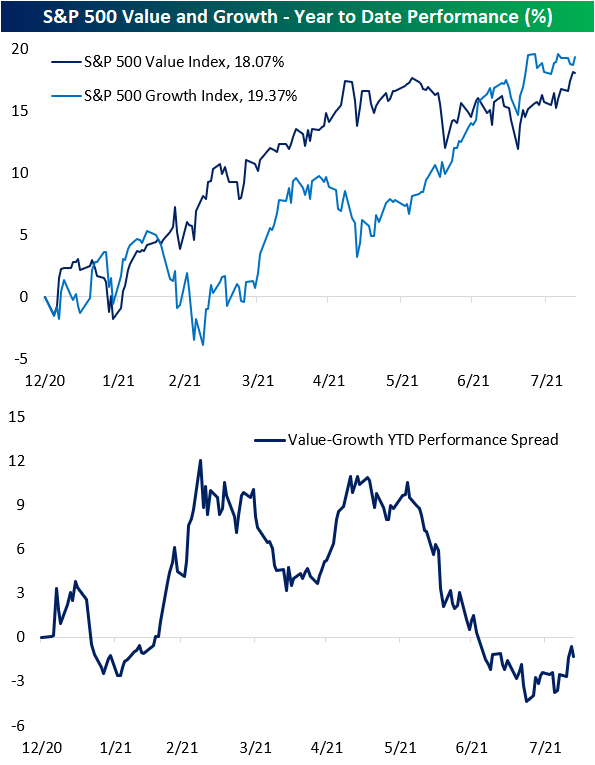

1. Value Catching Back Up to Growth

Bespoke Blog-Up until the early summer, value stocks had consistently outperformed growth on a year-to-date basis. But once markets came back from the Fourth of July holiday, S&P 500 growth stocks had overtaken value in terms of year-to-date performance. While the two groups have generally trended higher together since then, in the past week (save for yesterday), the two have diverged as value has rallied and growth has seen a minor pullback. As a result, there is only a 1.3 percentage point difference between the two factor’s YTD performance.

Taking a look at the longer term relative performance of value and growth, the past year’s stint of value outperformance has pretty much been a blip on the radar. As shown below, since the mid-2000s the ratio of value to growth has been in a consistent downtrend (meaning growth outperforms value) that accelerated early on in the pandemic. As could be expected with such dramatic outperformance of growth, the ratio of the two bottomed in the early fall of last year and regained some ground before peaking this past spring. Since then, the ratio of the two has been making a move back down to its lows. Click here to view Bespoke’s premium membership options.

https://www.bespokepremium.com/interactive/posts/think-big-blog/value-catching-back-up-to-growth

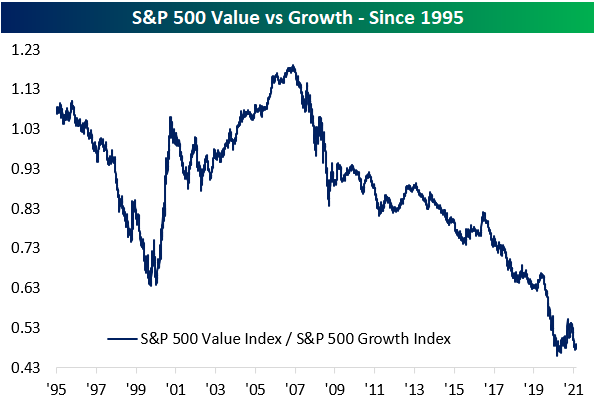

2.Still a Short Squeeze Happening in Bonds….

From Dave Lutz at Jones Trading

Nordea-The situation hasn’t been made any easier by positioning in the US bond market being very short. Since early June we have noted that the shortness comes from three different sources: i) in broader asset allocation terms investors are long equities and thus automatically short bonds, ii) bond investors have since long been positioned for steeper yield curves and iii) bond portfolios have since late May also gone outright short in duration.

https://corporate.nordea.com/article/67183/week-ahead-peak-growth-and-inflation-so-what

3.BABA -40% from Highs.

