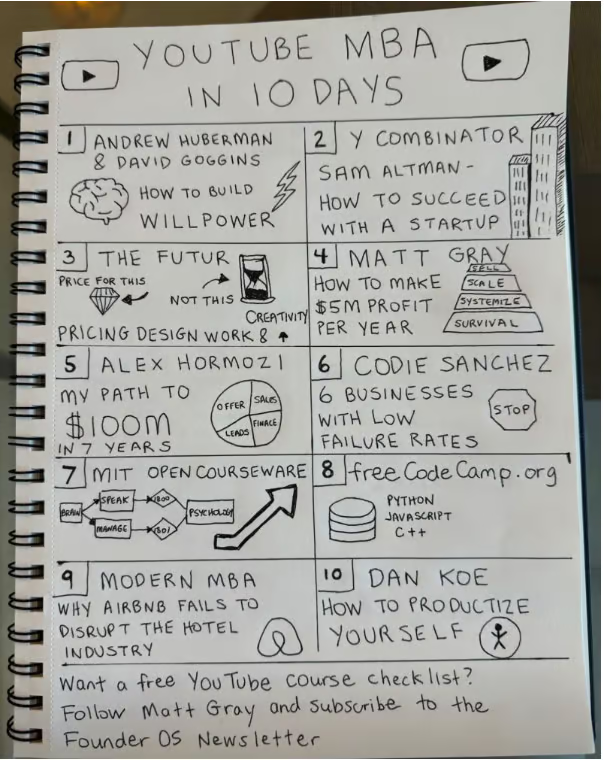

1. Major Indexes and Max Drawdowns

LIz Ann Sonders

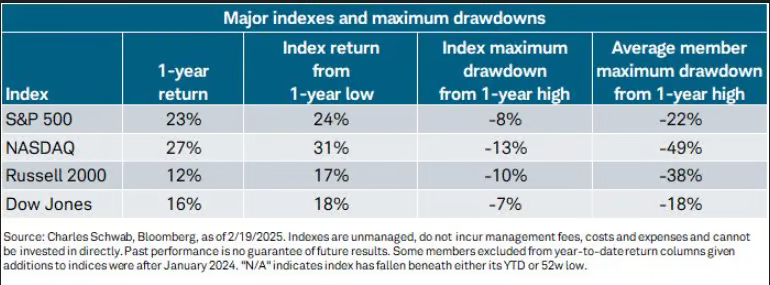

2. Stocks Saw Outflows Last Week

Weekly ETF flows. “Over past week, U.S. large-cap equity ETFs had most outflows (nearly $2.8B) while agg bond funds had most inflows (nearly $2.2B).

