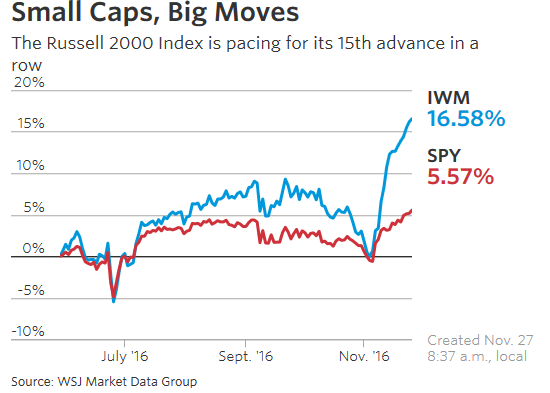

1.Small Cap Stocks on Longest Winning Streak in 20 Years.

Small company shares on Friday notch their longest winning streak in 20 years on a shortened Black Friday trading session. The Russell 2000 Index rose 0.4% in in the shortened session to book its 15th advance in row. This streak ties a run last seen in February 1996. The longest ever streak, 21, was hit back in 1988. Investors are betting that President-elect Donald Trump will relax regulations, lower taxes and pump money into infrastructure projects. Such policies should benefit small caps more than there larger brethren.

So far, the Russell 2000 has climbed 12.7% since Election Day, compared with an advance of 3.5% for the S&P 500. History suggests that long streaks of gains tend to keep going. On the heels of the 1996 streak of gains, the Russell 2000 was 2.2% higher after the first month and 8.4% higher over the next three

Thanks to Dave Lutz at Jones for Chart

Thanks to Dave Lutz at Jones for Chart

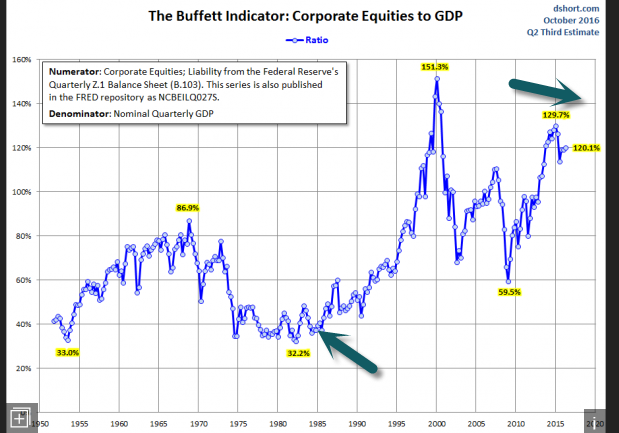

2.Reagan Started with a Much Different Economy than Trump.

Reagan Corporate Equities to GDP was 32%…Today 120%

https://www.advisorperspectives.com/dshort

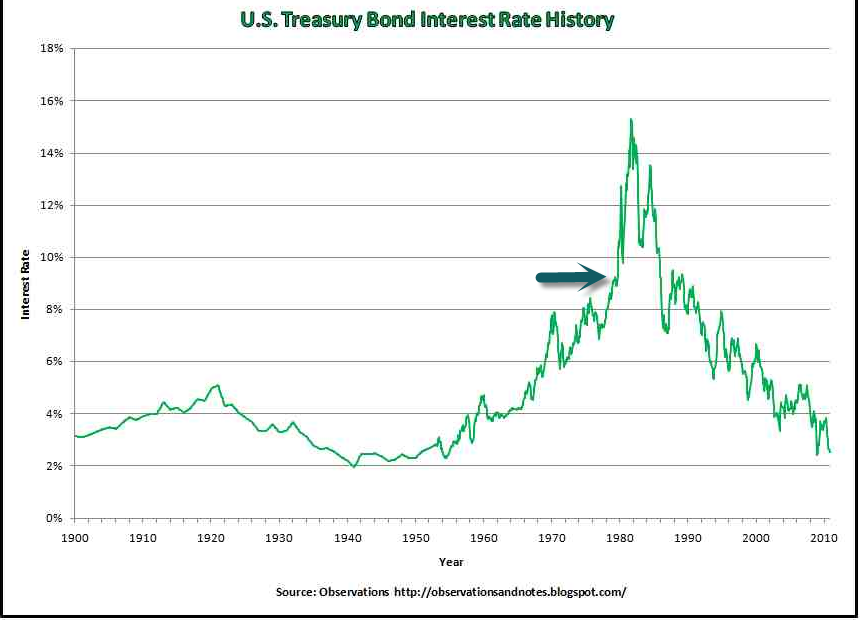

Reagan Interest Rates 8% vs. Trump 2%.

