1. Valuation Gap Between SPY Cap Weighted and RSP Equal Weighted S&P is Widest Since Internet Bubble

This chart compares SPY cap-weighted S&P to equal weighting the sectors RSP…straight up 2023

©1999-2023 StockCharts.com All Rights Reserved

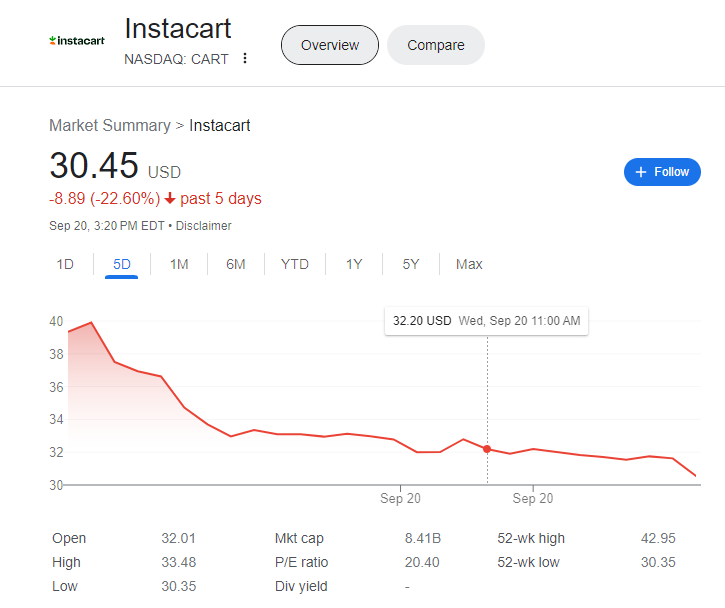

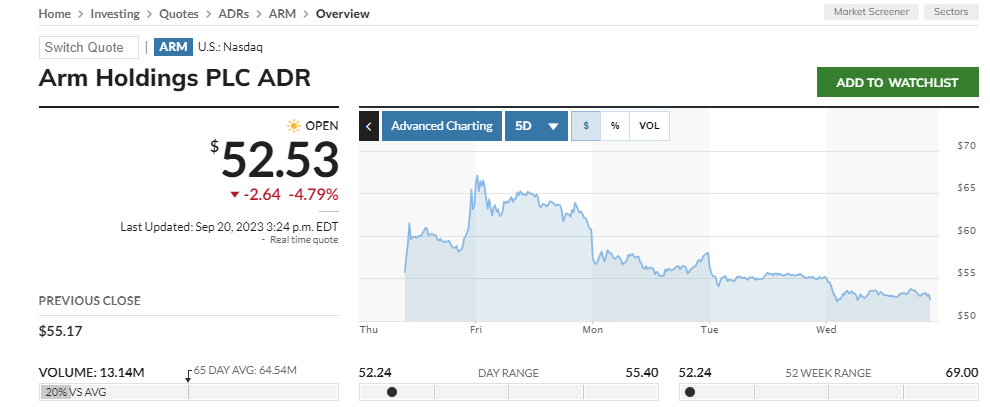

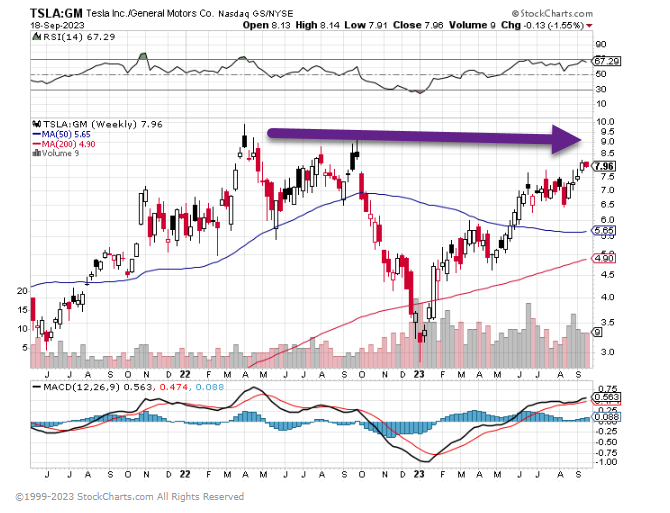

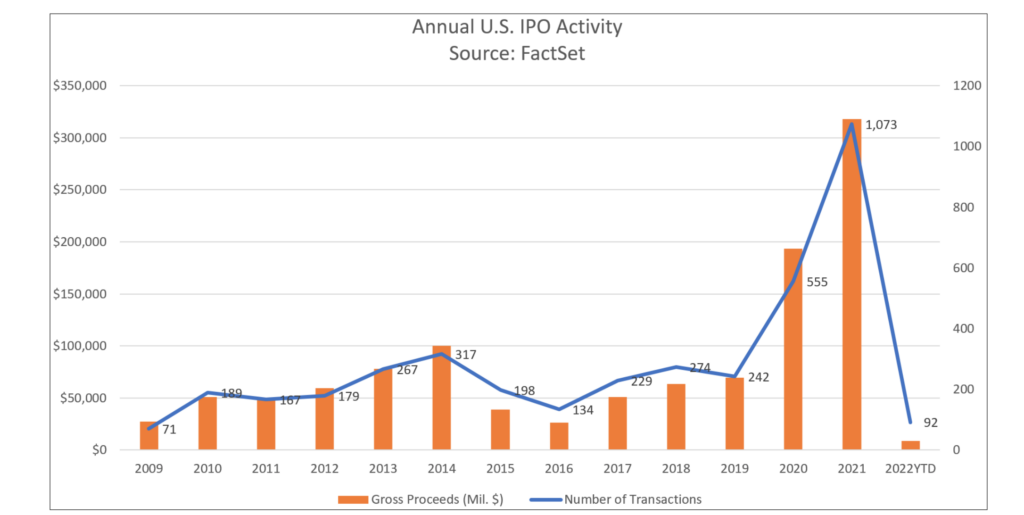

2. Flurry of IPO’s the Past Two Weeks are Top of Watch List

Barrons By Eric J. Savitz Recent IPO performance hasn’t helped matters. Goldman Sachs points out that the 2020-21 IPO class had “abysmal performance,” underperforming the Russell 3000 by 48 percentage points in the first 12 months after the IPOs. The worst performers are companies priced at more than 15 times sales, like Arm. Not a single IPO with that valuation level outperformed in the first two years, with an average return that’s 84 percentage points—yes, 84!—behind the market.

Factset IPO Dropoff

https://insight.factset.com/u.s.-ipo-activity-drops-dramatically-in-the-first-half-of-2022

3. MSCI China Stock Index Down $2 Trillion in Value

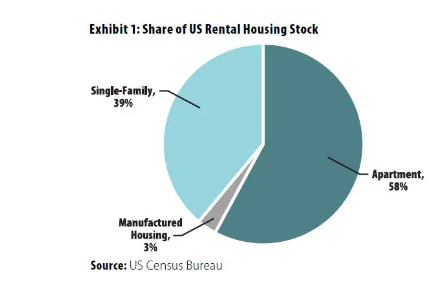

4. Homebuilders Need Land

Yahoo Finance Dani Romero Lennar’s (LEN) CEO Stuart Miller warned about the next big headache for housing — land.

“We believe that the new supply of homes will be limited as developed land is scarce and increasingly more expensive to develop,” Miller said on the company’s quarter earnings call Friday after blowing past quarterly orders and raising its fourth quarter deliveries forecast. “This will continue to limit available inventory and maintain supply/demand imbalance.”

Homebuilders are hungry for land. Yet, the US, a country that offers wide open spaces, is short of land for housing. Builders like Lennar have been able to grow through acquisitions of companies with coveted land pipelines.

