1. Dow Transports +100% Off Bottom…..Up 2000 Points 2021

Transports Huge Move

2. Utilities 15% Correction Erased

Utilities After Feb/March pullback making a run for new highs

3. Large Cap Growth Jumps Back into Leadership One Month Chart.

After giving up leadership to small cap………IVW S&P 500 Growth +8.25% vs. IWM small cap -5% One Month……13% swing one month

4. FAANG +16% in 12 Days.

theMarketEar

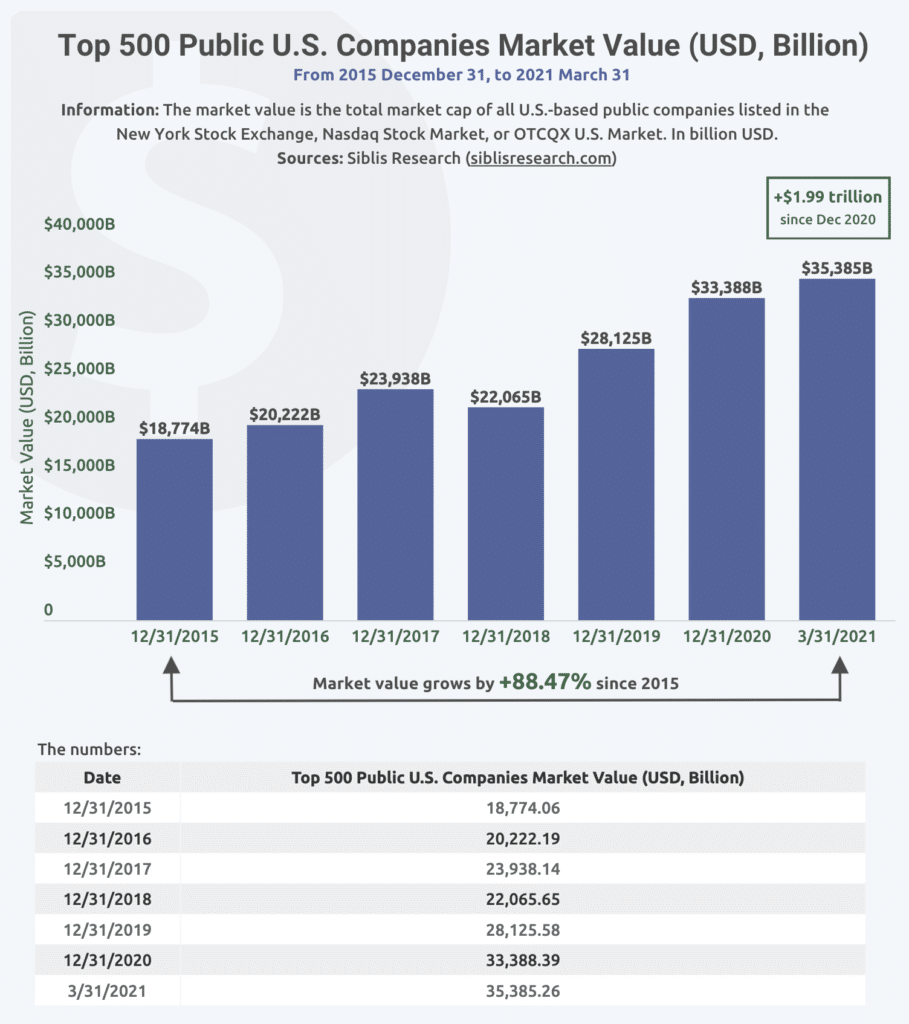

5. Top 500 Companies Add $2 Trillion in Market Cap

From Reformed Broker Blog

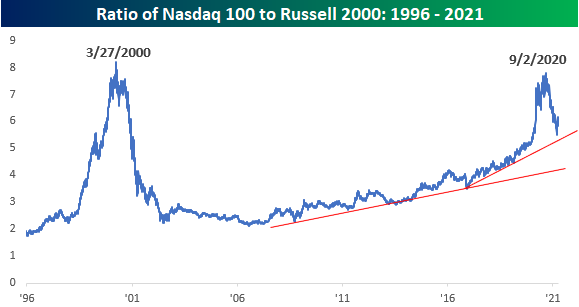

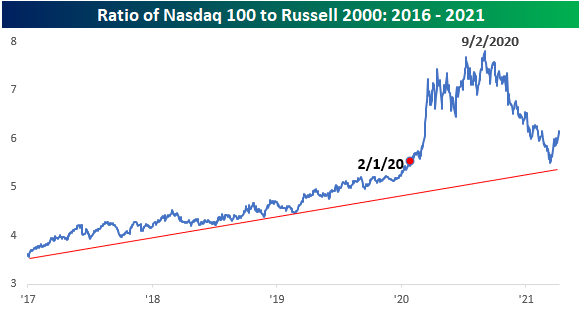

6. The Nasdaq 100 – Russell 2000 Roller Coaster Rolls On

Looking at the relationship between the largest of the large (Nasdaq 100) and the smallest of the small (Russell 2000) over the last 25 years, we can’t help but think of an old-time roller coaster with steep inclines and declines along the way. The runup of the Nasdaq 100 relative to the Russell 2000 in the late 1990s that peaked in March 2000 was nearly vertical, and the decline from that peak was just as steep. Once things bottomed out for the Nasdaq 100 in mid-2006, it embarked on a steady period of outperformance that started to accelerate in early 2016 and then really took off with the COVID outbreak in early 2020. Then in early September of last year, the Nasdaq 100’s relative strength peaked with the onset of the ‘big shift’. In the months following the Nasdaq 100’s relative peak in early September, the index saw its largest margin of underperformance relative to the Russell 2000 since the bursting of the Dot Com bubble.

The chart below takes a more detailed look at the ratio between the two indices going back to just 2017. While the Nasdaq 100’s recent underperformance relative to the Russell 2000 has been sharp, it wasn’t nearly as steep as its vertical outperformance at the onset of COVID. In recent weeks, the Nasdaq 100 has seen a sharp rebound on both an absolute and relative basis. Since March 12th, the Nasdaq 100 is up over 5% while the Russell 2000 is down over 5%. What’s noteworthy about this bounce is that it occurred just above the uptrend line from the early 2016 lows and nearly at the exact same spot as the ratio was at the start of February 2020 when the pandemic was just getting ready to explode. Click here to view

7. HYG High Yield Bond ETF Leads Inflows for the Week

