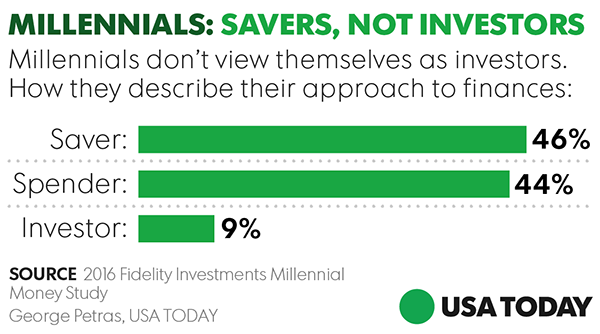

1.Euphoric Stage of Bull Kicking in….Investment Accounts Opened by Millennials +72% Annually at Ameritrade. 24 Hour Trading and Bitcoin Futures?

Millennials are leading an investment revolution. Now the largest demographic in the economy, young investors under 35 are catalyzing a transformation in the asset management and stock trading world.

Investment accounts opened by this demographic rose 72% annually, TD Ameritrade CEO Tim Hockey told Business Insider.In a wide-ranging interview following the $1.2 trillion brokerage’s earnings report that beat Wall Street expectations, Hockey said the firm has seen an explosion of interest in cryptocurrencies, cannabis stocks, and ETFs, particularly from millennials.

Hockey: Funny you should ask, last quarter I sat down at a restaurant with my 26-year-old son and we traded 100 shares of stock at the table using Facebook Messenger’s bot. We launched that last quarter.

Rapier: You recently turned on 24-hour trading, what was the logic behind that new offering? Is it receiving the response you expected?

Hockey: I’m glad you asked! It’s 24/5, so that allows clients to participate in after-hours market moving news that they didn’t have before because markets were open 9:30 to 4. Previously they had opportunities to do this only in the futures markets, but now we’ve offered 12 broad-based ETFs that are quite liquid, for example SPY, QQQ, the gold sector, oil, gas, China… these are all broad-based ETFs that can all now be traded 24 hours a day, five days a week.

It’s only been two days, so it’s just starting to get traction now in the media. It’s still quite narrow, but even last night we’re seeing a three cent spread, which is a nice tight range for people to trade in, even after hours.

Rapier: You also launched bitcoin futures for some clients back in December, how much interest are you seeing from clients in the cryptocurrency space? Will more products show up soon?

Hockey: We just turned on the Cboe product in a very limited release — just to futures clients that were more sophisticated and understood the risk they were taking, and we’ll expand that over time.

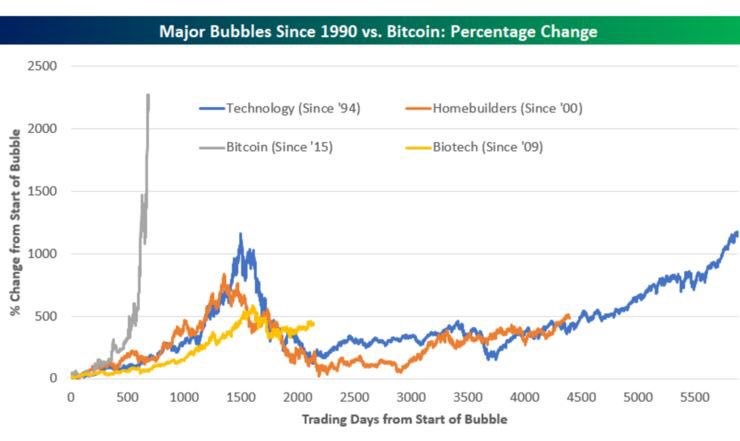

This market is certainly not mature. I would say that what we saw in terms of levels of absolute interest prior to the holiday season seemed to peak. Everybody was talking about crypto of all types all the time because it seemed like it was a one-way increase.

Ever since the pricing has been normalized and there’s been a bit of a correction, then you’ve seen a little bit less froth, if you will, in the market. We’ve actually seen that in the first few weeks of January, crypto trades — not just the Cboe product, but companies that are related to blockchain — have contributed a couple of points less toward our trading activity. It seems to have peaked just before the holidays.

