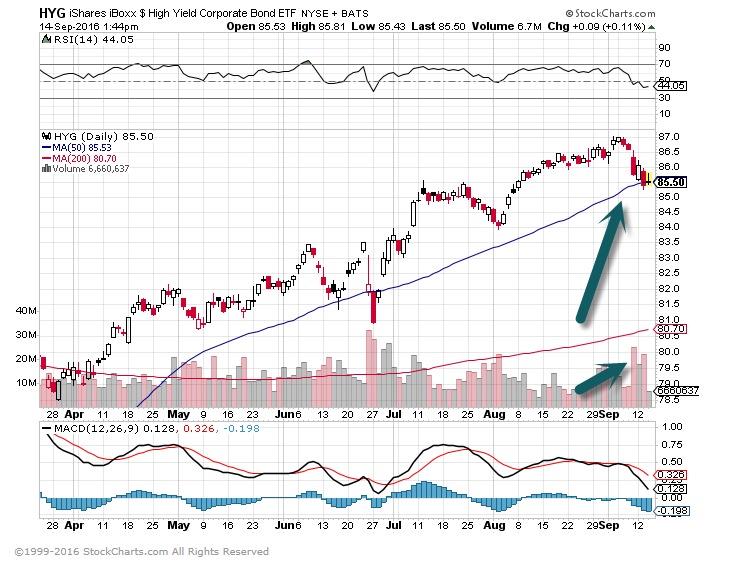

1.High Yield Bonds–HYG has seen $1B in Outflows in the last week (Bloomberg), and has closed under the 50dma.

