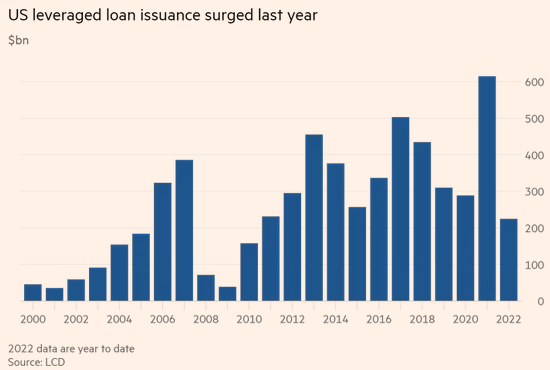

1. Leveraged Loan Issuance was Record in 2021

Dave Lutz at Jones Trading LBO DEBT– The Federal Reserve’s most aggressive pace of interest rate increases in decades is set to trigger a surge of defaults over the next two years in the $1.4tn market for risky corporate loans, according to Wall Street banks and rating agencies. Analysts across the industry forecast that defaults will at least double from today’s relatively low 1.6 per cent. But the disparity is stark, with some firms warning clients that anywhere from one-in-20 to one-in-10 loans could default next year, FT reports. Leveraged loans typically finance companies with high debt levels and poor credit ratings

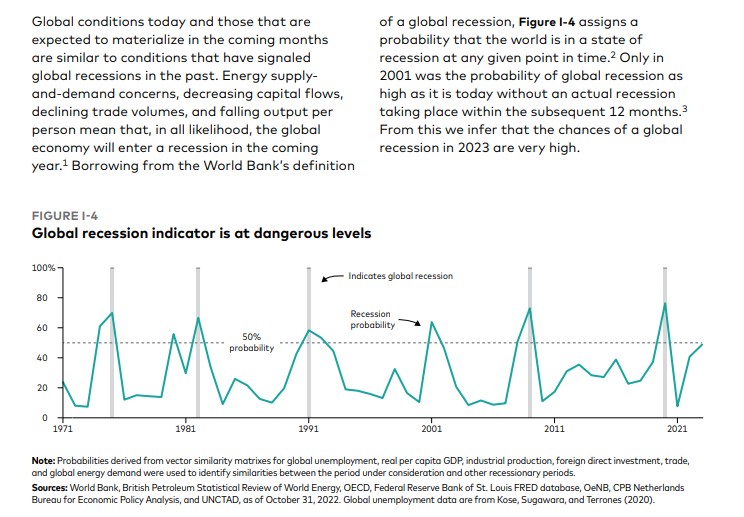

2. Vanguard-Probability of a Recession Chart

https://corporate.vanguard.com/content/dam/corp/research/pdf/isg_vemo_2023.pdf

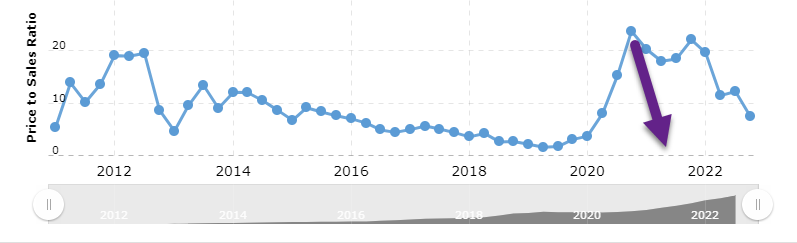

3. Tesla Clean Close Below 200 Week Moving Average…..Big Drop in Price to Sales Ratio

Tesla Price to Sales Ratio 2010-2022 | TSLA ….Still not cheap but Tesla Price to Sales Ratio Drops from 23.5x to 7.5x…Dropping down to 2014-2020 range.

