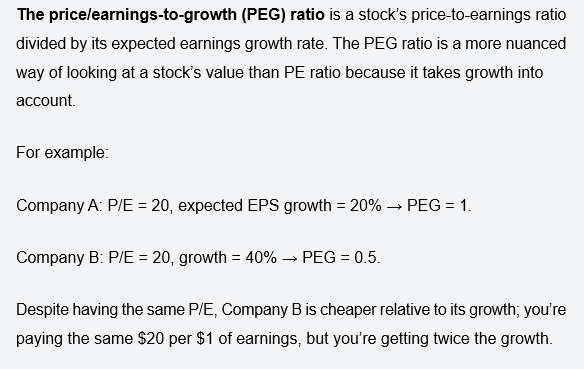

1. Consumer Staple Stocks and PEG Ratios-Prof G Newsletter

Prof G Markets

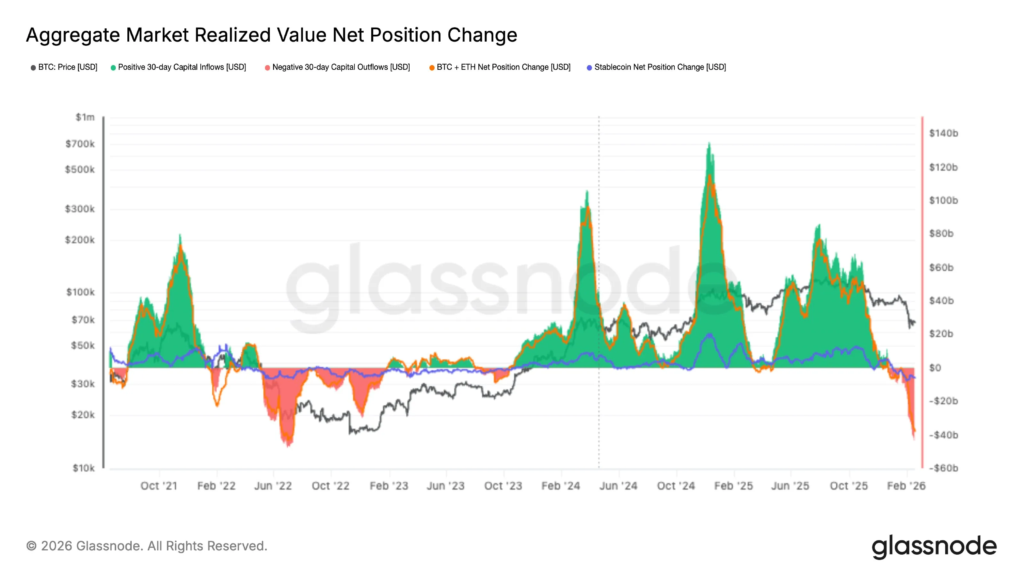

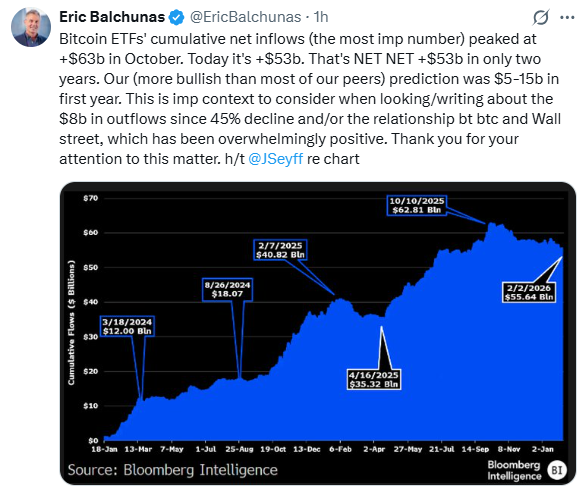

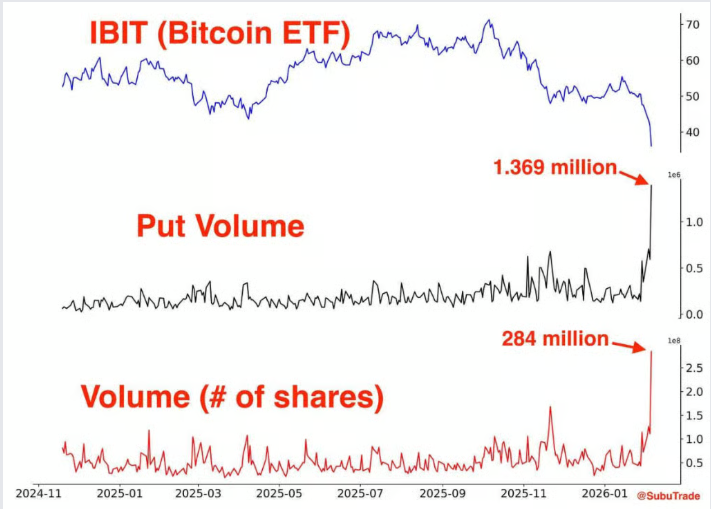

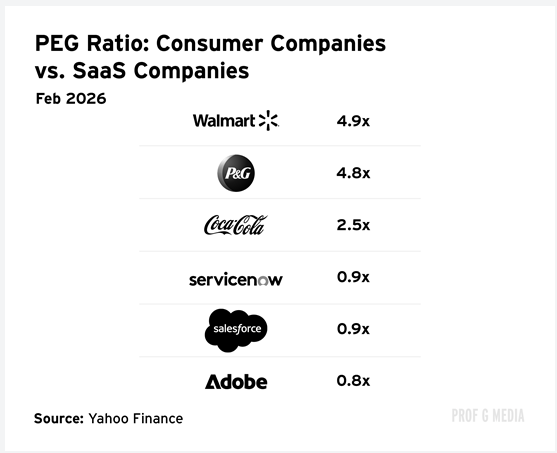

2. Retail Investor Not Buying Bitcoin Dip….5 Weeks of Outflows from ETF