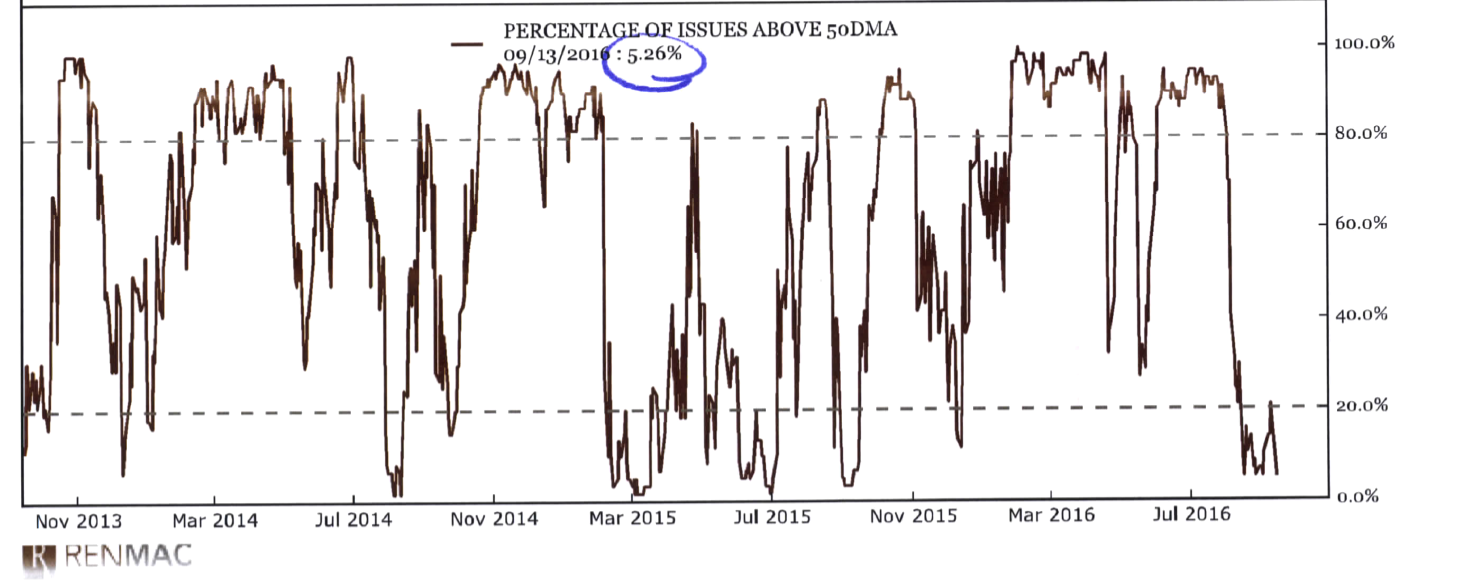

2. Follow up to Yesterday’s Utilities Chart…% of Names Above 50day 5%.

Utilities Short-Term Oversold…Jeff DeGraff at Renmac

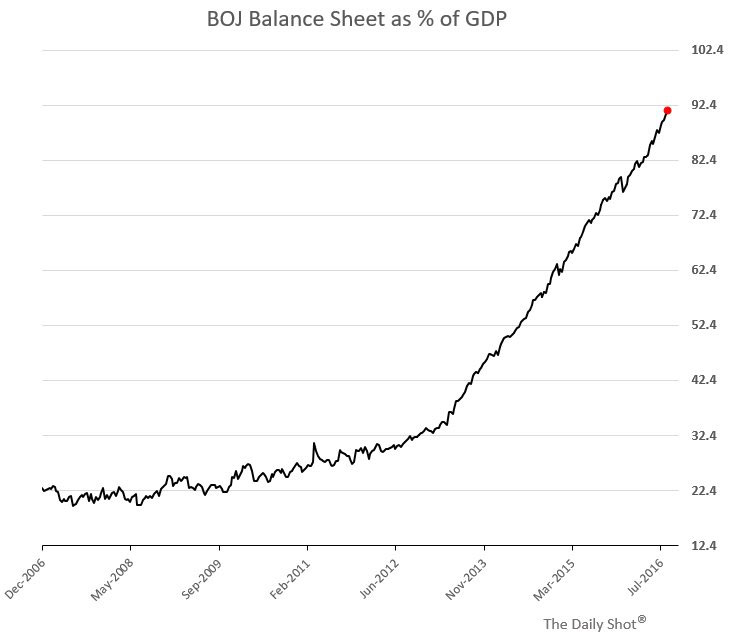

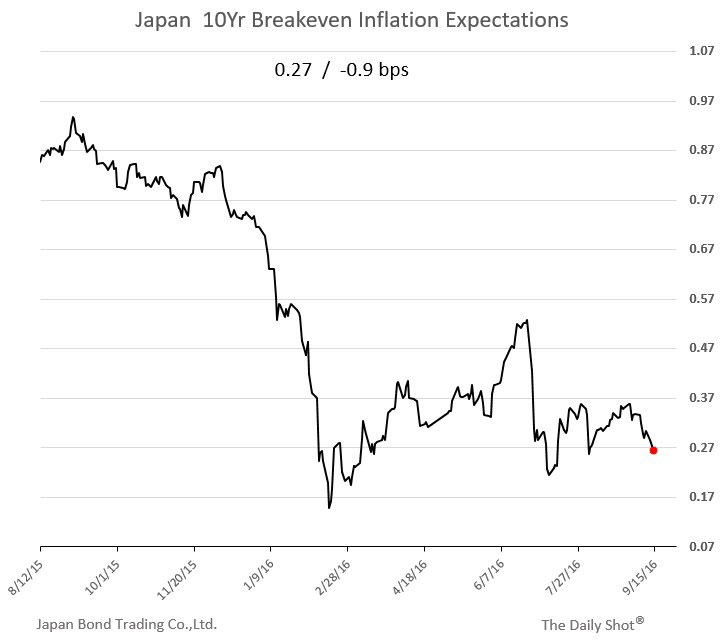

3. Japan’s Massive Stimulus has Failed to Create Inflation.

Turning to Japan, the BoJ balance sheet as a percentage of Japan’s GDP continues to climb. Despite the massive QE effort, Japan’s longer-dated inflation expectations are now declining.