The technology certainly has not matured, and I believe the transformative nature of what blockchain can do is only just starting to be understood by the majority of the world.

https://www.bespokepremium.com/think-big-blog/

Nothing can reverse this overnight like your friends at bar telling you how much they are making on Bitcoin.

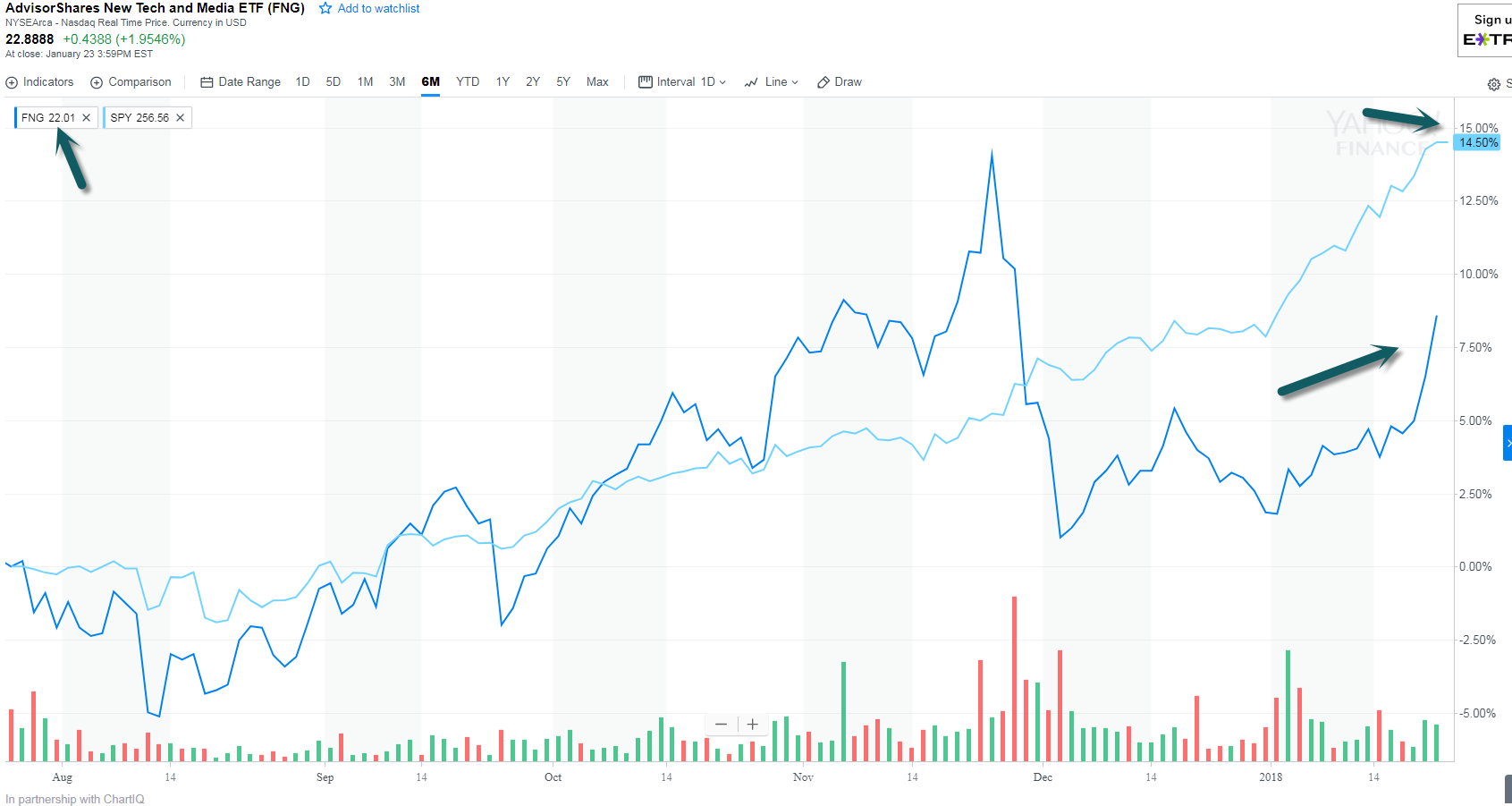

2.Euporia Kicking In….Leveraged 3x FANG Stocks ETF Hits the Market

Leveraged ‘FANG’ ETNs Debut

January 23, 2018

The Bank of Montreal (BMO) has teamed up with REX Shares to launch a pair of ETNs that offer leveraged and inverse exposure to some of the top U.S. stocks. The BMO REX MicroSectors FANG+ Index 3X Leveraged ETNs (FNGU) and the BMO REX MicroSectors FANG+ Index -3X Inverse Leveraged ETNs (FNGD) are tied to a highly concentrated index that targets technology and consumer discretionary stocks.

Both products come with an expense ratio of 0.95% and list on the NYSE Arca.