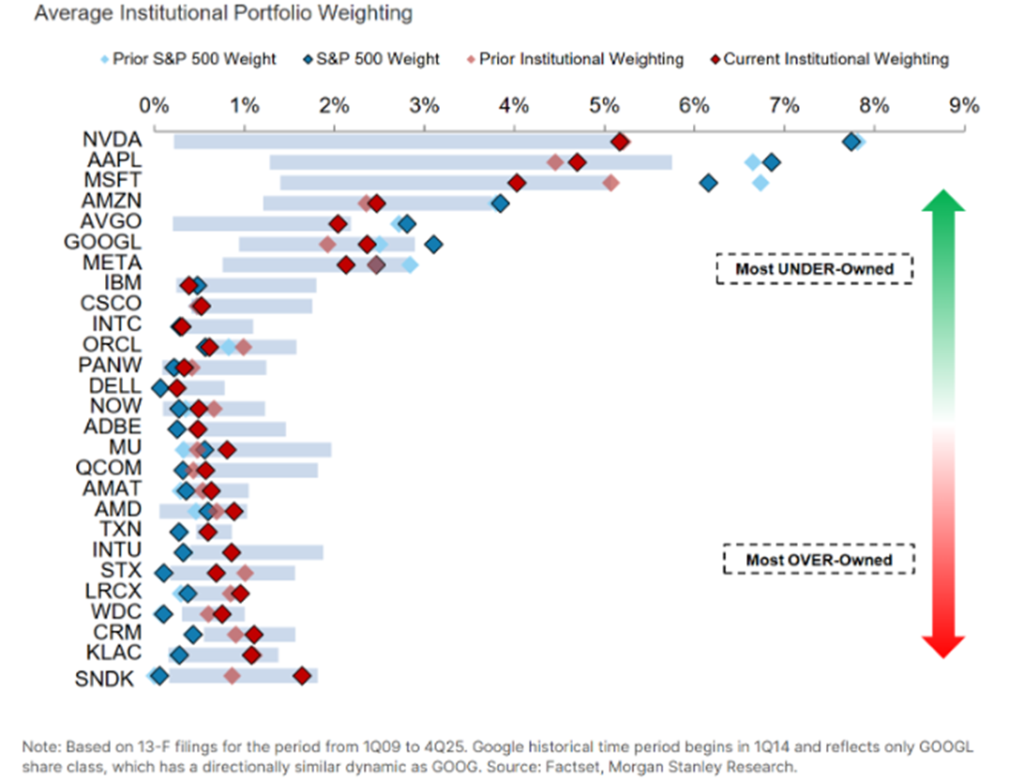

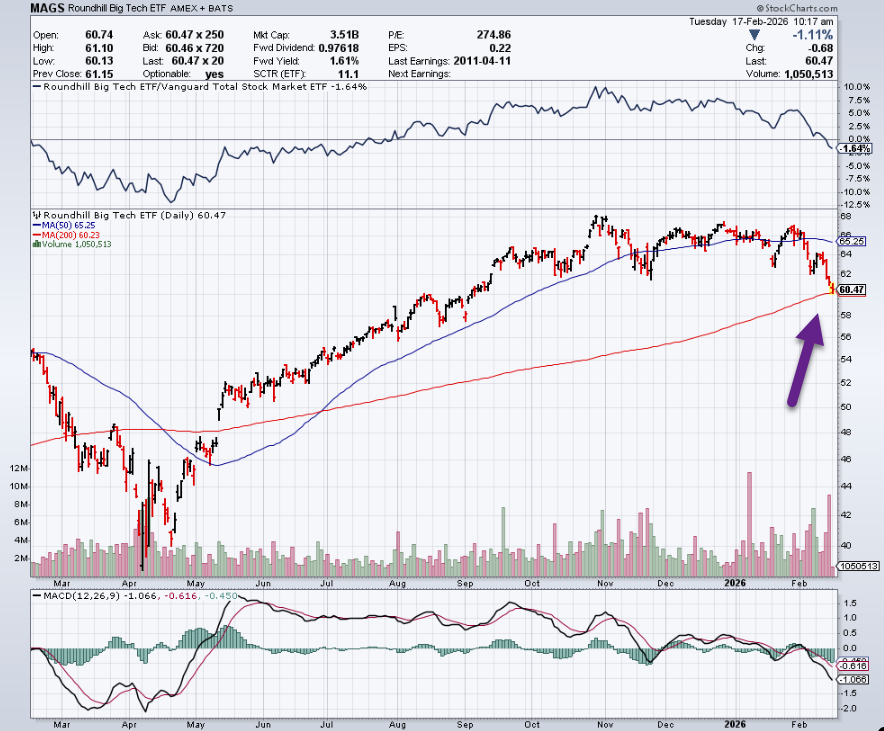

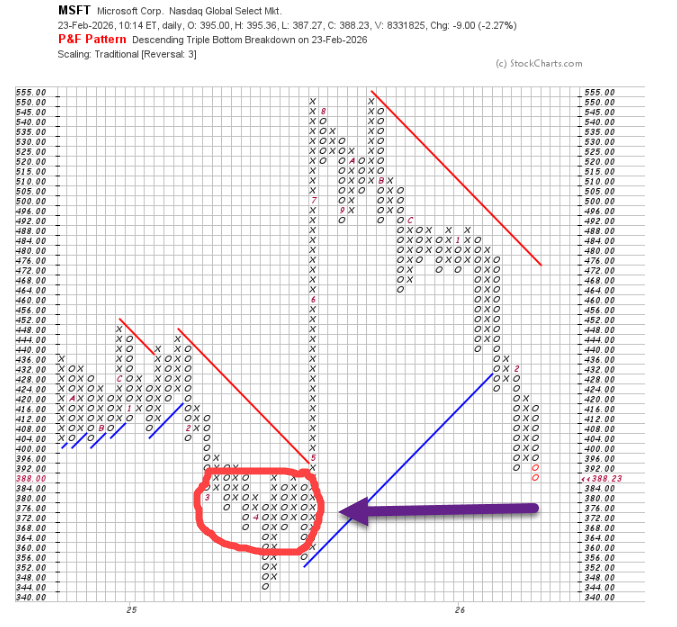

3. MSFT -30% from Highs…Hitting Liberation Day Support Levels

StockCharts

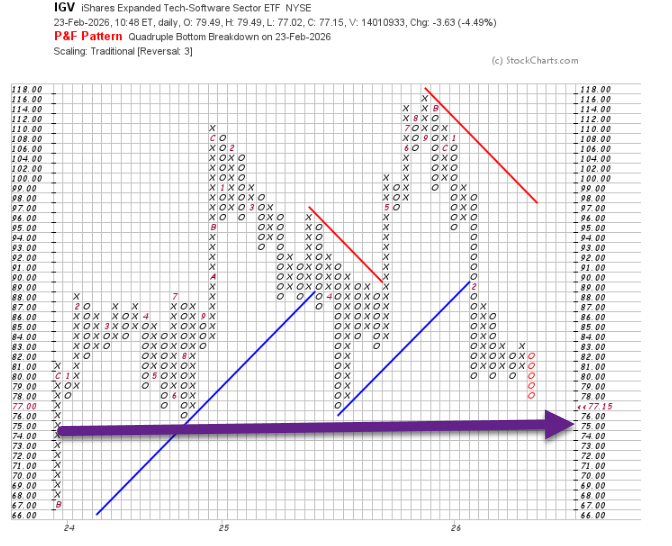

4. Software ETF IGV Hitting 2 ? Year Support Levels

StockCharts

