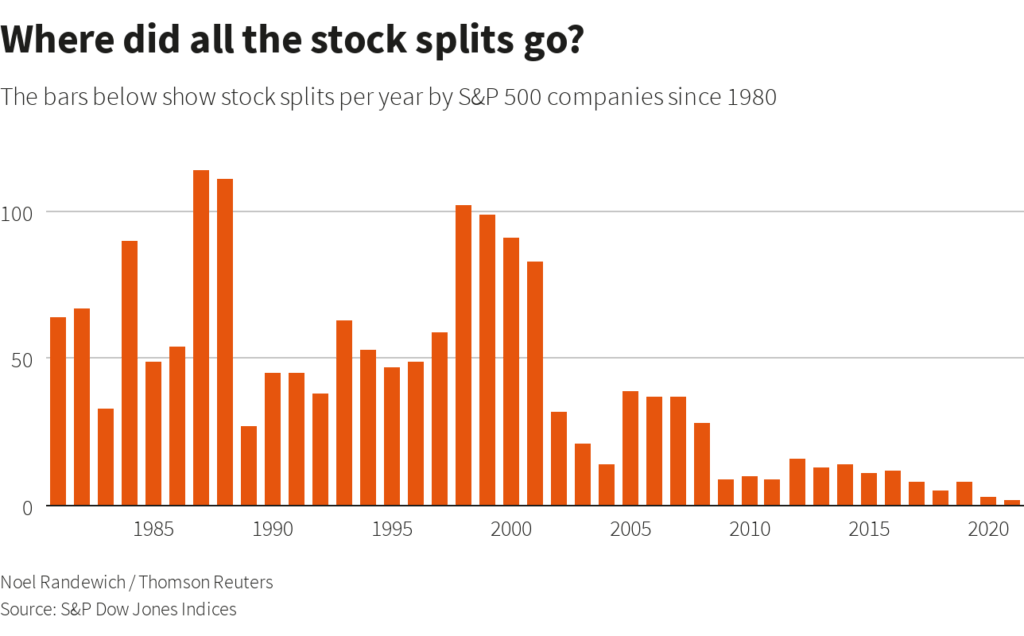

1. With Some 1999 Like Behaviors Starting to Perculate..It Will Be Interesting to See if we get a Spike in Stock Splits

https://www.ccn.com/apple-stock-split-marketing-trick-hurt-dow/

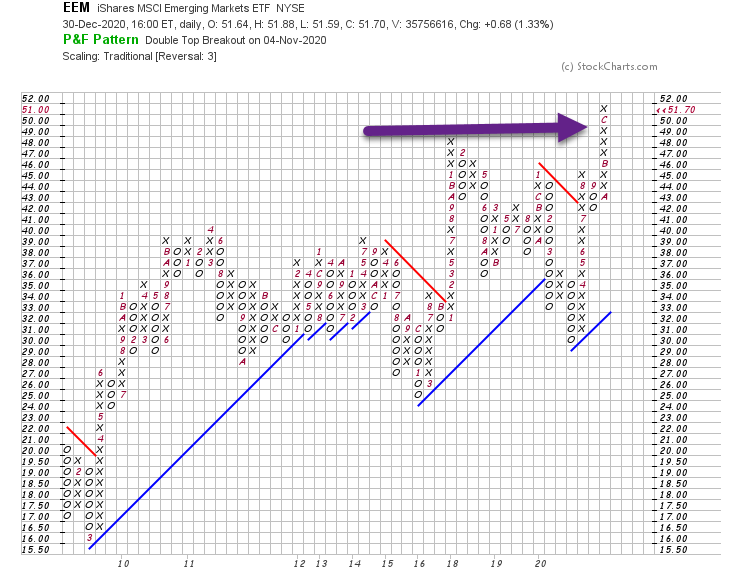

2. Dollar Weakness Helping Emerging Markets Break Out Above 2018 Highs.

EEM-Emerging Markets ETF was sideways for almost a decade before breakout

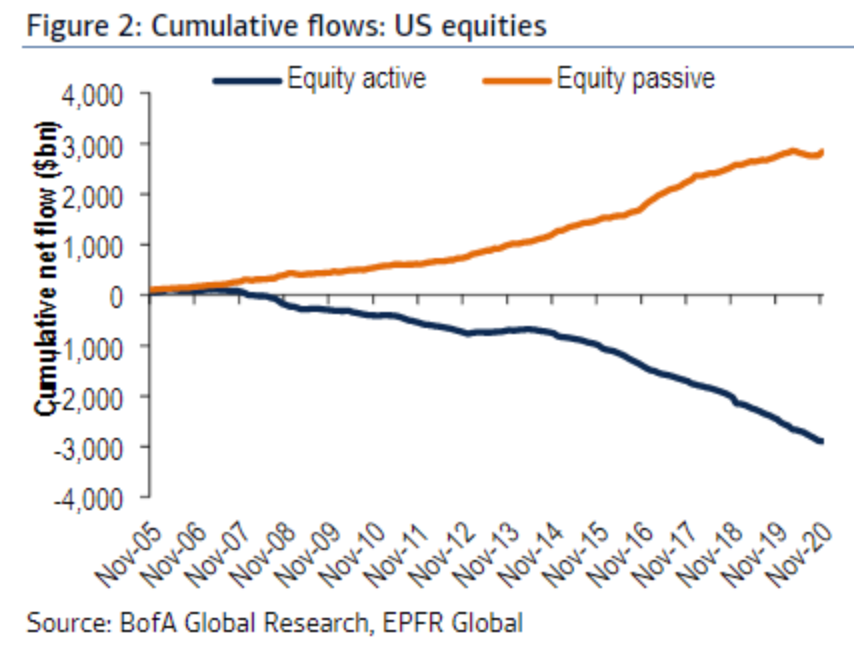

3. Updated Cumulative Equity Flows Passive vs. Active

Barry Ritholtz Blog

https://twitter.com/RitholtzWealth/status/1344289703172956160/photo/2