But buying land isn’t cheap. It can cost anywhere from a few thousand dollars per acre to tens of thousands of dollars for the lot, squeezing cash flows and balance sheets. That has prompted Lennar to hone in on its land strategy. https://finance.yahoo.com/news/lennar-reveals-the-next-big-headwind-for-housing-supply-121448525.html

LEN Pulling Back to 200-Day

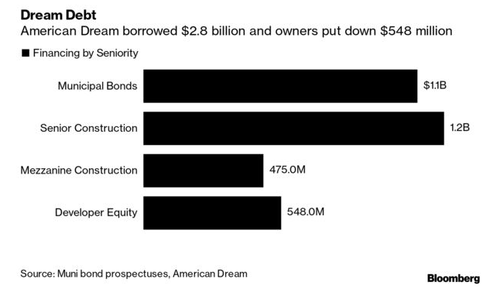

5. American Dream Mall $3 Billion in Debt…One Idea Start Knocking Down Malls for Homes?

Zerohedge Owners the Ghermezian family were having trouble preventing the mall from “hemorrhaging cash”, according to Bloomberg at the time, who also noted that the family had already hired advisors to help restructure the project’s $3 billion in debt.

Lenders for the project, including J.P. Morgan, Goldman Sachs and Soros Fund Management, stood to face losses on about $1.7 billion in construction loans, we noted last summer. The project was carrying about $1.1 billion in municipal debt at the time.

Neil Shapiro, a New York real estate attorney, said of the project last year:“It’s been like watching a train wreck that goes on forever. There aren’t a lot of projects that lose at least $3 billion that we’re still talking about as projects.”

