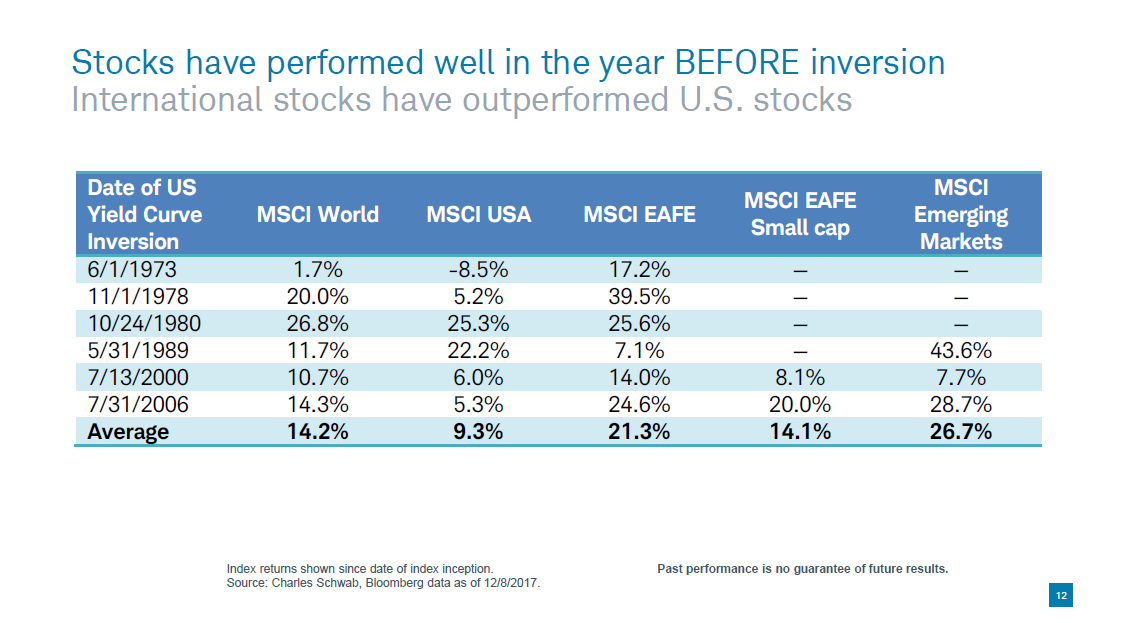

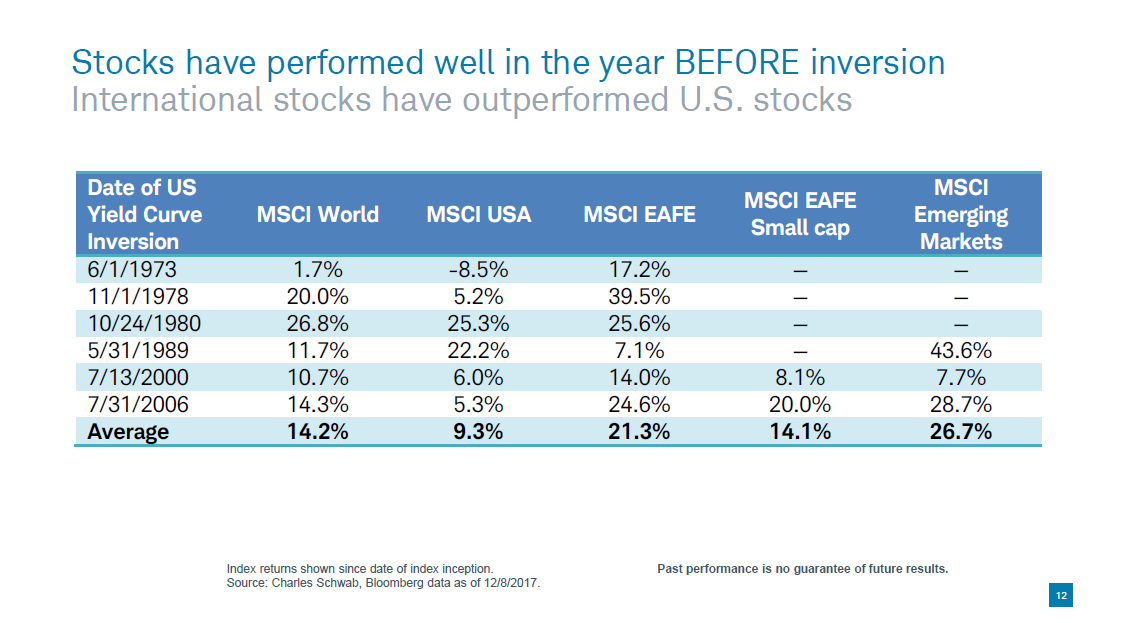

1.The Yield Curve Flattening has Taken Center Stage….How do Stock Perform Leading Up to Inverted Yield Curve?

From Charles Schwab.

From Charles Schwab.

