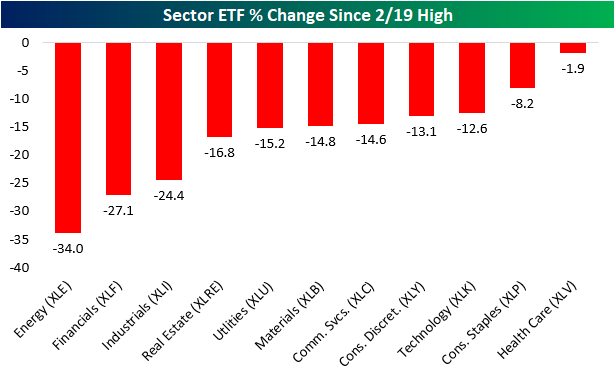

1.Sector ETF Changes Since 2/19 Highs.

Bespoke

This morning, we highlighted the recent performance of sector ETFs noting how Health Care has led the way higher rising the furthest above its 50-DMA. Consumer Discretionary (XLY), Technology (XLK), Materials (XLB), Communication Services (XLC), and Consumer Staples (XLP) each had also risen above their 50-DMAs. Given their outperformance, as shown in the table below, headed into today these were the sectors closest to their levels on the S&P 500’s last all time high on February 19th. The Health Care ETF (XLV) actually headed into today less than 2% away from its 2/19 levels and XLP was also under 10% away.

https://www.bespokepremium.com/interactive/posts/think-big-blog/outperformers-underperform

Continue reading →