4. Nikkei 225 Reclaims 27,000 After 29 Years.

Many headlines in the past 24 hours focused on the Nikkei surpassing its 1989 peak. However, this was in USD terms. In the local currency, Japanese equities remain nearly 45% below the levels traded over 30 years despite BoJ keeping rates at zero and doing QEs for years.

https://twitter.com/Orangeman1992/status/1344280157696237575/photo/1

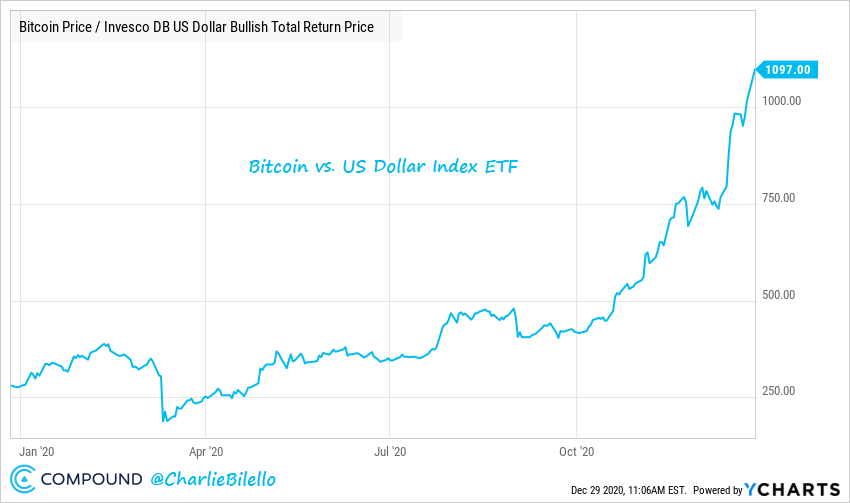

5. Bitcoin vs. U.S. Dollar ETF

Charlie Bilello

6. S&P New Highs Historically Bullish for Market

Value Walk Blog -Markets are at all-time highs… which typically lead to more all-time highs!

