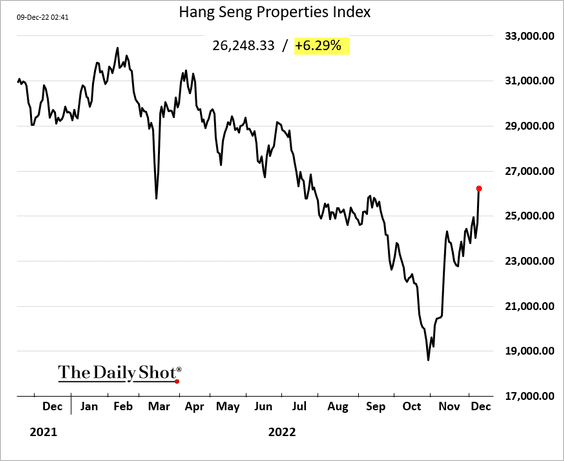

1. Fed 2009-2021 vs. Today-Howard Marks Oaktree

From Howard Marks Letter

https://www.oaktreecapital.

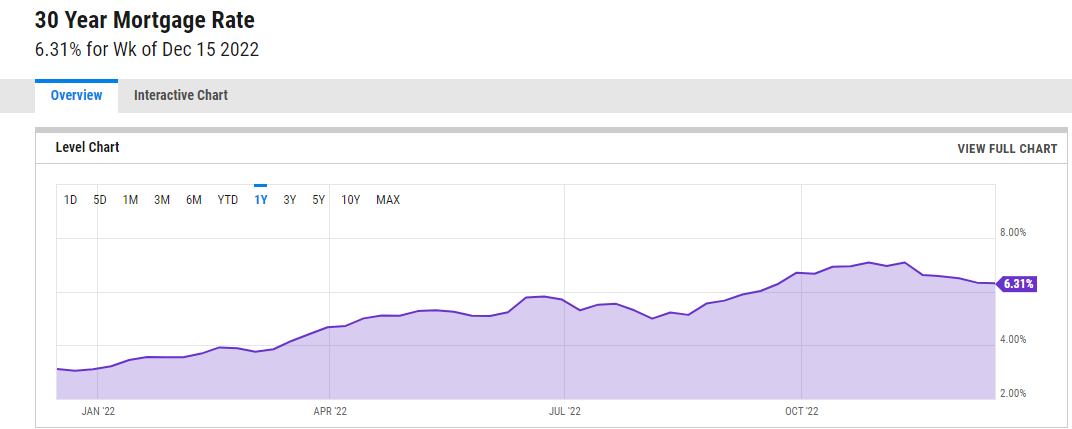

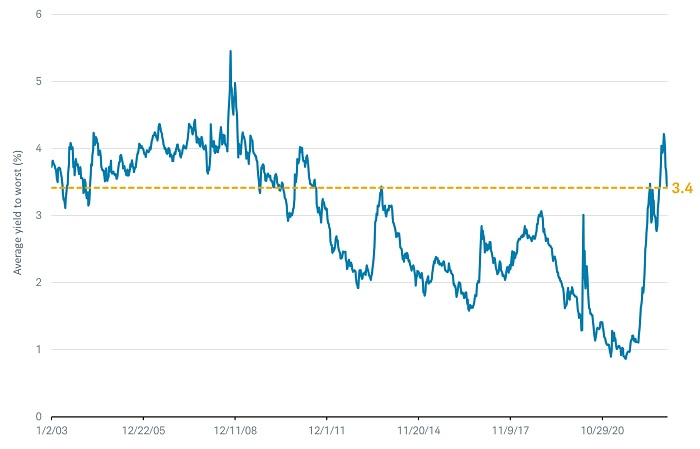

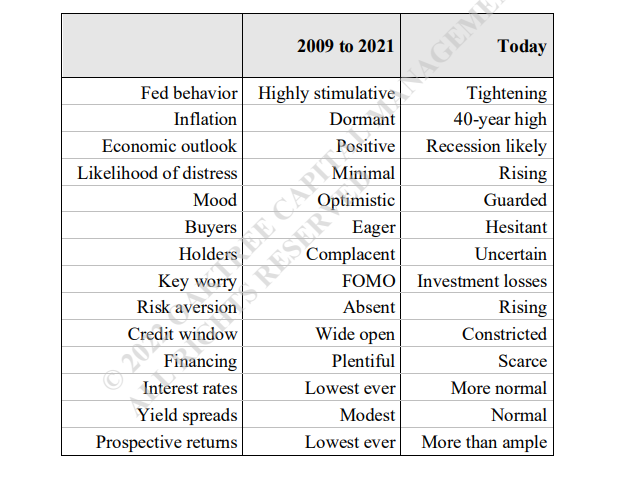

2. 30 Year Treasury Bond Traded Close to 2008 Levels

