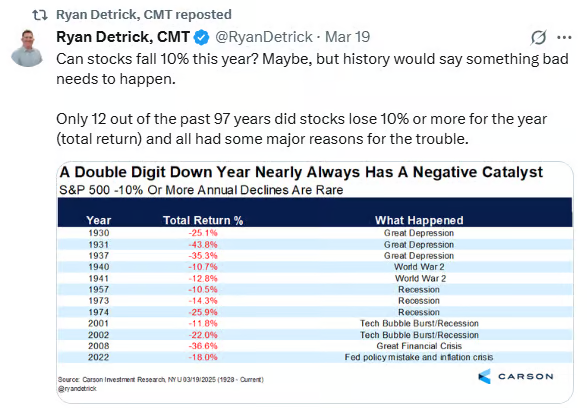

1. U.S. Tech vs. China Tech ETF History

QQQ vs. KWEB. Chinese Tech stocks (using $KWEB as our proxy) recently beat the Nasdaq 100 by 2 standard deviations over the prior year. When $QQQ has been this oversold in the past, it went on to outperform by strong-double digits and with a 100% win rate over the next year.

DataTrek

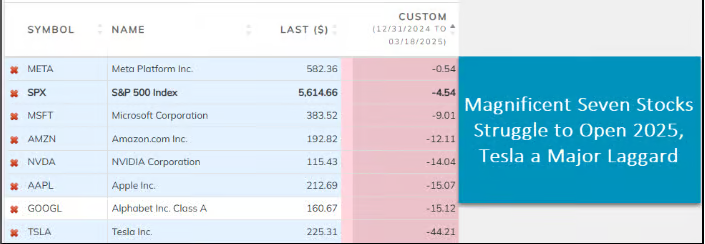

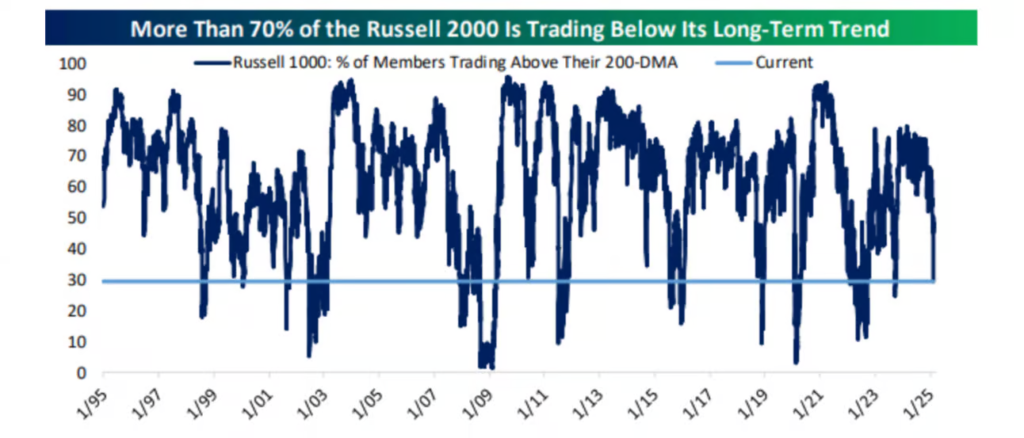

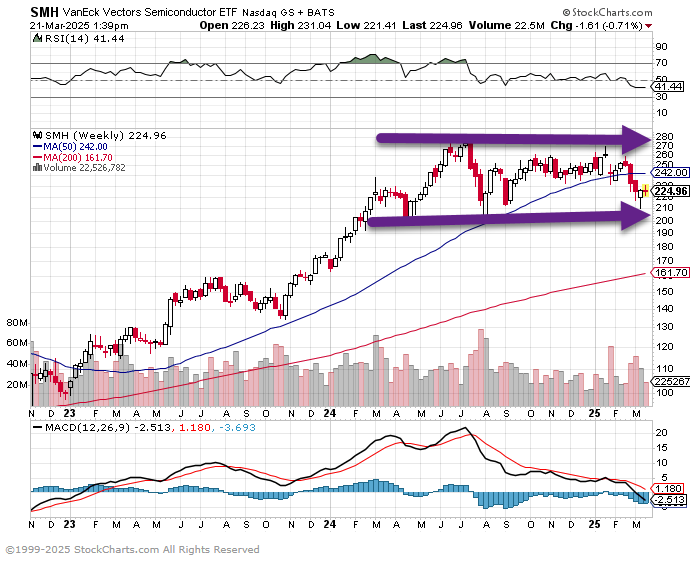

2. Small Cap Russell 2000 50-Day Thru 200day to Downside…History Not Bearish?

MarketWatch

3. Micro-Cap Stocks Never Made It Back to 2024 Highs

StockCharts

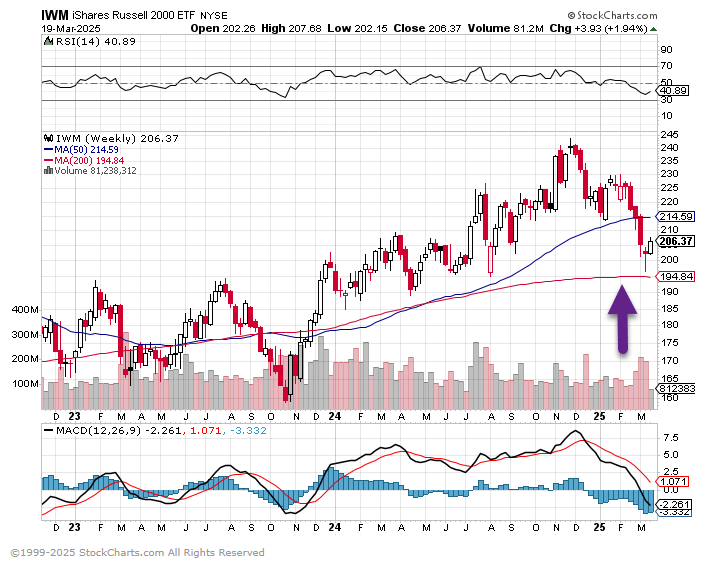

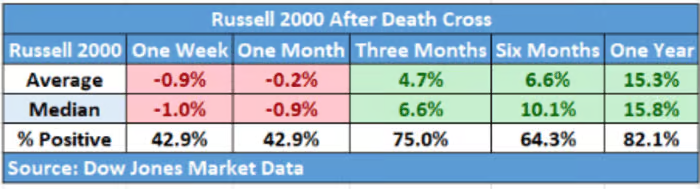

4. Retail Investors Buying TSLA Stock the Entire Way Down…$8B Over 13 Sessions

JPMorgan analyst Emma Wu told clients that the current level of retail enthusiasm for Tesla is unlike anything seen in the last ten years. This surge in retail buying comes as the stock remains halved from its December high of around $479. Weighing on shares are concerns over a potential slowdown in electric vehicle deliveries during the first quarter, along with mounting backlash from radical leftist nonprofits seeking to destroy the company and investors.

The global equity derivatives strategist told clients that retail net buying flows into Tesla topped $8 billion over the last 13 consecutive sessions through Thursday. This was the longest buying streaks for Tesla via JPM data dating back to 2015.

