1. Euro Currency Spike

1 Year Chart—Euro +5.5% vs. U.S. Dollar -6%

2. G4 Central Banks 31% YTD Increase in Balance Sheets….Gold vs. Balance Sheets.

State Street

One of the most notable actions taken by central banks has been the significant expansion of their balance sheets through debt and other asset purchases to spur market liquidity. G4 central banks alone have seen a 31% year–to-date increase of their balance sheets to $20 trillion as of May 31, 2020.

Maxwell Gold, CFA, Head of Gold Strategy

3. S&P 500 Value Falls Into Historical Abyss.

Topdown Charts

Topdown ChartsFollow

Whether you look at it on a price-only basis, or total return basis, Value stocks have been in a major relative bear market (vs Growth). But what’s behind this, and what will the next 10 years look like? (…and what are the catalysts to watch for?)

Check out this video for a walk-through of some key charts on this topic: https://lnkd.in/d8rDut8

4. Pimco Stock Valuation Method.

Pimco

5. China Consumer ETF 70% Off Lows.

6. 1 in 5 corporations say China has stolen their IP within the last year: CNBC CFO survey

PUBLISHED FRI, MAR 1 20195:00 AM ESTUPDATED FRI, MAR 1 201910:21 AM EST

KEY POINTS

- Theft of intellectual property by Chinese companies is a major point of contention between the Trump administration and Chinese government.

- Just under one-third of CFOs of North America-based companies on the CNBC Global CFO Council say Chinese firms have stolen from them at some point during the past decade.

- U.S. trade policy remains a negative for businesses around the world, but right now European CFOs are expressing the biggest concerns about trade policy as an external risk factor.

Global CFOs worrying less about trade policy

As President Donald Trump says his administration is moving closer to a trade deal with China, one of the major sticking points has been China’s disregard of intellectual property protections and claims dating back years about rampant Chinese theft of corporate trade secrets. The allegations are not hyperbole.

One in five North American-based corporations on the CNBC Global CFO Council says Chinese companies have stolen their intellectual property within the last year. In all, 7 of the 23 companies surveyed say that Chinese firms have stolen from them over the past decade.

As the Trump administration works on a trade deal with China and hundreds of billions in potential tariffs loom if a deal can’t be reached — Trump has delayed the tariffs scheduled for Mar. 1 based on “significant progress” he said is being made — the issue of IP theft has been a huge sticking point.

The CNBC Global CFO Council represents some of the largest public and private companies in the world, collectively managing nearly $5 trillion in market value across a wide variety of sectors. The survey was conducted between Feb. 7 and Feb. 22 among 54 members of the council located across the globe, including the subset of North America-based chief financial officers.

Hardline Trump U.S. Trade Representative Robert Lighthizer said on Wednesdayin testimony on Capitol Hill that a deal with China must not only include more Chinese purchases of U.S. products but enforcement. There have been recent reports that Lighthizer is unhappy with Trump’s willingness to make a deal with the Chinese without extracting strong enough terms. White House officials have downplayed the reported tensions.

“We can compete with anyone in the world, but we must have rule, enforced rules, that make sure market outcomes and not state capitalism and technology theft determine winners,” Lighthizer said in testimony to the House Ways and Means Committee on Wednesday.

“Let me be clear,” Lighthizer testified. “Much still needs to be done both before an agreement is reached and, more importantly, after it is reached, if one is reached.”

After the December G20 meeting in Buenos Aires, Argentina, China took a step that conservative think tank American Enterprise Institute — which for years has been sounding alarms about IP theft by China — described as significant, when the Chinese government issued a memo that set out some 38 punishments for IP violators, including denial of access to government funding.

“The mere publication of the memo (which explicitly referred to American complaints) was an important concession: Until quite recently the Chinese government had officially denied that significant IP theft occurred in China,” AEI’s Claude Barfield wrote in a blog post. But the issues are complicated by, among other things, blurred lines between cyber espionage committed by the Chinese government against corporate and military targets and the passing on of those secrets to Chinese companies.

How Chinese Officials Hijacked My Company

A joint venture applied to Beijing for patents on 510 of my designs, without notifying or crediting me.