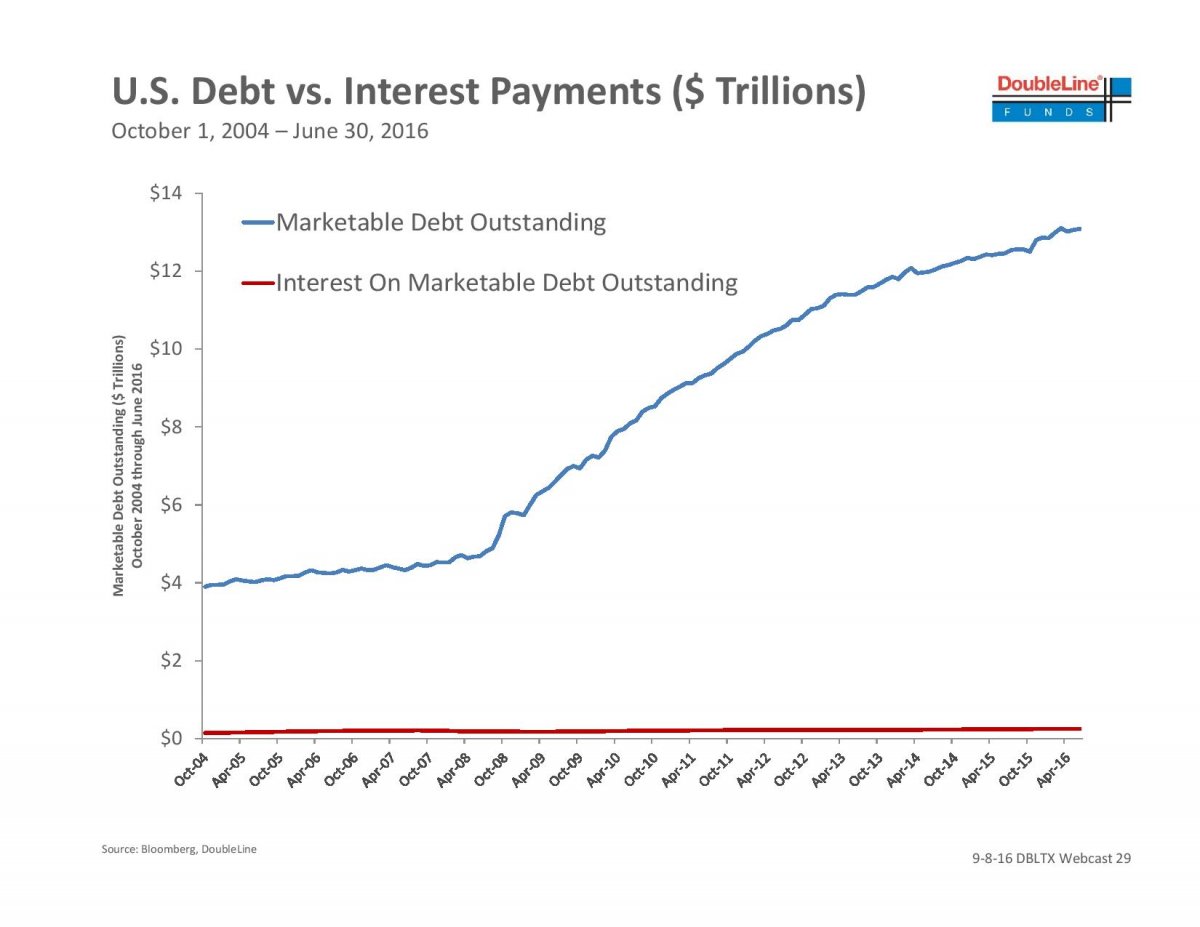

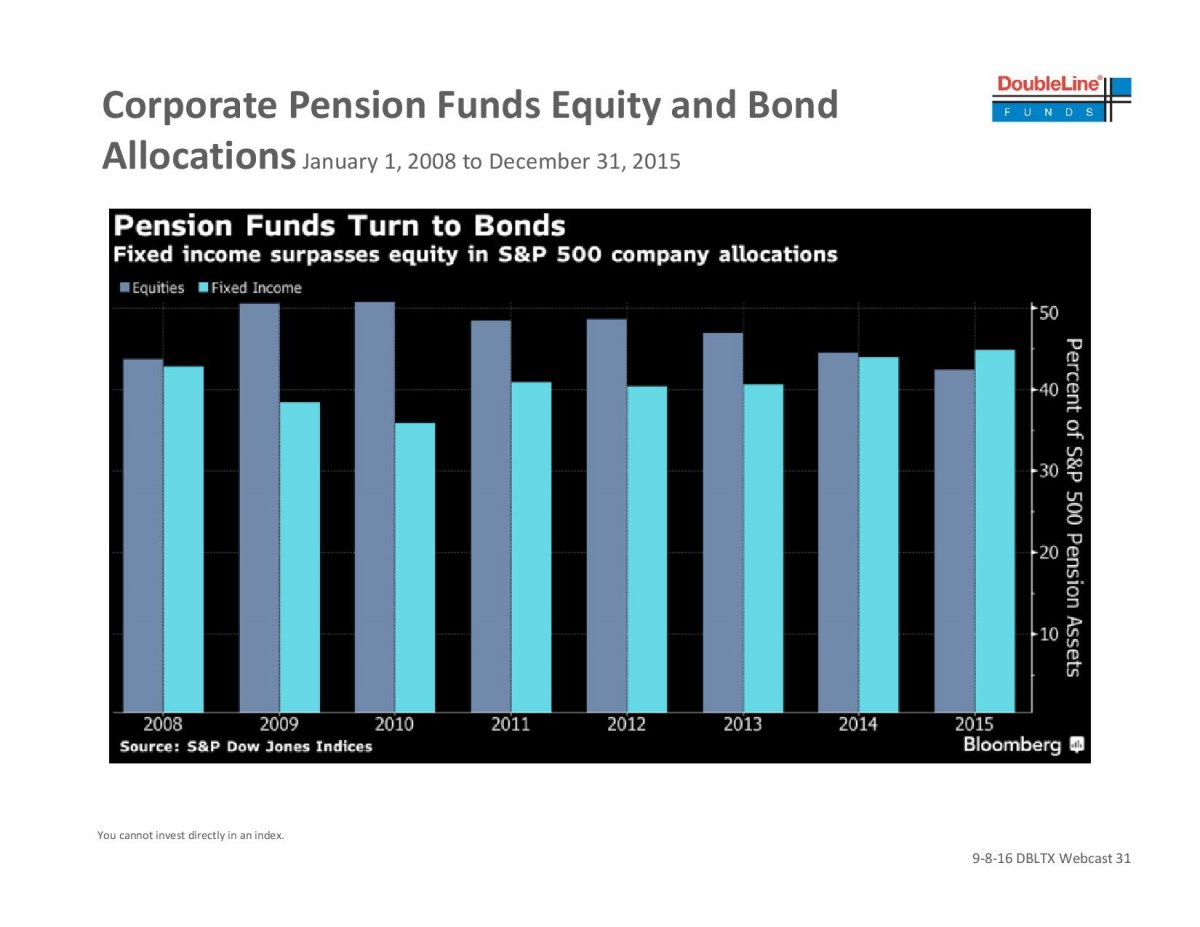

4. My Two Favorite Charts from Gundlach Slide Deck.

Debt Skyrockets, but Interest Payments Flat.

Underfunded Corporate Pensions Fixed Income Surpasses Equity Allocation.

See Full Slide Deck Here

http://www.businessinsider.com/jeff-gundlach-full-presentation-september-2016-election-economy-gold-2016-9