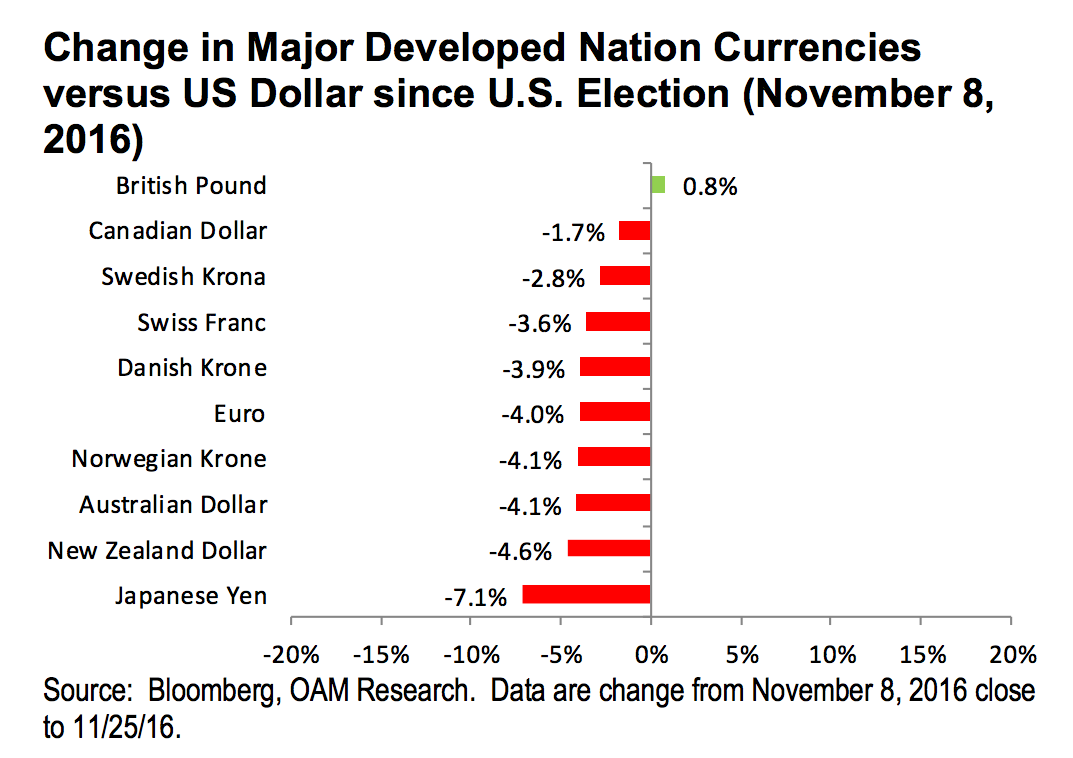

3.U.S.Dollar Back to Feb. 2015 Highs.

The dollar has been on a tear since the election

Nov. 28, 2016, 08:54 AM

The US dollar has been on a tear since Donald Trump’s election win in early November.

And consequently, most major developed nation currencies have been weaker against the greenback.

“Prospects for a faster paced US economy on the back of expectations of fiscal stimulus ahead along with the likelihood of monetary policy to push rates higher are the key drivers” of the dollar rally, wrote an Oppenheimer team led by chief investment strategist John Stoltzfus.

Here’s a chart from his team of what this looks like. Although, note that the data are from November 8 until November 25 – meaning Monday’s moves aren’t factored in.

http://abnormalreturns.com/2016/11/28/monday-links-investor-scar-tissue/

4.Yen vs. Dollar has Serious Export Implications.