Top 10 Creations (All ETFs)

| Ticker | Name | Net Flows ($,mm) | AUM ($, mm) | AUM % Change |

| HYG | iShares iBoxx USD High Yield Corporate Bond ETF | 1,458.75 | 23,049.94 | 6.33% |

| IYR | iShares U.S. Real Estate ETF | 1,246.67 | 6,064.09 | 20.56% |

| VOO | Vanguard S&P 500 ETF | 1,100.47 | 212,259.88 | 0.52% |

| VTI | Vanguard Total Stock Market ETF | 1,098.73 | 230,882.76 | 0.48% |

| IVV | iShares Core S&P 500 ETF | 1,097.20 | 270,151.71 | 0.41% |

| AGG | iShares Core U.S. Aggregate Bond ETF | 957.01 | 85,504.57 | 1.12% |

| QQQ | Invesco QQQ Trust | 935.70 | 162,097.37 | 0.58% |

| XLC | Communication Services Select Sector SPDR Fund | 663.46 | 13,976.70 | 4.75% |

| EMB | iShares JP Morgan USD Emerging Markets Bond ETF | 565.29 | 18,383.05 | 3.08% |

| XLB | Materials Select Sector SPDR Fund | 505.84 | 7,454.75 | 6.79% |

Top 10 Redemptions (All ETFs)

| Ticker | Name | Net Flows ($,mm) | AUM ($, mm) | AUM % Change |

| SPY | SPDR S&P 500 ETF Trust | -3,893.42 | 354,261.17 | -1.10% |

| LQD | iShares iBoxx USD Investment Grade Corporate Bond ETF | -2,151.10 | 39,710.16 | -5.42% |

| IWM | iShares Russell 2000 ETF | -1,535.63 | 67,861.99 | -2.26% |

| MBB | iShares MBS ETF | -552.61 | 25,828.91 | -2.14% |

| SHV | iShares Short Treasury Bond ETF | -461.94 | 15,418.51 | -3.00% |

| XLF | Financial Select Sector SPDR Fund | -421.97 | 38,936.36 | -1.08% |

| TQQQ | ProShares UltraPro QQQ | -393.17 | 11,912.95 | -3.30% |

| GLD | SPDR Gold Trust | -356.77 | 57,332.44 | -0.62% |

| USMV | iShares MSCI USA Min Vol Factor ETF | -350.26 | 28,460.98 | -1.23% |

| SMH | VanEck Vectors Semiconductor ETF | -304.45 | 5,361.07 | -5.68% |

ETF Weekly Flows By Asset Class

| Net Flows ($, mm) | AUM ($, mm) | % of AUM | |

| U.S. Equity | 6,569.03 | 3,524,101.51 | 0.19% |

| International Equity | 3,675.15 | 1,198,662.94 | 0.31% |

| U.S. Fixed Income | 3,011.49 | 982,477.05 | 0.31% |

| International Fixed Income | 1,346.51 | 131,563.67 | 1.02% |

| Commodities | -220.26 | 130,342.98 | -0.17% |

| Currency | 1.31 | 1,894.16 | 0.07% |

| Leveraged | -357.16 | 56,380.73 | -0.63% |

| Inverse | 175.67 | 11,230.49 | 1.56% |

| Asset Allocation | 94.66 | 14,818.90 | 0.64% |

| Alternatives | 60.21 | 5,896.88 | 1.02% |

| Total: |

https://www.etf.com/sections/weekly-etf-flows/weekly-etf-flows-2021-04-08-2021-04-02

