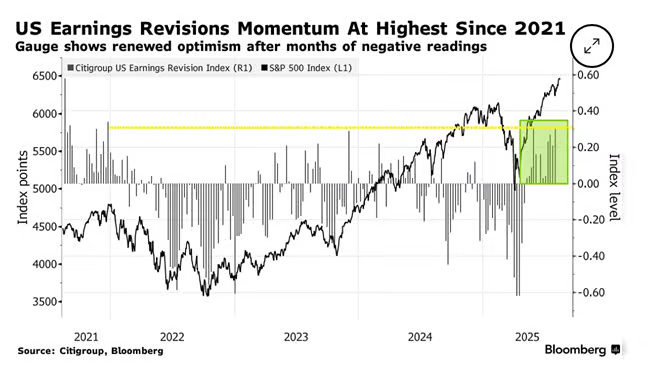

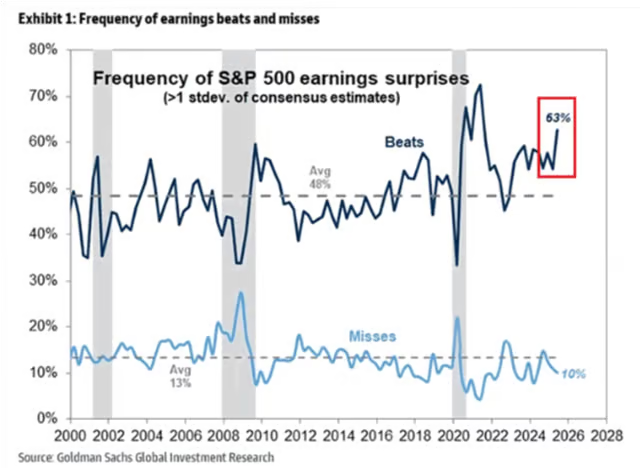

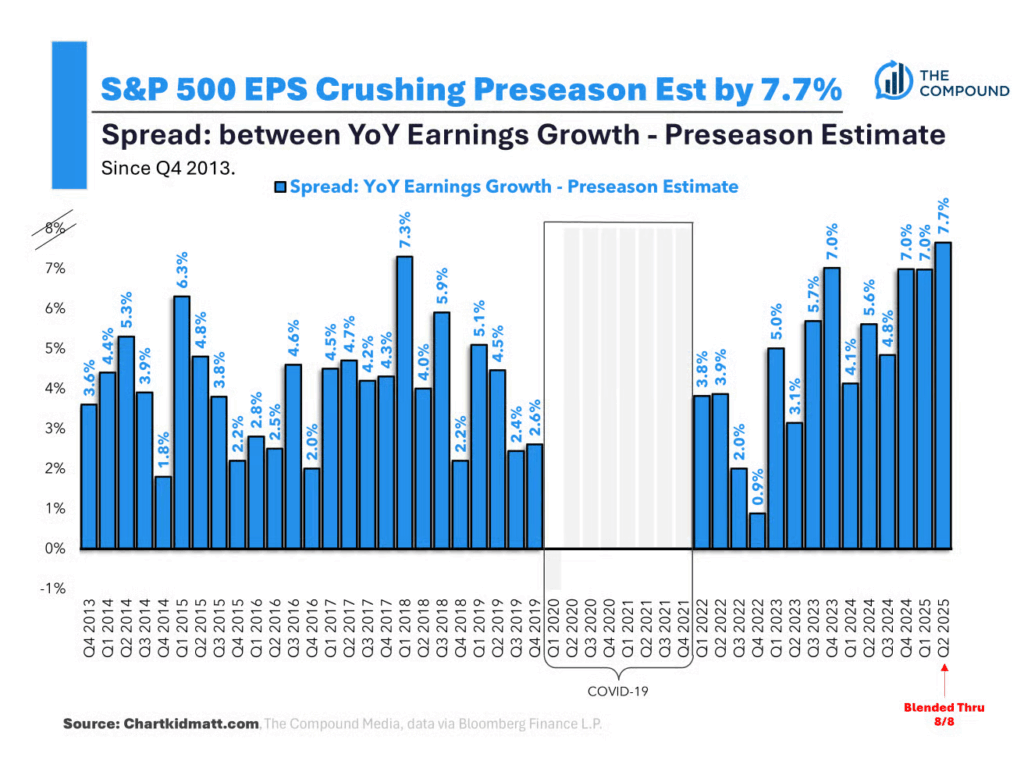

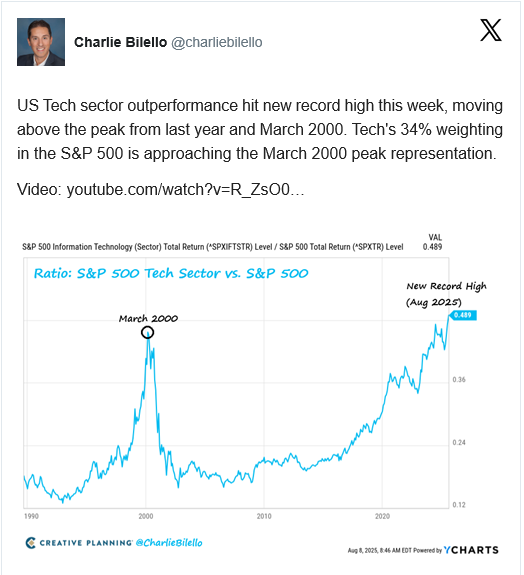

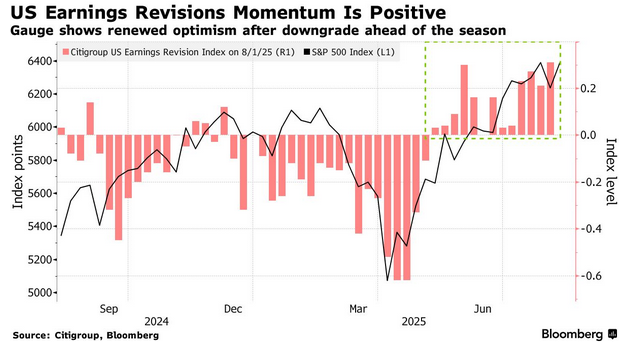

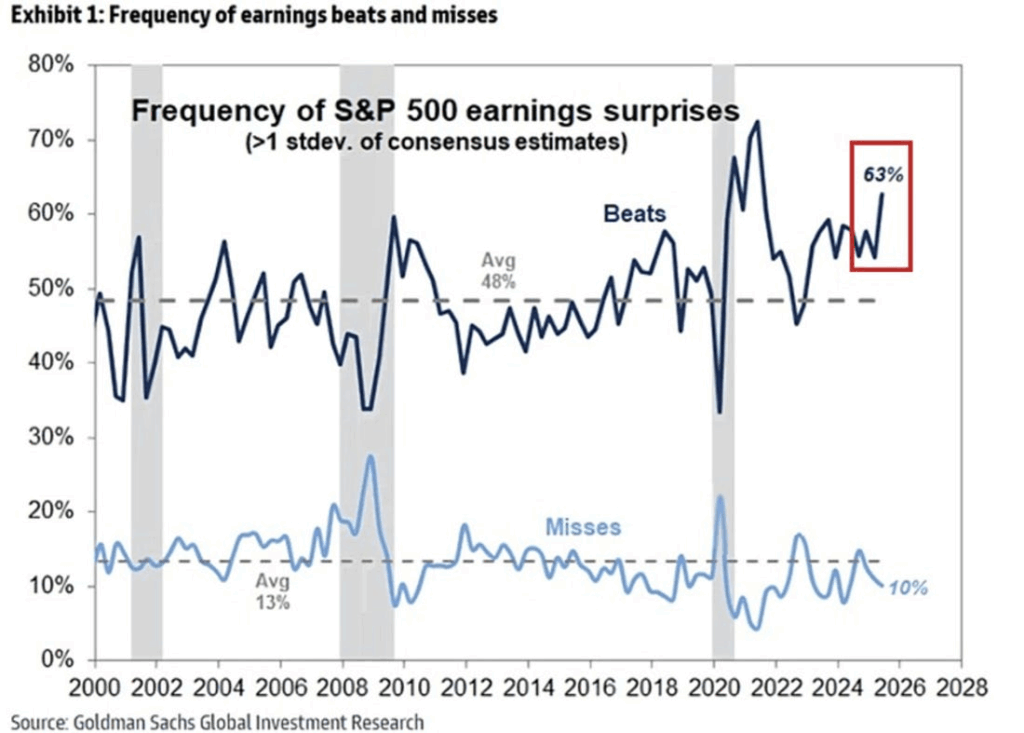

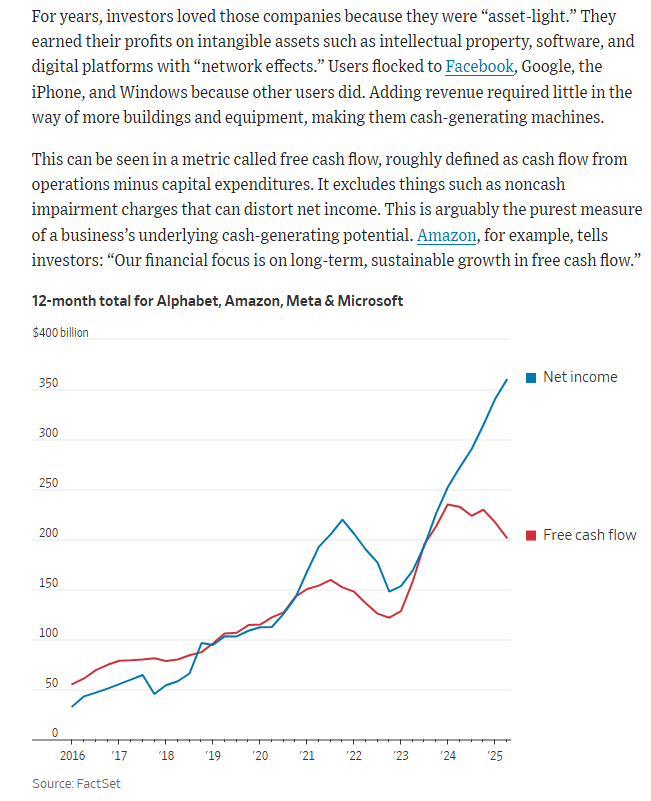

