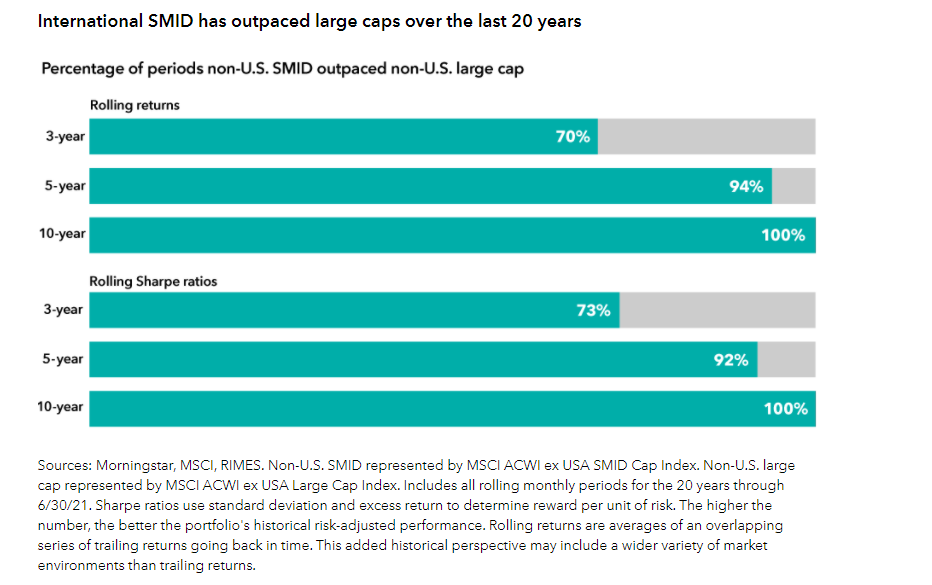

1. International Small/Mid Stocks vs. U.S. Large Cap.

American Funds Capital Group

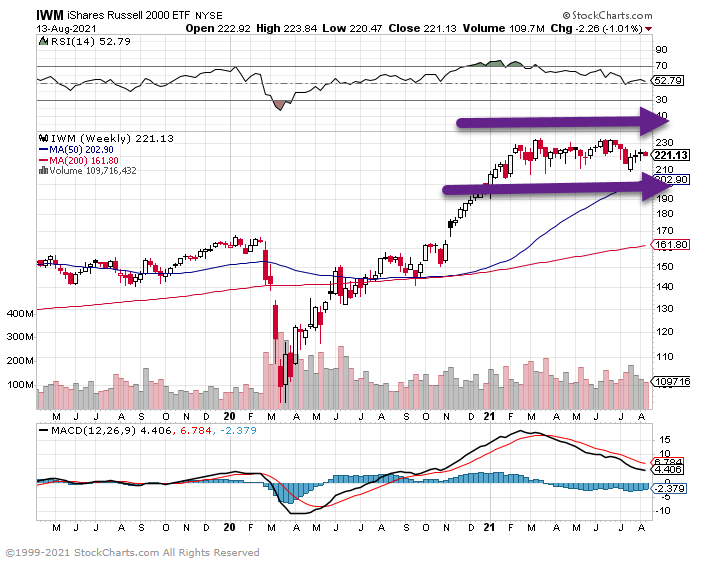

2. U.S. Small Cap…Sideways.

IWM-U.S. small cap 6 month sideways channel continues.