Since 1988, the S&P 500 returns were significantly higher on one-, three-, and five-year time horizons when the index was at all-time highs:

7. ARK’s Innovation ETF Posts $137 Million Outflow On Tuesday, Its Largest On Record

BY TYLER DURDEN

One day after we speculated the top in ARK Funds could be in, based on what appeared to be a technical trend in inflows breaking down, ARK’s Innovation ETF posted its largest outflow on record.

The ETF saw $137 million in outflows on Tuesday of this week, according to Bloomberg, marking a stark break from the trend of inflows that the fund has seen over the last 18 months. Prior to Tuesday, the fund had not had a daily withdrawal dating back to November. It also hadn’t seen a weekly withdrawal dating back to February, the report says.

Todd Rosenbluth, director of ETF research for CFRA Research told Bloomberg: “Given the strong demand in the fourth quarter for ARKK and its hard-to-duplicate returns in 2020, it was inevitable that some investors would want to take profits.”

8. Pimco-Defaults on a declining trajectory: The worst may be behind us

U.S. high yield defaults spiked in April and May 2020, when an earnings slowdown resulting from global lockdown measures and collapsing oil prices hit weaker issuers within the asset class. Defaults, however, have gradually declined since then. As the economic recovery continues, defaults are likely to continue to decline, although they may remain elevated vs. long-term averages into 2021, highlighting the importance of active management and security selection.

Today’s Credit Opportunities in 5 Charts

https://www.advisorperspectives.com/commentaries/2020/12/30/todays-credit-opportunities-in-5-charts

9.Ten Ways Covid-19 Has Changed the World Economy Forever

Enda Curran, Michelle Jamrisko and Catherine Bosley

(Bloomberg) — Economic shocks like the coronavirus pandemic of 2020 only arrive once every few generations, and they bring about permanent and far-reaching change.

Measured by output, the world economy is well on the way to recovery from a slump the likes of which barely any of its 7.7 billion people have seen in their lifetimes. Vaccines should accelerate the rebound in 2021. But other legacies of Covid-19 will shape global growth for years to come.

Some are already discernible. The takeover of factory and service jobs by robots will advance, while white-collar workers get to stay home more. There’ll be more inequality between and within countries. Governments will play a larger role in the lives of citizens, spending—and owing—more money. What follows is an overview of some of the transformations under way.

Leviathan

Big government staged a comeback as the social contract between society and the state got rewritten on the fly. It became commonplace for authorities to track where people went and who they met—and to pay their wages when employers couldn’t manage it. In countries where free-market ideas had reigned for decades, safety nets had to be patched up.

To pay for these interventions, the world’s governments ran budget deficits that add up to $11 trillion this year, according to McKinsey & Co. There’s already a debate about how long such spending can continue, and when taxpayers will have to start footing the bill. At least in developed economies, ultralow interest rates and unfazed financial markets don’t point to a near-term crisis.

In the longer run, a big rethink in economics is changing minds about public debt. The new consensus says governments have more room to spend in a low-inflation world, and should use fiscal policy more proactively to drive their economies. Advocates of Modern Monetary Theory say they pioneered those arguments and the mainstream is only now catching up.

Even Easier Money

Central banks were plunged back into printing money. Interest rates hit new record lows. Central bankers stepped up their quantitative easing, widening it to buy corporate as well as government debt.

All these monetary interventions have created some of the easiest financial conditions in history—and unleashed a frenzy of speculative investment, which has left plenty of analysts worried about moral hazards ahead. But the central-bank policies will be hard to reverse, especially if labor markets remain fractured and companies continue their recent run-up in saving.

And history shows that pandemics depress interest rates for a long time, according to a paper published this year. It found that a quarter-century after the disease struck, rates were typically some 1.5 percentage points lower than they otherwise would have been.

Debts and Zombies

Governments offered credit as a lifeline during the pandemic—and business grabbed it. One result was a surge in corporate debt levels across the developed world. The Bank for International Settlements calculates that nonfinancial companies borrowed a net $3.36 trillion in the first half of 2020.

With revenues plunging in many industries because of lockdowns or consumer caution, and losses eating into business balance sheets, the conditions are in place for a “major corporate solvency crisis,” according to one new report.