By Steve Saleen

The official experience center of Saleen in Shanghai on December 4, 2019.

PHOTO: WANG GANG/ZUMA PRESS

President Trump said last month that talks for a phase 2 trade agreement with China were on the back burner. If they resume, it is more important than ever that any deal protect American companies and their intellectual property from theft by China. My experience doing business in China shows the lengths to which the Chinese government will go to steal American intellectual property.

My story began in 2016, when I entered a joint venture with the government of Rugao, a city in Jiangsu province with a population of 1.4 million. Rugao needed expertise to start an automotive manufacturing company that would create jobs.

I would bring experience, design, engineering and related technologies developed over my 40-year career in the automotive industry building race cars and high-performance street cars. My contributions to the deal were valued at $800 million, and I would maintain a majority stake in the new company along with my American partners. Rugao would bring $500 million in capital and $600 million in subsidized loans over three years to fund manufacturing sites and operations, and receive a minority stake.

The deal was a sham. It was a trap designed to secure my intellectual property, then use intimidation tactics and lies to nullify the agreement and seize control.

The first few years of the venture, named Jiangsu Saleen Automotive Technologies, were relatively smooth. I contributed three well-designed, well-engineered vehicles, hired staff, set up supply chains and launched marketing. The Rugao government contributed some of the promised capital, but nowhere near the amount needed to get operations up and running at scale.

I would later find out that while I was busy fulfilling my end of the bargain, the joint venture applied for 510 Chinese patents for my designs, technologies, trade secrets and engineering developments. Most of the patent filings didn’t even list me as the inventor. With many of these Chinese patents approved, Rugao was ready to take over the joint venture and steal the intellectual property.

Rugao is now claiming the initial valuation of my contributions was based on false information. But the city government itself requested, verified and accepted the valuation, picking at the outset three separate firms to conduct independent appraisals. The government never contested any of what these reviews found. In the past three months, Rugao has demanded the valuation companies say their findings were based on false information.

7. What a Microsoft deal to buy TikTok would look like

Mike Allen, Dan Primack President Trump, who said Friday night that he’ll ban TikTok, may allow Microsoft to buy the app’s U.S. operations if there’s “complete separation” from the original Beijing-based company, Republican sources tell Axios.

What’s new: Conversations with Republicans over the weekend suggest a possible blueprint for making the proposed Microsoft deal palatable to the White House.

- Microsoft promises a complete break from the Chinese parent company, ByteDance — not just data and servers, but also software.

- What’s essential is there can be no lingering connection of any kind to ByteDance or non-U.S. TikTok.

Trump “has a deal on his desk” whereby Microsoft would lead an acquisition of 100% of the U.S. operations of TikTok, Axios’ Dan Primack reported yesterday.

- Microsoft seems to believe total separation from ByteDance is attainable.

- Microsoft has the technical know-how/capabilities, money and global government relationships to pull this off.

Context: Presidents normally can’t just order a ban on individual companies. But TikTok’s foreign ownership gives the Treasury Department’s Committee on Foreign Investment in the United States broad authority over it.

The bottom line: Look for the above formula to be theminimum.

- People who have discussed the issue with Trump think he’d be fine with a simple ban.

Primack’s thought bubble: Trump likely has a binary choice on TikTok: Shut it down, thus risking the ire of 100 million U.S. users just months from an election, or let Microsoft buy it.