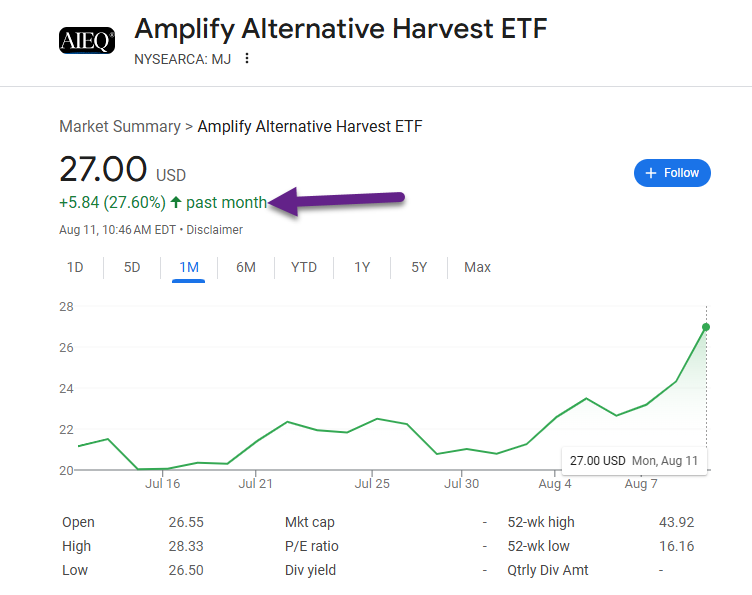

1. It’s All About Earnings = Tech

Bob Elliott

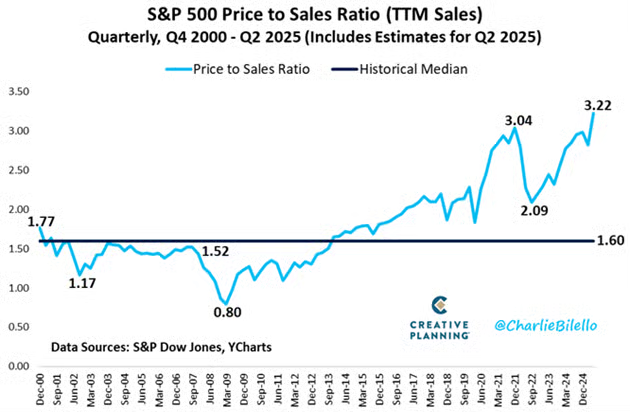

2. The S&P 500 is now trading at over 3.2x sales, its highest price to sales ratio in history

Charlie Bilello

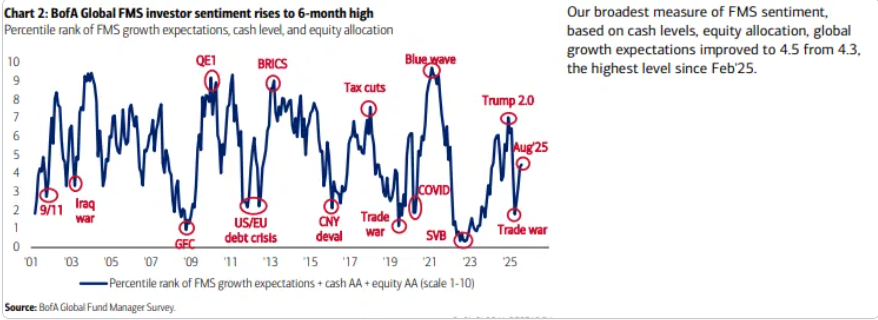