Arbor Data via LIz Ann Sonders

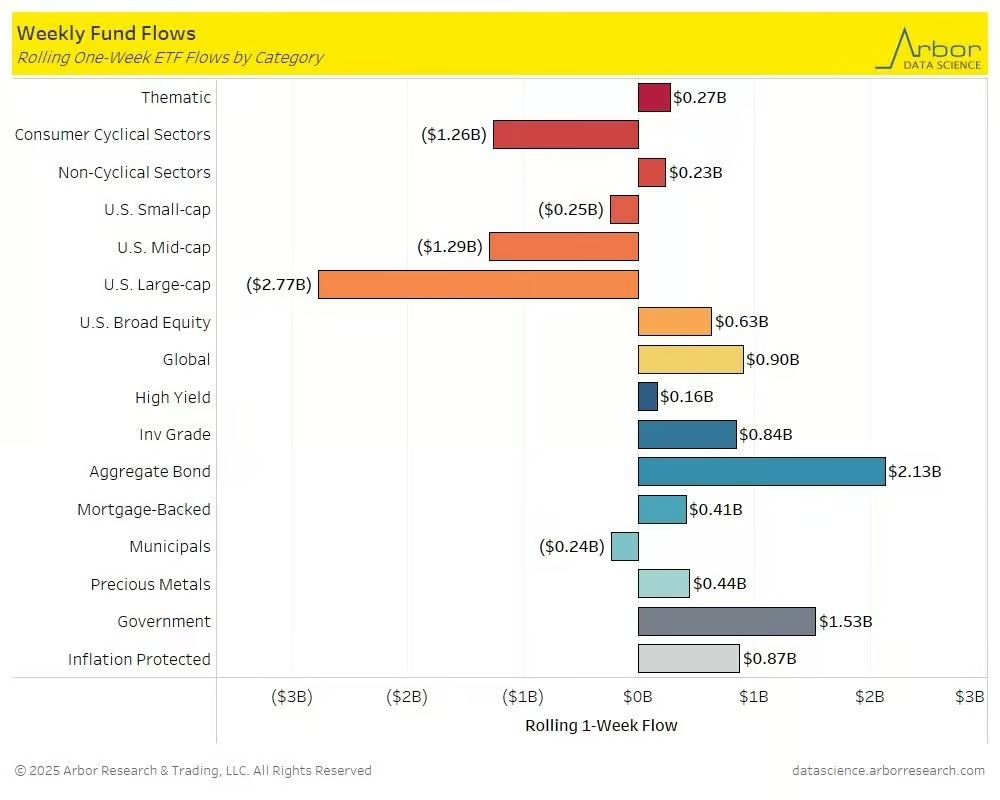

3. Bonds During Recent Stock Drawdowns

Capital Group

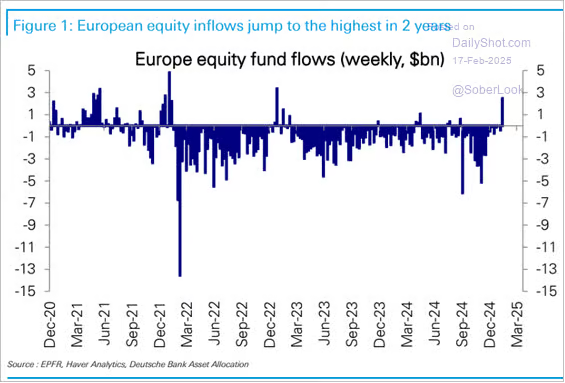

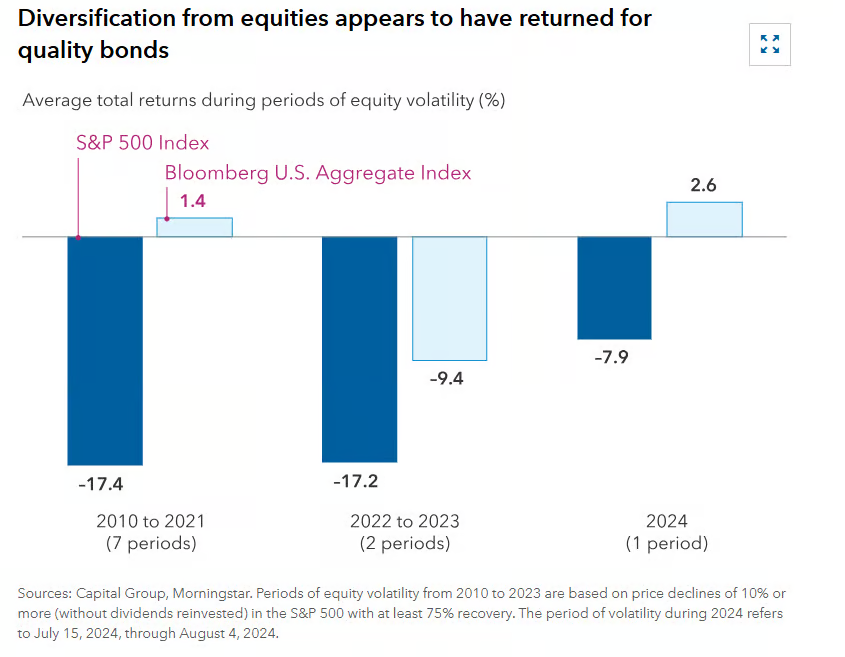

4. Euro Stock Large Cap 50 Breaks Out to New Highs

StockCharts

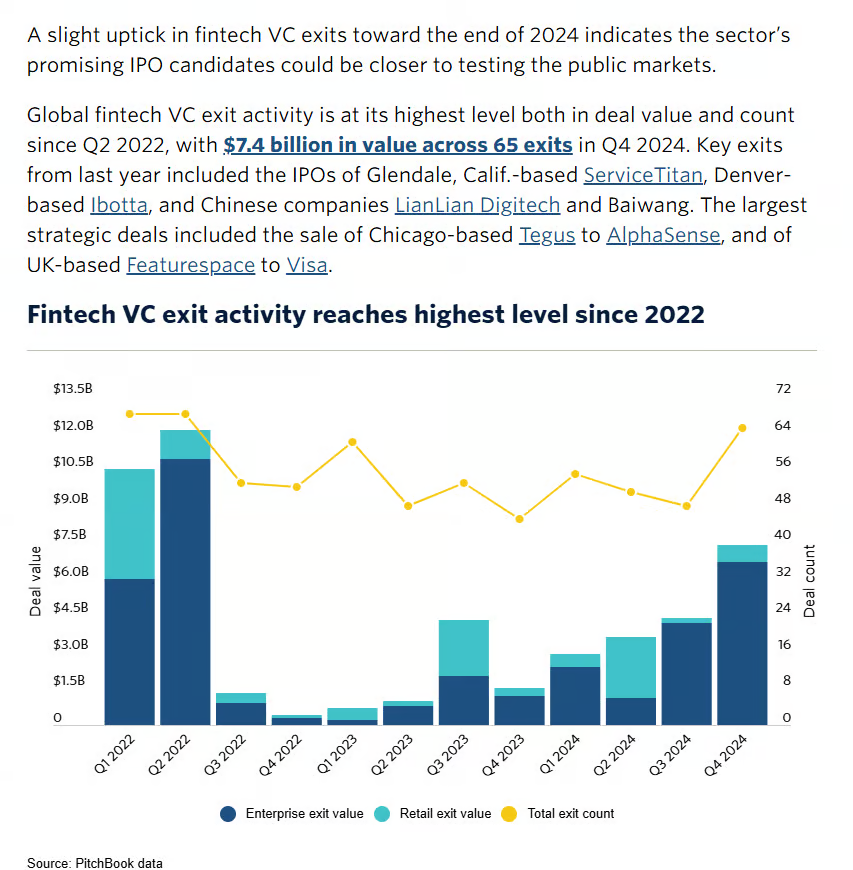

5. FinTech VC Activity Higher…Back to 2022 Levels

PitchBook

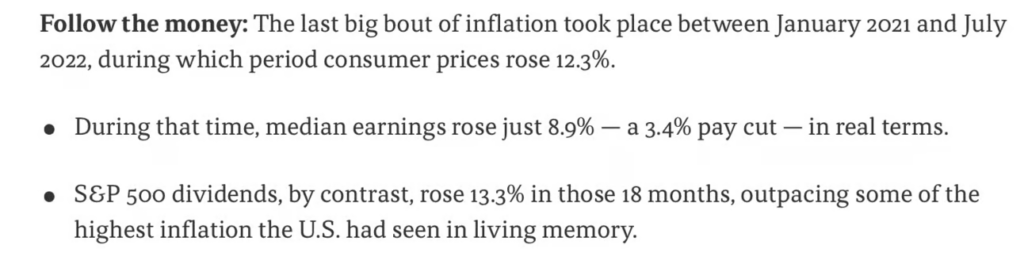

6. The End the “de minimis” Duty-Free Import Provision Hits Shein IPO Valuation

Shein faces investor pressure to slash valuation to $30 billion ahead of London IPO, Bloomberg News reports

Via Reuters: Online fast-fashion retailer Shein is under pressure to cut its valuation to about $30 billion ahead of its London listing, Bloomberg News reported on Monday, citing people familiar with the matter.

Its shareholders are suggesting that an adjustment is required to help get the potential initial public offering in the UK over the line, Bloomberg News reported.

A spokesperson for Shein declined to comment.

Advertisement · Scroll to continue

Earlier this month, Reuters reported that Shein was set to cut its valuation in the potential London listing to around $50 billion, nearly a quarter less than the company’s fundraising value of $66 billion in 2023, amid growing headwinds.

Shein is aiming to go public in London in the first half of this year, assuming it secured approvals from regulators in the UK and China, Reuters reported.

The Financial Times reported last week that Shein’s listing was likely to be postponed to the second half of this year after U.S. President Donald Trump’s move to end the “de minimis” duty-free import provision.