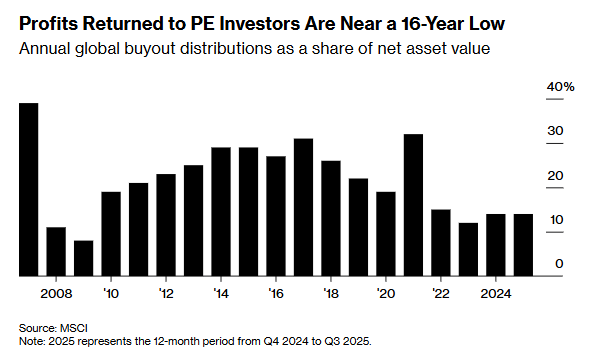

5. Private Equity’s Dry Spell Worse Than 2008 Crisis, Bain Says

By Preeti Singh

Bloomberg

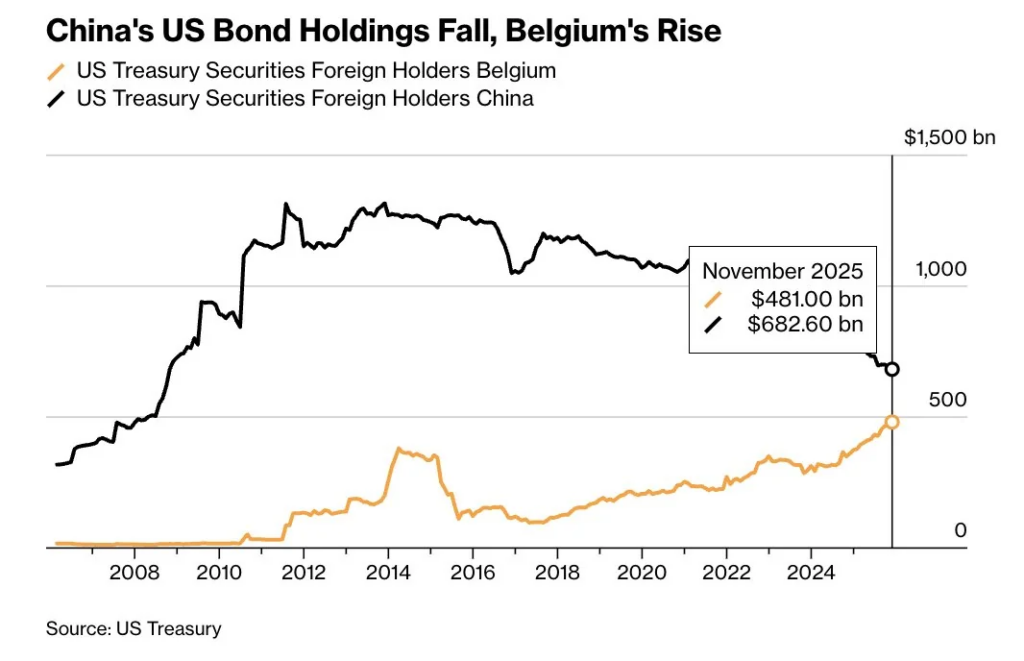

6. Is China Really Dumping US Treasuries?

Advisor Perspectives by Lance Roberts of Real Investment Advice, 2/23/26

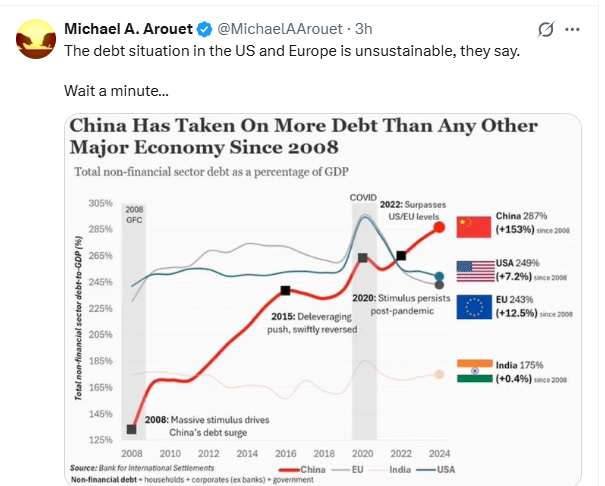