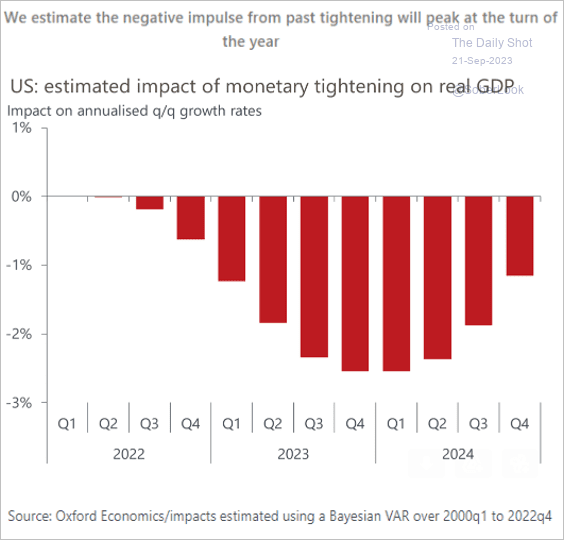

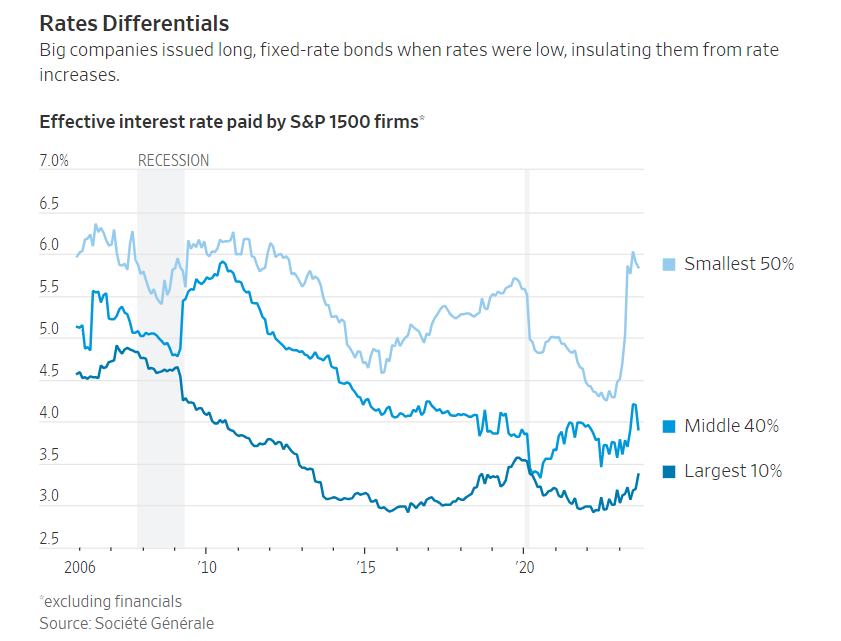

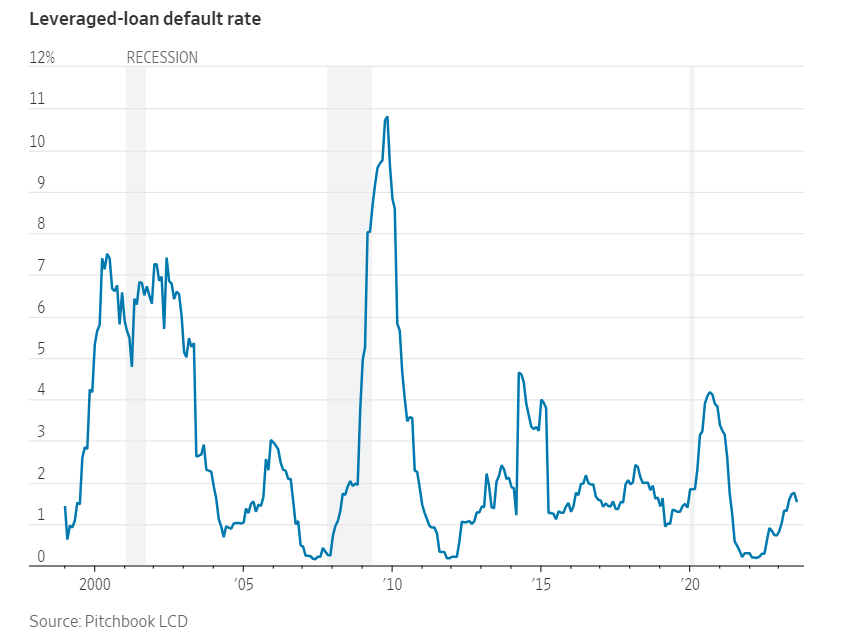

The financial difficulties plaguing the mall serve as a cautionary tale about the dangers of over-leveraging that we believe we are going to see over and over again as the Fed maintains its tight grip on the gears of the economy, via its “higher for longer” stance.

https://www.zerohedge.com/markets/american-dream-megamall-sees-losses-quadruple-245-million