https://www.macrotrends.net/stocks/charts/TSLA/tesla/price-sales

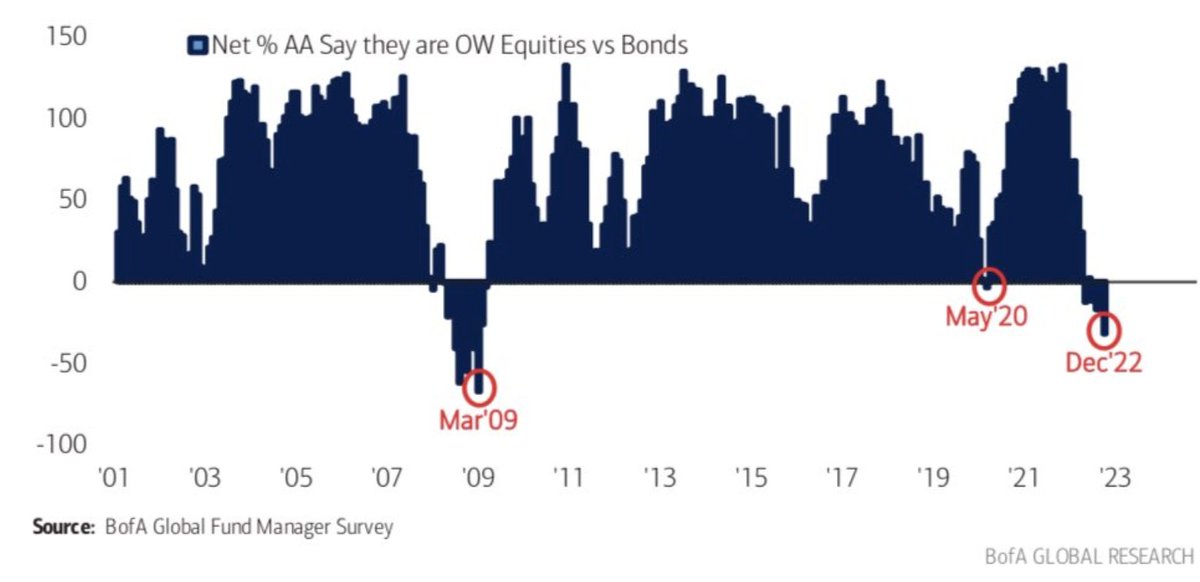

4. The Last Time Investors were this Underweight Stocks Relative to Bonds was April 2009

Ryan Detrick Carson Group The last time investors were this underweight stocks relative to bonds was April 2009. (BAC Global Fund Manager Survey) With further signs inflation is dropping quickly, this could be more fuel for the equity rally.

https://twitter.com/RyanDetrick

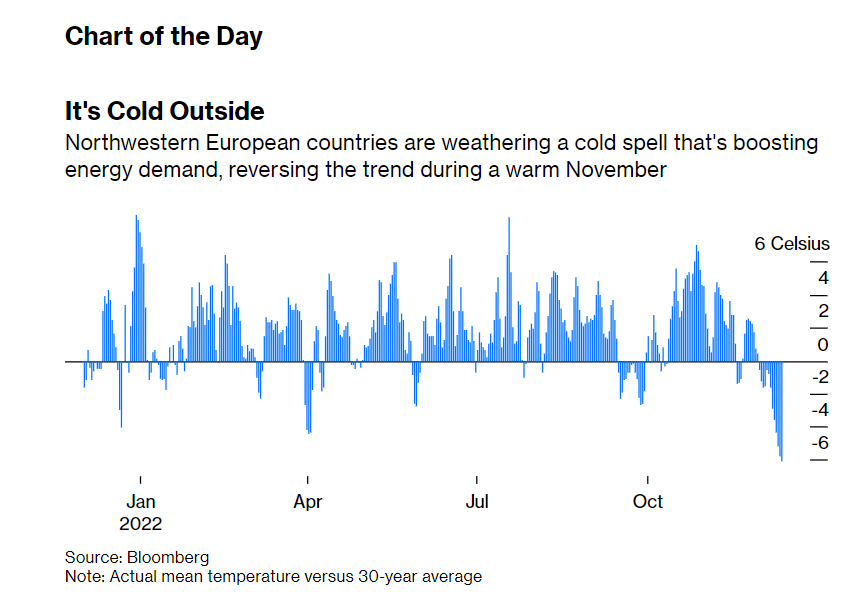

5. Northwestern Europe Cold Weather

Bloomberg ByJavier Blas https://www.bloomberg.com/

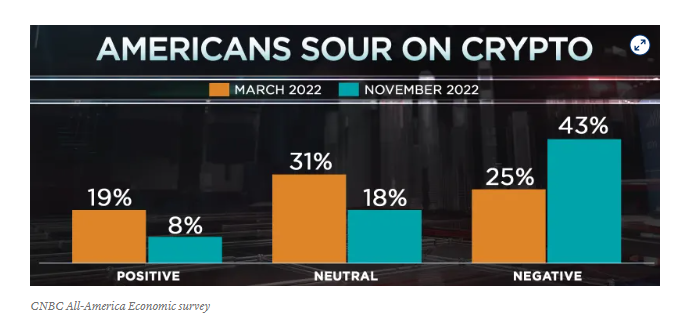

6. Only 8% of Americans have a Positive View on Crypto

CNBC Steve Liesman After a series of crypto-collapses, scandals and bankruptcies, Americans’ views on cryptocurrency have soured sharply, with the CNBC All-America Economic Survey finding a majority favoring strong regulation.