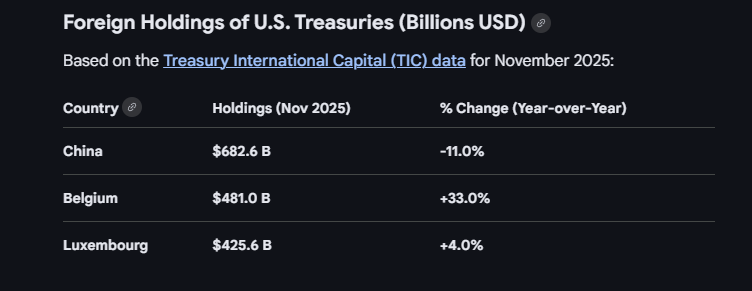

However, just because China owns U.S. Treasuries does not mean it must have custodial holdings in the U.S. Look at the same holdings table and focus on Belgium and Luxembourg. In the November 2025 snapshot, Belgium shows about $481 billion in Treasury holdings, and Luxembourg shows about $425 billion. Those are massive totals for very small countries that are not building reserves at that scale

In reality, Luxembourg and Belgium are “hosting custody” for China. Just for reference look at the chart of US Treasury holdings of China and Belgium. Over the same period, while China’s holdings fell by $600 billion, Belgiums rose by $500 billion.