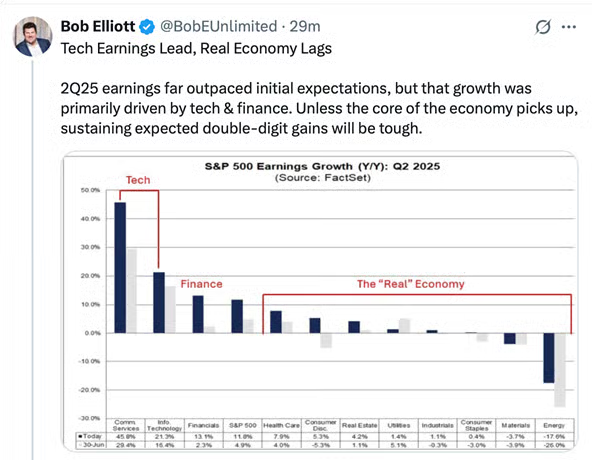

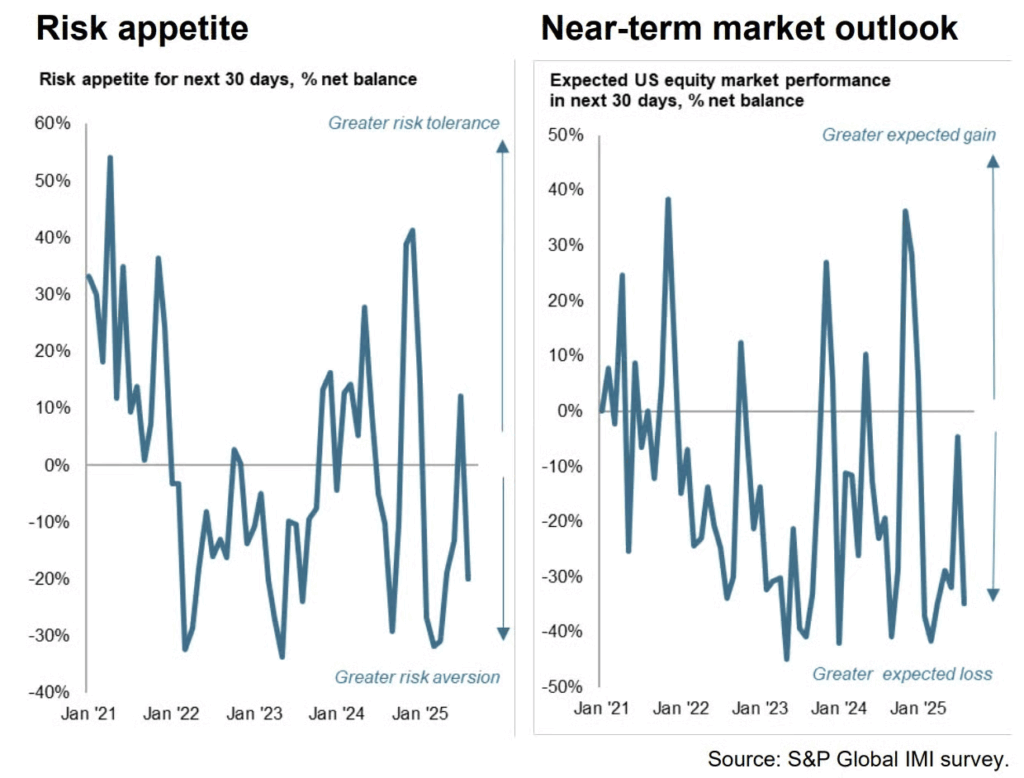

3. Investment Manger Sentiment is Far From Overly Bullish

@Callum Thomas (Weekly S&P500 #ChartStorm)

Investment Manager Sentiment: Similar thing in the Investment Manager survey; risk appetite and near-term market outlook have dropped back to quite pessimistic levels. The key causes for concern are valuations, politics, and macro. The only bright spot in the survey is earnings (which I also highlighted last week that indeed earnings look unequivocally good for now).