7. Walmart Sell Off Yesterday…Back to 50-Day

StockCharts

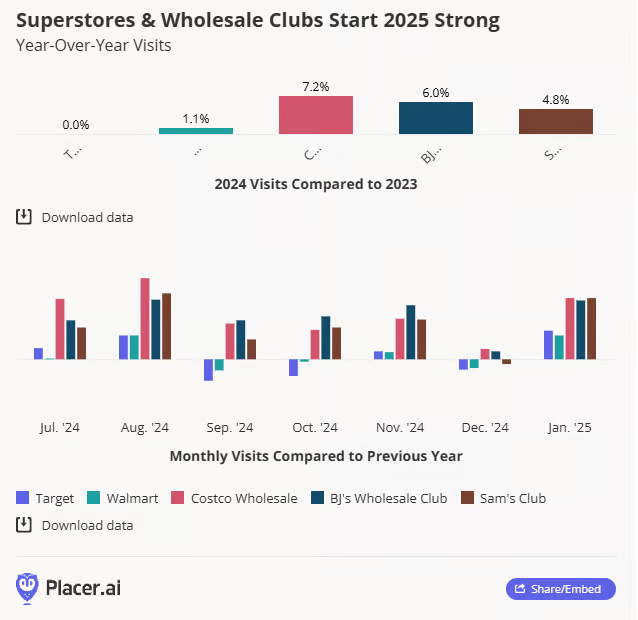

8. U.S. Superstores Good Start to Year

Business Insider

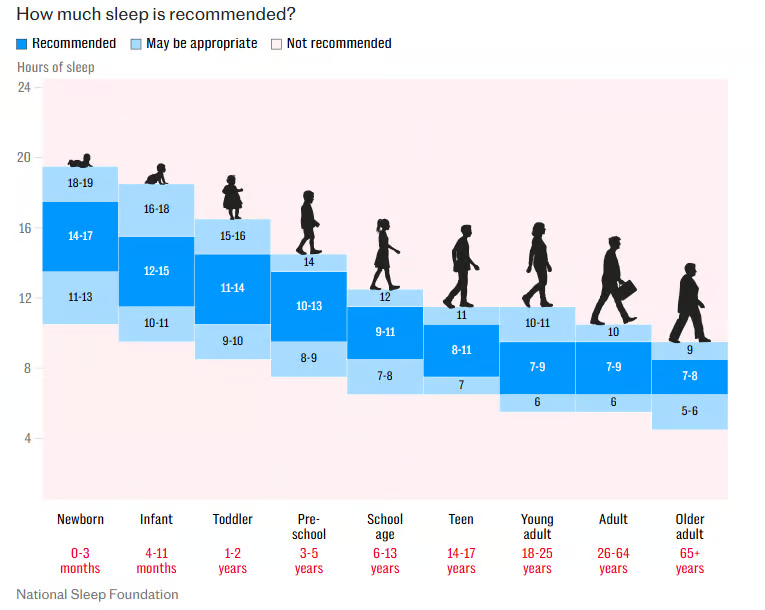

9. Four Ways to Get More Deep Sleep over 50

Via The Telegraph: While many of us tend to assume poorer sleep is a natural part of ageing, Dr Sabia urges over-50s to do everything they can to strive for more deep sleep.

“There are so many reasons for us not to get enough quality sleep – we live in a society where it isn’t prioritised,” she says. ‘But it is essential for brain health.

1. Get into daylight every morning

If we do one thing to improve our sleep, she advises: “Get up at the same time every day and get outside into daylight to regulate your circadian rhythm.”

Studies have shown that bright light therapy, in which people with dementia sit in front of a light box for 30 minutes every morning, can help reduce their sleep disturbances by reinforcing their body clock. Scientists are currently exploring whether this kind of therapy could be used to prevent the disease.

In the meantime, research has proved that making efforts to regulate our circadian rhythm, including exposure to natural light in the daytime, avoiding blue light from screens before bedtime and blocking out light at night using an eye mask or blackout blinds, can help us get better-quality, deeper sleep.

2. Keep naps short

It’s tempting, following a restless night, to try to catch up the following day, but this doesn’t offer the same brain benefits as night-time sleep, says Dr Sabia.