Their underlying index is equal weighted and covers just 10 “highly traded growth stocks,” according to the prospectus. The ETNs offer 300% and -300% exposure to their benchmarks.

Presumably, the index includes the “FANG” stocks—Facebook, Apple, Netflix and Google—in addition to a handful of others. However, these are not the first FANG-focused exchange-traded products. In July 2017, AdvisorShares rolled out the actively managed AdvisorShares New Tech and Media ETF (FNG), which is now a nearly $47 million fund.

http://www.etf.com/sections/daily-etf-watch/leveraged-fang-etns-debut?nopaging=1

Advisor Shares Started a FANG ETF 6 Months Ago…..The S&P has Returned Double FNG Since Launch

FNG ETF vs. S&P

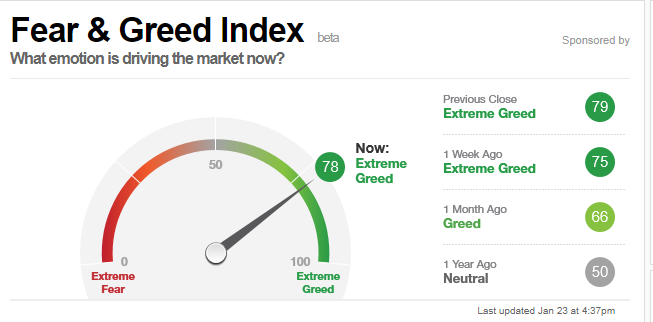

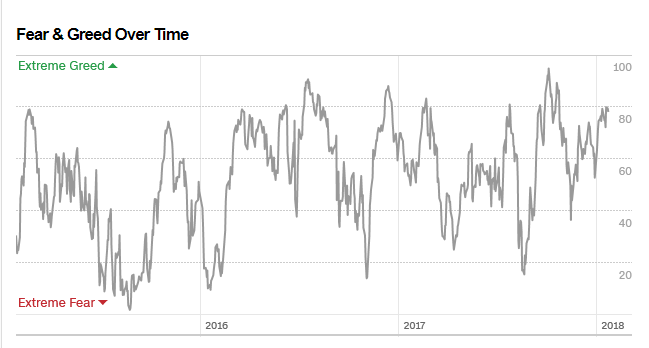

3.Fear and Greed Index Hitting Extreme Level.

Warning…Short-term indicator

http://money.cnn.com/data/fear-and-greed/

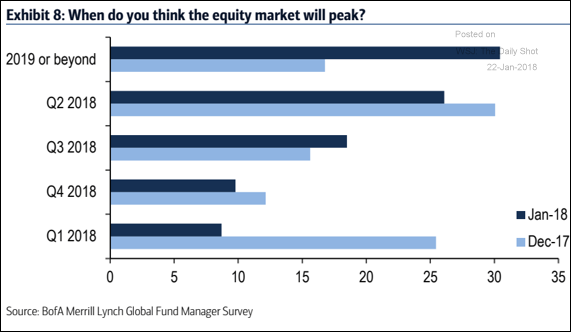

4.More Professional Managers Going All In…Rally will Last Past 2019.