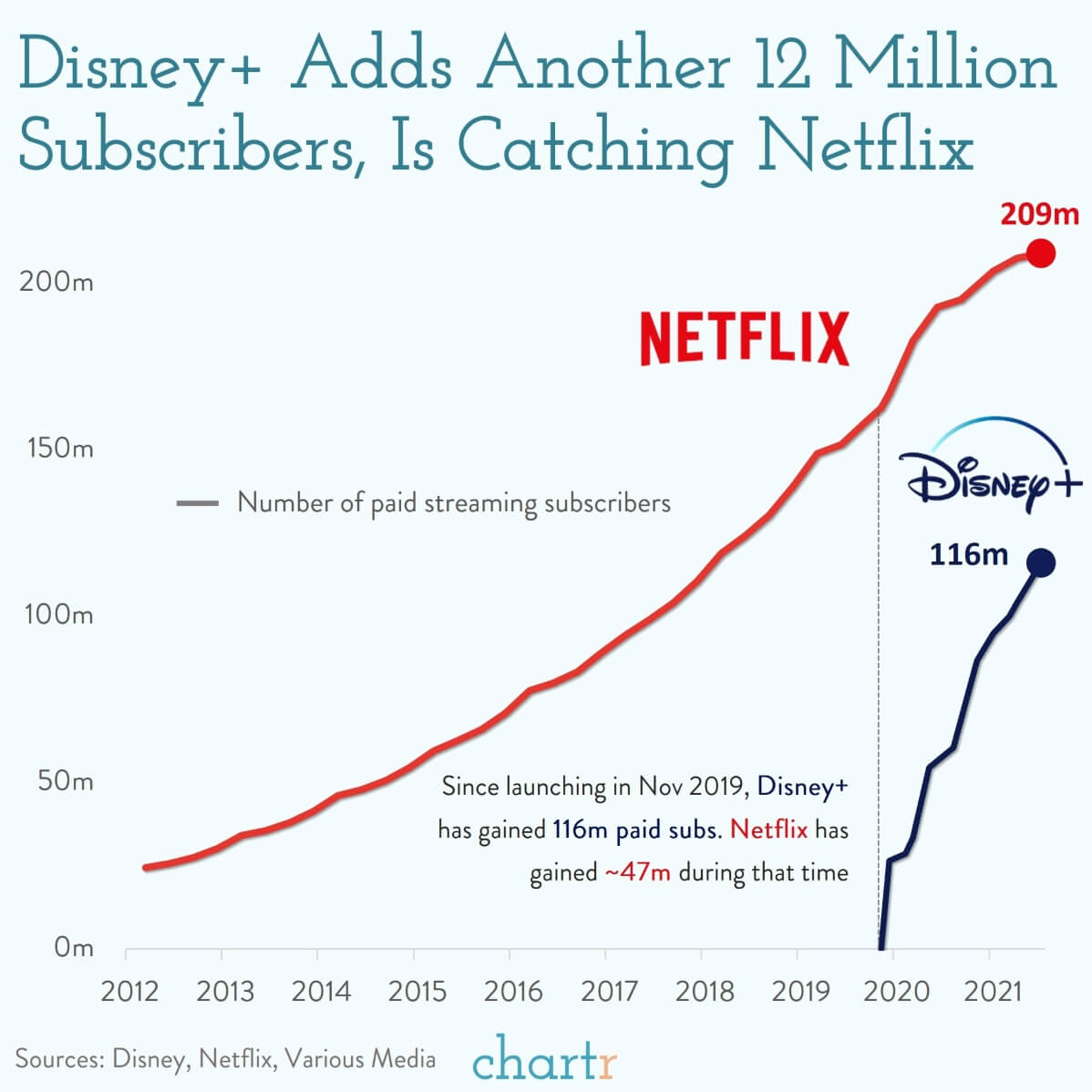

3. Disney Cuts Netflix Lead in Half.

| Disney took another big step towards catching Netflix this week, announcing that they had signed up another 12 million subscribers to streaming platform Disney+ in the most recent quarter, bringing the company to a total of 116 million. That’s still some ways off from Netflix’s 209m per our updated chart above, but it brings the gap between the two media giants subscriber bases to less than 100m. With Netflix adding just 1.5m in its most recent quarter, Disney closed the gap by about 10m. If that pace was maintained it suggests that Disney could catch and surpass Netflix’s subscriber base in less than 3 years. |