BABA facing new pressure closes below 200 day moving average…closing in on 2020 lows.

©1999-2021 StockCharts.com All Rights Reserved

www.stockcharts.com

4.Climate Change ETF Outperforming….Krane Shares Global Carbon ETF +84% Since Launch

This ETF Will Benefit From Climate-Change Regulations-Barrons-By

Evie Liu

The $579 million KraneShares Global Carbon ETF (ticker: KRBN), which launched a year ago, holds the most-traded carbon-credits futures contracts on major markets in Europe and the U.S. The fund has soared 84% since it started trading, currently reflecting a weighted carbon price of $37 per ton of carbon dioxide.

5.Utilities Traditional Negative Correlation to Treasury ETF is Reversed.

ETF (XLU) had a correlation of -0.39% with the Treasury ETF in the five years before the stock market hit its prepandemic peak on Feb. 18, 2020. Since then, its correlation is 0.24%. (A positive correlation means that two assets tend to move in the same direction; a negative one means they tend to move in opposite directions.)

Utilities: Why the Power Play May Be Ending· By Ben Levisohn

https://www.barrons.com/articles/dow-stock-market-sp-500-51628901659?mod=past_editions

This chart compares the XLU Utility ETF to SPY S&P

©1999-2021 StockCharts.com All Rights Reserved

www.stockcharts.com

6.Coffee Futures Spike….Higher Prices on Morning Brew Coming.

Price of coffee futures

Source: FactSet

By The New York Times

NY Times By Coral Murphy Marcos

https://www.nytimes.com/2021/08/12/business/coffee-prices-higher.html

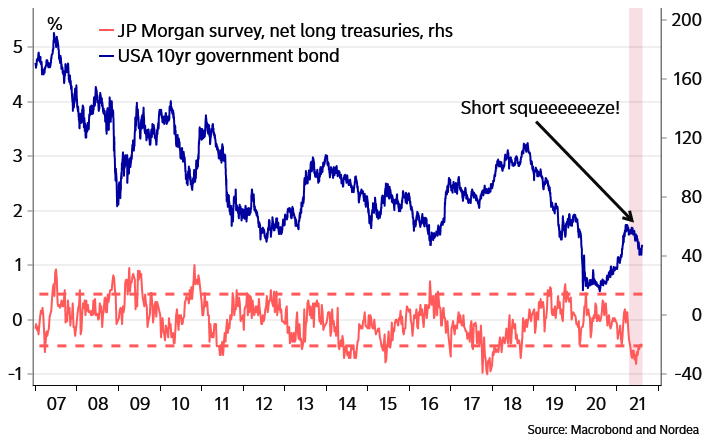

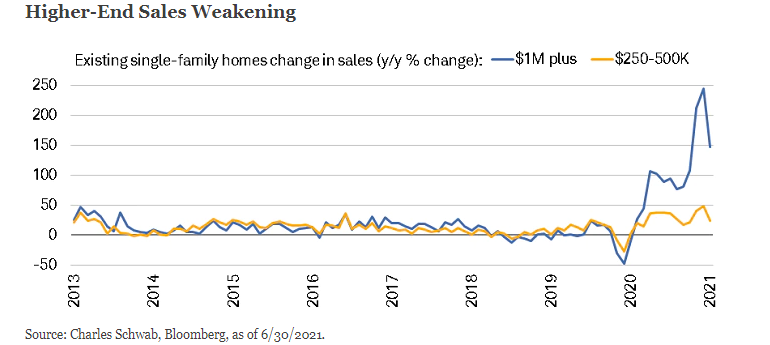

7.High Prices Slowing Home Sales.