Equity Markets: More managers think this market rally will last through 2019 and beyond.

Source: BofAML

The Daily Shot

www.thedailyshot.com

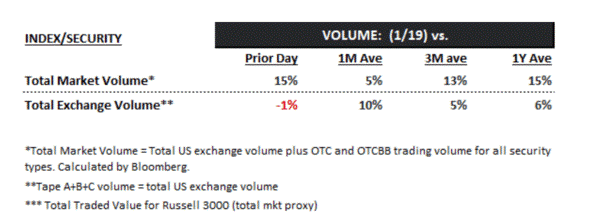

5.Volume was Up 15% Day Over Day..Wow

Below are Hedgeye CEO Keith McCullough’s three key takeaways from today’s edition of The Macro Show. For more access to more insight and analysis, click here for significant savings on your subscription to The Macro Show.)

INVESTORS BOUGHT THE ALL-TIME HIGHS WITH CONVICTION

|

https://app.hedgeye.com/insights/65003-the-macro-show-3-big-things-you-may-have-missed

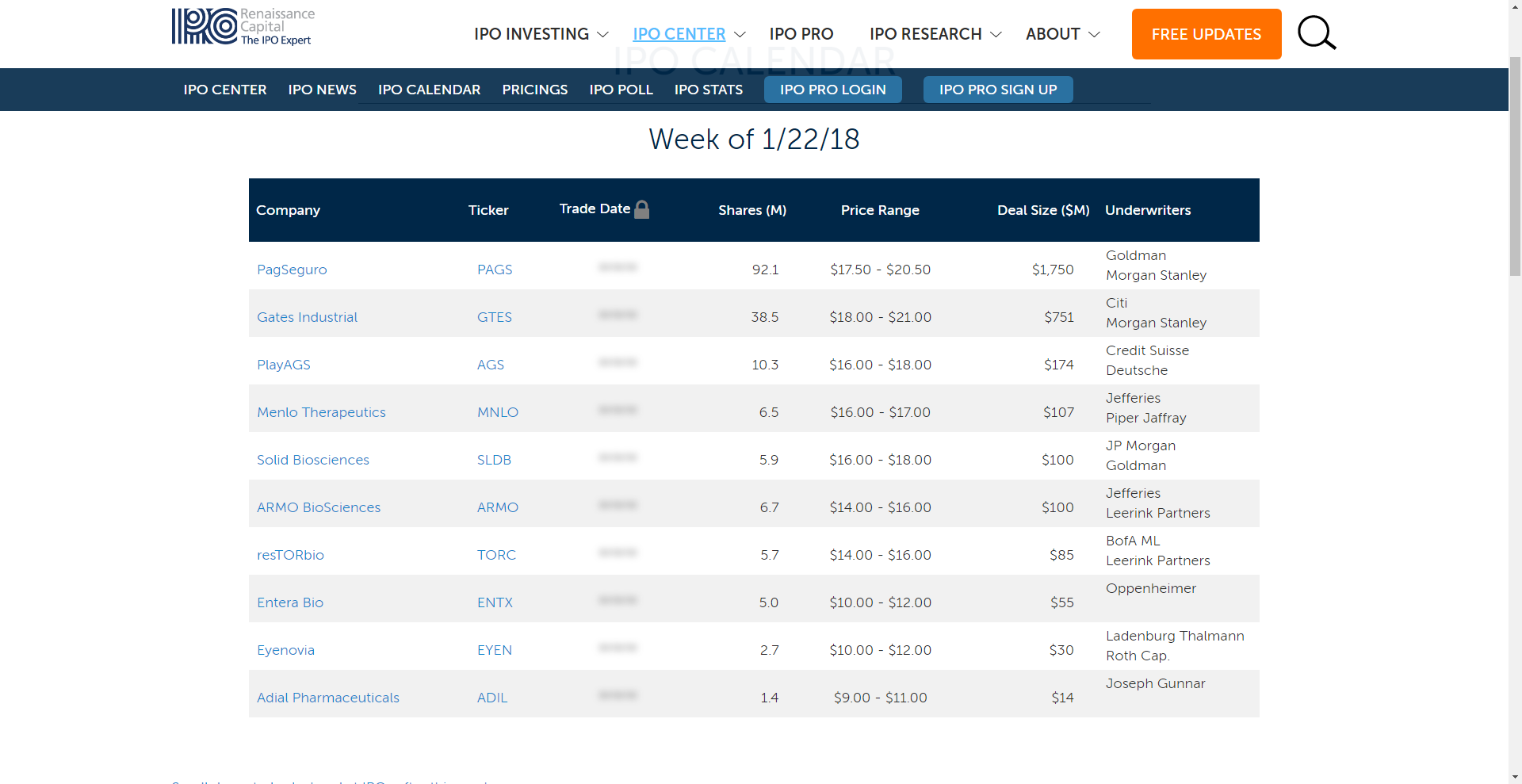

6.The IPO market is on track for its best start to the year in more than a decade

MarketWatch•January 24, 2018

The calendar of initial public offerings is off to a strong start to the year with about 10 more deals expected to come by the end of the