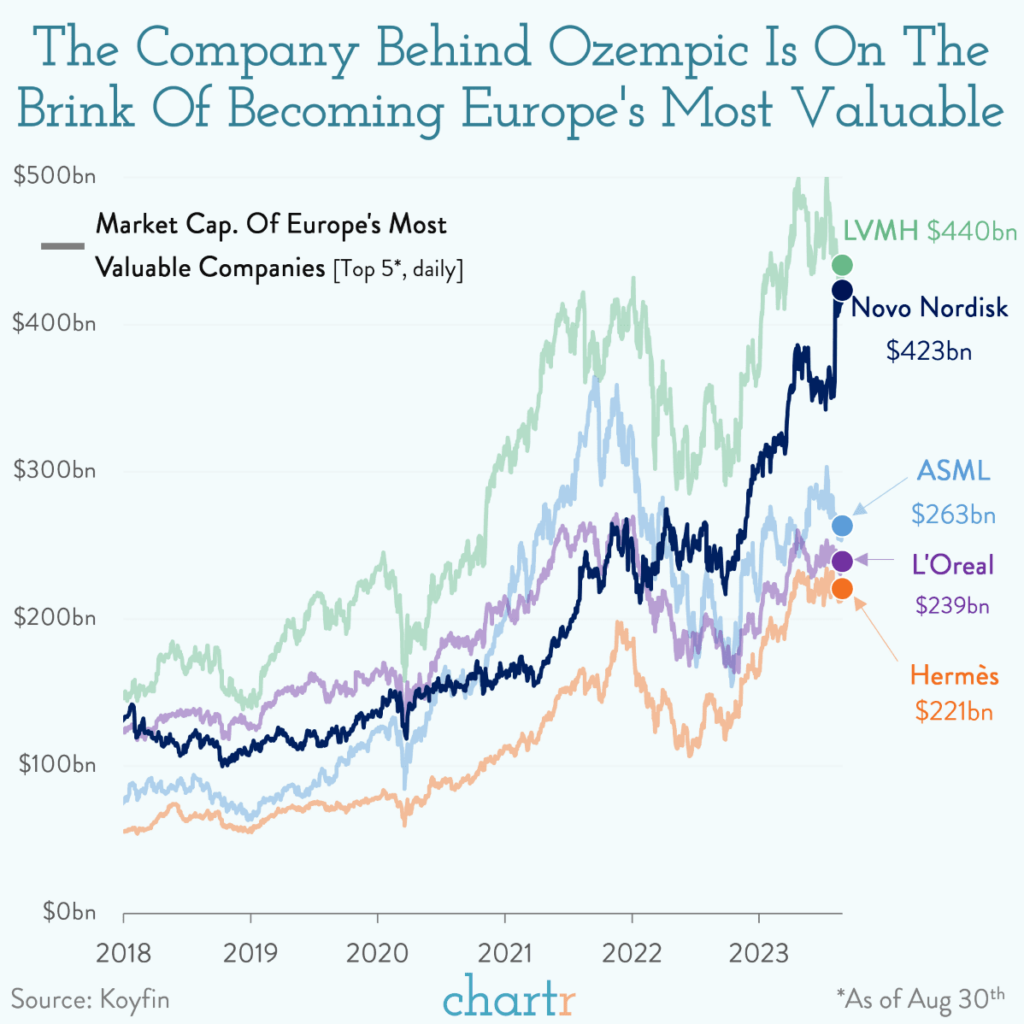

1. Novo Nordisk Riding Weight Loss Drug to Becoming Europe’s Most Valuable Company

Chart Blog Outweighed Novo Nordisk, the Danish pharma company responsible for Ozempicand Wegovy— two of the buzziest drugs in the weight loss game — has been bulking up, with its market cap. recently crossing the$400 billionthreshold, surpassing Denmark’s annual GDP. With sales up 30%, net profit rising 43%, and supply restrictions still in place for its most popular medication, Novo unsurprisingly raised its outlook for 2023 in its report earlier this month, as demand for the company’s “wonder drugs” continues to rise.

Very good shape The drug maker’s ascent has been meteoric, especially for a company celebrating its 100th birthday in a few months. The hype around its two flagship treatments — which both trace back to the 2012 development of semaglitude, designed to tackle type 2 diabetes — has catapulted Novo Nordisk to second on the list of Europe’s most valuable public companies, only behind luxury fashion giant LVMH. For another sense of scale, Novois now worth more than McDonald’s and Netflix combined.

