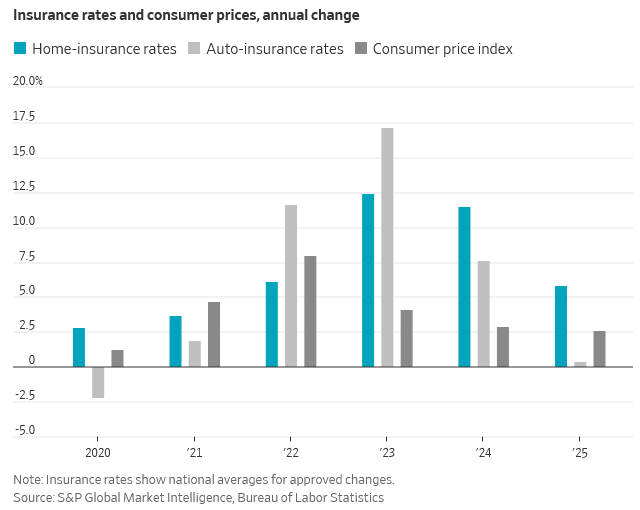

1. Central Banks Now Own More Gold than Treasuries

Special Situations

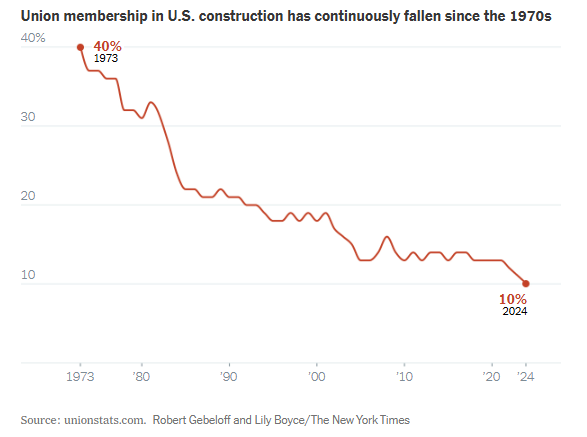

2. URA Uranium Break Out….Anything that Produces Power

StockCharts

3. TAN Solar ETF Breaking-Out…Anything Producing Power

StockCharts

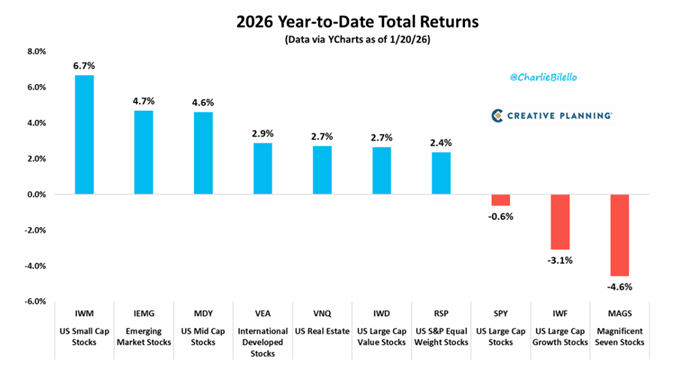

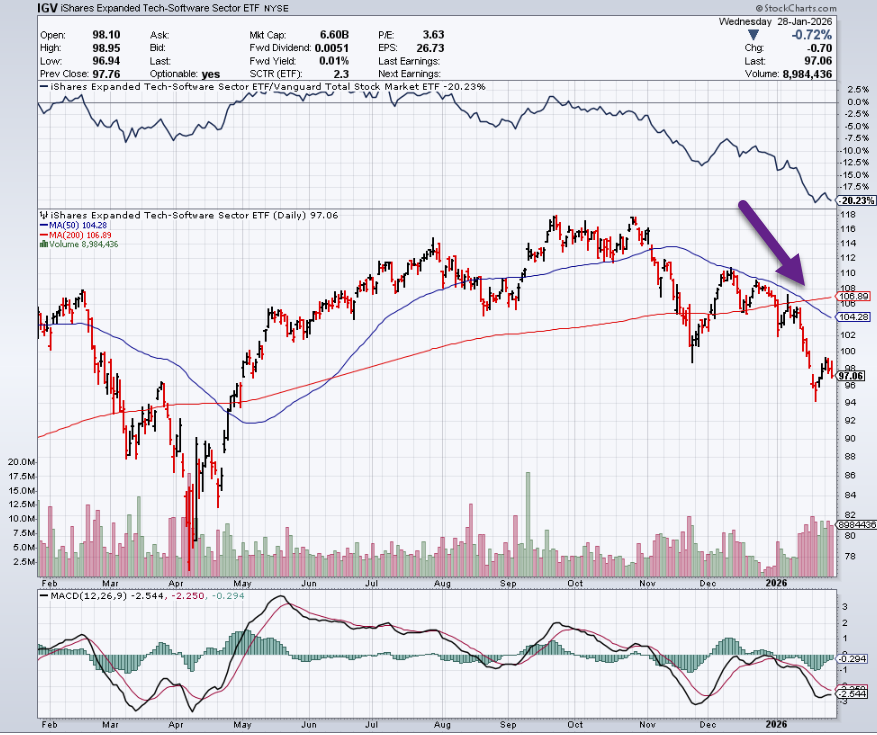

4. Software ETF 50day thru 200day to Downside 2026

StockCharts

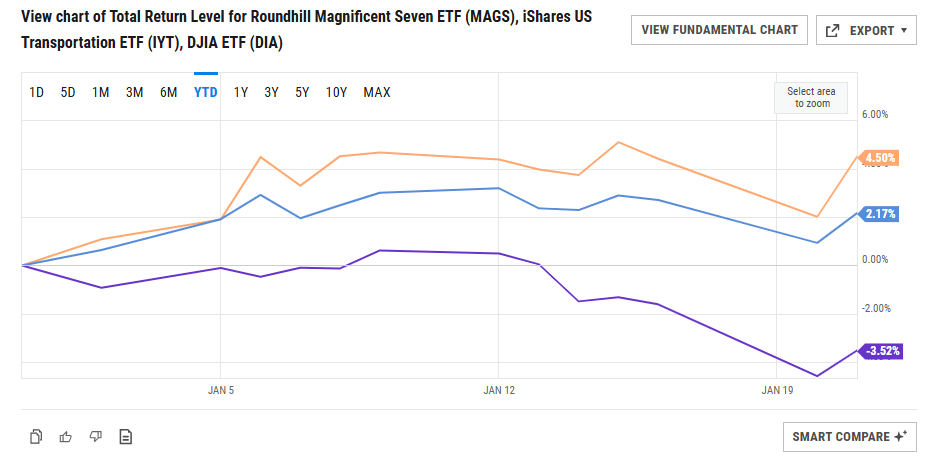

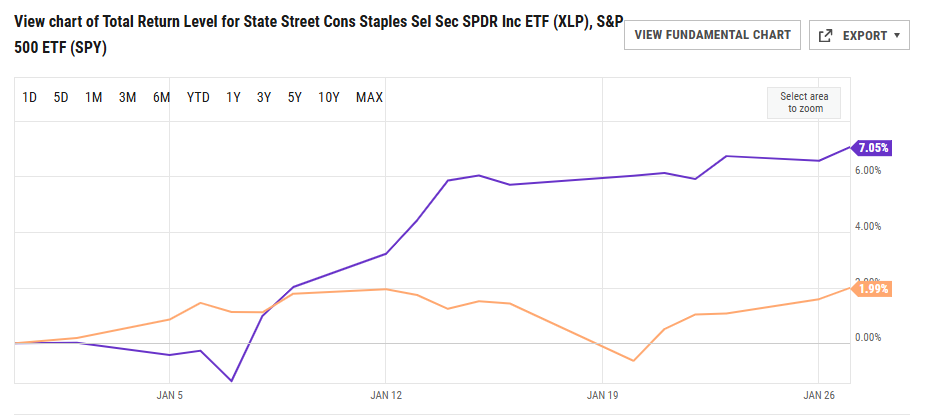

5. 2026 XLP (defensive) Consumer Staples +7% vs. S&P +2%

Ycharts

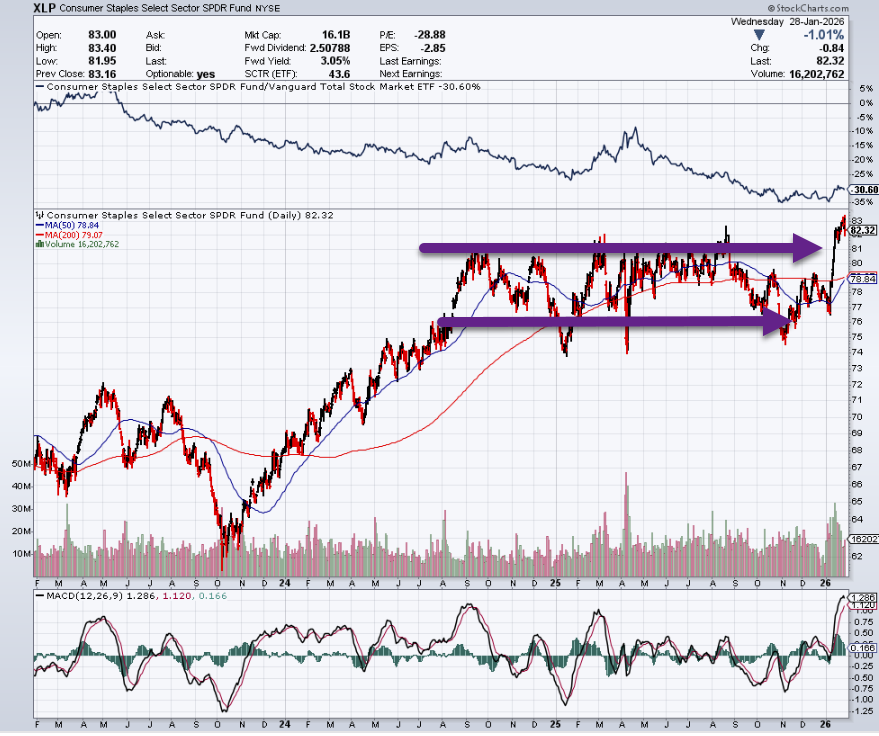

6. XLP Consumer Staples Chart Breaks Out