month to mark the busiest January for deals since 2014, according to Renaissance Capital, a manager of IPO exchange-traded funds. The 10 deals are expected to raise about $5 billion, which will be added to the $3.1 billion already raised in five deals. “If we get that $8 billion, it would be the most capital raised in the IPO market in January in more than a decade,” said Renaissance principal Kathleen Smith. The biggest deal in the pipeline is the IPO of PagSeguro Digital Ltd. PAGS, +0.00% , a Brazilian fintech operation that offers payment services to small

https://finance.yahoo.com/m/159f55bc-0187-3921-8464-e1c9a8402705/the-ipo-market-is-on-track.html

https://www.renaissancecapital.com/IPO-Center/Calendar

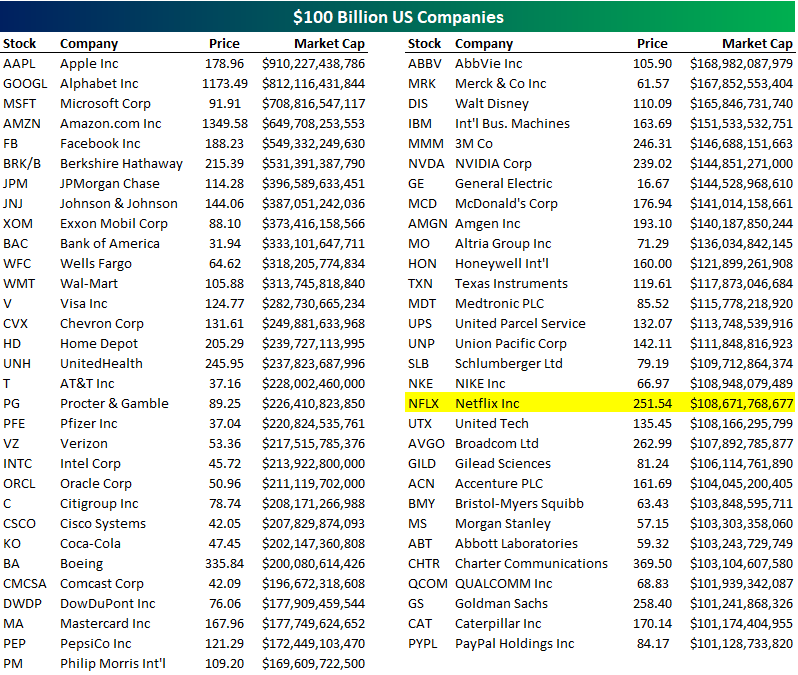

7.NFLX Joins the $100B Market Cap Club Just 61 Companies….At Financial Crisis Low…This List Hit a Financial Crisis Low of 9.