Chart shows Japanese YEN vs. U.S. dollar 12% off summer highs…Makes Japanese exports cheaper.

Yen weakness puts pressure on Chinese currency to compete….Weakening Yuan.

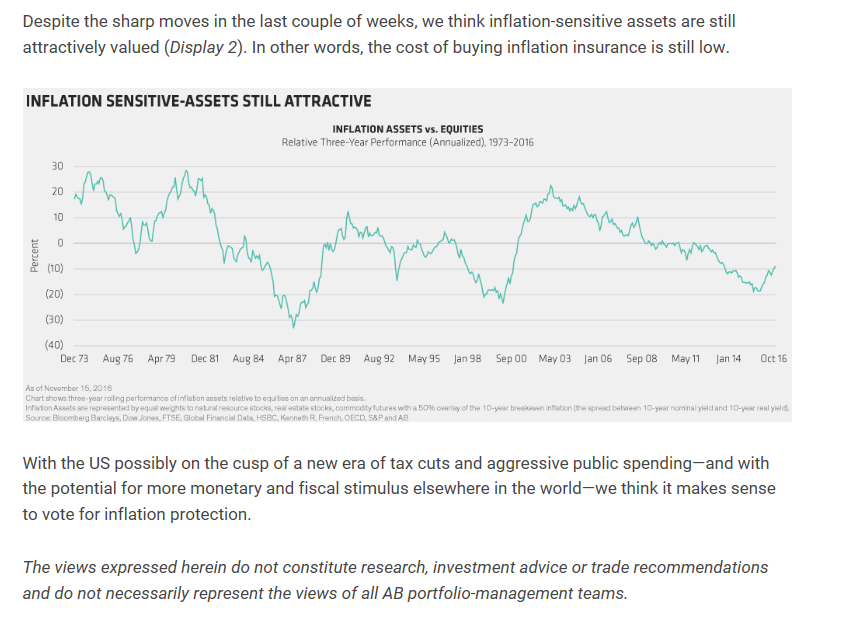

5.Inflation Sensitive-Assets Still Cheap Relative

6.Tide Turning For Value ETFs Vs. Growth

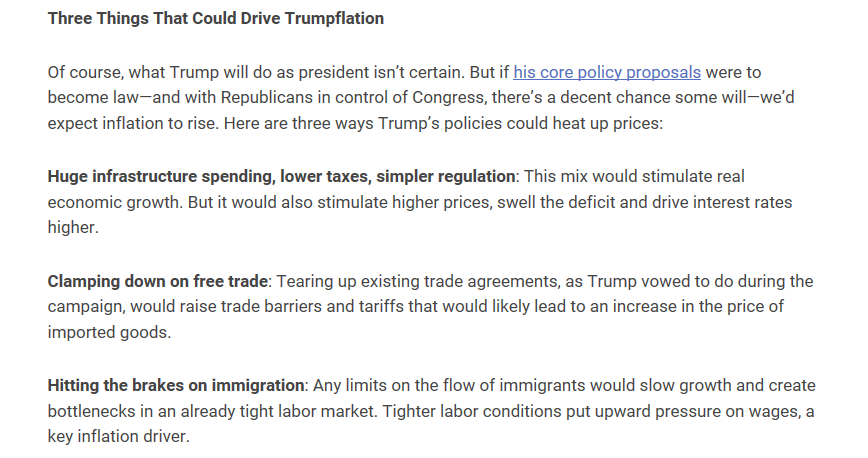

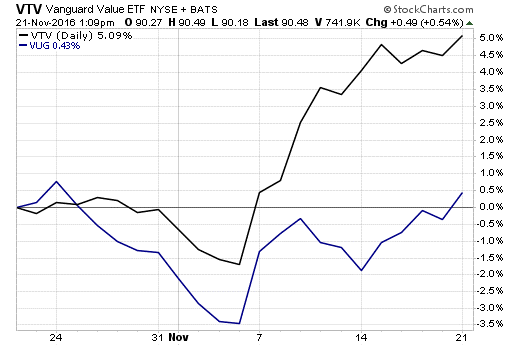

The time may be right to pay closer attention to value equity ETFs. Among the many investment ideas circulating in the market in the early post-election days, value versus growth seems to be one that’s gaining a following.