4. Winners and Losers in Dow Jones.

Nasdaq Dorsey Wright

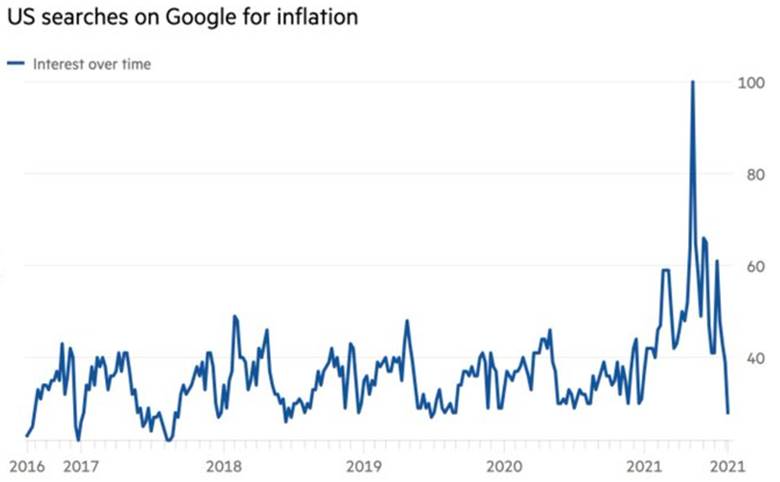

5. Google Search for “Inflation” Drops Back to 10 Year Average.

Liz Ann notes a Full round trip in GoogleTrends searches for inflation

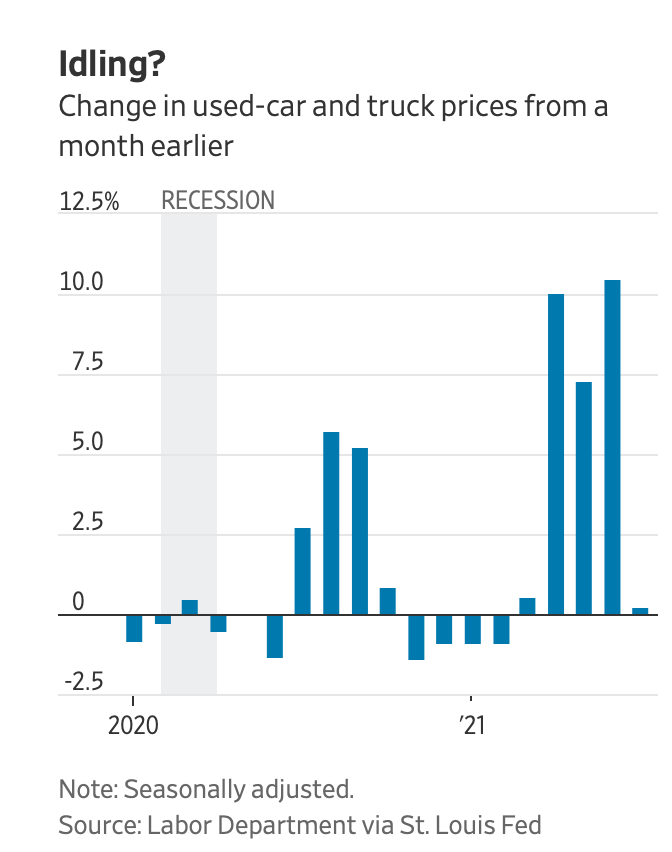

6. U.S. Used Car and Truck Prices Normalize

WSJ

https://www.wsj.com/articles/inflation-isnt-whipped-just-tamer-11628699102?mod=itp_wsj&ru=yahoo

7. Reddit is raising up to $700M in Series F funding

Brian Heater@bheater / 8:46 AM EDT•August 12, 2021

Comment

Image Credits: Omar Marques/SOPA Images/LightRocket / Getty Images

Earlier this year, Reddit raised $250 million, bringing the 16-year-old site up to around $800 million in total funding. Today, it announced plans for an even more massive windfall, with a Series F led by Fidelity. The company confirmed with TechCrunch that it has raised $410 million thus far, with plans to raise up to $700 million, putting Reddit at a $10 billion valuation.