S&P Global

4. Chinese Small Cap Stocks ECNS +51% 2025

Yahoo! Finance

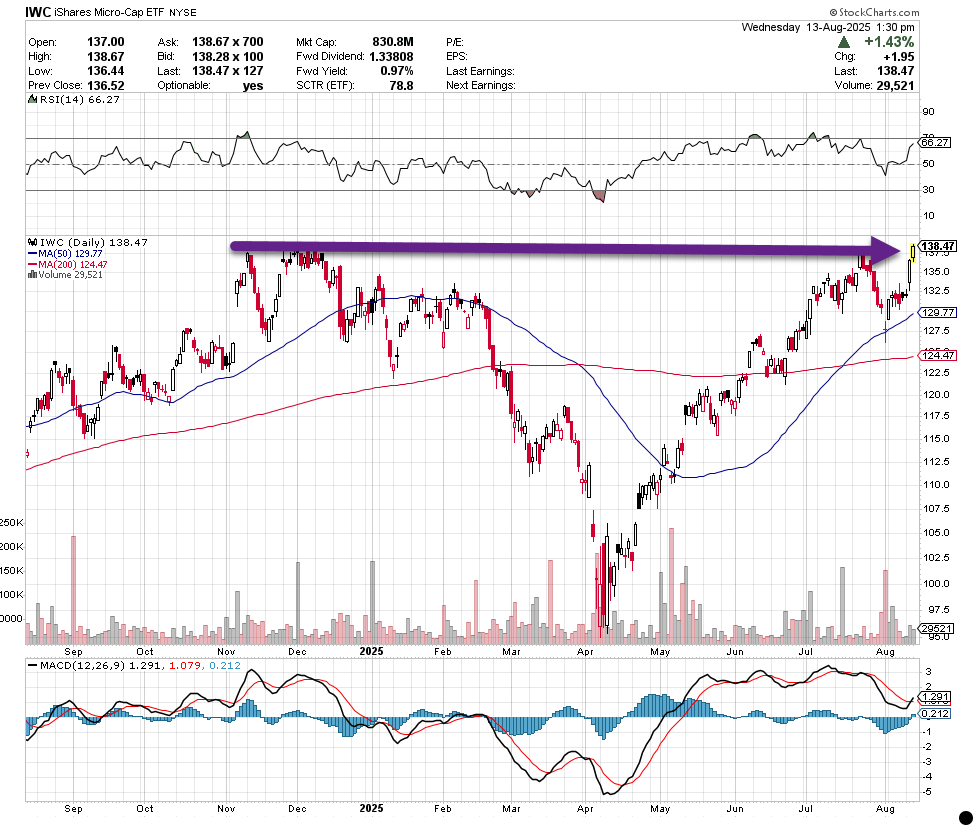

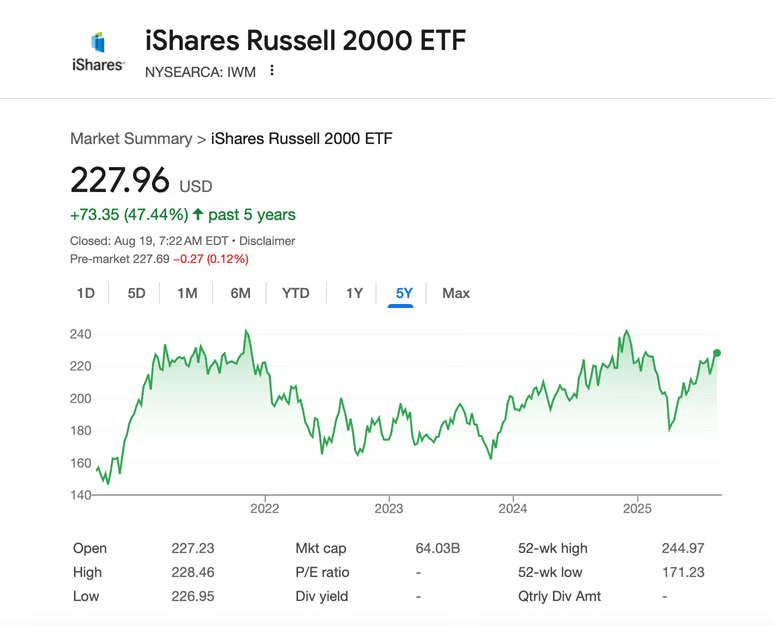

5. U.S. Small Cap IWM Outperforming S&P One Month…Needs $240 Handle to Break Above 2022 Levels