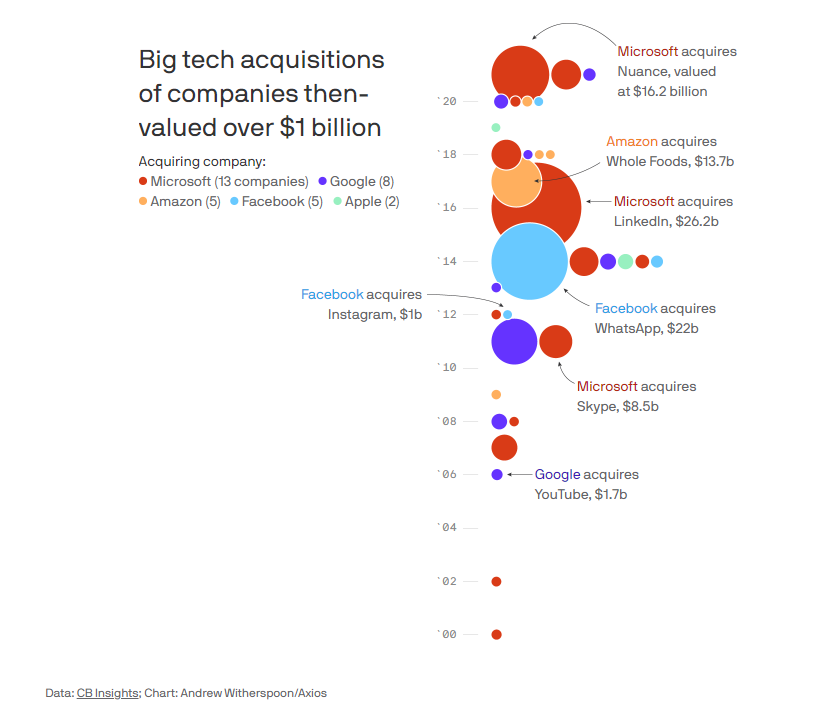

8. Microsoft looks to leapfrog Big Tech competitors with major acquisitions

Sara Fischer, author of Media Trends

Data: CB Insights; Chart: Andrew Witherspoon/Axios

Microsoft is trying to leapfrog competitors like Google and Amazon as they face record antitrust scrutiny.

The big picture: The deals Microsoft has been eyeing are larger than its usual targets and bigger than those of its competitors.

Driving the news: Microsoft announced Monday it would buy Nuance Communications, a software company that focuses on speech recognition through artificial intelligence, in an all-cash transaction valued at $19.7 billion (including debt assumption).

- This is Microsoft’s second-largest acquisition, behind the $26.2 billion deal for LinkedIn in 2016.

Microsoft tried to buy TikTok’s U.S. operations last year in a deal reportedly valued between $10 billion to $30 billion. Reports suggest it’s in advanced talks with gaming chat app Discord for a deal worth more than $10 billion.

- A report in February suggested Microsoft was eyeing a takeover of Pinterest, worth $51 billion on the public market. Last September, it bought gaming giant ZeniMax Media for $7.5 billion.

9. 19% Vaccinated

10. Nine pieces of advice I’d give to my younger self, according to a neuroscientist and business professor

Moran Cerf. Moran Cerf

- Moran Cerf is a professor of neuroscience and business at Kellogg School of Management.

- He regularly answers questions about psychology, business, and behavior via email from people who attend his talks.

- This week, he shares nine pieces of advice he’d give to his younger self to have a flourishing life and career.

- See more stories on Insider’s business page.

Q: What advice would you give to your younger self?

A: This is a loaded question with many nuances, but also one that offers a good way to reflect on things. Here are the nine pieces of advice I’d give to my younger self.

1. Invest in people — they show the highest ROI

My students often ask me, as a business professor, what is my investment recommendation. I half-jokingly say, “Lobbying, because people are cheap.” Unfortunately, this is becoming truer by the hour. If you buy someone a sandwich and accompany that with some conversation and nice comments about a picture of their kids, and then six months later call in a favor, that person typically will deliver.

Here’s the non-cynical answer: About 18% of startups fail because of disagreement and friction between the founders. The biggest financial strain on most people is their divorce, and what causes people the most stress is an unhealthy relationship. Point being, investing in finding the right people — partners in business and in life — is critical.

Easy ways to start forming relationships: Remember people’s important dates (birthday, anniversary, etc.) and call them on those dates, remember their kids’ names, listen when they speak, and ask questions about what they said.