With Netflix’s (NFLX) move higher today, its market cap has pushed above the $100 billion mark. That’s a big deal because it joins an exclusive club of 60 other companies that have a market cap of more than $100 billion. Below is a look at these $100 billion companies sorted from largest to smallest. Today alone, Netflix’s market cap surpassed companies like United Tech (UTX), Broadcom (AVGO), Morgan Stanley (MS), Goldman Sachs (GS), and Caterpillar (CAT).

https://www.bespokepremium.com/think-big-blog/

While the $100 Billion Club is an exclusive list of just 61 companies, we wondered how big the list was back in early 2009 at the lows of the Financial Crisis. The answer? Back then, just nine companies were part of the $100 Billion Club at the Financial Crisis lows, and Exxon Mobil (XOM) was the largest at just $319 billion! It’s truly astounding how far we’ve come since those dark days nine years ago.

Apple (AAPL) — now the largest company in the world — is nearly 3x as large as XOM was back then. In fact, the combined market caps of Apple and Alphabet now (roughly $1.7 trillion) is larger than the combined markets caps of the 13 largest companies at the lows in 2009. There are now 27 companies that are larger than the 2nd largest company (WMT) was in 2009. We could go on and on with similar stats, but you get the point!

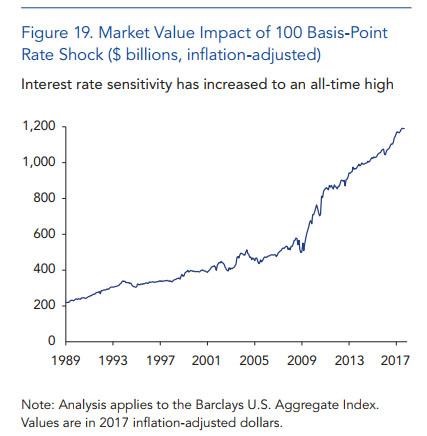

8.Interest Rate Sensitivity has Increased to an All-Time High.

I am not a bond guy but interesting and not shocking considering the amount of debt companies added with rates falling.

Dalio is referring to the record DV01 in the bond market, which according to the OFR has risen to $1.2 trillion: that’s the P&L loss from a 100bps rise in rates.

9.Read of the Day…Quant Trading was Started in a Loft Over a Communist Book Store ….It Also Spawned Amazon.

How a Misfit Group of Computer Geeks and English Majors Transformed Wall Street

In the 1980s, a quiet hedge fund located above a Marxist bookstore launched a revolution that would change finance (and give us Amazon).

In celebration of New York Magazine’s 50th anniversary, this weekly series, which will continue through October 2018, tells the stories behind key moments that shaped the city’s culture.

In the summer of 1988, the hedge-fund manager Donald Sussman took a call from a former Columbia University computer-science professor wanting advice on his new Wall Street career.

“I’d like to come see you,” David Shaw, then 37 years old, told Sussman. Shaw had grown up in California, receiving a Ph.D. at Stanford University, then moved to New York to teach at Columbia before joining investment bank Morgan Stanley, which had a new secretive trading group that was using computer modeling. A neophyte in the ways of Wall Street, Shaw wanted Sussman, who founded the investment firm Paloma Partners, to look at an offer he had received from Morgan Stanley’s rival, Goldman Sachs.

Sussman’s career has been built on recognizing and financing hedge-fund talent, but he had never encountered anyone like David Shaw. The cerebral computer scientist would go on to become a pioneer in a revolution in finance that would computerize the industry, turn long-standing practices on their head, and replace a culture of tough-guy traders with brainy eccentrics — not just math and science geeks, but musicians and writers — wearing jeans and T-shirts.

A harbinger of the techies who would storm Wall Street in a decade, this new generation of hedge-fund introverts would replace the profanity-laced trading rooms of the 1980s with quiet libraries of algorithmic research in every corner of the markets. They would also launch an early email system and look into the prospect of online retailing, leading one of Shaw’s most ambitious employees to take the idea and run with it. Yes, the seeds of Jeff Bezos’s Amazon were planted at a New York City hedge fund.