The company says funding will go toward building out community and advertising efforts and increasing headcount.

“These efforts require us to grow our teams and make smart bets on how to make Reddit better, faster, easier to use, and more empowering for communities,” Reddit writes. “We are also evolving as a business, maturing, and building the operational structures that will help propel us into the future with transparency, values and integrity.”

As we noted back in February, an extraordinarily strange couple of years found the content aggregation service playing a key role in rollercoaster stock figures for companies like GameStop and AMC, by way of the r/WallStreetBets subreddit. It also kicked off 2021 with a short Super Bowl spot. All of that helped lead to a doubling of the company’s valuation to $6 billion.

For now, it seems, the hype train is continuing. In Q2, Reddit broke $100 million in advertising revenue for the first time, marking a 192% year-over-year increase for the quarter. The site now attracts 50 million daily visitors and hosts 100,000 active subreddits. In March, it announced Drew Vollero would be joining as the site’s first-ever CFO, after assisting with Snap’s IPO efforts four years prior.

In an interview with The New York Times, co-founder Steve Huffman notes that it hadn’t planned to raise another round so quickly, but ultimately couldn’t turn down what Fidelity was offering. He adds that the funding will also factor into Reddit’s eventual IPO plans.

“We are still planning on going public, but we don’t have a firm timeline there yet,” he told the paper. “All good companies should go public when they can.”

https://techcrunch.com/2021/08/12/reddit-is-raising-up-to-700m-in-series-f-funding/?guccounter=1

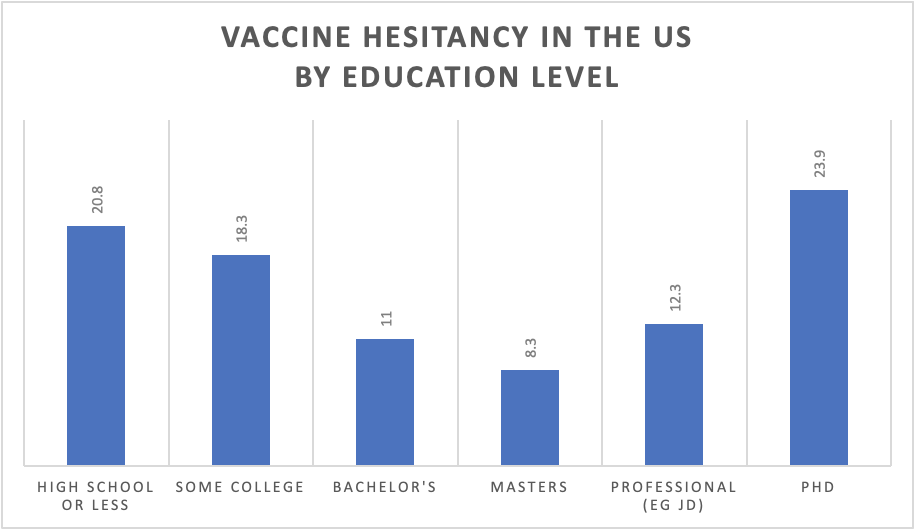

8. The most vaccine-hesitant group of all? PhDs

A new study found that the most educated are the least likely to get jabbed

The percentage of each education group that is somewhat vaccine hesitant. Source: Carnegie Mellon University

There has been much debate over how to get the unvaccinated to get their jabs — shame them, bribe them persuade them, or treat them as victims of mis- and disinformation campaigns — but who, exactly, are these people?

Most of the coverage would have you believe that the surge in cases is primarily down to less educated, ‘brainwashed’ Trump supporters who don’t want to take the vaccine. This may be partially true: the areas in which the delta variant is surging coincide with the sections of red America in which vaccination rates are lowest.