The company’s become so large, the government in Denmark — a nation of fewer than 6 millionpeople — is considering publishing separate economic statistics that strip out the “Novo effect”. The pharma giant’s success comes at a good time for Denmark after one of the country’s other iconic brands, Lego, suffered a rare misstep and recorded its largest profit drop for almost 2 decades.

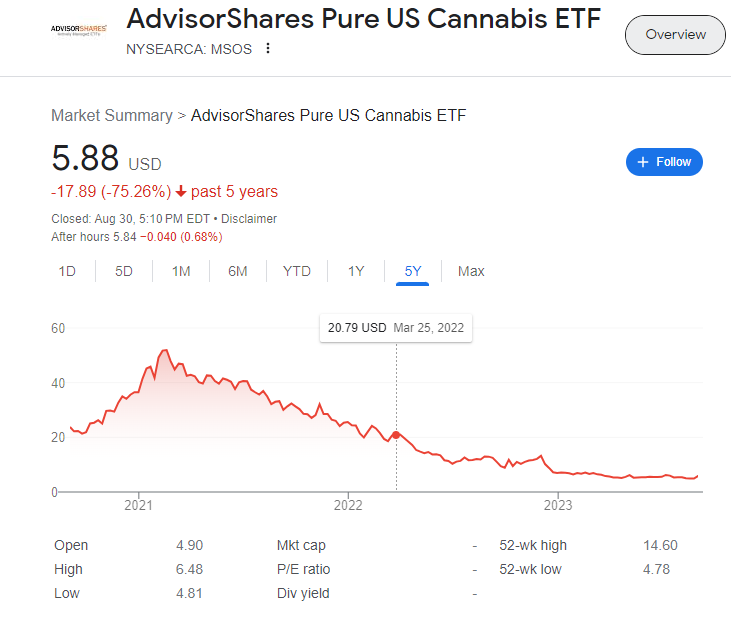

2. Bloomberg -US Health Officials Urge Moving Pot to Lower-Risk Category

· Change would remove drug from most restricted designation

· Cannabis industry stocks respond with double-digit jumps

By Riley Griffin, Ike Swetlitz, and Tiffany Kary

US health officials are recommending easing restrictions on marijuana, a move that sets the stage for potentially expanding the cannabis market across the country.

A top official at the Department of Health and Human Services wrote Drug Enforcement Agency Administrator Anne Milgram calling for marijuana to be reclassified as a Schedule III drug under the Controlled Substances Act, according to a letter dated Aug. 29 that was seen by Bloomberg News.

A DEA spokesperson confirmed the department had received the letter with HHS’s recommendation. With final authority to reschedule a drug, DEA will now initiate its own review, the spokesperson said.

Reclassification is a step short of legalizing the drug entirely, but it would mark a critical shift away from marijuana’s status as a Schedule I substance, which includes drugs with high risk of abuse, like heroin, LSD and ecstasy. Schedule III substances, such as ketamine, are seen as less dangerous and can be obtained legally with a prescription. https://www.bloomberg.com/news/articles/2023-08-30/hhs-calls-for-moving-marijuana-to-lower-risk-us-drug-category?sref=GGda9y2L

Cannabis ETF MSOS +21% Yesterday

MSOS -75% Since Inception

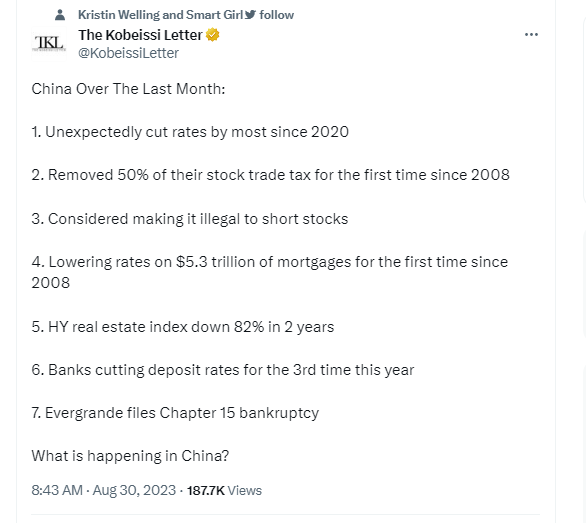

3. In the past 3 weeks, more than 400,000 news articles were published that mentioned China. More than 33,000 of them were explicitly negative. That’s the highest ratio in at least a decade