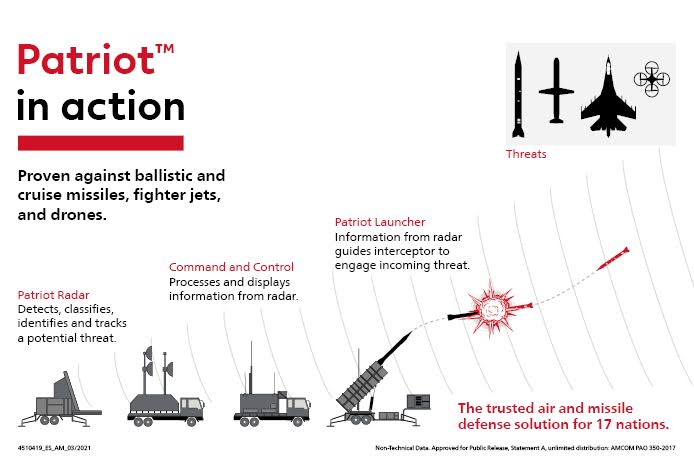

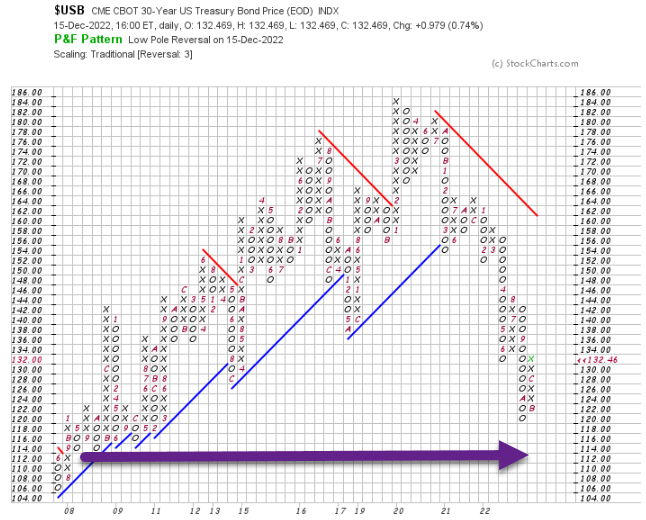

3. Worldwide Defense Spending Going Up …Aerospace/Defense Stocks Outperform

Japan Doubled Defense Spending This Year

Rising defense spending is buoying defense stocks. (chart via @ycharts)