Thirty years ago, all of that was yet to come. All Shaw told Sussman at the time was, “I think I can use technology to trade securities.”

Sussman told Shaw the Goldman offer he had received was inadequate. “If you’re confident this idea is going to work, you should come work for me,” Sussman told Shaw. The offer led to three days of sailing in Long Island Sound on Sussman’s 45-foot sloop with the financier, Shaw, and his partner, Peter Laventhol. The two men —without disclosing many details — “convinced me they believed they could generate models that would identify portfolios that would be market-neutral and able to outperform others,” Sussman remembers. In lay terms, the strategy would make a lot of money without taking much risk.

Hedge funds were still fairly primitive, and while they were already using mathematical formulas to capture small price disparities in such esoteric instruments as convertible bonds — then a dominant hedge-fund strategy — Shaw was planning to take the math to a whole new level.

Paloma Partners agreed to invest $30 million with D.E. Shaw. Since then, the company has grown into an estimated $47 billion firm, earning its investors more than $25 billion — as of the end of 2016, tied for the third biggest haul ever. It has made millionaires out of scores of employees and a multibillionaire out of Shaw, who stepped back in 2001 from day-to-day operation of the firm to start D.E. Shaw Research, which conducts computational biochemistry research in an effort to help cure cancer and other diseases. Shaw is estimated by Forbes to be worth $5.5 billion, and remains as elusive as ever: He declined to speak to New York for this article.

Meanwhile, the quantitative revolution D.E. Shaw helped spawn has become the biggest trend in hedge funds today, capturing some $500 billion of the industry’s more than $3 trillion in assets and dominating the top tier. Seven out of the top ten largest funds are considered “quants,” including D.E. Shaw itself. One of those seven quants, Two Sigma, was started by D.E. Shaw veterans. But the changes D.E. Shaw wrought haven’t just been felt in hedge funds. Shaw spit out orders accounting for an estimated 2 percent of the trading volume of the New York Stock Exchange in its early years, and thanks to it and other emerging quants, the NYSE was forced to automate. By the end of the 1990s, electronic stock exchanges were driving trading prices down, and by 2001, stocks began to be traded in penny increments, instead of eighths. These changes made it cheaper and easier for all investors to get into the game, leading to an explosion in trading volume.

From the beginning, D.E. Shaw was a quirky enterprise, even for a hedge fund. The first office was far from Wall Street, in a loftlike space above Revolution Books, a communist bookstore on 16th Street, in what was then a still fairly seedy Union Square. The office, about 1,200 square feet, was bare, with freshly painted walls and a tin ceiling. But it boasted two Sun Microsystem computers — the fastest, most sophisticated computers then in vogue on Wall Street. “He needed Ferraris; we bought him Ferraris,” says Sussman.

Read Full Story

http://nymag.com/selectall/2018/01/d-e-shaw-the-first-great-quant-hedge-fund.html

Found on Barry Ritholtz Big Picture Blog

http://ritholtz.com/2018/01/10-tuesday-reads-49/

10.7 Business Lessons Learned From The NFC Champion Philadelphia Eagles

- Published on Published onJanuary 22, 2018

Matt B. Britton

FollowFollow Matt B. Britton

Chief Executive Officer at Crowdtap, Generational Expert, & Bestselling Author Of YouthNation

Anyone who knows me is well aware of the fact that I am a die-hard & lifelong Philadelphia Eagles fan. Driving back from the amazing NFC Championship game in Philadelphia late last night I started to think about what factors have driven the Eagles unexpected success this season and what everyone in business can learn from them.

Here is where I “landed”:

Expect the best…but prepare for the unthinkable. During a critical late-season game against the contending Los Angeles Rams, the unthinkable happened: superstar quarterback Carson Wentz tore a ligament in his knee and was suddenly declared out for the season. However, this was a moment that the Eagles and General Manager Howie Roseman had prepared for all along. As it turns out, an experienced backup named Nick Foles was waiting in the wings and had been preparing every day as if his time to shine was inevitable. Despite Wentz’s catastrophic injury, the Eagles managed to defy logic, bounce back and somehow advance to the Super Bowl. Many teams (and businesses) are simply not prepared for the unthinkable, whether the loss of a top customer or sudden departure of a key executive. Know this: the unthinkable WILL very likely happen to you at some point … all that matters is how you respond!