The survey shows 43% of the public with a negative view of cryptocurrencies, up from 25% in March. The percentage with a positive view plummeted to just 8% from 19%, and those who are neutral fell almost in half to 18% from 31%

https://www.cnbc.com/2022/12/07/just-8percent-of-americans-have-a-positive-view-of-cryptocurrencies-now-cnbc-survey-finds.html

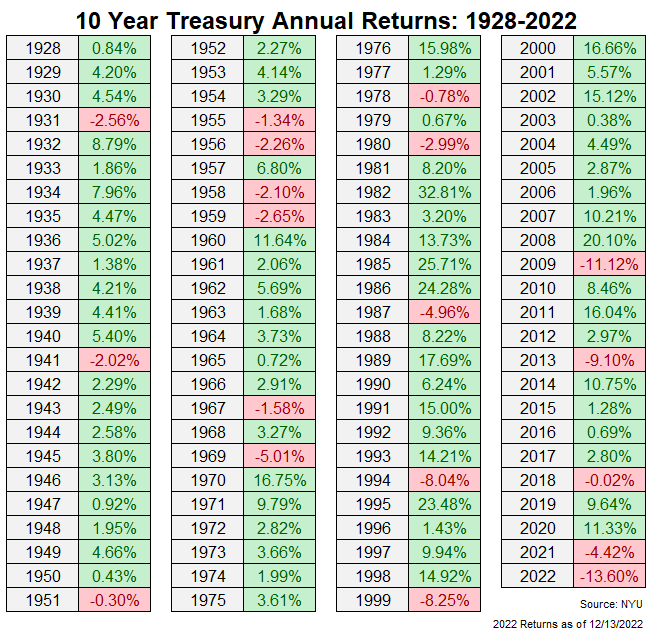

7. Worst Bond Year Ever 2022…Back to Back Down Bond Years Very Rare

Ben Carlson Blog Consecutive down years in the bond market are even more infrequent than the stock market: In fact, before back-to-back down years in 2021 and 2022, the only other time this has happened in the past nine-plus decades was in 1955-1956 and 1958-1959 (which coincidentally was another time when rates rose from a low starting point).

Shockingly, if it holds, 2022 would be the worst year for 10 year treasuries in modern financial market history. The only other time we witnessed a double-digit loss on the benchmark U.S. government bond was in 2009.

How Often is the Market Down in Consecutive Years? by Ben Carlson https://awealthofcommonsense.

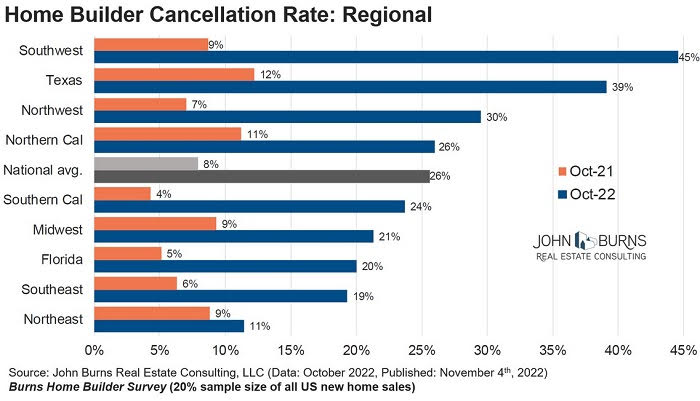

8. Cancellations of Signed Housing Contracts Spike

Cancellations of signed contracts with individual buyers have spiked. According to a survey by John Burns Real Estate Consulting of homebuilders that account for roughly 20% of all new home sales, the cancellation rate spiked to 26% in October, up from a rate of 8% a year ago, and up from 11% in October 2019.

