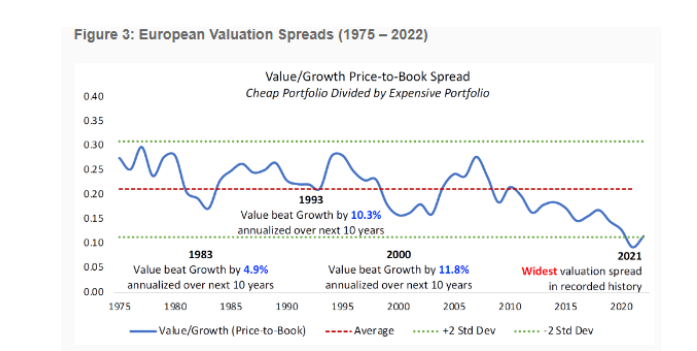

1. Value Factor vs. Growth Spread at Record Levels in Europe

Alpha Architect Blog

Larry Swedroe Given that the era of financial repression appears to be over (we seem to be returning to a more normal rate environment) and that valuation spreads remain at historically extreme levels, it seems likely that value stocks could be on the cusp of a winning stretch similar to the 1980s, 1990s or the 2000s. In other words, the rally that began in November 2020 may be just the tip of the iceberg, as wide divergences between the valuations of cheap stocks relative to expensive stocks have preceded significant outperformance for value over the subsequent decade, as shown in the figure below.

A Dark Winter for Value Stocks (alphaarchitect.com)

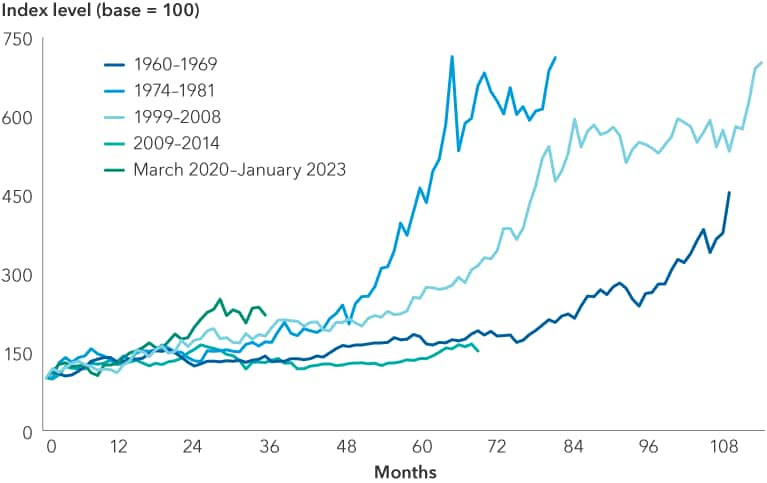

2. History of Energy Bull Markets.

Capital Group-Analysis of prior energy equity bull markets (we show Canada, as an example, in the chart below) suggests we may still be in the early innings of a positive rerating for the sector. Supported by higher energy prices, companies in the sector generated a record-breaking estimated $1.4 trillion of free cash flow (FCF) in 2022. Valuations remain attractive across a number of metrics including price-to-earnings and price-to-book ratios. And the resilience of oil stocks in the face of falling oil prices over the last three months suggests investors are looking past any near-term weakness in the underlying commodity price.

Energy equity bull markets have often shown staying power

Sources: Bloomberg, Peters & Co. Limited, S&P/TSX (Canada) Composite Index performance. Data as of January 25, 2023.

3. Banking Crypto Looks to be Killed by Regulators

Barrons Joe Light-One way to do that, it seems, is to keep crypto out of the banking system. Top federal regulators issued a joint statement in January saying they are “carefully reviewing any proposals from banking organizations to engage in activities that involve cryptoassets.” Banks such as Signature Bank (ticker:SBNY) have pared ties to crypto. The warning could make banks less likely to seek regulatory approval. The Federal Reserve also knocked down hopes for more crypto banking. The Fed rejected an application from digital-assets-focused Custodia Bank for a so-called Master Account, which would have enabled Custodia to get direct access to the Fed’s payment systems without going through an intermediary bank. Custodia has sued the Fed over its handling of the application.

