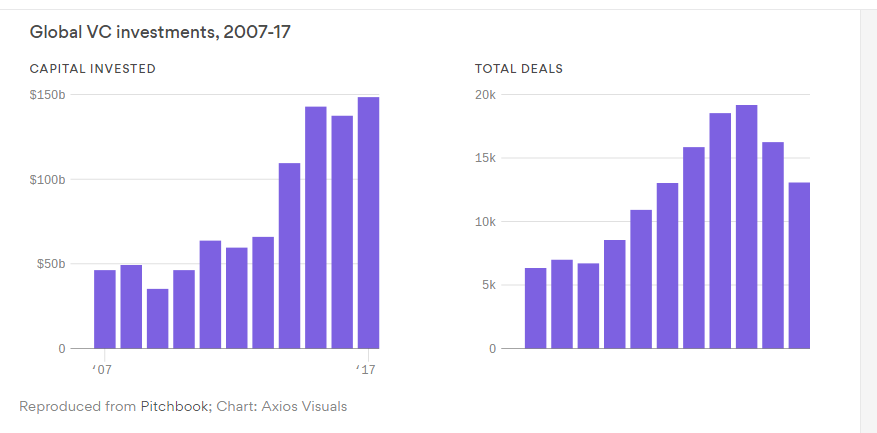

1.Venture capital investment hits all-time record

Global venture capital investment has hit an all-time record, with more than $142 billion already disbursed in 2017, according to data provider PitchBook.

- Fewer startups are raising money, but the round sizes are getting appreciably larger. For example, though mid-October, eight companies had raised rounds of $500 million or more.

- There has been a boom in fundraising by Chinese startups, partially driven by an increase in local capital sources.

- S. venture investment has hit $81.2 billion, which still trails dotcom era totals from 2000.

https://www.axios.com/vc-investments-2518448702.html

Continue reading