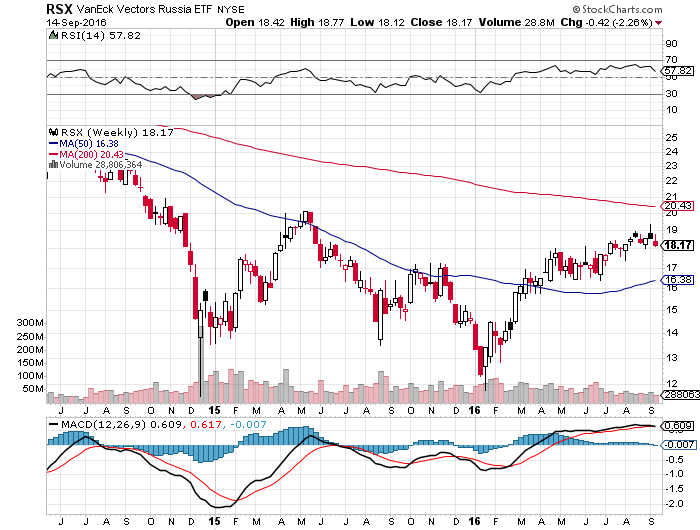

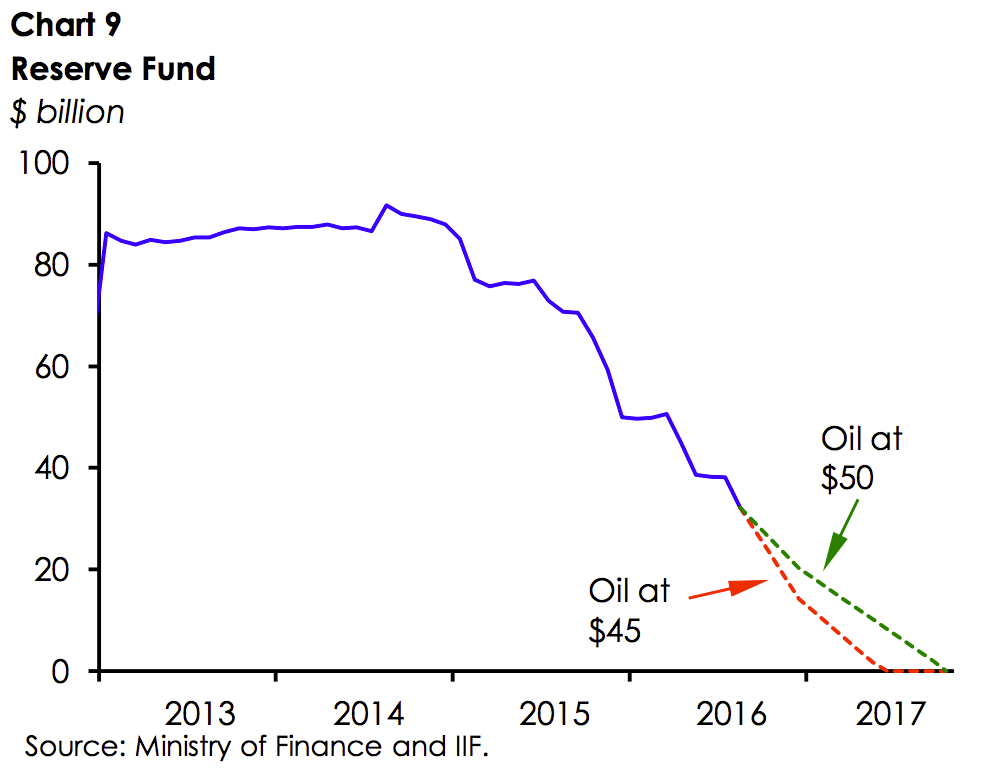

5. Russian Stock Market is Leading World this Year +23%….It’s Reserve Fund has gone from $100B to Zero.

RSX Russian ETF….See Rally from 2016 low.

Here is the IIF (emphasis ours):

“The federal budget was based on a $50/barrel price of oil, while the average price in January-August has been only $42.70.

“The budget also implausibly assumed a 1% real GDP growth this year, while the economy has been in recession. The impact of lower oil prices was especially painful. Export duties on oil fell to 1.1% of GDP in January-July, from almost 2% last year and 4% of GDP in 2011.“

Here is the chart from the IIF:

http://www.businessinsider.com/iif-report-on-russias-economy-and-fx-reserves-2016-9