Consider the recent performance of the Vanguard Value Index Fund (VTV) and the Vanguard Growth Index Fund (VUG). In the past one month, there’s been a jump in the performance of value stocks:

“If the initial reaction [to the election] can carry through, a shift from a growth tilt to a value tilt may be in order,” Clayton Fresk, portfolio manager at Stadion Money Management, told ETF.com.

“Looking past the bear market and recovery, this relationship has steadily favored growth since 2009,” he added. “However, that relationship has trended in favor of value since the beginning of 2016, and it has really spiked since the Trump election.”

Here’s what that value-versus-growth performance looks like in the past three years:

The reason for that performance in value names has a lot to do with sector exposures, Fresk says. In the case of value names, the “relative overweight” to financials and underweight to technology and consumer discretionary are what’s driving the recent performance.

In the past month, financials has been the best-performing S&P 500 sector, rallying more than 13%, or roughly twice the rally seen in the second-best-performing sector in the period—industrials. Technology, meanwhile, has been in the redin the past 30 days, sliding 0.4% in a month.

http://www.etf.com/sections/features-and-news/tide-turning-value-etfs-vs-growth

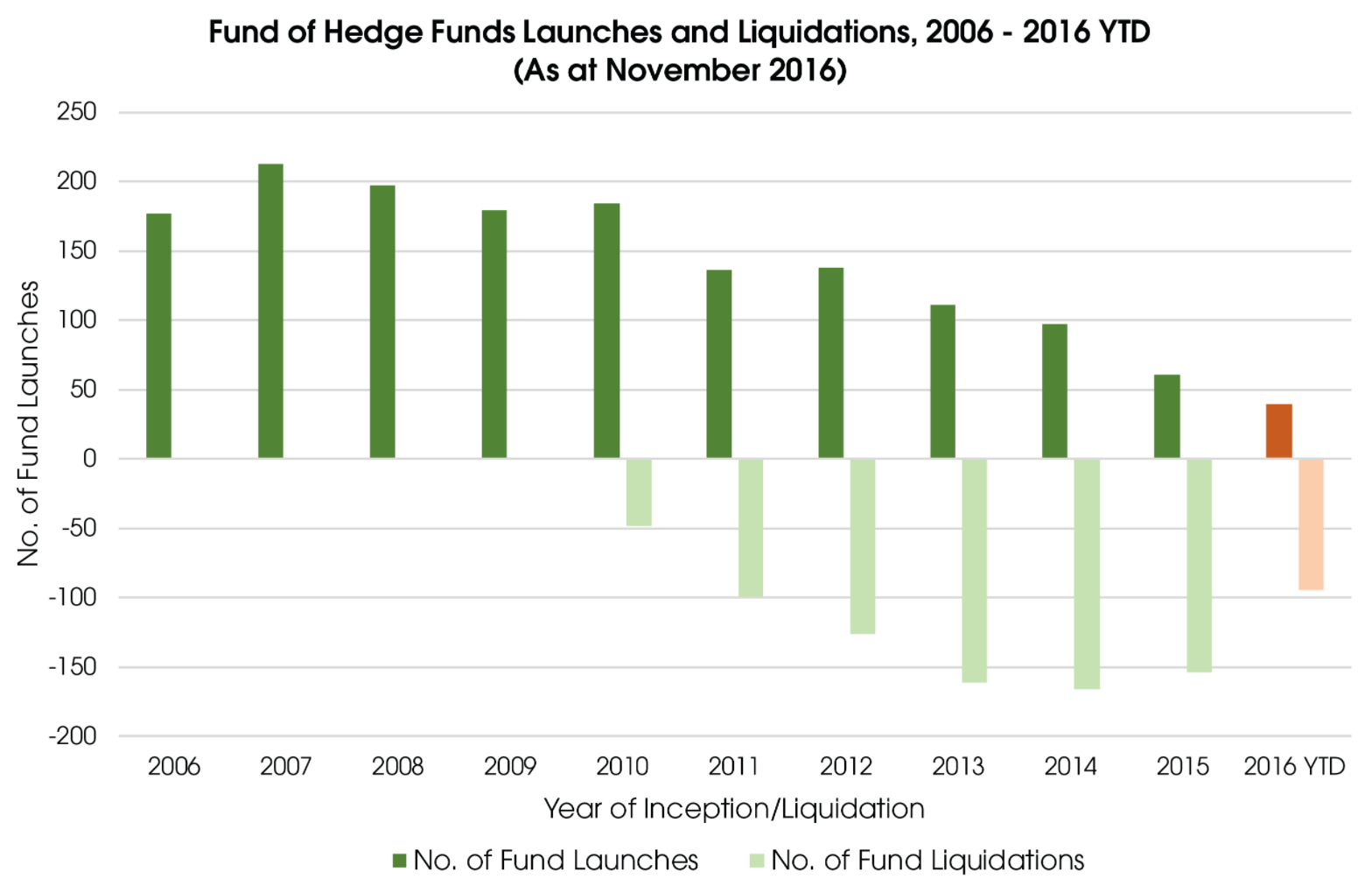

7. Number of Funds-of-Hedge-Funds Liquidations have been Double that of Fund Launches Over the Past Two Years.

Funds-of-Hedge Funds Liquidations Trump Launches, Preqin Says

Fund closings have been double fund launches for the past two years.

Funds-of-hedge-funds launches have been declining every year, prompting a “reinvention” in the multi-manager fund space, according to Preqin.

Preqin’s data showed the number of funds-of-hedge-funds liquidations have been double that of fund launches over the past two years.

In 2016 alone, new fund launches failed to reach 50 while liquidations were close to 100. Last year, the number of liquidations surpassed 150 despite only 50 or so new funds launching.

“The high number of liquidations in recent years shows that funds-of-hedge-funds managers are finding the current environment challenging, and for some, consolidating their firm is a route forward,” Preqin wrote in a note.