Schwab-Liz Ann Sonders

Source: Charles Schwab, Bloomberg, as of 6/30/2021.

https://www.linkedin.com/in/liz-ann-sonders-57a65619/

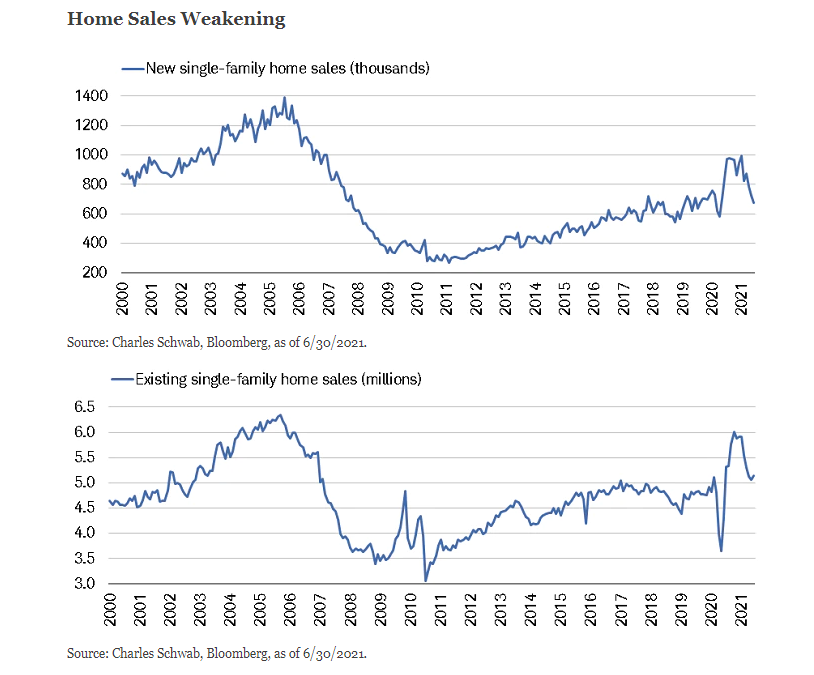

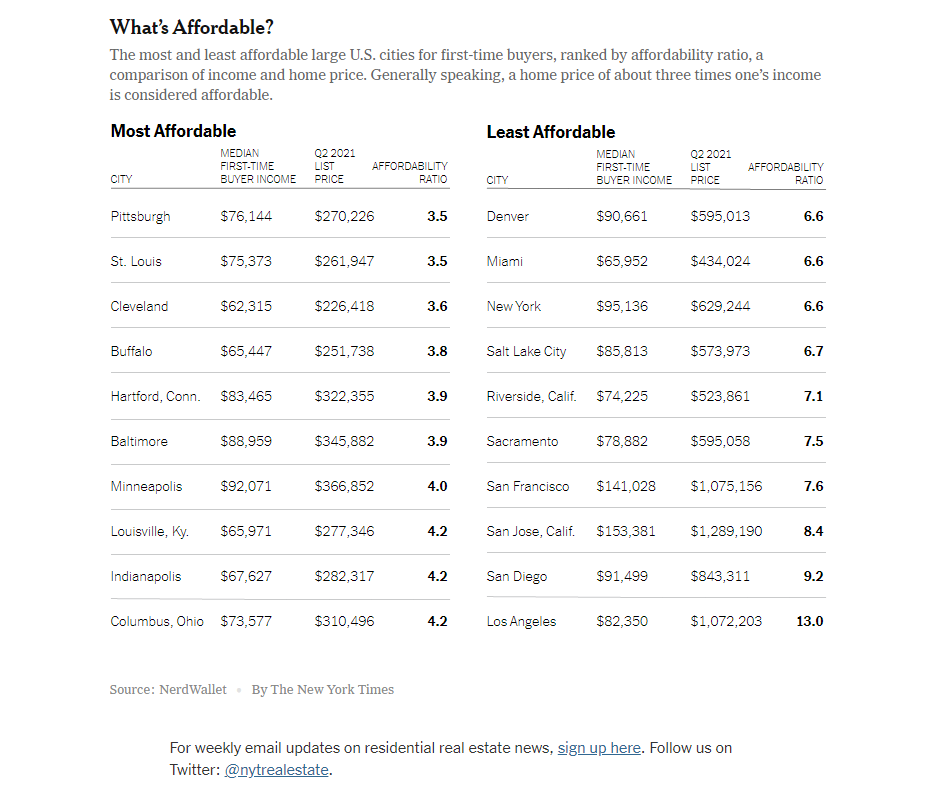

8.First-Time Home Buyers Struggle

A study reveals that home prices in the 50 largest U.S. cities present a major challenge to inexperienced buyers.