2. Calculate the value of your time

Determine how much an hour of your time is worth at any point in your life is worth. Then decide — whenever you give up your time — whether you are OK sacrificing that amount of money.

Spending five years of your life doing one thing, be that getting a degree or having a job, in your prime years (mid-20s to mid-30s) is invaluable. You should learn to recognize the value of your time as soon as possible, as it’s one of the few assets you can’t increase.

3. Learn to quantify luck

Most of us think of luck when we want something that is unlikely to happen and it does. Similarly, we think we’re unlucky when something we don’t want to happen still happens nonetheless.

Here’s a way of quantifying luck: Freeze your life for a moment and imagine what you would give to be in the very situation you have right now if things one day turned bad.

For example, every time you drive home and speed above the limit and don’t get a ticket, think of it as a lucky moment. Then, when you do get a speeding ticket, you should divide its cost by all the other times you didn’t get a ticket although you deserved one. That’s how you can remember that you were lucky many times before and just didn’t notice it.

Want another refresher? If you’re reading these lines, it means you have a computer or a cell phone, you are literate, and are healthy enough to care about things outside of your survival. Make a mental note of that.

4. Take financial risks proportional to your age

Just as you want to diversify your investments perpetually, you want to tie your risk to your age. When you’re younger (say, in your 20s) you’re able to afford to make mistakes and try again. At this age, not trying is the biggest mistake. That person you didn’t ask out because you were shy, that call you didn’t make to a friend of your parents who was starting a business, that course you didn’t take in college because it started at 8 a.m. are critical in your 20s. They are less critical in your 50s. So make more of them when you are young.

Here’s the diversification part comes in: Put money in safe investments younger. The key to making money in the stock market is time. Not timing, time. If you’re able to wait long enough, you can make a fortune.

5. Be rebellious

This one could get you in trouble. It could also get me in trouble for advocating for it. But I’m willing to take the risk (see bullet 4).

You should train yourself to do things that stretch the boundaries as much as possible whenever you can. History suggests that pushing the boundaries and being rebellious (in forms of activism, opinions, business ventures, research, and many other domains) proves useful.

If everyone walks to the right and you train your brain to think “what if I walk to the left,” you’ll at least learn that other options exist. Maybe in due time you’ll land on an idea that no one thought of or find a new path that no one saw.

6. Keep a diary

This advice appears in my final session at my Kellogg business class when I give students some “free advice for life.” Many of our students want to find a big startup or innovation idea. Here’s another way to find your big idea: Keep a diary.

Whenever you encounter something that doesn’t make sense — write it down. Your next startup is there.

You walk in the rain with an umbrella, but your shoes still get wet — a startup. You are annoyed that you need to separate the white shirts from the colored one before you do the laundry — a startup. You can’t understand why the line keeps disconnecting during your call with customer service and when you restart you have to go over the details again with the next agent — a startup. My list is long and full of these ideas, because I keep a diary.

Those geniuses who had great startup ideas are not smarter than you, nor are they luckier (see tip #3). They just made a note of something in the world that you saw too, but didn’t register.

The diary could be a recording or scattered pieces of papers that you combine once a year. But they have to be registered in the moment. Otherwise, you will forget, and when the time comes for an idea, you’ll think that you have none.

7. Don’t follow your passion

I recently had a conversation with two colleagues of mine — professors Scott Galloway from Stern School of Business and Sinan Aral, from MIT’s Sloan — where this topic came up. Scott explained it better than me, but I’d summarize with this: “Follow your passion” is terrible advice. Instead, follow what you’re good at and do it in a fantastic way. It will gradually become your passion. People love what they do when they do it perfectly.

8. Have a sense of humor

I recently finished reading Viktor Frankl “Man’s Search for Meaning.” I can’t do justice to his articulation of this advice, but if I were to rephrase it in my own words, it would be, “If you’re able to find humor even in the darkest moments, then you will be able to endure the toughest times.”

I was once in a room where a colleague of mine, Dr. Yossi Vardi, made the CEOs of Alcatel, Intel, Wix, and Orange wear clown hats while taking serious questions from kids about their role as CEO. I asked him how he got them to agree to that. He said he reminded them that their sense of humor was crucial in getting them to the position of CEO.

9. Develop self-control

Research shows that being able to exert self-control is correlated with health, good relationships, and successful business decisions. How do you train your brain for self-control? You practice.

Here’s how: Choose one thing that you don’t do — and stick to it. I, for example, decided at age 14 that I would never drink coffee. Accordingly, I have never tasted it. Ever. You can do the opposite — decide that there’s something you will do daily. Say, spend a minute doing push-ups. This exercise can be as easy as a one-minute thing, but you have to do it daily. That’s the way to train your brain.

Moran Cerf is a professor of neuroscience and business who explores how we can harness our understanding of the brain to improve our behavior, our business, and society.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.