https://abnormalreturns.com/

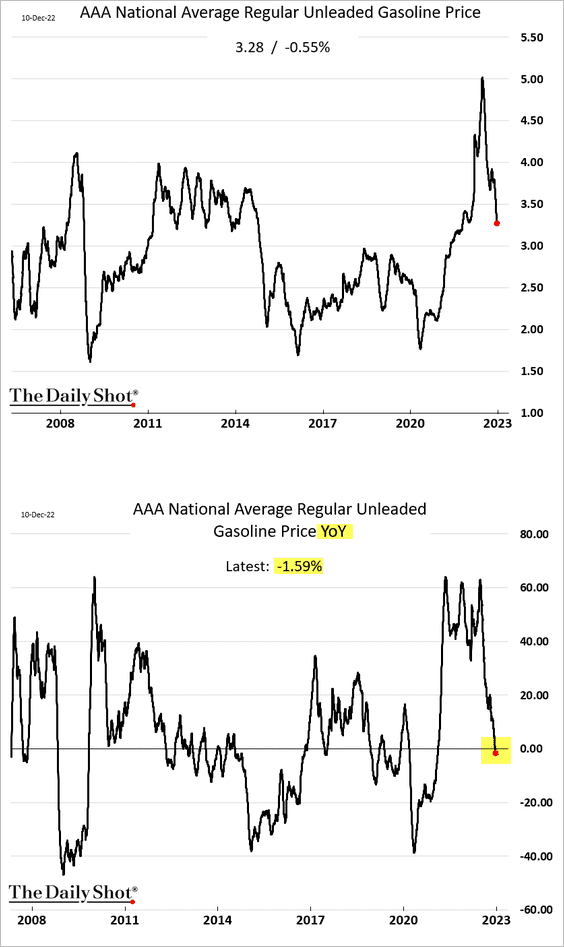

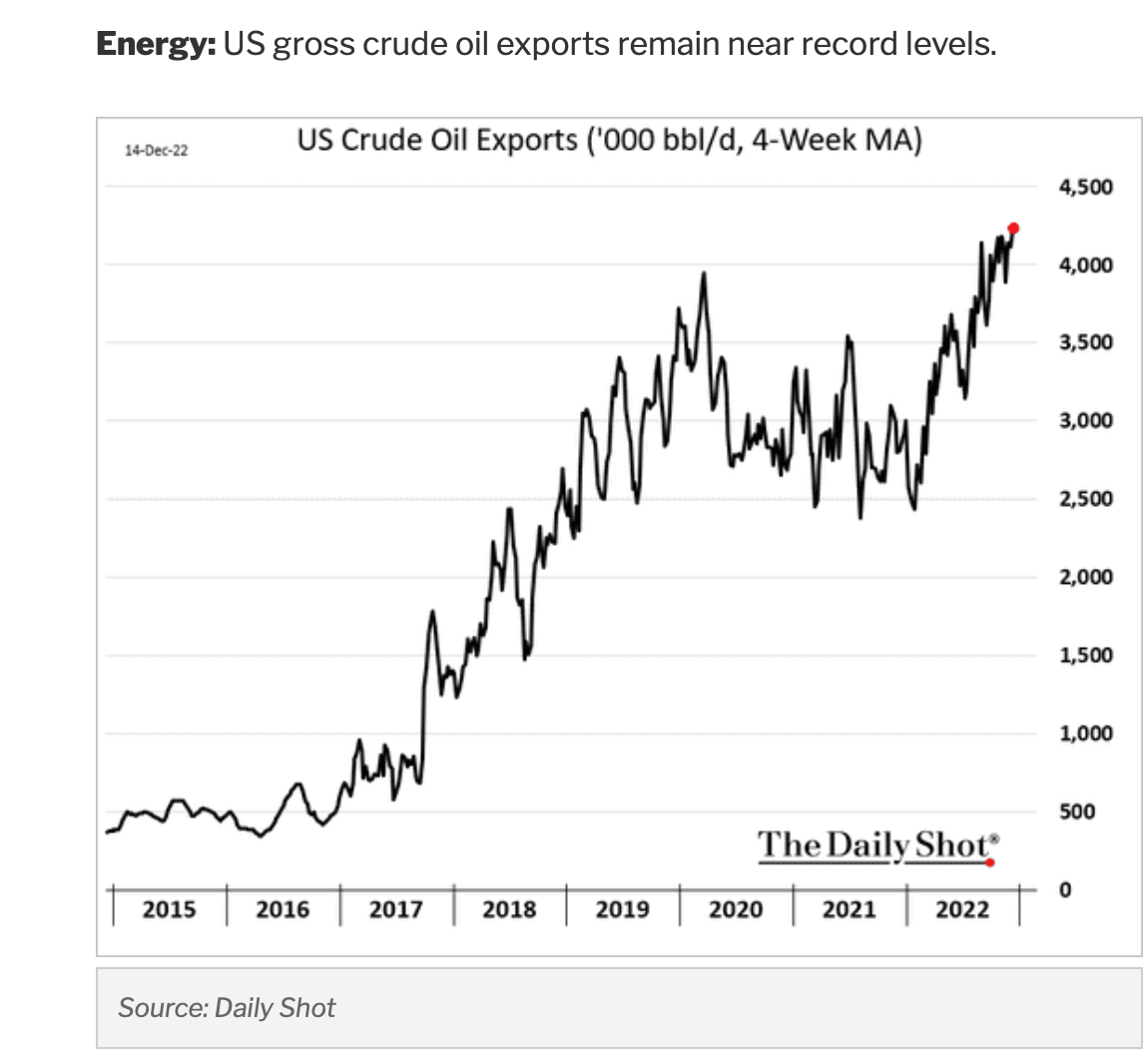

4. U.S. Gross Crude Oil Exports at Record

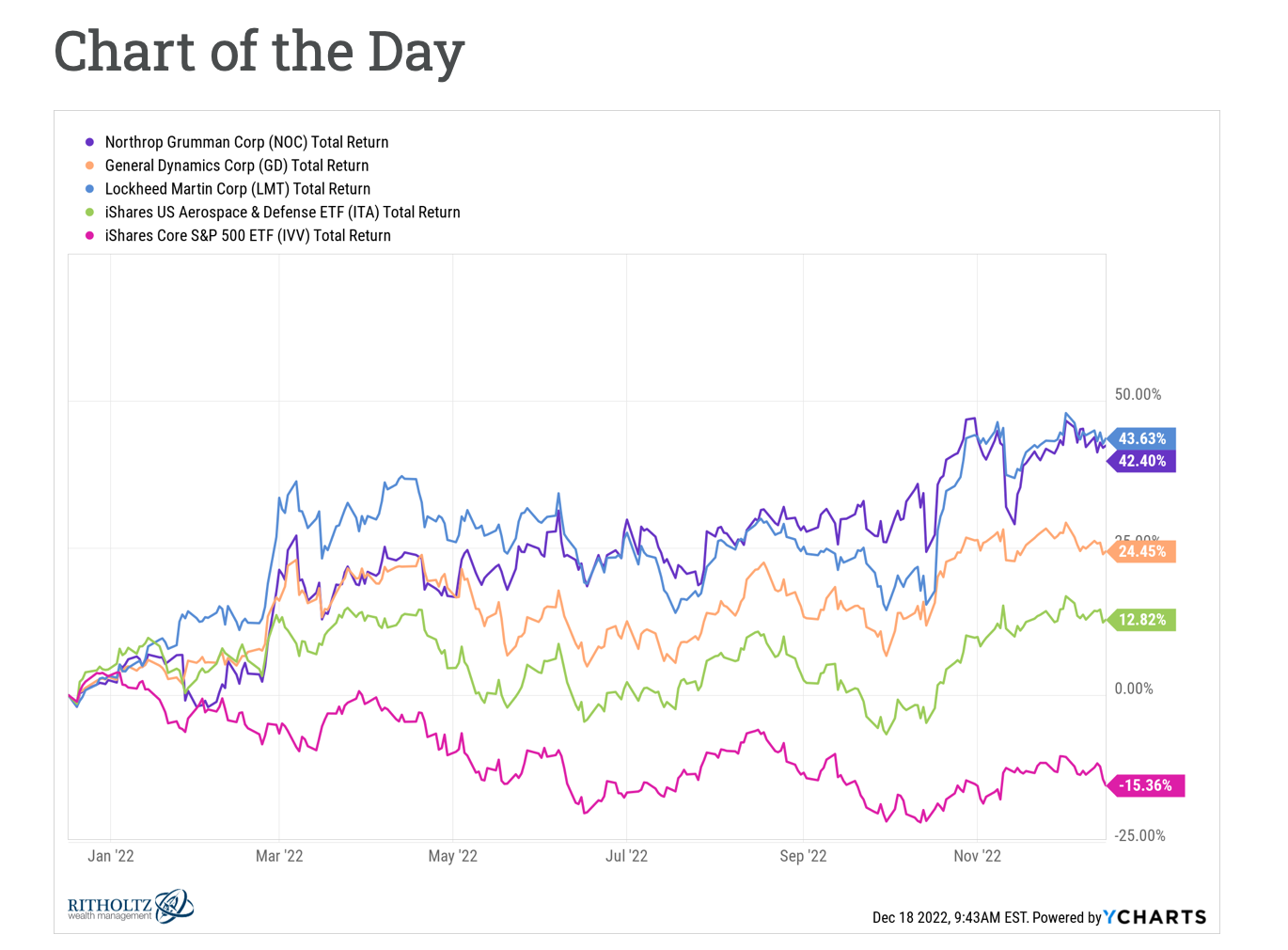

https://dailyshotbrief.com

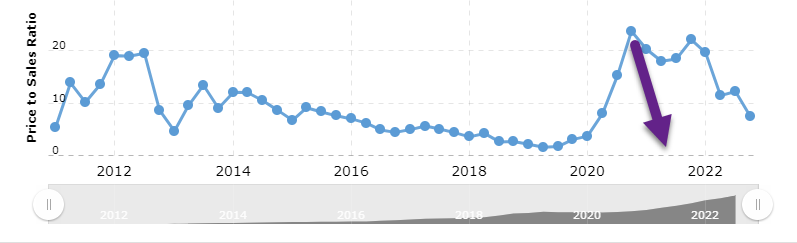

5. IPO ETF Makes New Lows Again

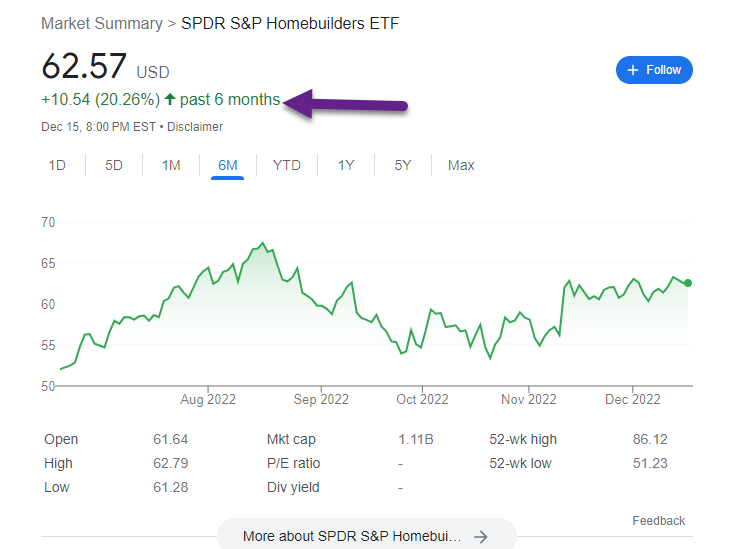

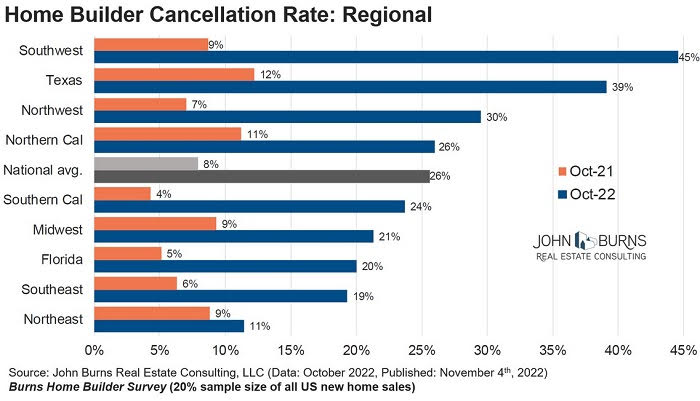

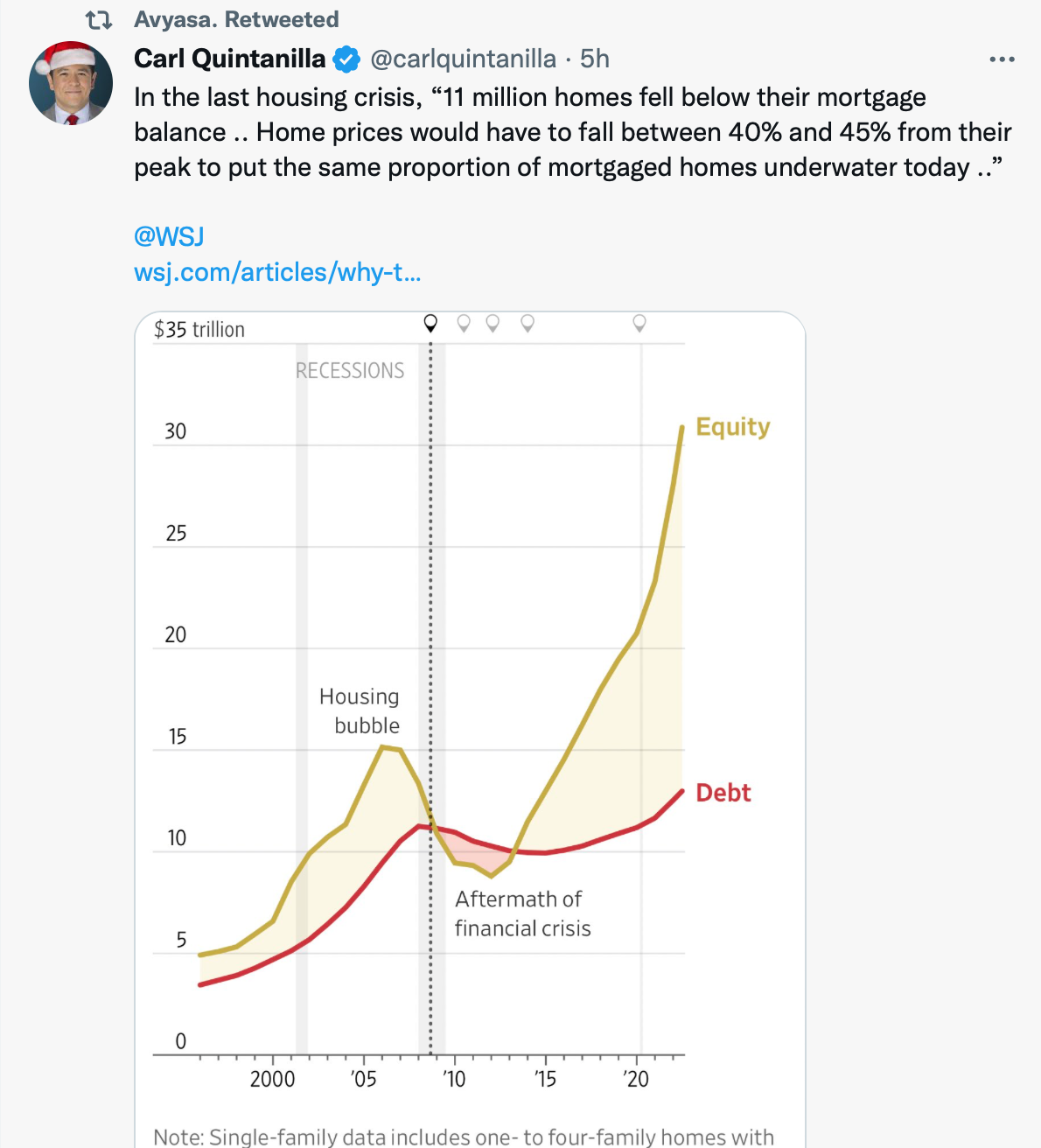

6. 2022 Housing Market is Not 2008 in One Chart

https://twitter.com/carlquintanilla/