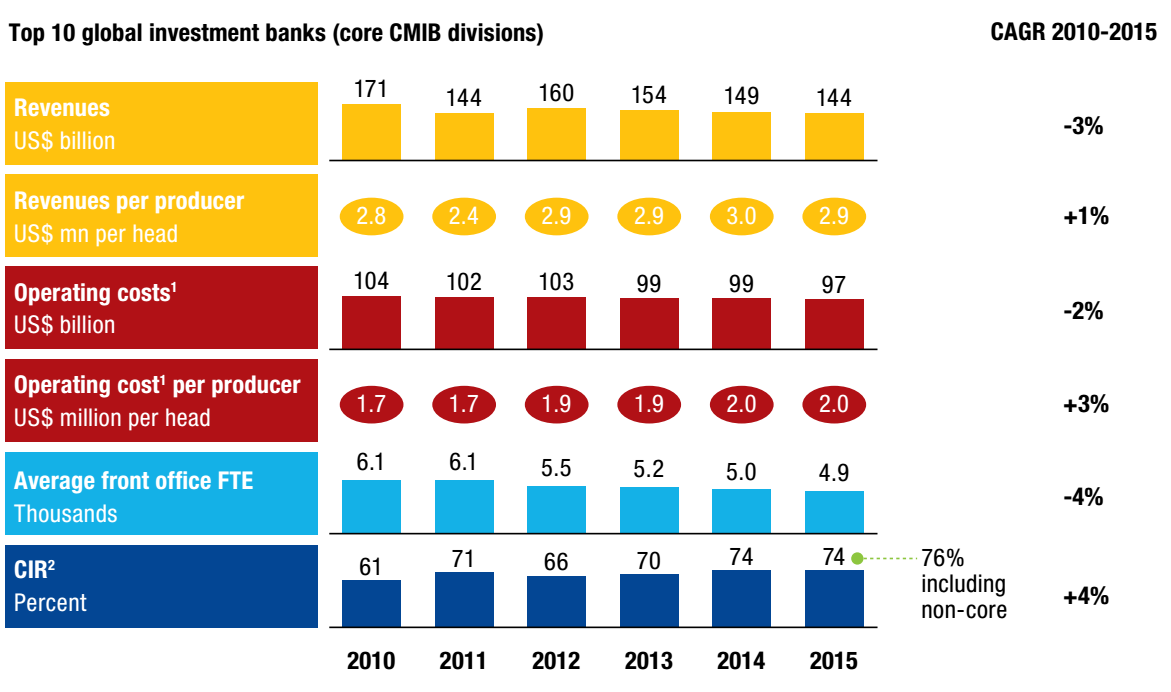

6. McKinsey Report on Investment Banks.

Cutting jobs on Wall Street isn’t working — here’s what could really lower costs

Traders watch stock prices as they work on the main trading floor of the New York Stock Exchange early in the trading session, October 10, 2008. Mike Segar/Reuters

Wall Street banks require major surgery.

The slump in several key businesses this year — from trading to deal underwriting — has been well documented.

But a new study on the industry, from consulting group McKinsey, points to a much longer-term problem with their performance, and specifically their cost structure.

It makes for grim reading.

The top ten banks posted a combined return on equity (RoE) — a key measure of performance — of 7% in 2015, according to McKinsey. That’s below their cost of equity, which is thought to be in the 10% to 12% region.

It means the industry at large is destroying value, rather than creating it. Returns are being dampened by both rising costs and lower revenues. Banks are also required to hold on to more capital — funds which otherwise would be invested and generate profits — because regulators are looking to make the banking system safer.

“Many banks will need to undergo transformative change to transition to a successful operating model, scaling back their aspirations for their capital markets and investment banking businesses and reducing their product set, client mix and regional footprint, accompanied by a commensurate change in their cost structure,” the report said.

So what to do?

If cutting jobs won’t do the job, what are bank executives to do to cut costs?

The answer is technology, according to McKinsey, which shouldn’t come as a surprise since technology seems to part of the answer to every question these days.

“New technologies remain underutilized, and many banks are struggling to make fundamental changes in their operating models and embrace the potential benefits of digitization,” the firm wrote.

Digitization has the potential to deliver a 20% to 30% improvement in profit, or a two to three percentage point improvement in RoE, over three years, according to the report. It encompasses things like increased electronic trading, electronic onboarding of clients, automation in back-office functions, big data analytics, and the use of public cloud infrastructure.

Read Full Story

http://www.businessinsider.com/mckinsey-report-paints-grim-picture-of-wall-street-outlook-2016-9

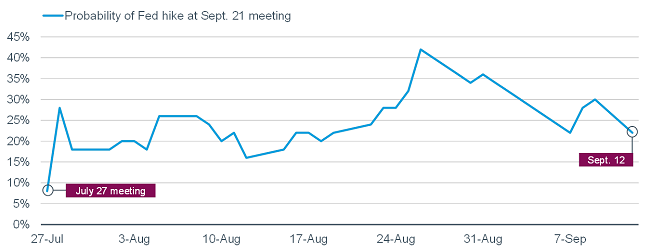

7. Probabilities of a Rate Hike…Huge Range Since July…10% to 40%….Settling now at 21%.

Third tantrum?

Many were worried Friday was setting up a third “tantrum”—the first being the “taper tantrum” in 2013, and the second being the tantrum which followed the Federal Reserve’s initial rate hike last December. Monday’s action eased those concerns…for now.

As you can see in the chart below, since the Fed’s July meeting, expectations for a September rate hike have ranged from a low of 16% to a more recent high of 42% (settling in at 22% as of Monday’s close). Unless the market begins to price in a higher likelihood of a rate hike in September, the Fed is unlikely to buck the market’s expectations.

Source: Bloomberg, as of September 12, 2016.