https://www.axios.com/authors/newsdesk

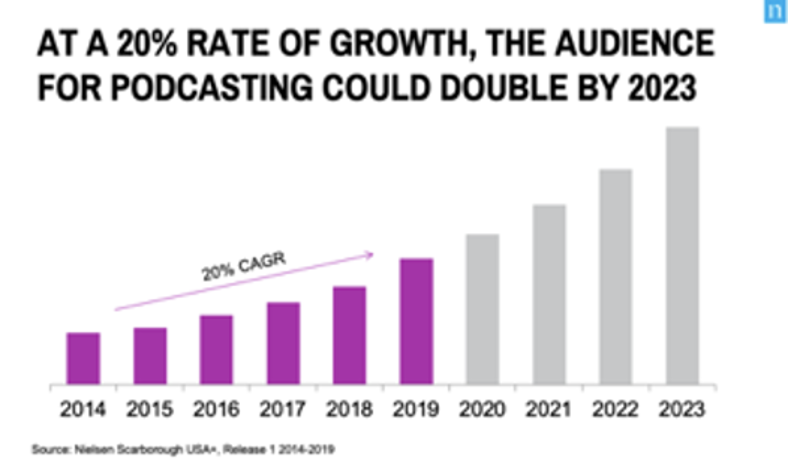

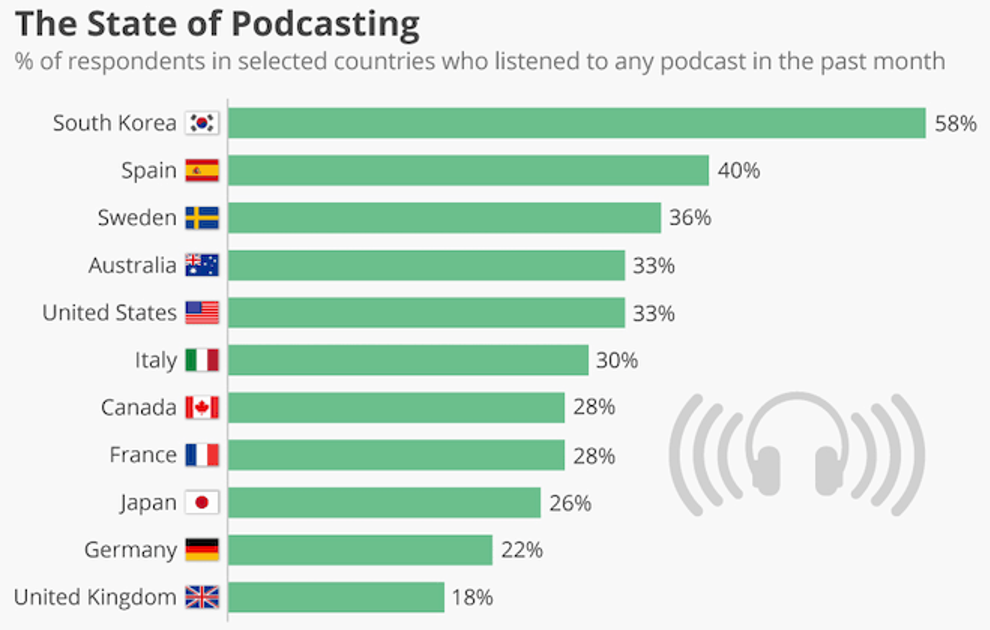

8. Podcast Growth…20% Per Year CAGR.

https://www.mediavillage.com/article/podcast-content-is-growing-audio-engagement/print/