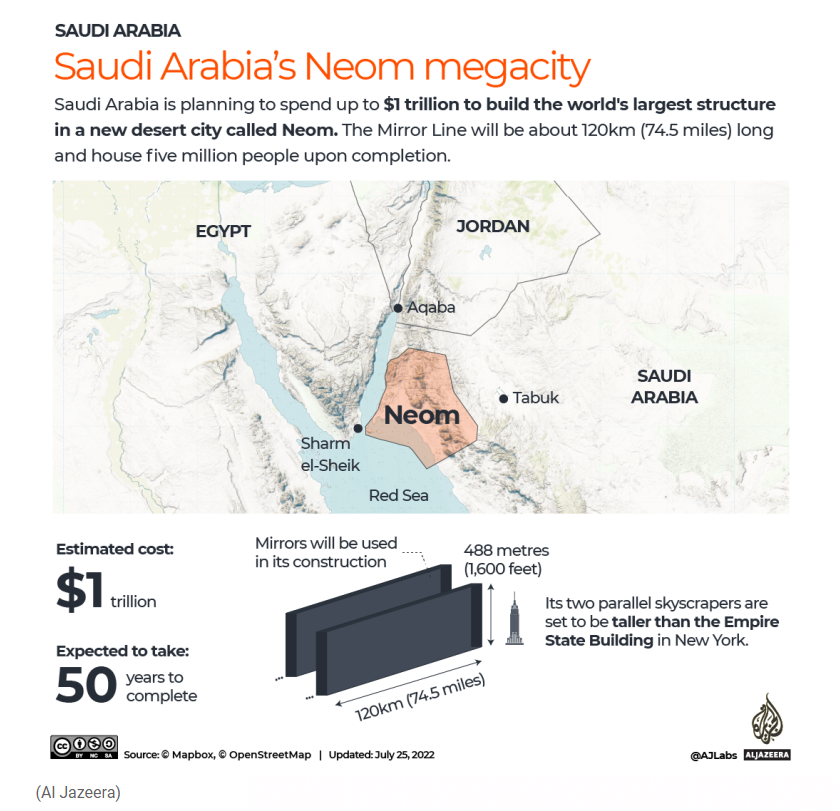

6. Saudis Have 6 Different $1 Trillion Projects Under Construction

https://www.aljazeera.com/news/2022/7/25/saudi-arabia-to-build-1tr-mirrored-skyscraper-in-neom

