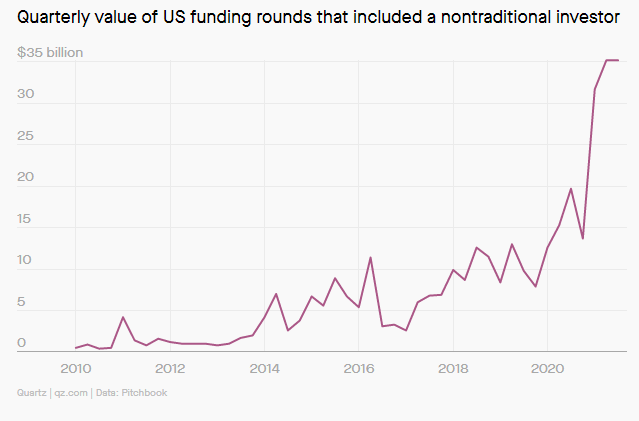

1.Hockey Sticks Galore in Venture Capital.

Venture Investments in Tech Spike

Nontraditional investors are breaking into venture capital-Venture capital firms are no longer the only—or even the biggest—game in town when it comes to startup funding, according to Pitchbook’s analysis. The firm estimates that traditional venture funds have about $221 billion in cash on hand to invest, compared with the $350 billion that nontraditional startup backers like hedge fund Tiger Global and private-equity firm SoftBank are prepared to invest in startups.

2021 has already shattered yearly records for startup funding By Nicolás Rivero

2021 has already shattered yearly records for startup funding — Quartz (qz.com)

2.QE Ending, Rates Rising, Oil Prices Rising…VIX Falling.

Bloomberg-The global pandemic is still raging, U.S. policy makers are about to cut stimulus, energy prices are surging and bonds are being sold off. And yet, Wall Street’s fear gauge is near an 18-month low.

The Cboe volatility index or VIX, which measures expected fluctuations in the S&P 500 Index, has been on a downtrend for the past month and dropped to 15.7 on Tuesday, near the lowest since February last year. The gauge is now well below its lifetime average of about 19.5, according to data compiled by Bloomberg stating in 1990.

The divergence between what is happening in the stock and bond markets can be seen in the ratio of the VIX and the MOVE Index, which tracks implied volatility in Treasury options. That proportion surged this week to the highest level since February 2020.

There are four potential reasons why the VIX may be so subdued, according to Chris Murphy, a derivatives strategist at Susquehanna International Group.

- U.S. earnings have been positive so far, and earnings season tends to reduce correlations and overall volatility

- Investors may be getting more comfortable with the “inevitable” Federal Reserve tapering of asset purchases, and are focusing on historical tendencies for equities to perform well in the early stages of a rate-hike cycle

- There may be expectations for investors to boost stock allocations due to a lack of appealing alternatives and high levels of cash

- The S&P 500 was below its 50-day moving average for most of the past two weeks, the longest stretch since it emerged from its Covid lows

3.Tesla Deliveries Still Beat During Chip Shortage.

Reporting by Subrat Patnaik in Bengaluru and Hyunjoo Jin in San Francisco; Editing by Maju Samuel

4.The Correlation Between Bond Yields and Total Returns Since 1984

Mark Hulbert Marketwatch-This chart plots the yields of intermediate-term corporate bonds for each month since 1984, along with what your total return would have been for each of those months had you bought and held for nine subsequent years. Notice how remarkably close is the correlation between the two.

https://www.marketwatch.com/story/you-can-beat-your-fear-of-losing-money-with-bonds-as-interest-rates-rise-if-you-understand-this-one-thing-11634742389?mod=home-page

5.BITO-Bitcoin Futures ETF $570m One Day vs. GLD $1B in 3 Days.

The fastest ETF to ever get to $1b (naturally) was $GLD in 2004. It did it in 3 days. No one has really come that close since. $BITO has $570m after one day a legit shot to at least tie this DiMaggio-esque feat. Here’s the fastest in a Missile Command-y looking chart from @JSeyff