ZeroHedge

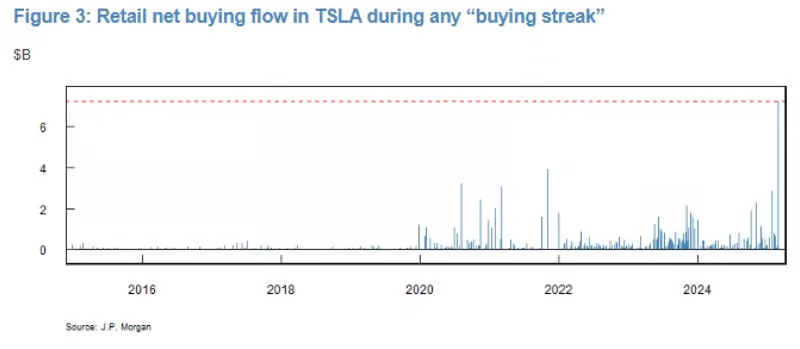

5. SMH Semiconductor ETF Back to Jan 2024 Levels

StockCharts

6. Crypto/Options Trader HOOD -45% Correction Top to Bottom

StockCharts

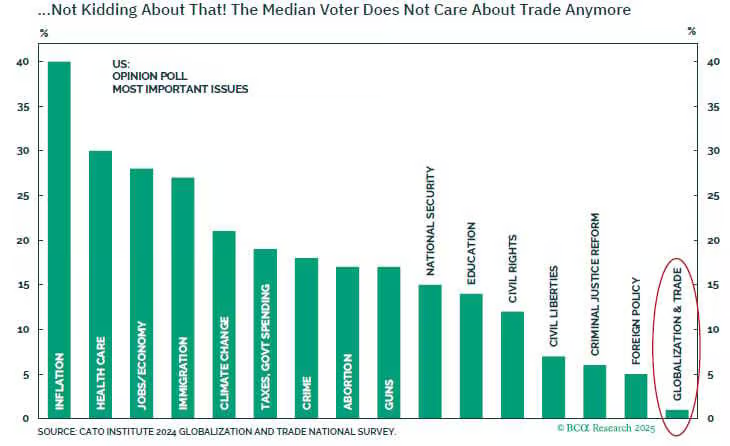

7. Inflation Still Dominating Voters’ Mindset….”Global Trade” Dead Last in List of Issues

People care about prices. They don’t care about global trade.

Bloomberg

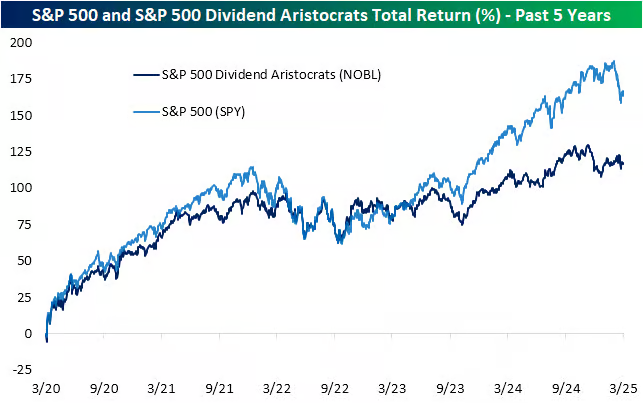

8. Dividend Stocks Outperforming 2025—See Big Gap Underperformance Post Covid vs. Historical

Bespoke

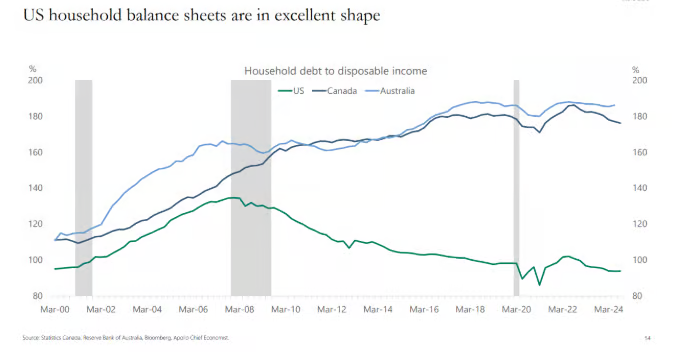

9. Reminder: U.S. Household Balance Sheets are in Excellent Shape

The Irrelevant Investor

10. How to Turn Regret Into Purpose

From Psychology Today: A life lesson from the dying: Regret can be a powerful teacher.

