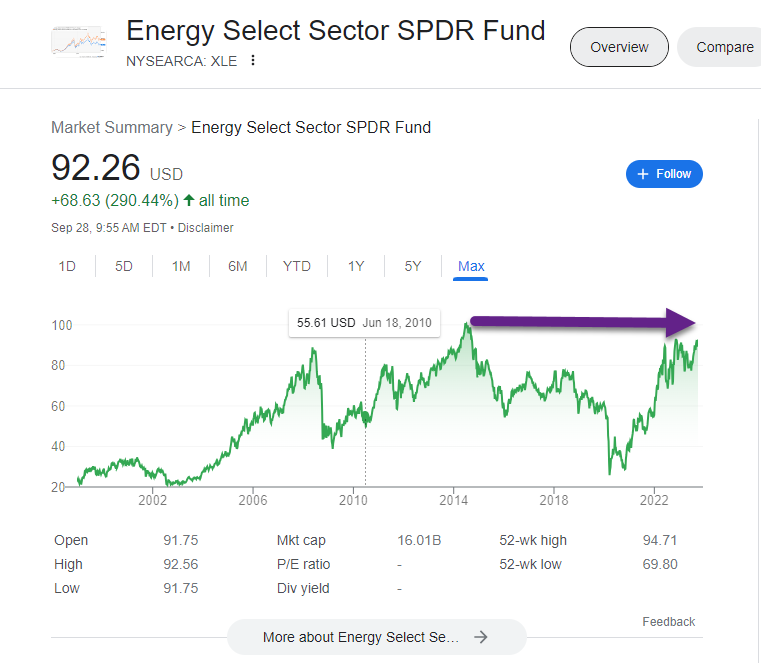

1. Energy XLE Making Run at 2014 Levels

2. Semiconductors Did Break the One-Year Line I Sent Earlier in the Week

3. Last 3 Months Energy XLE +16.9% vs. Semiconductors SMH -6.3%

4. Monster Beverage Best Stock Performer in 25 Years

One of my favorite morning newsletters The Daily Dirt Nap https://www.dailydirtnap.com/ mentioned Monster stock so I hit up chart….…A series of lower highs and close below 200-day