Advisor Perspectives

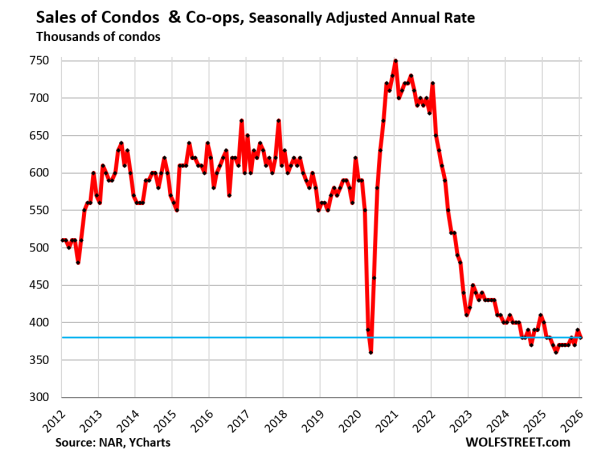

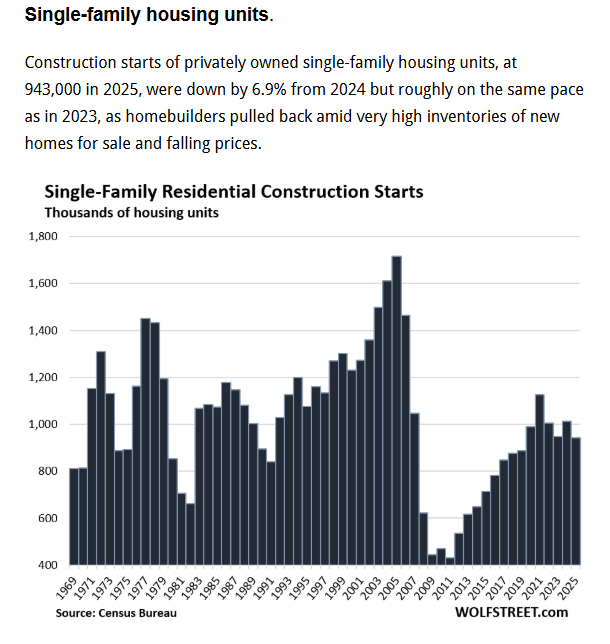

7. Single Family Housing Construction -6.9% Year Over Year

Wolf Street

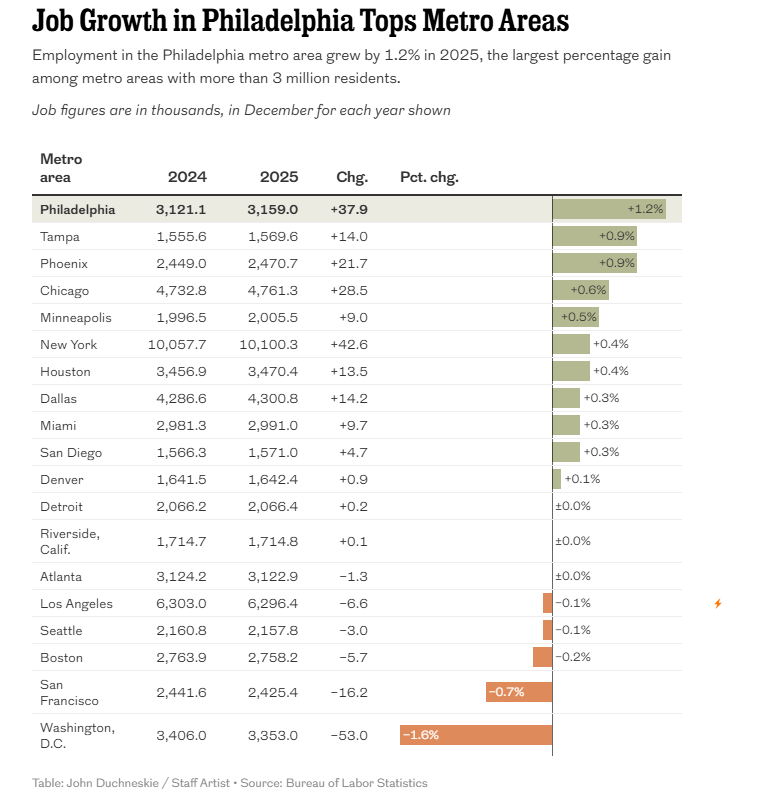

8. Philadelphia Leads Job Growth in Large Metro Areas

The Philadelphia Inquirer

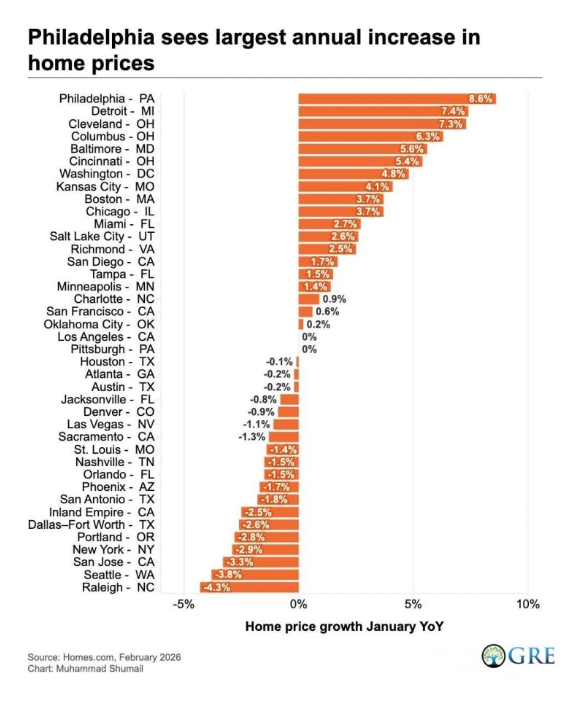

9. Philadelphia Sees Largest Annual Increase in Home Prices

10. Drinking 2-3 cups of coffee a day tied to lower dementia risk

The Harvard Gazzette Marked differences between caffeinated, decaffeinated drinks in analysis of more than 130,000 people

Mass General Brigham Communications

February 9, 2026 4 min read

Evidence from a study of more than 130,000 people suggests that two to three cups of coffee a day can reduce dementia risk and slow cognitive decline.

The research — published in JAMA and led by investigators from Mass General Brigham, Harvard T.H. Chan School of Public Health, and the Broad Institute of MIT and Harvard — analyzed data from the Nurses’ Health Study and Health Professionals Follow-Up Study.

“When searching for possible dementia prevention tools, we thought something as prevalent as coffee may be a promising dietary intervention — and our unique access to high-quality data through studies that have been going on for more than 40 years allowed us to follow through on that idea,” said senior author Daniel Wang, associate scientist with the Channing Division of Network Medicine in the Mass General Brigham Department of Medicine and assistant professor at Harvard Medical School. Wang is also an assistant professor in the Department of Nutrition at Harvard Chan School and an associate member at the Broad Institute.

“While our results are encouraging, it’s important to remember that the effect size is small and there are lots of important ways to protect cognitive function as we age. Our study suggests that caffeinated coffee or tea consumption can be one piece of that puzzle.”

“While our results are encouraging, it’s important to remember that the effect size is small and there are lots of important ways to protect cognitive function as we age.”

Daniel Wang

Early prevention is especially crucial for dementia, since current treatments are limited and typically offer only modest benefit once symptoms appear. Focus on prevention has led researchers to investigate the influences of lifestyle factors like diet on dementia development.