Some also see danger in offering too much support for companies, with too little discrimination over who gets it. They say that’s a recipe for creating “zombie firms” that can’t survive in a free market and are only kept alive by state aid—making the whole economy less productive.

Great Divides

The stimulus debate can feel like a first-world luxury. Poor countries lack the resources to protect jobs and businesses—or invest in vaccines—the way wealthier peers have done, and they’ll need to tighten belts sooner or risk currency crises and capital flight.

The World Bank warns that the pandemic is spawning a new generation of poverty and debt turmoil, and the IMF says developing nations risk getting set back by a decade.

Creditor governments in the G-20 have taken some steps to ease the plight of the poorest borrowers, but they’ve been slammed by aid groups for offering only limited debt relief and failing to rope private investors into the plan.

K-Shaped

Low-paying work in services, where there’s more face-to-face contact with customers, tended to disappear first as economies locked down. And financial markets, where assets are mostly owned by the rich, came roaring back much faster than job markets.

The upshot has been labeled a “K-shaped recovery.” The virus has widened income or wealth gaps across faultlines of class, race and gender.

Women have been hit disproportionately hard—partly because they’re more likely to work in the industries that struggled, but also because they had to shoulder much of the extra childcare burden as schools closed. In Canada, women’s participation in the labor force fell to the lowest since the mid-1980s.

Rise of the Robots

Covid-19 triggered new concerns about physical contact in industries where social distancing is tough—like retail, hospitality or warehousing. One fix is to replace the humans with robots.

Research suggests that automation often gains ground during a recession. In the pandemic, companies accelerated work on machines that can check guests into hotels, cut salads at restaurants, or collect fees at toll booths. And shopping moved further online.

These innovations will make economies more productive. But they also mean that when it’s safe to go back to work, some jobs just won’t be there. And the longer people stay unemployed, the more their skills can atrophy—something economists call “hysteresis.”

You’re on Mute

Higher up the income ladder, remote offices suddenly became the norm. One study found that two-thirds of U.S. GDP in May was generated by people working at home. Many companies told employees to stay away from the office well into 2021, and some signaled they’ll make flexible work permanent.

Work-from-home has mostly passed the technology test, giving employers and staff new options. That’s a worry for businesses catering to the old infrastructure of office life, from commercial real estate to food and transportation. It’s a boon for those building a new one: shares in videoconferencing platform Zoom jumped more than six-fold this year.

The option of remote work, along with fear of the virus, also triggered a stampede of urbanites toward the suburbs or countryside—and in some countries, a surge in rural property prices.

Not Going Anywhere?

Some kinds of travel came to a near halt. Global tourism fell 72% in the year through October, according to the United Nations. McKinsey reckons a quarter of business trips could disappear forever as meetings move online.

With vacations upended and mass events like festivals and concerts called off, the trend among consumers to favor “experiences” over goods has been disrupted. And when activities do resume, they may not be the same. “We still don’t know how concerts are going to be, really,” says Rami Haykal, co-owner of the Elsewhere venue in Brooklyn. “People will be more mindful, I think, of personal space, and avoiding places that are overly packed.”

Travelers may have to carry mandatory health certificates and pass through new kinds of security. Hong Kong based China Tech Global has developed a mobile disinfection booth that it’s trying to sell to airports. Chief Executive Sammy Tsui says it can clear pathogens from the body and clothes in 40 seconds or less. “You feel some cool air on your body, and some mist,” he says. “But you don’t feel wet.”

A Different Globalization

When Chinese factories shut down early in the pandemic, it sent shock waves through supply chains everywhere—and made businesses and governments reconsider their reliance on the world’s manufacturing powerhouse.

Sweden’s NA-KD.com, for example, is part of a flourishing “fast fashion” retail industry that moves with social media trends rather than the traditional seasons. After deliveries got jammed this year, the company shifted some production from China to Turkey, says Julia Assarsson, head of inbound and customs.

That’s an example of globalization adjusting without retreating. In other areas, the pandemic may encourage politicians who argue that it’s risky to rely on imports of goods vital to national security—as ventilators and masks turned out to be this year.