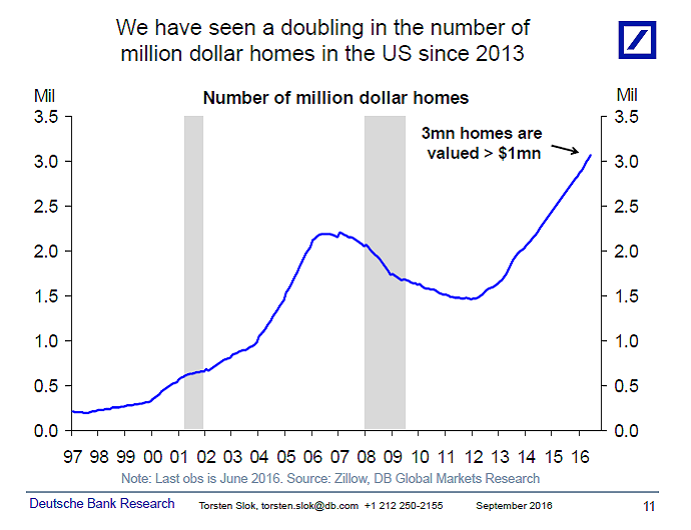

8. With Wage Increases in 2015, this Chart should Stay Stable….More Wealth Effect?

The outlook for consumer spending is significantly supported by the increase in home prices seen over the past three years, see chart below.

9. Read of the Day….The More Cash People Have, the Happier They Are

Happiness may not be about how much overall wealth you have, but how much cash you have on hand

Going to the ATM and seeing a large balance available feels more important to people, says Joe Gladstone, research associate at the University of Cambridge in the U.K. PHOTO: RIDVAN

Conventional wisdom says you should be investing as much of your excess money as you possibly can. That may be the best path to greater wealth. But it may not be the best path to happiness.

In a previous article we looked at a broad range of research about money and happiness. Some of the main conclusions: Experiences tend to provide more lasting happiness than material goods; giving money away makes people happier than spending it on themselves; and wealthier people do tend to be happier, but only up to a certain point.

More recent research has yielded surprising new insights. One study, for example, shows that when it comes to happiness, a bank balance may be more important than overall wealth. Meanwhile, a separate study suggests that buying material things can make you happier—but only if the things you buy fit your personality.

The Wall Street Journal spoke recently with Joe Gladstone, research associate at the University of Cambridge in the U.K. and co-author of both studies. Here are edited excerpts from that interview.

WSJ: And what did you find?

MR. GLADSTONE: We find a very interesting effect: that the amount of money you have in your bank account right now is a better predictor of happiness than your aggregate wealth. Having more money in their bank account makes people feel more financially secure, which leads to an increase in happiness.

That makes sense for the poorest 50% in the study, but it’s surprising that it’s still the case for the richest 50%. Even for a very wealthy person who has lots of savings and investments, having more money in their checking account seems to increase their happiness.

It is just a correlational study, so we don’t study the reasons for this. But we can hypothesize that when money is tied up in a pension or investments, it feels more abstract and inaccessible. Going to the ATM and seeing a large balance available feels more important to people.

Read Full Article.

http://www.wsj.com/articles/the-more-cash-people-have-the-happier-they-are-1473645781

10. This Simple Leadership Behavior Also Increases Resilience

What you may already be doing that is helping to grow your resilience

Posted Sep 14, 2016

Source: Jonathan Simcoe / Unsplash

Over the course of the summer, we’ve examined three of the four behaviors that differentiate a functional manager from a true leader. Thus far, we’ve explored:

Cultivating Reflective Silence

Today, we’ll dive into the final behavior: Posing Curious Questions.

Of all the behaviors, this fourth behavior may be the most linked to increasing resilience. Why? Because when we pose curious questions we expose ourselves to new information, which helps us find new solutions.

While I believe with absolute sincerity that each of these four behaviors is essential for next-level leadership, I would say if you are only open to implementing one that it should be this fourth behavior.

Let me tell you why.

The Future Calls for Resilient Leaders

As the world around us moves, grows, and changes with increasing rapidity, the need for resilient leaders increases as well. There will always be a place for servant leaders and visionary leaders, but there is now a fundamental need for resilient leaders.

With the near-constant volatility we experience from globalization, technological advances, terrorism, corruption, political upheaval, and generational interactions you would be hard-pressed to find an organization that was not repeatedly facing some form of adversity.

Advertisement

This is why resilient leadership is more important than ever. Simply put, resilience is the ability to bounce back after experiencing adversity. I define a resilient leader as someone who is able to bring themselves, their team, and their organization through difficult times and continue to thrive while doing so. That doesn’t mean that difficult times become easy, but it does mean that they become meaningful, productive, high-growth experiences.