Recent mergers in the industry include EnTrust Capital and Permal Group’s combinations into EntrustPermal, Fiera Capital’s acquisition of Larch Lane Advisors, and Aberdeen purchasing Arden Asset Management.

In an effort to better meet investors’ demands—and avoid liquidations—managers have been moving away from traditional commingled products towards “solutions-based services,” Preqin said.

This shift also contributed to the recent decline in fund launches, the note said.

“Now more than ever,” Preqin continued, “funds-of-hedge-funds managers need to offer more in the way of customized solutions, managed account platforms, and separately managed account services, with the increased flexibility in helping to insulate funds-of-hedge-funds managers from criticism of fee structures.”

Source: Preqin

http://www.ai-cio.com/

8.Read of the Day….Good Investors Understand the Art of Doing Nothing.

Understanding the Art of Doing Nothing

Most of what we end up doing in our lives is determined not by what we decide to do, but by what we decide NOT to do. In the course of any given day we decide not to do millions of things. Eliminating all of these actions results in a direction that determines how we end up acting out our day. For instance, at lunch you might think you’re choosing to eat a baloney sandwich. But you didn’t really choose to eat the baloney sandwich. You decided not to eat hamburger, a filafel, a Trump Taco Bowl, etc.

There is, presumably, a lot of logic behind most of these decisions.¹ Most of us follow some sort of system to simplify this whole process. We follow a routine which makes this process virtually automatic. For instance, I usually don’t eat because I enjoy food. I eat because I want to live. So, any time I walk into a restaurant I know what I am eating 99% of the time. I will order a chicken sandwich if it’s available. Boring? Hell yes. Efficient? Big league. The main reason this decision is efficient is because I’ve determined my goal (I want to live), determined my strategy for achieving that goal (eat food), determined what is the easiest and healthiest option that I won’t projectile vomit (chicken sando). This process was established not by deciding that I love chicken sandwiches (I like lobster rolls much more, for instance), but because I simplified the process of determining all the things I won’t do. It’s a rigorous empirical approach to getting this simple task done.