2020 Podcast Stats & Facts (New Research From Apr 2020)

Credit: Statista The State of Podcasting

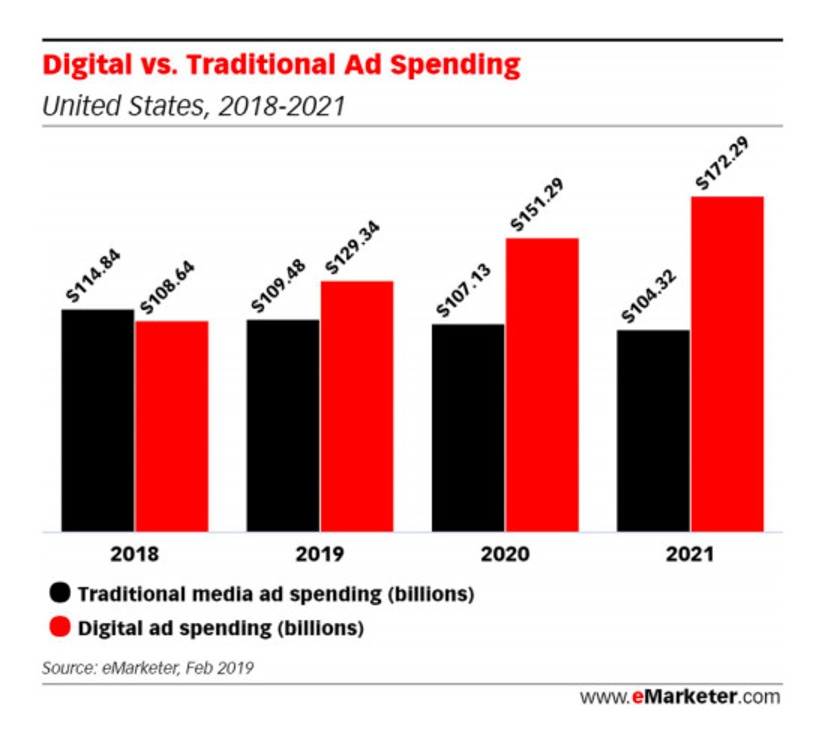

9. This Was Pre-Covid Predicted Growth in Digital Vs. Traditional Ad Spending….

10. Evidence-Based Suggestions to Help Prevent Alzheimer’s Disease

A sweeping review indicates that lifestyle factors are important.

One in ten Americans older than 65 develops Alzheimer’s disease. While there are medications available to treat the symptoms of Alzheimer’s disease and dementia, there are no treatments to cure the disease or slow its progression.

But a new systematic review from researchers at the University of Shanghai Medical College outlines steps that everyone can take to help prevent Alzheimer’s disease and dementia.

The review, published in the Journal of Neurology,NeurosurgeryandPsychiatry, combines the data from 396 different studies in a large meta-analysis that identifies the lifestyle factors throughout the life course that seem to contribute to or help to prevent Alzheimer’s disease.

The authors conducted meta-analyses for 134 different risk factors. They note that the studies they reviewed have limitations: For example, they included observational studies, which cannot prove that a particular factor associated with greater risk necessarily causes the increase in risk. But they ultimately provide a total of 21 suggestions, based on the available evidence to date, for helping to prevent Alzheimer’s disease. Among the suggestions are:

- Older adults should maintain or lose weight to achieve a healthy body mass index; they should not let their BMI fall below healthy levels.

- Everyone, and especially those older than 65, should participate in regular physical activity.

- Engage in mentally stimulating activities such as reading, puzzles, and games.

- Do not smoke and avoid being in smoky environments.

- Get enough good quality sleep and seek treatment for sleep problems.

- Avoid diabetes. If you develop diabetes, maintain careful control of your blood sugar levels.

- Cerebral vessel disease, or CVD, is a risk factor. Engage in a healthy lifestyle to avoid this disease and take the necessary medications if you develop it.

- Protect your head from injury.

- Avoid frailty by focusing on muscle strength later in life.

- Maintain a healthy lifestyle to avoid high blood pressure and take medications to control high blood pressure if needed.

- Depression is a risk factor. If you experience a mental health condition, seek treatment.

- Atrial fibrillation is a risk factor. The best way to avoid it is to maintain good cardiovascular health. If you experience atrial fibrillation, take the required medications.

- Relax your mind and avoid daily stress.

- Receive as much education as possible in early life.

- Have a regular blood test to check your homocysteine level. If levels rise, consider vitamin B and/or folic acid supplements.

- Make sure your diet includes plenty of Vitamin C or take a Vitamin C supplement.

In addition, two new studies presented this week at the Alzheimer Association’s International Conference provide evidence that getting at least one flu vaccination was associated with a 17 percent reduction in developing Alzheimer’s disease, and more frequent flu vaccinations were associated with even greater reductions. For study participants between ages 65 and 75, receiving the pneumonia vaccine corresponded with a reduction in Alzheimer’s risk by up to 40 percent. The studies also revealed that people with dementia are twice as likely to die after contracting an infection such as the flu or pneumonia.

The take home message: Alzheimer’s disease can feel like something that is completely out of our own control. But evidence demonstrates that leading a healthy lifestyle and addressing any health problems that do arise may reduce your risk of developing Alzheimer’s disease.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.