The cutthroat home market has frustrated buyers across the country, with many submitting multiple offers only to be outbid again and again. Low inventory, high prices and intense competition are challenging for any buyer, but first-timer buyers are facing the highest hurdles.

Their problems finding a home are not defined entirely by this wild pandemic market. First-time buyers have built-in challenges. Consider their financial picture: Generally younger, they lack a deep credit history, which could mean lower credit scores. Their employment history is shorter and their income is typically lower than that of older, more established bidders. First-timers also have had less time to save for a deposit and an emergency fund. All of this leaves them less competitive in bidding wars, less likely to secure a loan, and less appealing to sellers.

The pandemic has magnified those challenges, according to NerdWallet’s First-Time Home Buyer Metro Affordability Report, which examined the state of the market for this cohort in the 50 largest U.S. cities during the second quarter of 2021.

During that period, the number of available listings actually improved from Q1 by 2 percent in those 50 cities, but fell 5 percent across the nation. In prepandemic years, larger first- to second-quarter upticks in listings were the norm. (In 2018 they were up 10 percent; in 2019, 6 percent.) A better comparison may be year over year: Measured that way, Q2 inventory is down 48 percent from Q2 2020.

But it’s the rising prices (the result of shrinking supply and swelling competition) that have really hurt first-timers. A general formula used to determine affordability multiplies income by three — so if you earn $100,000, you can probably qualify to buy a $300,000 home. But in the 50 cities studied, list prices were, on average, 5.5 times the local median income of first-time buyers, leaving most homes out of reach.

This week’s chart, using data from NerdWallet’s study, shows the 10 most affordable and 10 least affordable cities for first-timer buyers among those 50 cities, ranked by using the affordability ratio in each city.

What’s Affordable?

https://www.nytimes.com/2021/08/12/realestate/first-time-home-buyers-struggle.html

9. Bernard Baruch’s Investing Rule

Novel Investor Blog-Baruch would reiterate this lesson in a list of rules on how to invest. The list is pulled from the lessons he learned over a lifetime in the markets.

- Don’t speculate unless you can make it a full-time job.

- Beware of barbers, beauticians, waiters — of anyone — bringing gifts of “inside” information or “tips.”

- Before you buy a security, find out everything you can about the company, its management and competitors, its earnings and possibilities of growth.

- Don’t try to buy at the bottom and sell at the top. This can’t be done — except by liars.

- Learn how to take your losses quickly and cleanly. Don’t expect to be right all the time. If you have made a mistake, cut your losses as quickly as possible.

- Don’t buy too many different securities. Better have only a few investments which can be watched.

- Make a periodic reappraisal of all your investments to see whether changing developments have altered their prospects.

- Study your tax position to know when you can sell to greatest advantage.

- Always keep a good part of your capital in a cash reserve. Never invest all your funds.

- Don’t try to be a jack of all investments. Stick to the field you know best.

These “rules” mainly reflect two lessons that experience has taught me — that getting the facts of a situation before acting is of crucial importance, and that getting these facts is a continuous job which requires eternal vigilance.

Found at Abnormal Returns

https://abnormalreturns.com/2021/08/15/sunday-links-you-versus-your-goals/

10.It’s hard to be a moral person. Technology is making it harder.

VOX By Sigal Samuel

Digital distractions such as social media and smartphones wreak havoc on our attention spans. Could they also be making us less ethical?

By Sigal Samuel Updated Aug 3, 2021, 8:00am EDT

There’s a reason why former President Barack Obama now says that the internet and social media have created “the single biggest threat to our democracy.”