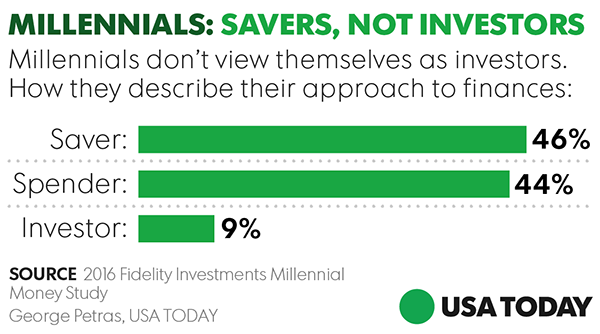

Millennials are leading an investment revolution. Now the largest demographic in the economy, young investors under 35 are catalyzing a transformation in the asset management and stock trading world.

Investment accounts opened by this demographic rose 72% annually, TD Ameritrade CEO Tim Hockey told Business Insider.In a wide-ranging interview following the $1.2 trillion brokerage’s earnings report that beat Wall Street expectations, Hockey said the firm has seen an explosion of interest in cryptocurrencies, cannabis stocks, and ETFs, particularly from millennials.

Hockey: Funny you should ask, last quarter I sat down at a restaurant with my 26-year-old son and we traded 100 shares of stock at the table using Facebook Messenger’s bot. We launched that last quarter.

Rapier: You recently turned on 24-hour trading, what was the logic behind that new offering? Is it receiving the response you expected?

Hockey: I’m glad you asked! It’s 24/5, so that allows clients to participate in after-hours market moving news that they didn’t have before because markets were open 9:30 to 4. Previously they had opportunities to do this only in the futures markets, but now we’ve offered 12 broad-based ETFs that are quite liquid, for example SPY, QQQ, the gold sector, oil, gas, China… these are all broad-based ETFs that can all now be traded 24 hours a day, five days a week.

It’s only been two days, so it’s just starting to get traction now in the media. It’s still quite narrow, but even last night we’re seeing a three cent spread, which is a nice tight range for people to trade in, even after hours.

Rapier: You also launched bitcoin futures for some clients back in December, how much interest are you seeing from clients in the cryptocurrency space? Will more products show up soon?

Hockey: We just turned on the Cboe product in a very limited release — just to futures clients that were more sophisticated and understood the risk they were taking, and we’ll expand that over time.

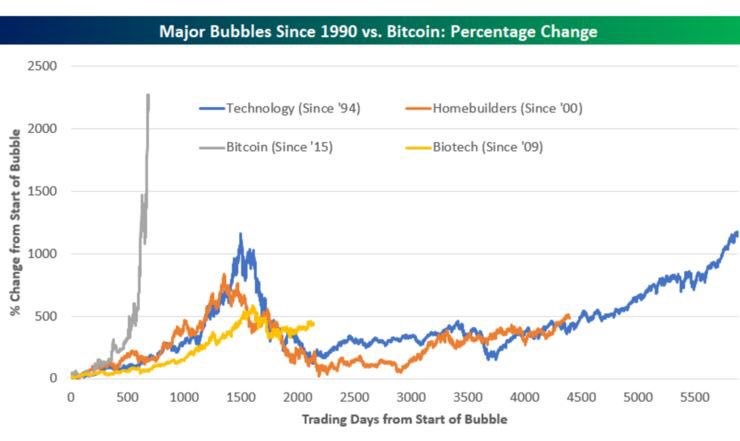

This market is certainly not mature. I would say that what we saw in terms of levels of absolute interest prior to the holiday season seemed to peak. Everybody was talking about crypto of all types all the time because it seemed like it was a one-way increase.

Ever since the pricing has been normalized and there’s been a bit of a correction, then you’ve seen a little bit less froth, if you will, in the market. We’ve actually seen that in the first few weeks of January, crypto trades — not just the Cboe product, but companies that are related to blockchain — have contributed a couple of points less toward our trading activity. It seems to have peaked just before the holidays.

The technology certainly has not matured, and I believe the transformative nature of what blockchain can do is only just starting to be understood by the majority of the world.

https://www.bespokepremium.com/think-big-blog/

https://businessradio.wharton.upenn.edu/programs/behind-the-markets

The February 2016 kickoff rally continued to build momentum. One way to quantify momentum was shown in the Nov. 19, 2017, Profit Radar Report:

“The S&P 500 was higher 8 of the first 9 months of 2017. This has only happened 8 other times (1936, 1950, 1954, 1958, 1964, 1995, 1996, 2006). 2, 3, 6, and 12 months later, the S&P was higher every time but one (0.7% loss 2 month later in 1964).

Such strong momentum readings (and they are seen across all time frames) are extremely rare. As mentioned in December 2016 and March 2017, stocks rarely top out at peak momentum. We have to go back to 1995/1996 to find similarly strong and persistent upside momentum.”

Simon Maierhofer is the founder of iSPYETF and publisher of the Profit Radar Report. He has appeared on CNBC and FOX News, and has been published in the Wall Street Journal, Barron’s, Forbes, Investors Business Daily and USA Today.

From Dave Lutz at Jones.