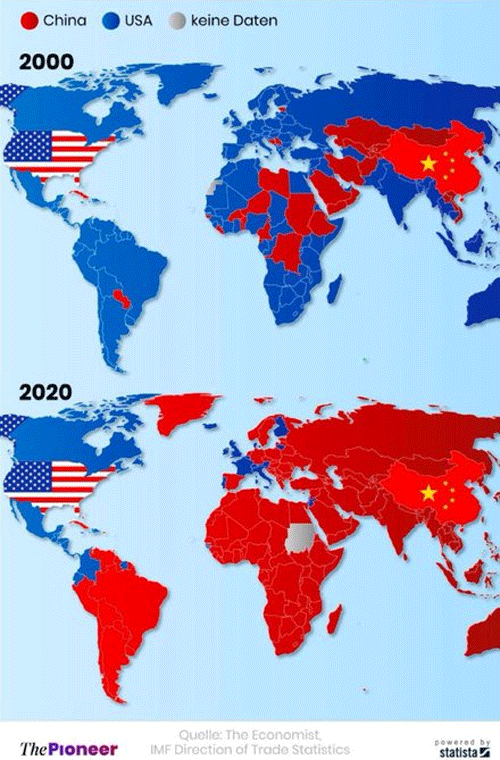

7. China Vs. U.S. Global Trade Footprint 2000-2020….Staggering Chart

John Mauldin Blog From Blue to Red: Striking Supply Side Shift At the turn of the century, America was the dominant supplier for the world, but in just 20 short years, China has taken that title. And, despite the naysayers, the trend continues.In the last two decades, China’s trade with Latin America and the Caribbean has grown 26-fold, from $12 billion to $315 billion. It also overtook America as the top supplier in Africa, Asia, Australia, Europe, and South America.

The visual is truly staggering:

https://talkmarkets.com/content/currenciesforex/a-decade-of-roller-coaster-markets?post=377792

8. School of Quant: At $29,000, a Public NYC College Outclasses Princeton-Bloomberg

New York’s Baruch College offers a no-frills financial engineering course that’s feeding some of the world’s most elite global trading firms.

Princeton has its Gothic spires, MIT its Great Dome. But for a no-frills lesson in 21st-century finance, head to a lackluster high-rise on Manhattan’s East 25th Street — AKA, Bernard Baruch Way.

Nine flights up, along scuffed linoleum hallways, a handful of math-loving graduate students consider equations that would make most people’s heads hurt. On the syllabus recently: three-dimensional volatility surface structures for options pricing models.

If you have to ask what those are, you probably don’t belong at the elite financial engineering program at Baruch College, part of New York City’s sprawling, 275,000-student public university system.