“Napping doesn’t result in the same deep cleaning as happens during the night,” she says. “It can also interfere with good quality nighttime sleep, particularly if you enter deep sleep during the nap as this means getting less deep sleep at night.”

3. Try pink noise

Sleep researchers at the University of Cardiff are working on sounds that may help to boost deep sleep, including soft “clicks” played to sleepers as they approach the peak of their brain activity during slow wave sleep. Their research has shown this can increase deep sleep.

Until the technique is marketed as a gadget we can use at home, it’s worth trying pink noise. A small recent study by researchers in Zurich found that playing pink noise, which includes sounds such as falling rain, a flowing river, crashing ocean waves or rustling leaves, enhanced slow wave brain activity during deep sleep in some participants.

4. Limit alcohol in the evening

Moderate drinking has not been linked to an increased risk of dementia, but research has proved a link between alcohol and diminished sleep quality.

Drinking tends to increase slow wave sleep in the first half of the night, but in the second half, all stages of sleep are disrupted, leading to frequent wakings. Ideally, it’s best to avoid alcohol for three hours before bed. Avoiding caffeine for at least seven hours before bedtime is also recommended, as it significantly reduces slow wave sleep.

10. Martial Arts Training Can Help You Change Your Mind

Key points

- Martial arts training can have widespread holistic health benefits.

- Changes in brain activity patterns related to mindfulness and meditation occur even with 12 weeks of training.

- Martial arts training stimulates neuroplasticity benefiting health, function, and creativity.

Via Psychology Today: When I was an undergraduate in the late 1980s, I did several research projects on the physiology of martial arts. At that time, there were only a handful of published scientific research on physiology, psychology and martial arts. There are now hundreds appearing every year. Often such studies are cross-sectional, meaning a group that do some martial arts are assessed on various measures and contrasted with “control” folks who don’t. There are far fewer experimental studies, especially related to measures in exercise neuroscience, which is why a recent study caught my eye.

Young Adults Kung Fu Fighting Are Also Fast as Lightning

Min Wang, Kurusart Konharn, Wichal Eungpinichpong, Sawitri Wanpen, and Paramaporn Sangpara from Huzhou University in China and Khon Kaen and Rajabhat Mahasarakham Universities in Thailand wanted to know if there were measurable changes in electroencephalographic (EEG) power bands arising from martial arts training. To answer this question, they conducted an intervention study that saw young (18-22) adults train tai chi forms for about 45 minutes, three days per week for 12 weeks. The comparison age-matched non-intervention group maintained their activity levels. Before and after the intervention, resting state EEG power bands were assessed along with measures of physical capacity including handgrip strength, explosive leg power, balance, and flexibility.

Much Ado About Brain Power

The key outcome from this study was that alpha band (8-12 Hz) power increased in the martial arts but not in the non-intervention group. Alpha band power is associated with performance of skilled motor acts, creativity, meditation, and mindfulness. As such, the martial arts training led to measurable changes associated with a calm and focused mindset. The authors also note that “….alpha band have been associated with the relaxation response, which is the body’s natural counterbalance to stress….” and thus martial arts training may contribute to overall holistic health. It is also important to point out that often studies of tai chi in particular are done with older populations. These results are important to emphasize the important role of martial arts as lifelong health activities.

Neuroplasticity Spills Over to Other Activities

That tai chi training, even for only 12 weeks, can enhance physical fitness and alpha-band power in college students highlights possible health benefits. Additionally, the authors of this study suggest that, since alpha band power was enhanced after training, it “may contribute to the experience of ‘flow’ or being in the zone during exercise. Flow is a state of optimal performance characterized by deep focus, heightened awareness, and a sense of effortless action. Alpha band have been observed in individuals experiencing flow states during various activities.”

This observation underscores an important characteristic of health benefiting activities—that they apply to other things. Martial arts training not only improves health related to the trained activity but may enhance capacity in many other activities. This nicely highlights my all time favorite martial arts quote from the 16th-century Samurai Miyamoto Musashi: “The true science of martial arts means practicing them in such a way that they will be useful at any time, and to teach them in such a way that they will be useful in all things.”

Martial arts training can clearly enhance many aspects of holistic health. So, if you are already training, please continue, or if you are considering giving martial arts a go, please do so as well. Many benefits for body, brain, mindfulness, and creativity await.