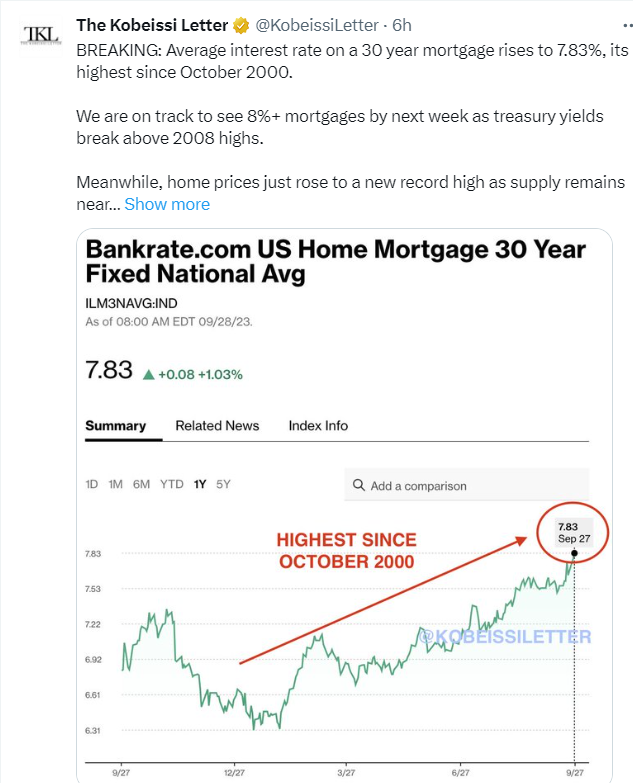

5. 30-Year Mortgage 7.83%

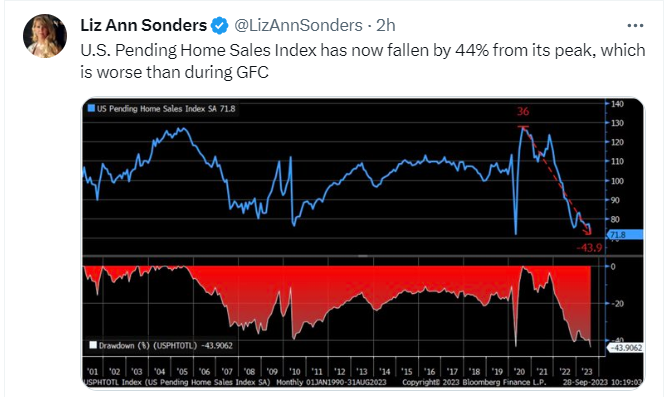

6. U.S. Pending Home Sales Index -44%

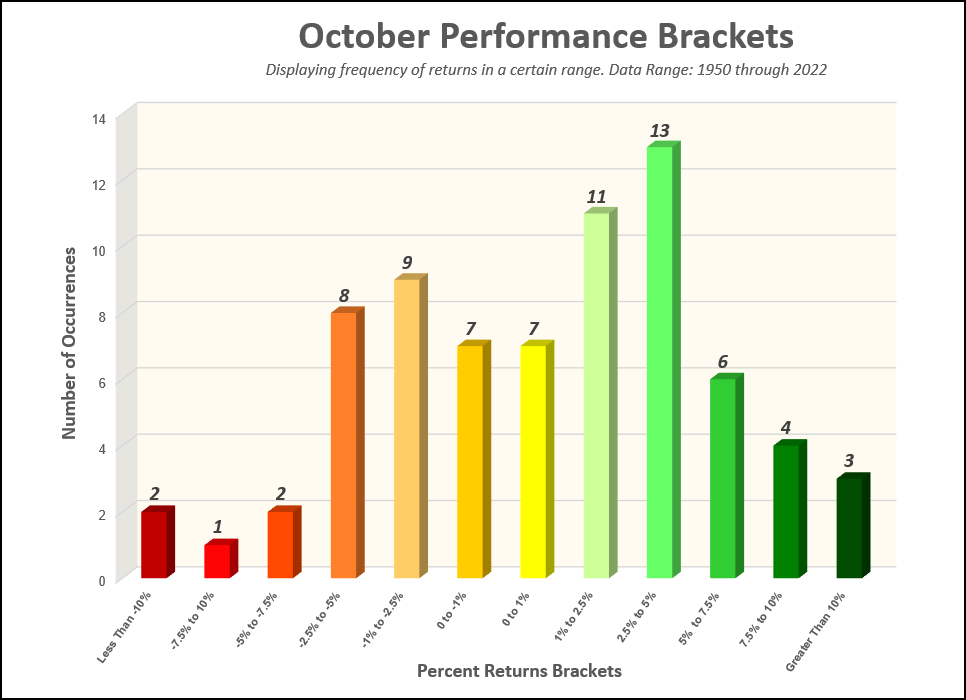

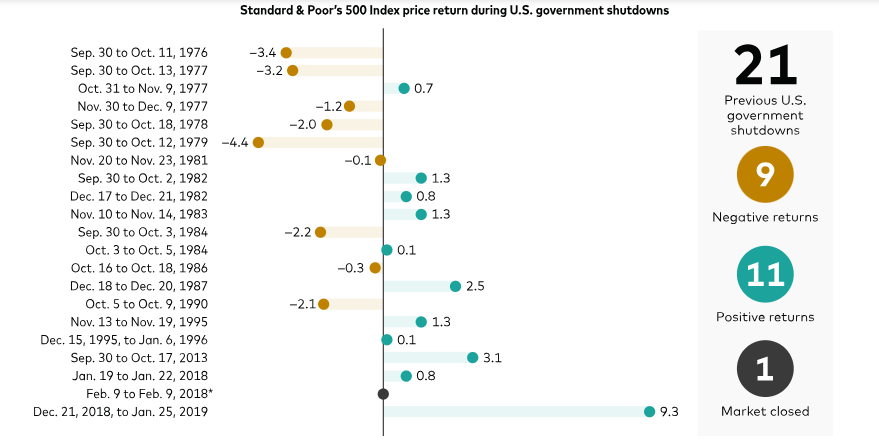

7. History of Government Shutdowns and Stock Market-Vanguard Group

Shutdown: A history of mixed results for markets and the economy Although there can be market volatility during a shutdown, history reveals no clear relationship between shutdowns and market returns. Markets might experience heightened volatility in response to the uncertainty in Washington. However, markets have historically had mixed reactions to government shutdowns, with equities finishing in positive territory more than half the time (as noted in the accompanying chart). In the seven instances where shutdowns have lasted 10 days or more, the Standard & Poor’s 500 Index fell four times within the shutdown period and rose three times. The worst return, –4.4%, came during an 11-day shutdown in 1979.