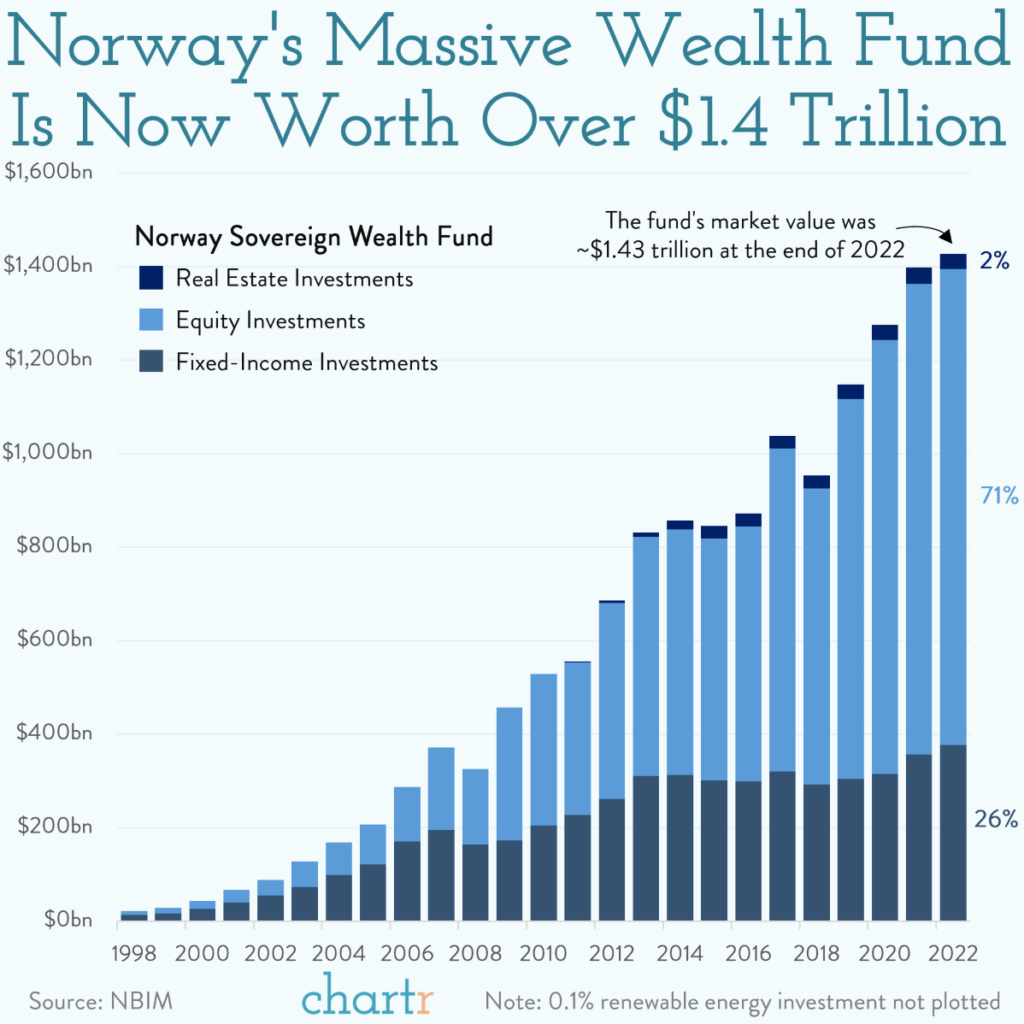

7. Norway Sovereign Wealth Fund $1.4 Trillion

8. Office Vacancy in China

WSJ

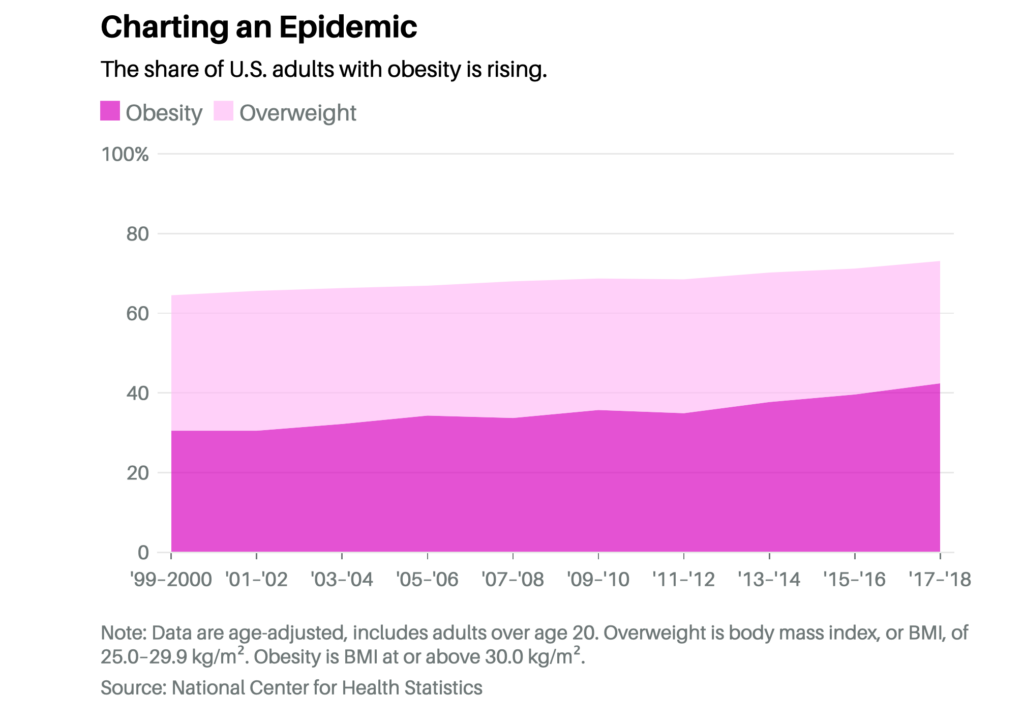

9. Obesity in America

Barrons By Josh Nathan-Kazis That means a potentially monumental tab for insurers: By 2030, J.P. Morgan analysts expect the amount spent on GLP-1 obesity treatments in the U.S. to be about $50 billion, or a tenth of the $421 billion spent on outpatient drugs in the U.S. in 2021.

Of course, curbing obesity would have the potential to save the healthcare system a lot of money. A recent USC Schaeffer paper argued that Medicare coverage of obesity medicines would save the program more than $700 billion over 30 years. But those savings, if they do materialize, won’t do much to mitigate the shorter-term crisis.