Empower your young talent. After an early-season injury to starting kicker Caleb Sturgis, the Eagles were left with no choice but to rely on unproven rookie kicker Jake Elliott, who had been cut by the Cincinnati Bengals during the preseason. The team stuck with Elliott through the ups and downs of being a rookie and were unwavering in their support. His teammates held him up in times of need and his empowerment has paid back in spades. Don’t be limited by your perception of others. Empower and trust those around you — regardless of age — who are capable to get the job done… and then get out of their way.

Measure twice, cut once. In addition to the Wentz injury, head coach Doug Pederson has had to contend with a slew of injuries to key personnel including Jason Peters, Darren Sproles, and Jordan Hicks. Instead of panicking or making excuses, Pederson and his team spent countless hours in the film room, figuring out how to leverage the unique talents of backup players now thrust into starting roles and how to exploit the varying weaknesses of their weekly opponents. Like many great war generals throughout history, Pederson outsmarted his opponents even in instances where he was greatly outmatched in talent and rode his players to victory.

Let the haters fuel your success. Nobody gave the Eagles a chance after Wentz went down. The Eagles and their new quarterback were laughed off by the media, became a national punchline as a desperate team, and were widely disregarded by competitors. Rather than let this doubt discourage them, the Eagles used it as a rallying cry, embracing the underdog role and even wearing dog masks after their first playoff win as a symbol of resiliency. DO not swim into the current of your criticism; instead, let it propel you to prove everyone wrong.

Persistence trumps all: During the 2017 NFL Draft, University of Wisconsin standout running back Corey Clement did not hear his name called among the 254 players that were selected thanks to questions about his character, stamina, and talent. Not one of the 32 teams was willing to take a chance on him. Undeterred, Clement pursued an unlikely “walk-on” role in the NFL by participating in a slew of open tryouts. Apparently, though, Clement always knew he would one day be an Eagle and simply did not give up on his dream. As fate would have it, it was indeed the Eagles who decided that Clement deserved a shot and allowed him to try out for the team during the preseason. Due to a combination of luck and opportunity, Clement miraculously made the team in August and has since made the most of it, turning into a critical contributor who now has a bright future in the NFL. At times, it will feel like everyone is saying no or hanging up on you. Be like Corey.. put your head down and keep pushing… do not give up on your dreams.

Invest in your top talent. The Eagles have done a stellar job at identifying elite talent and then quickly locking it up for the long term as they did this season with star wide receiver Alshon Jeffrey. Once your key contributors know that you are invested in them, they are likely to return the favor as Jeffrey proved Sunday night with two touchdowns in the Eagles’ most important game in nearly two decades. Don’t take the chance of letting your stars walk out the door — and worse, heading straight to your competitor. Over-invest, incentivize, and get them on your team for the long-term.

Team dynamic and work ethic are contagious. Perhaps the biggest reason for the Eagles’ success this year is that they loaded their roster with experienced, hard-working leaders who put the team first. This team does not have “me-first” players who throw tantrums when they aren’t in the spotlight or don’t get the credit they feel they deserve. Instead, the Eagles filled their locker room with vocal leaders such as Malcolm Jenkins, Chris Long, and Jason Peters who don’t look to take credit but to build character, respect, and determination from within. They lead by example, which has been contagious — and a major reason why despite endless adversity this season, the Eagles are headed to the Super Bowl.

There are really so many parallels between business and football and I believe that many of them emerged in closely following this lovable group of athletes. Win or lose the Eagles have a lot to be proud of and they certainly have pointed me in the direction of being a Super Bowl caliber CEO. Now if someone can just figure out how to stop Tom Brady ? #FlyEaglesFly