https://twitter.com/EricBalchunas/status/1450795276977987587/photo/1

6.Another bitcoin-futures ETF is slated to start trading in October

Carla Mozée

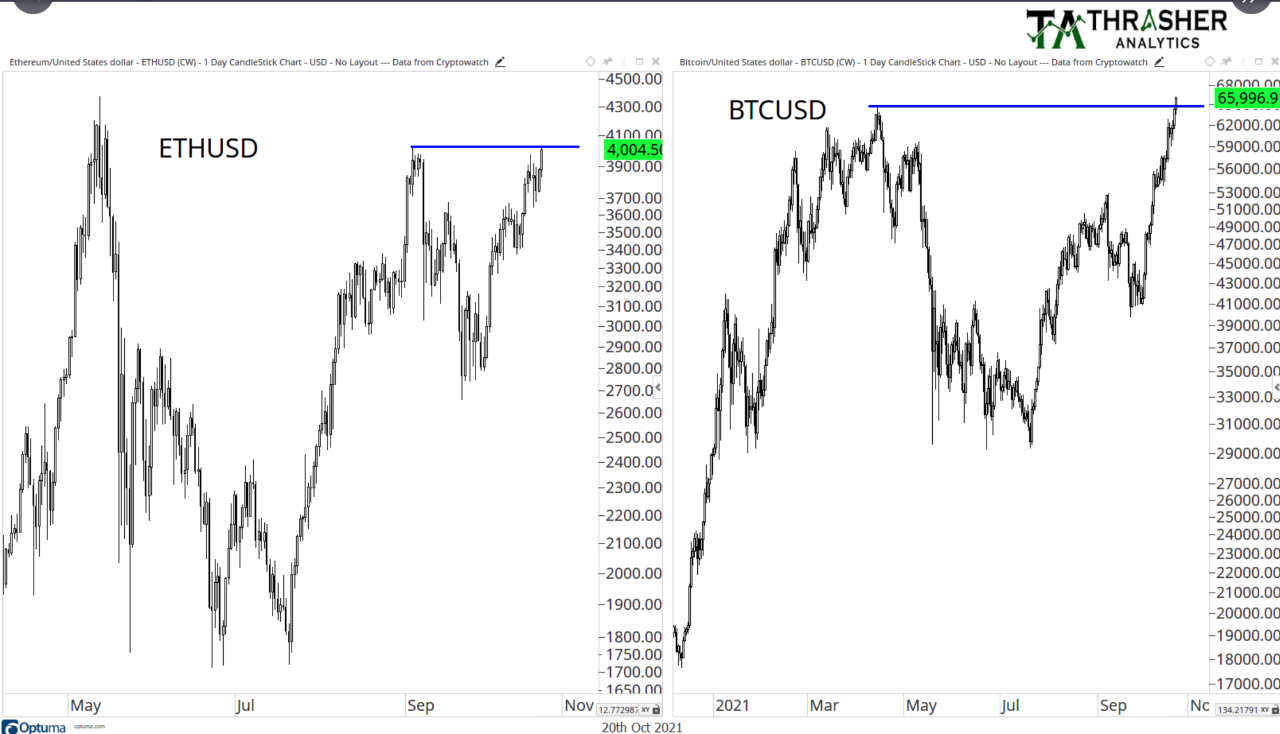

Bitcoin notched a new all-time high above $66,000 on Wednesday.

Edward Smith/Getty Images

- VanEck looks ready to launch its bitcoin-futures ETF next week under the ticker “XBTF,” according to an SEC filing.

- VanEck’s Bitcoin Strategy ETF will begin trading after October 23, suggesting the launch could be on Monday, October 25.

- ProShares on Tuesday was the first to launch a bitcoin-futures ETF.

Asset management firm VanEck looks set next week to launch an exchange-traded fund tied to bitcoin futures, just days after ProShares debuted the first-ever such product in the public markets.

VanEck’s Bitcoin Strategy ETF will begin trading after October 23 on the Cboe BZX Exchange, according to a company filing Wednesday with the Securities and Exchange Commission. The fund will only invest in cash-settled bitcoin futures traded on exchanges registered with the Commodity Futures Trading Commission, such as the CME Group.

The product will carry the ticker symbol “XBTF” and will begin trading “[as] soon as practicable after the effective date,” of the registration statement. Since October 23 is a Saturday, that points to a potential start date of Monday, October 25.

Investors would then have another choice in a futures-based product after Tuesday’s launch of the ProShares Bitcoin Strategy ETF. The “BITO” ETF invests in bitcoin futures contracts rather than the bitcoin, the world’s most-traded cryptocurrency.

Meanwhile, a filing on Monday by alternative asset management firm Valkyrieindicates it’s also set to soon launch its own bitcoin futures ETF.

The new ETFs will follow a blockbuster debut by ProShares, which reportedly said its ETF brought in $570 million in assets on its launch day. It was the second-most heavily traded fund, landing turnover of nearly $1 billion with more than 24 million shares exchanged, according to Bloomberg data.