But according to a new paper by researchers from Carnegie Mellon Universityand the University of Pittsburgh, this does not paint the full picture. The researchers analysed more than 5 million survey responses by a range of different demographic details, and classed those people who would “probably” or “definitely” not choose to get vaccinated as “vaccine hesitant.”

In some respects the findings are as predicted — for example the paper finds that there is a strong correlation between counties with higher Trump support in the 2020 presidential election and higher hesitancy in the period January 2021 — May 2021.

But more surprising is the breakdown in vaccine hesitancy by level of education. It finds that the association between hesitancy and education level follows a U-shaped curve with the highest hesitancy among those least and most educated. People with a master’s degree had the least hesitancy, and the highest hesitancy was among those holding a Ph.D.

What’s more, the paper found that in the first five months of 2021, the largest decrease in hesitancy was among the least educated — those with a high school education or less. Meanwhile, hesitancy held constant in the most educated group; by May, those with Ph.Ds were the most hesitant group.

So not only are the most educated people most sceptical of taking the Covid vaccine, they are also the least likely the change their minds about it…

https://unherd.com/thepost/the-most-vaccine-hesitant-education-group-of-all-phds/

9. Taliban-The World’s Biggest Drug Cartel.

The “world’s biggest cartel” is getting bigger

Even insurgents need capital to fuel their ventures, and the Taliban’s biggest source of revenue is the drug trade. The organization made $416 million trafficking opium, heroin, and increasingly meth in fiscal year 2020, per the Conversation.

And in the Afghan countryside now under Taliban control, opium poppies are in perpetual superbloom. Afghanistan is the world’s biggest producer of opium, which most heroin is derived from: 84% of all the world’s opium was sourced from the country from 2015–20, per the UN’s World Drug Report.

- The Taliban has also started peddling meth recently. And ephedra, a plant used to make methamphetamine, grows natively in Afghanistan.

But the Taliban didn’t just beef up its drug supply. It also took over international crossing points to ramp up distribution, gaining access to Tajikistan, Uzbekistan, Turkmenistan, Iran, and Pakistan. From those countries, drugs can be shipped to the rest of the world.

Bottom line: The Taliban’s power grab likely means more heroin and meth will be pushed into the hands of dealers and users around the world.

https://www.morningbrew.com/daily

The Taliban are megarich – here’s where they get the money they use to wage war in Afghanistan

Author

Education and Outreach Program Coordinator, University of Nebraska Omaha

The Taliban militants of Afghanistan have grown richer and more powerful since their fundamentalist Islamic regime was toppled by U.S. forces in 2001.

In the fiscal year that ended in March 2020, the Taliban reportedly brought in US$1.6 billion, according to Mullah Yaqoob, son of the late Taliban spiritual leader Mullah Mohammad Omar, who revealed the Taliban’s income sources in a confidential report commissioned by NATO and later obtained by Radio Free Europe/Radio Liberty.

In comparison, the Afghan government brought in $5.55 billion during the same period.

I study the Taliban’s finances as an economic policy analyst at the Center for Afghanistan Studies. Here’s where their money comes from.

1. Drugs – $416 million

Afghanistan accounted for approximately 84% of global opium production over the five years ending in 2020, according to the United Nation’s World Drug Report 2020.

Much of those illicit drug profits go to the Taliban, which manage opium in areas under their control. The group imposes a 10% tax on every link in the drug production chain, according to a 2008 report from the Afghanistan Research and Evaluation Unit, an independent research organization in Kabul. That includes the Afghan farmers who cultivate poppy, the main ingredient in opium, the labs that convert it into a drug and the traders who move the final product out of country.

2. Mining – $400 million to $464 million

Mining iron ore, marble, copper, gold, zinc and other metals and rare-earth minerals in mountainous Afghanistan is an increasingly lucrative business for the Taliban. Both small-scale mineral-extraction operations and big Afghan mining companies pay Taliban militants to allow them to keep their businesses running. Those who don’t pay have faced death threats.