Call it Quant U.

Baruch, it turns out, has built a pipeline to Wall Street that rivals those at many richer, more prestigious institutions. Its faculty includes pros from the likes of Goldman Sachs Group Inc. and JPMorgan Chase & Co. Its students routinely graduate into six-figure jobs at big banks or, more likely, head to hedge funds such as Citadel and Millennium Management.

Similar top-rated programs at Princeton, MIT, Cornell and Carnegie Mellon? They’re good, yes — but Baruch bests them all, according to annual surveys by QuantNet, an online forum for financial engineers.

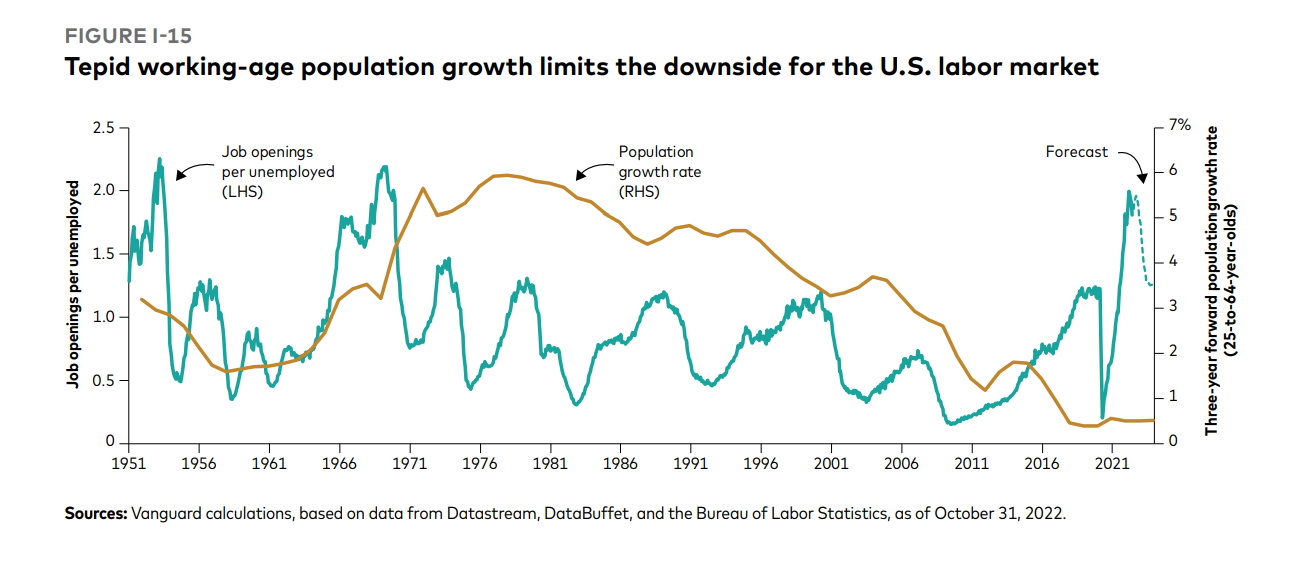

9. Working-Age Population Decrease

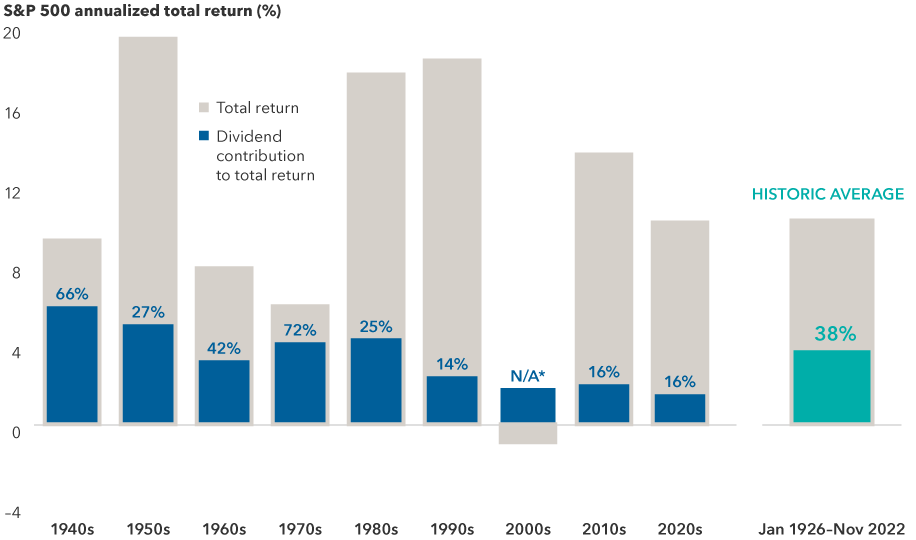

Vanguard

https://corporate.vanguard.com/content/dam/corp/research/pdf/isg_vemo_2023.pdf

10. 3 Powerful Strategies for a Better Brain in 2023

Skip the diet resolutions and focus on your brain in the coming year. Austin Perlmutter M.D.

