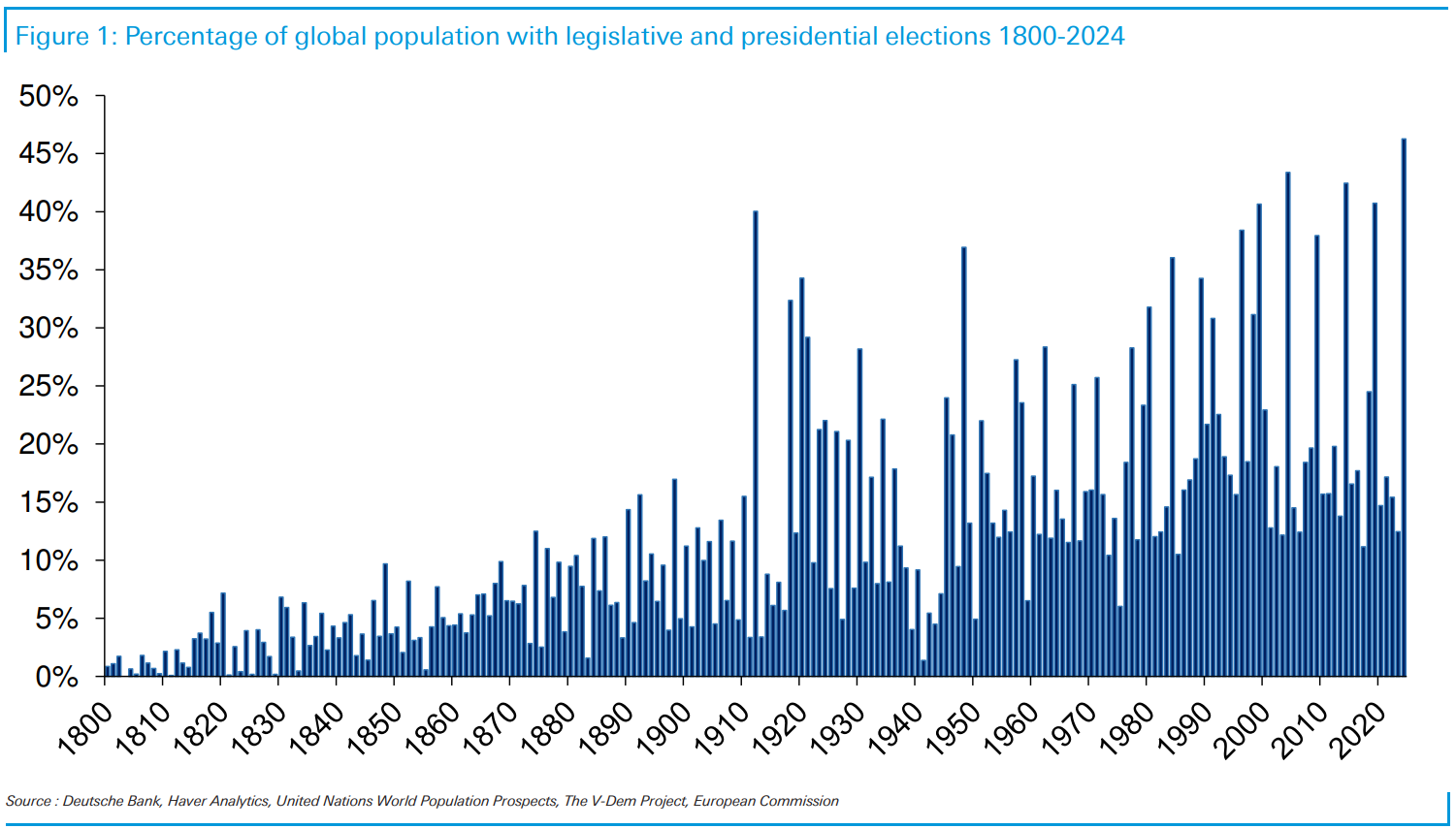

1. History of S&P in Election Year.

@callumthomas Next Year: As we’re soon headed into election year it’s worth highlighting an interesting stat — returns historically were positive 83% of the time during presidential election years (and 4 out of the past 24 election years were negative, i.e. 17%). Again, the odds are with you, but remember it’s a statistical observation of the past… and there is nothing to preclude 2024 becoming the 5th. But still, interesting.

2. REITS +18% Off Lows

VNQ Vanguard REIT closes above 200-day moving average

3. MEME Stocks Back in the Mix

GS Meme basket up double the QQQ in November.

4. Best Performers in November.

Bespoke Investment Group Below are the 30 stocks that rose the most in November. For each name, we also include its market cap, its year-to-date total return, its distance from its 52-week high, and short interest as a percentage of float. As shown, buy-now-pay-later company Affirm (AFRM) was up the most in November with a huge gain of 95.4%, followed by streaming company Roku (ROKU), crypto-trading platform Coinbase (COIN), and digital payments company Block (SQ). Are we back in late 2020/early 2021??

https://www.bespokepremium.com/interactive/posts/think-big-blog/november-winners

5. Bitcoin Fully in Rally 20 Month High

Bloomberg Sunil Jagtiani and Suvashree Ghosh The crypto industry is also awaiting the outcome of applications from the likes of BlackRock Inc. to start the first US spot Bitcoin ETFs. Bloomberg Intelligence expects a batch of these products to win Securities & Exchange Commission approval by January.