According to the Taliban’s Stones and Mines Commission, or Da Dabaro Comisyoon, the group earns $400 million a year from mining. NATO estimates that figure higher, at $464 million – up from just $35 million in 2016.

3. Extortion and taxes – $160 million

Like a government, the Taliban tax people and industries in the growing swath of Afghanistan under their control. They even issue official receipts of tax payment.

“Taxed” industries include mining operations, media, telecommunications and development projects funded by international aid. Drivers are also charged for using highways in Taliban-controlled regions, and shopkeepers pay the Taliban for the right to do business.

The group also imposes a traditional Islamic form of taxation called “ushr” – which is a 10% tax on a farmer’s harvest – and “zakat,” a 2.5% wealth tax.

According to Mullah Yaqoob, tax revenues – which may also be considered extortion – bring in around $160 million annually.

Since some of those taxed are poppy growers, there could be some financial overlap between tax revenue and drug revenue.

4. Charitable donations – $240 million

The Taliban receive covert financial contributions from private donors and international institutions across the globe.

Many Taliban donations are from charities and private trusts located in Persian Gulf countries, a region historically sympathetic to the group’s religious insurgency. Those donations add up to about $150 million to $200 million each year, according to the Afghanistan Center for Research and Policy Studies. These charities are on the U.S. Treasurey Department’s list of groups that finance terrorism.

Private citizens from Saudi Arabia, Pakistan, Iran and some Persian Gulf nations also help finance the Taliban, contributing another $60 million annually to the Taliban-affiliated Haqqani Network, according to American counterterrorism agencies.

5. Exports – $240 million

In part to launder illicit money, the Taliban import and export various everyday consumer goods, according to the United Nations Security Council. Known business affiliates include the multinational Noorzai Brothers Limited, which imports auto parts and sells reassembled vehicles and spare automobile parts.

The Taliban’s net income from exports is thought to be around $240 million a year. This figure includes the export of poppy and looted minerals, so there may be financial overlap with drug revenue and mining revenue.

6. Real estate – $80 million

The Taliban own real estate in Afghanistan, Pakistan and potentially other countries, according to Mullah Yaqoob and the Pakistani TV Channel SAMAA. Yaqoob told NATO annual real estate revenue is around $80 million.

7. Specific countries

According to BBC reporting, a classified CIA report estimated in 2008 that the Taliban had received $106 million from foreign sources, in particular from the Gulf states.

Today, the governments of Russia, Iran, Pakistan and Saudi Arabia are all believed to bankroll the Taliban, according to numerous U.S. and international sources. Experts say these funds could amount to as much as $500 million a year, but it is difficult to put an exact figure on this income stream.

Building a peacetime budget

For nearly 20 years, the Taliban’s great wealth has financed mayhem, destruction and death in Afghanistan. To battle its insurgency, the Afghan government also spends heavily on war, often at the expense of basic public services and economic development.

[Deep knowledge, daily. Sign up for The Conversation’s newsletter.]

A peace agreement in Afghanistan would allow the government to redirect its scarce resources. The government might also see substantial new revenue flow in from legal sectors now dominated by the Taliban, such as mining.

Stability is additionally expected to attract foreign investment in the country, helping the government end its dependence on donors like the United States and the European Union.

There are many reasons to root for peace in war-scarred Afghanistan. Its financial health is one of them.

10. How to Speak Up in a Meeting, and When to Hold Back-HBR

moodboard – Mike Watson/Getty Images

Summary. In many organizations, our leadership readiness is measured in part by our willingness to speak up in a meeting.Here are three strategies for speaking up effectively. First, prepare comments or questions before the meeting so you’re not speaking entirely off…more

I recently spent a month interviewing the group heads of a large financial services company in order to understand how their direct reports need to communicate as they move into leadership positions. Again and again, I heard the same comment: “If you are in the room for a meeting, we expect you to speak up. Don’t wait for someone to ask you.”

In many organizations, our leadership readiness is measured in part by our willingness to speak up in meetings. How we speak off the cuff can have a bigger impact on our career trajectory than our presentations or speeches, because every single day we have an opportunity to make an impact.