https://www.barrons.com/

SBNY $350 to $124

Silvergate $220 to $18

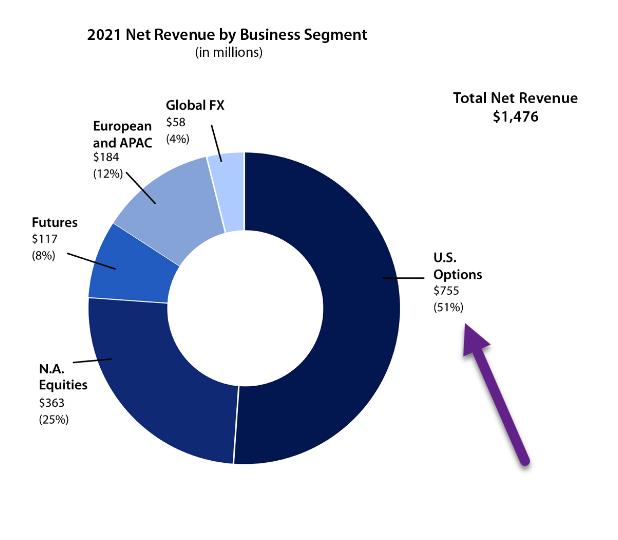

4. CBOE Stock About to Break Out to New Highs

Record option activity…speculation still alive in markets despite record Fed rate increases

51% of Revenue is U.S. Options

https://ir.cboe.com/investor-overview#:~:text=Sources%20of%20Revenue,licensing%20of%20our%20proprietary%20products.

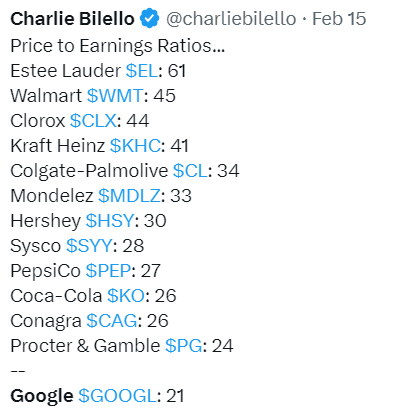

5. Charlie B with Interesting Chart on High Valuations of Consumer Staple Stocks (safe stocks?)

| @Charlie Bilello Google now has a lower P/E ratio than many leading consumer staples companies. Is this evidence of a safety bubble? |

6. QQQ Naz 100 Chart

QQQ did not make it back to Summer 2022 highs on this rally

Liz Ann Sonders Schwab-NASDAQ 100’s selloffs from end of 2021 into middle of 2022 were consistent with increase in forward EPS (orange); yet now, forward EPS have fallen considerably as index has attempted to claw back losses

[Past performance is no guarantee of future results]

https://www.linkedin.com/in/lizannsonders/

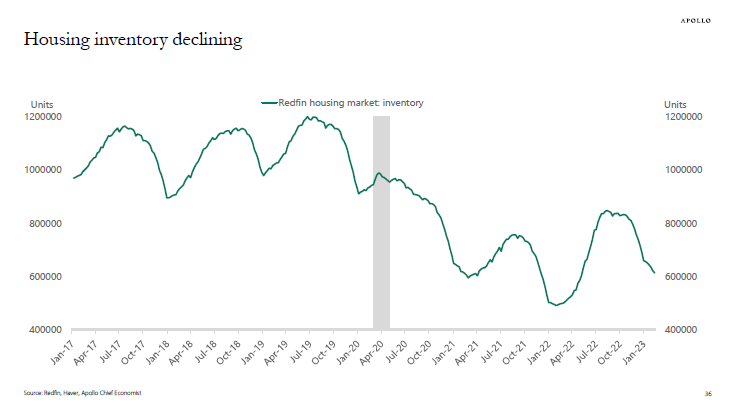

7. Housing Inventory Declining

Torston Slok Apollo Group

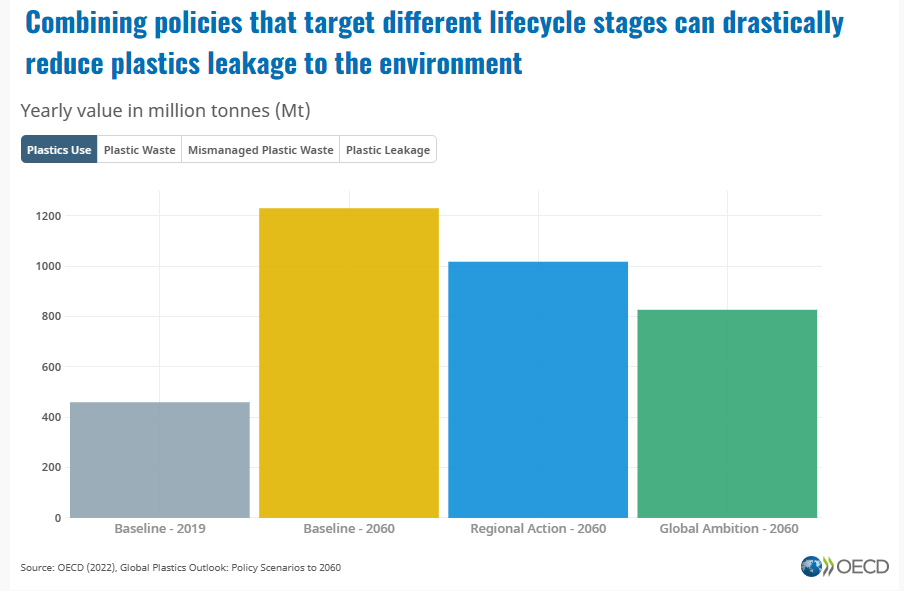

8. Global plastic waste set to almost triple by 2060, says OECD

03/06/2022 – The amount of plastic waste produced globally is on track to almost triple by 2060, with around half ending up in landfill and less than a fifth recycled, according to a new OECD report.