Yahoo! Finance

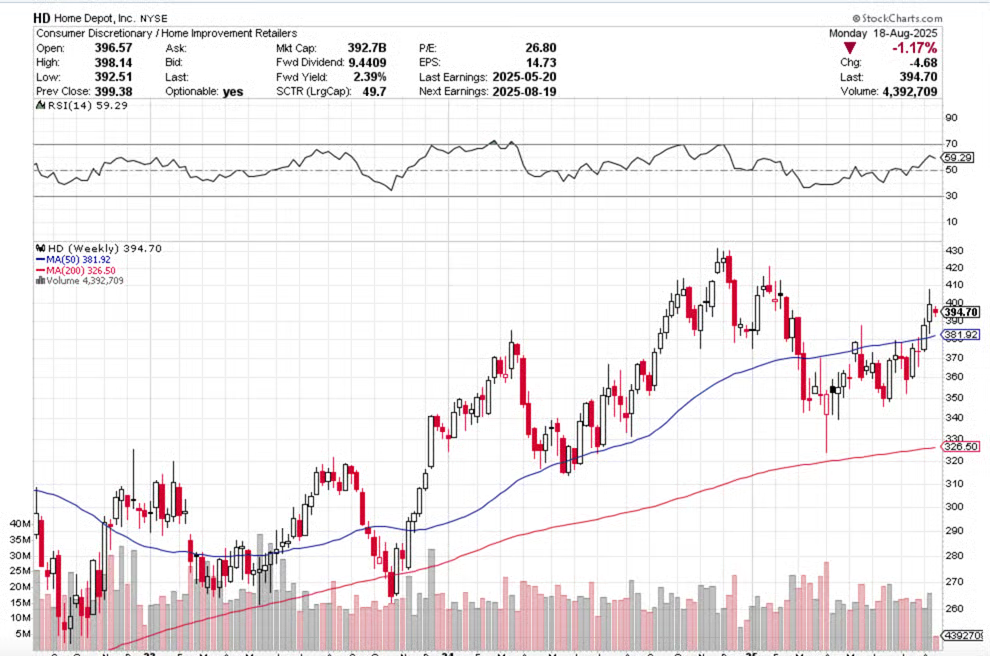

6. Home Depot Earnings …. Stock Trading Below 2024 Highs

StockCharts

7. Home Price Drops from 2022 Covid Highs

The 19 metros whose prices are down from their 2022 highs.