The idea of moral attention goes back at least as far as ancient Greece, where the Stoics wrote about the practice of attention (prosoché) as the cornerstone of a good spiritual life. In modern Western thought, though, ethicists didn’t focus too much on attention until a band of female philosophers came along, starting with Simone Weil.

Weil, an early 20th-century French philosopher and Christian mystic, wrote that “attention is the rarest and purest form of generosity.” She believed that to be able to properly pay attention to someone else — to become fully receptive to their situation in all its complexity — you need to first get your own self out of the way. She called this process “decreation,” and explained: “Attention consists of suspending our thought, leaving it detached, empty … ready to receive in its naked truth the object that is to penetrate it.”

Weil argued that plain old attention — the kind you use when reading novels, say, or birdwatching — is a precondition for moral attention, which is a precondition for empathy, which is a precondition for ethical action.

Later philosophers, like Iris Murdoch and Martha Nussbaum, picked up and developed Weil’s ideas. They garbed them in the language of Western philosophy; Murdoch, for example, appeals to Plato as she writes about the need for “unselfing.” But this central idea of “unselfing” or “decreation” is perhaps most reminiscent of Eastern traditions like Buddhism, which has long emphasized the importance of relinquishing our ego and training our attention so we can perceive and respond to others’ needs. It offers tools like mindfulness meditationfor doing just that.

The idea that you should practice emptying out your self to become receptive to someone else is antithetical to today’s digital technology, says Beverley McGuire, a historian of religion at the University of North Carolina Wilmington who researches moral attention.

“Decreating the self — that’s the opposite of social media,” she says, adding that Facebook, Instagram, and other platforms are all about identity construction. Users build up an aspirational version of themselves, forever adding more words, images, and videos, thickening the self into a “brand.”

What’s more, over the past decade a bevy of psychologists have conducted multiple studiesexploring how (and how often) people use social media and the way it impacts their psychological health. They’ve found that social media encourages users to compare themselves to others. This social comparison is baked into the platforms’ design. Because the Facebook algorithms bump posts up in our newsfeed that have gotten plenty of “Likes” and congratulatory comments, we end up seeing a highlight reel of our friends’ lives. They seem to be always succeeding; we feel like failures by contrast. We typically then either spend more time scrolling on Facebook in the hope that we’ll find someone worse off so we feel better, or we post our own status update emphasizing how great our lives are going. Both responses perpetuate the vicious cycle.

In other words, rather than helping us get our own selves out of the way so we can truly attend to others, these platforms encourage us to create thicker selves and to shore them up — defensively, competitively — against other selves we perceive as better off.

And what about email? What was really happening the day I got distracted from my sick friend’s Facebook post and went to look at my Gmail instead? I asked Tristan Harris, a former design ethicist at Google. He now leads the Center for Humane Technology, which aims to realign tech with humanity’s best interests, and he was part of the popular Netflix documentary The Social Dilemma.

“We’ve all been there,” he assures me. “I worked on Gmail myself, and I know how the tab changes the number in parentheses. When you see the number [go up], it’s tapping into novelty seeking — same as a slot machine. It’s making you aware of a gap in your knowledge and now you want to close it. It’s a curiosity gap.”

n a 2015 Pew Research Center survey, 89 percent of American respondents admitted that they whipped out their phone during their last social interaction. What’s more, 82 percent said it deteriorated the conversation and decreased the empathic connection they felt toward the other people they were with.

But what’s even more disconcerting is that our devices disconnect us even when we’re not using them. As the MIT sociologist Sherry Turkle, who researches technology’s adverse effects on social behavior, has noted: “Studies of conversation, both in the laboratory and in natural settings, show that when two people are talking, the mere presence of a phone on a table between them or in the periphery of their vision changes both what they talk about and the degree of connection they feel. People keep the conversation on topics where they won’t mind being interrupted. They don’t feel as invested in each other.”

https://www.vox.com/the-highlight/22585287/technology-smartphs-gmail-attention-morality

Found at The Big Picture Blog https://ritholtz.com/2021/08/weekend-reads-482/