The cancellation rates topped out in the Southwest at 45%, up from a cancellation rate of 9% a year ago. In Texas, the cancellation rate spiked to 39%, up from 12% a year ago (chart via Rick Palacios Jr., Director of Research at John Burns, click to enlarge):

Found at Wolf Street Blog https://wolfstreet.com/2022/

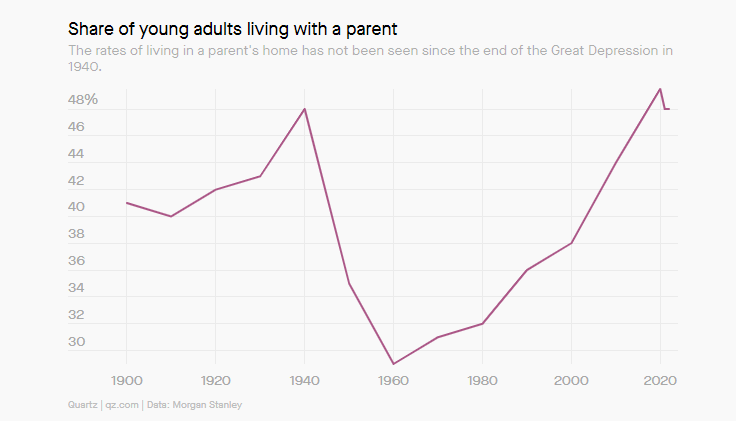

9. 50% of 18-29 Year Olds Living with their Parents.

Quartz ByTiffany Ap

Nearly half of all young adults in the US ages 18 to 29 live with their parents, and this living arrangement is boosting the profits of luxury goods companies, according to Morgan Stanley.

The number of people moving back in with at least one parent spiked in 2020 at the height of the covid-19 pandemic to 49.5%, according to census data. It’s since edged down to 48% last year, but the rate is expected by the bank to remain there for 2022, even as people return to a hybrid work set up.

https://qz.com/nearly-half-of-americans-age-18-to-29-are-living-with-t-1849882457? utm_source=chartr&utm_medium=newsletter&utm_campaign=chartr_202212

10. 12 Questions to Ask Yourself If You Want to Reinvent Your Life in 2023

Trying to figure out what you want your life to look like? These questions can help.

BY JESSICA STILLMAN, CONTRIBUTOR, INC.COM@ENTRYLEVELREBEL

As 2022 winds to a close, I think we can all agree on one thing — it’s been a weird year. With the worst of the pandemic (hopefully) behind us, many people have emerged blinking into the light from two years in survival mode, looked around, and wondered: What do I want to do with my life now?

That confused determination to chart a new course is reflected in persistently high quit rates, ballooning interest in entrepreneurship and digital nomadism, a surge in labor organizing, and millions of posts, articles, and think pieces about just how many of us are reconsidering our priorities and our relationship to work.

“It’s not easy to nail down a movement that spans striking nurses and unionizing strippers, Amazon warehouse workers and work-from-home Wall Street bankers,” writes Helaine Olen in The Washington Post. “But what’s increasingly clear is that the March 2020 decision to partially close down the American economy shattered Americans’ dysfunctional, profoundly unequal relationship with work like nothing in decades.”

In short, a whole lot of people out there are determined to reinvent themselves and their lives in 2023. Where should they start? There are life audits, articles from PhD organizational psychologists, and even whole books that promise to help guide you on the path toward reinvention. But one of the most thought-provoking resources I’ve stumbled across recently is a set of questions from Thought Catalog.

The simple list of 31 questions is designed to get you thinking about what lights you up, what drains your energy, what’s holding you back, and where you ultimately hope to end up in life. You can check out the complete list here, but I’ve selected 12 of my favorite to get you started:

If the obstacle of money was removed, how would my life look different?

What productive activities do I spend time doing for no other reason than they make me happy? (Bill Gates has recommended asking yourself a version of this question as well.)

What traits and values do the people I most admire have in common?

How much money do I *really* need to be happy? (There are plenty of exercises and experts to help you zoom in on a number.)

How would I most like someone to describe me?

What things do I do only because it makes other people validate me?

What do I most look forward to each day?

When was the last time I felt a big rush of satisfaction?

What did I like doing when I was younger that I’ve lost touch with? (Reconnecting with these is a great way to fight back against exhaustion and impending burnout, according to experts.)

Which habit do I most wish I could work on getting rid of this year?

What do I want to be remembered for?

What would I be most sad to have never tried? (This reminds me of Jeff Bezos’s famous regret minimization framework.)

Give these questions a think and you’ll already be at least a few steps down the path to inventing a new you for the new year.