Going Green

Before the pandemic, it was mainly environmentalists musing over theories of peak oil—the idea that the rise of electric vehicles could permanently dent the world’s demand for one of the most polluting fossil fuels.

But when 2020 saw planes grounded and people staying home, even oil majors like BP felt a real threat from the world getting serious about climate.

Governments from California to the U.K. announced plans to ban the sale of new gasoline and diesel cars by 2035. And Joe Biden was elected with a promise the U.S. will rejoin the Paris Agreement.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P

https://finance.yahoo.com/news/ten-ways-covid-19-changed-000121052.html

10. Why the Most Successful Leaders Don’t Care About Being Liked

Being liked is fleeting. Here’s what matters more

BY DEBORAH GRAYSON RIEGEL, KEYNOTE SPEAKER AND LEADERSHIP CONSULTANTTHERE’S NOTHING WRONG WITH WANTING TO BE LIKED AT WORK. ACCORDING TO TIM SANDERS, AUTHOR OF THE LIKEABILITY FACTOR: HOW TO BOOST YOUR L-FACTOR AND ACHIEVE YOUR LIFE’S DREAMS WHEN YOUR COLLEAGUES, DIRECT REPORTS AND BOSSES LIKE YOU, YOU HAVE A BETTER CHANCE OF GETTING PROMOTED, BEING ASSIGNED SPECIAL PROJECTS THAT INTEREST YOU, HAVING PEOPLE GO ABOVE AND BEYOND FOR YOU, GETTING TIMELY RESPONSES AND FEEDBACK, AND HAVING THE KIND OF SOCIAL CAPITAL THAT YOU DRAW ON TO GET WHAT YOU WANT AND NEED FROM OTHERS.

So, when does wanting to be liked become a problem?

When it comes at the expense of being respected. According to scientist Cameron Anderson of the Haas School of Business at the University of California, Berkeley, overall happiness in life is related to how much you are respected by those around you. Nevertheless, when we sacrifice what it takes to be respected for the quicker, and often easier, win of feeling liked, we lose out on the benefits that respect yields.

Like what? Like greater enjoyment and satisfaction with their jobs, more focus and prioritization, increased sense of meaning and significance, better health and well-being, and more feelings of trust and safety, and increased engagemen

Professionals who want (and often need) to feel liked tend to:

· Seek positive attention and approval

· Engage in gossip rather than giving direct feedback

· Try to please everyone

· Make promises they can’t keep

· Keep strong opinions to themselves

· Flood people with credit, compliments and praise

· Play favorites (but pretend they don’t)

· Use information as leverage, withholding or giving it away

· Give people tasks they enjoy rather than assignments that stretch and challenge them

· Focus more on how people feel (in general, and about them personally) than about achieving outcomes

Professionals who recognize the importance of being respected — with or without being liked — are more inclined to:

· Tell the truth, even if it’s unpopular

· Explain their thinking behind the difficult decisions they make

· Acknowledge the elephant in the room, even if they can’t fix it

· Say no when they need to

· Be open-minded and decisive

· Give credit when it’s due to others and also take it when it’s due themselves

· Tolerate feelings of disappointment, frustration, sadness and anger in themselves and others

· Hold people accountable for their results

· Be consistent and fair in setting rules and expectations

· Set and honor boundaries for themselves and others

· Deliver negative feedback directly and in a timely manner

· Ask for feedback regularly and then act on it

· Apologize when they make mistakes and then move on

· Model the behavior they expect from others

For professionals who want to grow in their roles and careers, being liked is good, but being respected is a requirement. As Margaret Thatcher once remarked, “If you just set out to be liked, you would be prepared to compromise on anything at any time, and you would achieve nothing.”

Inc. helps entrepreneurs change the world. Get the advice you need to start, grow, and lead your business today. Subscribe here for unlimited access.

OCT 16, 2018

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

https://www.inc.com/deborah-grayson-riegel/why-most-successful-leaders-dont-care-about-being-liked.html?cid=sf01003

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.