KEY POINTS

- You don’t find purpose—you build it using regrets as anchors for growth and meaning.

- Inaction regrets are missed opportunities; take steps now to prevent future regret.

- Action regrets can’t be undone, but they can be transformed into purpose through learning and service.

- Reflect on your regrets today to create a life you won’t look back on with sorrow.

If you feel lost when it comes to purpose, you’re not alone. Many of us spend years searching for that one big thing that will make our lives feel meaningful.

But here’s the truth: You don’t find your purpose—you build it. Purpose isn’t a lightning bolt of revelation; it’s a structure we create, brick by brick, using the anchors, inklings, and beckonings that light us up.

As a hospice doctor, I sit with people at the end of their lives, and I’ve learned an important lesson from them: Regret is a powerful teacher. The saddest thing about regret for the dying is that, by the time they acknowledge it, they no longer have the agency, energy, or time to turn those regrets into something meaningful.

But you and I? We still do.

The Two Types of Regret

Understanding regret is the first step in using it as a tool for purpose. As Daniel Pink explores in his work on regret, there are two primary types: inaction regrets (things we never did) and action regrets (things we did but wish we hadn’t).

Inaction Regrets: The Things We Never Did

Inaction regrets are often the easier ones to spot. They are the untraveled roads, the missed opportunities, the dreams left unexplored. And I am a perfect example of this.

Ten years ago, I carried a deep regret: I had never traditionally published a book. Writing had always been a passion, but I never felt like I had the time, courage, or energy to pursue it seriously. Working with dying patients, I often asked myself: If I were in their shoes, what would I regret never doing?

For me, the answer was clear—I would regret never becoming a published author. This realization turned my inaction regret into a purpose anchor. Instead of just feeling bad about it, I used that regret as motivation to take action. I got an agent, wrote a manuscript, and eventually published my book. That’s the power of recognizing inaction regret: it can become the foundation upon which we build a meaningful life.

Action Regrets: The Things We Did but Wish We Hadn’t

Action regrets are more complicated because they involve mistakes we’ve made. They are the choices we look back on with sorrow, embarasment or guilt. Unlike inaction regrets, they can’t be undone.

I once took care of a patient who, as a young woman, had been texting while driving and caused a car accident that severely injured another person. The guilt stayed with her for the rest of her life, an ever-present burden. She deeply regretted that one decision, and no matter how much she wished she could, she could never undo it.

So how do we turn action regrets into purpose?

For her, the answer was education. She couldn’t erase the past, but she could prevent others from making the same mistake. She became a national speaker on the dangers of texting and driving, using her own painful experience to teach and protect others. In doing so, she transformed her action regret into a purpose anchor.

Turning Regret into Purpose

Both types of regret—inaction and action—have the potential to serve as powerful guides. They show us what matters, what we wish we had done differently, and where we can create meaning moving forward.

So, what about you? Ask yourself:

- What are the things you regret not doing?

- What are the actions you regret taking?

- How can you build a life of purpose around those regrets?

If you regret not traveling, can you start prioritizing experiences over possessions? If you regret not expressing love to someone, can you start showing up more fully in your relationships? If you regret hurting someone, can you work toward making amends or helping others in a similar situation?

These reflections aren’t meant to fill you with guilt. They are meant to empower you. Unlike my hospice patients, you still have time. You can make different choices, shift your priorities, and turn regret into action.

What Will You Regret on Your Deathbed?

One day, you will be at the end of your life. When that time comes, will you look back with a sense of fulfillment, knowing you used your regrets as fuel for a meaningful life? Or will you be haunted by all the things you never did, never said, and never became?

The good news is that you still have a choice. Regret doesn’t have to be an anchor that weighs you down—it can be the foundation upon which you build a life of deep purpose.

So, what will you do today to ensure that, when your time comes, regret isn’t the final chapter of your story?