Bitcoin on Wednesday soared to a new all-time record high of $66,930.39, according to CoinMarketCap.

https://markets.businessinsider.com/news/currencies/vaneck-launch-bitcoin-futures-etf-october-cryptocurrencies-xbtf-sec-markets-2021-10

7.Chicago Board Options Exchange to aquire cryptocurrency market Erisx…Adds to Institutionalizing Crypto Market

Kia Kokalitcheva-Axios

The Chicago Board Options Exchange (Cboe) has agreed to acquire ErisX, a crypto derivatives and spot market. Cboe invested in ErisX back in 2018.

Why it matters: The move underscores the increasing institutional interest in cryptocurrency investments.

Details: A group, including DRW, Fidelity Digital Assets, Galaxy Digital, Interactive Brokers, NYDIG, Paxos, Robinhood, Virtu Financial and Webull have agree to advise Cboe as part of a committee, and some participants also intend to acquire minority stakes in Cboe Digital (the ErisX rebrand).

The bottom line: “Cboe was among the first companies to try listing bitcoin futures in the U.S., taking its cash-settled futures product live at the end of 2017 just days before CME launched a similar product. … ‘That was an early entry and looking back at it, it was, it was a good entry … we tend to iterate on products and usually the first iteration of a product is not perfect,’ [Cboe COO Chris] Isaacson said.” — Nikhilesh De, Coindesk

https://www.axios.com/authors/kiakokalitcheva/

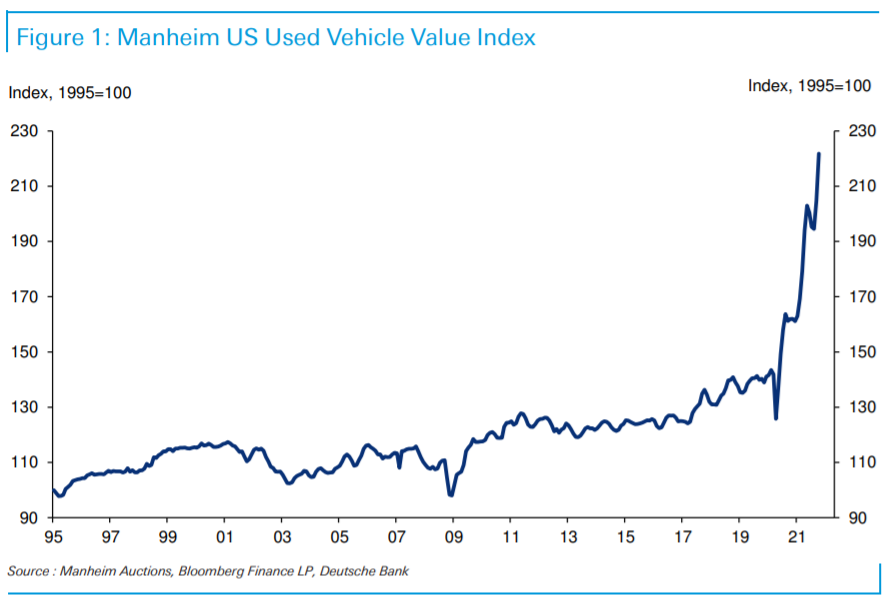

8.Manheim Used Vehicle Index Spike.

Jim Reid DB Bank–Yesterday we saw another spectacular increase in the Manheim used car index for the first half of October which could easily lead to this month seeing the largest increase in prices ever. The index was up +8.3% in the first 15 days of the month. The record is the +8.9% and +9% mom rate seen in May and June 2020 after a -11.3% monthly fall in April 2020 immediate after the pandemic hit.

Although used cars and trucks make up only about 4% of the core US CPI index, they have added nearly 1pp to YoY core CPI inflation recently. You can see this graphically on pages 13 and 14 of DB’s US economists’ latest chart book (link here) on the current more persistent price pressures.

The YoY rate is currently at +37% for the Manheim index with used cars at +24.4% YoY in the last US CPI report. There has been a lag of 2-3 months between the two so as we enter 2022 used cars will still likely be a big upward influence on the CPI number.

Clearly this can’t last forever and at some point this will surely mean revert and take a chunk out of CPI. However, remember primary rents and owners’ equivalent rent (OER) make up around a third of the basket (40% for core), and while they are not going to grow at the same breakneck speed, the forward looking models suggest that they could be a big story in 2022 and the baton could be passed from cars to housing for CPI strength.

