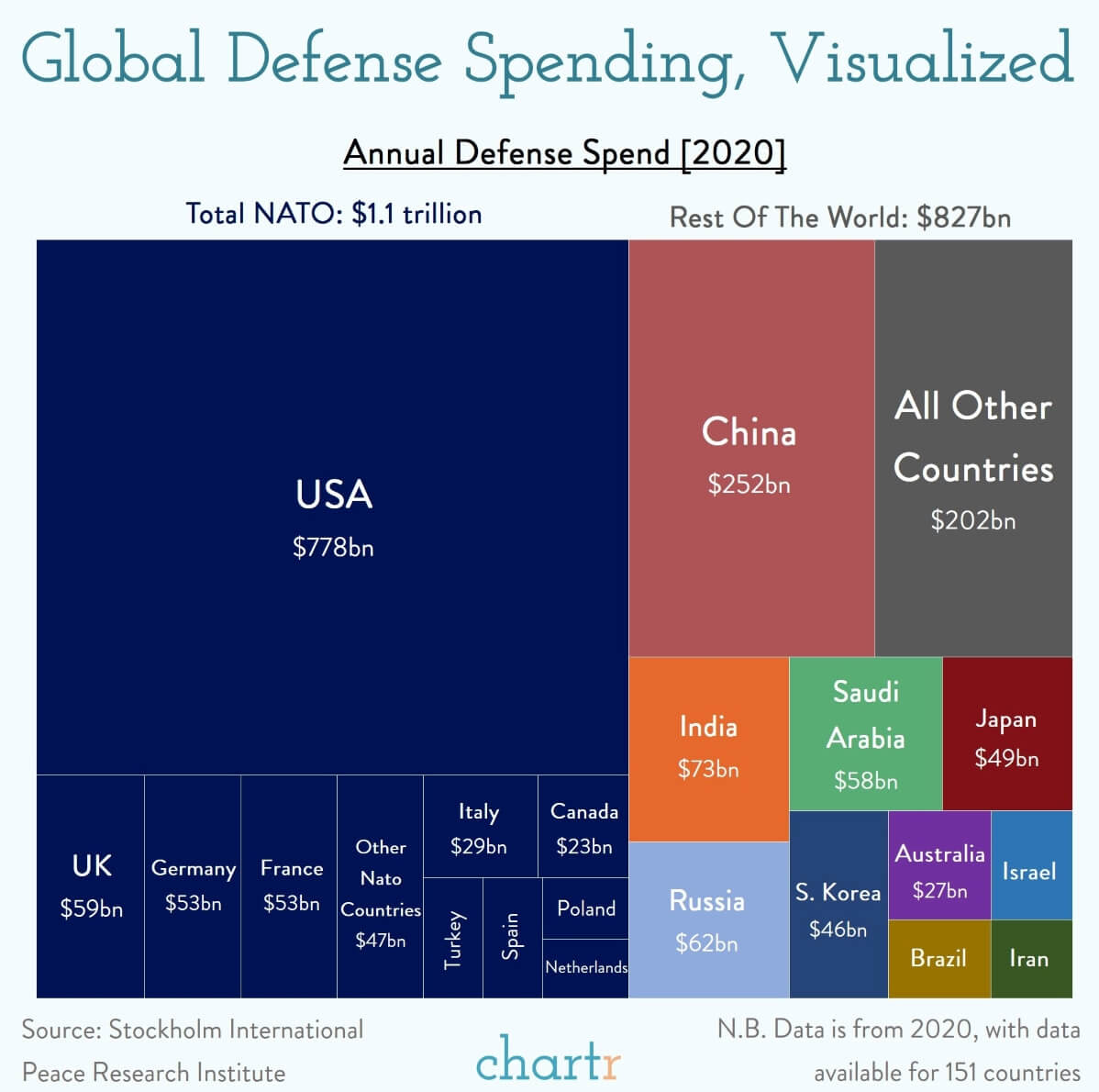

8. Global Defense Spending

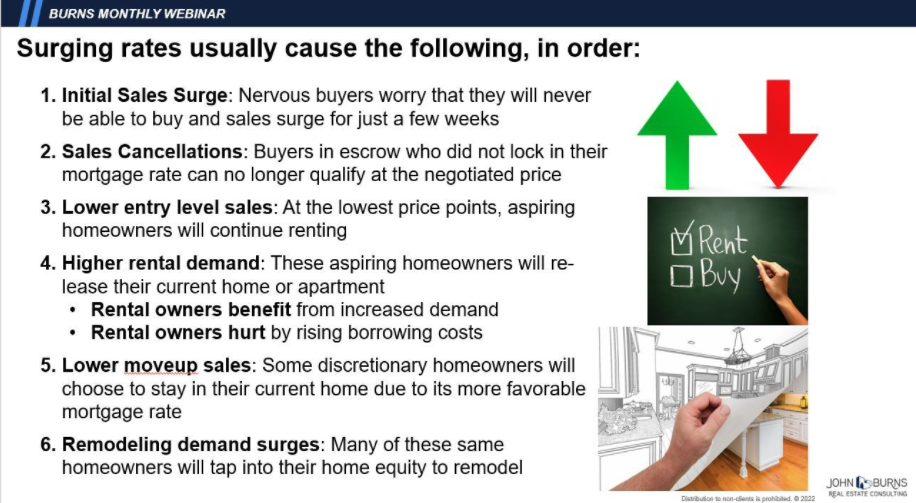

9. Housing Traditional Response to Surging Interest Rates.

John Burns Real Estate

https://www.linkedin.com/in/johnburns7/

10. Hard work vs. Long work

Seth Blog

Long work is what the lawyer who bills 14 hours a day filling in forms does.

Hard work is what the insightful litigator does when she synthesizes four disparate ideas and comes up with an argument that wins the case–in less than five minutes.

Long work has a storied history. Farmers, hunters, factory workers… Always there was long work required to succeed. For generations, there was a huge benefit that came to those with the stamina and fortitude to do long work.

Hard work is frightening. We shy away from hard work because inherent in hard work is risk. Hard work is hard because you might fail. You can’t fail at long work, you merely show up. You fail at hard work when you don’t make an emotional connection, or when you don’t solve the problem or when you hesitate.

I think it’s worth noting that long work often sets the stage for hard work. If you show up enough and practice enough and learn enough, it’s more likely you will find yourself in a position to do hard work.

It seems, though that no matter how much long work you do, you won’t produce the benefits of hard work unless you are willing to leap.