Dave Lutz Jones Trading CHINA PMIS– China’s August PMIs look set to show broad deterioration, with the official services gauge falling close to the contraction threshold and the manufacturing gauge showing activity shrinking at a faster rate. Brisk travel during the summer holiday season likely failed to offset a host of negatives – including a deepening housing slump – that have hurt investment and consumption, Bloomberg says.

“In the past 3 weeks, more than 400,000 news articles were published that mentioned China. More than 33,000 of them were explicitly negative. That’s the highest ratio in at least a decade. The only other time that came close was 8 years ago almost to the day”

(SentimentTrader) – the End of 2013 was not a bad time to own China Equities. SHCOMP rallied 159% over the next 2 years

4. China Moves Over the Last Month

5. Chinese Internet Stock ETF Sideways for Almost 2 Years

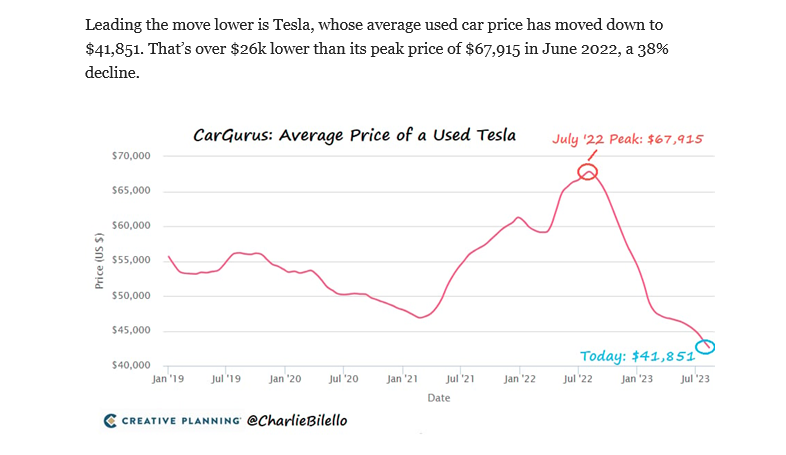

6. Tesla Used Car 38% Decline in Price

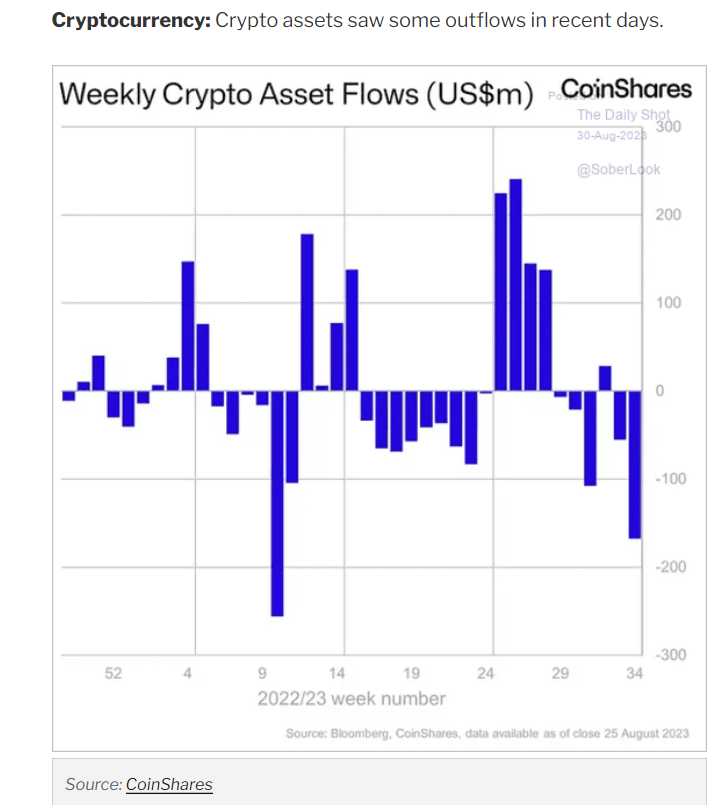

7. Crypto Saw Selling on the ETF News

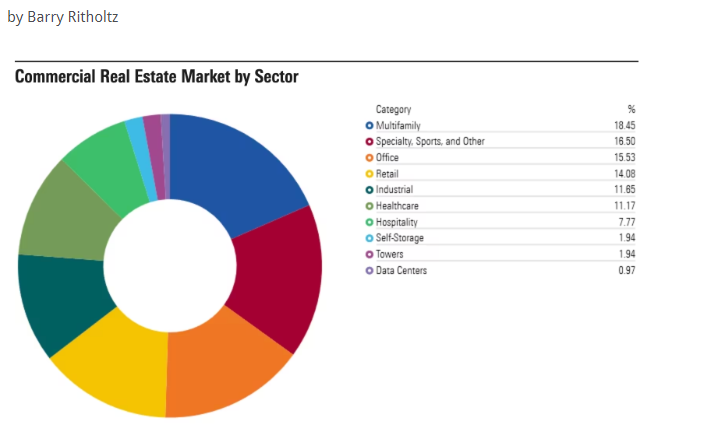

8. Commercial Real Estate Sub-Sector Breakdown….Office 15%

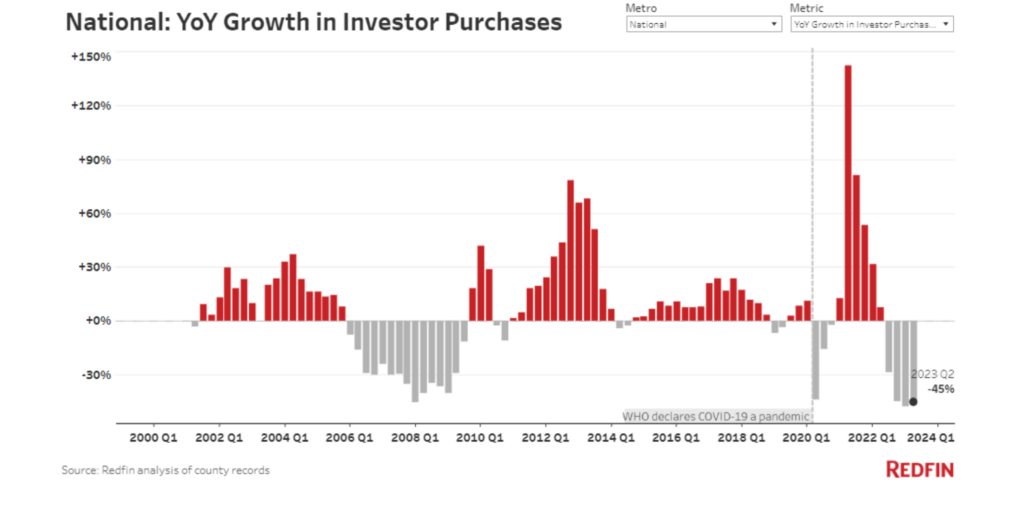

9. Investors Purchase on Homes -42%

Zerohedge Investors bought a total of $36.4 billion worth of homes in the second quarter, down 42% from a year earlier. That’s still above pre-pandemic levels, but dropping closer to it: Investors bought a total of $34 billion in the second quarter of 2018, and a total of $31.9 billion in the second quarter of 2019. The typical home purchased by investors in the second quarter cost $470,120, comparable with the $467,885 median price a year earlier.

In terms of market share, investors bought 15.6% of homes that were sold in the U.S. during the second quarter, down from 19.7% a year earlier and a record high of 20.4% in the beginning of 2022.

And while investors’ market share is still above pre-pandemic levels (15.6% compared with roughly 14% in the second quarters of both 2018 and 2019), real estate investors are steadily pulling back.Their market share has dropped or remained flat every quarter since it peaked at the start of 2022.

10. The Dangers of Overthinking-Psychology Today

Overthinking can paralyse decision-making and cost your career- Eva M. Krockow Ph.D.

KEY POINTS

- Overthinking simple decisions can lead to analysis paralysis and prevent us from making a choice altogether.

- In sports, overthinking can result in athletes experiencing the yips, a sudden loss of skill.