In the investing world we struggle with the urge to be active and to always be doing something. But smart investing is mostly the art of doing nothing. It’s knowing why you shouldn’t act on your urges. We aren’t picking the things we want to own. We’re understanding why we shouldn’t be buying/selling most of the time. Do you think Warren Buffett got rich investing in every deal that came across his desk? No, Warren Buffett got rich doing nothing with 99% of the deals that came across his desk.

Personally, I use macro to build a foundation for the investment process. This means I’ve developed a systematic model for asset allocation that is based on rigorous empirics that describe the financial world for what it is and I apply those understandings to personal situations. But most of my work as a portfolio manager is understanding why I shouldn’t do anything. I write this website almost exclusively because it’s part of my process of understanding the world around me so I can reject acting on most of the world events around us. For me, reading and writing about silly things like Brexit or Donald Trump is a behavioral tool for understanding the world around me so I can become comfortable with the likelihood that these big macro events shouldn’t steer me off course.

The thing that makes investing so difficult is that it’s analogous to ordering a chicken sandwich in a restaurant while hundreds of sales people are coming up to you explaining why their sandwich is going to protect you against inflation, market crashes, etc. Meanwhile, TVs are blaring in the background explaining how sandwiches are on the verge of imminent disaster….We are constantly barraged with news and events that trigger that urge to act. And 99% of the time you should say no to these sales people and just order your plain old chicken sandwich.²

Of course, investing requires some activity. There truly is no purely passive portfolio. But the difference between the good active investors and the bad active investors is that the good active investors know that smart investing is mostly the art of doing nothing. And they’ve developed a systematic model based on their understandings of the world to help guide them through the art of doing nothing.

¹ – This argument cannot be made for the majority of the 47% of Americans who decided not to vote on Tuesday.

² – To be fair, I have found that this is not always easy. My wife has much more cultured tastes than I do and insists on diversifying her tastes at times. This results in meal picking deferment for me. In short, I become a slave to my authoritarian food ordering master and I simply eat what is put in front of me. Since I mostly eat to survive I find this arrangement helps in many ways as it not only nourishes me, but keeps my wife happy and avoids the scenario of her wanting to end my existence.

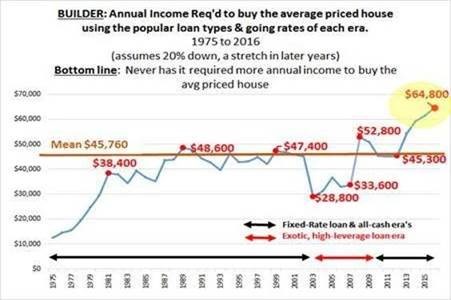

9.Median Number of Months for Newly Completed Homes on Sales Market at 1980 Lows.

This is a problem for first time home buyers… From real estate maven Mark Hanson:

The average $274k builder house requires nearly $53k in income assuming a 4.5% rate, 20% down, and A-grade credit. Problem is, 20% + A-credit are hard to come by. For buyers with less down or worse credit, far more than $53k is needed.

For the past 30-YEARS income required to buy the average priced house has remained relatively consistent, as mortgage rate credit manipulation made houses cheaper.

From Doug Kass

http://realmoneypro.thestreet.com/

10. How Complaining Rewires Your Brain for Negativity

Research shows that most people complain once a minute during a typical conversation. Complaining is tempting because it feels good, but like many other things that are enjoyable — such as smoking or eating a pound of bacon for breakfast — complaining isn’t good for you.

Your brain loves efficiency and doesn’t like to work any harder than it has to. When you repeat a behavior, such as complaining, your neurons branch out to each other to ease the flow of information.

This makes it much easier to repeat that behavior in the future — so easy, in fact, that you might not even realize you’re doing it.