Staying the course during a government shutdown (vanguard.com)

8. JPMorgan Chase to offer 6% interest rate for minimum of $5 million in high-end CD product: WSJ

The 6% rate for a six-month CD is a step up from JPM’s 5% offer for a minimum of $100,000.

Those wealthy enough to park $5 million in a certificate of deposit for six months will earn a lofty 6% interest rate at JPMorgan Chase & Co., The Wall Street Journal reported Thursday in an exclusive story.

There’s an important catch with the certificate of deposit, which has been a popular product with banks from people looking to cash in on higher interest rates than available on traditional savings accounts.

To qualify for the 6% CD, money must come from outside JPMorgan Chase JPM, 1.32%, in a bid to draw in fresh capital into the bank, the WSJ report said. The CD’s maximum deposit level is $100 million, with the offering ending on Saturday.

Also read: JPMorgan Chase names new investment-bank boss and sets up digital bank in flurry of personnel moves

Adam Stockton, managing director at bank data provider Curinos, told the newspaper that banks have been typically offering interest rates of about 2.5% to draw in regular customer deposits, but have been offering 4% to 5% for new wealth-management deposits.

For its part, JPMorgan Chase has been offering 5% to retail banking customers with a minimum of $100,000, while customers who put in less than $100,000 earn 4%. Meanwhile, the bank only pays 0.1% interest for interest-bearing checking and savings accounts, the WSJ said.

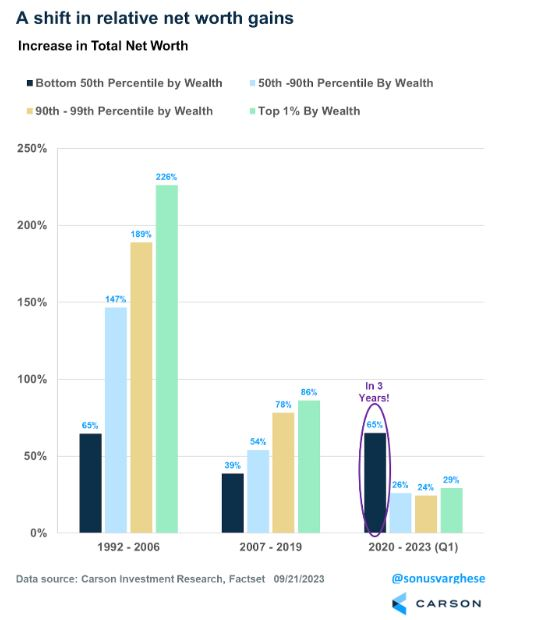

9. Bottom 50th Percentile See Large Increase in Net Worth

From Irrelevant Investor Blog

https://theirrelevantinvestor.com/2023/09/27/animal-spirits-house-poor/

10. A Harvard brain expert shares 6 things he never does in order to stay ‘sharp, energized and healthy’-CNBC

Christopher Palmer, Contributor@CHRISPALMERMD

As a psychiatrist and neuroscience researcher, I’ve spent 27 years studying the surprising connections between our mental health, physical health and brain health.

I’ve also learned a lot from my personal journey. In my 20s, I was diagnosed with metabolic syndrome, a combination of disorders that increases the risk of cardiovascular disease and diabetes.

But by making some lifestyle changes, I was able to overcome it in just a few months. To continue staying sharp, energized and healthy, here are six things I never do:

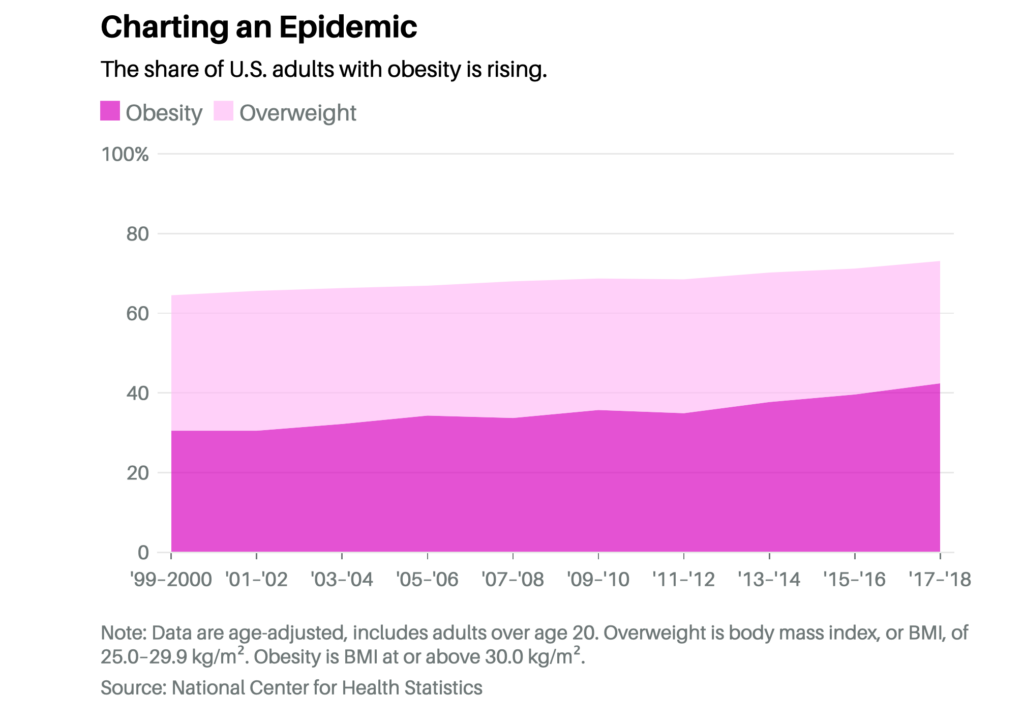

1. I never load up on high-carb foods.

Diet plays a role in obesity, diabetes and heart health, but most people don’t realize that it also has profound effects on the brain.

I reversed my metabolic syndrome by committing to a low-carb diet. Generally, low-carb diets eliminate or cut back on grains, baked goods, sweets and fruits that are high in sugar or starch.

I typically have eggs for breakfast. Throughout the day, I eat vegetables, fruits, and a good amount of meat, fish and poultry. This has helped me maintain a healthy weight and keep my blood sugar low.

2. I never take more than 2 days off from exercising.

A study of 1.2 million Americans found that exercise is good for mental health.

For me, the optimal workout is 45 minutes, three to five times a week. In addition to stretching and core exercises, I lift weights, run, cycle, swim and take brisk walks.

I don’t push myself to exercise every day, but I also never take more than two days off from aerobic activities.

3. I never get less than 7 hours of sleep a night.

Poor sleep can result in cognitive impairment that might lead to a greater risk of Alzheimer’s disease over time. It can also impact mood and contribute to depression.

When you sleep, your body enters a “rest and repair” state. The brain undergoes many changes in neurons that play a role in learning and memory consolidation. Without sleep, cells can fall into a state of disrepair and begin to malfunction.

The amount of sleep people need varies, but I always get in at least seven hours a night. I’m usually in bed by 8 p.m. or 9 p.m., and wake up at 4 a.m. The “early to bed, early to rise” routine makes me sharper and more focused throughout the day.

4. I never drink alcohol.

I used to drink regularly, and would sometimes have a glass of wine in the evenings to relax.

But in June 2020, I decided to give it up for one month. Within weeks, I noticed improvements in my sleep and productivity, so I decided to quit drinking altogether. What’s shocking is that I don’t miss it at all.

This doesn’t mean you should give up drinking completely, but the benefits that we once thought alcohol conferred are now being questioned. In a study of over 36,000 people, consuming even one to two drinks a day was associated with brain atrophy or shrinkage.

5. I’m never done with self-growth.

Exploring your emotional health through psychotherapy can be life-changing. It can help you understand who you are and what you want from life, which will strengthen your sense of purpose.

Psychotherapy that focuses on empathy, relationships, social skills or improving cognitive abilities can strengthen brain circuits that have been underdeveloped.

6. I never lose sight of my purpose in life.

Humans are driven to have a sense of purpose. I believe this is hardwired into our brains. When people lack a sense of purpose, it can induce a chronic stress response and lead to poor cognitive function.

Remember that purpose is multifaceted. It involves relationships with other people, yourself and your community. We should all aim to have least one role in society that allows us to contribute and feel valued.

This can be as simple as having household chores, or take the form of being a student, employee, caretaker, volunteer or mentor.

Christopher Palmer, MD is a professor of psychiatry at Harvard Medical School and the author of “Brain Energy: A Revolutionary Breakthrough in Understanding Mental Health.” For the past 27 years, he has been an academic physician with administrative, research, educational, and clinical roles. Follow him on Twitter @ChrisPalmerMD.