- The yips are a psychological phenomenon, which is surprisingly difficult to overcome and can cost careers.

Ever heard of Buridan’s ass? No, not that kind ofass!

I’m talking about the horse-like animal otherwise known as the donkey. More specifically, the donkey is famously stuck in a choice dilemma described by French philosopher Jean Buridan. The donkey in question faces a tricky choice. She finds herself in the middle of two identical haystacks. With both stacks equal in distance, size, and hayey goodness, the donkey has absolutely no preference for either. Deeply troubled, she looks from one haystack to the other. Which one should she choose? She supposes she might be able to gobble up both, but again: Which one should be first? The despairing ass finds herself trapped in an impossible conundrum. Hours and days pass by, until she suffers the tragic consequences of her indecision, eventually succumbing to starvation.

What do you make of this little tale? Fair enough, it’s hard to feel sorry for a donkey who starves to death with perfectly good food in plain sight. Indeed, the entire story seems somewhat far-fetched. After all, when do we ever find ourselves presented with completely identical options? And isn’t it obvious that a random choice is always preferable to starvation? Also, if the dilemma is too tough to resolve, couldn’t the ass just walk away and find herself a third haystack to munch on?

Analysis paralysis

It’s easy to discount Buridan’s ass as just another philosophical thought experiment with little real-life relevance. But hold your horses (or donkeys) and wait until you write it off completely! The starving ass offers an important lesson for human decision-making that’s often overlooked: Overthinking your choices can have dangerous consequences.

By obsessively weighing up similar or near-identical options, we stand very little to gain. After all, the outcomes are likely to be almost the same. However, the lengthy decision process may lead to unnecessary delays or even prevent us from making a choice altogether—often at a significant personal detriment. Umming and erring over which outfit to buy may mean you wear the same old clothes forever. Not being able to choose between two parties may leave you spending the evening at home alone. Struggling to commit to one of two lovers may mean you lose them both.

This phenomenon of indecision, often referred to as analysis paralysis, may be linked to perfectionist attitudes and the desire to identify the very best option, which I discussed in a recent post on satisficing. Additionally, it can be worsened by the availability of too many options, resulting in choice overload that leaves you feeling overwhelmed.

Overthinking in sports

Interestingly, the tendency to overthink choices and actions can even interfere with trained intuition and experience. A striking example of this comes from the context of competitive sports such as golf, tennis, or cricket, where skilled athletes sometimes report the sudden loss of skills acquired during years of practice. The phenomenon is commonly referred to as the “yips”, “choking,” or the “twisties” depending on the context, and research suggests it may be linked to heightened levels of anxiety, self-conscious overthinking, and perfectionism. By trying to consciously master certain movements or actions, athletes affected by the yips may end up bypassing their muscle memory and fail to perform to the standard they are used to.

Researchers have tried to understand the bizarre phenomenon through qualitative studies. One project involved interviewing competitive cricket players who had suffered the yips, and identifying common themes associated with their symptoms. Extreme anxiety and panic were reported frequently, with one interviewee explaining: “I felt very nervous and out of control—I know it sounds stupid but it was like I’d been taken over, I just couldn’t do it.” Trying to compensate for their nerves, it appeared that the affected cricketers tried to overthink and control their subsequent movements. This strategy was rarely followed by success, as illustrated by the following comment: “I was telling myself when to let it go [the ball] because I realized I was not letting the ball go at the right time, so I was saying to myself “let it go” and, of course, you can’t say that because by the time you’ve said that your arm is down on the ground.”

Sudden, cruel, and often difficult to overcome, the yips have ruined entire careers, for example, forcing gymnast Simone Biles to withdraw from the Olympics and Stephen Hendry to abandon his previously skyrocketing career in snooker.

Researchers, sports psychologists, and athletes agree that it’s hard to understand “the yips” if you haven’t experienced them yourself. If you’re struggling to understand the concept of overthinking, I leave you to ponder the following little poem:

The Centipede’s Dilemma

Katherine Craster

A centipede was happy – quite!

Until a toad in fun

Said, “Pray, which leg moves after which?”

This raised her doubts to such a pitch,

She fell exhausted in the ditch

Not knowing how to run.

https://www.psychologytoday.com/us/blog/stretching-theory/202308/the-dangers-of-overthinking