Coffee and tea contain bioactive ingredients like polyphenols and caffeine, which have emerged as possible neuroprotective factors that reduce inflammation and cellular damage while protecting against cognitive decline. Though promising, findings about the relationship between coffee and dementia have been inconsistent, as studies have had limited follow-up and insufficient detail to capture long-term intake patterns, differences by beverage type, or the full continuum of outcomes — from early subjective cognitive decline to clinically diagnosed dementia.

Data from Nurses’ Health Study and Health Professionals Follow-Up Study help to overcome these challenges. Participants repeated assessments of diet, dementia, subjective cognitive decline, and objective cognitive function, and were followed for up to 43 years. Researchers compared how caffeinated coffee, tea, and decaffeinated coffee influenced dementia risk and cognitive health of each participant.

Of the 131,821 participants, 11,033 developed dementia. Both male and female participants with the highest intake of caffeinated coffee had an 18 percent lower risk of dementia compared with those who reported little or no caffeinated coffee consumption. Caffeinated coffee drinkers also had lower prevalence of subjective cognitive decline (7.8 percent versus 9.5 percent). By some measurements, those who drank caffeinated coffee also showed better performance on objective tests of overall cognitive function.

Higher tea intake showed similar results, while decaffeinated coffee did not — suggesting that caffeine may be the active factor producing these neuroprotective results, though further research is needed to validate the responsible factors and mechanisms.

The cognitive benefits were most pronounced in participants who consumed two to three cups of caffeinated coffee or one to two cups of tea daily. Contrary to several previous studies, higher caffeine intake did not yield negative effects — instead, it provided similar neuroprotective benefits to the optimal dosage.

“We also compared people with different genetic predispositions to developing dementia and saw the same results — meaning coffee or caffeine is likely equally beneficial for people with high and low genetic risk of developing dementia,” said lead author Yu Zhang, a student at Harvard Chan School and a research trainee at Mass General Brigham.