In my work, I have found there are several traits and skills resilient leaders share. One of those is the habit of continually posing curious questions.

Resilience Depends on Curiosity

I remember when my grandson was little he used to ask me tons of questions. He wanted to know what a rainbow was. He wanted to know why he could see the veins on the backs of my hands. He wanted to know how big a dinosaur was. He wanted to know everything.

As he grew up, he asked fewer and fewer questions, until today in his teenage years, he asks no questions. He, like almost all of us, hit an age where curiosity becomes synonymous with weakness, ignorance, and stupidity.

Sadly, many of us (leaders especially) have been culturally conditioned to confuse curiosity with ignorance, and ignorance with stupidity. We have also been conditioned to think that power and authority are dependent on “rightness” and having all the answers.

Yet consider this: without a curious, questioning mind, you use the same knowledge and information over and over again—whether it brings the right answer or not, whether it calls forth an unexpected solution or not.

Without risking ignorance to gain fresh knowledge, which we get from posing curious questions, we condemn ourselves to coming to the same conclusions over and over again.

Advertisement

Isn’t that the definition of insanity? Yet we all fall into this trap.

I long for the day when my grandson’s curiosity is once again aroused, seeing his questions as an expression of interest. It’s so easy and rewarding to be curious. It’s as easy as acting on a passing thought. It costs nothing but a moment in time. The benefit of taking that risk, of posing a curious question, is more valuable than any discomfort or embarrassment that he might feel revealing a gap in his knowledge.

Because the benefit of posing curious questions is resilience.

The Fourth Behavior: Posing Curious Questions

The behavior of posing curious questions is about allowing yourself to cultivate curiosity about everything and anything, and bringing that curiosity into your daily interactions. This means challenging yourself to ask at least one more follow-up question than you may be comfortable doing. Practice it with your spouse, practice it with your team, practice in line at the grocery store. In as many interactions as you can, push yourself to ask just one more question. And then truly listen to the answer.

Here’s a few ways you can do that:

Ask questions to build relationships. I have found posing curious questions to be a powerful strategy not only to infusing my daily life with unexpected, fresh knowledge but also to deepening my relationships. Nothing communicates interest, investment, and presence in a moment with someone like asking them a question and another and even another. Whether it is what happened during their day, a project they are working on, or how they’re feeling, they will appreciate you wanting to learn more from (or about) them.

Ask questions to get under the surface of things. Sometimes posing curious questions may mean posing difficult questions. To go deeper or satisfy your curiosity on something, you may need to ask someone to explain how they feel, describe a perspective contradictory to your own, or account for a mistake they made. For resilient leaders, posing these kinds of questions is necessary. It demonstrates the questions open up new understanding and knowledge. Teams learn that questions are powerful means to better understanding. They also learn simply how to ask those questions.

Advertisement

Ask questions to model the value of curiosity. Asking questions begins to erode the impression that questions reflect ignorance. Teams begin to see that questions can also reflect interest. Every question models what it looks like to ask questions and what it looks like to express interest through questions. In this way, you are able to move yourself, your team, and your organization through difficult times. If you can keep asking questions, possibilities begin to open up that help you get through difficult times, better understand unexpected challenges, and get around what others might call impossible blocks.

Ask questions to teach the skill of asking questions. Moreover, every question models for your team what it looks like to ask questions and what it looks like to express interest through your questions. It begins to erode the impression that questions reflect only ignorance. This way, you are able to move yourself, your team, and your organization through those difficult times. Don’t shy away from questions!

If you’re having a hard time finding an appropriate follow-up question, a great way to pose curious questions is to ask people where they get their information. If someone is sharing an interesting anecdote from the current news cycle, ask them what paper they read so you can read it as well. If someone is sharing their expertise in an area, ask them what books they’d recommend you read on the topic to learn more.

The bottom line? Ask questions. Take a page from the children in your life, and ask questions as often as possible. Then reflect on all you learned from this simple yet powerful behavior. Be sure to tell me about how this behavior is working for you here or on Twitter:@madelynblair!

If you enjoyed this series on the four behaviors of next-level leadership, I invite you to sign up for Resilience Brilliance, a free weekly email that shares a short thought and action to develop your resilient leadership.