While much of my work focuses on women in leadership, everyone can use meetings as an opportunity to move up in their careers — and bring others with them.

Here are three strategies for speaking up effectively, followed by three warnings for when you should hold back.

Strategies for Speaking Up Effectively

- Prepare a few bullets in advance. One senior executive I worked with was deathly afraid of public speaking early in her career. In order to overcome that fear, she challenged herself to speak up at every single meeting and prepared comments or questions in advance. That executive is now a role model within her organization and is considered one of the most confident and authentic speakers in her industry. Don’t wait for inspiration to hit in the meeting; prepare in advance.

- Ask, “why you?” This is a question I recommend people ask before they craft a presentation, walk into a meeting, or even prepare for a networking event. It means, why do you care about what you do, about your organization, or about your role? Answering this question helps you connect with a sense of purpose and builds your confidence. It reminds you that you’re speaking up not to show off but because you truly care about the subject. It reminds you that your credibility doesn’t come solely from your title or years of experience but can also comes from your commitment and passion.

- Pause and breathe to build your confidence. Speaking up in a meeting takes courage. You have the ability to affect the trajectory of the conversation, potentially guiding your client towards saying yes to a deal when your colleagues have taken the meeting off track. Pausing and breathing helps center you and strengthens your voice so that when you do speak up, you speak with the full weight of your conviction. While you pause, ask yourself, “If one other person in this room has the same question, am I willing to ask on behalf of that person?” The answer should build your confidence. A client recently shared that she had used this technique to ask a question — in public — at a large conference, and her question changed the direction of the entire panel discussion, shedding light on a critical issue that the panel had been avoiding.

With that being said, sometimes it’s the person who says the least in a meeting who has the most power. Your executive presence comes from being strategic about when you speak up in addition to what you say. Here are three warnings for when you should hold back.

Warnings for When to Hold Back

- If you’re only trying to show off. We’ve all had the experience of sitting in a meeting or on a conference call that runs late, where everyone is trying to wrap up, and someone is rambling about a topic the group had already moved on from 30 minutes ago. Right before you speak up, ask yourself why you are speaking. If you are speaking up just to show how much you know, it’s better to let someone else talk or let the meeting run its natural course.

- If you are trying to empower others on your team. I had a pivotal moment in graduate school where I received feedback that I spoke up too much in class. Why was that a problem? A classmate said, “You become a crutch for others. We can’t wrestle with the question being asked because you jump in with the answer. Sometimes leadership is about letting others find their own solution.” Ten years later, that comment has stayed with me and has deeply influenced my leadership style. In the meeting, let members of your team speak up in order to build their own relationships of trust with your clients. Giving others an opportunity to speak in a meeting is one of the most powerful ways we can build their leadership skills, raise their visibility — both internally and externally — and give the client a more comprehensive sense of support from your whole team.

- If your comment would be better left for a one-on-one conversation. Senior executives consistently offer feedback on their direct reports in my training programs by saying, “They need to learn when to leave something to a one-on-one conversation.” So many difficult conversations within an organization can be mitigated by talking privately to someone — in person whenever possible — rather than addressing the issue in a group where the person will feel defensive. This applies to email as well as spoken conversation. Before speaking up or hitting “reply all,” ask yourself, “Would this be better said privately?”

Speaking up in a meeting is one of the single-most effective ways to raise your visibility and build a relationship of trust with your clients and colleagues. Practice it strategically every single day and you will have a powerful impact on your career and in your business.

Read more on Meetings or related topics Communication and Managing yourself

- Allison Shapira teaches “The Arts of Communication” at the Harvard Kennedy School and is the Founder/CEO of Global Public Speaking, a training firm that helps emerging and established leaders to speak clearly, concisely, and confidently. She is the author of the new book, Speak with Impact: How to Command the Room and Influence Others (HarperCollins Leadership).

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.