StockCharts

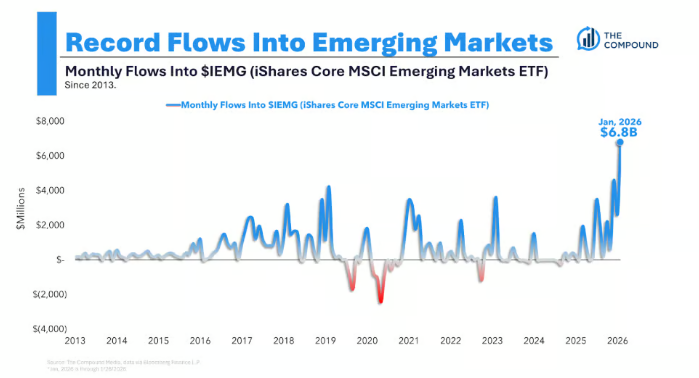

7. Record Inflows into Emerging Markets

The Irrelevant Investor

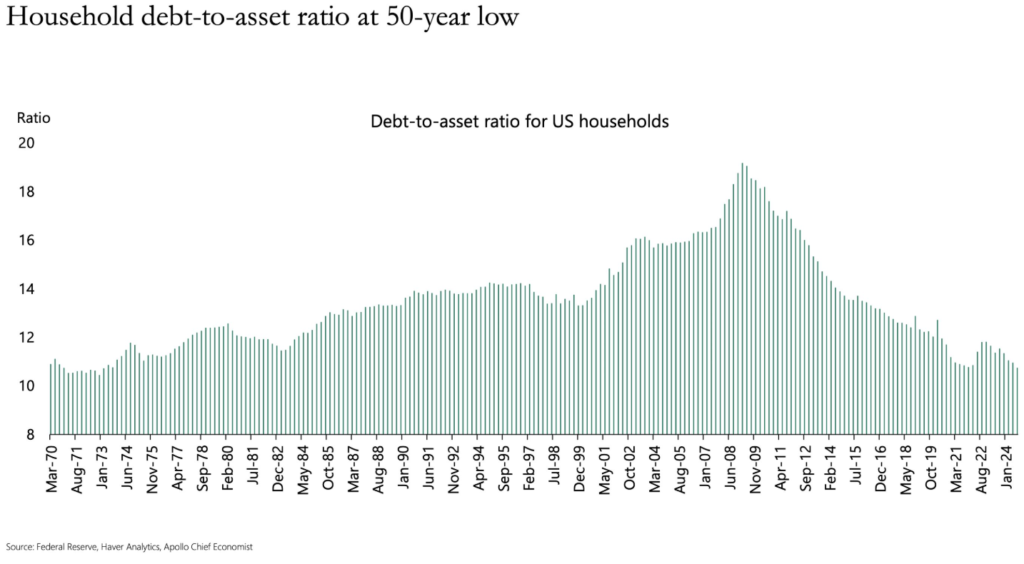

8. Household Debt to Asset Ratio at 50-Year Low

The Daily Spark

9. Mass Deportation by the Numbers

ICE arrests are growing but fewer have a criminal history. WSJ By The Editorial Board

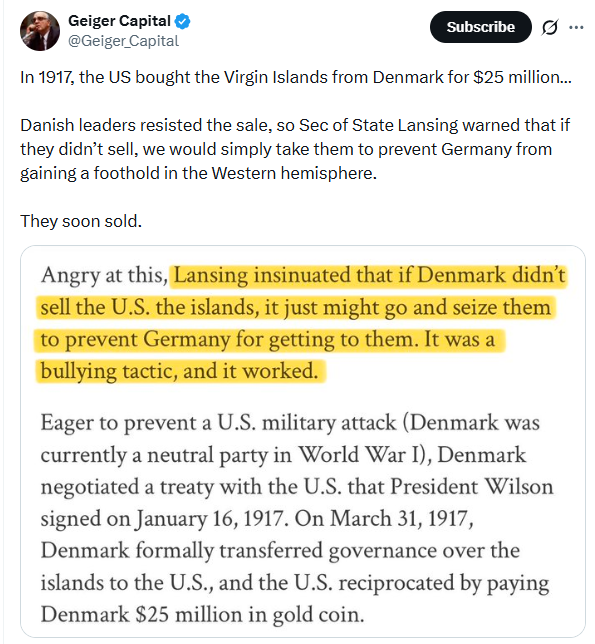

At the beginning of 2025, 87% of ICE arrests were immigrants with either a prior conviction or a criminal charge pending, according to ICE data obtained by the Deportation Data Project. Only 13% of those arrested at the beginning of 2025 didn’t have either a conviction or a pending charge.

But the criminal share of apprehensions has declined as the months have gone on. By October 2025, the percentage of arrested immigrants with a prior conviction or criminal charge had fallen to 55%. Since October, 73% taken into ICE custody had no criminal conviction and only 5% had a violent criminal conviction, according to a Cato Institute review of ICE data.

Syracuse professor Austin Kocher, who tracks official ICE data, finds that between Sept. 21, 2025, and Jan. 7, 2026, single-day ICE detentions increased 11,296. But only 902 of those were convicted criminals, 2,273 had pending criminal charges and 8,121 were other immigrant violators. ICE arrests have been trending upward since January 2025, but criminal arrests have plateaued.

10. The Art and Value of Paying Attention

Psychology Today Think of attention as a vital tool for self-development in the 21st century. Bruce Rosenstein

Key points

- Paying careful attention, and cultivating attention to detail, are crucial for lifelong learning.

- Pay attention to what you read, view, and listen to.

Your attention is a crucial asset and resource. Its proper application can be a differentiating factor in your life and work, in distinguishing you in relation to other people and, crucially, in what you can offer to the world that artificial intelligence/AI can’t.