6. Gold Rallies Right to 2020 Highs.

GLD 50day crossing 200day to upside

7. Big Business Interest Rate Risk

Chartr.com

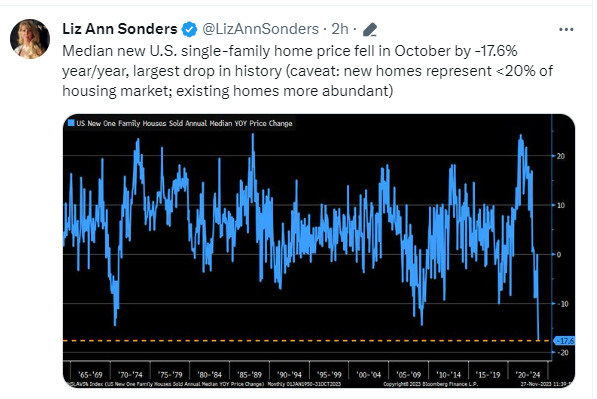

8. U.S. Existing Home Sales Data 2021-2023

9. ‘We’re killing the youth of America’: calls grow for crackdown on US gambling

Worries that gambling addiction has spiked in the US as legal sports betting booms have led to calls for increased regulation Callum Jones in New York

The United States is heading into a “quagmire, if not crisis” of gambling addiction among young people, according to counselors and clinicians – prompting calls for a regulatory crackdown.

Treatment clinics are grappling with an influx of patients in their teens and early 20s and helplines are reporting record levels of calls.

“There’s a lot of kids that are gambling,” said Felicia Grondin, executive director of the Council on Compulsive Gambling of New Jersey.

Ironically, New Jersey was the state that led the charge for the legalization of sports betting and, in 2018, successfully convinced the supreme court to overturn a decades-old federal law that prohibited the state from legalizing sports betting.

Requests for support through New Jersey’s helpline more than doubled over the ensuing years, as the legal market ballooned. Hundreds of calls from concerned relatives each year have heightened fears in the state that problem gambling is sweeping through a new generation. It is not unique.

“Calls to gambling helplines in most states in America are up, by sheer numbers,” said Timothy Fong, co-director of the gambling studies program at UCLA. “More and more younger clients” – aged 25 and under – are seeking treatment, he added.

Arnie Wexler, a counselor, has not seen anything like this before. “We’re killing the youth of America. It’s gotten crazy. Nobody cares,” he said.

Gambling gets younger

Placing a bet in the US has never been easier. Access to legal gambling, once confined to casinos and racetracks, now sits in millions of pockets across the country. Smartphones “made all avenues available to all people”, said Brad Ruderman, of the Beit T’Shuvah treatment center in Los Angeles, California. “This is the first generation where this is normal.”

While you are required to be 21 to bet on sports in most states in which it is legal, or 18 to take part in fantasy contests in much of the US, underage activity is a cause of mounting unease. When Keith Whyte, executive director at the National Council on Problem Gambling, asked a room of 40 17-year-old boys in Virginia earlier this year how many had a sports betting app on their phone, 36 hands rose.

The US is now headed into more of a gambling addiction quagmire, if not crisis

https://www.theguardian.com/us-news/2023/dec/01/sports-betting-regulation-gambling-addiction Found at Barry Ritholtz Blog https://ritholtz.com/

10. More Charlie Munger from Farnam Street. https://fs.blog/

In memory of one of my heroes, Charlie Munger, who passed away this week.

1. “I think a life properly lived is just learn, learn, learn all the time.”

— Charlie Munger

2. “You should never, when faced with one unbelievable tragedy, let one tragedy increase into two or three because of a failure of will.”

— Charlie Munger

3. “Spend each day trying to be a little wiser than you were when you woke up. Discharge your duties faithfully and well. Systematically you get ahead, but not necessarily in fast spurts. Nevertheless, you build discipline by preparing for fast spurts. Slug it out one inch at a time, day by day. At the end of the day – if you live long enough – most people get what they deserve.”

— Charlie Munger

4. “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

— Charlie Munger

5. “Take a simple idea, and take it seriously.”

— Charlie Munger

6. “I see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than they were when they got up and boy does that help.”

— Charlie Munger

7. “I didn’t get to where I am by going after mediocre opportunities.”

— Charlie Munger

8. “I want to think about things where I have an advantage over others. I don’t want to play a game where people have an advantage over me. I don’t play in a game where other people are wise and I am stupid. I look for a game where I am wise, and they are stupid. And believe me, it works better. God bless our stupid competitors. They make us rich.”

— Charlie Munger

9. “I am not smart enough to make decisions with no time to think. I make actual decisions very rapidly, but that’s because I have spent so much time preparing ourselves by quietly reading.”

— Charlie Munger (lightly edited)