Global Plastics Outlook: Policy Scenarios to 2060 says that without radical action to curb demand, increase product lifespans and improve waste management and recyclability, plastic pollution will rise in tandem with an almost threefold increase in plastics use driven by rising populations and incomes. The report estimates that almost two-thirds of plastic waste in 2060 will be from short-lived items such as packaging, low-cost products and textiles.

“If we want a world that is free of plastic pollution, in line with the ambitions of the United Nations Environment Assembly, we will need to take much more stringent and globally co-ordinated action,” OECD Secretary-General Mathias Cormann said. “This report proposes concrete policies that can be implemented along the lifecycle of plastics that could significantly curb – and even eliminate – plastic leakage into the environment.”

The report (available as a preliminary version ahead of its full publication later this year) projects global plastics consumption rising from 460 million tonnes (Mt) in 2019 to 1,231 Mt in 2060 in the absence of bold new policies, a faster rise than most raw materials. Growth will be fastest in developing and emerging countries in Africa and Asia, although OECD countries will still produce much more plastic waste per person (238 kg per year on average) in 2060 than non-OECD countries (77 kg).

Globally, plastic leakage to the environment is seen doubling to 44 Mt a year, while the build-up of plastics in lakes, rivers and oceans will more than triple, as plastic waste balloons from 353 Mt in 2019 to 1,014 Mt in 2060. Most pollution comes from larger debris known as macroplastics, but leakage of microplastics (synthetic polymers less than 5 mm in diameter) from items like industrial plastic pellets, textiles and tyre wear is also a serious concern.

The projected rise in plastics consumption and waste will come despite an expected increase in the use of recycled plastic in manufacturing new goods as well as technological advances and sectoral economic shifts that should mean an estimated 16% decrease by 2060 in the amount of plastic required to create USD 1 of economic output.

The share of plastic waste that is successfully recycled is projected to rise to 17% in 2060 from 9% in 2019, while incineration and landfilling will continue to account for around 20% and 50% of plastic waste respectively. The share of plastic that evades waste management systems – ending up instead in uncontrolled dumpsites, burned in open pits or leaking into the soil or aquatic environments – is projected to fall to 15% from 22%.

The new report builds on the OECD’s first Global Plastics Outlook: Economic Drivers, Environmental Impacts and Policy Options, released in February 2022. That first report found that plastic waste has doubled in two decades, with most ending up in landfill, incinerated or leaking into the environment. Since that report release, UN member states have pledged to negotiate a legally binding international agreement by 2024 to end plastic pollution.

Global Plastics Outlook: Policy Scenarios to 2060 looks at the impact of two potential scenarios. The first, a regional action scenario comprising a mix of fiscal and regulatory policies primarily in OECD countries could decrease plastic waste by almost a fifth and more than halve plastic leakage into the environment without a substantial impact on global GDP, which would be lower by 0.3% by 2060. The second, a global action scenario comprising more stringent policies implemented worldwide, could decrease plastic waste by a third and almost completely eliminate plastic leakage to the environment while lowering global GDP by an estimated 0.8%.

The report also looks at how actions to reduce greenhouse emissions could reduce plastic pollution given the interplay between the plastics lifecycle, fossil fuels and climate change.

Policies to reduce the environmental impacts of plastics and encourage a more circular use of them should include:

- Taxes on plastics, including on plastic packaging

- Incentives to reuse and repair plastic items

- Targets for recycled content in new plastic products

- Extended producer responsibility (EPR) schemes

- Improved waste management infrastructure

- Increased litter collection rates

Read more about OECD work on plastics

Global plastic waste set to almost triple by 2060, says OECD

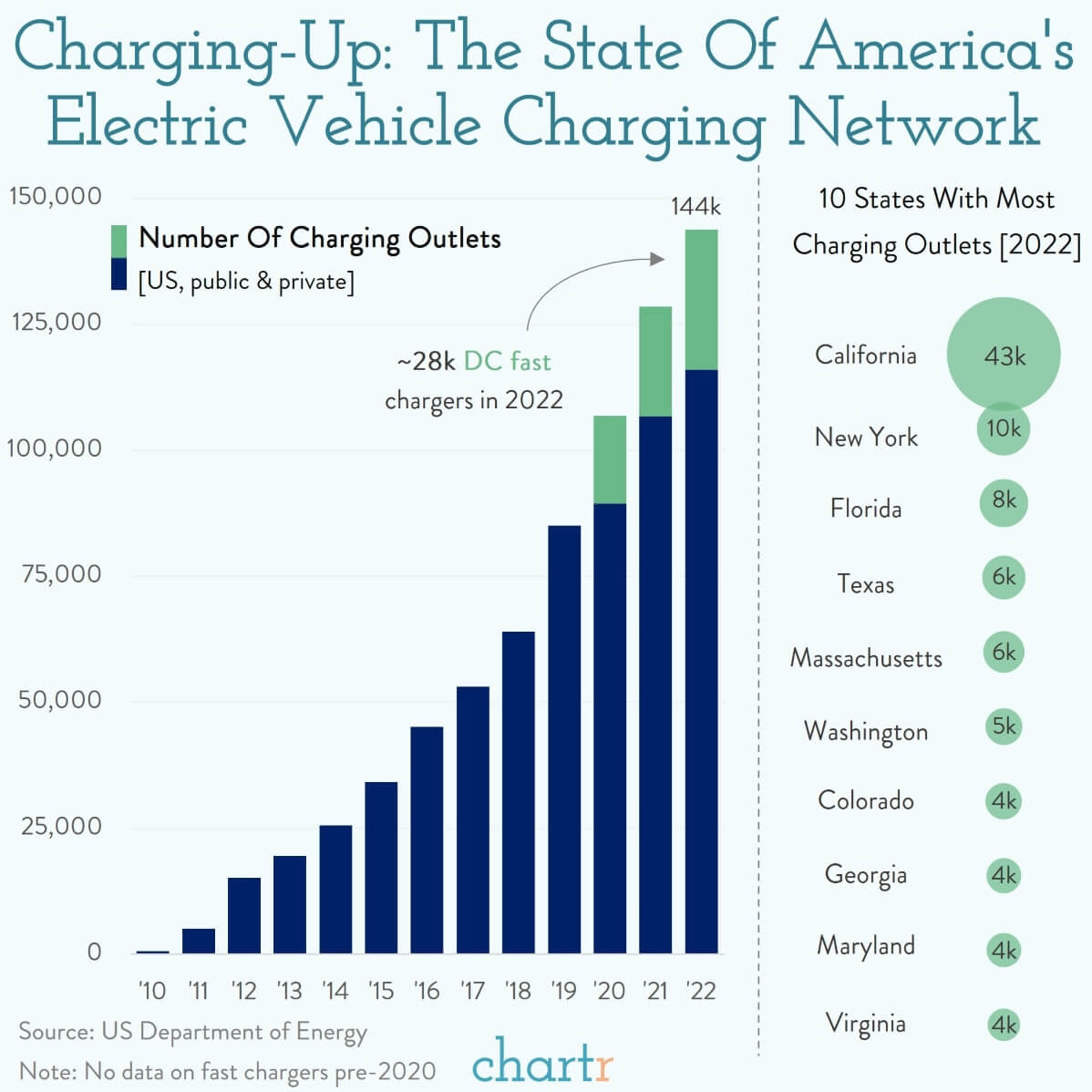

9. The State of America’s Electric Vehicle Charging Network

Chartr

Electric avenueOn Wednesday, The White House announced that Tesla is set to start opening up part of its charging network, making 7,500 charging stations — roughly half of which will be Tesla’s fast “superchargers” — available to non-Tesla EVs by 2024.That’s a big deal, and gives the government a better chance of achieving its goal of 500,000 accessible chargers across the country by 2030. Indeed, Tesla isn’t the only company plugging in to help. Hertz, BP, GM, and EVgo are among the 16 companies that will provide an additional 100,000 chargers to the US network. A bigger network should, of course, accelerate the switch to EVs, and mitigate some of the current range anxiety.

NudgingThe carrot for participating in building out the charging network is getting a slice of the Biden administration’s $7.5bn EV charging fund. That’s encouraged Tesla execs to deviate from their prior policy, where they kept their setup from rival brands in a similar way to how Apple has shielded much of its tech ecosystem from competitors. The pivot has already got some Tesla drivers worried about long waiting times at busier charging stations though.

10. Cognitive Rigidity

Farnam Street Blog https://fs.blog/

Adding Exceptions is easier than updating: “Once the mind has accepted a plausible explanation for something, it becomes a framework for all the information that is perceived after it. We’re drawn, subconsciously, to fit and contort all the subsequent knowledge we receive into our framework, whether it fits or not. Psychologists call this “cognitive rigidity”. The facts that built an original premise are gone, but the conclusion remains—the general feeling of our opinion floats over the collapsed foundation that established it. Information overload, “busyness,” speed, and emotion all exacerbate this phenomenon. They make it even harder to update our beliefs or remain open-minded.”

— Source