KEY POINTS

- Limiting consumption of unnecessary, excessive, and stressful media may help improve brain function.

- Having more close friends late in life is linked to a significantly lower risk for dementia.

- Perpetually challenging one’s brain, even by simply exploring an opposing ideological perspective, can help keep it sharp and healthy.

At the end of each year, we find ourselves reflecting on accomplishments and struggles while looking ahead to what comes next. For many, this leads to resolutions around improving diet, getting more exercise, and becoming better at work or relationships. Yet far too often in the process of committing to these changes, we miss the fundamental significance of improving our brain health and function. With this in mind, consider skipping the fad diets and quick-fix strategies and instead focusing on your brain. Here are three powerful and science-backed strategies to power your brain for success in the coming year.

1. Cut out unnecessary brain-draining media.

Our brains are incredibly energetically demanding, comprising 3 percent of our body weight but using 20 percent of our energy in a given day. Most of that energy is used by our neurons, and the amount of energy they use is directly related to how much they are being used. This means that our brain’s energy and function are a reflection of where we direct our focus.

If you’re like the average adult, most of your focus is going to be on the media around you. American adults, on average, spend upward of 11 hours of their day on screens and listening to the radio. While there’s plenty of healthy and valuable content on our screens and airwaves, it’s also the case that media content (especially news) has grown increasingly negative and sensationalized.

Stressful and polarizing media content activates stress-responsive parts of our brains and may increase the risk for mood issues as well as damage our brain health and function. To this end, limiting your consumption of unnecessarily stressful, draining, sensationalized, and polarizing media may do wonders for your brain health. And, at a very basic level, removing the unhelpful content frees your brain up to consume the healthier stuff.

2. Consume more of the good stuff: healthy relationships and sleep.

One of the most impactful areas of brain research speaks to the brain benefits of very simple daily habits. Besides the usual (and important) topic of eating right for brain health, here’s why relationships and sleep are fundamental for better brain health.

Quality relationships are clearly fundamental to overall health as well as brain health. Loneliness, for example, is thought to be a risk factor for worse mental health. In a recent observational study of over 12,000 people, loneliness correlated with a 40 percent increased risk of developing dementiaover a 10-year period. On the other hand, having more close friends late in life is linked to a significantly lower risk for dementia, suggesting a protective effect of close interpersonal bonds. When taken together, this research speaks to the value of cultivating and maintaining close friendships. How to put it into practice? Consider setting a regular phone date, plan a trip to see loved ones, and prioritize date nights (and even group video chats).

When considering lifestyle factors associated with better brain function and health, sleep is all too often ignored. Yet we now know that poor sleep is a risk factor for everything from dementia to depression to worse decision-making. Getting better sleep may be one of the most important strategies we have for quickly achieving better brain health. The unfortunate reality is that despite this science, most people neglect to prioritize sleep.

A number of simple steps can be used to help improve sleep quality. These range from minimizing artificial light in the hours before bed to minimizing caffeine consumption in the afternoon. However, if sleep issues are severe or don’t respond to basic lifestyle modification, it’s likely a good idea to seek professional help with consideration for a sleep study or other testing.

3. Challenge your brain daily.

How can we take steps to constantly move our brains toward a better state? One of the most powerful tools is to perpetually challenge our brains. This can be as simple as entertaining or exploring an opposing ideological perspective. So don’t just be adventurous with travel and new foods; consider opening up space for compassionate conversations with people who have different viewpoints. Another example is learning a new language or practicing an instrument. Even consistent word puzzles (Wordle anyone?) may help keep your brain sharp.

When we challenge our brains, we may help form new connections between neurons through the process of neuroplasticity (a neuroscience term for the brain’s ability to reshape itself throughout our lifespans). Research has even indicated that regularly exercising our brains may help to slow down and even prevent certain aspects of cognitive decline.