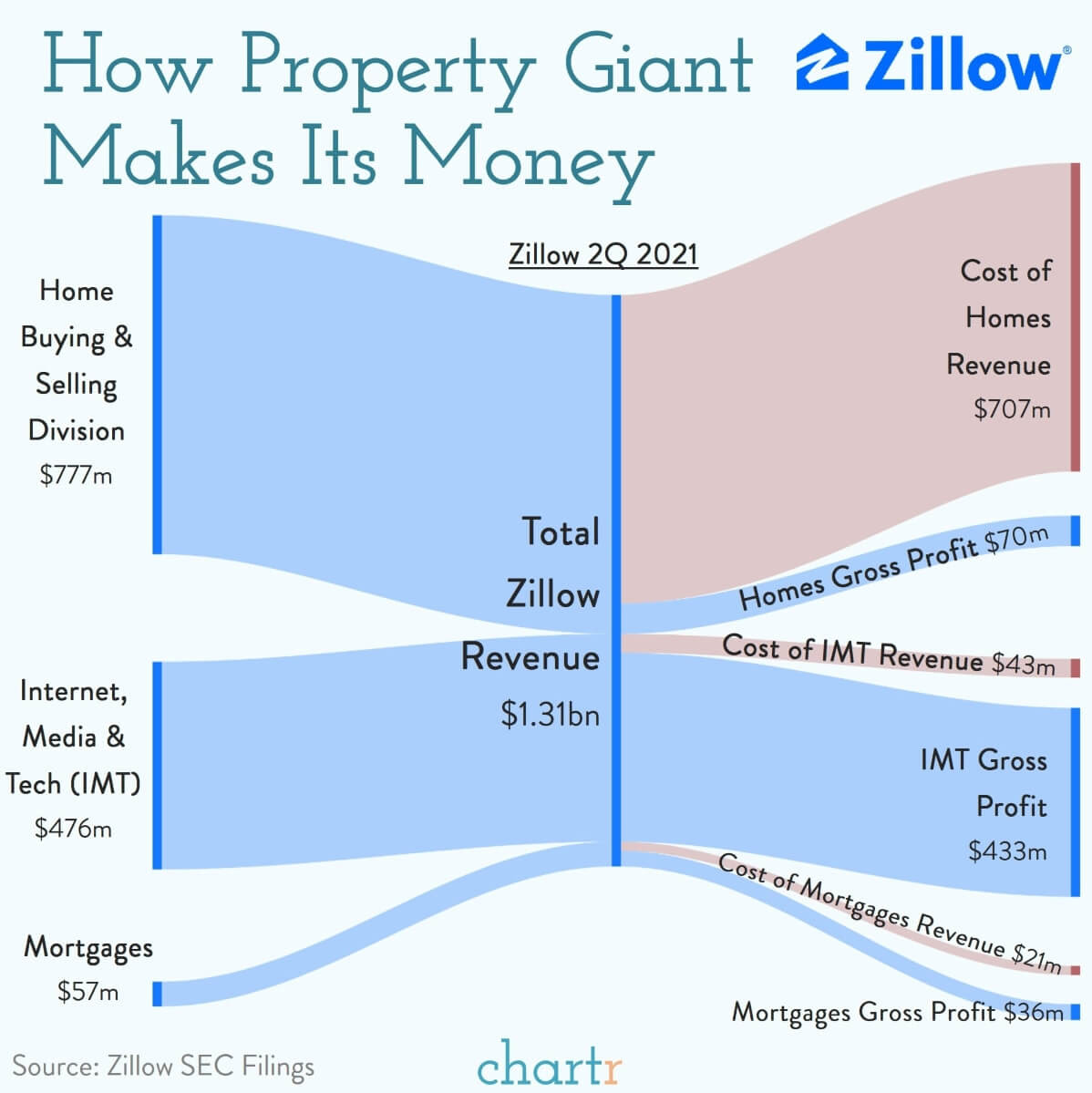

9.Zillow …How do they Make Money?

Off the market

For a long time, property website Zillow didn’t surprise anyone. The company listed houses for sale or rent, making money from sponsored listings, advertising and agent fees.

Then, in 2019, Zillow started ramping up its side hustle: house flipping.

Armed with a mountain of property data, Zillow was — in theory — in a unique position to find bargains in the home aisle. Since then the company has scaled “house flipping” into a sizeable business that accounted for almost 60% of its revenue last quarter.

Open door for OpenDoor

But this week Zillow slammed the brakes on buying homes, announcing that it would stop buying and renovating homes for the rest of 2021, as it grapples with labor shortages and a huge backlog of properties that it’s already bought. That news sent Zillow shares down more than 10% on Monday, while doing the opposite for shares of OpenDoor — Zillow’s biggest competitor in the space.