Attention can also be a valuable component of self-development. Thinking of attention as one of your most closely-guarded assets can be life-changing. Applying inner resource tools like listening, observation, mindfulness, memory, self-awareness, self-efficacy, and the mind-body connection can help you place your attention where it really belongs.

Peter Drucker and the Attention to Detail

Peter Drucker, the founding father of modern management, was a master of inwardly and outwardly-focused attention, a major contributing factor to his success as a writer, professor, and consultant in a career spanning more than 70 years. He kept an attentive eye and ear for information that helped him see around corners and glimpse a future that others could not.

He listened carefully while interacting with his students at the Drucker School of Management and with his consulting clients. If he did not focus his attention, he could not have written the nearly 40 books he did nor contributed regularly to such publications as the Harvard Business Review and The Wall Street Journal.

Drucker learned the importance of attention to detail in an early, formative professional experience, as a 20-year old journalist in Germany. It laid the foundation of a diligent work ethic.

His first reporting assignment, at the newspaper Frankfurter General-Anzeiger, was to cover a criminal trial. As he remembered it, when he returned to the office from court to write his article, the editor asked him the name of the prosecutor. Drucker had missed that crucial piece of information. He had to make an embarrassing visit to the judge’s home to get the necessary detail.

If attention is not scattered on unimportant tasks and actions, Drucker believed, it could serve larger work and life goals and purposes. Attention sometimes needs to be turned to what seems urgent, but such activities may turn out not to be so important.

Attention to Lifelong Learning

Drucker was a major practitioner and proponent of lifelong learning, which requires paying careful attention whether or not you are a formal student. Think conferences, seminars, webinars, in-person and virtual meetings, and more, but always choose them carefully. Some might be unavoidable, Others may not be a productive use of your time.

No matter the experience, attention can always be enhanced by thoughtful note-taking, focused listening, minimizing distractions, and finding alternative ways of capturing thoughts and ideas—visual aids or meeting by careful review, which may spark further useful ideas and knowledge.

Teaching Immersive Attention

Some methods for training attention may seem extreme at first but could yield significant benefits. In a Harvard Magazine article titled “Teaching Students the Value of Deceleration and Immersive Attention,” Harvard art historian Jennifer L. Roberts reports that she assigns students to spend three full hours in front of a single painting in a museum, noting their own “evolving observations as well as the questions and speculations that arise from those observations.”

The lesson about art, vision, and time, she insists “goes far beyond art history. It serves as a master lesson in the value of critical attention, patient investigation, and skepticism about immediate surface appearances. I can think of few skills that are more important in academic or civic life in the twenty-first century.”

The Leader’s Attention

Jeremy Hunter, one of Drucker’s academic colleagues, has been a pioneer in teaching the management of attention to busy and often-distracted executives. He is the founding director of the Executive Mind Leadership Institute and was one of the earliest professors to incorporate mindfulness into an MBA program—as a tool for focusing attention.

In an article in Leader to Leader, “How to Recapture Leadership’s Lost Moment,” Hunter, along with the University of Virginia’s Lili Powell, writes that “to recapture leadership’s lost moment, leaders can learn to refocus on their immediate experience so they can lead more mindfully. Our approach emphasizes using intention, attention, and awareness to act and perform skillfully and dynamically in real time. Using diverse practices ranging from meditation, yoga, athletics, and the performing arts, leaders can learn to experience a moment in a high-definition way that increases the potential for better choices and leadership results.”

The Attention Economy

There will always be a scarcity of anyone’s attention. Information overload is rampant and will only increase. Time is often limited for absorbing what others write and say. The digital universe is set up to constantly hijack attention.

We are, it is said, now living in “the attention economy.” Yet the book that introduced the concept, The Attention Economy: Understanding the New Currency of Business, by Thomas H. Davenport and John C. Beck, was published 25 years ago—before the introduction of the smartphone and social media. You can expect the introduction of new formats of information delivery that further challenge your ability to maintain attention focus.

Attention: A Concrete Resource

Consider attention as a concrete resource rather than as an abstract concept. It is an overlooked aspect of self-management that takes time, effort, and care, but can pay dividends now and in the future.