You can’t blame your brain. Who’d want to build a temporary bridge every time you need to cross a river? It makes a lot more sense to construct a permanent bridge.

So, your neurons grow closer together, and the connections between them become more permanent. Scientists like to describe this process as, “Neurons that fire together, wire together.”

Repeated complaining rewires your brain to make future complaining more likely. Over time, you find it’s easier to be negative than to be positive, regardless of what’s happening around you. Complaining becomes your default behavior, which changes how people perceive you.

And here’s the kicker: complaining damages other areas of your brain as well. Research from Stanford University has shown that complaining shrinks the hippocampus — an area of the brain that’s critical to problem solving and intelligent thought. Damage to the hippocampus is scary, especially when you consider that it’s one of the primary brain areas destroyed by Alzheimer’s.

Complaining Is Also Bad for Your Health

While it’s not an exaggeration to say that complaining leads to brain damage, it doesn’t stop there. When you complain, your body releases the stress hormone cortisol. Cortisol shifts you into fight-or-flight mode, directing oxygen, blood, and energy away from everything but the systems that are essential to immediate survival. One effect of cortisol, for example, is to raise your blood pressure and blood sugar so that you’ll be prepared to either escape or defend yourself.

All the extra cortisol released by frequent complaining impairs your immune system and makes you more susceptible to high cholesterol, diabetes, heart disease, and obesity. It even makes the brain more vulnerable to strokes.

It’s Not Just You…

Since human beings are inherently social, our brains naturally and unconsciously mimic the moods of those around us, particularly people we spend a great deal of time with. This process is called neuronal mirroring, and it’s the basis for our ability to feel empathy.

The flip side, however, is that it makes complaining a lot like smoking — you don’t have to do it yourself to suffer the ill effects. You need to be cautious about spending time with people who complain about everything. Complainers want people to join their pity party so that they can feel better about themselves.

Think of it this way: If a person were smoking, would you sit there all afternoon inhaling the second-hand smoke? You’d distance yourself, and you should do the same with complainers.

The Solution to Complaining

There are two things you can do when you feel the need to complain. One is to cultivate an attitude of gratitude. That is, when you feel like complaining, shift your attention to something that you’re grateful for. Taking time to contemplate what you’re grateful for isn’t merely the right thing to do; it reduces the stress hormone cortisol by 23%.

Research conducted at the University of California, Davis, found that people who worked daily to cultivate an attitude of gratitude experienced improved mood and energy and substantially less anxiety due to lower cortisol levels. Any time you experience negative or pessimistic thoughts, use this as a cue to shift gears and to think about something positive. In time, a positive attitude will become a way of life.

The second thing you can do — and only when you have something that is truly worth complaining about — is to engage in solution-oriented complaining. Think of it as complaining with a purpose. Solution-oriented complaining should do the following:

- Have a clear purpose. Before complaining, know what outcome you’re looking for. If you can’t identify a purpose, there’s a good chance you just want to complain for its own sake, and that’s the kind of complaining you should nip in the bud.

- Start with something positive. It may seem counterintuitive to start a complaint with a compliment, but starting with a positive helps keep the other person from getting defensive. For example, before launching into a complaint about poor customer service, you could say something like, “I’ve been a customer for a very long time and have always been thrilled with your service…”

- Be specific. When you’re complaining it’s not a good time to dredge up every minor annoyance from the past 20 years. Just address the current situation and be as specific as possible. Instead of saying, “Your employee was rude to me,” describe specifically what the employee did that seemed rude.

- End on a positive. If you end your complaint with, “I’m never shopping here again,” the person who’s listening has no motivation to act on your complaint. In that case, you’re just venting, or complaining with no purpose other than to complain. Instead, restate your purpose, as well as your hope that the desired result can be achieved, for example, “I’d like to work this out so that we can keep our business relationship intact.”

Bringing It All Together

Just like smoking, drinking too much, and lying on the couch watching TV all day, complaining is bad for you. Put my advice to use, and you’ll reap the physical, mental, and performance benefits that come with a positive frame of mind.

http://www.earlytorise.com/complaining-rewires-brain-negativity/