It will be interesting to see if Zillow returns to house flipping in the same way in 2022. Buying real houses, renovating and selling them is a much messier business than just listing properties on a website — and it’s a lot less profitable too. Zillow’s gross profit margin was around 9% in its Homes division. Its Internet, Media and Tech division? More than 90%.

10.3 Stoic Exercises That Will Help Create Your Best Month Yet

Stoic Exercises, Wisdom, and More

For more than two thousand years, wise men and women have relied on an ancient philosophy known as Stoicism to help them live their best lives. It’s been a source of guidance, wisdom and practical advice for millions. It’s been used by everyone from Marcus Aurelius and Seneca (one of the richest men in Rome), to Theodore Roosevelt, Frederick the Great and Michel de Montaigne and now coaches like Pete Carroll and athletes like Kerri Walsh Jennings to help them live better, more resiliently and more peacefully. Below are three Stoic exercises and strategies, pulled from The Daily Stoic, that will help you have your best month yet.

RISE AND SHINE

“On those mornings you struggle with getting up, keep this thought in mind—I am awakening to the work of a human being. Why then am I annoyed that I am going to do what I’m made for, the very things for which I was put into this world? Or was I made for this, to snuggle under the covers and keep warm? It’s so pleasurable. Were you then made for pleasure? In short, to be coddled or to exert yourself?”

—Marcus Aurelius, Meditations, 5.1

Nobody likes Mondays so it’s comforting to think that even two thousand years ago the emperor of Rome (who was reportedly a bit of an insomniac) was giving himself a pep talk in order to summon up the willpower to throw the blankets off each morning and get out of bed. From the time we’re first sent off to school until we retire, we’re faced with that same struggle. It’d be nicer to shut our eyes and hit the snooze button a few more times. But we can’t.

Because we have a job to do. Not only do we have the calling we’ve dedicated ourselves to, but we have the larger cause that the Stoics speak about: the greater good. We cannot be of service to ourselves, to other people, or to the world unless we get up and get working—the earlier the better. So c’mon. Get in the shower, have your coffee, and get going.

THE CHAIN METHOD

“If you don’t wish to be a hot-head, don’t feed your habit. Try as a first step to remain calm and count the days you haven’t been angry. I used to be angry every day, now every other day, then every third or fourth . . . if you make it as far as 30 days, thank God! For habit is first weakened and then obliterated. When you can say ‘I didn’t lose my temper today, or the next day, or for three or four months, but kept my cool under provocation,’ you will know you are in better health.”

—Epictetus, Discourses, 2.18.11b–14

The comedian Jerry Seinfeld once gave a young comic named Brad Isaac some advice about how to write and create material. Keep a calendar, he told him, and each day that you write jokes, put an X. Soon enough, you get a chain going—and then your job is to simply not break the chain. Success becomes a matter of momentum. Once you get a little, it’s easier to keep it going.

Whereas Seinfeld used the chain method to build a positive habit, Epictetus was saying that it can also be used to eliminate a negative one. It’s not all that different than taking sobriety “one day at a time.” Start with one day doing whatever it is, be it managing your temper or wandering eyes or procrastination. Then do the same the following day and the day after that. Build a chain and then work not to break it. Don’t ruin your streak.

HOW YOU DO ANYTHING IS HOW YOU DO EVERYTHING

“Pay attention to what’s in front of you—the principle, the task, or what’s being portrayed.”

—Marcus Aurelius, Meditations, 8.22

It’s fun to think about the future. It’s easy to ruminate on the past. It’s harder to put that energy into what’s in front of us right at this moment—especially if it’s something we don’t want to do. We think: This is just a job; it isn’t who I am. It doesn’t matter. But it does matter. Who knows—it might be the last thing you ever do. Here lies Dave, buried alive under a mountain of unfinished business.

There is an old saying: “How you do anything is how you do everything.” It’s true. How you handle today is how you’ll handle every day. How you handle this minute is how you’ll handle every minute.

A final trick for having a great month comes to us from the Stoic philosopher Seneca. In a letter to his older brother Novatus, Seneca describes a beneficial exercise he borrowed from another prominent philosopher. At the end of each day he would ask himself variations of the following questions: What bad habit did I curb today? How am I better? Were my actions just? How can I improve?

We shouldn’t just do this daily, but also monthly, quarterly and yearly. We should reflect on our lives and on our actions. What could we do better? How have we kept our chain of progress and good actions unbroken (or indeed, where have we failed?) And finally, have we done our proper job as people? Have we done the work we’ve needed to do? The more we think about this, the more we follow these habits, the better we will get at them.

3 Stoic Exercises That Will Help Create Your Best Month Yet (dailystoic.com)