Led by these metros with percentage declines from their highs in 2022:

- Austin: -22.8%

- San Francisco: -10.1%

- Phoenix: -9.0%

- San Antonio: -8.0%

- Denver: -7.0%

- Sacramento: -6.7%

- Tampa: -5.3%

- Honolulu: -5.2%

- Dallas: -5.0%

- Portland: -4.7%

- Salt Lake City: -3.7%

- Seattle: -3.3%

- Raleigh: -2.1%

| The Most Splendid Housing Bubbles in America, July 2025: The Price Drops & Gains in 33 Large Expensive Metros | Wolf Street wolfstreet.com/2025/08/18/the-most-splendid-housing-bubbles-in-america-july-2025-the-price-drops-gains-in-33-large-expensive-metros |

8. Home builders boost sales incentives to 5-year high as they struggle to sell newly built homes

Two-thirds of builders are offering sales incentives to lure home buyers

Builder sentiment has been in negative territory for the last 16 months in a row, the NAHB noted.

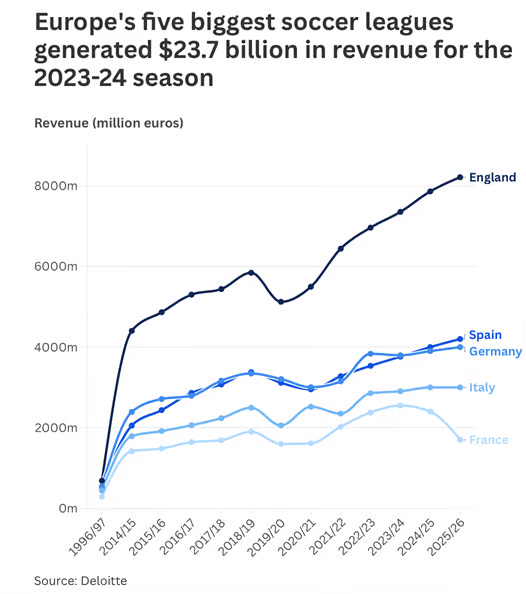

9. American Money Pouring into European Soccer

10. I’m a psychologist who studies couples: People in the happiest relationships talk about 5 things every day—that most neglect

- The state of their relationship Couples in thriving relationships always make a point to check in and make sure the other partner is happy. On some days, that means asking: “Do you feel loved? Supported? Connected?” Other days, it’s about expressing appreciation, sharing a laugh over a favorite memory or talking about something they’re looking forward to doing together. Having these daily check-ins help prevent small misunderstandings from growing into larger issues.

- What they’re currently into In the strongest relationships, both partners stay curious about what excites the other. It could be a song they can’t stop listening to, a book they’ve been devouring, a hobby they’re exploring or even a TikTok that made them laugh. Regardless of whether their interests overlap, they stay curious about each other’s passions. This is what keeps the spark alive. Over their years together, these little updates remind one another of perhaps the most important thing to remember in a relationship: “We’re constantly growing and evolving, and we’re doing it together.”

- Their future dreams Happy couples are never stuck in the present or past. They often have conversations about long-term goals: owning a home, traveling more, starting a business or raising kids. They also don’t shy away from less practical, more whimsical topics, like what they’d do with a year off, how they’d renovate their dream kitchen or where they’d go if money wasn’t a concern. DON’T MISS: How to Build a Standout Personal Brand: Online, In Person, and At Work Discussing dreams, no matter how realistic or farfetched, keeps the relationship future-oriented by instilling a joint sense of purpose and possibility. Even if a dream can’t be acted on right away, talking it over allows them to keep track of each other’s values.

- Their fears and stressors Happy couples aren’t uncomfortable bringing up what’s bothering them. A healthy relationship should feel like a safe space where couples can work through their troubles together as a team. Whether it’s a tough day at work, a lingering insecurity or even a fear about the relationship itself, they trust their partner to respond with empathy. Over time, this daily practice of being emotionally honest builds a rock-solid sense of safety. Both partners will never feel like they have to carry their baggage alone.

- Their random thoughts Even a half-formed musing can be a fun way to connect. Happy couples never think twice about sharing their random ideas: their shower thoughts, their “what-ifs,” their “this just popped into my head” theories. And these don’t always have to be deep or profound. In fact, they’re usually pretty silly, weird or seemingly irrelevant. Adding a little bit of playfulness and spontaneity into every conversation also makes space for laughter and even intimacy. I always remind couples that a big part of building a successful relationship is about being intentional with the conversations you choose to have. Couples who stay connected day after day create a shared space for curiosity, growth and joy.