10. A Massive Study Reveals the Only Habit You Can Adopt That’s Linked to Intelligence and Cognitive Ability

Fortunately, the key isn’t who you are, or how you’re wired. The key is what you do.

BY JEFF HADEN, CONTRIBUTING EDITOR, INC.@JEFF_HADEN

Are personality and intelligence linked? Plenty of people think so.

A friend is convinced that seemingly disorganized people — messy desk, workshop, workspace, whatever — are the most creative. Another believes — maybe because he admittedly embodies it — the trope of the genius who sometimes treats people poorly because they’re so smart. (Steve Jobs, maybe?) Another thinks highly intelligent people tend to be less happy because they’re tormented by bigger-picture concerns; to him, “happy” must mean “simple.”

Science says they’re wrong.

For example, take the seemingly inverse relationship between intelligence and happiness: Research shows levels of happiness are lowest in the lowest IQ groups and highest in the highest IQ groups. (I don’t know my IQ; since it’s bound to be low, my ignorance is bliss.) The same is true for the stereotypical moody genius, as research shows “negative emotionality” is a strong predictor of lower intelligence.

So what are some science-relationships between personality and intelligence? Let’s start by defining personality and intelligence:

· Personality is how you think, feel, and act. (Think the Big 5 independent traits: neuroticism, extroversion, conscientiousness, openness, and agreeableness.)

· Intelligence is your ability to understand and apply information. Some cognitive abilities are acquired, like learning to read financial statements. Others are at least somewhat more innate, like the ability to match patterns. (Which of course is an ability that can also be acquired.)

Turns out there are plenty of links between personality and intelligence, but they tend to be more nuanced. According to a meta-analysis of over 1,300 studies that involved millions of people, openness — not “I’ll tell you all my secrets” but a willingness to engage and explore new experiences, ideas, information, etc. — is the only personality trait with a substantial correlation to intelligence.

Otherwise, the “big” links aren’t really linked. That messy desk doesn’t mean you’re more creative. Then again, it could: While conscientiousness is linked to higher cognitive ability, “routine-seeking” predicts lower intelligence.

Extroversion has almost no correlation to intelligence, although being more sociable does have a negative relationship to some cognitive abilities; as other research shows, the most intelligent people tend to love spending time alone.

Which leads to the real point.

If you hope to get smarter — and who doesn’t? — don’t feel limited by your personality. And don’t try to change your personality. You don’t need to be more or less extroverted, more or less neurotic, more or less agreeable, etc.

You should just try to be more open to new ideas, new information, and new experiences.

As Jeff Bezos says:

The smartest people are constantly revising their understanding, reconsidering a problem they thought they’d already solved. They’re open to new points of view, new information, new ideas, contradictions, and challenges to their own way of thinking.

Science backs him up. A series of experiments published by Harvard Business Review show that while changing your mind might make you seem less smart, changing your mind is actually smarter. For example, entrepreneurs who adapted, revised, and changed their positions during a pitch competition were six times more likely to win the competition.

The next time you question your intelligence, think about how often you’ve changed your mind in recent days.

If the answer is “not often,” you’re likely not as open as you could be.

Instead, take Thinking, Fast and Slow author Daniel Kahneman’s approach. As Kahneman says, “No one enjoys being wrong, but I do enjoy having been wrong, because it means I am now less wrong than I was before.”

Because wisdom isn’t found in certainty. Wisdom is knowing that while you might know a lot, there’s also a lot you don’t know. Wisdom is trying to find out what is right rather than trying to be right.

Want to be more open? Don’t be afraid to be wrong. Don’t be afraid to admit you don’t have all the answers. Don’t be afraid to say “I think” instead of “I know.”

As Adam Grant writes in Think Again, “Arrogance leaves us blind to our weaknesses. Humility is a reflective lens: it helps us see them clearly. Confident humility is a corrective lens: it enables us to overcome those weaknesses.”

In short, you and I already know what we know. What we don’t know is what other people know.

At least not yet.